Table of Contents

Rheumatoid Arthritis (RA) is a chronic, inflammatory autoimmune disease that leads to progressive and destructive polyarthritis and affects approximately 1% of the population. It is characterized by chronic pain and joint destruction that usually progress from distal to more proximal joints.

DelveInsight estimates that the rheumatoid arthritis population in the 7MM is estimated to be 4.7 million in 2022, adding a considerable number of patients seeking treatments, making it a billion-dollar therapeutic area.

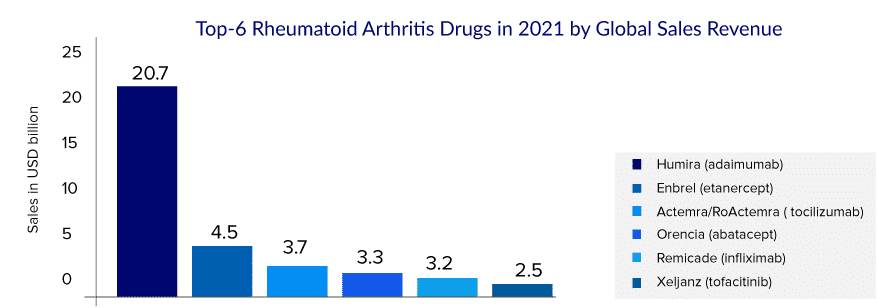

Furthermore, to understand how big the market opportunity lies in this autoimmune segment, six of the top 50 bestselling medications worldwide are now being used to treat rheumatoid arthritis. Large-cap pharmaceutical and biotech firms such as AbbVie, Amgen, Roche, Pfizer, Johnson & Johnson, and Bristol Myers Squibb dominate the market. Some of these pharmaceutical behemoths have also safeguarded their assets with strong patents, preventing biosimilars and generics from entering the market.

Over the past few years, a dramatic improvement in outcomes of rheumatoid arthritis has been observed due to the direct consequence of paradigm shifts in the treatment. Conventional DMARDs (csDMARDS) and methotrexate (MTX) are part of the first treatment strategy. Methotrexate remains the anchor drug in rheumatoid arthritis; its usage as monotherapy is also the basis for combination therapies with other csDMARDs, biologics DMARDs (bDMARDs), and targeted synthetic DMARDs (tsDMARDs). Patients refractory to csDMARDS or with severe symptoms are usually treated with a wide variety of DMARDs classes like anti-TNF, T-cell inhibitors, B-cell inhibitors, interleukin inhibitors, and targeted synthetic DMARDs like JAK inhibitors. It is worth mentioning that, in rheumatoid arthritis, the US FDA has become more cautious about eliminating agents that could result in many complications and deaths.

Will the Expiring Patent of HUMIRA Give an Upper Hand to Competitors?

HUMIRA, AbbVie’s flagship product, is a classic example of maintaining a market monopoly for an extended period. This product has been a golden goose for AbbVie since its first approval. However, AbbVie’s concerns began after HUMIRA’s patent protection lapsed internationally. The primary patent in the United States and Europe expired in 2016 and 2018, respectively. Owing to HUMIRA’s popularity and buzz among physicians, several adalimumab biosimilars have been approved (the US, the EU-5, and Japan) and launched (the EU-5 and Japan). Introducing biosimilars has significantly affected HUMIRA’s sales in Europe and Japan.

Despite losing its core patent, AbbVie is expected to maintain its monopoly in the United States until 2023 by leveraging additional patents and establishing multiple agreements with biosimilar producers, preventing market competition. However, the debut of several biosimilars against one of the world’s best-selling medications by 2023 will likely reduce AbbVie’s sales revenue in the United States.

Amgen’s ENBREL (etanercept) is another blockbuster that has circumvented market competition by having long-term patent protection and winning the war of several patent disputes. ENBREL’s primary patent in the United States expired in October 2012, and patents in Europe expired in February 2015.

Many biosimilars are authorized in Europe and Japan. The US FDA also approved biosimilars of ENBREL; however, Amgen successfully kept its copycats off the pharmacy shelves due to its strong patent portfolio and by winning patent challenges. ENBREL’s exclusivity will be maintained by 2029, and this product will enjoy more than 30 years of exclusivity in the United States.

HUMIRA’s knockoffs are expected to hit the US market by 2023; therefore, the company is already devising measures to compensate for the revenue loss. RINVOQ, AbbVie’s Janus kinase inhibitor (JAKi), was approved in 2019 to treat rheumatoid arthritis. Furthermore, SKYRIZI is expanding in the autoimmune domain to compensate for any decline in AbbVie’s profits. With this multifaceted route, AbbVie is adopting a more secure strategy for the company’s growth. RINVOQ and SKYRIZI are excelling in their respective authorized domains. RINVOQ has only been on the market for a few years, yet, it has already taken a sizable share of the patient market. The product is also giving tough competition to Pfizer’s XELJANZ.

DelveInsight analysts estimate that if RINVOQ continues to leverage the rheumatoid arthritis field similarly, it will potentially become one of AbbVie’s most valuable assets over the next decade. The company expects that SKYRIZI and RINVOQ will have the same impact as HUMIRA in the upcoming years.

In 2006, the European Medicines Agency (EMA) became the first regulatory agency to approve biosimilars and provide biosimilar guidance documents. The HUMIRA and ENBREL case proves several gaps in the United States market and has trailed behind Europe in biosimilar expansion and adoption. In recent years, Europe’s considerably higher approval rating has widened its advantage over the United States. Patents of blockbuster therapies are likely to expire in the coming years. Companies wanting to join the rheumatoid arthritis market may have a commercial opportunity to fetch patients access to key drugs at a reasonable cost.

Rheumatoid Arthritis Emerging Therapies in Development

Companies like GlaxoSmithKline, Taisho Pharmaceuticals, R-Pharm, Pfizer, Cyxone, Istesso, Abivax, Gilead Sciences, Aclaris Therapeutics, and many others are evaluating their lead assets for rheumatoid arthritis.

GSK’s otilimab is the first-in-class GM-CSF antibody currently being investigated in Phase III. The company anticipates that Phase III results will be available by the end of 2022. Although the earlier Phase II study of otilimab failed to fulfill its primary goal, the findings show superiority in CDAI (clinical disease activity index) and pain. The current work is intriguing since the Contrast 3 trial is against IL-6. There are also two further trials, Contrast 1 or 2 versus content to add methotrexate. The results of the Phase III study would indicate its position in the rheumatoid arthritis therapeutic landscape. Because this medicine reduces pain, which patients accept and prefer, it may not win widespread physician acceptance.

In Japan, ozoralizumab (next-generation anti-TNF nanobody) is being tested for rheumatoid arthritis. The corporation has already submitted the NDA. R-Pharm’s Olokizumab is already on the market in Russia and another Eastern European country under the brand name Artlegia. The firm intended to start filing in the US, EU, and globally; however, there is uncertainty about its future in the 7MM. Talking about its clinical safety and efficacy, the most recent Credo 1, 2, and 3 studies have demonstrated clinical and physical improvements for individuals with rheumatoid arthritis who had insufficient responses to methotrexate and inhibitor treatment. CREDO1 results reveal that six months of therapy with Olokizumab significantly improves disease activity and physical performance in patients currently taking methotrexate for rheumatoid arthritis. Olokizumab plus methotrexate was not shown to be inferior to adalimumab plus methotrexate in CREDO2. That has not been demonstrated with tocilizumab or sarilumab. Tocilizumab and sarilumab were studied in comparison to adalimumab monotherapy.

In 2022, Cyxone plans to begin a Phase IIb trial of rabeximod. This asset was previously studied for Covid-19. However, its Phase II results in COVID-19 were disappointing due to a lack of statistical significance. As of now, the company is focused on rheumatoid arthritis. The company had already completed a Phase IIa study in rheumatoid arthritis and had not published any data related to rheumatoid arthritis. It has a unique mechanism of action, a convenient RoA, and a favorable tolerability profile (per the company).

In June 2021, Abivax announced the results of the Phase IIa induction clinical study of ABX464 conducted on 60 patients. The primary endpoint of this study was achieved, demonstrating good tolerance of the 50 mg dose of ABX464 administered once daily during the 12 weeks of induction treatment. Although the sample size of this study was not planned to show a significant difference in the efficacy endpoints, the 50 mg group was found to be statistically superior to the placebo on the key secondary endpoint (ACR20) at Week 12 for the per-protocol population. In March 2022, Abivax reported data from the Phase IIa maintenance study in rheumatoid arthritis after 1-year treatment. Of the 40 patients, 23 have completed the first year of treatment (as of February 28, 2022), and all have achieved at least an ACR20 response, with 19 and 12 patients had achieved an ACR50 and ACR70 response, respectively. Phase IIb study is being considered and initiated depending on the resources and funding availability. It is worth mentioning that ABX464 has demonstrated promising outcomes in ulcerative colitis. And unlike JAKi, TNF-a, and ILs, where multiple candidates are being investigated/approved and competing for market share, ABX464 is the only medicine currently being examined with this mechanism of action. The company is planning to present ABX464 findings in the EULAR 2022.

Zunsemetinib (ATI-450) from Aclaris Therapeutics is another important rheumatoid arthritis contender. Zunsemetinib is a new oral MK2 inhibitor that has outperformed JAK inhibitors in efficacy and safety during the Phase II trial. The oral mode of administration is more convenient than biological DMARDs. The results of Phase II reveal that zunsemetinib has a clean safety profile, with no major side events like infection, VTE, or PE, which plagued standard-of-care medicines like TNF-a and JAKi.

Pfizer is researching PF-06650833, as well as Ritlecitinib, for rheumatoid arthritis. PF-06650833 is a novel drug (Interleukin-1 Receptor Associated Kinase 4 Inhibitor); some adverse events were identified in the research; effectiveness was satisfactory. Regarding ritlecitinib, another JAK inhibitor, the PII safety, and effectiveness results seem promising. The company is conducting another Phase II research, along with rheumatoid arthritis; this asset has shown promising benefits in a late-stage investigation of alopecia areata. Because it is a JAK inhibitor, it may have a more difficult route to approval than predicted due to increased safety concerns. However, management is confident that its assets provide a favorable risk/benefit profile.

Recent Developments

- In July 2022, Enosi Therapeutics announced a partnership with Danuo Science Group, based in Hong Kong, to further develop two products currently in Enosi’s pipeline for Greater China. Enosi’s Growth Factor Trap (EN-2000 Program) and TNFR1 Blocker (EN-1000 Program) were licensed as part of the partnership. Both programs can potentially be used as cross-over drugs to treat cancer and autoimmune diseases. EN-2000 blocks inflammatory growth factors that drive cancer and rheumatoid arthritis, while EN-1000 is a specific blocker of TNFR1, which Enosi believes may be useful in treating autoimmune disease.

- In February 2022, Biogen Inc. and Xbrane Biopharma AB announced that they have entered into a commercialization and license agreement to develop, manufacture, and commercialize Xcimzane™, a preclinical monoclonal antibody that is a proposed biosimilar referencing CIMZIA® (certolizumab pegol).

- In June 2022, Biogen Inc. and Bio-Thera Solutions, Ltd. presented positive Phase III data for BIIB800 (BAT1806), a biosimilar candidate referencing. The double-blind 52-week Phase III study randomized 621 patients with moderate to severe rheumatoid arthritis to receive either BIIB800 or the reference tocilizumab administered intravenously every 4 weeks at a dose of 8 mg/kg for the first 24 weeks. Data from the Phase III comparative clinical trial demonstrated that the investigational biosimilar candidate BIIB800 has equivalent efficacy and comparable safety and immunogenicity profile to the reference tocilizumab product.

- In June 2022, Revolo Biotherapeutics announced that it was awarded an Innovative Medicines Designation, or Innovation Passport, from the Medicines and Healthcare products Regulatory Agency (MHRA) for its immune-resetting drug candidate, ‘1805, for the treatment of patients with moderately to severely active Rheumatoid Arthritis (RA). In February 2022, Revolo Biotherapeutics secured approval from the UK Medicines and Healthcare products Regulatory Agency (MHRA) to initiate two Phase II trials of its autoimmune disease drug candidate ‘1805. One of the trials will enroll moderate-to-severe active rheumatoid arthritis (RA) patients, while another Phase II trial will have individuals with non-infectious, active, intermediate, or posterior uveitis or panuveitis.

- In December 2021, Theramex, entered into an agreement with Enzene Biosciences Limited to develop, register, and commercialize a biosimilar drug of Roche’s reference medicine RoActemra (Tocilizumab). Tocilizumab, in combination with Methotrexate (MTX), is indicated for the treatment of rheumatoid arthritis. It is planned to be commercialized in 2026 in Europe, the UK, Switzerland, and Australia.

Conclusion

Rheumatoid arthritis therapies have garnered positive and negative attention from medical and political parties. Still, there is no denying that rheumatoid arthritis is a massive market with commercial potential if adequately addressed. If TNF-alpha inhibitors do not work, rheumatologists will move patients to another treatment option. The rising trend of switching after one agent may also continue. The current domination of TNF-alpha inhibitors suggests that rheumatologists are comfortable with them, owing to their favorable long-term safety and physician familiarity. New therapies entering the rheumatoid arthritis market will be assessed against these comparators. They must demonstrate better safety and efficacy benefits to be regarded in the same line of treatment as TNF-alpha inhibitors. It is worth noting that some of the blockbuster drugs for rheumatoid arthritis are already facing biosimilar competition, and few will soon face patent expiration/protection, affecting current patients’ share of existing therapies, particularly in European countries where biosimilar acceptance is higher. In addition, with a negative opinion against JAK inhibitors in the United States, key players may focus more on the major European market, where the attitude toward JAK inhibitors is different, at least for the time being.

FAQ

Rheumatoid arthritis (RA) is a chronic, inflammatory autoimmune disease that leads to progressive and destructive polyarthritis and is characterized by chronic pain and joint destruction that usually progress from distal to more proximal joints. RA is the result of an immune response in which the body’s immune system attacks its own healthy cells, and the specific causes of RA are still unknown.

Rheumatoid arthritis is caused by autoimmunity when the body is unable to differentiate between non-self cells. The immune system attacks joints and causes inflammation and degeneration of cells.

RA is a chronic disease that causes joint pain, stiffness, swelling, and decreased movement of the joints. Small joints in the hands and feet are most affected. Sometimes RA can affect other organs, such as the eyes, skin, or lungs.

RA is diagnosed by a combination of the patient’s symptoms, results of the doctor´s examination, assessment of risk factors, family history, a joint assessment by ultrasound sonography, and assessment of laboratory markers such as elevated levels of CRP and ESR in serum and detection of RA-specific autoantibodies.

Large-cap pharmaceutical and biotech firms such as AbbVie, Amgen, Roche, Pfizer, Johnson & Johnson, and Bristol Myers Squibb dominate the Rheumatoid Arthritis therapeutics market. Moreover, to further improve the treatment scenario and strengthen their most in the market, companies like GSK, Taisho Pharmaceutical Holding Co Ltd, R-Pharm, Cyxone, Istesso, Abivax, Gilead Sciences, Aclaris Therapeutics, Inc. Therapeutics, and many others are evaluating their lead assets for Rheumatoid Arthritis.

-Agonist.png)