Over the past decades, there has been an eruption in understanding treatment strategies of gliomas with the development of clinical immunotherapy, providing exceptional success in employing checkpoint inhibitors and cancer vaccines as treatment options that have given significant momentum to the growth of the GBM market. The pre-existing treatment includes complete resection followed by radiotherapy and pharmacological treatment with chemotherapeutic agents, such as temozolomide – a major type of high-grade glioma.

Avastin (bevacizumab) is approved in the GBM market in adult patients whose cancer has progressed after prior treatment (recurrent or rGBM). In September 2009, the US Food and Drug Administration (FDA) granted accelerated approval of Avastin for people with rGBM, followed by its full approval in December 2017; since then, Avastin remains the standard of care in refractory GBM. Although Mvasi (bevacizumab-awwb, Amgen) was the first Avastin biosimilar to get FDA approval in 2017, Zirabev proved to be a better biosimilar for GBM patients when launched in 2019.

GBM Failure Stories: Missing Clinical Trial Endpoints

The development of new drugs for this hard-to-treat disease is a slow and incremental process. Most of the investigational medications for GBM hit a snag before even entering the GBM therapeutics market as the rate of successfully achieving their primary endpoints remains extremely low. Bristol Myers Squibb (BMS) witnessed one such failure in 2019 as the company had to shelve its approval plans for Opdivo (nivolumab) due to its inability to meet the primary endpoint in Phase III CheckMate-498 trial.

Additionally, Tocagen’s Toca 5 trial evaluating gene therapy and prodrug combination of Toca 511 and Toca FC (Phase II/III) in recurrent GBM failed to improve overall survival (OS). As it happened, the patients in the study group did worse than those in the control group. Such failures are not new to GBM drug development. Adopting a conservative approach, we are sceptical about the future of several investigational therapies; however, we still count on these therapies to accomplish the needful.

Pharma companies’ Showing Glimmers of Promise in GBM Market

The key pharma players engaged in developing novel therapeutic modalities for GBM include VBL Therapeutics, Diffusion Pharmaceuticals, Bayer, MedImmune, Oncoceutics, Karyopharm Therapeutics, Kazia Therapeutics, Aivita Biomedical, Medicenna Therapeutics, DelMar Pharmaceuticals, Immunomic Therapeutics, Ziopharm, Kintara Therapeutics, Inovio Pharmaceuticals, and several others. The overall market size of GBM in the 7MM (the US, EU5 countries, and Japan), following the launch of a few of many emerging therapies, is likely to reach 1,083 million by 2023.

The target pool for most of these medications is a mix of newly diagnosed and recurrent GBM patients. Most of these are targeted therapies inhibiting specific molecular targets, including EGFR (epidermal growth factor receptor), mTOR (mammalian target of rapamycin), PI3K (phosphatidylinositol 3-kinase), VEGF (vascular endothelial growth factor), and XPO1 Inhibitor (Exportin 1).

A few of the prospective emerging therapies are as follows:

VBL Therapeutics’s VB-111 displayed significant survival (414 vs. 223 days) and progression-free survival (PFS) advantage (90 vs. 60 days) compared to a cohort of patients that had limited exposure to VB-111. The drug has been rewarded fast track designation by the US FDA to prolong survival in patients with rGBM. Currently, the drug has completed the Phase III stage of clinical development for patients with rGBM and is expected to enter the GBM market in 2023. In addition to VBL’s potential gene therapy, Bayer’s Stivarga is also being evaluated in a Phase III cohort under the GBM Global Coalition for Adaptive Research (GCAR) Agile study. GBM AGILE is an international, innovative platform trial designed to more rapidly identify and confirm effective therapies for patients with GBM through response adaptive randomization and a seamless Phase II/II design.

Excitingly, in January 2021, GBM GCAR Agile study included Kazia therapeutics’s paxalisib and Kintara therapeutics’ VAL-083 in its revolutionary patient-centred, adaptive platform. While Kintara is thrilled to be the first investigational drug selected for newly diagnosed methylated GBM in the study, considering the positive interim Phase II results of Kazia therapeutics’s paxalisib,we have high expectations with this mTOR/PI3K inhibitor.

Oncoceutics’s ONC201 is being explored in patients with rGBM, H3 K27M-mutant glioma, and diffuse midline glioma, with its expected presence in the GBM market by 2024. As per DelveInsight, High-grade Glioma (HGG) Market analysis, the market size of HGG in the 7MM is expected to be 1,342 million in 2021. The report also provides a detailed analysis of the epidemiology and market size of HGGs, along with the incidence of grade III anaplastic astrocytoma and diffuse midline glioma (earlier known as DIPG) in adult and childrenin the 7MM countries.

Additionally, Ziopharm also presented its Phase II positive results evaluating IL-12 along with a PD-1 inhibitor for GBM.

What are the prevailing unmet needs?

Given the tremendous unmet need in the GBM market, therapies able to extend OS, including immunotherapies, novel vaccines, and immune checkpoint inhibitors, could provide a valuable treatment option for GBM patients who do not respond to or experience a recurrence of their disease following conventional therapy. Unfortunately, limited therapeutic access to a brain tumor and peritumoral tissue caused by the blood-brain barrier (BBB) still offers a challenge to optimize glioma treatment, despite such efforts.

Sadly, there are issues with the standard clinical trial model, enabling them to deliver new and improved treatments to patients facing a GBM diagnosis. Most GBM patients are usually not expected to remain alive while a single drug is getting tested. Efforts to bring any one particular new product to the GBM market may last more than 8 years, cost hundreds of millions of dollars per treatment tested, require an enormous amount of devotion and leave us no closer to a cure than when the process had all started.

The Era of Personalized Cancer Vaccines

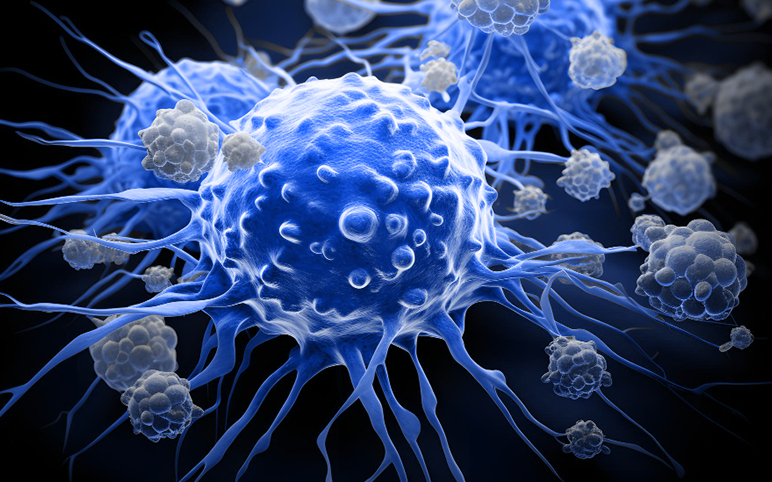

Vaccines engender a beacon of hope amidst the washout of various drug prospects in achieving clinical endpoints in this tough-to-treat indication. Few companies have established data to prove that vaccines targeted against tumour-specific mutations might be a successful way to leverage the immune system against cancer and that even tumors in the brain might be treatable. VBL Therapeutics’s VBI-1901, Aivita Biomedical’s AV-GBM-1 and Immunomic Therapeutics’s and Lineage Cell Therapeutics’s pp65 DC Vaccine are few active companies and their drug candidates.

During the recent American Association for Cancer Research (AACR) in April 2021, Immunomic Therapeutics announced its worldwide license and development collaboration agreement with Lineage Cell Therapeutics on the clinical development of a novel VAC product candidate for GBM. Previously the company had published Phase II results of ITI-1000 (pp65 DC vaccine) and remains quite optimistic about its CMV-Specific Dendritic Cell Vaccines. Its optimism is based on its approach of harnessing the body’s immune system to recognize, attack and destroy tumor cells that express CMV, over-expressed in GBM.

Recently, another dendritic cell personalized cancer vaccine, AV-GBM-1, also demonstrated an improvement in PFS in patients with newly diagnosed GBM in its Phase II trial. Aivita Biomedical considers its PFS of 10 months as a significant victory against GBM. However, the company is expected to submit more data from late-phase trials to establish complete efficacy in the future.

Although cancer vaccines are expected to boost the oncology sector and, as a consequence GBM market as well in the coming years, when it comes to GBM, we still need to wait for robust efficacy data in high stage trials improving survival. Also, the difficulty of producing and harvesting enough vaccine cannot be ignored, which will diminish its ultimate availability for clinical usage.

Value Addition by Devices

In addition to these pharmacological interventions, oncologists have started relying on the FDA approved wearable and portable device Optune, which has marked a significant advancement in GBM treatment by adding months and sometimes years to these patients’ lives since its initial approval in 2011. Initially, Optune was approved for patients whose GBM had recurred or progressed after chemotherapy. However, later in 2015, the FDA broadened the approval to newly diagnosed patients too.

Considering that the prognosis of GBM remains poor, with a median survival of about 15 months, there are few patients whose possibility of living beyond 5 years is doubled or tripled with the usage of this device, which is good news for cancer that is difficult to tame. Although GBM’s clinical development has witnessed many stumbling blocks, it has still managed to come a long way.

-Agonist.png)