Cervical Cancer Market

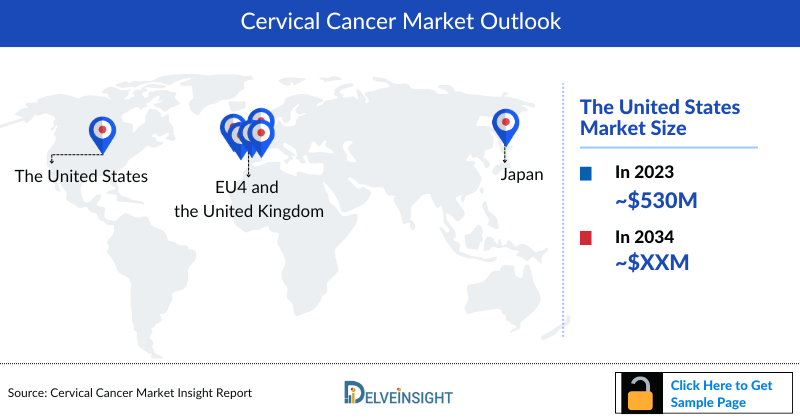

- The Cervical Cancer Market Size in the 7MM was ~USD 930 million in 2023 and is anticipated to grow with a significant CAGR during the study period (2020-2034).

- The US accounted for the largest Cervical Cancer Market Size, i.e., nearly USD 530 million in 2023.

- Cervical cancer is most often diagnosed between the ages of 35 and 44. The average age of diagnosis in the US is 50. Over 20% of cervical cancers are diagnosed after age 65. It is rare for people younger than 20 to develop cervical cancer.

- Over the past two decades, the majority of countries in the 7MM have experienced a decrease in cervical cancer cases. In the United States, incidence rates showed a decline from the mid-1970s to the mid-2000s, attributed in part to increased screening efforts. However, an analysis of SEER data revealed a rise in cases in 2021 following the COVID-19 pandemic, which later returned to a declining trend. In the EU4 and the UK, most nations observed a gradual decrease, though Spain and the UK saw relatively stable numbers over the past decade. Despite being a latecomer to HPV vaccination, Japan reported fewer cases in 2023 compared to 2020. While vaccination resumed in November 2021, it remains to be seen whether a significant decline in numbers will occur in the future.

- Immunotherapy holds promise for establishing new standards in cervical cancer treatment. Biomarkers to evaluate immunotherapy response will likely play a crucial role in identifying suitable candidates.

- KEYTRUDA (pembrolizumab) approval marks a groundbreaking development, positioning it as the inaugural immune checkpoint inhibitor sanctioned for the treatment of cervical cancer.

- Leading Cervical Cancer companies include Roche, Merck, Bristol Myers Squibb, Advaxis, Zydus, and others developing innovative diagnostic and treatment solutions.

- In 2023, the total Cervical Cancer Incident Cases were nearly 40,600 in the 7MM, which is expected to decrease by 2034. The US, in 2023, accounted for the highest cases.

- In February 2024, Pfizer and Genmab announced that the European Medicines Agency (EMA) validated tisotumab vedotin’s marketing authorization application for the treatment of adult patients with recurrent or metastatic cervical cancer with disease progression on or after first-line therapy.

- In January 2024, Merck announced that the United States Food andDrug Administration (US FDA) approved KEYTRUDA combinationwith chemoradiotherapy (CRT) for the treatment of patients withFIGO (International Federation of Gynecology and Obstetrics) 2014Stage III–IVA cervical cancer. The approval is based on data fromthe Phase III KEYNOTE-A18 trial.

- In September 2023, Nykode Therapeutics announced the US FDA approval of its Investigational New Drug (IND) application for the Phase II clinical trial of VB10.16, for HPV16-positive cancers, in combination with Roche’s PD-L1 inhibitor atezolizumab in patients with HPV16-positive, PD-L1-positive, recurrent or metastatic cervical cancer.

Request for unlocking the sample page of the "Cervical Cancer Treatment Market"

Request for unlocking the CAGR of the “Cervical Cancer Diagnostics Market”

Factors affecting Cervical Cancer Market Growth

-

Rising Incidence of Cervical Cancer

Increasing cases, particularly in developing countries due to limited screening and vaccination, are driving demand for effective treatments and preventive measures. -

Advancements in Diagnostic Techniques

Improved screening methods, including Pap smears, HPV DNA testing, and advanced imaging technologies, enable early detection and timely intervention. -

Development of Novel Therapies

Introduction of targeted therapies, immunotherapies, and advanced surgical and radiotherapy options is improving treatment outcomes and patient survival. -

Growing Awareness Among Healthcare Providers

Enhanced knowledge about cervical cancer management among gynecologists and oncologists contributes to better diagnosis and adoption of advanced therapies. -

Increasing HPV Vaccination Programs

Government and healthcare initiatives promoting HPV vaccination are helping in prevention, which indirectly supports the market for related therapies and diagnostics. -

Aging Female Population

Higher susceptibility to cervical cancer in older women is driving demand for screening and treatment solutions. -

Expansion of Healthcare Infrastructure

Improved access to hospitals, cancer treatment centers, and diagnostic facilities, particularly in emerging markets, supports market growth.

DelveInsight's "Cervical Cancer Market Insight, Epidemiology and Market Forecast–2034” report delivers an in-depth understanding of cervical cancer, historical and forecasted epidemiology as well as the cervical cancer market trends in the United States, EU4 (Germany, France, Italy, and Spain), and the United Kingdom, and Japan.

The Cervical Cancer Therapeutics Market report provides current treatment practices, emerging drugs, market share of individual therapies, and current and forecasted 7MM cervical cancer market size from 2020 to 2034. The report also covers current cervical cancer treatment market practices/algorithms, and unmet medical needs to curate the best of the opportunities and assesses the underlying potential of the Cervical Cancer therapeutics market.

|

Study Period |

2020 to 2034 |

|

Forecast Period |

2024-2034 |

|

Geographies Covered |

|

|

Cervical Cancer Market |

|

|

Cervical Cancers Market Size | |

|

Cervical Cancer Companies |

Roche, AstraZeneca, Precigen, Puma Biotechnology, Iovance Biotherapeutics, Nykode Therapeutics, ISA Pharmaceuticals, Regeneron, Transgene, Daiichi Sankyo, and others. |

|

Cervical Cancer Epidemiology Segmentation |

|

Key Factors Driving the Cervical Cancer Market

Impact of KEYTRUDA and LIBTAYO on Patient Outcomes

Introduction of immunotherapies such as KEYTRUDA and LIBTAYO, enhancing early diagnosis and treatment, has significantly enhanced survival rates in cervical cancer.

KEYTRUDA’s Position in the Cervical Cancer Treatment Landscape

KEYTRUDA (pembrolizumab) approval marks a groundbreaking development, positioning it as the sole approved immunotherapy agent for PD-L1(+) cervical cancers and cervical cancers with a tumor mutational burden of 10 or higher.

Promise of Immunotherapy in Cervical Cancer Treatment

Immunotherapy presents an opportunity to set new standards of care for treating cervical cancers. The identification of biomarkers to evaluate response to immunotherapy is also expected to play a crucial role in identifying optimal candidates for treatment.

Evolving Treatment Paradigms in r/mCC

New therapies for r/mCC should offer substantial clinical advantages while avoiding excessive healthcare resource utilization. Further investigation is crucial to grasp how treatment approaches for r/mCC correlate with subsequent clinical results.

Robust Cervical Cancer Clinical Trial Activity

Promising therapies such as TECENTRIQ (atezolizumab) (Roche), Volrustomig (AstraZeneca), AL3818 (Advenchen Laboratories), ANKTIVA (N-803) (ImmunityBio), ZEJULA (niraparib) (Merck/GSK), Telaglenastat (Calithera Biosciences), JEMPERLI (dostarlimab) + cobolimab (GSK), TUKYSA (tucatinib) (Seagen), Cadonilimab (Akeso), Avutometinib (Verastem), LN-145 (Iovance Biotherapeutics), Vudalimab (Xencor), ENHERTU (trastuzumab deruxtecan) (Daiichi Sankyo/ AstraZeneca), and others.

Cervical Cancer Treatment Market

Cervical cancer starts in the cells of the cervix. The cervix is the lower, narrow end of the uterus (womb); the cervix connects the uterus to the vagina (birth canal). Cervical cancer usually develops slowly over time. At first, the changes in a cell are abnormal, not cancerous, and are sometimes called “atypical cells.” Researchers believe that some of these abnormal changes are the first step in a series of slow changes that can lead to cancer. Before cancer appears in the cervix, the cells of the cervix go through dysplasia, and abnormal cells begin to appear in the cervical tissue. Over time, if not destroyed or removed, the abnormal cells may become cancer cells and start to grow and spread more deeply into the cervix and to surrounding areas.

Cervical Cancer Diagnosis

Diagnosis of cervical cancer typically involves several steps. Initially, a thorough medical history is taken, encompassing any pertinent symptoms and risk factors. This is followed by a physical examination, including a pelvic exam, to detect any abnormalities in the cervix. A Pap smear, also known as a Pap test, is then conducted to screen for abnormal cervical cells. This involves collecting cells from the cervix and examining them under a microscope. Additionally, an HPV test may be performed concurrently to check for the presence of the human papillomavirus (HPV), a common cause of cervical cancer. Depending on the results of these tests, further diagnostic procedures such as colposcopy, biopsy, or imaging studies may be necessary to confirm the presence of cervical cancer and determine its extent.

Cervical Cancer Treatment

Treatment for cervical cancer varies depending on factors like the cancer's stage, the patient's health, and their preferences. Typically, options include surgery, radiation therapy, chemotherapy, targeted therapy, or a combination. Surgical interventions may entail removing cancerous tissue or performing procedures like hysterectomy for advanced cases. Immunotherapy is another option, leveraging the body's immune system to fight cancer cells. Cervical cancer clinical trials explore innovative therapies, improving early detection, treatment outcomes, and survival rates for affected patients globally.

Cervical Cancer Epidemiology

The Cervical Cancer epidemiology covered in the Cervical Cancer diagnostics market report provides historical as well as forecasted epidemiology segmented by Total Incident Cases of Cervical Cancer, Total Cervical Cancer Cases by histology, Stage-specific Cases of Cervical Cancer, and Age-specific Cases of Cervical Cancer in the 7MM covering the United States, EU4 (Germany, France, Italy, and Spain), and the United Kingdom, and Japan from 2020 to 2034.

- The total incident cases of cervical cancer in the 7MM comprised 40,600 in 2023 and are projected to decrease during the forecast period.

- The US contributed to the largest incident population of cervical cancer, accounting for nearly 34% of the 7MM in 2023.

- Among the total cervical cancer cases by histology, the cases of squamous carcinoma comprised nearly 9,000 cases in 2023 in the US.

- Among the stage-specific cases of cervical cancer, Stage IB comprised the highest number of cases, followed by IVB in the US in 2023.

- Among EU4 and the UK, Germany accounted for the highest number of cervical cancer cases, followed by the UK, whereas Spain accounted for the lowest cases in 2023.

Stay ahead with insights on Cervical Cancer prevalence and patient population projections.

Cervical Cancer Recent Developments

- In September 2025, Merck (NYSE: MRK) announced U.S. FDA approval of KEYTRUDA QLEX™—a subcutaneous formulation of pembrolizumab combined with berahyaluronidase alfa—for use in adults across most solid tumor indications for KEYTRUDA®. Developed with Alteogen Inc.'s hyaluronidase technology, KEYTRUDA QLEX must be administered by a healthcare provider and is expected to be available in the U.S. by late September.

- In May 2025, following FDA approval, Teal Health® published results of its SELF-CERV study in JAMA Network Open, supporting the Teal Wand™—the first FDA-approved prescription device for at-home self-collection of vaginal samples for cervical cancer screening using primary HPV testing.

- In May 2025, Teal Health® announced FDA approval of the Teal Wand™, the first at-home self-collection device for cervical cancer screening in the U.S. Designed for women aged 25–65 at average risk, the prescription device offers a convenient, comfortable, and clinically accurate alternative to in-office Pap smears. The at-home kit includes telehealth support, with medical providers overseeing prescriptions, results, and patient care.

Cervical Cancer Drug Chapters

The drug chapter segment of the Cervical Cancer Diagnostics Market Report encloses a detailed analysis of cervical cancer marketed and emerging (Phase-III and Phase II and Phase I/II) pipeline drugs. It also helps to understand the cervical cancer clinical trials details, expressive pharmacological action, agreements and collaborations, approval and patent details, advantages and disadvantages of each included drug, and the latest Cervical Cancer news and press releases. The Cervical Cancer drugs market is witnessing growth due to rising awareness, early diagnosis, and advancements in targeted therapies.

Marketed Cervical Cancer Drugs

- KEYTRUDA (pembrolizumab): Merck Sharp & Dohme

Pembrolizumab is the active ingredient of KEYTRUDA, a humanized monoclonal antibody that binds to the programmed cell death-1 (PD-1) receptor and blocks its interaction with PD-L1 and PD-L2, releasing PD-1 pathway-mediated inhibition of the immune response, including antitumor immune response. Binding the PD-1 ligands, PD-L1 and PD-L2, to the PD-1 receptor on T cells inhibits T-cell proliferation and cytokine production. Upregulation of PD-1 ligands occurs in some tumors, and signaling through this pathway can inhibit active T-cell immune surveillance of tumors. It has been approved by the US FDA three times, with the latest approval being in January 2024.

Merck announced that the US FDA has approved KEYTRUDA combination with chemoradiotherapy (CRT) for the treatment of patients with FIGO (International Federation of Gynecology and Obstetrics) 2014 Stage III–IVA cervical cancer. In April 2022, Merck announced that the European Commission approved KEYTRUDA in combination with chemotherapy, with or without bevacizumab, for the treatment of persistent, recurrent, or metastatic cervical cancer in adults whose tumors express PD-L1.

In September 2022, Merck announced that KEYTRUDA in combination with chemotherapy, with or without bevacizumab, received approvals from Japan’s Ministry of Health, Labor and Welfare (MHLW) for the treatment of patients with advanced recurrent cervical cancer with no prior chemotherapy who are not amenable to curative treatment.

- TIVDAK (Tisotumab vedotin-tftv): Genmab/Pfizer

TIVDAK (tisotumab vedotin-tftv) is an antibody–drug conjugate (ADC) composed of Genmab’s human monoclonal antibody directed to tissue factor (TF) and Pfizer’s ADC technology that utilizes a protease-cleavable linker that covalently attaches the microtubule-disrupting agent monomethyl auristatin E (MMAE) to the antibody. It is co-developed globally and copromoted in the US in collaboration with Pfizer.

In September 2021, Genmab and Seagen announced that the US FDA granted accelerated approval to TIVDAK for the treatment of adult patients with recurrent or metastatic cervical cancer with disease progression on or after chemotherapy. In February 2024, Pfizer and Genmab announced that the European Medicines Agency had validated tisotumab vedotin’s marketing authorization application for the treatment of adult patients with recurrent or metastatic cervical cancer with disease progression on or after first-line therapy.

Emerging Cervical Cancer Drugs

- Volrustomig: AstraZeneca

Volrustomig is a bispecific monoclonal antibody that is administered through an intravenous route. It acts by targeting programmed cell death protein 1 (PD-1) and cytotoxic T lymphocyte Protein 4 (CTLA4). Currently, the company is conducting a Phase III (NCT06079671) eVOLVE-Cervical/eVOLVECervical study to explore the efficacy and safety of volrustomig in women with high-risk locally advanced cervical cancer (FIGO 2018 stage IIIC to IVA cervical cancer with lymph node involvement) who have not progressed following platinum-based CCRT. The company anticipates the first estimated filing acceptance after 2025.

- PRGN-2009: Precigen

PRGN-2009 is a novel, replication-incompetent gorilla adenovirus targeting HPV-associated cancers. It can be administered repeatedly, leading to the enhancement of T cells without increasing neutralizing antibodies. PRGN-2009 leverages Precigen’s UltraVector and AdenoVerse platforms to optimize HPV 16/18 antigen design and delivery using gorilla adenovector with a large payload capacity and the ability for repeat administration. Recently, in May 2023, IND for a Phase II trial of PRGN-2009 was cleared by the FDA, and the company has initiated a Phase II (NCT06157151) trial to evaluate the efficacy and safety of PRGN-2009 in combination with pembrolizumab compared to pembrolizumab alone in patients with pembrolizumab-resistant recurrent or metastatic cervical cancer. In addition, The company completed a Phase I (NCT04432597) study and presented positive Phase 1I clinical data from the monotherapy and combination therapy arms in patients with recurrent or metastatic HPV-associated cancers at the 2023 ASCO annual meeting.

Stay ahead with key updates on Cervical Cancer treatments. Access the 2025 pipeline report for exclusive insights!

|

Table 1: Comparison of Emerging Drugs | |||

|

Emerging Therapy (Company) |

Phase |

RoA |

MoA |

|

TECENTRIQ (atezolizumab) (Roche) |

III |

IV infusion |

PD-1/PD-L1 inhibitor |

|

Volrustomig (AstraZeneca) |

III |

IV Infusion |

PD-1/CTLA-4 bispecific mAb |

|

AL3818 (Advenchen Laboratories) |

I/IIa/III |

Oral | |

|

ANKTIVA (N-803) (ImmunityBio) |

IIb |

SC |

Interleukin-15 receptor agonists |

|

ZEJULA (niraparib) (Merck/GSK) |

II |

Oral |

Poly (ADP-ribose) polymerase 1 and 2 inhibitors; Poly(ADP-ribose) polymerase 2 inhibitors |

|

Telaglenastat (Calithera Biosciences) |

II |

Oral |

Glutaminase inhibitors |

|

JEMPERLI (dostarlimab) + cobolimab (GSK) |

II |

IV infusion |

Programmed cell death-1 receptor antagonists |

|

TUKYSA (tucatinib) (Seagen) |

II |

Oral |

HER2-tyrosine kinase inhibitor |

|

Cadonilimab (Akeso) |

II |

IV infusion |

CTLA-4 inhibitors; PD-1 receptor agonists |

|

Avutometinib (Verastem) |

II |

Oral |

RAF/MEK inhibitor |

|

LN-145 (Iovance Biotherapeutics) |

II |

Infusion |

Immunologic cytotoxicity |

|

Vudalimab (Xencor) |

II |

IV |

PD-1 and CTLA-4 inhibitors |

|

ENHERTU (trastuzumab deruxtecan) (Daiichi Sankyo/ AstraZeneca) |

II |

IV infusion |

HER2- antagonist with DNA topoisomerase I inhibitor |

Cervical Cancer Diagnostics Market

The Cervical Cancer diagnostics market landscape has evolved with the introduction of immune checkpoint inhibitors, reshaping the treatment paradigm of cervical cancer. Pembrolizumab’s approval marks a groundbreaking development, positioning it as the inaugural immune checkpoint inhibitor sanctioned for the treatment of cervical cancer. Genmab/Pfizer’s TIVDAK (Tisotumab vedotin-tftv), an antibody–drug conjugate also presents a promising option for second-line treatment, its potential could be further enhanced when combined with PD-L1 inhibitors in the frontline setting. LIBTAYO (cemiplimab-rwlc), a fully human monoclonal antibody targeting the PD-1 immune checkpoint receptor is another therapy that became the first single-agent immunotherapy in Japan.

Cervical Cancer Market Outlook

A robust pipeline with a novel Cervical Cancer mechanism of action and increasing incidence are major market drivers of the Cervical Cancer therapeutics market. Additionally, the cervical cancer pipeline is also expected to change the current dynamics of the market, which presently comprises biologics and molecules with new Cervical Cancer mechanisms of action. Women with unresectable, locally advanced cervical cancer often undergo treatment with chemoradiotherapy (CRT), but this approach is linked to late toxicities that adversely affect quality of life. Moreover, recurrence following CRT carries a grim prognosis. In recent years, the standard first-line treatment for persistent, recurrent, or metastatic cervical cancer has evolved.

While chemotherapy doublets, typically platinum-based, have long been the go-to option, the current preferred regimen involves augmenting cisplatin-paclitaxel with bevacizumab, a VEGF monoclonal antibody. In 2014, the FDA approved Genentech/Roche’s AVASTIN (bevacizumab) for use in combination with chemotherapy in women with advanced cervical cancer. This approval marked a significant milestone, as it was the first drug to gain FDA approval for late-stage cervical cancer patients since the approval of topotecan with cisplatin in 2006. Over the past decade, biosimilars have emerged as a transformative force within the healthcare industry, offering the potential to foster a more sustainable healthcare system.

In September 2017, the FDA achieved a historic milestone by granting approval to Amgen's MVASI, marking the first biosimilar for cancer therapy authorized for use in the United States as a counterpart to Roche's AVASTIN. AVASTIN had been shielded by patents until 2019. Treatment innovations, such as targeted therapies and immunotherapies, are reshaping cervical cancer management, with drugs like tisotumab vedotin marking a breakthrough. Ongoing research drives advancements in therapies and diagnostics, emphasizing precision medicine. Key players like AstraZeneca and Roche, Precigen, and Nykode Therapeutics are driving progress in the cervical cancer treatment landscape. Overall, the cervical cancer market is further expected to increase in the forecast period (2024–2034).

- The total Cervical Cancer Market Size in the 7MM was ~USD 930 million in 2023 and is projected to increase during the forecast period.

- Among EU4 and the UK, Germany accounted for the maximum Cervical Cancer market size in 2023, while Italy occupied the bottom of the ladder.

- Among the therapies, KEYTRUDA is expected to generate the highest Cervical Cancer revenue in the 7MM by 2034.

- TIVDAK, as the only ADC approved for cervical cancer, carries a boxed warning for ocular side effects. However, Seagen/Genmab's TIVDAK demonstrates the potential for advancement into earlier lines of treatment, akin to Merck’s Keytruda, especially for patients whose tumors express the PD-L1 biomarker.

- Key Cervical Cancer companies such as AstraZeneca, Roche, Precigen, and Nykode Therapeutics are leading advancements in the treatment of cervical cancer.

Recent Developments in Cervical Cancer Clinical Trials

- On December 3, 2024, Corbus Pharmaceuticals Holdings, Inc. announced that the FDA granted Fast Track designation to CRB-701 for the treatment of relapsed or refractory metastatic cervical cancer.

Cervical Cancer Drugs Uptake

This section focuses on the rate of uptake of the potential Cervical Cancer drugs expected to be launched in the Cervical Cancer therapeutics market during the study period. The analysis covers cervical cancer market uptake by drugs; patient uptake by therapies; and sales of each drug. For example- Iovance’s therapeutic candidate is an autologous tumor-infiltrating lymphocyte (TIL) cell therapy. As per the analysis, Lifileucel drug uptake in the US is expected to be medium-fast with a peak share of ~11%, the drug may achieve its highest peak share in 8 years.

Cervical Cancer Pipeline Development Activities

The Cervical Cancer therapeutics market report provides insights into different Cervical Cancer clinical trials within Phase III, Phase II, and Phase I/II stage. It also analyzes key Cervical Cancer companies involved in developing targeted therapeutics.

Pipeline Development Activities

The Cervical Cancer diagnostics market report covers detailed information on collaborations, acquisitions and mergers, licensing, and patent details for cervical cancer emerging therapies.

KOL- Views

To keep up with current Cervical Cancer diagnostics market trends, we take KOLs and SMEs' opinions working in the domain through primary research to fill the data gaps and validate our secondary research. Some of the leaders like MD, Professor and Vice Chair Department of Critical Care Medicine and Director, PhD, and others. Their opinion helps to understand and validate current and emerging therapies and treatment patterns or cervical cancer market trends. This will support the clients in potential upcoming novel treatments by identifying the overall scenario of the Cervical Cancer therapeutics market and the Cervical Cancer unmet needs.

Delveinsight’s analysts connected with 30+ KOLs to gather insights; however, interviews were conducted with 10+ KOLs in the 7MM. Centers such as the Center for Cervical Dysplasia, Department of Gynecological Oncology, Division of Obstetrics and Gynecology, etc., were contacted. Their opinion helps understand and validate cervical cancer epidemiology and market trends.

Cervical Cancer Diagnostics Market: Qualitative Analysis

We perform Qualitative and Cervical Cancer Therapeutics Market Intelligence analysis using various approaches, such as SWOT analysis and Analyst views. In the SWOT analysis, strengths, weaknesses, opportunities, and threats in terms of disease diagnosis, patient awareness, patient burden, competitive landscape, cost-effectiveness, and geographical accessibility of therapies are provided. These pointers are based on the Analyst’s discretion and assessment of the patient burden, cost analysis, and existing and evolving Cervical Cancer treatment market landscape.

The analyst analyzes multiple emerging therapies based on relevant attributes such as safety, efficacy, frequency of administration, route of administration, and order of entry. In efficacy, the trial’s primary and secondary outcome measures are evaluated. Further, the therapies’ safety is evaluated wherein the acceptability, tolerability, and adverse events are majorly observed, and it sets a clear understanding of the side effects posed by the drug in the trials.

Cervical Cancer Diagnostics Market Access and Reimbursement

According to the Centers for Disease Control and Prevention, if cancer diagnosis and treatment were divided into phases of care, then the initial phase would be the first year after a diagnosis, the end-of-life phase would be the year before death from cancer, and the continuing care phase would be the time in between these two phases.

The average per-patient costs for medical services were highest for the end-of-life phase, which is nearly USD 97,000, followed by the initial care phase with nearly USD 60,000, and the continuing care phase with nearly USD 4,000. The average per-patient costs for oral prescription drugs were USD 500 for the last year of life. The list price for each indicated dose of KEYTRUDA, when given every 3 weeks, is USD 11,115.04. The list price for each indicated dose of KEYTRUDA, when given every 6 weeks, is USD 22,230.08. Most people will not pay the list price, although it may have an impact on the patient’s out-of-pocket costs. The amount that the patient will pay will depend on many factors, including the patient’s insurance situation.

Cervical Cancer Diagnostics Market Report Scope

- The Cervical Cancer diagnostics market report covers a descriptive overview, explaining its causes, signs and symptoms, pathogenesis, and currently available therapies.

- Comprehensive insight has been provided into cervical cancer epidemiology and treatment.

- Additionally, an all-inclusive account of both the current and Cervical Cancer emerging therapies is provided, along with the assessment of new therapies, which will have an impact on the current Cervical Cancer treatment market landscape.

- A detailed review of the cervical cancer diagnostics market; historical and forecasted is included in the report, covering the 7MM drug outreach.

- The Cervical Cancer diagnostics market report provides an edge while developing business strategies, by understanding trends shaping and driving the 7MM cervical cancer therapeutics market.

Cervical Cancer Treatment Market Report Insights

- Patient-based Cervical Cancer Market Forecasting

- Cervical Cancer Therapeutic Approaches

- Cervical Cancer Pipeline Analysis

- Cervical Cancer Market Size and Trends

- Cervical Cancer Treatment Market Opportunities

- Impact of Upcoming Cervical Cancer Therapies

- Cervical Cancer Drugs Market

Cervical Cancer Treatment Market Report Key Strengths

- 11 Years Cervical Cancer Market Forecast

- 7MM Coverage

- Cervical Cancer Epidemiology Segmentation

- Key Cross Competition

- Highly Analyzed Cervical Cancer Treatment Market

- Cervical Cancer Drugs Uptake

Cervical Cancer Treatment Market Report Assessment

- Current Cervical Cancer Treatment Market Practices

- Cervical Cancer Unmet Needs

- Cervical Cancer Pipeline Product Profiles

- Cervical Cancer Therapeutics Market Attractiveness

- Qualitative Analysis (SWOT and Conjoint Analysis)

- Cervical Cancer Market Drivers

- Cervical Cancer Market Barriers

FAQs

- What was the cervical cancer market share (%) distribution in 2020 and what it would look like in 2034?

- What would be the cervical cancer market size as well as market size by therapies across the 7MM during the study period (2020–2034)?

- What are the key findings about the Cervical Cancer treatment market across the 7MM and which country will have the largest cervical cancer market size during the study period (2020–2034)?

- At what CAGR, the cervical cancer market is expected to grow at the 7MM level during the study period (2020–2034)?

- What would be the cervical cancer market outlook across the 7MM during the study period (2020–2034)?

- What would be the cervical cancer market growth till 2034 and what will be the resultant market size in the year 2034?

- What are the disease risk, burden, and Cervical Cancer unmet needs?

- What is the historical cervical cancer patient pool in the United States, EU4 (Germany, France, Italy, and Spain), and the UK, and Japan?

- What would be the forecasted Cervical Cancer patient pool at the 7MM level?

- What will be the growth opportunities across the 7MM concerning the Cervical Cancer patient population?

- Out of the above-mentioned countries, which country would have the highest incident population of cervical cancer during the study period (2020–2034)?

- At what CAGR the population is expected to grow across the 7MM during the study period (2020–2034)?

- How many Cervical Cancer Companies are developing therapies for the Cervical Cancer treatment?

- How many emerging Cervical Cancer therapies are in the mid-stage and late stage of development for the treatment of cervical cancer?

- What are the key collaborations (Industry–Industry, Industry–Academia), Mergers and acquisitions, and licensing activities related to cervical cancer therapies?

- What are the recent novel therapies, targets, Cervical Cancer Mechanisms of Action, and technologies developed to overcome the limitations of existing therapies?

- What are the clinical studies going on for cervical cancer and their status?

- What are the key designations that have been granted for the emerging Cervical Cancer therapies?

- What are the 7MM historical and forecasted Cervical Cancer market?

Reasons to Buy

- The Cervical Cancer treatment market report will help in developing business strategies by understanding trends shaping and driving cervical cancer.

- To understand the future market competition in the cervical cancer market and Insightful review of the SWOT analysis of cervical cancer.

- Organize sales and marketing efforts by identifying the best opportunities for cervical cancer in the US, EU4 (Germany, France, Italy, and Spain), the United Kingdom, and Japan.

- Identification of strong upcoming players in the Cervical Cancer treatment market will help in devising strategies that will help in getting ahead of competitors.

- Organize sales and marketing efforts by identifying the best opportunities for the cervical cancer market.

- To understand the future market competition in the cervical cancer drugs market.

Stay Updated with us for Recent Articles

- Cervical Cancer: What You Need to Know!

- Cervical Cancer: Current Scenario

- Cervical Cancer Treatment: Navigating the Changing Landscape

- Preventing Cervical Cancer through Screening and HPV Vaccines

- Widespread Usage of HPV Vaccine Reduces Cervical Cancers and Pre-cancers

- Cervical Cancer Market Has a Lot Going On Under the Hood

- Cervical Cancer Market: Infographics

- Latest DelveInsight Blogs