Adeno-Associated Virus Vectors in Gene Therapy Market Summary

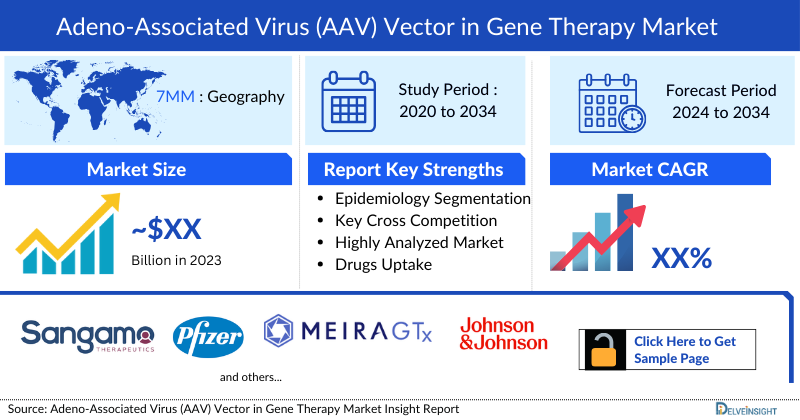

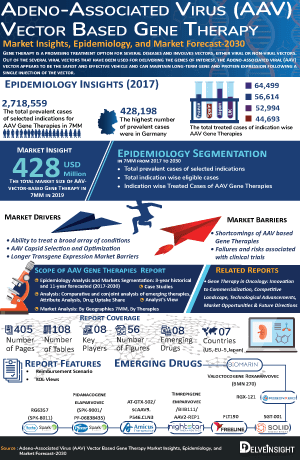

- The AAV Vectors in Gene Therapy Market Size is anticipated to grow with a significant CAGR during the study period (2020-2034).

- AAVs have emerged as the predominant vectors for delivering genes of interest to target tissues with improved specificity, efficiency, and safety.

Adeno-Associated Viruses Gene Therapy Market & Epidemiology Analysis

- The first Adeno Associated Virus Vectors in Gene Therapy drug, GLYBERA, was approved by the European Medicines Agency (EMA) in 2012 but later in 2020, it was withdrawn from the market mainly due to commercial failure. Many AAV-based gene therapies are currently FDA-approved, ELEVIDYS and ROCTAVIAN were approved in 2023, HEMGENIX was approved in 2022, LUXTURNA was approved in 2020 for a rare inherited retinal dystrophy, ZOLGENSMA was approved in 2019 for spinal muscular atrophy and GLYBERA was approved by EMA.

- In November 2023, REGENXBIO Presented positive one-year data from the Phase II ALTITUDE trial of ABBV-RGX-314 for the treatment of diabetic retinopathy using suprachoroidal delivery

- In November 2023, Pfizer announced dosing completed in the Phase III AFFINE trial of giroctocogene fitelparvovec; pivotal data read-out expected in mid-2024; BLA and MAA submissions anticipated in the second half of 2024.

- From the perspective of unmet medical needs, the majority of rAAV gene therapy programs are centered around the liver, striated muscles, and the CNS. Essentially all characteristics of AAV capsids can transduce liver productively following systemic administration.

- The leading Adeno Associated Viruses Gene Therapy Companies such as BioMarin Pharmaceutical, Sarepta Therapeutics, Roche (Spark Therapeutics), Sangamo, Pfizer, NightstaRx, Freeline Therapeutics, Horama S.A, MeiraGTx, RegenxBio, Asklepios Biopharmaceutical, Audentes Therapeutics, and others.

Request for Unlocking the Sample Page of the "AAV Gene Therapy Treatment Market"

Key Factors Driving the Adeno-Associated Viruses (AAV) Gene Therapy Market Growth

- Growing Prevalence of Genetic Disorders

The rising burden of rare and inherited genetic diseases—such as hemophilia, spinal muscular atrophy (SMA), and retinal dystrophies—is creating significant demand for advanced and durable therapeutic solutions like AAV-based gene therapies.

- Advancements in Vector Engineering & Delivery Platforms: Continuous improvements in AAV capsid design, enhanced tissue-specific targeting, reduced immunogenicity, and higher transduction efficiency are accelerating the adoption and development of AAV gene therapy candidates.

- Increasing R&D Investments and Strong Pipeline Activity: Pharmaceutical companies, biotech firms, and academic institutions are expanding their R&D efforts, resulting in a robust pipeline of AAV-based therapies across multiple therapeutic areas, including neurology, ophthalmology, and metabolic disorders.

- Favorable Regulatory Landscape: Accelerated approval programs, orphan drug designations, and regulatory incentives from major authorities such as the FDA and EMA are boosting innovation and enabling faster clinical progression for first-in-class AAV therapies.

- Growing Clinical Success and Real-World Evidence: Positive outcomes from approved AAV therapies and encouraging clinical trial data are strengthening confidence among clinicians and investors, thereby propelling further development activity and commercial momentum.

- Expansion of Manufacturing Capabilities: Significant investments in scalable and high-yield AAV vector manufacturing technologies such as suspension bioreactors and improved purification systems are addressing production bottlenecks and supporting broader commercialization.

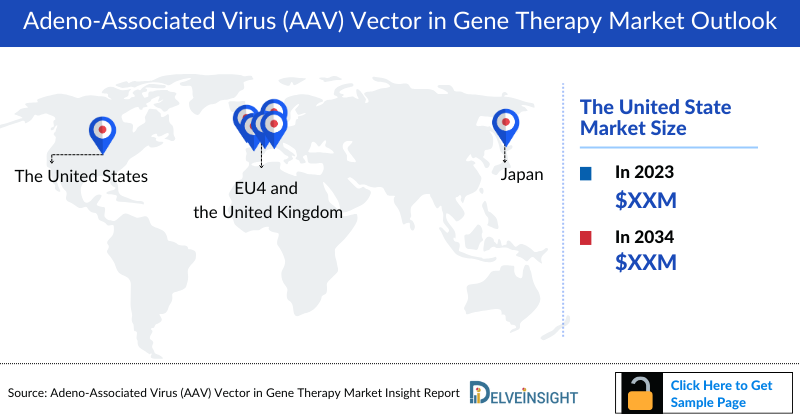

DelveInsight’s "Adeno-Associated Virus Vector in Gene Therapy Treatment Market Insights, Epidemiology, and Market Forecast – 2034" report delivers an in-depth understanding of Adeno-Associated Virus Vector in Gene Therapy, historical and forecasted epidemiology as well as Adeno-Associated Virus Vector in Gene Therapy therapeutics market trends in the United States, EU4 (Germany, France, Italy, and Spain) and the United Kingdom, and Japan.

The Adeno-Associated Virus Vector in Gene Therapy Treatment Market Report provides current treatment practices, emerging drugs, Adeno-Associated Virus Vector in Gene Therapy market share of individual therapies, and current and forecasted Adeno-Associated Virus Vector in Gene Therapy market size from 2020 to 2034, segmented by seven major markets. The report also covers current Adeno-Associated Virus Vector in Gene Therapy treatment practices/algorithms and unmet medical needs to curate the best of the opportunities and assess the underlying potential of the market.

|

Study Period |

2020 to 2034 |

|

Forecast Period |

2024-2034 |

|

Geographies Covered |

|

|

AAV Gene Therapy Market |

|

|

AAV Gene Therapys Market Size | |

|

AAV Gene Therapy Companies |

BioMarin Pharmaceutical, Sarepta Therapeutics, Roche (Spark Therapeutics), Sangamo, Pfizer, NightstaRx, Freeline Therapeutics, Horama S.A, MeiraGTx, RegenxBio, Asklepios Biopharmaceutical, Audentes Therapeutics, and others. |

|

AAV Gene Therapy Epidemiology Segmentation |

|

Adeno-Associated Virus Vector in Gene Therapy Disease Understanding

Adeno-Associated Virus Vector in Gene Therapy Overview

Recent advancements in genetic analysis, enabling rapid and cost-effective sequencing of genomes, have facilitated the identification of genes underlying various diseases. In particular, monogenic diseases caused by mutations in a single gene present promising targets for gene therapy interventions. However, realizing this potential has been hindered by challenges in safely delivering therapeutic nucleic acids into cells. While viral vectors, such as AAV, initially showed promise, concerns over immunogenicity and safety limitations have tempered their widespread use.

Alternative delivery methods, like nanoparticles, have also encountered hurdles. Despite these challenges, rAAV, a genetically engineered form of AAV devoid of viral DNA, has emerged as a promising gene therapy vehicle. Engineered to efficiently transport therapeutic DNA into target cells, rAAV circumvents integration into the host genome, thus minimizing the risk of unintended genetic alterations. Instead, rAAV-delivered DNA persists in the cell nucleus as episomal concatemers, ensuring sustained therapeutic effect without genomic integration. Despite ongoing research to enhance delivery efficiency and safety, rAAV holds significant potential for treating a wide range of genetic diseases, with ongoing clinical trials providing valuable insights for future therapeutic strategies.

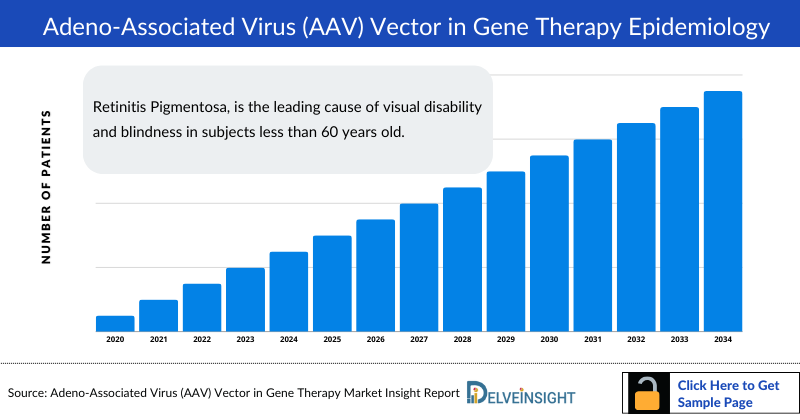

Adeno-Associated Virus Vector in Gene Therapy Epidemiology

The Adeno-Associated Virus Vector in Gene Therapy epidemiology chapter in the report provides historical as well as forecasted epidemiology segmented by the Total Prevalent Cases of Selected Indications Adeno-Associated Virus Vector in Gene Therapy, Total Diagnosed Prevalent Cases of Selected Indications of Adeno-Associated Virus Vector in Gene Therapy, Total Treated Cases of Selected Indications for Adeno-Associated Virus Vector in Gene Therapy, in the 7MM covering the United States, EU4 (Germany, France, Italy, and Spain) and the United Kingdom, and Japan from 2020 to 2034.

Key findings from the AAV Vector in Gene Therapy Epidemiological Forecast

- Retinitis Pigmentosa, is the leading cause of visual disability and blindness in subjects less than 60 years old.

- Hemophilia A is more common than Hemophilia B, representing approximately 80–85% of the total hemophilia population.

AAV Vector in Gene Therapy Epidemiology Insights

- Total Prevalence and Incidence

- Diagnosed and Treatable Patient Pool

- Age-Based Segmentation

- Severity and Mutation Type Segmentation

Adeno-Associated Virus Vector in Gene Therapy Drug Analysis

The drug chapter segment of the adeno-associated virus vector in gene therapy Therapeutics Market Report encloses a detailed analysis of the late-stage (Phase III ) and mid-stage (Phase II/III and Phase II) Adeno Associated Viruses Gene Therapy Pipeline Drugs. The current key players include Sangamo and Pfizer (Giroctocogene fitelparvovec), MEIRAGTx/J&J (Bota-vec), Johnson & Johnson (JNJ-81201887) and others. The drug chapter also helps understand the adeno-associated virus vector in gene therapy clinical trial details, pharmacological action, agreements and collaborations, approval, and patent details, and the latest news and press releases.

Adeno Associated Virus Vectors in Gene Therapy Marketed Drugs

-

LUXTURNA: Spark Therapeutics

LUXTURNA (voretigene neparvovec-rzyl) is a suspension of an adeno-associated virus vector-based gene therapy for subretinal injection. LUXTURNA is a live, non-replicating adeno-associated virus serotype 2 which has been genetically modified to express the human RPE65 gene. LUXTURNA is derived from naturally occurring adeno-associated virus using recombinant DNA techniques. LUXTURNA, is a one-time gene therapy for the treatment of patients with vision loss due to a genetic mutation in both copies of the RPE65 gene. The FDA approved Spark Therapeutics’ LUXTURNA in December 2017.

-

ZOLGENSMA: Novartis

ZOLGENSMA is a suspension of an adeno-associated viral vector-based gene therapy for intravenous infusion. It is a recombinant self-complementary AAV9 containing a transgene encoding the human survival motor neuron (SMN) protein, under the control of a cytomegalovirus enhancer/chicken-β-actin hybrid promoter. ZOLGENSMA an AAV-delivered gene therapy used to treat spinal muscular atrophy (SMA), was approved for clinical use in the US by the FDA.

Adeno Associated Virus Vectors in Gene Therapy Emerging Drugs

-

LUMEVOQ: GenSight Biologics

LUMEVOQ (GS010; lenadogene nolparvovec) targets Leber Hereditary Optic Neuropathy (LHON) by leveraging a mitochondrial targeting sequence (MTS) proprietary technology platform, arising from research conducted at the Institut de la Vision in Paris, which, when associated with the gene of interest, allows the platform to specifically address defects inside the mitochondria using an AAV vector. According to Phase III results all treated participants showed sustained improvement over 4 years, but that patients treated with a bilateral injection of the gene therapy continued to have a better visual acuity than the patients treated with a unilateral injection, a disparity that had been seen in REFLECT since 1.5 years posttreatment. The company is planning to submit to MHRA in the second half of 2024 and aiming to receive a decision from MHRA on LUMEVOQ in the second half of 2025, in the hopes of commercializing the product in the UK that same year.

-

Giroctocogene fitelparvovec: Sangamo and Pfizer

Giroctocogene fitelparvovec comprises of a recombinant AAV6 encoding the complementary deoxyribonucleic acid for B-domain deleted human FVIII. It is being developed as part of a collaboration agreement for the global development and commercialization of gene therapies for hemophilia A between Sangamo and Pfizer. Currently, the company is conducting Phase III trials to attain better and clear results about the efficacy of SB-525. A Phase III clinical trial (NCT03587116) evaluates the effectiveness and safety of preventive replacement therapy in the usual care setting in hemophilia A patients. A pivotal readout is expected in mid-2024, with Pfizer anticipating BLA and MAA submissions in the second half of 2024 if the pivotal readout is supportive.

Adeno-Associated Virus Vector in Gene Therapy Market Outlook

Adeno Associated Virus Vectors in Gene Therapy has provided a unique opportunity to treat and even cure degenerative diseases, offering hope to the millions of people either affected by inherited disorders or carrying disease-causing mutations. Addressing optimal intervention timing, standardized outcome assessments, inflammation mitigation, awareness enhancement, and equitable access are key to advancing inherited retinal disease treatments and reshaping the landscape of visual impairment.

Gene therapies have brought about a change in the treatment paradigm for genetic diseases by providing lasting therapeutic effects with a single intervention. Gene therapy holds significant potential for addressing various eye diseases. However, individuals considering this treatment should be mindful of certain challenges and crucial factors. Although the recent successes in rare disease therapy approvals have provided momentum for AAV therapy research and funding, several limitations make this a difficult, capital-intensive platform to develop.

In December 2017, Spark Therapeutics announced that their drug candidate LUXTURNA received US FDA approval for the treatment of patients with confirmed biallelic RPE65 mutation-associated retinal dystrophy. LUXTURNA is the first FDA-approved gene therapy for a genetic disease, the first and only pharmacologic treatment for an inherited retinal disease, and the first AAV vector gene therapy approved in the United States. The drug was developed and commercialized in the United States by Spark Therapeutics. In Europe, Novartis is currently marketing LUXTURNA as per a licensing agreement covering the development, registration, and commercialization rights of LUXTURNA in markets outside the United States. The US FDA’s advisory panel had all the way commended LUXTURNA approval in October 2017.

In the past few years, the treatment landscape of many diseases has rapidly changed. Now companies are developing gene and cell therapies that will have a promising role in the future, especially for the treatment of rare genetic diseases. The task of defining appropriate candidates for given gene therapy and cell therapy will need to await the enrollment and long-term follow-up of a sufficient number of study subjects to provide acceptable clarity about its safety and efficacy. To summarize, the outlook for gene and cell therapies is promising. Various clinical trials have been fairly positive in terms of safety and efficacy. The results of these studies are encouraging further investigation into multiple indications. The current scenario also anticipates a positive shift in the market for the forecast period.

Key Findings of Adeno Associated Virus Vectors in Gene Therapy Treatment Market

- The United States captured the major market shared of AAV gene therapy market among the 7MM.

- Recently, Pfizer BEQVEZ approved or the treatment of adults with moderate to severe hemophilia B who currently use factor IX (FIX) prophylaxis therapy, or have current or historical life-threatening hemorrhage, or have repeated, serious spontaneous bleeding episodes, and do not have neutralizing antibodies to adeno-associated virus serotype Rh74var (AAVRh74var) capsid as detected by an FDA-approved test.

- Pfizer set the similar price of BEQVEZ as HEMGENIX, i.e., around USD 3.5 million.

- Advancements in viral vector research, including targeted cell-based delivery, hold potential for enhancing treatment efficacy

- Larger firms have an edge in the gene therapy industry because they have the resources and expertise to organize intricate development pathways.

Adeno-Associated Virus Vector in Gene Therapy Pipeline Development Activities

The Adeno Associated Viruses Gene Therapy Therapeutics Market Report provides insights into therapeutic candidates in Phase III, Phase II/III, and Phase II. It also analyzes key Adeno Associated Viruses Gene Therapy Companies involved in developing targeted therapeutics. Adeno Associated Viruses Gene Therapy Companies like Sangamo and Pfizer, MEIRAGTx/J&J, Johnson & Johnson, and others actively engage in late and mid-stage research and development efforts for Adeno-Associated Virus Vector in Gene Therapy pipeline possesses potential drugs. However, there is a positive outlook for the therapeutics market, with expectations of growth during the forecast period (2024–2034). The report covers information on collaborations, acquisitions and mergers, licensing, and patent details for Adeno-Associated Virus Vector in Gene Therapy emerging therapy.

Latest KOL-Views on Adeno Associated Viruses Gene Therapy

To keep up with current market trends, we take KOLs and SMEs' opinions working in the domain through primary research to fill the data gaps and validate our secondary research. This will support the clients in potential upcoming novel treatments by identifying the overall scenario of the market and the unmet needs.

Adeno Associated Virus Vectors in Gene Therapy Qualitative Analysis

We perform Qualitative and market Intelligence analysis using various approaches, such as SWOT analysis, Conjoint analysis and Analyst views. In the SWOT analysis, strengths, weaknesses, opportunities, and threats in terms of disease diagnosis, patient awareness, patient burden, competitive landscape, cost-effectiveness, and geographical accessibility of therapies are provided. These pointers are based on the Analyst’s discretion and assessment of the patient burden, cost analysis, and existing and evolving treatment landscape.

Adeno Associated Virus Vectors in Gene Therapy Market Access and Reimbursement

Approaching reimbursement proactively can have a positive impact both during the late stages of product development and well after product launch. In the report, we consider reimbursement to identify economically attractive indications and market opportunities. When working with finite resources, the ability to select the markets with the fewest reimbursement barriers can be a critical business and price strategy.

Since the patients’ healthcare payments are substantial and such high healthcare expenditure is burdensome for the patients and their families. To help these patients, various third parties and nonprofits also have reimbursement schemes based on the demonstration of acceptable cost-effectiveness.

Scope of the Adeno Associated Viruses Gene Therapy Market Report

- The Adeno Associated Viruses Gene Therapy Therapeutics Market Report covers a segment of key events, an executive summary, and a descriptive overview, explaining currently used therapies.

- Additionally, an all-inclusive account of the emerging therapies and the elaborative profiles of late-stage and prominent therapies will impact the current treatment landscape.

- A detailed review of the Adeno-Associated Virus Vector in Gene Therapy market, historical and forecasted market size, market share by therapies, detailed assumptions, and rationale behind our approach is included in the report, covering the 7MM drug outreach.

- The report provides an edge while developing business strategies by understanding trends through SWOT analysis and expert insights/KOL views around Adeno-Associated Virus Vector in Gene Therapy market.

Adeno-Associated Virus Vector in Gene Therapy Market Report Insights

- Patient-based Adeno Associated Viruses Gene Therapy Market Forecasting

- Therapeutic Approaches

- Adeno-Associated Virus Vector in Gene Therapy Pipeline Analysis

- Adeno-Associated Virus Vector in Gene Therapy Market Size and Trends

- Existing and Future Adeno Associated Viruses Gene Therapy Drugs Market Opportunity

Adeno-Associated Virus Vector in Gene Therapy Market Report Key Strengths

- 11 Years Adeno Associated Viruses Gene Therapy Market Forecast

- The 7MM Coverage

- Adeno-Associated Virus Vector in Gene Therapy Epidemiology Segmentation

- Key Cross Competition

- Adeno Associated Viruses Gene Therapy Drugs Uptake

- Key Adeno Associated Viruses Gene Therapy Market Forecast Assumptions

Adeno-Associated Virus Vector in Gene Therapy Market Report Assessment

- Current Adeno Associated Viruses Gene Therapy Treatment Practices

- Adeno Associated Viruses Gene Therapy Unmet Needs

- Adeno Associated Viruses Gene Therapy Pipeline Profiles

- Adeno Associated Viruses Gene Therapy Drugs Market Attractiveness

- Qualitative Analysis (SWOT and Analyst Views

- Adeno Associated Viruses Gene Therapy Market Drivers

- Adeno Associated Viruses Gene Therapy Market Barriers

Reasons to Buy the Adeno-Associated Virus Vectors in Gene Therapy Market Report

- The Adeno Associated Viruses Gene Therapy Therapeutics Market Report will help develop business strategies by understanding the latest trends and changing treatment dynamics driving Adeno-Associated Virus Vector in Gene Therapy Drugs Market.

- Insights on patient burden/disease Adeno Associated Viruses Gene Therapy Prevalence, evolution in diagnosis, and factors contributing to the change in the epidemiology of the disease during the forecast years.

- Understand the existing market opportunities in varying geographies and the growth potential over the coming years.

- Identifying strong upcoming players in the Adeno Associated Viruses Gene Therapy Drugs Market will help devise strategies to help get ahead of competitors.

- Detailed analysis ranking of class-wise potential current and emerging therapies under the analyst view section to provide visibility around leading classes.

- Highlights of access and reimbursement policies of current therapies, barriers to accessibility of expensive off-label therapies, and patient assistance programs.

- To understand Key Opinion Leaders’ perspectives around the accessibility, acceptability, and compliance-related challenges of existing treatment to overcome barriers in the future.

- Detailed insights on the unmet needs of the existing Adeno Associated Viruses Gene Therapy Drugs Market so that the upcoming players can strengthen their development and launch strategy.

Stay updated with us for Recent Articles