Recent years have been experiencing a dramatic increase in the number of Hepatitis D cases. It is spreading at a rapid rate. DelveInsight estimated that the total diagnosed Hepatitis D prevalence was reported to be 204,976 in 2017 in the 7MM (the US, EU5 (the UK, Germany, Spain, France, and Italy) and Japan). Further, the Hepatitis D epidemiology forecast estimates that the prevalence is expected to increase significantly in the foreseeable future.

Hepatitis D is a liver infection caused by the Hepatitis D virus (HDV). HDV infection can be acute or lead to chronic, long-term illness. It can cause liver inflammation, which sometimes progresses to serious liver damage, liver-related death, and hepatocellular carcinoma. HDV is nothing but a defective RNA virus, a satellite of the helper Hepatitis B virus (HBV) that needs the HBsAg of the hepatitis B virus (HBV) for virion assembly, release, and transmission. In simple terms, it can only infect only those who are already infected by the hepatitis B virus (HBV). Therefore, it becomes necessary for the chronic Hepatitis B patient pool to get screened for HDV infection.

As per the data presented by the WHO, Hepatitis D virus affects nearly 5% of people who have a chronic infection with hepatitis B virus worldwide. HDV-HBV coinfection is considered the most severe form of chronic viral hepatitis due to more rapid progression towards liver-related death and hepatocellular carcinoma. The infection can be acquired either altogether with HBV as a co-infection or as a super-infection in people who are already chronically infected with HBV. However, for those who get infected by HDV, one of the few treatment options is the off-label drug interferon, which arms the immune system against viruses.

The treatment goal of Hepatitis D is to suppress viral replication in the initial stages. The current treatment strategies for HDV primarily include interferon (IFN)-based therapy. The therapy leverages standard or pegylated IFN alpha (PegIFN-α). PegIFNa is the only available drug that has shown some antiviral efficacy against chronic HDV infection. It has been observed that interferons may prove to be effective during the early stages of infection; however, they are rendered useless if HDV, after invading hepatocytes, has established intracellular hepatocyte infection. Antiviral therapy with interferon alfa can also be considered in patients with chronic hepatitis D virus (HDV) infection. The treatment course is usually at least one year. However, in cases where the disease has advanced to cirrhosis, liver transplantation appears to be the only viable option.

Unquestionably, considerable advances have been made to advance the treatment of Hepatitis D in the past decades. The Hepatitis D therapeutic market offers limited options that lack optimal treatment options. The treatment of acute Hepatitis D is not yet available. Specific therapies for HDV infection are not approved; and the standard of care for chronic infection is 48 weeks of pegylated interferon alfa, which is associated with clearance of HDV RNA in around 25% of patients and long-term relapses are likely to occur. Interferon normally suppresses the hepatitis delta virus temporarily; however, the drug can have unpleasant side effects, such as nausea and headache. The ideal treatment endpoint, which is the eradication of both HDV and its helper HBV, still remains unachievable and a huge challenge in Hepatitis D treatment. Thus, the Hepatitis D therapeutic market is in dire need of standard, specific, and effective curative treatment.

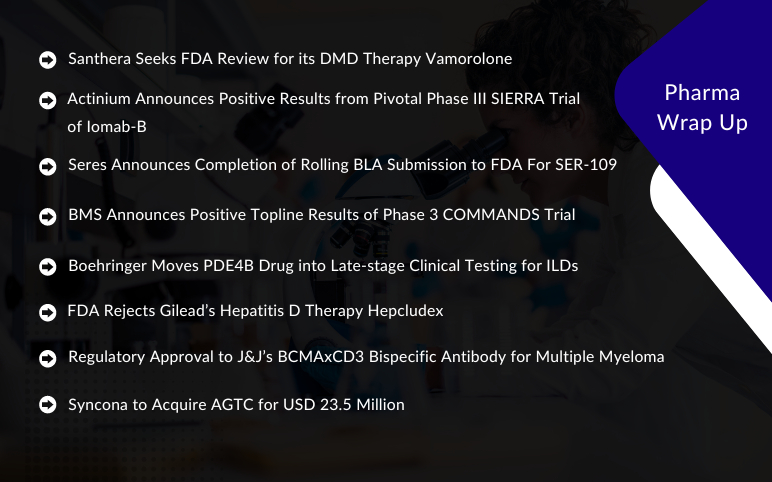

The present Hepatitis D market homes several pharmaceutical companies that are exploring the waters in the domain. MYR Pharmaceuticals, Eiger Biopharmaceuticals, Janssen Pharmaceuticals, and several others are exploiting novel molecules and therapeutic approaches to advance the treatment market of Hepatitis D. Recently, the Europe commission approved Bulevirtide (brand name Hepcludex) for the treatment of Hepatitis D after decades of research and trials. Developed by MYR Pharmaceuticals/Hepatera, it is the first therapy to receive approval in Europe and has been granted Conditional Marketing Authorization (CMA) for the treatment of HDV. It works as an entry inhibitor and prevents HDV cells and the HBV cells from entering healthy liver cells. Eiger Biopharmaceuticals is also leading a program developing Lonafarnib, a first-in-class prenylation inhibitor, boosted with ritonavir, for the treatment of Hepatitis Delta Virus (HDV) infection. Currently, the pivotal phase III D-LIVR study (NCT03719313) is ongoing and enrolling patients. The company plans to complete enrollment in 2020. The second molecule the company is putting its faith into is Peginterferon Lambda (Lambda), a well-characterized, late-stage, first in class, type III interferon (IFN) being developed as better-tolerated interferon. Janssen Pharmaceuticals is also investigating JNJ-73763989 (aka JNJ-3989), a liver-targeted antiviral therapeutic for subcutaneous injection via ribonucleic acid interference mechanism. Currently, the company is conducting phase II (NCT04535544), a multicenter, randomized, double-blind, placebo-controlled study to evaluate the safety and efficacy of JNJ-73763989 in HBV infected patients who are co-infected with HDV.

Several novel compounds are under different stages of a clinical trial as a treatment option for Hepatitis D. Significant advances have been and are being made in the chronic viral Hepatitis D market over the past decade. While major leaps have been taken in the treatment market of Hepatitis B and C, targeting HDV, to date, poses a huge concern owing to the unconventional nature of this virus along with the severity of its disease. Thus, there is a need for a better pathophysiological understanding of the virus and disease course. Further, better diagnostic tools and methodologies at affordable prices shall help in better diagnosing rate. Overall, medical advancements, a firm devotion to eliminating the chronic HBD viral infection from its root, pharma companies developing robust pipeline therapies are going to add considerably to the Hepatitis D market growth in the next coming years.

-Agonist.png)