Clostridioides Difficile Infection Market

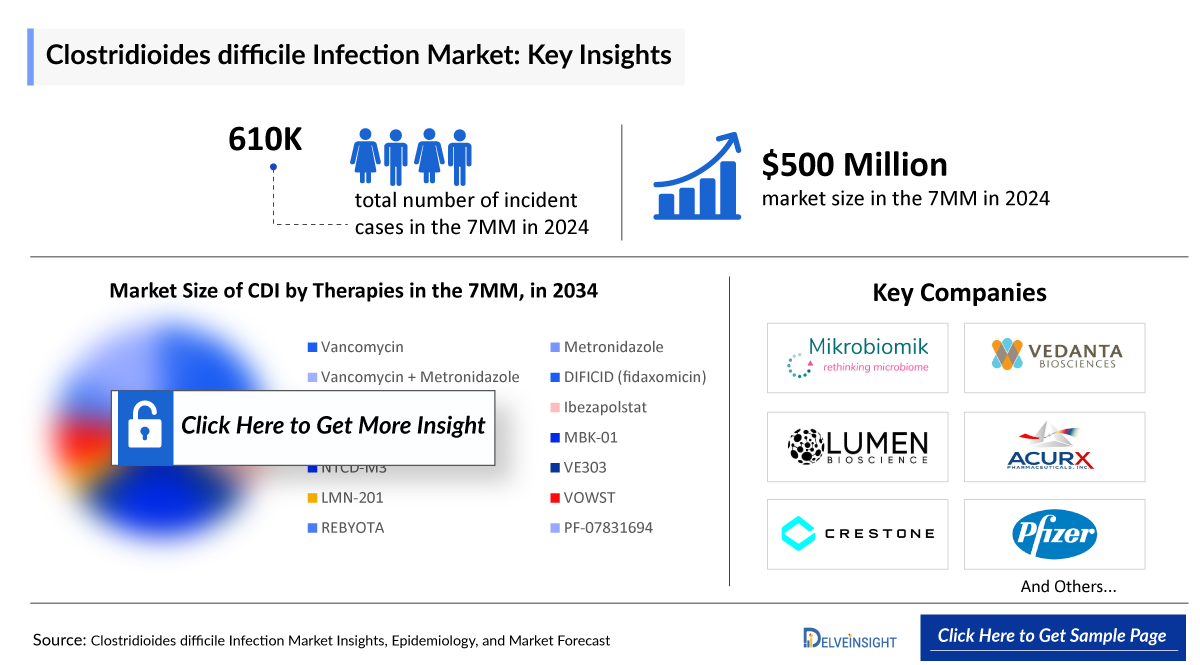

- The Clostridioides Difficile Infection market in the 7MM is USD 551 million in 2025 and projected to reach USD 1715 million by 2034.

- The Clostridioides Difficile Infection market is projected to grow at a CAGR of 13.5% by 2034 in leading countries (US, EU4, UK and Japan)

Clostridioides Difficile Infection Market and Epidemiology Analysis

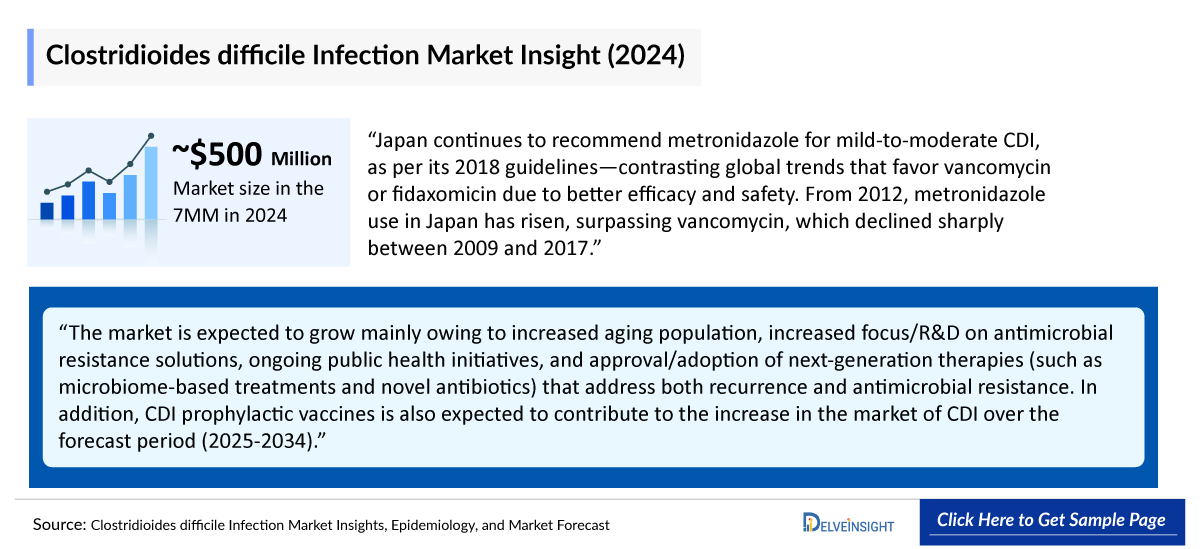

- The total Clostridioides Difficile Infection market size in the 7MM was ~USD 500 million in 2024. This is expected to increase by 2034.

- Over the past decade, healthcare-associated Clostridioides Difficile Infection incidence and mortality have declined, attributed to enhanced infection prevention, reduced use of high-risk antibiotics (notably fluoroquinolones), and targeted stewardship initiatives. The prevalence of the hypervirulent ribotype 027 strain has also declined, though it remains a significant cause of healthcare-associated Clostridioides Difficile Infection.

- Clostridioides Difficile Infection management requires a comprehensive, multifaceted approach. Key priorities include treating the acute episode, identifying and mitigating risk factors, and minimizing recurrence. Effective antimicrobial options include metronidazole, oral vancomycin (in various dosing regimens), and fidaxomicin.

- Vancomycin and fidaxomicin are the foundational treatments for Clostridioides Difficile Infection, offering the most reliable efficacy across patient populations. Metronidazole may be considered in limited cases, specifically in younger patients with mild-to-moderate disease and low risk for recurrence.

- MBK-01 is anticipated to be Europe’s first biologic therapy based on intestinal microbiota and stands out as the only emerging single-dose treatment for primary and recurrent Clostridioides difficile infection (CDI).

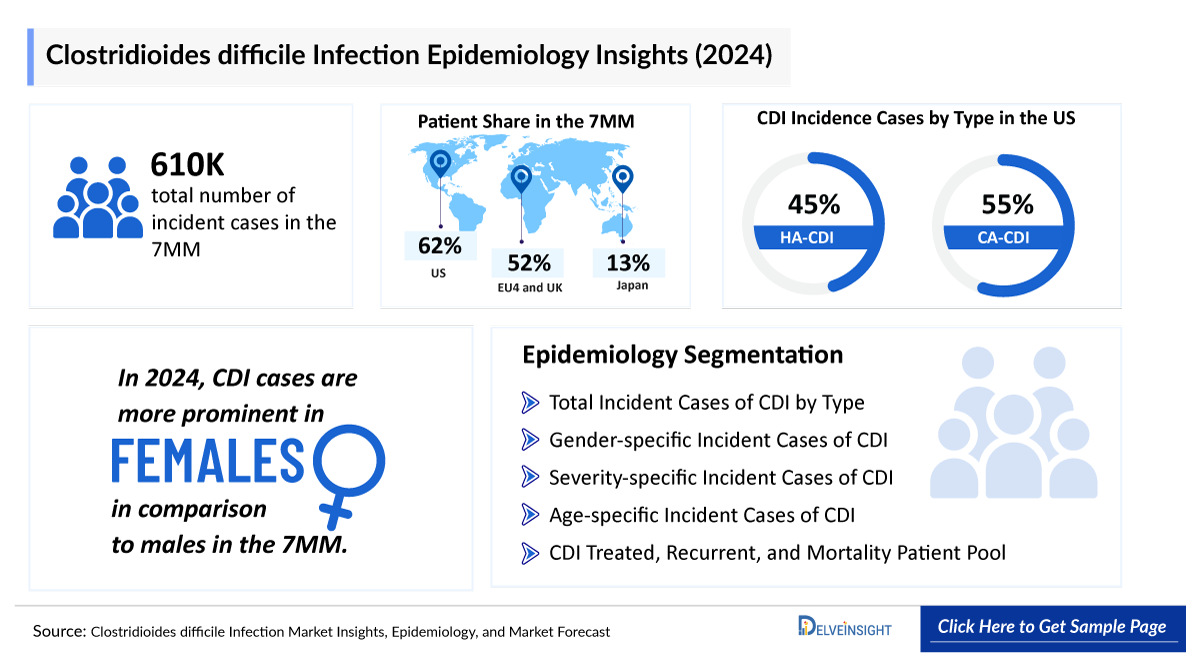

- The total number of incident cases of Clostridioides Difficile Infection in the 7MM was around 6,11,000 in 2024.

- In the 7MM, the highest incident cases of Clostridioides Difficile Infection were in the US, accounting for nearly 3,80,000 cases in 2024. These cases are anticipated to increase in the upcoming years.

- In 2024, the Clostridioides Difficile Infection incidence cases by type in the US were identified to be HA-Clostridioides Difficile Infection at ~45% and CA-Clostridioides Difficile Infection at ~55% share.

- Live biotherapeutic products such as REBYOTA and VOWST are well-positioned to bridge the gap between innovative microbiome science and clinical application. By targeting the restoration of eubiosis, these FDA-approved therapies offer a novel, mechanism-based approach supported by regulatory assurance.

- In the prevention space, REBYOTA distinguishes itself as the only single-dose therapy currently available, while VOWST offers competitive convenience with its oral route of administration.

- The total market size of the Clostridioides Difficile Infection treatment market is anticipated to experience growth during the forecast period due to promising emerging treatments and prevention options that include Ibezapolstat, CRS3123, LMN-201, MBK-01, VE303, and others.

- In February 2025, Mikrobiomik announced it has reached a new milestone upon receiving the approval of the Paediatric Investigation Plan (PIP) from the EMA for the treatment of Clostridioides Difficile Infection in paediatric patients.

Clostridioides Difficile Infection Market size and forecast

- 2025 Clostridioides Difficile Infection Market Size: USD 551 million

- 2034 Projected Clostridioides Difficile Infection Market Size: USD 1715 million

- Clostridioides Difficile Infection Growth Rate (2025-2034): 13.5% CAGR

- Largest Clostridioides Difficile Infection Market: United States

Request a sample to unlock the CAGR for "Clostridioides difficile Infection Market Forecast"

Key Factors Driving the Growth of the Clostridioides difficile Infection Market

Aging Clostridioides difficile Infection population and at-risk groups

Advanced age, frequent hospital exposure, comorbidities, and immunosuppression are major risk factors for CDI. Global population aging and increased hospital/long-term care use concentrate vulnerable patients, thereby enlarging the addressable CDI market. According to DelveInsight analysis, in 2024, the incidence of CDI in the US was estimated at approximately 184,000 cases in individuals aged 65 years and older.

Need for next-generation Clostridioides difficile Infection therapies and vaccines

With vancomycin’s efficacy declining due to the rise of antimicrobial resistance, there is a clear need for next-generation treatments. While current therapies reduce recurrence, a significant opportunity exists to expand preventive strategies, including CDI vaccines, which hold considerable clinical and economic promise despite the limited number of candidates currently in development.

Ibezapolstat: A dual advantage in Clostridioides difficile Infection treatment

Ibezapolstat demonstrates a dual benefit of clinical efficacy comparable to that of standard-of-care antibiotics, while preserving and positively modulating the gut microbiome — an increasingly significant advantage as microbiome restoration therapies, such as fecal microbiota transplantation and live biotherapeutics, gain traction in managing recurrent CDI by addressing underlying dysbiosis.

Expanding Clostridioides difficile Infection pipeline

The CDI pipeline includes several drugs in mid- to late-stage development that are anticipated to gain approval soon. The evolving landscape features a broad spectrum of therapeutic options, such as MBK-01 (Mikrobiomik), VE303 (Vedanta Biosciences), and LMN-201 (Lumen Bioscience), among others. The anticipated launch of these therapies is likely to drive further positive momentum in the market.

DelveInsight’s “Clostridioides Difficile Infection Market Insights, Epidemiology, and Market Forecast – 2034” report delivers an in-depth understanding of the Clostridioides Difficile Infection, historical and forecasted epidemiology as well as the Clostridioides Difficile Infection therapeutics market trends in the US, EU4 (Germany, France, Italy, and Spain) and the United Kingdom, and Japan.

Clostridioides difficile Infection market report provides current treatment practices, emerging drugs, and market share of the individual therapies, current and forecasted 7MM Clostridioides difficile Infection market size from 2020 to 2034. The report also covers current Clostridioides difficile Infection treatment practice/algorithm and unmet medical needs to curate the best of the opportunities and assess the underlying potential of the market.

Scope of the Clostridioides Difficile Infection Market | |

|

Study Period |

2020 to 2034 |

|

Forecast Period |

2025-2034 |

|

Geographies Covered |

|

|

Clostridioides Difficile Infection Market |

|

|

Clostridioides Difficile Infections Market Size | |

|

Clostridioides Difficile Infection Companies |

Calliditas Therapeutics AB, Travere Therapeutics Inc., Omeros Corporation, Novartis Pharmaceuticals, Chinook Therapeutics Inc., Vera Therapeutics Inc., Otsuka Pharmaceutical, and others. |

|

Clostridioides Difficile Infection Epidemiology Segmentation |

|

Clostridioides Difficile Infection Disease Understanding

Clostridioides Difficile Infection Overview

Clostridioides difficile, formerly Clostridium difficile, is a gram-positive and spore-forming bacterium. This obligate anaerobic bacillus is recognized for its ability to produce toxins and is the leading cause of antibiotic-associated diarrhea worldwide. C difficile infections can range from an asymptomatic carrier to diarrhea, progressing to severe conditions such as pseudomembranous colitis and toxic megacolon with septic shock, often resulting in a high mortality rate.

Clostridioides Difficile Infection Diagnosis

Clostridioides Difficile Infection diagnosis is primarily clinical but should be supported by laboratory tests and, when necessary, imaging and endoscopic findings. A prompt diagnosis is crucial both for correct patient management and implementation of infection control measures, especially in healthcare settings.

- Stool Examination

- Imaging

- Endoscopy

- Histologic Features

- Biomarkers

Clostridioides Difficile Infection Treatment Landscape

Clostridioides Difficile Infection treatment should begin only in symptomatic patients, as detecting C. difficile toxin without symptoms does not warrant therapy. Metronidazole and oral vancomycin have been standard treatments since the 1980s. While early studies showed similar efficacy, newer evidence indicates higher failure rates for metronidazole in severe cases. Oral vancomycin is generally well-tolerated, though rare systemic absorption can occur. Metronidazole may cause gastrointestinal side effects, alcohol-related reactions, and peripheral neuropathy with prolonged use. Approved therapies for the management of Clostridioides Difficile Infection, includes DIFICID, VOWST, REBYOTA, and others.

Further details related to diagnosis and treatment are provided in the report…

Clostridioides Difficile Infection Epidemiology

The Clostridioides Difficile Infection epidemiology covered in the report provides historical as well as forecasted epidemiology segmented by total incident cases of Clostridioides Difficile Infection, type-specific incident cases of Clostridioides Difficile Infection, gender-specific incident cases of Clostridioides Difficile Infection, severity-specific incident cases of Clostridioides Difficile Infection, age-specific incident cases of Clostridioides Difficile Infection, and Clostridioides Difficile Infection recurrence pool and mortality pool in the 7MM market covering the US, EU4 (Germany, France, Italy, and Spain) and the United Kingdom, and Japan from 2020 to 2034.

Key Findings from Clostridioides Difficile Infection Epidemiological Analyses and Forecast

- The total number of incident cases of Clostridioides Difficile Infection in the 7MM was around 6,11,000 in 2024.

- In the 7MM, the highest incident cases of Clostridioides Difficile Infection were in the US, accounting for nearly 3,80,000 cases in 2024. These cases are anticipated to increase in the upcoming years.

- In 2024, the Clostridioides Difficile Infection incidence cases by type in the US were identified to be HA-Clostridioides Difficile Infection at ~45% and CA-Clostridioides Difficile Infection at ~55% share.

- There are significant gaps in the epidemiological data of Clostridioides Difficile Infection in Japan, and Clostridioides Difficile Infection is frequently underdiagnosed in the country despite its clinical relevance.

- In the United States, the incident cases of Clostridioides Difficile Infection by gender were higher among females compared to males in 2024.

- In the 7MM in 2024, approximately 464,000 Clostridioides Difficile Infection cases were classified as mild to moderate, while around 147,000 cases were categorized as severe.

- In 2024, the incidence cases of Clostridioides Difficile Infection in the UK were estimated at approximately 1,000 in <18 years, around 7,500 cases in those aged 18–64 years, and approximately 17,000 cases in individuals aged 65 years and older.

- Clostridioides Difficile Infection was predominantly a HA-Clostridioides Difficile Infection, especially affecting older adults and those with recent antibiotic exposure or hospitalization. However, there is a growing recognition of CA-Clostridioides Difficile Infection, which now constitutes a significant portion of cases. Community cases often involve younger, previously healthy individuals, although severe outcomes remain more common in older or immunocompromised patients.

Clostridioides Difficile Infection Epidemiology Segmentation

- Total incident cases of Clostridioides Difficile Infection

- Type-specific incident cases of Clostridioides Difficile Infection

- Gender-specific incident cases of Clostridioides Difficile Infection

- Severity-specific incident cases of Clostridioides Difficile Infection

- Age-specific incident cases of Clostridioides Difficile Infection

- Clostridioides Difficile Infection recurrence pool

- Clostridioides Difficile Infection mortality pool

Clostridioides Difficile Infection Drug Analysis

The drug chapter segment of the Clostridioides Difficile Infection report encloses the detailed analysis of Clostridioides Difficile Infection mid and late-stage pipeline drugs. It also helps understand the Clostridioides Difficile Infection clinical trial details, expressive pharmacological action, agreements and collaborations, approval and patent details of each included drug, and the latest news and press releases.

Clostridioides Difficile Infection Marketed Drugs

DIFICID/DIFICLIR/DAFCLIR (fidaxomicin): Merck & Co./Tillotts Pharma/Astellas Pharma

DIFICID, manufactured by Merck & Co and Astellas Pharma, is a macrolide antibiotic used to treat CDAD in adults and children 6 months of age or older. Clostridioides (formerly Clostridium) difficile-associated diarrhea is a bacterium that can cause an infection that can damage the colon and cause stomach pain and severe diarrhea.

DIFICID (also known as OPT-80 and PAR-101) is a novel antibiotic agent and the first representative of a new class of antibacterials called macrocycles. It has a narrow-spectrum antibacterial profile mainly directed against CD and exerts moderate activity against some other gram-positive species. The drug product is poorly absorbed and exerts its activity in the GI tract, which is an advantage when used in the applied indication and treatment of Clostridioides Difficile Infection (also known as CDAD).

DIFICID has received global approvals for treating Clostridioides Difficile Infection. The US FDA approved DIFICID tablets in 2011 and later expanded approval in 2020 to include pediatric use. In the EU, it was approved as DIFICLIR in 2011, with the first launch in the UK in 2012. In Japan, Astellas Pharma’s DAFCLIR was approved in 2018 for treating C. difficile-related infectious enteritis.

VOWST: Seres Therapeutics/Nestlé Health Science

VOWST, formerly called SER-109, is an orally administered microbiota-based therapeutic to prevent the recurrence of Clostridioides Difficile Infection in adults following antibacterial treatment for rClostridioides Difficile Infection. VOWST is not indicated for the treatment of Clostridioides Difficile Infection. VOWST is the first orally administered microbiota-based therapeutic for the prevention of recurrent Clostridioides Difficile Infection.

- In January 2025, Seres Therapeutics announced the receipt of a USD 50 million installment payment related to the Company’s previously announced sale of its VOWST business to Société des Produits Nestlé S.A (SPN, and with certain of its affiliates, collectively, Nestlé Health Science). This installment payment was expected as Seres is fulfilling its transition obligations

Clostridioides Difficile Infection Emerging Drugs

The Clostridioides Difficile Infection pipeline possesses some drugs in mid- and late stage development to be approved in the near future. The emerging landscape holds a diverse range of therapeutic alternatives for treatment, including MBK-01 (Mikrobiomik), VE303 (Vedanta Biosciences), LMN-201 (Lumen Bioscience) and others. The expected launch of these therapies shall further create a positive impact on the market.

Ibezapolstat: Acurx Pharmaceuticals

Ibezapolstat is a novel, orally administered antibiotic, being developed as a GPSS antibacterial. It is the first of a new class of DNA polymerase IIIC inhibitors under development by Acurx to treat bacterial infections. Ibezapolstat’s unique spectrum of activity, which includes CD but spares other Firmicutes and the important Actinobacteria phyla, appears to contribute to the maintenance of a healthy gut microbiome.

- In June 2025, Acurx Pharmaceuticals announced the publication of results in Lancet Microbe of its Phase IIb clinical study entitled: “Efficacy, safety, pharmacokinetics, and associated microbiome changes of ibezapolstat compared with vancomycin in adults with Clostridioides Difficile Infection: A Phase IIb, randomized, double-blind, active-controlled, multicenter study.

- In January 2025, Acurx Pharmaceuticals announced that they received positive regulatory guidance from the EMA for the Ibezapolstat Phase III clinical trial program. The EMA guidance also confirmed Ibezapolstat’s regulatory pathway for a Marketing Authorization Application (MAA) to be filed by the company after successful completion of the Phase III clinical trials

MBK-01: Mikrobiomik

MBK-01, an investigational drug based on faecal microbiota transplantation, presents a promising alternative to the current standard of care for Clostridioides Difficile Infection. MBK-01 is the EU’s first biologic based on intestinal microbiota, Full-spectrum Purified Intestinal Microbiota (FSPIM), in the form of lyophilised capsules for oral administration.

- It is currently being evaluated in Phase III clinical trials, with a regulatory submission expected in 2026.

- In February 2025, received the approval of the Paediatric Investigation Plan (PIP) from the EMA for the treatment of Clostridioides Difficile Infection in paediatric patients.

- In January 2025, Mikrobiomik announced it has received the best innovation in the healthcare sector and the highest distinction of the competition, Innovation of Innovations at Quality Innovation Awards 2024.

As per Mikrobiomik’s pipeline, the company anticipates CTD and MAA submission of MBK-01 in 2026, followed by market launch in 2027.

VE303: Vedanta Biosciences

VE303 is a potential first-in-class live biotherapeutic product for the prevention of rClostridioides Difficile Infection. VE303 is an orally administered, defined bacterial consortium therapeutic candidate that consists of eight strains that were rationally selected using Vedanta’s product engine. VE303 is produced from pure, clonal bacterial cell banks, which yield a standardized drug product in powdered form and bypass the need to rely on direct sourcing of donor fecal material of inconsistent composition.

- The Phase III RESTORATiVE303 trial is evaluating the efficacy and safety of VE303 in patients with rClostridioides Difficile Infection and is intended to form the basis for a BLA to be filed with the US FDA.

- The US FDA granted VE303 ODD in 2017 and FTD in 2023 for the prevention of rClostridioides Difficile Infection.

Note: Detailed therapy assessment will be provided in the final report...

Clostridioides Difficile Infection Drug Class Insights

Clostridioides Difficile Infection has traditionally been treated with antibiotics like fidaxomicin, a RNA polymerase inhibitor approved in 2011, which effectively kills the bacteria but often leads to high recurrence rates due to continued disruption of the gut microbiome. In recent years, the treatment landscape has shifted with the introduction of microbiota-based therapeutics such as VOWST (Seres Therapeutics/Nestlé Health Science) and REBYOTA (Ferring), both approved for preventing recurrent Clostridioides Difficile Infection. These live biotherapeutic products aim to restore the natural gut flora after antibiotic treatment—REBYOTA via rectal delivery of standardized fecal microbiota, and VOWST as an oral capsule containing purified bacterial spores. Their popularity has grown as they offer a novel, targeted approach to reducing Clostridioides Difficile Infection recurrence by addressing the root cause—gut dysbiosis—marking a significant evolution in Clostridioides Difficile Infection management.

Clostridioides Difficile Infection Market Outlook

In the current market, multiple treatment options are available for Clostridioides Difficile Infection, including traditional antibiotics such as vancomycin and fidaxomicin, the latter being a RNA polymerase inhibitor approved in 2011. While these antibiotics can effectively treat acute infections, they often fail to fully restore the gut microbiota, leading to high recurrence rates. Recently, the treatment paradigm has begun to shift with the emergence of microbiota-based therapies such as REBYOTA (Ferring) and VOWST (Seres Therapeutics/Nestlé Health Science), both approved for preventing recurrent Clostridioides Difficile Infection. REBYOTA, approved in 2022, is a rectally administered live biotherapeutic derived from human fecal microbiota, while VOWST, approved in 2023, is an orally delivered capsule containing purified bacterial spores. These novel approaches aim to re-establish a healthy gut microbiome rather than solely eliminate the pathogen, marking a significant step forward in Clostridioides Difficile Infection management. As of now, the treatment space is increasingly dominated by non-antibiotic therapies targeting recurrence, and the pipeline is rapidly evolving. Key players such as Seres Therapeutics, Ferring, Finch Therapeutics, and others are actively advancing next-generation microbiome-based interventions that have the potential to transform the future of Clostridioides Difficile Infection treatment and possibly provide curative outcomes.

Key Clostridioides Difficile Infection Market Insights:

- This section includes a glimpse of the Clostridioides Difficile Infection in the 7MM

- The total market size of Clostridioides Difficile Infection in the 7MM is nearly USD ~ 500 million in 2024 and is projected to grow during the forecast period (2025–2034).

- According to DelveInsight’s estimates, the largest market size of Clostridioides Difficile Infection is captured by the US in 2024.

- In EU4 and the UK, Germany has the maximum market share, followed by France in 2024 while Spain had the lowest market share.

- The market size of Clostridioides Difficile Infection in Japan was USD ~9 million in 2024, which is expected to rise during the forecast period (2025–2034).

- The upcoming therapies for Clostridioides Difficile Infection are expected to combat the current unmet needs faced by patients with Clostridioides Difficile Infection.

Clostridioides Difficile Infection Drugs Uptake

This section focuses on the anticipated uptake of emerging therapies for Clostridioides Difficile Infection expected to enter the market during the 2020–2034 study period. The analysis covers drug adoption trends, patient uptake across therapeutic approaches, and projected sales performance. One of the most notable developments in this space is the advancement of microbiota-based therapies, such as VOWST (Seres Therapeutics/Nestlé Health Science), an oral live biotherapeutic, and REBYOTA (Ferring), a rectally administered microbiota suspension.

These therapies represent a significant shift from traditional antibiotics, as they aim to restore gut microbial balance rather than simply eliminate C. difficile. Their unique mechanisms of action, which involve re-establishing a healthy microbiome environment, have shown improved outcomes in preventing recurrence, especially in patients at high risk for repeated infections. Among these, VOWST has garnered strong clinical interest due to its oral route of administration, enabling greater patient convenience and adherence. These next-generation therapies are expected to capture increasing market share over time, particularly as awareness grows around the limitations of conventional antibiotics and the need for sustained, microbiome-targeted treatment strategies in Clostridioides Difficile Infection management.

Clostridioides Difficile Infection Pipeline Development Activities

The Clostridioides Difficile Infection pipeline report provides insights into different Clostridioides Difficile Infection clinical trials within Phase III, Phase II, and Phase I stages. It also analyzes key players involved in developing targeted therapeutics.

Clostridioides Difficile Infection Pipeline Development Activities

The Clostridioides Difficile Infection clinical trials analysis report covers detailed information on collaborations, acquisitions and mergers, licensing, and patent details for Clostridioides Difficile Infection emerging therapies.

Latest KOL Views on Clostridioides Difficile Infection

To keep up with current market trends, we take KOLs and SMEs’ opinions working in the domain through primary research to fill the data gaps and validate our secondary research. Their opinion helps understand and validate current and emerging therapies and treatment patterns or Clostridioides Difficile Infection market trends. This will support the clients in potential upcoming novel treatments by identifying the overall scenario of the market and the unmet needs.

What KOLs are saying on Clostridioides Difficile Infection Patient Trends?

“Recurrence remains a significant clinical challenge in the management of Clostridioides Difficile Infection, with many patients experiencing multiple episodes. This pattern of relapse complicates treatment decisions and contributes to increased morbidity and overall healthcare burden.”

– Harvard Medical School, Boston, USA

Clostridioides Difficile Infection Qualitative Analysis

We perform Qualitative and market Intelligence analysis using various approaches, such as SWOT analysis and Analyst views. In the SWOT analysis, strengths, weaknesses, opportunities, and threats in terms of disease diagnosis, patient awareness, patient burden, competitive landscape, cost-effectiveness, and geographical accessibility of therapies are provided. These pointers are based on the Analyst’s discretion and assessment of the patient burden, cost analysis, and existing and evolving treatment landscape.

The analyst analyzes multiple emerging therapies based on relevant attributes such as safety, efficacy, frequency of administration, route of administration, and order of entry.

In efficacy, the trial’s primary and secondary outcome measures are evaluated. Further, the therapies’ safety is evaluated wherein the acceptability, tolerability, and adverse events are majorly observed, and it sets a clear understanding of the side effects posed by the drug in the trials.

Clostridioides Difficile Infection Market Access and Reimbursement

Antibiotics are typically prescribed for short durations, often just two weeks, and face reimbursement challenges. Government and private insurers generally use bundled payments for antibiotic treatments, covering the entire course rather than itemizing costs for the drug, administration, and other services. Hospitals receive a fixed amount, so if they manage treatment at a lower cost, they can keep the savings, improving margins. However, this system has led to poor returns for antibiotic developers, resulting in numerous company failures, bankruptcies, and low-value acquisitions in the sector.

To be continue in the final report…

Scope of the Clostridioides Difficile Infection Market Report

- The report covers the descriptive overview of Clostridioides Difficile Infection, explaining its causes, signs and symptoms, pathogenesis, and currently available therapies.

- Comprehensive insight has been provided into the Clostridioides Difficile Infection epidemiology and treatment.

- Additionally, an all-inclusive account of both the current and emerging therapies for Clostridioides Difficile Infection is provided, along with the assessment of new therapies that will have an impact on the current treatment landscape.

- A detailed review of the Clostridioides Difficile Infection market, historical and forecasted, is included in the report, covering the 7MM drug outreach.

- The report provides an edge while developing business strategies by understanding trends shaping and driving the 7MM Clostridioides Difficile Infection market.

Clostridioides Difficile Infection Market Report Highlights

- In the coming years, the Clostridioides Difficile Infection market is set to change due to emerging therapies in the pipeline and incremental healthcare spending across the world, which would expand the size of the market to enable drug manufacturers to penetrate more into the market.

- The companies and academics are working to assess challenges and seek opportunities that could influence Clostridioides Difficile Infection R&D. The therapies under development are focused on novel approaches to treat or improve the disease condition.

- The report also encompasses other major segments, i.e., type-specific, gender-specific, age-specific, severity-specific cases of Clostridioides Difficile Infection, and recurrent pool and mortality pool of Clostridioides Difficile Infection.

- Expected launch of potential therapies, Ibezapolstat, CRS3123, LMN-201, MBK-01, VE303, and others might change the landscape in the treatment of Clostridioides Difficile Infection.

Clostridioides Difficile Infection Market Report Insights

- Clostridioides Difficile Infection Patient Population

- Clostridioides Difficile Infection Therapeutic Approaches

- Clostridioides Difficile Infection Pipeline Analysis

- Clostridioides Difficile Infection Market Size and Trends

- Clostridioides Difficile Infection Market Opportunities

- Impact of Upcoming Clostridioides Difficile Infection Therapies

Clostridioides Difficile Infection Market Report Key Strengths

- 10 Year Forecast

- 7MM Coverage

- Clostridioides Difficile Infection Epidemiology Segmentation

- Key Cross Competition

- Highly Analyzed Market

- Clostridioides Difficile Infection Drugs Uptake

Clostridioides Difficile Infection Market Report Assessment

- Current Clostridioides Difficile Infection Treatment Practices

- Clostridioides Difficile Infection Unmet Needs

- Clostridioides Difficile Infection Pipeline Product Profiles

- Clostridioides Difficile Infection Market Attractiveness

- SWOT and Conjoint Analysis

- Clostridioides Difficile Infection Market Drivers

- Clostridioides Difficile Infection Market Barriers

FAQs on Clostridioides Difficile Infection Market

- What was the Clostridioides Difficile Infection market share (%) distribution in 2020, and what it would look like in 2034?

- What would be the Clostridioides Difficile Infection total market size as well as market size by therapies across the 7MM during the study period (2020–2034)?

- What are the key findings pertaining to the market across the 7MM, and which country will have the largest Clostridioides Difficile Infection market size during the study period (2020–2034)?

- At what CAGR, the Clostridioides Difficile Infection market is expected to grow at the 7MM level during the study period (2020–2034)?

- What would be the Clostridioides Difficile Infection market outlook across the 7MM during the study period (2020–2034)?

- What would be the Clostridioides Difficile Infection market growth till 2034, and what will be the resultant market size in 2034?

- How would the market drivers, barriers, and future opportunities affect the market dynamics and subsequent analysis of the associated trends?

- What are the disease risk, burden, and unmet needs of Clostridioides Difficile Infection?

- What is the historical Clostridioides Difficile Infection patient pool in the US, EU4 (Germany, France, Italy, and Spain) and the UK, and Japan?

- What would be the forecasted patient pool of Clostridioides Difficile Infection at the 7MM level?

- What will be the growth opportunities across the 7MM with respect to the patient population pertaining to Clostridioides Difficile Infection?

- Out of the above-mentioned countries, which country would have the highest prevalent population of Clostridioides Difficile Infection during the study period (2020–2034)?

- At what CAGR is the population expected to grow across the 7MM during the study period (2020–2034)?

Reasons to buy Clostridioides Difficile Infection Market Forecast Report

- The report will help in developing business strategies by understanding trends shaping and driving the Clostridioides Difficile Infection market.

- To understand the future market competition in the Clostridioides Difficile Infection market and an insightful review of the key market drivers and barriers.

- Organize sales and marketing efforts by identifying the best opportunities for Clostridioides Difficile Infection in the US, EU4 (Germany, France, Italy, and Spain) and the United Kingdom, and Japan.

- Identification of strong upcoming players in the market will help in devising strategies that will help in getting ahead of competitors.

- Organize sales and marketing efforts by identifying the best opportunities for the Clostridioides Difficile Infection market.

- To understand the future market competition in the Clostridioides Difficile Infection market.