Ankylosing Spondylitis Market

DelveInsight’s ‘Ankylosing Spondylitis Market Insights, Epidemiology, and Market Forecast - 2032’ report deliver an in-depth understanding of the Ankylosing Spondylitis, historical and forecasted epidemiology as well as the Ankylosing Spondylitis market trends in the United States.

The Ankylosing Spondylitis market report provides current treatment practices, emerging drugs, and market share of the individual therapies, current and forecasted Ankylosing Spondylitis market size from 2019 to 2032. The Ankylosing Spondylitis market report also covers current treatment practice, market drivers, market barriers, SWOT analysis, reimbursement and market access, and unmet medical needs to curate the best of the opportunities and assesses the underlying potential of the Ankylosing Spondylitis market.

Study Period: 2019-2032

Ankylosing Spondylitis Treatment Market

Ankylosing Spondylitis Overview

Ankylosing Spondylitis also called as Bechterew's disease is a common inflammatory rheumatic disease that affects the axial skeleton, causing characteristic inflammatory back pain, which can lead to structural and functional impairments and a decrease in quality of life. Clinical features of this group include inflammatory back pain, asymmetrical peripheral oligoarthritis (predominantly of the lower limbs), enthesitis, and specific organ involvement such as anterior uveitis, psoriasis, and chronic inflammatory bowel disease. Aortic root involvement and conduction abnormalities are rare complications of AS. AS affects men more often than women.

General onset of AS commonly occurs in younger people, between the ages of 17 and 45. However, it can also affect children and those who are much older (Spondylitis association of america).AS is a type of spondyloarthropathy (SpA)—Spondyloarthropathies are a family of related inflammatory rheumatic disorders which also include reactive arthritis (RA), psoriatic arthritis (PsA), spondyloarthropathy associated with inflammatory bowel disease (IBD), undifferentiated spondyloarthropathy (USpA), and, possibly, Whipple disease and Behçet disease—and is often found in association with other spondyloarthropathies, including ReA, PsA, ulcerative colitis (UC), and Crohn disease. It has also been found that such patients quite often have a family history of either AS or another spondyloarthropathy.

Continued in the report…..

Ankylosing Spondylitis Diagnosis

The most commonly used criteria for the classification of AS were developed in 1966 and modified in 1984. They are:

1. Low back pain of at least three months duration with inflammatory characteristics (improved by exercise, not relieved by rest)

2. Limitation of lumbar spine motion in sagittal and frontal planes

3. Decreased chest expansion (relative to normal values for age and sex)

4. Bilateral sacroiliitis grade 2 or higher

5. Unilateral sacroiliitis grade 3 or higher.

Definite Ankylosing Spondylitis is said to be present when the fourth or fifth criterion presents with any clinical criteria. However, radiological sacroiliitis may not develop for many years, and the development of new criteria (including magnetic resonance imaging) has been proposed to allow confirmation of the diagnosis in patients with early disease.

Continued in the report…..

Ankylosing Spondylitis Treatment

Treatment of Ankylosing spondylitis will depend on the symptoms, age, and general health. It will also depend on how severe the condition is. The treatment goal is to reduce pain and stiffness, prevent deformities, and maintain as normal lifestyle as possible. Treatment may include: Nonsteroidal anti-inflammatory medications to reduce pain and inflammation, tumor-necrosis-factor blockers (biologic medications) to reduce inflammation and swelling, disease-modifying antirheumatic drugs (DMARDs) such as sulfasalazine to decrease inflammation and control Ankylosing Spondylitis, short-term use of corticosteroids to reduce inflammation, short-term use of muscle relaxants and pain relievers to relieve severe pain and muscle spasms, surgery to replace a joint, place rods in the spine, or remove parts of the thickened and hardened bone. Moreover, maintaining proper posture and regular exercise, including exercises that strengthen back muscles, is vital (Johns Hopkins Medicine, n.d.).

Continued in the report…..

Ankylosing Spondylitis Epidemiology

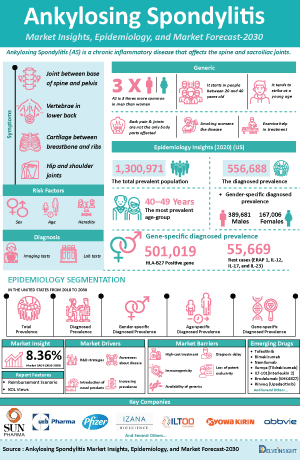

The disease epidemiology covered in the report provides historical as well as forecasted epidemiology segmented by Total Prevalence of Ankylosing Spondylitis, Diagnosed Prevalence of Ankylosing Spondylitis, Gender-specific Diagnosed Prevalence of Ankylosing Spondylitis, Age-specific Diagnosed Prevalence of Ankylosing Spondylitis, and Gene-specific Diagnosed Prevalence of Ankylosing Spondylitis scenario in the the United States from 2018 to 2030.

Key Findings

- The total prevalent population of Ankylosing Spondylitis in the US is anticipated to rise from 2018 to 2030. Out of the total prevalent population of 1,300,971 cases, 556,688 cases were diagnosed in 2020. These prevalent cases are expected to increase at a CAGR of 0.97% for the study period of 2018–2030.

- The prevalent population of Ankylosing Spondylitis showed a male predominance. Out of the total diagnosed population of 556,688 cases in the US, 389,681 and 167,006 cases were contributed by males and females, respectively, in 2020.

“The diagnosis of Ankylosing Spondylitis can be tough to spot as so many people have back pain—its main symptom. Additionally, there are no specific lab tests to identify ankylosing spondylitis. All these factors play a major role in the low diagnosis of AS. Due to the increase in advancement, it is estimated that in the coming years, the diagnosis rate may increase.”

Ankylosing Spondylitis Epidemiology

The epidemiology segment also provides the Ankylosing Spondylitis epidemiology data and findings across the United States.

Ankylosing Spondylitis Drug Chapters

Ankylosing Spondylitis Emerging Drugs

Tofacitinib: Pfizer

Tofacitinib (CP-690,550) is a Janus kinase inhibitor. In the signaling pathway, JAKs phosphorylate and activate Signal Transducers and Activators of Transcription (STATs), which modulate intracellular activity including gene expression. Tofacitinib modulates the signaling pathway at the point of JAKs, preventing the phosphorylation and activation of STATs.The drug is approved in the US for four indications: adults with moderately to severely active rheumatoid arthritis (RA) after methotrexate failure, adults with active psoriatic arthritis (PsA) after disease-modifying antirheumatic drug (DMARD) failure, adults with moderately to severely active ulcerative colitis (UC) after tumor necrosis factor inhibitor (TNFi) failure, and patients 2 years of age or older with active polyarticular course juvenile idiopathic arthritis (pcJIA).

Bimekizumab: UCB Biopharma

Bimekizumab (UCB4940) is the first humanized monoclonal IgG1 antibody that potently and selectively neutralizes IL-17A and IL-17F. These are the two key pro-inflammatory cytokines that share similar biological function and structural homology. IL-17A and IL-17F are the most closely related members of the IL-17 family of cytokines. They are both co-expressed at sites of inflammation and have overlapping pro-inflammatory functions. Both IL-17A and IL-17F can independently cooperate with other inflammatory mediators to drive chronic inflammation and tissue destruction. This therapeutic candidate is in the phase III stage of development to treat patients with Ankylosing Spondylitis. The company is using the subcutaneous route of administration for AS.

Products detail in the report…

List to be continued in the report…

Ankylosing Spondylitis Market Outlook

Ankylosing Spondylitis is an inflammatory disease that, over time, can cause some of the small bones in the spine (vertebrae) to fuse. This fusing makes the spine less flexible and can result in a hunched-forward posture. If ribs are affected, it can be difficult to breathe deeply. There is no cure for Ankylosing Spondylitis, but treatments can lessen your symptoms and possibly slow progression of the disease. Recent studies show that the newer biologic medications can potentially slow disease progression in some people. Different people respond to different medications with varying levels of effectiveness. Thus, it may take time to find the most effective course of treatment.

A common treatment regimen for the various forms of spondyloarthritis (Ankylosing Spondylitis, psoriatic arthritis, enteropathic arthritis, reactive arthritis, juvenile spondyloarthritis, and undifferentiated spondyloarthritis) involves medication, exercise, physical therapy, good posture practices, and other options such as applying heat/cold to help relax muscles and reduce joint pain. In severe cases, posture correcting surgery may also be an option.

Depending on the type of spondyloarthritis, there may be some variation in treatment. For example, in psoriatic arthritis, both the skin component and joint component must be treated. In enteropathic arthritis (spondylitis/arthritis associated with inflammatory bowel disease), medications may need to be adjusted so the gastrointestinal component of the disease is also treated and not exacerbated.

As per the study conducted by Ward et al., (2019), recommendations for Ankylosing Spondylitis and nonradiographic axial SpA are similar. TNFi are recommended over secukinumab or ixekizumab as the first biologic to be used. Secukinumab or ixekizumab is recommended over the use of a second TNFi in patients with primary nonresponse to the first TNFi. TNFi, secukinumab, and ixekizumab are favored over tofacitinib. Co‐administration of low‐dose methotrexate with TNFi is not recommended, nor is a strict treat‐to‐target strategy or discontinuation or tapering of biologics in patients with stable disease. Sulfasalazine is recommended only for persistent peripheral arthritis when TNFi are contraindicated.

Of the patients included in the study, 40.6% persisted on the index TNFi for ≥12 months, 31.0% discontinued, 21.4% switched to a different TNFi, and 7.0% discontinued and then restarted. Of the 333 patients who persisted on their TNFi for >90 days, 44.7% received ≥1 add-on medication. Approximately half of the patients (45.1%) initiated etanercept, followed by adalimumab (28.6%), golimumab (11.7%), infliximab (11.7%), and certolizumab pegol (2.8%) as their index TNFi was stated in a study conducted by Walsh et al., (2018).

Continued in the report…..

Key Findings

- The total Ankylosing Spondylitis market size in the US is anticipated to rise from 2019-2032. The total Ankylosing Spondylitis market size in 2020 was estimated to be USD 3,366.93 million. The Ankylosing Spondylitis market size is expected to increase at a CAGR of 8.36% from 2019-2032.

- According to DelveInsight’s analysis, the Ankylosing Spondylitis market of current treatment includes conventional therapies, biologics, and Cox Inhibitors.

- Among all the upcoming potential therapies, Bimekizumab is estimated to generate highest revenue. In its phase III clinical results, the molecule have shown the most effective result.

At a dose of 160 mg, Efficacy response at week 96 in ASAS20 and ASAS40 was 76.9% and 64.6%, respectively, which is the highest as compared to all other therapies. Additionally, the Efficacy response at week 96 with shifting dose from 320mg to 160 mg in ASAS20 and ASAS40 was 79.8%, and 66.9%, respectively.

“A common treatment regimen for Ankylosing Spondylitis, involves medication, exercise, physical therapy, good posture practices, and other options such as applying heat/cold to help relax muscles and reduce joint pain. There are several different classes of biologics such as Cox Inhibitors, JAK inhibitors, TNF inhibitors, IL-17 inhibitors, IL-12 and IL-23, and much more available in the market for the treatment.

Drugs such as Humira, Enbrel, Remicade, Rayos, and Celebrex entered the Ankylosing Spondylitis market earlier between the years 2000–2010. While some of the drugs were recently approved by the FDA, these drugs include Taltz, Cosentyx, and Simponi Aria while Cimzia was approved in the year 2013. Drugs like, Humira (Adalimumab), Remicade (Infliximab), and Celebrex (Celecoxib) have lost their patent in the US, in 2016, 2018, and 2014 respectively, and their generics have enetered the market as well. Although the entry of generic drugs has historically spelled doom for the reference product, biosimilars are not likely to play the same role in the marketplace, at least at first. Due to these challenges, Remicade sales have not been substantially eroded by biosimilar competition just yet. Over the last 20 years, the greatly improved knowledges of underlying pathogenic mechanisms of AS, including the role of tumor necrosis factor (TNF), the interleukin 23/Th17 axis, and interleukin-17 (Il-17), constituted the rationale to develop biologics selectively inhibiting these pathways. Recent knowledge of the pathophysiology of spondyloarthritis has highlighted the emerging role of the IL-17/IL-23 axis.

New therapies with selective biological drugs have emerged in the treatment of this pathology. Recently, the approval of Taltz (ixekizumab)—a new anti–IL-17A—for the treatment of ankylosing spondylitis, is anticipated to show positive growth in the market. The pipeline therapies belonging to IL-17A are estimated to generate a good market share due to their effectiveness and potential.”

The United States: Ankylosing Spondylitis Market Outlook

This section provides the total Ankylosing Spondylitis market size and market size by therapies & class in the United States.

Ankylosing Spondylitis Drugs Uptake

This section focuses on the rate of uptake of the potential Ankylosing Spondylitis drugs recently launched in the Ankylosing Spondylitis market or expected to get launched in the market during the study period 2018–2030. The analysis covers the Ankylosing Spondylitis market uptake by drugs; patient uptake by therapies; and sales of each drug.

This helps in understanding the drugs with the most rapid uptake, reasons behind the maximal use of new drugs, and allows the comparison of the drugs based on market share and size which again will be useful in investigating factors important in market uptake and in making financial and regulatory decisions.

Ankylosing Spondylitis Development Activities

The Ankylosing Spondylitis market report provides insights into different therapeutic candidates in phase II, and phase III stage. It also analyzes key players involved in developing targeted therapeutics.

Pipeline Development Activities

The Ankylosing Spondylitis market report covers the detailed information of collaborations, acquisition, and merger, licensing, and patent details for AS emerging therapies.

Reimbursement Scenario in Ankylosing Spondylitis

Approaching reimbursement proactively can have a positive impact both during the late stages of product development and well after product launch. In the report, we consider reimbursement to identify economically attractive indications and market opportunities. When working with finite resources, the ability to select the markets with the fewest reimbursement barriers can be a critical business and price strategy.

Competitive Intelligence Analysis

We perform competitive and market Intelligence analysis of the AS market by using various competitive intelligence tools that include–SWOT analysis, PESTLE analysis, Porter’s five forces, BCG Matrix, Market entry strategies, etc. The inclusion of the analysis entirely depends upon the data availability.

Scope of the Ankylosing Spondylitis Market Report

- The Ankylosing Spondylitis market report covers the descriptive overview of AS, explaining its causes, symptoms, pathophysiology, genetic basis, and currently available therapies.

- Comprehensive insight has been provided into the Ankylosing Spondylitis epidemiology and treatment.

- Additionally, an all-inclusive account of both the current and emerging therapies for Ankylosing Spondylitis is provided, along with the assessment of new therapies, which will have an impact on the current treatment landscape.

- A detailed review of the Ankylosing Spondylitis market; historical and forecasted is included in the report, covering the United States drug outreach.

- The Ankylosing Spondylitis market report provides an edge while developing business strategies, by understanding trends shaping and driving the United States Ankylosing Spondylitis market.

Ankylosing Spondylitis Market Report Highlights

- The robust pipeline with novel MOA and oral ROA, increasing incidence, effectiveness of drugs as both mono and combination therapy will positively drive the Ankylosing Spondylitis market.

- The companies and academics are working to assess challenges and seek opportunities that could influence Ankylosing Spondylitis R&D. The therapies under development are focused on novel approaches to treat/improve the disease condition.

- Major players are involved in developing therapies for Ankylosing Spondylitis. The launch of emerging therapies will significantly impact the Ankylosing Spondylitis market.

- Our in-depth analysis of the pipeline assets across different stages of development (phase III and phase II), different emerging trends and comparative analysis of pipeline products with detailed clinical profiles, key cross-competition, launch date along with product development activities will support the clients in the decision-making process regarding their therapeutic portfolio by identifying the overall scenario of the research and development activities.

Ankylosing Spondylitis Market Report Insights

- Patient Population

- Therapeutic Approaches

- Ankylosing Spondylitis Pipeline Analysis

- Ankylosing Spondylitis Market Size

- Ankylosing Spondylitis Market Trends

- Ankylosing Spondylitis Market Opportunities

- Impact of upcoming Ankylosing Spondylitis Therapies

Ankylosing Spondylitis Market Report Key Strengths

- 10 Years Forecast

- United States Coverage

- AS Epidemiology Segmentation

- Key Cross Competition

- Highly Analyzed Ankylosing Spondylitis Market

- Ankylosing Spondylitis Drugs Uptake

Ankylosing Spondylitis Market Report Assessment

- Current Treatment Practices

- Unmet Needs

- Pipeline Product Profiles

- Ankylosing Spondylitis Market Attractiveness

- Ankylosing Spondylitis Market Drivers

- Ankylosing Spondylitis Market Barriers

- SWOT analysis

Key Questions

Ankylosing Spondylitis Market Insights:

- What was the Ankylosing Spondylitis market share (%) distribution in 2019 and how it would look like in 2032?

- What would be the Ankylosing Spondylitis market size as well as market size by therapies across the United States during the forecast period (2023–2032)?

- What are the key findings pertaining to the Ankylosing Spondylitis market across the United States and which country will have the largest Ankylosing Spondylitis market size during the forecast period (2023–2032)?

- At what CAGR, the Ankylosing Spondylitis market is expected to grow at the United States level during the forecast period (2023–2032)?

- What would be the Ankylosing Spondylitis market outlook across the United States during the forecast period (2023–2032)?

- What would be the Ankylosing Spondylitis market growth till 2032 and what will be the resultant market size in the year 2032?

- How would the market drivers, barriers, and future opportunities affect the Ankylosing Spondylitis market dynamics and subsequent analysis of the associated trends?

Epidemiology Insights:

- What are the disease risk, burdens, and unmet needs of Ankylosing Spondylitis?

- What is the historical Ankylosing Spondylitis patient pool in the United States?

- What would be the forecasted patient pool of Ankylosing Spondylitis at the United States level?

- What will be the growth opportunities across the United States with respect to the patient population pertaining to Ankylosing Spondylitis?

- At what CAGR the population is expected to grow across the United States during the forecast period (2023–2032)?

Current Treatment Scenario, Marketed Drugs, and Emerging Therapies:

- What are the current options for the treatment of Ankylosing Spondylitis along with the approved therapy?

- What are the current treatment guidelines for the treatment of Ankylosing Spondylitis in the US?

- What are the Ankylosing Spondylitis marketed drugs and their MOA, regulatory milestones, product development activities, advantages, disadvantages, safety, and efficacy, etc.?

- How many companies are developing therapies for the treatment of Ankylosing Spondylitis?

- How many emerging therapies are in the mid-stage and late stages of development for the treatment of AS?

- What are the key collaborations (Industry–Industry, Industry-Academia), Mergers and acquisitions, licensing activities related to the Ankylosing Spondylitis therapies?

- What are the recent novel therapies, targets, mechanisms of action, and technologies developed to overcome the limitation of existing therapies?

- What are the clinical studies going on for Ankylosing Spondylitis and their status?

- What are the key designations that have been granted for the emerging therapies for Ankylosing Spondylitis?

- What are the United States historical and forecasted Ankylosing Spondylitis market?

Reasons to buy

- The Ankylosing Spondylitis market report will help in developing business strategies by understanding trends shaping and driving AS.

- To understand the future market competition in the Ankylosing Spondylitis market and Insightful review of the key market drivers and barriers.

- Organize sales and marketing efforts by identifying the best opportunities for Ankylosing Spondylitis in the US.

- Identification of strong upcoming players in the market will help in devising strategies that will help in getting ahead of competitors.

- Organize sales and marketing efforts by identifying the best opportunities for the Ankylosing Spondylitis market.

- To understand the future market competition in the Ankylosing Spondylitis market.