Glaucoma Market Summary

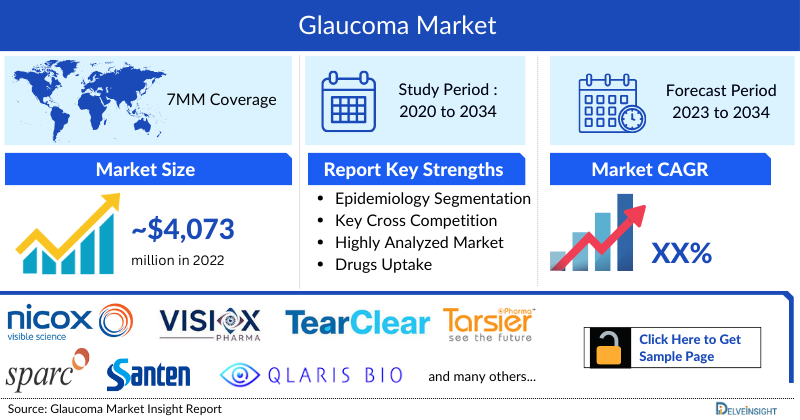

- The Glaucoma Market Size in the 7MM was around USD 4,073 million in 2022. This is estimated to increase by 2034 at a significant CAGR.

- The leading Glaucoma Companies such as Nicox Ophthalmics, Sun Pharma Advanced Research Company Limited (SPARC), Visiox Pharma, TearClear, Glaukos Corporation, Santen Inc., Ono Pharmaceutical, Santen Pharmaceuticals, Omikron Italia S.r.l., OPIS Spain, Ocular Therapeutix Inc., MediPrint Ophthalmics (formerly Leo Lens Pharma), Tarsier Pharma, Peregrine Ophthalmic, Ocuphire Pharma, Qlaris Bio Inc., Betaliq Inc., VivaVision Biotech Inc., D. Western Therapeutics Institute (DWTI), and others.

Glaucoma Market and Epidemiology Analysis

- The Glaucoma Treatment Market includes Prostaglandin analogs, beta-blockers, carbonic anhydrase inhibitors, fixed Combinations, alpha-2-selective adrenergic agonists, and Others.

- The total Glaucoma Market Size is anticipated to upsurge during the forecast period due to the expected entry of emerging therapies that include iDose TR (travoprost intraocular implant), NCX 470, PDP-71, and others.

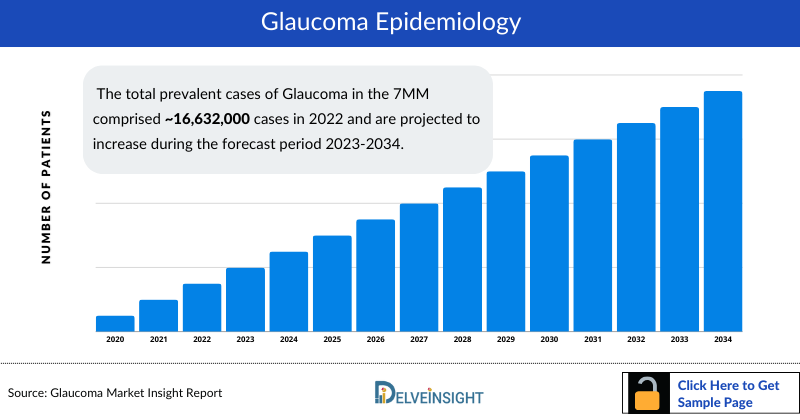

- Total Glaucoma Diagnosed Prevalent Cases were estimated at nearly 7,045,443 cases in 2022 in the 7MM; however, the overall burden of Glaucoma has been estimated to be nearly 16,632,421 (Prevalent cases) in 2022 in the 7MM.

- Most Glaucoma Diagnosed Patients were estimated in the US, followed by Japan, Germany, and France in 2022.

- Open Angle Glaucoma is most prominent type of Glaucoma with high burden in the 7MM.

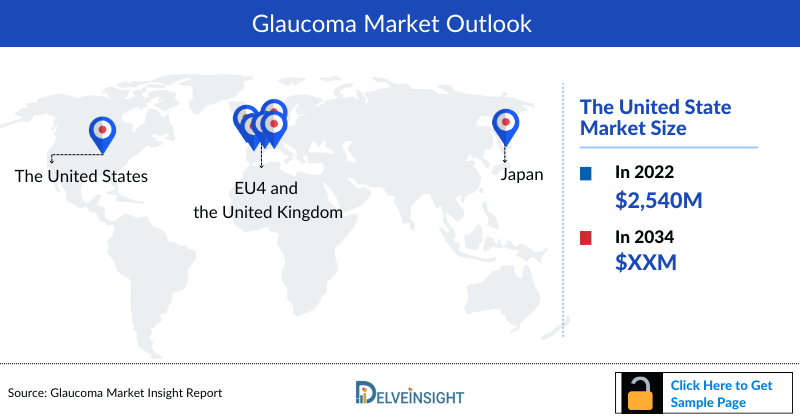

- As per DelveInsight estimations, the US consistently captured the highest Glaucoma Market Size with USD 2,571 million net sales revenue in 2022 among the 7MM, whereas the UK had the lowest market with a market size of nearly USD 132 million.

Request for Unlocking the CAGR of the "Glaucoma Therapeutics Market"

Factors Impacting Glaucoma Market Growth

-

Rising Prevalence of Glaucoma

The increasing prevalence of glaucoma worldwide, particularly among the aging population, is a major market driver. With glaucoma being one of the leading causes of irreversible blindness, the rising patient pool significantly boosts the demand for effective diagnostic tools and treatment options.

-

Advancements in Diagnostic Technologies

The development of advanced diagnostic tools such as optical coherence tomography (OCT), scanning laser polarimetry, and tonometry devices is enhancing early detection rates of glaucoma. Improved diagnostic accuracy and accessibility contribute to higher treatment adoption, driving market growth.

-

Growing Demand for Minimally Invasive Surgeries

The rising preference for minimally invasive glaucoma surgeries (MIGS) over traditional procedures is fueling market expansion. These techniques offer improved safety, faster recovery, and better patient compliance, thereby increasing their adoption among both physicians and patients globally.

DelveInsight’s “Glaucoma Treatment Market Insights, Epidemiology and Market Forecast – 2034” report delivers an in-depth understanding of the Glaucoma, historical and forecasted epidemiology and the Glaucoma market trends in the United States, EU4 (Germany, France, Italy, and Spain) and the United Kingdom, and Japan.

The Glaucoma Therapeutics Market Report provides current treatment practices, emerging drugs, market share of individual therapies, and current and forecasted 7MM, Glaucoma market size from 2020 to 2034. The report also covers current Glaucoma treatment market practices/algorithms and Glaucoma unmet needs to curate the best of the opportunities and assess the underlying potential of the market.

Scope of the Glaucoma Market Report | |

|

Study Period |

2020 to 2034 |

|

Forecast Period |

2024 to 2034 |

|

Geographies Covered |

|

|

Glaucoma Therapeutics Market |

|

|

Glaucoma Drug Market | |

|

Glaucoma Companies |

|

Glaucoma Disease Understanding

According to the American Academy of Ophthalmology, glaucoma describes a group of conditions in which there is characteristic cupping of the optic disc with corresponding visual field defects due to retinal ganglion cell loss. It is a progressive condition and the most common cause of irreversible blindness worldwide. The two major categories of glaucoma are open-angle glaucoma (OAG) and narrow-angle glaucoma/angle-closure glaucoma (ACG). Glaucoma often does not cause noticeable symptoms in the early stages, so it is often called the “silent thief of sight.” As the condition progresses, peripheral (side) vision may be affected, gradually narrowing the visual field.

Glaucoma Diagnosis

Although glaucoma is not curable, early diagnosis and adequate treatment effectively reduce or prevent further optic nerve (ON) damage. The diagnosis of glaucoma typically involves a comprehensive eye examination and several specific tests, namely, tonometry (measurement of intraocular pressure), an ophthalmoscopy (evaluation of the optic nerve for signs of damage), visual field testing (perimetry), gonioscopy (assessing the drainage angle of the eye to determine the type of glaucoma) to assess the health of the optic nerve and evaluate IOP levels. The Glaucoma diagnosis typically involves a combination of clinical evaluation, visual field testing, optic nerve examination, and measurement of intraocular pressure (IOP). The diagnosis guidelines for glaucoma can vary to some extent based on geographical regions and medical societies, such as separate guidelines published by American Academy of Ophthalmology, European Glaucoma Society Terminology, and others.

Further details related to country-based variations are provided in the report

Glaucoma Treatment

There is no cure for glaucoma, but early treatment can often stop the damage and protect the vision. Doctors use a few different types of treatment for glaucoma, including medicines (usually eye drops), laser treatment, and surgery.Glaucoma is treated by lowering the eye pressure (intraocular pressure), and depending on the situation, management includes prescription eye drops, oral medications, laser treatment, surgery, or a combination of any of these.

- Medicines: Medications for glaucoma treatment aim to lower IOP by decreasing AH production and increasing AH outflow. Prostaglandin analogs and beta-blockers are currently the most frequently used agents.

- Surgery: The most common type of surgery for glaucoma is called trabeculectomy. It involves removing part of the eye-drainage tubes to allow fluid to drain more easily.

Glaucoma Epidemiology

As the market is derived using the patient-based model, the Glaucoma epidemiology chapter in the report provides historical as well as forecasted epidemiology segmented by Total Prevalent Cases of Glaucoma, Total Diagnosed Prevalent Cases of Glaucoma, Type-specific Diagnosed Prevalent Cases of Glaucoma, Type-specific Diagnosed Prevalent Cases of Open-angle Glaucoma, Gender-specific Diagnosed Prevalent Cases of Glaucoma, and Age-specific Diagnosed Prevalent Cases of Glaucoma in the 7MM covering the United States, EU4 countries (Germany, France, Italy, and Spain) and the United Kingdom, and Japan, from 2020 to 2034. The total prevalent cases of Glaucoma in the 7MM comprised approximately 16,632,421 cases in 2022 and are projected to increase during the forecast period 2023-2034.

Key Findings from Glaucoma Epidemiological Analysis and Forecast

- Glaucoma remains undetected in most of the patients due to many factors. According to DelveInsight estimations, of 16,632,421 Glaucoma prevalent cases in 2022 in the 7MM, only 7,045,443 cases are estimated to have received a formal diagnosis.

- The US showed the highest Glaucoma diagnosed prevalent population compared to other 7MM countries, with nearly 2,451,089 cases in 2022. As per DelveInsight’s estimates, the country alone accounts for nearly 35% of total diagnosed prevalent cases, for Glaucoma in the 7MM, followed by Japan, contributing 23% of all the Glaucoma cases.

- Glaucoma can affect both men and women, however the ratio of male to female Glaucoma patients suggest that female are predominantly affected more than males. In 2022, there were 3,234,796 cases of glaucoma among male population and 3,810,646 cases among female population.

- The Glaucoma diagnosed prevalent cases were further divided into open-angle glaucoma (OAG) and closed-angle glaucoma. The distribution showed that nearly 90% of glaucoma cases are of OAG type.

- Primary Open-Angle Glaucoma (POAG) and Secondary Open-Angle Glaucoma (SOAG) are two types of Open-angle glaucoma.

- Normal tension glaucoma (NTG) is a subtype of POAG occurring in the presence of normal IOP. As per DelveInsight’s estimates, of all POAG cases in the 7MM, 52% were of NTG type.

- Among EU4 and the UK, Germany had the highest diagnosed prevalent population of glaucoma, with 701,946 cases, followed by France in 2022. On the other hand, Spain had the lowest diagnosed prevalent population of glaucoma among EU4 and the UK in 2022.

- Japan accounted for 23% of the total diagnosed prevalent cases of Glaucoma in the 7MM in 2022.

Glaucoma Epidemiology Segmentation

- Total Glaucoma Prevalent Cases

- Total Glaucoma Diagnosed Prevalent Cases

- Glaucoma Type-specific Diagnosed Prevalent Cases

- Type-specific Diagnosed Prevalent Cases of Open-angle Glaucoma

- Glaucoma Gender-specific Diagnosed Prevalent Cases

- Glaucoma Age-specific Diagnosed Prevalent Cases

Glaucoma Market Recent Developments and Breakthroughs

- In August 2025, Qlaris Bio Inc. launched a study to evaluate the safety and tolerability of QLS-111 0.015% compared to Timolol Maleate 0.5% PF ophthalmic solution in patients with normal-tension glaucoma (NTG). The trial’s primary goal is to assess both ocular and systemic safety while determining how well patients tolerate QLS-111 versus the active control.

Glaucoma Drugs Analysis

The drug chapter segment of the Glaucoma therapeutics market report encloses a detailed analysis of Glaucoma marketed drugs and late-stage (Phase III and Phase II) Glaucoma pipeline drugs. It also understands the Glaucoma clinical trial details, expressive pharmacological action, agreements and collaborations, approval and patent details, advantages and disadvantages of each included drug, and the latest Glaucoma news and press releases.

Glaucoma Marketed Drugs

-

ROCKLATAN/ ROCLANDA (netarsudil/latanoprost, 0.02%/0.005%): Aerie Pharmaceuticals

Roclanda (in Europe), known as Rocklatan in the United States, is fixed-dose combination of a Rho kinase inhibitor and a prostaglandin F2a analog that reduces elevated intraocular pressure (IOP) in individuals diagnosed with open-angle glaucoma or hypertension. While it obtained approval in the US in March 2019, it gained approval in the European region in January 2021.

-

DURYSTA (bimatoprost SR): AbbVie Inc.

DURYSTA is an ophthalmic drug delivery system for a single intracameral administration of a biodegradable bimatoprost implant which is believed to lower IOP in humans by increasing the outflow of aqueous humor through both the trabecular meshwork (conventional) and uveoscleral routes (unconventional). It imitates the effects of prostamides, specifically prostaglandin F2a.

Glaucoma Emerging Drugs

-

NCX-470: Nicox Ophthalmics

NCX 470 is an investigational ophthalmic treatment by Nicox Ophthalmics designed to address ocular hypertension and open-angle glaucoma. It belongs to the second-generation nitric oxide (NO) category-donating prostaglandin analogs. This therapeutic candidate is administered through the ophthalmic route, targeting the prostaglandin F2 alpha receptor and soluble guanylate cyclase to achieve its effects.Based on a dual mechanism of action, NCX 470, a monotherapy, has the potential to be a new standard of care in reducing IOP glaucoma patients.

-

TRS01: Tarsier Pharma

TRS01, a lead product of Tarsier Pharma in Phase III, is a breakthrough immunomodulatory approach based on a bio-inspired new molecular platform. TRS was developed to engineer the immune system. The platform approaches inflammatory diseases from within the system. The technology can effectively treat various autoimmune and inflammatory ocular diseases. Currently, TRS01 is being evaluated in a Phase III trial, called TRS4VISION, in patients with active noninfectious anterior uveitis and uveitic glaucoma. Uveitis glaucoma is a severe late-stage blinding condition that occurs when a patient develops glaucoma on top of uveitis

Glaucoma Drugs Market Insights

Management of the disease focuses on lowering intraocular pressure (IOP) with the current class of Glaucoma drugs, like prostaglandin analogs, beta-blockers, alpha-agonists, rho kinase inhibitors (ROCK) and carbonic anhydrase inhibitors. Prostaglandin analogs increase fluid outflow, beta-blockers reduce fluid production, alpha-adrenergic agonists decrease fluid production and increase outflow, carbonic anhydrase inhibitors reduce fluid production, rho kinase inhibitors increase fluid outflow, and cholinergic agonists increase fluid drainage. The choice of medication depends on factors such as glaucoma severity, patient response, and potential side effects.

Glaucoma Market Outlook

The primary objective of disease management is to reduce intraocular pressure (IOP), typically accomplished through the use of various drug classes such as prostaglandin analogs, beta-blockers, alpha-agonists, rho kinase inhibitors (ROCK), and carbonic anhydrase inhibitors. However, not all patients benefit from these treatments, as some may still experience optic nerve deterioration despite having normal IOP levels. In addition to pharmacological interventions, alternative measures such as incisional surgery, laser surgery, and medication are also commonly recommended.

- The launch of Glaucoma emerging therapies such as NCX 470 (Nicox Ophthalmics), PDP-716 (Sun Pharma Advanced Research Company Limited (SPARC)/ Visiox Pharma), and others are expected to impact the market positively.

- The total Glaucoma Market Size in the 7MM was around USD 4,073 million in 2022. This is estimated to increase by 2034 at a significant CAGR.

- In the 7MM, most of the Glaucoma market share was accommodated by prostaglandin analogs generating nearly USD 2,541 million, followed by fixed combination therapies in 2022.

- Among the 7MM, the US captured the highest Glaucoma Drug Market in 2022, covering a total of 63% market, followed by Japan which is anticipated to grow during the forecast period (2023–2034).

- In 2022, EU4 and the UK captured nearly 24% of the total market in the 7MM.

- Among the forecasted emerging therapies, iDose TR is expected to capture the highest market in the 7MM by 2034.

Glaucoma Drugs Uptake

This section focuses on the uptake rate of potential Glaucoma drugs expected to launch in the market during 2020–2034. For example, for PDP-716, in the US we expect the drug uptake to be Slow-medium with a probability-adjusted peak share of around 2%, and years to the peak is expected to be 8 years from the year of launch.

Glaucoma Pipeline Development Activities

The Glaucoma pipeline segment provides insights into different therapeutic candidates in Phase III, Phase II, and Phase I stage. It also analyzes Glaucoma Companies involved in developing targeted therapeutics.

Latest KOL Views on Glaucoma

To keep up with current Glaucoma market trends, we take KOLs and SMEs’ opinions working in the domain through primary research to fill the data gaps and validate the secondary research. Industry Experts were contacted for insights on the evolving Glaucoma treatment market landscape, patient reliance on conventional therapies, patient’s therapy switching acceptability, and drug uptake along with challenges related to accessibility, including KOL from Duke University Eye Center; Glaucoma Research Foundation; Centre Hospitalier National d'Ophtalmologie; European Board of Ophthalmology; Department of Ophthalmology, Kyushu University; and others.

Delveinsight’s analysts connected with 50+ KOLs to gather insights; however, interviews were conducted with 15+ KOLs in the 7MM. Their opinion helps to understand and validate current and emerging therapies and treatment patterns or Glaucoma market trends. This will support the clients in potential upcoming novel treatments by identifying the overall scenario of the market and the Glaucoma unmet needs.

Glaucoma Qualitative Analysis

We perform Qualitative and market Intelligence analysis using various approaches, such as SWOT and Conjoint Analysis. In the SWOT analysis, strengths, weaknesses, opportunities, and threats in terms of disease diagnosis, patient awareness, patient burden, competitive landscape, cost-effectiveness, and geographical accessibility of therapies are provided. These pointers are based on the Analyst’s discretion and assessment of the patient burden, cost analysis, and existing and evolving Glaucoma treatment landscape. Conjoint Analysis analyzes multiple approved and emerging therapies based on relevant attributes such as safety, efficacy, frequency of administration, route of administration, and order of entry. Scoring is given based on these parameters to analyze the effectiveness of therapy.

Further, the therapies’ safety is evaluated wherein the acceptability, tolerability, and adverse events are majorly observed, and it sets a clear understanding of the side effects posed by the drug in the trials. In addition, the scoring is also based on the route of administration, order of entry and designation, probability of success, and the addressable patient pool for each therapy. According to these parameters, the final weightage score and the ranking of the emerging therapies are decided.

Glaucoma Drug Market Access and Reimbursement

The high cost of therapies for the treatment of glaucoma is a major factor restraining the growth of the global glaucoma drug market. Because of the high cost, the economic burden is increasing, leading the patient to escape from proper treatment. In the US, between 2000 and 2020, the average adjusted reimbursement for the 22 analyzed procedures decreased by 20.5%. Reimbursement is a crucial factor that affects the drug’s access to the market. Glaucoma Drug Market access and reimbursement options can differ depending on regulatory status, target population size, care setting, unmet need, the magnitude of incremental benefit claims, and costs.

The Glaucoma market share in Europe report further provides detailed insights on the country-wise accessibility and reimbursement scenarios, cost-effectiveness scenario of approved therapies, programs making accessibility easier and out-of-pocket costs more affordable, insights on patients insured under federal or state government prescription drug programs, etc.

Glaucoma Market Share Report Scope

- The Glaucoma market share in Europe report covers a segment of key events, an executive summary, descriptive overview, explaining its causes, signs and symptoms, pathogenesis, and currently available therapies.

- Comprehensive insight has been provided into the epidemiology segments and forecasts, the future growth potential of diagnosis rate, disease progression, and Glaucoma treatment guidelines.

- Additionally, an all-inclusive account of the current and emerging therapies, along with the elaborative profiles of late-stage and prominent therapies, will impact the current Glaucoma treatment market landscape.

- A detailed review of the Glaucoma therapeutics market, historical and forecasted Glaucoma market size, Glaucoma market share in Europe by therapies, detailed assumptions, and rationale behind the approach is included in the report covering the 7MM drug outreach.

- The Glaucoma therapeutics market report provides an edge while developing business strategies, by understanding trends, through SWOT analysis and expert insights/KOL views, patient journey, and treatment preferences that help shape and drive the 7MM Glaucoma therapeutics market.

Glaucoma Treatment Market Report Insights

- Patient-based Glaucoma Market Forecasting

- Therapeutic Approaches

- Glaucoma Pipeline Analysis

- Glaucoma Market Size

- Glaucoma Market Trends

- Existing and Future Glaucoma Therapeutics Market Opportunity

Glaucoma Treatment Market Report Key Strengths

- 11 Years- Glaucoma Market Forecast

- The 7MM Coverage

- Glaucoma Epidemiology Segmentation

- Key Cross Competition

- Attribute Analysis

- Glaucoma Drugs Uptake

- Key Glaucoma Market Forecast Assumptions

Glaucoma Treatment Market Size Report Assessment

- Current Glaucoma Treatment Market Size Practices

- Glaucoma Unmet Needs

- Glaucoma Pipeline Drugs Profiles

- Glaucoma Therapeutics Market Attractiveness

- Qualitative Analysis (SWOT and Conjoint Analysis)

Key Questions Answered in the Glaucoma Market Report

Glaucoma Drugs Market Insights

- What was the Glaucoma market size, the Glaucoma treatment market size by therapies, and Glaucoma market share in Europe (%) distribution in 2020, and how would it all look in 2034? What are the contributing factors for this growth?

- What Glaucoma unmet needs are associated with the current Glaucoma treatment market?

- What will be the impact of the XELPROS patent expiry in the market?

- How will OMLONTI compete with the existing therapies for Glaucoma during the study period?

- Which Glaucoma drug is going to be the largest contributor in 2034?

- What are the pricing variations among different geographies for approved and off-label therapies?

- How would the Glaucoma market drivers, barriers, and future opportunities affect the market dynamics and subsequent analysis of the associated trends?

Glaucoma Epidemiology Insights

- What are the disease risks, burdens, and Glaucoma unmet needs? What will be the Glaucoma therapeutics market growth opportunities across the 7MM concerning the Glaucoma patient population?

- What is the historical and forecasted Glaucoma patient pool in the United States, EU4 (Germany, France, Italy, and Spain), the United Kingdom, and Japan?

- Why do only limited patients appear for diagnosis?

- Which type of Glaucoma is more prevalent and why?

- What factors are affecting the diagnosis of the indication?

Current Glaucoma Treatment Market Scenario, Marketed Drugs, and Emerging Therapies

- What are the current options for treating Glaucoma? What are the current guidelines for treating Glaucoma in the US and Europe?

- How many Glaucoma companies are developing therapies for treating Glaucoma?

- How many Glaucoma emerging therapies are in the mid-stage and late stage of development for treating Glaucoma?

- What are the recent novel therapies, targets, mechanisms of action, and technologies developed to overcome the limitations of existing therapies?

- What are the key designations that have been granted for the Glaucoma emerging therapies?

- What is the cost burden of approved therapies on the patient?

- Patient acceptability in terms of preferred treatment options as per real-world scenarios?

- What are the country-specific accessibility issues of expensive, recently approved therapies? Focus on reimbursement policies.

- What are the 7MM historical and Glaucoma Market Forecasted?

Reasons to Buy the Glaucoma Market Report

- The patient-based Glaucoma market forecasting report will help develop business strategies by understanding the latest trends and changing treatment dynamics driving the Glaucoma Drug Market.

- Insights on patient burden/disease Glaucoma Prevalence, evolution in diagnosis, and factors contributing to the change in the Glaucoma epidemiology of the disease during the forecast years.

- To understand the existing Glaucoma Therapeutics Market opportunity in varying geographies and the growth potential over the coming years.

- Distribution of historical and current patient share based on real-world prescription data along with reported sales of approved products in the US, EU4 (Germany, France, Italy, and Spain), the United Kingdom, and Japan.

- Identifying strong upcoming Glaucoma companies in the market will help devise strategies that will help get ahead of competitors.

- Detailed analysis and ranking of class-wise potential current and emerging therapies under the conjoint analysis section to provide visibility around leading classes.

- Highlights of Access and Reimbursement policies of approved therapies, barriers to accessibility of off-label expensive therapies, and patient assistance programs.

- To understand the perspective of Key Opinion Leaders around the accessibility, acceptability, and compliance-related challenges of existing treatment to overcome barriers in the future.

- Detailed insights on the Glaucoma unmet needs of the existing market so that the upcoming Glaucoma Companies can strengthen their development and launch strategy.

Stay Updated with Us for New Articles