Diabetic Retinopathy Market Summary

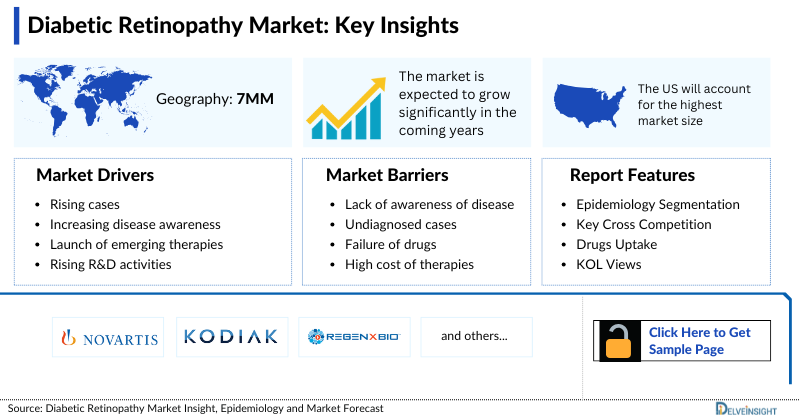

- The Diabetic Retinopathy Market is projected to experience a rise in CAGR during the forecast period. The growth in Diabetic Retinopathy Market revenue is primarily driven by increase in prevalence of diabetic patients, growing aging population, and increase in awareness about the consequences of uncontrolled diabetes and its complications.

- The Diabetic Retinopathy Market Dynamics are anticipated to change in the coming years owing to the improvement in novel treatment options to treat diabetic retinopathy, increasing healthcare spending across the world. Key Diabetic Retinopathy Companies in the emerging landscape are Novartis, Kodiak Sciences Inc., Regenxbio, and others.

- Despite advancements in treatment options, several unmet needs persist in the management of diabetic retinopathy which include personalized treatment approaches, early diagnosis methods, and comprehensive patient education.

Request for Unlocking the CAGR of the Diabetic Retinopathy Treatment Market

Factors Contributing to the Growth of the Diabetic Gastroparesis Market

-

Increasing Prevalence of Diabetes Worldwide

The primary driver of diabetic gastroparesis is long-standing diabetes, particularly in patients with poor glycemic control. As global diabetes prevalence continues to rise due to sedentary lifestyles, aging populations, and urbanization, the incidence of diabetic complications such as gastroparesis is also escalating. This growing patient pool fuels the demand for effective disease management strategies.

-

Recognition of Gastroparesis as a Significant Comorbidity

Historically underdiagnosed, diabetic gastroparesis is gaining recognition among clinicians and patients alike. Increased awareness improves early diagnosis, enhancing patient care and expanding the addressable market. Enhanced screening practices and improved diagnostic tools contribute to identifying patients sooner, stimulating market growth.

-

Limited Treatment Options and High Unmet Need

Current therapeutic options for diabetic gastroparesis are limited, and many patients experience suboptimal symptom relief. This unmet need encourages investment in novel therapies, including prokinetic agents, neuromodulators, and advanced pharmacologic approaches. The lack of robust treatment alternatives creates a lucrative landscape for emerging therapies to gain market share.

-

Advancements in Clinical Research and Pipeline Expansion

The pipeline for diabetic gastroparesis is expanding as pharmaceutical and biotech companies explore innovative mechanisms of action. Ongoing clinical trials investigating novel molecules and formulations support product diversification and future approvals, boosting investor and stakeholder interest.

-

Improved Healthcare Infrastructure and Access

Enhanced healthcare access, particularly in emerging regions, is leading to better diagnosis and management of gastrointestinal complications in diabetic patients. As healthcare systems strengthen, patient referral rates for specialized care increase, offering greater market potential for gastroenterology therapeutics.

- Patient Quality of Life and Economic Burden

Diabetic gastroparesis often leads to nausea, vomiting, malnutrition, and poor glycemic control, significantly affecting patient quality of life and productivity. These burdens drive demand for effective therapeutic options, positioning the market for sustained growth.

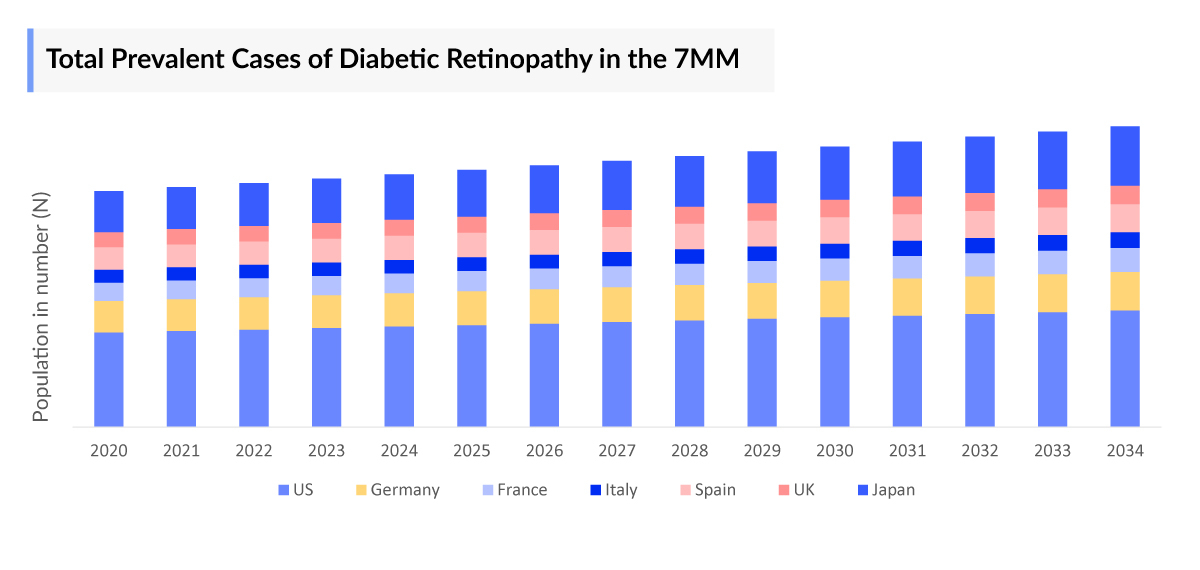

DelveInsight’s comprehensive report titled “Diabetic Retinopathy Treatment Market Insights, Epidemiology, and Market Forecast – 2034” offers a detailed analysis of Diabetic Retinopathy. The report presents historical and projected epidemiological data covering Total Prevalent Cases of Diabetic Retinopathy, Total Diagnosed Prevalent Cases of Diabetic Retinopathy, Gender-specific Diagnosed Prevalent Cases of Diabetic Retinopathy, Severity-specific Diagnosed Prevalent Cases of Diabetic Retinopathy and Age-specific Diagnosed Prevalent Cases of Diabetic Retinopathy.

In addition to epidemiology, the Diabetic Retinopathy Drugs Market report encompasses various aspects related to the patient population. These aspects include the diagnosis process, prescription patterns, physician perspectives, market accessibility, treatment options, and prospective developments in the Diabetic Retinopathy Drugs Market across seven major markets: the United States, EU4 (Germany, France, Italy, and Spain), the United Kingdom, and Japan, spanning from 2020–2034. The Diabetic Retinopathy Drugs Market Report analyzes the existing treatment practices and unmet medical requirements in Diabetic Retinopathy. It evaluates the market potential and identifies potential business prospects for enhancing therapies or interventions. This valuable information enables stakeholders to make well-informed decisions regarding product development and strategic planning for the Diabetic Retinopathy Drugs Market.

Scope of the Diabetic Retinopathy Market Report | |

|

Study Period |

2020–2034 |

|

Forecast Period |

2024–2034 |

|

Geographies Covered |

|

|

Diabetic Retinopathy Epidemiology |

|

|

Diabetic Retinopathy Drugs Market |

|

|

Diabetic Retinopathy Treatment Market Analysis |

|

|

Diabetic Retinopathy Companies |

|

|

Future Opportunity |

The Diabetic Retinopathy Drugs Market holds promise due to rising diabetes prevalence, demand for effective treatments, advancing medical technologies, introduction of novel therapies, and increasing awareness of Diabetic Retinopathy management. |

Diabetic Retinopathy Understanding

Diabetic retinopathy is a diabetic complication that affects the eyes, caused by damage to the blood vessels of the light-sensitive tissue at the back of the eye (retina). It can lead to vision impairment and blindness if left untreated. Early detection and management, including regular eye exams and blood sugar control, are crucial for preventing severe vision loss. The main factor related to the development and progression of diabetic retinopathy is poor blood sugar control. Consistently high blood sugar levels damage the blood vessels in the retina, leading to the onset and worsening of the condition. As per the historical data from 2020–2022, the treatment paradigm has already seen significant changes. Going forward key players are developing therapies to overcome the existing unmet needs of the patients.

Diabetic Retinopathy Diagnosis and Treatment Algorithm

Diabetic retinopathy is diagnosed through a comprehensive eye examination, often starting with a dilated eye exam where an ophthalmologist uses special drops to widen the pupil and examine the retina for any damage. During this exam, signs of blood vessel changes, such as leakage or abnormal growths, which are indicative of retinopathy are analyzed. Additional diagnostic tools like fluorescein angiography or optical coherence tomography (OCT) may be employed to capture detailed images of the retina and assess the extent of damage. Early detection through regular eye exams is crucial, as diabetic retinopathy can progress without symptoms until significant damage has occurred.

Current diabetic retinopathy treatments are predominantly focused on addressing macular edema, a common complication. Traditional therapies like vitrectomy, photocoagulation, and corticosteroids, historically utilized, lack the potential for vision enhancement and are associated with significant complication rates. However, in recent years, anti-vascular endothelial growth factor (anti-VEGF) drugs have emerged as a promising advancement in managing Diabetic Macular Edema. While these drugs have substantially improved outcomes for many DME patients, they may not be effective for all cases, particularly in those who have undergone multiple treatments. Therapies for diabetic retinopathy include laser surgery to seal leaking blood vessels, anti-VEGF injections to reduce swelling and inhibit abnormal vessel growth, and vitrectomy to remove the vitreous gel and blood. Effective management of blood sugar, blood pressure, and cholesterol is crucial to complement these treatments.

Diabetic Retinopathy Epidemiology

The epidemiology section on the Diabetic Retinopathy drugs market report offers information on the patient populations, including historical and projected trends for each of the seven major markets. Examining key opinion leader views from physicians or clinical experts can assist in identifying the reasons behind historical and projected trends. The diagnosed patient pool, their trends, and the underlying assumptions are all included in this section of the report. This section also presents the data with relevant tables and graphs, offering a clear and concise view of the Diabetic Retinopathy Prevalence. Additionally, the report discloses the assumptions made during the analysis, ensuring data interpretation and presentation transparency. This epidemiological data is valuable for understanding the disease burden and its impact on the patient population across various regions.

Key findings from Diabetic Retinopathy Epidemiological Analysis

- Diabetic retinopathy is a major neurovascular complication of diabetes, leading to blindness in working-age adults. According to the American Academy of Ophthalmology, with a global diabetes burden of 387 million people, expected to rise to 592 million by 2035, Diabetic Retinopathy affects 93 million worldwide. Its prevalence is 77.3% in type 1 diabetes and 25.1% in type 2 diabetes, with approximately 25–30% at risk of diabetic macular edema. Lifetime risk estimates range from 50–60% in type 2 diabetes to over 90% in type 1 diabetes.

- According to a meta-analysis on Global Diabetic Retinopathy Prevalence and Projection of Burden through 2045, there are approximately 93 million patients suffering with Diabetic Retinopathy, 17 million patients with proliferative Diabetic Retinopathy, and 21 million patients with diabetic macular edema, worldwide. These data highlight the significant global public health burden of Diabetic Retinopathy.

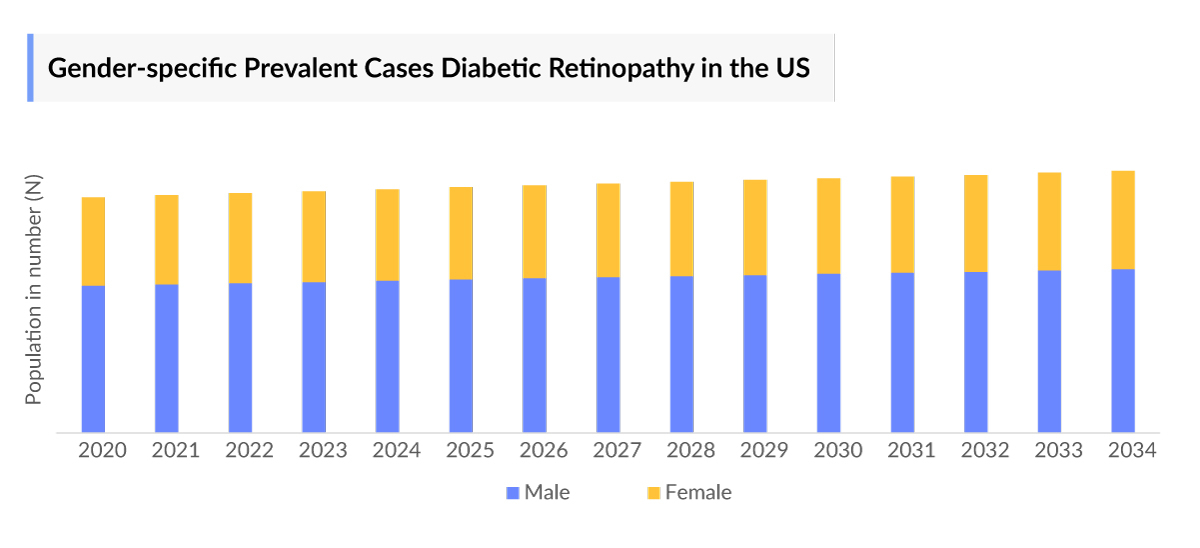

- As per the insights, in a large-scale study in the United States found that men have a 50% higher Diabetic Retinopathy Prevalence compared to women among patients over 40 years old. However, some studies suggest that females may have a higher Diabetic Retinopathy Prevalence in certain populations, particularly among those with type 2 diabetes.

- According to research conducted by the American Academy of Ophthalmology, the Diabetic Retinopathy occurrence among individuals aged 60 and above is most prominent in France, closely trailed by Germany.

- According to secondary research, at any given point, 15–30% of the diabetic population suffers from some form of diabetic retinopathy. Approximately half of the patients are unaware of their condition due to lack of symptoms and mild non-proliferative disease that might go undetected. Although diabetic retinopathy—through diabetic macular edema and proliferative diabetic retinopathy—is the leading cause of vision loss among working-age populations in the US and many other countries, much of the causative ophthalmic pathology is treatable.

Diabetic Retinopathy Epidemiological Segmentation in the 7MM

- Total Diabetic Retinopathy Prevalent Cases

- Total Diabetic Retinopathy Diagnosed Prevalent Cases

- Diabetic Retinopathy Gender-specific Diagnosed Prevalent Cases

- Diabetic Retinopathy Severity-specific Diagnosed Prevalent Cases

- Diabetic Retinopathy Age-specific Diagnosed Prevalent Cases

Diabetic Retinopathy Market Recent Breakthroughs and Developments

- In January 2026, Boehringer Ingelheim initiated a clinical study to evaluate the efficacy of BI 764524 in individuals with diabetic retinopathy, while also determining an optimal treatment regimen for the investigational therapy. Participants are randomly assigned to one of five study groups. Those in Groups 1, 2, and 3 receive BI 764524 administered as intravitreal injections into one eye. Over a one-year period, participants receive varying numbers of injections at the same dose. At certain visits, a sham procedure—mimicking an eye injection without the use of a needle—is performed to maintain masking, ensuring participants remain unaware of the number of active injections received.

- In January 2026, Invirsa Inc. announced a Phase 2 clinical study designed to assess the efficacy of topically administered INV-102 eye drops. The study evaluates a 12-week dosing regimen in subjects with non-center-involved diabetic macular edema (NCIDME) associated with non-proliferative diabetic retinopathy (NPDR) in Part 1, and an 8-week dosing regimen in subjects with center-involved diabetic macular edema (CIDME) associated with NPDR in Part 2.

Diabetic Retinopathy Marketed Drugs

-

LUCENTIS: Genentech, Inc.

LUCENTIS is a vascular endothelial growth factor (VEGF) inhibitor that blocks VEGF from inside the eye. It is administered by intravitreal injection into the eye once a month, typically every 28 days. LUCENTIS is an FDA-approved prescription medicine for diabetic retinopathy and diabetic macular edema (DME), being the first to receive approval for all forms of diabetic retinopathy, with or without DME, in 2017, after initial approval in 2015.

-

EYLEA (aflibercept): Regeneron, Inc.

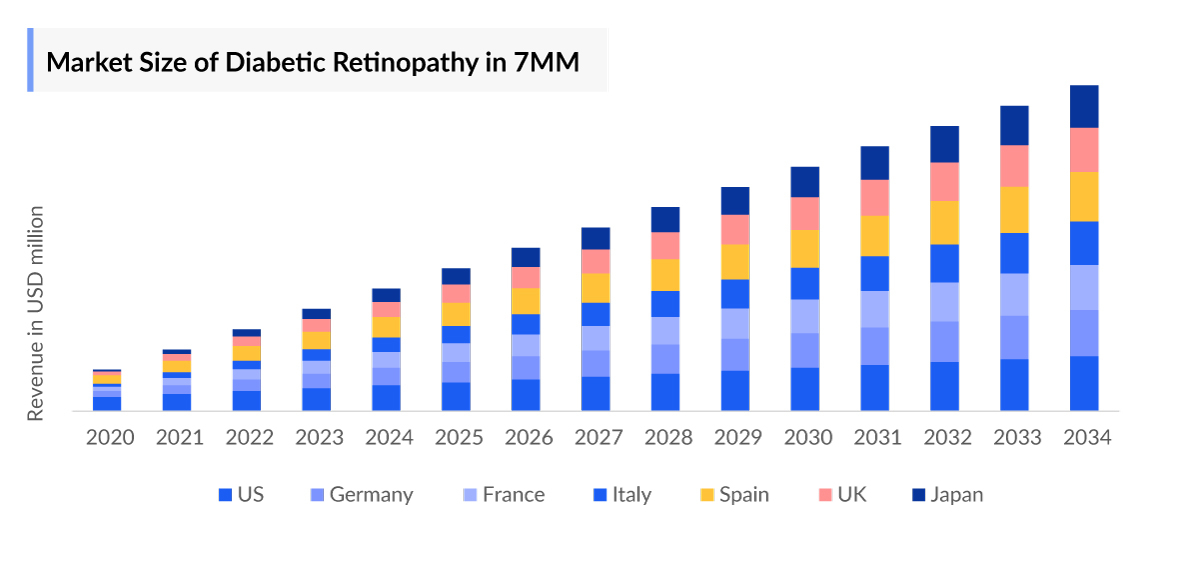

EYLEA was approved by the FDA for the treatment of diabetic retinopathy in 2019. This approval marked the first time a VEGF inhibitor was approved for all stages of DR, including diabetic macular edema (DME), to reduce the risk of blindness. EYLEA is the only VEGF inhibitor approved with two dosing options for DR, allowing doctors to customize treatment to their patients' needs. With ongoing research and continued dedication, the future holds hope for even more effective treatments and, ultimately, a cure for this challenging condition. According to DelveInsight, the Diabetic Retinopathy market in the 7MM is projected to grow significantly during the study period 2020–2034.

Emerging Diabetic Retinopathy Drugs

-

ABBV-RGX-314: Regenxbio

ABBV-RGX-314 is being investigated as a potential one-time treatment for diabetic retinopathy, wet AMD, and other chronic retinal conditions. ABBV-RGX-314 consists of the NAV AAV8 vector, which encodes an antibody fragment designed to inhibit VEGF. ABBV-RGX-314 is believed to inhibit the VEGF pathway by which new, leaky blood vessels grow and contribute to the fluid accumulation in the retina. It is currently in Phase II of its clinical development.

-

Tarcocimab Tedromer: Kodiak Sciences Inc.

Tarcocimab tedromer (KSI-301) is a novel anti-VEGF biologic built on a propriety antibody biopolymer conjugate (ABC) platform. KSI-301 is given as an intravitreal injection and is expected to inhibit VEGF for up to 6 months continuously. The unique properties of KSI-301 are intended to provide patients with long-term control of DME and improve visual results while reducing the burden of frequent anti-VEGF injections. In addition, KSI-301 is designed to prevent and reverse the progression of DR with long-term efficacy and may reduce the risk of vision-threatening complications from diabetic retinopathy. It is currently in Phase III of its clinical development.

|

Drug |

MoA |

RoA |

Company |

Logo |

Phase |

|

Tarcocimab tedromer (KSI-301) |

XX Inhibitor |

Intravitreal injection |

Kodiak Sciences Inc. |

III | |

|

ABBV-RGX-314 |

VEGF Inhibitor |

Intravitreal injection |

Regenxbio |

II | |

|

XXX |

XX |

XXX |

XXX |

XX |

Note: Detailed emerging therapies assessment will be provided in the final report.

Diabetic Retinopathy Drugs Market Segmentation

DelveInsight’s ‘Diabetic Retinopathy Treatment Market Insights, Epidemiology, and Market Forecast – 2034’ report provides a detailed outlook of the current and future Diabetic Retinopathy Therapeutics Market, segmented within countries, by therapies, and by classes. Further, the market of each region is then segmented by each therapy to provide a detailed view of the current and future Diabetic Retinopathy Market Share of all therapies.

Diabetic Retinopathy Treatment Market Size by Countries

The Diabetic Retinopathy Market Size is assessed separately for various countries, including the United States, EU4 (Germany, France, Italy, and Spain), the UK, and Japan. In 2023, the United States held a significant share of the overall 7MM (Seven Major Markets) Diabetic Retinopathy Therapeutics Market, primarily attributed to the country's higher prevalence of the condition and the elevated cost of the available treatments. This dominance is projected to persist, especially with the potential early introduction of new products.

Diabetic Retinopathy Treatment Market Size by Therapies

Diabetic Retinopathy Market Size by Therapies is categorized into current and emerging markets for the study period 2020–2034. One of the emerging drugs anticipated to launch during the forecast period is Tarcocimab Tedromer under the developmental pipeline of Kodiak Sciences Inc.

Diabetic Retinopathy Drugs Uptake

This section focuses on the sales uptake of potential Diabetic Retinopathy drugs that have recently been launched or are anticipated to be launched in the Diabetic Retinopathy market between 2020 and 2034. It estimates the market penetration of Diabetic Retinopathy drugs for a given country, examining their impact within and across classes and segments. It also touches upon the financial and regulatory decisions contributing to the probability of success (PoS) of the drugs in the Diabetic Retinopathy Therapeutics Market.

Diabetic Retinopathy Therapeutics Market Access and Reimbursement

DelveInsight’s ‘Diabetic Retinopathy Market Insights, Epidemiology, and Market Forecast – 2034’ report provides a descriptive overview of the market access and reimbursement scenario of Diabetic Retinopathy. This section includes a detailed analysis of the country-wise healthcare system for each therapy, enlightening the market access, reimbursement policies, and health technology assessments.

Latest KOL Views on Diabetic Retinopathy

To keep up with current Diabetic Retinopathy market trends and fill gaps in secondary findings, we interview KOLs and SMEs working in the Diabetic Retinopathy domain. Their opinion helps understand and validate current and emerging therapies and treatment patterns or Diabetic Retinopathy market trends. This will support the clients in potential upcoming novel treatments by identifying the overall scenario of the market of Diabetic Retinopathy unmet needs.

Diabetic Retinopathy: KOL Insights

DelveInsight’s analysts connected with 50+ KOLs to gather insights; however, interviews were conducted with 15+ KOLs in the 7MM. These KOLs were from organizations, institutes, and hospitals, such as Department of Pathology, University of California, San Diego, US, American Academy of Ophthalmology, Annapolis, MD, United States, Palo Alto Medical Foundation, US, Department of Ophthalmology, University of Bonn, Germany, Department of Medical Biometry, Informatics and Epidemiology, Germany, Department of Ophthalmology, Hospital Universitario y Politécnico La Fe, Spain, Department of Ophthalmology, The Jikei University School of Medicine, Japan, Department of Preventive Medicine, School of Medicine, Japan, Omiya City Clinic, Saitama, Japan and others.

“The rising prevalence of Diabetic Retinopathy and awareness regarding its early diagnosis plays a key factor impacting Diabetic Retinopathy market.”

Diabetic Retinopathy Competitive Intelligence Analysis

We conduct a Competitive and Diabetic Retinopathy Therapeutics Market Intelligence analysis of the Diabetic Retinopathy Market, utilizing various Competitive Intelligence tools such as SWOT analysis, Conjoint Analysis, and Market entry strategies. The inclusion of these analyses is contingent upon data availability, ensuring a comprehensive and well-informed assessment of the market landscape and competitive dynamics. The emerging Diabetic Retinopathy therapies are analyzed based on various attributes such as safety and efficacy in randomized clinical trials, order of entry and other market dynamics, and the unmet need they fulfill in the Diabetic Retinopathy market.

Key Diabetic Retinopathy Companies

Novartis, Kodiak Sciences Inc., Regenxbio, and others.

Diabetic Retinopathy Clinical Trials Activities

The Diabetic Retinopathy Therapeutics Market Report offers an analysis of therapeutic candidates in Phase II and III stages and examines Diabetic Retinopathy Companies involved in developing targeted therapeutics for Diabetic Retinopathy. It provides valuable insights into the advancements and progress of potential treatments in clinical development for this condition.

Diabetic Retinopathy Pipeline Development Activities

The Diabetic Retinopathy pipeline segment report covers information on collaborations, acquisition and merger, licensing, patent details, and other information for emerging Diabetic Retinopathy.

Diabetic Retinopathy Therapeutic Market Report Insights

- Patient-based Diabetic Retinopathy Market Forecasting

- Diabetic Retinopathy Therapeutic Approaches

- Diabetic Retinopathy Pipeline Drugs Analysis

- Diabetic Retinopathy Market Size and Trends

- Diabetic Retinopathy Therapeutics Market Opportunities

- Impact of Upcoming Diabetic Retinopathy Therapies

Diabetic Retinopathy Therapeutics Market Report Key Strengths

- 11 Years Diabetic Retinopathy Market Forecast

- The 7MM Coverage

- Diabetic Retinopathy Epidemiology Segmentation

- Key Cross Competition

- Highly Analyzed Diabetic Retinopathy Therapeutics Market

- Diabetic Retinopathy Drugs Uptake

Diabetic Retinopathy Therapeutics Market Report Assessment

- Current Diabetic Retinopathy Treatment Market Practices

- Current Diabetic Retinopathy Unmet Needs

- Diabetic Retinopathy Pipeline Drugs Analysis Profiles

- Diabetic Retinopathy Therapeutics Market Attractiveness

Key Questions Answered in the Diabetic Retinopathy Market Report

Diabetic Retinopathy Market Insights

- How common is Diabetic Retinopathy?

- What are the key findings of Diabetic Retinopathy epidemiology across the 7MM, and which country will have the highest number of Diabetic Retinopathy Patients during the study period (2020–2034)?

- What are the currently available treatments for Diabetic Retinopathy?

- What is the disease risk, burden, and Diabetic Retinopathy Unmet Needs?

- At what CAGR is the Diabetic Retinopathy Treatment Market and its epidemiology expected to grow in the 7MM during the forecast period (2024–2034)?

- How would the unmet needs impact the Diabetic Retinopathy market dynamics and subsequently influence the analysis of the related trends?

- What would be the forecasted Diabetic Retinopathy patient pool in the 7MM covering the United States, EU4 (Germany, France, Italy, and Spain), the UK, and Japan?

- Among EU4 and the UK, which country will have the highest number of patients during the forecast period (2024–2034)?

- How many companies are currently developing therapies for the Diabetic Retinopathy Treatment?

Read Our Articles