Table of Contents

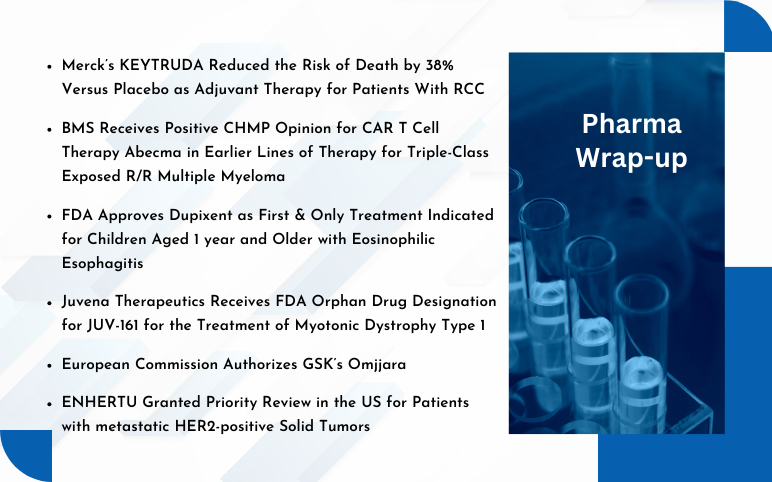

As per DelveInsight, the CAR T-Cell Therapy Market size for Non-Hodgkin lymphoma in the 6MM (the US, EU5 (the UK, Germany, France, Italy and Spain)) is expected to be USD 2796.2 Million by 2030.

During the course of past decades, with the advancement in technology and a clear understanding of the molecular pathogenesis, cellular processes that take place during lymphomagenesis such as signal transduction pathways, transcriptional and translational regulation, protein stability and degradation, cell cycle regulation, and mitosis and apoptosis, as well as the study of the microenvironment, a significant number of effective treatments have graced the Non-Hodgkin lymphoma therapeutics market, improving the quality of lives of the patients, increasing survival rates, and life expectancies of the patients.

Ultimately, it has led to an increase in the discovery and progress of new therapies with a considerable number of breakthrough molecules quite impressively managed to influence the Non-Hodgkin lymphoma treatment landscape.

Chemotherapies, radiation therapies and immunotherapies are either used in combination or alone, depending upon the severity, success rate, age and several other factors. Immunotherapies such as BCR pathway inhibitors including Bruton’s tyrosine kinase (BTK) inhibitors, spleen tyrosine kinase (Syk) inhibitors, and phosphatidyl-inositol-3-kinase (PI3K) inhibitors; Bcl-2 inhibitors comprising are such agents that proved to be effective to some extent in treating Non-Hodgkin lymphoma. However, the emergence of new generation monoclonal antibodies (mAbs) and drug conjugates such as Obinutuzumab were even more effective when used with chemotherapy have complemented the existing conventional therapies. Chemotherapy is one of the most conventional methods to treat patients, and most patients are given cytotoxic chemotherapy in combination with the anti-CD20 monoclonal antibody Rituximab (Rituxan) for successful removal of tumor.

However, the treatment approach has its limitations, and the results are never 100% depicting a conflicting side of the story. The patients develop progressive tumors, and there were cases when the cancer relapsed or recurred. Hence, the dire need to shift the complete reliance of patients from such conventional therapies to a novel approach that can treat cancer for once and all.

CAR-T cell therapy market for lymphomas

A branch of immunotherapy has recently caught attention involves the transfer of patient’s own immune cells to target the cancerous cells – known adoptive cell transfer (ACT). However, it is of several types, but one that received much attention is CAR-T cell therapy.

Until recently, CAR-T cell therapy was confined to clinical trials on smaller scales, in patients who opted for it as a last resort. However, the remarkable rates of success garnered much attention from researchers, investors and patients equally.

The therapy proved to be a miracle for cancer patients – regardless of their ages – for whom results of every treatment approach looked nothing but grim.

As the name goes, CAR-T cell therapy relies on T-cells – workhorses of immune cells -which are extracted from patient, cultured, and genetically engineered to bear receptors on their cells – Chimeric antigen receptors (CARs). These genetically engineered T-cells bind to cancerous cells, hence killing them.

The available therapeutics treatment options in CAR T-Cell Therapy market for Non-Hodgkin lymphoma aim to kill the leukemia cells in the blood and bone marrow. The approval of Yescarta was proved to be the light of the day for the group of cancer patients who were left with a few other options, and those with certain types of lymphoma that had not responded to previous treatments.

CAR-T cell therapy market for Non-Hodgkin Lymphoma

While opting for Yescarta, the patient’s T-cells are modified ex-vivo to generate a CAR consisting of anti-CD19 CAR T-cells linked to CD28 and CD3-zeta co-stimulatory domains. These anti-CD19 CAR T-cells are then transferred back to the patient, which recognizes CD-19 expressing target cells, eliminating it. The tussle between anti-CD19 CAR T-cells and CD19-expressing target cells leads to the activation of downstream signals, which further result in the activation of T-cells, proliferation, and release of inflammatory cytokines, as well as killing CD19-expressing cells.

Effectiveness of the CAR-T cell therapy has led scientists and researchers to ponder over its use in cancer patients at earlier stages. Nonetheless, it still requires extensive research and studies which are underway, comparing the results of the patients given CAR-T at different stages.

CAR-T cell therapy market: Emerging therapies and growing size

The approval of the novel CAR-T cell therapy attracted many pharma investors and pharma companies, highlighting the bright scope of CAR-T cell therapies in oncology.

Several companies, including Celgene, and Gilead, are working to fuel the CAR-T cell therapy market for Non-Hodgkin lymphoma. The expected launch of Lisocabtagene maraleucel (also known as JCAR017) of Celgene’s, (a BMS company) and KTE-X19 by Gilead will significantly drive the NHL market in the near future.

Gilead’s KTE-X19, an investigational CD19 CAR T-cell therapy, has been granted fast-track review designation by the FDA for cellular drug therapy to treat a rare form of non-Hodgkin lymphoma. Moreover, KTE-X19 is currently in Phase I/II trials in acute lymphoblastic leukemia (ALL) and chronic lymphocytic leukemia (CLL). Similarly, Celgene’s JCAR017 (Lisocabtagene maraleucel), is in phase I stage of development for the treatment of pediatric Acute Lymphoblastic Leukemia and adult Non-Hodgkin Lymphoma.

Among the EU-5 countries, Germany, Italy and France are observed to be among top holders of the largest CAR T-Cell Therapy market share for Non-Hodgkin lymphoma followed by UK and Spain.

Drivers and Barriers

The major market driver in the CAR T-Cell Therapy market for NHL is the launch of the anticipated gene therapies. The surge in the CAR-T cell therapy market size would automatically mean a decline in the market share of the current therapies present in the Non-Hodgkin lymphoma market. Developing such advanced CAR-T cell therapies is complex and is faced with several challenges. However, with two approved CAR-T cell therapies (Kymriah, Novartis; Yescarta, Kite Pharma) available in the market for different types of lymphomas, regulatory bodies have enhanced their support by easing out the regulations such as FDA’s breakthrough designations, and orphan designations; and EMA’s PRIority MEdicines (PRIME) scheme to make available CAR-T cell therapies in the market. Regulatory authorities have started to consider the results on the basis of small-scale trials and smaller databases. However, every story has two sides. CAR-T cell therapy is met with significant challenges related to its cost and affordability. Curative, and life-changing gene therapies, for sure have graced our lives, promising a cancer-free life, however; at a hefty amount.

However, EMA-HTA Parallel Consultation and other schemes help to discuss and agree on approving a reimbursement plan that assesses risk and values, maintaining a balance. Moreover, an early plan among medicines developers, regulators, health technology assessment bodies, and health care insurers benefits the patients to get a clear understanding of the reimbursement procedure. With two CAR-T cell therapies available, might have transitioned to next level, however; several challenges await, which pharma companies and academia through their collaboration and partnership are trying to overcome to fuel the CAR-T cell therapy market for Non-Hodgkin lymphoma.

As per DelveInsight, the CAR T-Cell Therapy Market size for Non-Hodgkin lymphoma in the 6MM is expected to be USD 2796.2 Million by 2030.

The major market driver in the CAR T-Cell Therapy market for NHL is the launch of the anticipated gene therapies, including Lisocabtagene maraleucel of Celgene’s, (a BMS company) and KTE-X19 by Gilead.

The major market barriers in the CAR T-Cell Therapy market for NHL are complexity of tissue engineering, different regulatory guidelines, and attached price tag.

Several companies are working to fuel the CAR-T cell therapy market for NHL, including Celgene – a BMS subsidiary, Gilead, and others.

-Agonist.png)