Exocrine Pancreatic Insufficiency Market

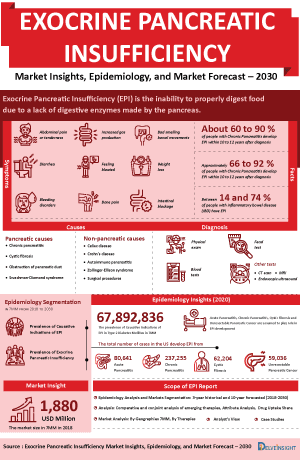

DelveInsight's "Exocrine Pancreatic Insufficiency Market Insights, Epidemiology, and Market Forecast-2032" report delivers an in-depth understanding of the Exocrine Pancreatic Insufficiency, historical and forecasted epidemiology as well as the Exocrine Pancreatic Insufficiency market trends in the United States, EU5 (Germany, Spain, Italy, France, and United Kingdom) and Japan.

The Exocrine Pancreatic Insufficiency market report provides current treatment practices, emerging drugs, Exocrine Pancreatic Insufficiency market share of the individual therapies, current and forecasted Exocrine Pancreatic Insufficiency market Size from 2019 to 2032 segmented by seven major markets. The Report also covers current Exocrine Pancreatic Insufficiency treatment practice/algorithm, market drivers, market barriers and unmet medical needs to curate the best of the opportunities and assesses the underlying potential of the Exocrine Pancreatic Insufficiency market.

Geography Covered

- The United States

- EU5 (Germany, France, Italy, Spain, and the United Kingdom)

- Japan

Study Period: 2019-2032

Exocrine Pancreatic Insufficiency Disease Understanding and Treatment Algorithm

The DelveInsight’s Exocrine Pancreatic Insufficiency market report gives a thorough understanding of the Exocrine Pancreatic Insufficiency by including details such as disease definition, symptoms, causes, pathophysiology, diagnosis, and treatment.

Exocrine Pancreatic Insufficiency Diagnosis

This segment of the report covers the detailed diagnostic methods or tests for Exocrine Pancreatic Insufficiency.

Exocrine Pancreatic Insufficiency Treatment

It covers the details of conventional and current medical therapies available in the Exocrine Pancreatic Insufficiency market for the treatment of the condition. It also provides Exocrine Pancreatic Insufficiency treatment algorithms and guidelines in the United States, Europe, and Japan.

Exocrine Pancreatic Insufficiency Epidemiology

The Exocrine Pancreatic Insufficiency epidemiology section provides insights about the historical and current Exocrine Pancreatic Insufficiency patient pool and forecasted trends for individual seven major countries. It helps to recognize the causes of current and forecasted trends by exploring numerous studies and views of key opinion leaders. This part of the Exocrine Pancreatic Insufficiency market report also provides the diagnosed patient pool and their trends along with assumptions undertaken.

Key Findings

The disease epidemiology covered in the report provides historical as well as forecasted Exocrine Pancreatic Insufficiency epidemiology scenario in the 7MM covering the United States, EU5 countries (Germany, Spain, Italy, France, and the United Kingdom), and Japan from 2019 to 2032.

Country Wise- Exocrine Pancreatic Insufficiency Epidemiology

The epidemiology segment also provides the Exocrine Pancreatic Insufficiency epidemiology data and findings across the United States, EU5 (Germany, France, Italy, Spain, and the United Kingdom), and Japan.

Exocrine Pancreatic Insufficiency Drug Chapters

The drug chapter segment of the Exocrine Pancreatic Insufficiency report encloses the detailed analysis of Exocrine Pancreatic Insufficiency marketed drugs and late-stage (Phase-III and Phase-II) Exocrine Pancreatic Insufficiency pipeline drugs. It also helps to understand the Exocrine Pancreatic Insufficiency clinical trial details, expressive pharmacological action, agreements and collaborations, approval and patent details, advantages and disadvantages of each included drug and the latest news and press releases.

Exocrine Pancreatic Insufficiency Marketed Drugs

The report provides the details of the marketed products/off-label treatments available for Exocrine Pancreatic Insufficiency treatment.

Exocrine Pancreatic Insufficiency Emerging Drugs

The report provides the details of the emerging therapies under the late and mid-stage of development for Exocrine Pancreatic Insufficiency treatment.

Exocrine Pancreatic Insufficiency Market Outlook

The Exocrine Pancreatic Insufficiency market outlook of the report helps to build a detailed comprehension of the historic, current, and forecasted Exocrine Pancreatic Insufficiency market trends by analyzing the impact of current Exocrine Pancreatic Insufficiency therapies on the market, unmet needs, drivers and barriers, and demand for better technology.

This segment gives a thorough detail of Exocrine Pancreatic Insufficiency market trend of each marketed drug and late-stage pipeline therapy by evaluating their impact based on the annual cost of therapy, inclusion and exclusion criteria's, mechanism of action, compliance rate, growing need of the market, increasing patient pool, covered patient segment, expected launch year, competition with other therapies, brand value, their impact on the market and view of the key opinion leaders. The calculated Exocrine Pancreatic Insufficiency market data are presented with relevant tables and graphs to give a clear view of the market at first sight.

According to DelveInsight, the Exocrine Pancreatic Insufficiency market in 7MM is expected to witness a major change in the study period 2019-2032.

Key Findings

This section includes a glimpse of the Exocrine Pancreatic Insufficiency market in 7MM.

The United States Market Outlook

This section provides the total Exocrine Pancreatic Insufficiency market size and market size by therapies in the United States.

EU-5 Countries: Market Outlook

The total Exocrine Pancreatic Insufficiency market size and market size by therapies in Germany, France, Italy, Spain, and the United Kingdom is provided in this section.

Japan Market Outlook

The total Exocrine Pancreatic Insufficiency market size and market size by therapies in Japan is also mentioned.

Exocrine Pancreatic Insufficiency Drugs Uptake

This section focuses on the rate of uptake of the potential Exocrine Pancreatic Insufficiency drugs recently launched in the Exocrine Pancreatic Insufficiency market or expected to get launched in the market during the study period 2019-2032. The analysis covers Exocrine Pancreatic Insufficiency market uptake by drugs; patient uptake by therapies; and sales of each drug.

Exocrine Pancreatic Insufficiency Drugs Uptake helps in understanding the drugs with the most rapid uptake, reasons behind the maximal use of new drugs, and allow the comparison of the drugs on the basis of Exocrine Pancreatic Insufficiency market share and size which again will be useful in investigating factors important in market uptake and in making financial and regulatory decisions.

Exocrine Pancreatic Insufficiency Pipeline Development Activities

The Exocrine Pancreatic Insufficiency report provides insights into different therapeutic candidates in Phase II, and Phase III stage. It also analyses Exocrine Pancreatic Insufficiency key players involved in developing targeted therapeutics.

Pipeline Development Activities

The Exocrine Pancreatic Insufficiency report covers the detailed information of collaborations, acquisition, and merger, licensing, patent details, and other information for Exocrine Pancreatic Insufficiency emerging therapies.

Reimbursement Scenario in Exocrine Pancreatic Insufficiency

Approaching reimbursement proactively can have a positive impact both during the late stages of product development and well after product launch. In a report, we take reimbursement into consideration to identify economically attractive indications and market opportunities. When working with finite resources, the ability to select the markets with the fewest reimbursement barriers can be a critical business and price strategy.

KOL- Views

To keep up with current Exocrine Pancreatic Insufficiency market trends, we take KOLs and SMEs ' opinion working in the Exocrine Pancreatic Insufficiency domain through primary research to fill the data gaps and validate our secondary research. Their opinion helps to understand and validate current and emerging therapies treatment patterns or Exocrine Pancreatic Insufficiency market trends. This will support the clients in potential upcoming novel treatment by identifying the overall scenario of the market and the unmet needs.

Competitive Intelligence Analysis

We perform Competitive and Market Intelligence analysis of the Exocrine Pancreatic Insufficiency Market by using various Competitive Intelligence tools that include - SWOT analysis, PESTLE analysis, Porter's five forces, BCG Matrix, Market entry strategies etc. The inclusion of the analysis entirely depends upon the data availability.

Scope of the Report

- The report covers the descriptive overview of Exocrine Pancreatic Insufficiency, explaining its causes, signs and symptoms, pathophysiology, diagnosis and currently available therapies

- Comprehensive insight has been provided into the Exocrine Pancreatic Insufficiency epidemiology and treatment in the 7MM

- Additionally, an all-inclusive account of both the current and emerging therapies for Exocrine Pancreatic Insufficiency is provided, along with the assessment of new therapies, which will have an impact on the current treatment landscape

- A detailed review of the Exocrine Pancreatic Insufficiency market; historical and forecasted is included in the report, covering drug outreach in the 7MM

- The report provides an edge while developing business strategies, by understanding trends shaping and driving the global Exocrine Pancreatic Insufficiency market

Report Highlights

- In the coming years, the Exocrine Pancreatic Insufficiency market is set to change due to the rising awareness of the disease, and incremental healthcare spending across the world; which would expand the size of the market to enable the drug manufacturers to penetrate more into the market

- The companies and academics are working to assess challenges and seek opportunities that could influence Exocrine Pancreatic Insufficiency R&D. The therapies under development are focused on novel approaches to treat/improve the disease condition

- Major players are involved in developing therapies for Exocrine Pancreatic Insufficiency. The launch of emerging therapies will significantly impact the Exocrine Pancreatic Insufficiency market

- A better understanding of disease pathogenesis will also contribute to the development of novel therapeutics for Exocrine Pancreatic Insufficiency

- Our in-depth analysis of the pipeline assets across different stages of development (Phase III and Phase II), different emerging trends and comparative analysis of pipeline products with detailed clinical profiles, key cross-competition, launch date along with product development activities will support the clients in the decision-making process regarding their therapeutic portfolio by identifying the overall scenario of the research and development activities

Exocrine Pancreatic Insufficiency Report Insights

- Exocrine Pancreatic Insufficiency Patient Population

- Therapeutic Approaches

- Exocrine Pancreatic Insufficiency Pipeline Analysis

- Exocrine Pancreatic Insufficiency Market Size and Trends

- Exocrine Pancreatic Insufficiency Market Opportunities

- Impact of upcoming Exocrine Pancreatic Insufficiency Therapies

Exocrine Pancreatic Insufficiency Report Key Strengths

- 11 Years Forecast

- 7MM Coverage

- Exocrine Pancreatic Insufficiency Epidemiology Segmentation

- Key Cross Competition

- Highly Analyzed Market

- Drugs Uptake

Exocrine Pancreatic Insufficiency Report Assessment

- Current Treatment Practices

- Unmet Needs

- Exocrine Pancreatic Insufficiency Pipeline Product Profiles

- Exocrine Pancreatic Insufficiency Market Attractiveness

- Market Drivers and Barriers

Key Questions

Market Insights:

- What was the Exocrine Pancreatic Insufficiency drug class share (%) distribution in 2019 and how it would look like in 2032?

- What would be the Exocrine Pancreatic Insufficiency total market size as well as market size by therapies across the 7MM during the forecast period (2019-2032)?

- What are the key findings pertaining to the market across 7MM and which country will have the largest Exocrine Pancreatic Insufficiency market size during the forecast period (2019-2032)?

- At what CAGR, the Exocrine Pancreatic Insufficiency market is expected to grow by 7MM during the forecast period (2019-2032)?

- What would be the Exocrine Pancreatic Insufficiency market outlook across the 7MM during the forecast period (2019-2032)?

- What would be the Exocrine Pancreatic Insufficiency market growth till 2032, and what will be the resultant market Size in the year 2032?

- How would the unmet needs affect the market dynamics and subsequent analysis of the associated trends?

Epidemiology Insights:

- What are the disease risk, burden, and regional/ethnic differences of the Exocrine Pancreatic Insufficiency?

- What are the key factors driving the epidemiology trend for seven major markets covering the United States, EU5 (Germany, Spain, France, Italy, UK), and Japan?

- What is the historical Exocrine Pancreatic Insufficiency patient pool in seven major markets covering the United States, EU5 (Germany, Spain, France, Italy, UK), and Japan?

- What would be the forecasted patient pool of Exocrine Pancreatic Insufficiency in seven major markets covering the United States, EU5 (Germany, Spain, France, Italy, UK), and Japan?

- Where will be the growth opportunities in the 7MM with respect to the patient population pertaining to Exocrine Pancreatic Insufficiency?

- Out of all 7MM countries, which country would have the highest prevalent population of Exocrine Pancreatic Insufficiency during the forecast period (2019-2032)?

- At what CAGR the patient population is expected to grow in 7MM during the forecast period (2019-2032)?

Current Treatment Scenario, Marketed Drugs and Emerging Therapies:

- What are the current options for the Exocrine Pancreatic Insufficiency treatment in addition to the approved therapies?

- What are the current treatment guidelines for the treatment of Exocrine Pancreatic Insufficiency in the USA, Europe, and Japan?

- What are the Exocrine Pancreatic Insufficiency marketed drugs and their respective MOA, regulatory milestones, product development activities, advantages, disadvantages, safety and efficacy, etc.?

- How many companies are developing therapies for the treatment of Exocrine Pancreatic Insufficiency?

- How many therapies are in-development by each company for Exocrine Pancreatic Insufficiency treatment?

- How many are emerging therapies in mid-stage, and late stage of development for Exocrine Pancreatic Insufficiency treatment?

- What are the key collaborations (Industry - Industry, Industry - Academia), Mergers and acquisitions, licensing activities related to the Exocrine Pancreatic Insufficiency therapies?

- What are the recent novel therapies, targets, mechanisms of action and technologies being developed to overcome the limitation of existing therapies?

- What are the clinical studies going on for Exocrine Pancreatic Insufficiency and their status?

- What are the current challenges faced in drug development?

- What are the key designations that have been granted for the emerging therapies for Exocrine Pancreatic Insufficiency?

- What are the global historical and forecasted market of Exocrine Pancreatic Insufficiency?

Reasons to buy

- The report will help in developing business strategies by understanding trends shaping and driving the Exocrine Pancreatic Insufficiency market

- To understand the future market competition in the Exocrine Pancreatic Insufficiency market and Insightful review of the key market drivers and barriers

- Organize sales and marketing efforts by identifying the best opportunities for Exocrine Pancreatic Insufficiency in the US, Europe (Germany, Spain, Italy, France, and the United Kingdom) and Japan

- Identification of strong upcoming players in the market will help in devising strategies that will help in getting ahead of competitors

- Organize sales and marketing efforts by identifying the best opportunities for Exocrine Pancreatic Insufficiency market

- To understand the future market competition in the Exocrine Pancreatic Insufficiency market