crohns disease cd market insight

DelveInsight’s ‘Crohn’s Disease (CD) - Market Insights, Epidemiology, and Market Forecast—2030’ report delivers an in-depth understanding of the CD, historical and forecasted epidemiology as well as the CD market trends in the United States.

The CD market report provides current treatment practices, emerging drugs, CD market share of the individual therapies, current and forecasted CD market size from 2018 to 2030 segmented by the United States market. The Report also covers current CD treatment practice/algorithm, market drivers, market barriers, and unmet medical needs to curate the best of the opportunities and assesses the underlying potential of the market.

Geography Covered

- The United States

Study Period: 2018–2030

Crohn’s Disease (CD): Disease Understanding and Treatment Algorithm

Crohn’s Disease Overview

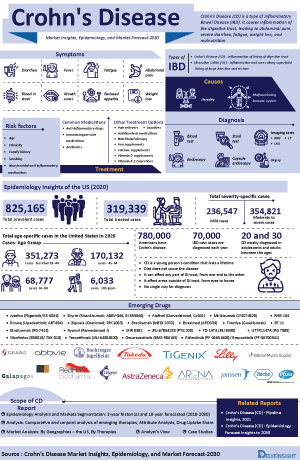

Crohn’s Disease (CD) is a type of Inflammatory Bowel Disease (IBD). It causes inflammation of the digestive tract, leading to abdominal pain, severe diarrhea, fatigue, weight loss, and malnutrition. Inflammation caused by CD can involve different areas of the digestive tract in different people. However, this type of IBD most commonly affects the small intestine and the start of the colon. CD can cause patches of inflammation that damage multiple layers of the GI tract wall. CD can be painful and sometimes may lead to life-threatening complications.

Crohn’s is sometimes described as a chronic condition. This means that it is ongoing and life-long. The disease runs a benign course with few flare-ups in many people, while other people may have more severe disease. CD is not infectious. Crohn’s can start at any age but usually appears for the first time between the ages of 10 and 40, although there is a small peak in the number of people diagnosed over 60. Crohn’s is often categorized according to which part or parts of the gut are most affected. Sometimes it can affect more than one part of the gut. There are different types of CD, each affecting different parts of the digestive tract including ileocolitis, ileitis, gastroduodenal Crohn’s disease, jejunoileitis, and Crohn’s colitis. The causes of CD are not yet well understood but genetic, immune response and environmental factors are suspected to contribute to CD development

Crohn’s symptoms may range from mild-to-severe and vary from person to person. Patients most often present with abdominal cramps, diarrhea, delayed growth (in prepubescent patients), weight loss, fever, anemia, a right lower quadrant abdominal mass (if a complication has developed in the ileal area), or perianal fistula. In addition to having symptoms in the GI tract, some people may also experience various symptoms in other parts of the body associated with CD.

Crohn’s Disease (CD) Diagnosis

Diagnosis of CD requires a complete assessment based on clinical history, physical examination, and complementary diagnostic tests, such as assays for serological and fecal biomarkers, blood tests. The doctor may recommend additional testing to look inside the GI tract and intestine. While these tests are more invasive than others, they are often done in an outpatient setting. Intestinal endoscopies are the most accurate methods for diagnosing CD and ruling out other possible conditions, such as ulcerative colitis, diverticular disease, or cancer.

Cross-sectional imaging refers to using computerized tomography (CT) scanning or magnetic resonance imaging (MRI) to evaluate the intestinal tract and surrounding structures for the presence of inflammation or complications such as strictures, fistulae, or abnormal fluid collections. There is no single test to confirm a Crohn’s diagnosis, and CD symptoms are often similar to other conditions, including bacterial infection. The doctors may also perform a differential diagnosis to rule out other conditions that can have some of the common symptoms of CD, such as abdominal pain and diarrhea.

Crohn’s Disease Treatment

The basic goals of treatment are to decrease the inflammation in the intestine, to prevent flare-ups of the symptoms, to achieve remission, and, once that is accomplished, to maintain remission. The drug therapies involve less effective, potentially less toxic treatment strategies, such as aminosalicylates (sulfasalazine), antibiotics, or corticosteroids (budesonide). Once remission is achieved, immunomodulators (azathioprine, mercaptopurine, and methotrexate) are considered for maintenance of remission.

For those who do not get into remission with conventional therapy, escalation to the highly effective but potentially more toxic treatment strategies treatment with biologics (infliximab, adalimumab, certolizumab, vedolizumab, natalizumab, ustekinumab) is typically indicated. Also, surgery may become necessary when medical therapies no longer control the disease or treat complications. Some people with CD may be prescribed exclusive enteral nutrition (a special liquid-only diet), usually for 2-8 weeks. People on this diet do not eat ordinary food or drink because the liquid diet provides them with all the nutrients they need.

CD Epidemiology

The CD epidemiology division provides insights about the historical and current CD patient pool and forecasted trends for the United States. It helps to recognize the causes of current and forecasted trends by exploring numerous studies and views of key opinion leaders. This part of the DelveInsight report also provides the diagnosed patient pool and their trends along with assumptions undertaken.

Key Findings

In the year 2020, the total prevalent case of CD was 825,165 cases in the United States which are expected to grow during the forecast period, i.e., 2021–2030.

The disease epidemiology covered in the report provides historical as well as forecasted CD epidemiology [segmented as Total Prevalent Cases of CD, Total Diagnosed Cases of CD, Age-specific cases of CD, Severity-specific Cases of CD, and Treated cases of CD] in the United States from 2018 to 2030.

CD Drug Chapters

The drug chapter segment of the CD report encloses the detailed analysis of CD marketed drugs and late stage (Phase-III and Phase-II) pipeline drugs. It also helps to understand the CD clinical trial details, expressive pharmacological action, agreements and collaborations, approval and patent details, advantages and disadvantages of each included drug, and the latest news and press releases.

CD Approved Drugs

Entyvio/Vedolizumab (Takeda Pharmaceutical)

Entyvio (Vedolizumab) is a gut-selective biologic developed by Takeda Pharmaceutical and marketed under the trade name Entyvio. It is approved in the US for the treatment of adult patients with moderately to severely active CD, who have had an inadequate response with, lost response to, or were intolerant to either conventional therapy or a tumor necrosis factor-alpha (TNFα)-antagonist. It is a humanized monoclonal antibody designed to specifically antagonize the alpha 4 beta 7 integrin, inhibiting the binding of alpha 4 beta 7 integrins to intestinal Mucosal Addressin Cell Adhesion Molecule 1 (MAdCAM-1), but not Vascular Cell Adhesion Molecule 1 (VCAM-1).

Stelara/Ustekinumab (Janssen Pharmaceutical)

Stelara (Ustekinumab) is a prescription medicine approved for the treatment of adults 18 years and older with moderately to severely active Crohn’s disease. Patients with Crohn's disease and Ulcerative colitis are found to have elevated levels of two of these proteins, IL-12 and IL-23. Stelara is the only FDA-approved medicine that targets IL-12 and IL-23, which are thought to be associated with gastrointestinal inflammation in Crohn's disease. Stelara is a human IgG1κ monoclonal antibody, are a human interleukin-12 and -23 antagonist. Using DNA recombinant technology, ustekinumab is produced in a murine cell line (Sp2/0).

Cimzia/Certolizumab pegol (UCB)

Cimzia (Certolizumab pegol) is a TNF blocker. Cimzia is a recombinant, humanized antibody Fab' fragment, with specificity for human tumor necrosis factor-alpha (TNFα), conjugated to an approximately 40kDa polyethylene glycol (PEG2MAL40K). The Fab' fragment is manufactured in E. coli and is subsequently subjected to purification and conjugation to PEG2MAL40K, to generate certolizumab pegol. In April 2008, the US FDA approved Cimzia (certolizumab pegol), the first and only PEGylated anti-TNFa (Tumor Necrosis Factor-alpha) antibody indicated for reducing signs and symptoms of Crohn's disease and maintaining clinical response in adult patients with moderate to severely active disease who have an inadequate response to conventional therapy.

Tysabri/Natalizumab (Biogen)

Tysabri (Natalizumab) is a recombinant humanized IgG4κ monoclonal antibody. Natalizumab contains human framework regions and the complementarity determining regions of a murine antibody that binds to α4-integrin. In Crohn’s disease, the interaction of the α4β7 integrin with the endothelial receptor MAdCAM1 has been implicated as an important contributor to the chronic inflammation that is a hallmark of the disease. The clinical effect of natalizumab in CD may therefore be secondary to blockade of the molecular interaction of the α4ß7-integrin receptor with MAdCAM-1 expressed on the venular endothelium at inflammatory foci. In January 2008, Tysabri was approved by the US FDA for inducing and maintaining clinical response and remission in adult patients with moderately to severely active CD with evidence of inflammation who have had an inadequate response to, or are unable to tolerate, conventional CD therapies and inhibitors of TNF-alpha.

Remicade /Infliximab (Janssen Biotech)

Remicade (Infliximab) is a product developed by Janssen Biotech (formerly known as Centocor), a subsidiary of Johnson & Johnson. The active ingredient in Remicade is a chimeric IgG1κ monoclonal antibody (composed of human constant and murine variable regions) specific for human tumor necrosis factor-alpha (TNFα). Infliximab neutralizes the biological activity of TNFα by binding with high affinity to the soluble and transmembrane forms of TNFα and inhibits binding of TNFα with its receptors. In August 1998, Remicade (Infliximab), received its initial marketing approval from the US FDA for the treatment of CD. Subsequently, in May 2006, FDA also approved an expanded indication for Infliximab to include a labeled use in pediatric patients for the treatment of CD.

Humira/Adalimumab (AbbVie)

Humira (Adalimumab) is a tumor necrosis factor blocker. Adalimumab is a recombinant human IgG1 monoclonal antibody that binds specifically to TNF-alpha and blocks its interaction with the p55 and p75 cell surface TNF receptors. Adalimumab also lyses surface TNF expressing cells in vitro in the presence of complement. Adalimumab does not bind or inactivate lymphotoxin (TNF-beta). Humira injection is supplied as a sterile, preservative-free solution for subcutaneous administration. In February 2007, Humira received US FDA market approval as a treatment for reducing the signs and symptoms and inducing and maintaining clinical remission in adults with moderately to severely active CD who have had an inadequate response to conventional therapy. In September 2014, the US FDA has approved Humira (adalimumab) for reducing signs and symptoms and achieving and maintaining clinical remission, in pediatric CD patients 6 years of age and older when certain other treatments have not worked well enough.

Note: Detailed Current therapies assessment will be provided in the full report of CD

CD Emerging Drugs

Risankizumab/ABBV-066 (AbbVie/Boehringer Ingelheim)

Risankizumab (ABBV-066) is an anti-IL-23 antibody being investigated by AbbVie and Boehringer Ingelheim. It is investigated for the treatment of multiple inflammatory diseases, including CD and UC. Risankizumab is a humanized monoclonal antibody that targets the p19 subunit of IL-23, which subsequently inhibits the binding of IL-23R and activation of the pro-inflammatory JAK/STAT intracellular signaling pathway. Risankizumab is currently in the Phase III stage of clinical development. It is undergoing four of these Phase III trials for CD. In November 2016, the US FDA granted Orphan Drug Designation to risankizumab (ABBV-066; formerly BI 655066) for the investigational treatment of CD in pediatric patients.

Zeposia/Ozanimod (Celgene)

Zeposia (Ozanimod; RPC1063) developed by Celgene, is an investigational candidate for the treatment of Inflammatory Bowel Disease (including CD and UC). Zeposia contains ozanimod, an S1P receptor modulator, and is supplied as ozanimod hydrochloride (HCl). Ozanimod is a sphingosine 1-phosphate (S1P) receptor modulator that binds with high affinity to S1P receptors 1 and 5. Ozanimod blocks the capacity of lymphocytes to egress from lymph nodes, reducing the number of lymphocytes in peripheral blood Currently, Zeposia is in the Phase III development stage for the treatment of CD.

Tremfya/Guselkumab (Janssen)

Tremfya (Guselkumab) is a human monoclonal antibody against the p19 subunit of interleukin (IL)-23 developed by Janssen. Guselkumab, an interleukin-23 blocker, is a human immunoglobulin G1 lambda (IgG1λ) monoclonal antibody. Guselkumab is produced in a mammalian cell line using recombinant DNA technology. Guselkumab selectively binds to the p19 subunit of interleukin 23 (IL-23) and inhibits its interaction with the IL-23 receptor. Guselkumab inhibits the release of pro-inflammatory cytokines and chemokines. Currently, Tremfya (Guselkumab) is undergoing a Phase II/III clinical trial development stage for Crohn’s Disease.

Jyselica/Filgotinib (Gilead Sciences/Galapagos NV)

Filgotinib is an investigational agent with potential anti-inflammatory and immunomodulating activities discovered and developed by Galapagos, in collaboration with Gilead. It is a selective JAK1 (Janus kinase 1) inhibitor. Upon oral administration, filgotinib specifically targets, binds to, and inhibits the phosphorylation of JAK1, which interferes with JAK/STAT (signal transducer and activator of transcription)-dependent signaling. As JAK1 mediates the signaling of many pro-inflammatory cytokines, JAK1 inhibition prevents cytokine signaling and activity in many inflammatory and immune-mediated processes and leads to a decrease in inflammation and activation of certain immune cells. Currently, Filgotinib is in Phase III clinical development stage in the US for CD. In July 2019, Gilead Sciences announced that at a recent pre-New Drug Application (NDA) meeting with the US FDA, the company provided an update about the investigational oral, selective JAK1 inhibitor, filgotinib.

Rinvoq/Upadacitinib (AbbVie)

Rinvoq (Upadacitinib, ABT-494), is a JAK1 selective inhibitor being investigated to treat CD by AbbVie. Upadacitinib modulates the signaling pathway at the point of JAKs, preventing the phosphorylation and activation of STATs. JAKs are intracellular enzymes that transmit signals arising from cytokine or growth factor-receptor interactions on the cellular membrane to influence cellular processes of hematopoiesis and immune cell function. Upadacitinib is currently in Phase III investigational stage for the treatment of CD. AbbVie is conducting three Phase III clinical trials as well as one Phase II clinical trial for CD.

Note: Detailed emerging therapies assessment will be provided in the final report.

CD Market Outlook

As discussed in previous sections, the CD is a chronic inflammatory condition of the gastrointestinal tract with complications causing destructive intestinal inflammation, which often tunnels into the layers of affected bowel tissue and may create fistulas that penetrate through the bowel wall. It is a type of inflammatory bowel disease and can be painful, debilitating, and, sometimes, life-threatening. Crohn’s is often categorized according to which part or parts of the gut are most affected. Sometimes it can affect more than one part of the gut. The goals of treatment are to decrease the inflammation in the intestines, prevent flare-ups of the symptoms, and keep the patient in remission. No single treatment works for everyone with CD.

Currently, the treatment strategies in the United States include drug therapies and surgery. The current treatment for CD groups the therapeutic agents according to the different CD severity levels, with an ultimate goal to maintain clinical remission. The treatment strategy often begins with a less effective, potentially less toxic treatment strategy, such as aminosalicylates (sulfasalazine), antibiotics or corticosteroids (budesonide), with escalation to the highly effective but potentially more toxic treatment strategies, such as prednisone, immunomodulators (azathioprine, mercaptopurine, methotrexate) and biological therapy (infliximab, adalimumab, certolizumab, vedolizumab, natalizumab, ustekinumab), in patients who failed each line of therapy.

The US FDA-approved biologics for the treatment of CD include infliximab, adalimumab, certolizumab, vedolizumab, natalizumab, ustekinumab.

At present, some companies have indulged themselves in initiating clinical trials that investigate new treatment options or studying how to use existing treatment options better. Current ongoing trials evaluate therapies with novel MOAs that are less immunogenic than current offerings and many new classes of therapies are looking to enter the market over the next 10 years. Key players such as Gilead Sciences and Galapagos (Filgotinib), AbbVie and Boehringer Ingelheim (Risankizumab), Takeda Pharmaceuticals (Alofisel), Eli Lilly and Company (Mirikizumab), RedHill Biopharma (RHB-104), Roche (Genentech) (Etrolizumab), AbbVie (Upadacitinib), Celgene (Ozanimod), AstraZeneca (Brazikumab), Mesoblast (Remestemcel-L), Arena Pharmaceuticals (Etrasimod), Janssen (Guselkumab) and several others are investigating their candidates for the management of Crohn’s Disease in the United States.

Key Findings

The CD market size in the United States is expected to change during the study period 2018–2030. The therapeutic market of CD in the United States market is expected to increase during the study period (2018–2030) with a CAGR of 7.6%.

CD Pipeline Development Activities

The drugs which are in pipeline include:

1. Jyselica/Filgotinib (Gilead Sciences/Galapagos NV)

2. Rinvoq/Upadacitinib (AbbVie)

3. Etrolizumab/RG 7413 (Hoffmann-La Roche/Genentech)

4. Ozanimod/Zeposia (Celgene)

5. Skyrizi/Risankizumab (AbbVie/Boehringer Ingelheim)

6. Brazikumab/MEDI-2070 (Astrazeneca)

7. Alofisel/Darvadstrocel (Takeda/TiGenix)

8. Mirikizumab/LY-3074828 (Eli Lilly and Company)

9. RHB-104 (RedHill Biopharma)

10. Etrasimod/APD334 (Arena Pharmaceuticals)

11. Tremfya/Guselkumab (Janssen)

12. Deucravacitinib/BMS-986165 (Bristol-Myers Squibb)

13. Tesnatilimab/JNJ-64304500 (Janssen)

14. Sibofimloc/EB8018 (Takeda/Enterome)

15. BT-11 (Landos Biopharma)

16. UTTR1147A/RG 7880 (Genentech)

17. TD-1473/JNJ 8398 (Theravance Biopharma/Janssen)

18. JNJ-67864238/PTG 200 (Protagonist Therapeutics/Janssen)

19. SHR0302 (Reistone Biopharma)

20. Ryoncil/Remestemcel-L (Mesoblast)

21. Ritlecitinib/Brepocitinib (Pfizer)

Note: Detailed emerging therapies assessment will be provided in the final report.

Analyst Commentary

- Targeted therapies (mainly biologics) penetration rate in case of moderate to severe CD patients are in the range of 40%-50% currently and the penetration rate is expected to be more in the future owing to the availability of more products with better clinical profile and patient convenient RoA.

- Currently, the biologics market is dominated by anti-TNF agents mainly adalimumab and infliximab, however, classes such as anti-integrin and interleukin inhibitor are making inroads into the CD market owing to better clinical profile (i.e. no black box warnings) and also patient convenient dosing. Adalimumab still expected to hold the maximum market share by 2023 after which biosimilars in the case of the US are expected to enter and will erode the sales value.

- Among emerging therapies, ozanimod expected to garner the highest patient share by 2030 owing to once-daily oral dosing, the potential for a differentiated cardiovascular profile compared to JAKs class, and promising efficacy signals from the phase 2 STEPSTONE study where clinical remission (CDAI <150 points) was shown 39·1% patients and response (CDAI decrease from baseline ≥100) 56·5% of patients.

- Risankizumab an IL-23 inhibitor from AbbVie recently demonstrates significant improvements in clinical remission and endoscopic response in 2 phase III induction studies in patients with CD and is expected to generate the highest revenue among the emerging.

Access and Reimbursement Scenario in CD Therapies

IBD represents a group of intestinal disorders that cause prolonged inflammation of the digestive tract. Payers view spending on IBD drugs as significant, as there is a large patient base requiring expensive biologic therapies. The market has been long dominated by the TNF-alpha inhibitors Humira and Remicade, but more recent biologic launches such as Entyvio and Stelara have focused on novel mechanisms of action. Additionally, another alpha integrin, etrolizumab, is a further biologic of interest to clinicians.

Although data exist that ongoing medical care for patients with IBD incurs substantial health-care costs, with approximately USD 2.04 billion per year for CD alone in the United States, studies are lacking using actual reimbursement cost data from commercial health plans.

The mean health-care costs were USD 4,701 higher for the ≤20-year age group than the mean health-care costs for the >20-year-old age group. The analysis also found that 28% of CD patients comprised 80% of total costs. Among this subgroup (28%) of patients, mean health-care costs per patient were more than USD 45,000 per year; 77% had more than one comorbidity, 64% required anti-TNF agents, and 11% were ≤20 years.

Janssen CarePath for Stelara offers a range of tools for patients who are starting on Stelara. Eligible patients using commercial or private insurance can save on out-of-pocket medication costs for Stelara. Depending on the health insurance plan, savings may apply toward co-pay, co-insurance, or deductible. Eligible patients pay USD5 for each dose, with a USD 20,000 maximum program benefit per calendar year. It is not valid for patients using Medicare, Medicaid, or other government-funded programs to pay for their medications. The patient may be eligible for the Janssen CarePath Savings Program if they are age 6 and older and currently use commercial or private health insurance for Stelara.

Note: Detailed HTA assessment will be provided in the final report.

KOL-Views

To keep up with current market trends, we take KOLs and SME’s opinion working in the CD domain through primary research to fill the data gaps and validate our secondary research. Their opinion helps to understand and validate current and emerging therapies treatment patterns or CD market trends. This will support the clients in potential upcoming novel treatment by identifying the overall scenario of the market and the unmet needs.

Competitive Intelligence Analysis

We perform Competitive and Market Intelligence analysis of the CD Market by using various Competitive Intelligence tools that includes – SWOT analysis, PESTLE analysis, Porter’s five forces, BCG Matrix, Market entry strategies, etc. The inclusion of the analysis entirely depends upon the data availability.

Scope of the Report

- The report covers the descriptive overview of CD, explaining its causes, signs and symptoms, pathophysiology, and currently available therapies.

- Comprehensive insight has been provided into the CD epidemiology and treatment in the United States.

- Additionally, an all-inclusive account of both the current and emerging therapies for CD is provided, along with the assessment of new therapies, which will have an impact on the current treatment landscape.

- A detailed review of the CD market; historical and forecasted is included in the report, covering drug outreach in the United States.

- The report provides an edge while developing business strategies, by understanding trends shaping and driving the US CD market.

Report Highlights

- In the coming years, the CD market is set to change due to the rising awareness of the disease and incremental healthcare spending across the world; which would expand the size of the market to enable the drug manufacturers to penetrate more into the market.

- The companies and academics are working to assess challenges and seek opportunities that could influence CD R&D. The therapies under development are focused on novel approaches to treat/improve the disease condition.

- Major players are involved in developing therapies for CD. The launch of emerging therapies will significantly impact the CD market.

- A better understanding of disease pathogenesis will also contribute to the development of novel therapeutics for CD.

- Our in-depth analysis of the pipeline assets across different stages of development (Phase III and Phase II), different emerging trends, and comparative analysis of pipeline products with detailed clinical profiles, key cross-competition, launch date along with product development activities will support the clients in the decision-making process regarding their therapeutic portfolio by identifying the overall scenario of the research and development activities.

CD Report Insights

- Patient Population

- Therapeutic Approaches

- CD Pipeline Analysis

- CD Market Size and Trends

- Market Opportunities

- Impact of upcoming Therapies

CD Report Key Strengths

- 10 Years Forecast

- The United States Coverage

- CD Epidemiology Segmentation

- Key Cross Competition

- Highly Analyzed Market

- Drugs Uptake

CD Report Assessment

- SWOT Analysis

- Current Treatment Practices

- Unmet Needs

- Pipeline Product Profiles

- Conjoint Analysis

- Market Attractiveness

- Market Drivers and Barriers

Key Questions

Market Insights:

- What was the CD Market share (%) distribution in 2018 and how it would look like in 2030?

- What would be the CD total market size as well as market size by therapies across the United States during the study period (2018–2030)?

- What are the key findings of the market across the United States during the study period (2018–2030)?

- At what CAGR, the CD market is expected to grow in the United States during the study period (2018–2030)?

- What would be the CD market outlook across the United States during the study period (2018–2030)?

- What would be the CD market growth till 2030 and what will be the resultant market size in the year 2030?

- How would the market drivers, barriers, and future opportunities affect the market dynamics and subsequent analysis of the associated trends?

- CD patient types/pool where unmet need is more and whether emerging therapies will be able to address the residual unmet need?

- How emerging therapies are performing on the parameters like efficacy, safety, route of administration (RoA), treatment duration, and frequencies based on their clinical trial results?

- Among the emerging therapies, what are the potential therapies which are expected to disrupt the CD market?

Epidemiology Insights:

- What are the disease risks, burdens, and unmet needs of the CD?

- What is the historical CD patient pool in the United States market?

- What would be the forecasted patient pool of CD in the United States market?

- What will be the growth opportunities in the United States concerning the patient population about CD?

- At what CAGR the population is expected to grow in the United States during the study period (2018–2030)?

- What are the various recent and upcoming events which are expected to improve the diagnosis of CD?

Current Treatment Scenario and Emerging Therapies:

- What are the current options for the treatment of CD?

- What are the current treatment guidelines for the treatment of CD in the US?

- How many companies are developing therapies for the treatment of CD?

- How many therapies are developed by each company for the treatment of CD?

- How many emerging therapies are in the mid-stage and late stages of development for the treatment of CD?

- What are the key collaborations (Industry–Industry, Industry-Academia), Mergers and acquisitions, licensing activities related to the CD therapies?

- What are the recent novel therapies, targets, mechanisms of action, and technologies developed to overcome the limitation of existing therapies?

- What are the clinical studies going on for CD and their status?

- What are the key designations that have been granted for the emerging therapies for CD?

- What is the US historical and forecasted market of CD?

Reasons to buy

- The report will help in developing business strategies by understanding trends shaping and driving the CD market.

- To understand the future market competition in the CD market and Insightful review of the key market drivers and barriers.

- Organize sales and marketing efforts by identifying the best opportunities for CD in the US.

- Identification of strong upcoming players in the market will help in devising strategies that will help in getting ahead of competitors.

- Organize sales and marketing efforts by identifying the best opportunities for the CD market.

- To understand the future market competition in the CD market.