Table of Contents

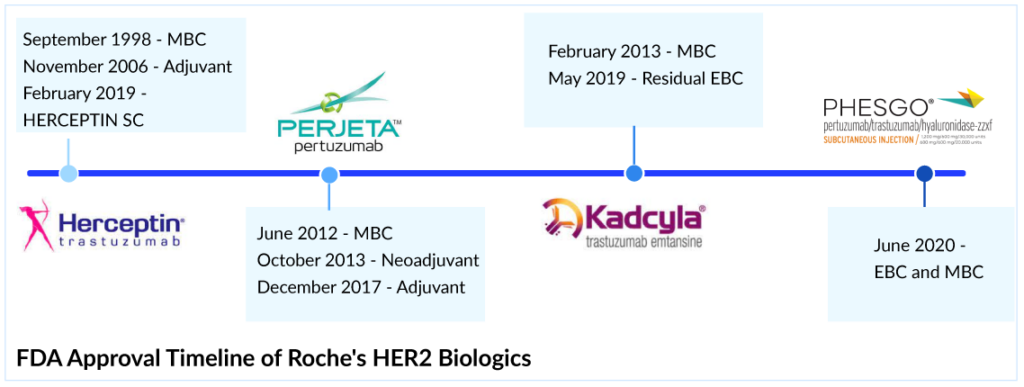

For most of the last century, breast cancer was categorized only by its location in the body; as a result, treatment results varied significantly. Patients with metastatic HER2+ breast cancer were traditionally treated with conventional chemotherapy regimens until trastuzumab became available. In September 1998, the FDA approved Roche and Genentech’s breast cancer therapy, HERCEPTIN, as a treatment regimen containing doxorubicin, cyclophosphamide, and paclitaxel, for the adjuvant treatment of HER2-positive node-positive breast cancer. Later in 2000, the European authority and 2001, the Japanese Ministry of Health, Labor and Welfare approved HERCEPTIN in metastatic HER2-positive breast cancer.

In many regards, the approval of HERCEPTIN marked a turning point in HER2+ breast cancer treatment. HERCEPTIN was the first targeted treatment for a solid tumor and the first drug to be paired with a companion diagnostic. By identifying patients with an improved risk–benefit profile, those patients gained critical time that would otherwise have been spent searching for a viable treatment.

Entry into the adjuvant setting

The approval of HERCEPTIN was certainly a milestone in the history of targeted cancer therapy, but the very best was still to come. In 2006, the FDA approved HERCEPTIN for the adjuvant treatment of HER2-positive breast cancer based on a significant 50% decrease in the risk of relapse and a 33% reduction in the risk of death. These landmark studies changed the lives of women with HER2-positive breast cancer. HERCEPTIN became the only approved targeted biological therapy for HER2-positive breast cancer treatment in adjuvant and metastatic settings. Later, pertuzumab was approved in 2017 for adjuvant HER2-positive breast cancer treatment, but it was to be used with trastuzumab, so HERCEPTIN had a significant opportunity to grab all the market share in the adjuvant setting. But the launch of the trastuzumab and pertuzumab combination shifted the market toward PHESGO; however, it helped Roche ward off the HERCEPTIN biosimilars.

The decline of Herceptin’s revenue after the biosimilar launch

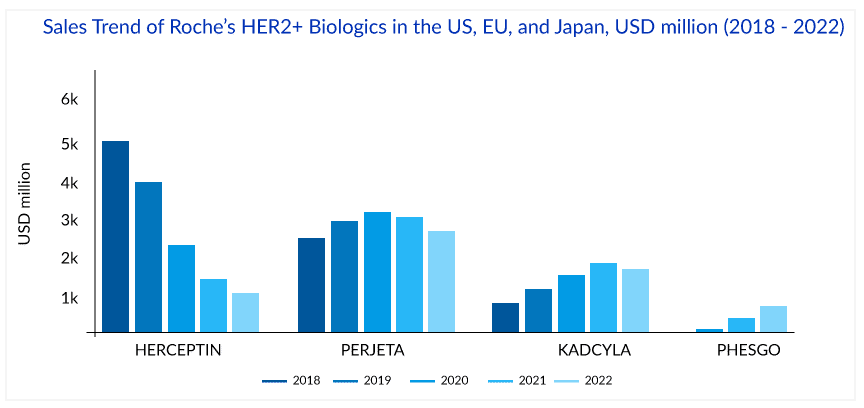

The success of HERCEPTIN has helped fuel Roche’s revenue with ~USD 7 billion global and ~USD 3 billion, ~USD 1.75 billion, and ~USD 0.25 billion sales in the US, EU, and Japan, respectively, in 2018. But in the International region, biosimilar versions of HERCEPTIN have been launched in many countries, and this, together with the impact of regular price and volume changes, has led to a continuous decline in the sales of HERCEPTIN. The first HERCEPTIN biosimilar’s price was 15% lower than the HERCEPTIN in 2019. In 2022, the price of the fifth HERCEPTIN biosimilar was 58% lower than Herceptin in 2019. The cost of HERCEPTIN peaked at USD 89,706 in 2019; the addition of biosimilars to the market fell 29% to USD 63,592 in 2022. The mean unweighted biosimilar treatment cost is 40% lower than HERCEPTIN, at USD 38,173. HERCEPTIN generated ~USD 2.2 billion in sales globally in 2022, with 19% degrowth and 28%, 17%, and 28% degrowth regionally in the US, EU, and Japan, respectively.

HERCEPTIN Subcutaneous (SC) versus Biosimilars

In the US, the first biosimilar of HERCEPTIN was launched in July 2019; however, in Europe and Japan, the first biosimilar was launched in March 2018 and November 2018, respectively.But Roche did not stand by idly with increasing physician awareness and confidence in biosimilars, and took on a more active role to potentially combat biosimilar competition and launched a novel SC formulation of HERCEPTIN in the EU in 2013 and 2019 in the US. All approved HERCEPTIN biosimilars (KANJINTI, OGIVRI, TRAZIMERA, HERZUMA, and ONTRUZANT) are limited to IV infusion as a route of administration which takes approximately 60–90 min, whereas HERCEPTIN SC would take only 2–5 min.

The launch of HERCEPTIN SC provided the preference-based selection of HERCEPTIN over biosimilar products, as demonstrated in the prefHER study, in which 86% of patients preferred SC HERCEPTIN over IV administration. But still, the company does not expect it to garner a significant share as the US market is very structured for IV dosing and unlikely to change. As an adjuvant therapy, the SC formulation probably does not present an advantage in time or convenience to the patient because trastuzumab would likely be combined with another IV therapy, and in many cases, the patient would have a central venous port in place. Therefore, IV administration could be more convenient for these patients, avoiding an additional injection. Comparing the cost of HERCEPTIN IV with SC formulation, IV is associated with more cost due to longer chair time and hospital charges, but trastuzumab biosimilars are more cost-effective than SC formulation trastuzumab biosimilars could improve access by giving physicians a lower-cost option to prescribe. A major decline in HERCEPTIN sales has been observed in the US.

PERJETA: One more feather in the Cap of Roche’s HER2 Biologics

Another strategy to extend the reach of Roche’s HER2 franchise was the launch of PERJETA (pertuzumab), KADCYLA (ado-trastuzumab emtansine), and PHESGO (fixed-dose combination of pertuzumab, trastuzumab, and hyaluronidase–zzx). PERJETA was a follow-on to Roche’s second-biggest seller HERCEPTIN and part of its strategy to develop new drugs to extend the longevity of its best-selling brands. It won FDA approval in June 2012, EMA approval in March 2013, and Japan in August 2013. PERJETA would not cannibalize the standard HER2 treatment HERCEPTIN because it was designed for use with the older drug. PERJETA and HERCEPTIN are aimed at different regions of the HER2 receptor, so the combination hits HER2-positive cancer with a one-two punch. PERJETA became another potential oncology driver for Roche, and sales grew strongly in all regions. The increased patient demand for PERJETA for adjuvant early breast cancer therapy supported its continued growth. PERJETA generated sales of around USD 3.8 billion, 4 billion, and 4.3 billion globally in 2020, 2021, and 2022, respectively.

In 2021, the sales of PERJETA declined in the US, EU, and Japan by 1%, 1%, and 4%, respectively, due to patients with residual disease being switched to KADCYLA and the launch of PHESGO in 2020. However, in 2022, PERJETA gained back the lost market share in the US and registered 4% growth, probably due to increasing demand in the early breast cancer setting. But this momentum has not been seen in the EU, where PERJETA registered a 16% degrowth due to the cannibalization from PHESGO in 2022.

KADCYLA – The entry of Roche’s first ADC

In continuing efforts of Roche to extend the HER2 franchise, Roche’s first ADC, KADCYLA, received approval from the FDA in 2013 for HER2-positive metastatic breast cancer treatment after prior treatment with Roche’s own HERCEPTIN and chemotherapy. In 2018 KADCYLA built up ~USD 1 billion in sales, which was only a fraction of HERCEPTIN sales (~USD 7 billion) during the same period; however, KADCYLA continued to grow in all regions and became the preferred treatment option in second-line HER2-positive breast cancer treatment. But Roche knew that the more Roche worked on label expansion for KADCYLA, the better because of the upcoming HERCEPTIN biosimilars.

In the UK, NICE initially rejected KADCYLA for use under the government-paid health system in 2014, stating that trastuzumab emtansine with its list price of GBP 90,000 (approximately USD 114,000) per patient per year failed its cost-benefit analysis. But in 2017, after the negotiation with Roche, England’s National Health Service (NHS) approved the routine use of KADCYLA. Roche offered a confidential price discount to make KADCYLA available in the UK. After that, the FDA approval of KADCYLA in early breast cancer in May 2019 gave the much-needed booster to KADCYLA. KADCYLA generated ~USD 1.8, 2, and 2 billion in sales in 2020, 2021, and 2022 respectively. In 2022, the sales of KADCYLA declined by 3% in the US, majorly due to competition in metastatic breast cancer; however, a good uptake with 5%, 16%, and 34%, has been seen in the EU, Japan, and internationally respectively, probably due to good uptake in adjuvant early breast cancer. But after the recent approval of ENHERTU in the second-line setting, KADCYLA will face strong competition ahead as ENHERTU has been included in the ASCO treatment guidelines for second-line HER2-positive breast cancer treatment.

PHESGO – Will Roche ward off copycats?

To ward off HERCEPTIN copycats, Roche launched a fixed-dose combination of HERCEPTIN and PERJETA, administered under the skin alongside IV chemo, for early and metastatic HER2-positive breast cancer patients. The new product, PHESGO, comes in a single-dose vial and can be given at a treatment center or home. After an initial 8-min loading dose, administering each treatment takes about 5 min. PHESGO sales showed a very strong uptake since launch, mainly in Europe and the US, reaching ~USD 370 million in 2021 and USD 775 million in 2022, with 121% growth globally and 93% and 142% growth in the US and EU, respectively. Roche estimated about a 33% conversion of patients to PHESGO globally in the early launch markets. Also, Roche reported that in the UK, 80% of breast cancer patients switched to PHESGO, which helped to reduce the number of patients who receive their medicines via IV infusion, freeing up capacity in hospitals. Chugai, a member of the Roche Group, also recently filed for regulatory approval in Japan, which could represent another opportunity for continued PHESGO growth.Overall sales in the HER2 franchise (PERJETA, HERCEPTIN, KADCYLA, and PHESGO) increased by 3% to approximately USD 9.4 billionglobally. Roche’s HER2 franchise has been the backbone of the company’s growth. However, Roche may continue to face more challenges from the upcoming biosimilars of PERJETA and KADCYLA and erosion from HERCEPTIN biosimilar. Launching several other products like MARGENZA by MacroGenics and tyrosine kinase inhibitors by Seagen and Novartis made metastatic breast cancer crowded. The expanding indications of ENHERTU and upcoming ADCs like SYD985 (Byondis), which already have filed BLA in the US and EU with an FDA PDUFA date of May 2023, will further increase competition for Roche.

-Agonist.png)