Year-End Sale is Live! Find Exclusive Prices on the Best Selling Pharma & MedTech Reports.Check Now!

Download Case Study to Unlock Valuable Insights

Fill out the form to gain access to exclusive content and data-driven strategies

Market & Competitive Assessment

- Home

- case study

- market %26 competitive assessment

Objective

A leading Asian conglomerate aimed to strategically expand its asset portfolio into the technology-driven Cell Imaging and Analysis market segment. The primary objective was to obtain an accurate, evidence-based understanding of the market landscape for software-based devices in cell analysis and observation, including high-content screening (HCS) systems, cell analyzers, and flow cytometers. The client sought detailed market sizing and forecasts segmented by device type, end users, and applications across key geographical regions: the United States (US), European Union (EU), and select Asia-Pacific (APAC) countries. This analysis was critical to support their decision-making regarding potential market entry and to estimate future commercial success.

Problem Statement: Navigating Complexity in Cell Analysis Technology Markets

A large Asian conglomerate was working to develop their asset portfolio in Cell Imaging and Analysis, and was interested to assess the market scenario of software based devices in the Cell Analysis and Cell Observation segment, such as HCS, Cell Analyzers, Flow Cytometers etc., to understand the past and forecasted market, to assess decision of possible market entry and potential future commercial success. The client requested evidence-based market estimation, segmented by type, end users, and application in US, EU, and some select APAC nations.

Solution Provided

DelveInsight designed a multi-faceted market assessment approach providing:

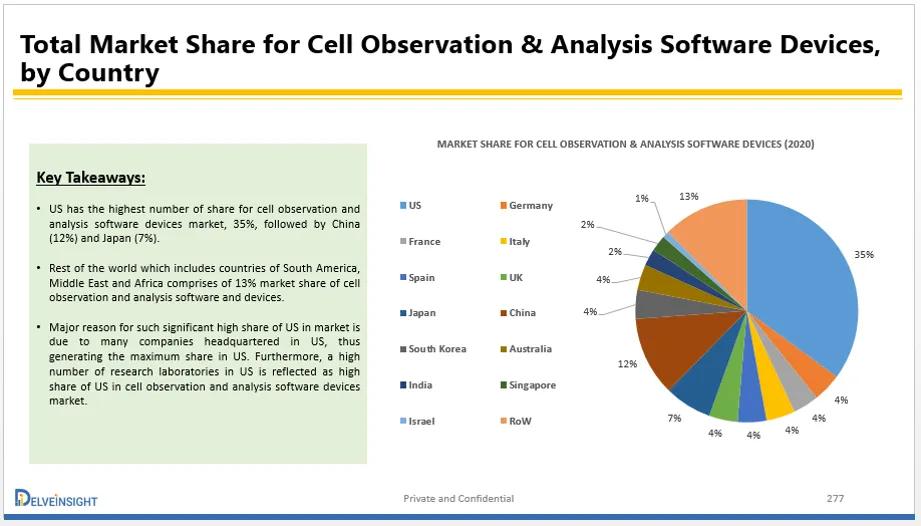

- Current and Forecasted Market Size: Detailed segmentation of the cell analysis and observation market by device types such as HCS systems, flow cytometers, and cell analyzers, as well as by end users and application segments. Regional analysis covered the US, EU, and key APAC nations, reflecting trends and growth patterns specific to each territory.

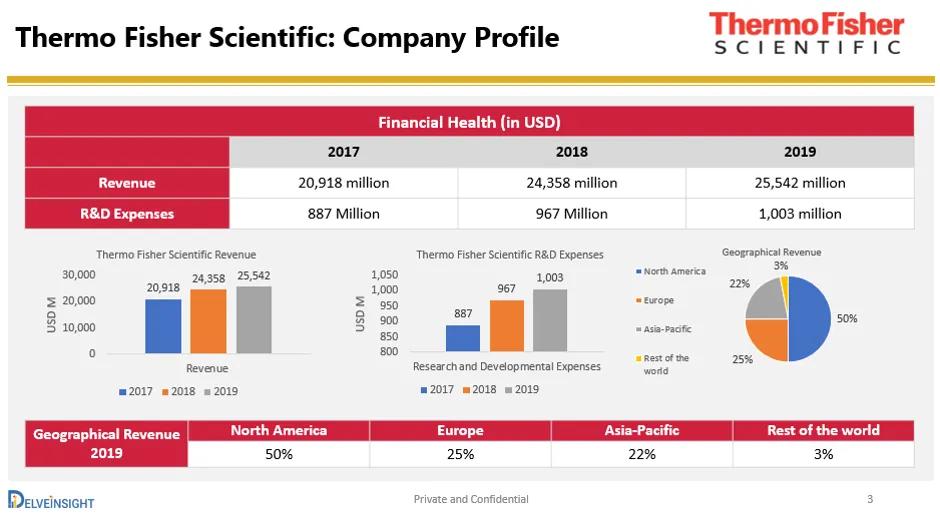

- Competitive Intelligence: Assessed leading companies’ portfolios, geographical reach, and product offerings to map the competitive environment thoroughly. This enabled the client to identify major players, uncover gaps, and benchmark against industry standards.

- Market Dynamics and Commercial Opportunity: Deep-dive analysis into pricing structures, adoption trends, regulatory impacts, and technological innovations influencing market dynamics. Highlighted potential barriers to entry and areas ripe for investment or partnership.

- Outcome-Oriented Reporting: Delivered forecasts aligned to varying scenarios and provided actionable recommendations to strengthen market entry strategies.

Our Methodology

Comprehensive Competitive Analysis

Understanding the competitive landscape was pivotal. Our team performed extensive research on key companies active in the Cell Imaging and Analysis market, evaluating their product portfolios, innovation pipelines, and market penetration. This analysis included pricing strategies and regional presence to identify competitive advantages or threats.

Segmentation and Market Sizing

We utilized both secondary and primary market research methods. Historical revenue data segmented by country and company allowed accurate trend analysis. Market sizing was approached systematically, combining supply-side insights (such as device production and sales volumes) with demand-side factors (including end-user consumption patterns and application growth).

Forecasting and Scenario Modeling

Sophisticated forecasting models projected market growth up to 2030, considering macroeconomic factors, healthcare expenditure, technological disruption, and regional healthcare policy influences. Scenarios simulated varied growth trajectories, helping the client prepare flexible and resilient strategies.

Detailed Market Insights

Our reports included granular insights on price trends, reimbursement scenarios, and sales channels. Additionally, end-user feedback was synthesized to highlight purchasing behavior, unmet needs, and preferences, creating a comprehensive market entry blueprint.

Key Findings and Impact

Region-Centric Market Differences:

Data revealed significant variance across geographies in market size and growth drivers. For example, North America led the market in cell analysis adoption driven by advanced healthcare infrastructure and high R&D spend, while APAC exhibited the fastest growth trajectory due to expanding healthcare access and increased investments. The EU demonstrated moderate yet steady expansion, emphasizing regulatory compliance and personalized medicine applications.

Strategic KPI Adjustments:

The client realigned their KPIs to reflect regional market realities - adapting sales targets, marketing focus, and resource deployment accordingly. This granular understanding improved the precision of their performance metrics.

Informed Sales Planning:

Insights on end-user preferences and unmet needs guided tailored sales approaches, leading to optimized messaging and product positioning. Understanding customer pain points allowed for enhanced sales effectiveness and alignment with clinical requirements.

Efficient Resource Allocation:

With clear market entry benchmarks and competitive positioning, the company redirected investments towards high-potential markets and device segments. This ensured optimal utilization of development and commercialization resources for maximum ROI.

Conclusion

DelveInsight’s evidence-based market analysis enabled the client to make informed, strategic decisions about entering the cell imaging and analysis device market. By combining detailed market sizing, competitor profiling, and dynamic forecasting segmented by geography and use case, the client gained a holistic view of the landscape.

This comprehensive market intelligence fostered competitive advantage by clarifying regional opportunities and challenges, guiding KPI refinement, optimizing sales plans, and enhancing operational efficiency. The partnership reinforced the client’s preparedness for launch and sustainable growth within a highly competitive and technologically complex market.

Market Context and Outlook

The Cell Analysis market itself is poised for significant expansion, supported by factors including increasing prevalence of chronic diseases, drug discovery acceleration, and advances in high-content screening technologies.

This positive outlook underscores the strategic value of early, detailed market intelligence in shaping successful entry and growth strategies. With technologies becoming increasingly sophisticated - ranging from flow cytometry to single-cell sequencing - market actors must stay agile, data-informed, and user-focused to sustain competitive leadership.

Our Related Services

Sample Visuals

Get Visuals