Table of Contents

Mitsubishi replacing RADICAVA’s Intravenous (IV) formulation with Oral. Opinion on Amylyx Pharma’s recent approval, RELYVRIO

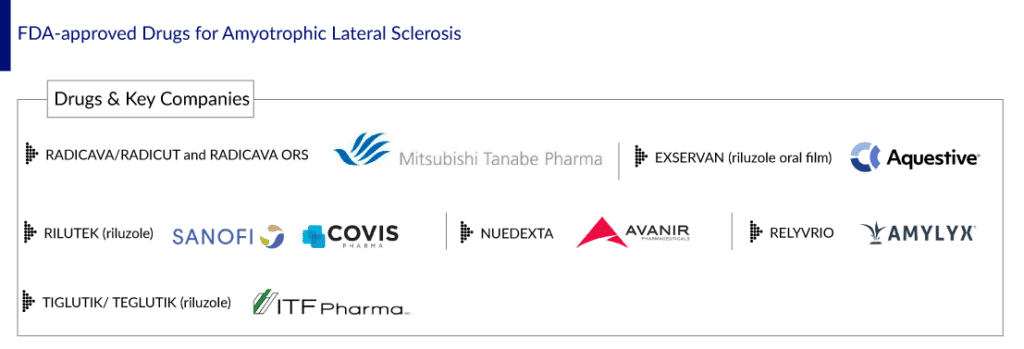

The amyotrophic lateral sclerosis treatment landscape is stringent and includes multidisciplinary care, such as physical therapy, speech therapy, dietary counseling, heat or whirlpool therapy, and others. The approved drugs for amyotrophic lateral sclerosis treatment include RILUZOLE, RADICAVA, TIGLUTIK, EXSERVAN, and RELYVRIO. Currently, there is no cure for ALS and no effective treatment to halt or reverse the progression of the disease. The mainstay of ALS treatment is symptom management and palliative care.

Riluzole and its formulations approval journey

Riluzole, the first approved drug for ALS treatment, was approved by the FDA in 1995. In the ensuing decades, many other countries recommended the drug as first-line therapy for ALS treatment. Riluzole is suggested to improve survival and/or time until tracheostomy. The drug’s tablets have limitations that may have restricted their broader clinical application. Key limitations of the drug include poor oral bioavailability, negative food effects on the body, especially the liver, pharmacokinetic variability, and oral numbness. Riluzole has been on the ALS treatment market in the United States for more than 20 years, and generic versions are available. In the 7MM, the usage of riluzole is more than 80%, as per secondary findings. Owing to the entry of convenient riluzole formulations, the usage of oral tablets is anticipated to decline during the upcoming years.

Riluzole usage in China

According to secondary findings, the proportion of riluzole users in China has increased approximately 2.5-fold from 2005–2009 to 2015–2018. The increased usage of riluzole in China could be due to several reasons, such as the decrease in drug price in China that has enabled more patients to afford the drug, enhanced understanding of ALS among the general public, and an increase in the number of patients realizing that the progress of the disease can be partly controlled by riluzole and that the prognosis can be improved. In addition, since 2016, the expenditure for riluzole use has gradually been covered by basic medical insurance in different provinces of China, making it more accessible to ALS patients in this study’s last two years. We assume that until other amyotrophic lateral sclerosis therapies establish in the China market, riluzole usage will grow more in China. TIGLUTEK/TEGLUTIK and EXSERVAN are the brand names for different formulations of riluzole.

TIGLUTEK/TEGLUTIK is an oral liquid suspension formulation of riluzole. The drug was launched in the European markets under the brand name TEGLUTIK. It was offered to patients with swallowing difficulties as an alternative to their treatment with riluzole. TEGLUTIK is the only novel liquid formulation of riluzole available in Europe and has been specially developed for dysphagic ALS patients. In September 2018, Italfarmaco’s oral liquid suspension formulation of riluzole was approved by the US FDA under the brand name TIGLUTIK. In 2022, China joined the numerous countries in which Teglutik is already present. The drug is sold directly in Italy, Germany, Spain, France, Greece, Switzerland, Benelux, and Nordics and distributed in the US, UK, Australia, Argentina, Slovenia, Hong Kong, and Bangladesh. However, this formulation of riluzole is not yet available in Japan.

In November 2019, Aquestive Therapeutics (previously called MonoSol Rx) announced that it had received FDA approval for EXSERVAN (riluzole oral film). Even though EXSERVAN was approved in November 2019 in the US, this product was launched in June 2021. At present, EXSERVAN is not available in the EU-4 and the UK, but as per Aquestive therapeutics’ Q3 2021 transcript, the launch of EXSERVAN may happen at some point later this year. According to our estimates, the entry of EXSERVAN in EU4 and the UK is expected shortly. In Japan, there is no clarity on the development progress of this drug. While in the case of China, Haisco Pharma in-licensed China rights to EXSERVAN from Aquestive Therapeutics in March 2022. In terms of ease of administration, EXSERVAN may have the edge over the riluzole oral pill and oral suspension due to the ease of administration.

RADICAVA, the first Amyotrophic Lateral Sclerosis medication in decades since Riluzole approval with an eye-popping price tag

RADICAVA (edaravone) is the second drug used for treating ALS patients, and it works by lowering the deterioration of physical functioning in patients with ALS. Although RADICAVA has been available in Japan for treating acute stroke since 2001, under the product name RADICUT, it took almost two decades to get approved for ALS.

Following acute stroke approval, it was approved for the treatment of ALS in Japan in June 2015 and in South Korea in December 2015, based on a series of ALS clinical trials done in Japan.

The US FDA was so impressed with Mitsubishi’s drug that after learning about the use of edaravone to treat ALS in Japan, the US FDA rapidly engaged with Mitsubishi about filing a marketing application in the US. The drug was approved in the US in May 2017, based on the efficacy of edaravone for ALS treatment, which was demonstrated in a six-month clinical trial conducted in Japan.

However, the United States, owing to its higher cost and payers’ policies, has restricted the use of RADICAVA to patients with early-stage disease who can remain independent and retain functionality for most activities of daily living and normal respiratory function.

The submitted price of RADICAVA to the Canadian Agency for Drugs and Technologies in Health (CADTH) was USD 1,424 per 60 mg or USD 185,182 annually.

RADICAVA made its debut in China in 2019. Mitsubishi announced in August 2019 that Edaravone was approved by National Medical Products Administration (NMPA).

Application withdrawal of RADICAVA from EU after CHMP requested a new trial

The Committee for Medicinal Products for Human Use (CHMP) noted that the main study did show significant improvements in ALSFRS-R scores in patients receiving RADICAVA compared with those receiving placebo. However, the study involved only a small number of patients, and there was not enough evidence of improvements in other important measures, such as those related to survival, breathing, and muscle strength. When patients in the placebo group were later switched to RADICAVA, there was no noticeable effect.

Given the clear need for further evidence of RADICAVA’S effectiveness, the committee considered the possibility of conditional approval, which would allow the company to provide more data later. The company proposed a registry study whereby patients treated with RADICAVA could be compared with patients who previously received other treatments for ALS. However, on May 24, 2019, Mitsubishi Tanabe Pharma GmbH notified the CHMP that it desired to withdraw its application for a marketing license for Radicava to treat ALS.

Even though RADICAVA is not authorized in the European Union. It is worth noting that the drug was formally accepted as compassionate therapy for ALS by the Italian Medicines Agency (AIFA) in July 2017. Since then, the drug has been used as compassionate therapy in Italy.

Mitsubishi attempts to retain RADICAVA sales with a new formulation

In 2017, RADICAVA generated a revenue of USD 107 million (JPY 12.3 billion) and was a major contributor to the overall revenue of Mitsubishi. By the end of August 2018, the number of patients treated with RADICAVA had surpassed 3,000, and marketing authorizations were subsequently granted in Canada (October 2018), Switzerland (January 2019), China (July 2019), Indonesia (July 2020), and Thailand (April 2021).

According to Mitsubishi, when RADICAVA is used outside of Japan, it is utilized in a medical setting that is different from that in Japan, and as a result, vigilance in safety management is required. In FY2015, the company last reported its revenue of JPY 7.3 billion. After that, no revenue estimates in the domestic region are available for RADICUT.

On analyzing the combined worldwide sales of RADICAVA through the years, we observed that the drug’s overall sales had declined since its initial launch, and a further decline is expected in the coming years. The sales have been gradually falling, with a revenue of about USD 190 million in 2020 and USD 160 million in 2021, including the US, Japan, and China. Among the factors responsible for this decline is the NHI drug price revision in Japan, the difficulties the patients face in administering the drug, as well as entry of RADICUT generics in Japan. A key limitation of RADICAVA is its IV administration. This requires patients to visit an infusion center, which may be difficult for patients suffering from mobility issues and thus could result in patients being unwilling to start therapy.

To overcome this issue, Mitsubishi developed RADICAVA oral suspension called RADICAVA ORS, which was recently approved in May 2022 in the United States and is currently under review in Japan. This oral administration would overcome many of the risks, burdens, and logistical challenges of the intravenous administration of edaravone. RADICAVA ORS will be much simpler to administer than the present form of intravenous drip infusion, broadening the spectrum of patient eligibility and addressing unmet medical requirements while boosting the value of the therapy.

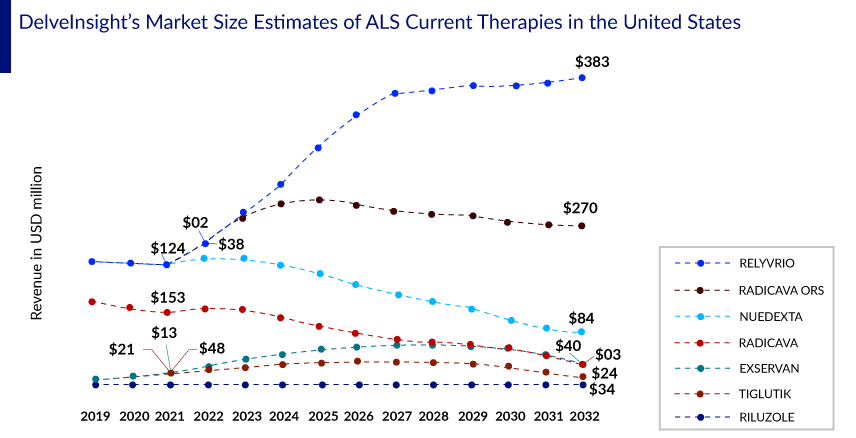

We believe that the sales revenue of IV RADICAVA will decrease due to the introduction of an oral version of RADICAVA in the United States and Japan. However, Mitsubishi Tanabe’s development of RADICAVA ORS is a significant strategy for extending the drug’s life cycle, as the IV formulation’s patent expires in 2024.

DelveInsight estimates that RADICAVA ORS is expected to achieve approximately USD 370 million by 2032, including the seven major amyotrophic lateral sclerosis treatment markets and China, wherein the chances of getting launched in Europe remain uncertain.

What do we know about this new drug, RELYVRIO?

In September 2022, the FDA approved Amylyx Pharmaceuticals’ AMX0035, a coformulation of sodium phenylbutyrate-taurursodiol, for treating ALS. The drug, marketed as RELYVRIO, became the third approved therapy to help slow disease progression or mortality in ALS. Additionally, the European Medicines Agency (EMA) is reviewing the company’s marketing authorization application for AMX0035 for treating ALS in Europe.

Approved under the accelerated approval pathway, the regulatory journey for AMX0035 has been unique. Less than a month ago, the FDA’s Peripheral and Central Nervous System Drugs Advisory Committee (PCNSDAC) did an about-face, voting 7–2 (7 yes; 2 no) in favor of recommending the therapy for FDA approval after previously voting against it back in March 2022, citing doubts in the drug’s efficacy.

Even though the FDA did not yet approve AMX0035, its manufacturer had not announced what the treatment’s US price would be; the Institute already criticized it during the Clinical and Economic Review (ICER). The organization stated that if priced similarly to IV edaravone at approximately USD 169,000 per year, the incremental cost-effectiveness of AMX0035 would far exceed typical cost-effectiveness thresholds. However, Amylyx has decided to price RELYVRIO below the latest FDA-approved product available to people with ALS. Amylyx also announced that it would provide patients support through the Amylyx Care Team (ACT) Support Program.

The ALS Association is also celebrating RELYVRIO approval. Since the Association invested USD 2.2 million of funds raised through the 2014 ALS Ice Bucket Challenge into the development and trial of AMX0035 and led the years-long advocacy campaign that pushed the FDA to approve the treatment before completion of an ongoing Phase III trial.

Why did the advisory committee vote against approving RELYVRIO earlier?

In March 2022, the PCNSDAC voted (4 yes and 6 no votes) against RELYVRIO, stating that the data did not establish a conclusion regarding RELYVRIO’s effectiveness. Some of the committee members expressed concerns over the robustness of the AMX0035’s data, while others felt the ALSFRS-R scores for those in the placebo group were high, potentially altering the perception of the findings. In early September 2022, the advisory committee voted (7 yes and 2 no votes) and announced that the available evidence of effectiveness is sufficient to support the approval of AMX0035. On September 29, the FDA fully approved the drug.

As per DelveInsight’s estimates, RELYVRIO is expected to capture a market size of approximately USD 560 million by 2032 in the seven major markets and China.

What is expected from the ALS treatment market in the future?

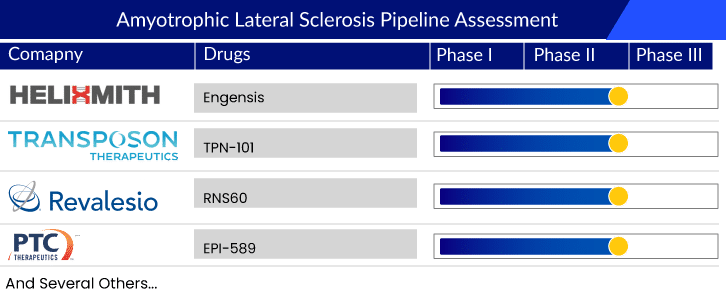

Overall, the current ALS treatment market consists of approved therapies such as riluzole formulations, RADICAVA, and RELYVRIO. NUEDEXTA, on the other hand, is a symptomatic treatment and does not affect reducing the disease progression. The ALS pipeline possesses various promising mid- and early-phase therapies like RNS60 (Revalesio Corporation), EPI-589 (PTC Therapeutics), AT-1501 (Eledon Pharmaceuticals), AP-101 (AL-S Pharma), ANX005 (Annexon), Pegcetacoplan (Apellis Pharmaceuticals), PrimeC (NeuroSense Therapeutics), and BIIB078 (Biogen). Although the pipeline holds multiple promising amyotrophic lateral sclerosis therapies in various stages of development, the history of drug development in ALS has seen many ups and downs and multiple trial failures. It has been quite a challenge to understand the pattern and speed of ALS progression, which differ significantly from patient to patient. What compounds the problem is the fact that the patients do not have enough time to survive after they get diagnosed with the disease.

Nevertheless, the current pipeline holds great potential as it contains symptomatic ALS treatments and therapies targeting specific mutations, which could help fulfill the unmet treatment needs of ALS patients. Overall, the increasing prevalence of amyotrophic lateral sclerosis, along with the promising emerging pipeline therapy with new mechanisms of action, will fuel the disease market.

DelveInsight’s forecast, which includes the estimated launch of 20+ emerging amyotrophic lateral sclerosis therapies and the above-mentioned current therapies, we expect the ALS treatment market to reach more than USD 6 billion in the 7MM and China by 2032.

FAQs

Amyotrophic Lateral Sclerosis (ALS), also known as Lou Gehrig’s disease, is a rare neurological disease that primarily affects the nerve cells (neurons) that control voluntary muscle movement. Voluntary muscles are responsible for movements such as chewing, walking, and talking.

The exact amyotrophic lateral sclerosis causes are not known, and it is also unknown why some people are affected while others are not. Scientific evidence, on the other hand, suggests that both genetics and environment play a role in the development of ALS.

The signs and amyotrophic lateral sclerosis symptoms vary greatly depending on which neurons are affected. It usually starts with muscle weakness that spreads and worsens over time. The common amyotrophic lateral sclerosis symptoms include cognitive and behavioral changes, clumsiness, trouble swallowing, muscle cramps, and others.

There is no single test that can provide a definitive amyotrophic lateral sclerosis diagnosis. ALS is primarily diagnosed based on a detailed history of amyotrophic lateral sclerosis symptoms and signs observed by a physician during a physical examination, as well as a battery of tests to rule out other diseases that mimic ALS.

The approved drugs for amyotrophic lateral sclerosis treatment include RILUZOLE, RADICAVA, TIGLUTIK, EXSERVAN, and RELYVRIO. Currently, there is no cure for ALS and no effective treatment to halt or reverse the progression of the disease. The mainstay of ALS treatment is symptom management and palliative care.

-Agonist.png)