Hemophilia A Market

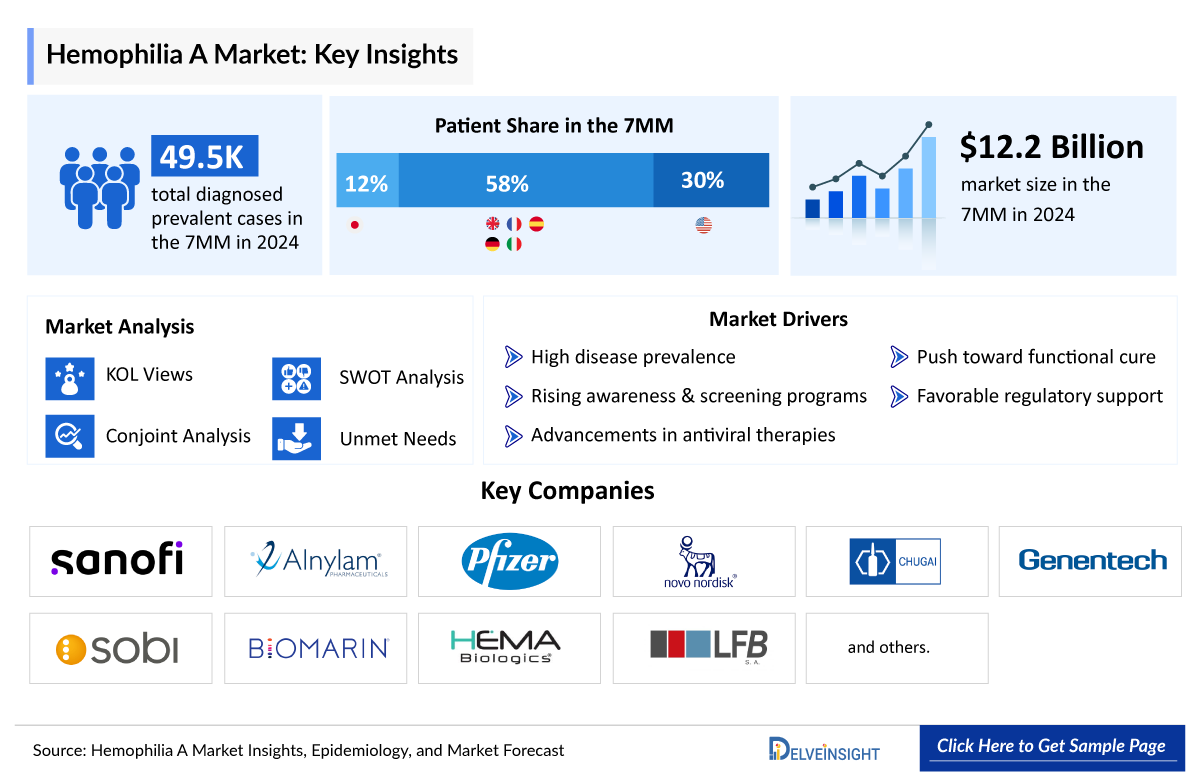

- The Hemophilia A market size in the 7MM was USD 12918 million in 2025 and projected to reach USD 16756 million by 2034.

- The Hemophilia A market is projected to grow at a CAGR of 2.9% by 2034 in leading countries (US, EU4, UK and Japan)

Hemophilia A Market and Epidemiology Analysis

- In 2024, the market size of hemophilia A was the largest in the US among the 7MM, accounting for approximately USD 5,920 million, which is further expected to increase by 2034.

- In March 2025, the US FDA approved QFITLIA (fitusiran) as the first antithrombin-lowering therapy indicated for routine prophylaxis to prevent or reduce the frequency of bleeding episodes in adult and pediatric patients (12 years and older) with hemophilia A or B, with or without factor VIII or IX inhibitors.

- In October 2024, Pfizer announced that the US FDA has approved HYMPAVZI (marstacimab-hncq) for routine prophylaxis to prevent or reduce the frequency of bleeding episodes in adults and pediatric patients aged 12 years and older with hemophilia A (congenital factor VIII deficiency) who do not have factor VIII (FVIII) inhibitors.

- In September 2023, concizumab was approved in Japan under the brand name ALHEMO for treating hemophilia A and B with inhibitors.

- The US FDA has approved several recombinant forms of factor VIII for the treatment of hemophilia A including HELIXATE FS, RECOMBINATE, KOGENATE FS, ADVATE, REFACTO, ELOCTATE, NUWIQ, ADYNOVATE, KOVALTRY, JIVI, and XYNTHA. Human plasma-derived preparations include MONARC-M, MONOCLATE-P, HEMOFIL M, and KOATE-DVI.

- HEMLIBRA is now considered a first-line drug for prophylaxis in patients who have hemophilia A with inhibitors, although ITI remains the standard therapy. Additionally, HEMLIBRA may be a valuable alternative for patients who face challenges with ITI because those on HEMLIBRA prophylaxis require less frequent dosing of FVIII during ITI.

- In June 2023, the US FDA approved ROCTAVIAN by BioMarin Pharmaceutical for the treatment of adults with severe hemophilia A without pre-existing antibodies to adeno-associated virus serotype 5 detected by an FDA-approved test.

- The emerging pipeline for hemophilia A includes several potential drugs in the late and early stages (Phase III and I/II) that include Giroctocogene fitelparvovec (SB-525 or PF-07055480), Mim8, NXT007/RG6512, and others, which can bring about significant change in the market during the forecast period.

- Several companies are actively developing emerging therapies for hemophilia A, including Novo Nordisk (Mim8, ALHEMO), Sangamo Therapeutics (Giroctocogene fitelparvovec), Roche/Chugai (NXT007), ASC Therapeutics (ASC-618), Ultragenyx (DTX201), and others.

Hemophilia A Market size and forecast

- 2025 Hemophilia A Market Size: USD 12918 million

- 2034 Projected Hemophilia A Market Size: USD 16756 million

- Hemophilia A Growth Rate (2025-2034): 2.9% CAGR

- Largest Spinal Cord Injury Market: United States

Download the Sample PDF to Get More Insight @ Hemophilia A Treatment Market

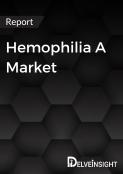

DelveInsight’s “Hemophilia A – Market Insights, Epidemiology, and Market Forecast – 2034” report delivers an in-depth understanding of the Hemophilia A, historical and forecasted epidemiology as well as the Hemophilia A market trends in the United States, EU4 (Germany, France, Italy, and Spain) and the United Kingdom, and Japan.

Hemophilia A market report provides current treatment practices, emerging drugs, and market share of the individual therapies, current and forecasted 7MM Hemophilia A market size from 2020 to 2034. The report also covers current Hemophilia A treatment practice/algorithm and unmet medical needs to curate the best of the opportunities and assess the underlying potential of the market.

Scope of the Hemophilia A Market | |

|

Study Period |

2020 to 2034 |

|

Forecast Period |

2024-2034 |

|

Geographies Covered |

The US, EU4 (Germany, France, Italy, and Spain) and UK, Japan |

|

Hemophilia A Market |

|

|

Hemophilia As Market Size | |

|

Hemophilia A Companies |

BioMarin Pharmaceutical, Roche (Spark Therapeutics), ApcinteX, Novo Nordisk, Sanofi (Genzyme), Alnylam Pharmaceuticals, Pfizer, Sangamo Therapeutics, Bayer, Ultragenyx Pharmaceutical, and others. |

|

Hemophilia A Epidemiology Segmentation |

|

Factors Impacting the Hemophilia A Market Growth

Rising Hemophilia A Target Patient Pool

The diagnosed prevalence of Hemophilia A is expected to rise from 49K in 2024 to 50K by 2034. Improved diagnostic capabilities and increased disease awareness mainly drive this increase in cases.

Advancements in Gene Therapy

Gene therapy has emerged as a transformative approach in hemophilia A treatment. Notably, BioMarin’s ROCTAVIAN has been approved in the U.S. and EU, offering a one-time infusion that provides long-term correction of the factor VIII deficiency. Pfizer's gene therapy giroctocogene fitelparvovec for hemophilia A has also demonstrated promising results in late-stage trials, significantly reducing bleeding episodes and outperforming traditional treatments.

Regulatory Approvals and Hemophilia A Market Expansion

Recent regulatory approvals have bolstered the availability of hemophilia A treatments. For instance, the U.S. FDA approved Pfizer's once-weekly injection, HYMPAVZI (in October 2024), for hemophilia A patients aged 12 and above, aiming to prevent or reduce bleeding episodes. Similarly, Sanofi's QFITLIA (in March 2025), a subcutaneous treatment administered every two months, was approved for patients with Hemophilia A or B aged 12 and older.

Emergence of Non-Factor Hemophilia A Therapies

Expanding beyond traditional therapies, hemophilia A care now includes two cutting-edge non-factor approaches: anti-TFPI therapies (Pfizer’s HYMPAVZI and Novo Nordisk’s ALHEMO) and siRNA therapies (Sanofi’s QFITLIA).

Robust Hemophilia A Clinical Trial Activity

Several hemophilia A companies are actively developing emerging therapies, including Novo Nordisk (Mim8, ALHEMO), Sangamo Therapeutics (Giroctocogene fitelparvovec), Roche/Chugai (NXT007), ASC Therapeutics (ASC-618), Ultragenyx (DTX201), and others.

Hemophilia A Disease Understanding

Hemophilia A Overview

Hemophilia A is a genetic bleeding disorder in which an individual lacks or has low levels of proteins named clotting factor VIII. The mainstay treatment option has long been FVIII replacement therapy. Initially, FVIII replacement was accomplished by donated whole blood, subsequently by plasma, and currently by recombinant human FVIII (rFVIII) replacement therapies, which revolutionized the treatment of Hemophilia A. Although hemophilia is usually diagnosed at birth, the disorder can also be acquired later in life if the body begins to produce antibodies that attack and destroy clotting factors. However, this acquired type of hemophilia is very rare.

Hemophilia A Diagnosis

The symptoms of Hemophilia A can vary greatly from one person to another; it ranges from mild to moderate to severe. The age of onset and frequency of bleeding episodes depend upon the amount of factor VIII protein and the overall clotting ability of the blood. In most individuals, regardless of severity, bleeding episodes tend to be more frequent in childhood and adolescence than in adulthood.

Additionally, the diagnosis of Hemophilia A depends on the identification of characteristic symptoms, a detailed patient history, a thorough clinical evaluation, and a variety of specialized laboratory tests. The identification of a hemizygous F8 pathogenic variant on molecular genetic testing in a male proband confirms the diagnosis.

Hemophilia A Treatment

About 30% of severe Hemophilia A patients develop neutralizing anti-FVIII alloantibodies (inhibitors), which render the FVIII replacement ineffective. The standard of care therapy for patients with inhibitors is to induce immune tolerance with high-dose, high-frequency FVIII and treatment with bypassing agents (e.g., recombinant activated factor VII such as NOVOSEVEN, FEIBA). There are many approved therapies for the management of Hemophilia A, which include ALTUVIIIO, ROCTAVIAN, HEMLIBRA, ALHEMO, and others.

Further details related to diagnosis and treatment are provided in the report…

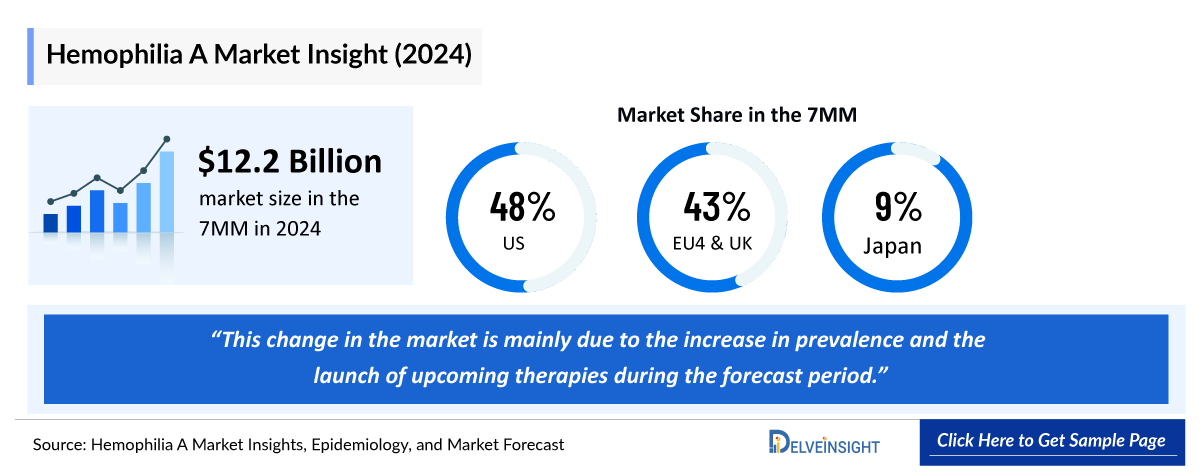

Hemophilia A Epidemiology

The disease epidemiology covered in the report provides historical as well as forecasted epidemiology segmented by total prevalent cases of hemophilia A, age-specific prevalent cases of hemophilia A, severity-specific prevalent cases of hemophilia A, prevalent cases of hemophilia A with or without inhibitors and the treated patient pool of hemophilia A in the 7MM market covering the United States, EU4 (Germany, France, Italy, and Spain) and the United Kingdom, and Japan from 2020 to 2034.

Key Findings from Hemophilia A Epidemiological Analyses and Forecast

- The epidemiology segment also provides the Hemophilia A epidemiology data and findings across the United States, EU4 (Germany, France, Italy, and Spain) and the United Kingdom, and Japan.

- The total diagnosed prevalent population of Hemophilia A in the 7MM comprised nearly 49,500 cases in 2024 and is projected to increase during the forecast period.

- The total diagnosed prevalent population of Hemophilia A in the United States was nearly 14,900 in 2024.

- EU4 and the UK contributed to the largest prevalent population of Hemophilia A, accounting for ~58% of the 7MM in 2024.

- In EU4 and the UK, the diagnosed prevalence of Hemophilia A was found to be maximum in France, followed by the UK. While the least number of cases were found in Spain in 2024.

- In 2024, the prevalent cases of mild Hemophilia A in the United States were identified to be ~35%, moderate as ~15%, and severe as ~50%.

- In the US, nearly 2,000 cases accounted for inhibitors and ~12,700 cases for non-inhibitors in 2024.

Hemophilia A Epidemiology Segmentation

- Total Diagnosed Prevalent Pool of Hemophilia A in the 7MM

- Severity-specific Prevalent Pool of Hemophilia A in the 7MM

- Inhibitor-specific Prevalent Pool of Hemophilia A in the 7MM

- Treated Prevalent Pool of Hemophilia A in the 7MM

Stay informed on the latest Hemophilia A epidemiology trends. Access our comprehensive forecast report for insights into 2034 and beyond!

Hemophilia A Market Recent Developments and Breakthroughs

- In May 2025, the FDA approved Jivi (antihemophilic factor [recombinant], PEGylated-aucl; Bayer) for treating pediatric patients aged 7 and older with hemophilia A, as announced by Bayer.

- In May 2025, the FDA approved Antihemophilic factor (recombinant), PEGylated-aucl (Jivi; Bayer) for treating pediatric patients aged 7 and older with hemophilia A. The approval was supported by results from the Alfa-PROTECT and PROTECT Kids trials.

- In April 2025, the FDA approved Qfitlia (fitusiran) for routine prophylaxis to prevent or reduce bleeding episodes in patients aged 12 and older with hemophilia A or B, with or without factor VIII or IX inhibitors.

- In March 2025, Alnylam Pharmaceuticals announced the FDA's approval of Qfitlia™ (fitusiran), the sixth Alnylam-discovered RNAi therapeutic approved in the U.S. It is the first and only treatment to lower antithrombin (AT), aiming to promote thrombin generation, rebalance hemostasis, and prevent bleeds.

- On October 11, 2024, Pfizer Inc. announced that the FDA has approved HYMPAVZI™ (marstacimab-hncq) for routine prophylaxis in adults and pediatric patients aged 12 and older with hemophilia A or B, without FVIII or FIX inhibitors.

- In May 2024, the FDA updated the label for ALTUVIIIO (Antihemophilic Factor), confirming that once-weekly dosing offers bleed protection for children with hemophilia A.

- In July 2024, the Cure 4 The Kids Foundation announced Nevada’s first successful infusion of Hemgenix, a gene therapy for adult patients with hemophilia B.

- In July 2024, Pfizer reported a Phase III trial success for its investigational gene therapy, giroctocogene fitelparvovec, for hemophilia A, meeting all primary and secondary endpoints, with 84% of participants maintaining over 5% FVIII activity at 15 months post-infusion.

- In May 2024, the FDA approved an update for Altuviiio (efanesoctocog alfa) to include full results from the XTEND-Kids trial, affirming its use in hemophilia A treatment.

- In May 2024, the FDA approved Labcorp’s companion diagnostic test to detect preexisting antibodies against the viral carrier used in Beqvez (fidanacogene elaparvovec-dzkt), Pfizer’s gene therapy for hemophilia B.

Hemophilia A Drugs Analysis

The drug chapter segment of the Hemophilia A report encloses the detailed analysis of Hemophilia A mid and late-stage pipeline drugs. It also helps understand the Hemophilia A clinical trial details, expressive pharmacological action, agreements and collaborations, approval and patent details of each included drug, and the latest news and press releases.

Hemophilia A Marketed Drugs

ROCTAVIAN (valoctocogene roxaparvovec)

ROCTAVIAN (valoctocogene roxaparvovec) is an AAV5 gene therapy for treating severe hemophilia A. It delivers a functional gene designed to enable the body to produce Factor VIII independently without needing continued hemophilia prophylaxis, thus relieving patients of their treatment burden relative to currently available therapies. People with hemophilia A have a mutation in the gene responsible for producing Factor VIII, a protein necessary for blood clotting. The expressed hFVIII-SQ replaces the missing coagulation factor VIII needed for effective hemostasis. Following valoctocogene roxaparvovec infusion, vector DNA is processed in vivo to form full-length, episomal transgenes that persist as the stable DNA forms that support the long-term production of hFVIII-SQ.

OBIZUR (susoctocog alfa): Takeda

OBIZUR treats bleeding episodes in adults with acquired hemophilia (a bleeding disorder caused by a lack of Factor VIII activity due to antibody development). These antibodies have a less neutralizing effect against OBIZUR than against human Factor VIII. OBIZUR contains the active substance susoctocog alfa, antihemophilic Factor VIII, and porcine sequence.

Hemophilia A Emerging Drugs

Mim8: Novo Nordisk

Mim8 is currently being evaluated in Phase III clinical trials, with a regulatory submission expected in 2025. Mim8 is a next-generation FVIIIa mimetic bispecific antibody that delivers sustained hemostasis for once-weekly or once-monthly prophylaxis in people living with hemophilia A, with and without inhibitors. Administered subcutaneously, Mim8 bridges Factor IXa/X (FIXa/FX) together upon activation, thereby replacing missing FVIII, which effectively restores the body’s thrombin generation capacity, helping blood to clot.

Peboctocogene camaparvovec (DTX201 or BAY2599023): Ultragenyx Pharmaceutical

DTX201 is the first clinical-stage adeno-associated virus (AAV) gene therapy vector based on the AAVhu37 serotype. DTX201 is a non-replicating AAV vector and contains a single-stranded DNA genome encoding a B-domain-deleted FVIII under the control of a liver-specific promoter/enhancer combination optimized for transgenic expression. It is currently being evaluated in Phase I/II clinical trials by Ultragenyx Pharmaceutical.

Note: Detailed therapy assessment will be provided in the final report.

Hemophilia A Drug Class Analysis

In the market, there are several third-generation products available; ADVATE (Baxter) and XYNTHA (Pfizer) are examples of recombinant factor VIII products. There are several other products approved under this category; however, these products were approved a long time ago, and since then, short and longer-acting recombinant (not derived from human plasma) factor therapies have entered the market, of which ELOCTATE and ADVATE have gained the popularity, in terms of treatment horizon of Hemophilia A. ELOCTATE is a recombinant fusion protein that temporarily replaces the missing Coagulation Factor VIII needed for effective hemostasis. KOGENATE FS is a new formulation of recombinant factor VIII formulated with sucrose, as opposed to human plasma protein (Albumin). Another class of factor concentrate is plasma-derived factor concentrate FVIII products that are produced by utilizing human plasma. But this class of products acquires less market share because of their less usage in comparison to the recombinant-derived factor concentrates. Several drugs are approved under this category, such as FEIBA (Pfizer), MONOCLATEP (CSL Behring), and HEMOFIL-M (Baxter).

Hemophilia A Market Outlook

- The total market size of Hemophilia A in the 7MM is nearly USD ~12,250 million in 2024 and is projected to grow during the forecast period (2025–2034).

- The upcoming therapies for Hemophilia A are expected to combat the current unmet needs faced by patients with Hemophilia A.

United States Hemophilia A Market

- According to DelveInsight’s estimates, the largest market size of Hemophilia A is captured by the US in 2024.

European Hemophilia A Market

- In EU4 and the UK, France has the maximum market share, followed by the United Kingdom in 2024 while Spain had the lowest market share.

Japan Hemophilia A Market

- The market size of Hemophilia A in Japan was USD ~1,150 million in 2024, which is expected to rise during the forecast period (2025–2034)

In the market, several recombinant factor VIII (FVIII) products are available with high-specific activities (the amount of desired clotting factor per mg of total protein). Plasma-derived clotting factors products are also available. However, the current market is mainly dominated by the recombinants of several generations (recombinant third-generation and recombinant second-generation). Although several products are available at present, then again, none of these products might be able to cure or manage this situation, completely. HEMLIBRA a product of “Genentech/Chugai/Roche,” is a novel bispecific antibody that was first approved in 2017 for patients with Hemophilia A with FVIII inhibitors in the US. However, in 2018, HEMLIBRA was approved for routine prophylaxis to prevent or reduce the frequency of bleeding episodes in adults and children, ages newborn and older, with Hemophilia A without factor VIII inhibitors. This therapy is also approved for treatment for people with Hemophilia A without or without inhibitors in Europe as well as in Japan. At the start of 2023, the FDA approved ALTUVIIIO for routine prophylaxis and on-demand treatment to control bleeding episodes, as well as perioperative management for adults and children with hemophilia A. Later, in June 2023, the FDA approved ROCTAVIAN, a gene therapy for the treatment of adults with severe hemophilia A without pre-existing antibodies to adeno-associated virus serotype 5 detected by an FDA-approved test. Both the drug’s efficacy and safety are better than HEMLIBRA. Currently, the treatment hemisphere is mainly driven by non-inhibitor drug candidates. However, the Hemophilia treatment landscape continues to evolve, and several companies are furiously working toward the development of new treatments that could potentially cure and change the treatment landscape of Hemophilia A. Key players, like Novo Nordisk, Sanofi, Pfizer/Sangamo, Roche/Spark Therapeutics, and others, are coming up with novel therapeutic approaches that can entirely change the treatment landscape of Hemophilia A.

Hemophilia A Drugs Uptake

This section focuses on the rate of uptake of the potential drugs expected to be launched in the market during the study period 2020–2034. The analysis covers Hemophilia A market uptake by drugs, patient uptake by therapies, and sales of each drug. Novo Nordisk developing Mim8, an Human IgG4 bispecific antibody for the treatment of hemophilia A and B (with/without inhibitors). Mim8 offers many of the same advantages seen with anti-TFPI antibodies, particularly in terms of improved convenience through subcutaneous administration, The drug demonstrates differentiated efficacy in patients with inhibitors, as its mechanism does not involve targeting FVIII or FIX directly—allowing it to bypass issues associated with inhibitors. Mim8 is a next-generation bispecific antibody that mimics the function of activated FVIII by bridging activated factor IX (FIXa) and factor X (FX), thereby enhancing FX activation and restoring thrombin generation capacity to help blood clot. This approach enables Mim8 to achieve potent and sustained hemostasis at lower concentrations than other therapies, especially with convenient subcutaneous dosing, which has generated considerable interest among clinicians.

Hemophilia A Pipeline Development Activities

The Hemophilia A pipeline report provides insights into Hemophilia A clinical trials Phase III, Phase II, and Phase I stages. It also analyzes key players involved in developing targeted therapeutics.

Hemophilia A Pipeline Development Activities

The Hemophilia A clinical trials within report covers detailed information on collaborations, acquisitions and mergers, licensing, and patent details for Hemophilia A emerging therapies.

Latest KOL Views on Hemophilia A

To keep up with current market trends, we take KOLs and SMEs’ opinions working in the domain through primary research to fill the data gaps and validate our secondary research. Their opinion helps understand and validate current and emerging therapies and treatment patterns or Hemophilia A market trends. This will support the clients in potential upcoming novel treatments by identifying the overall scenario of the market and the unmet needs.

Hemophilia A Qualitative Analysis

We perform Qualitative and market Intelligence analysis using various approaches, such as SWOT analysis and Analyst views. In the SWOT analysis, strengths, weaknesses, opportunities, and threats in terms of disease diagnosis, patient awareness, patient burden, competitive landscape, cost-effectiveness, and geographical accessibility of therapies are provided. These pointers are based on the Analyst’s discretion and assessment of the patient burden, cost analysis, and existing and evolving treatment landscape.

The analyst analyzes multiple emerging therapies based on relevant attributes such as safety, efficacy, frequency of administration, route of administration, and order of entry.

In efficacy, the trial’s primary and secondary outcome measures are evaluated. Further, the therapies’ safety is evaluated wherein the acceptability, tolerability, and adverse events are majorly observed, and it sets a clear understanding of the side effects posed by the drug in the trials.

Hemophilia A Market Access and Reimbursement

Reimbursement is a crucial factor affecting the drug’s market access. Often, the decision to reimburse comes down to the price of the drug relative to the benefit it produces in treated patients. To reduce the healthcare burden of these high-cost therapies, payers and other industry insiders are considering many payment models. One can obtain the initial 30-day supply of ALTUVIIIO typically within 24–48 h upon presenting a valid prescription from the healthcare provider. During the collaborative decision-making process between the individual and the doctor regarding suitable treatment, the assigned Sanofi professional will assess health insurance information.

Scope of the Hemophilia A Market Report

- The report covers the descriptive overview of Hemophilia A, explaining its causes, signs and symptoms, pathogenesis, and currently available therapies.

- Comprehensive insight has been provided into the Hemophilia A epidemiology and treatment.

- Additionally, an all-inclusive account of both the current and emerging therapies for Hemophilia A is provided, along with the assessment of new therapies that will have an impact on the current treatment landscape.

- A detailed review of the Hemophilia A market, historical and forecasted, is included in the report, covering the 7MM drug outreach.

- The report provides an edge while developing business strategies by understanding trends shaping and driving the 7MM Hemophilia A market.

Hemophilia A Market Report Highlights

- In the coming years, the Hemophilia A market is set to change due to emerging therapies in the pipeline and incremental healthcare spending across the world, which would expand the size of the market to enable drug manufacturers to penetrate more into the market.

- The companies and academics are working to assess challenges and seek opportunities that could influence Hemophilia A R&D. The therapies under development are focused on novel approaches to treat or improve the disease condition.

- The report also encompasses other major segments, i.e., age-specific, severity-specific cases of hemophilia A, prevalent pool based on inhibitor and non-inhibitor segment, and treated pool of Hemophilia A.

- Expected launch of potential therapies, Mim8 (Novo Nordisk), Peboctocogene camaparvovec (DTX201 or BAY2599023) (Ultragenyx Pharmaceutical), and others might change the landscape in the treatment of Hemophilia A.

- Currently, there are many approved therapies targeting the non-inhibitor segments. The current emerging pipeline consists of a number of novel candidates targeting both inhibitor and non-inhibitor segments. Many drugs are also being studied with subcutaneous route of administration.

Hemophilia A Market Report Insights

- Hemophilia A Patient Population

- Hemophilia A Therapeutic Approaches

- Hemophilia A Pipeline Analysis

- Hemophilia A Market Size and Trends

- Hemophilia A Market Opportunities

- Impact of Upcoming Hemophilia A Therapies

Hemophilia A Market Report Key Strengths

- 10 Year Forecast

- 7MM Coverage

- Hemophilia A Epidemiology Segmentation

- Key Cross Competition

- Highly Analyzed Market

- Hemophilia A Drugs Uptake

Hemophilia A Market Report Assessment

- Current Hemophilia A Treatment Practices

- Hemophilia A Unmet Needs

- Hemophilia A Pipeline Product Profiles

- Hemophilia A Market Attractiveness

- SWOT

- Conjoint Analysis

- Hemophilia A Market Drivers

- Hemophilia A Market Barriers

Key Questions Answered in the Hemophilia A Report

- What was the Hemophilia A market share (%) distribution in 2020, and what it would look like in 2034?

- What would be the Hemophilia A total market size as well as market size by therapies across the 7MM during the study period (2020–2034)?

- What are the key findings pertaining to the market across the 7MM, and which country will have the largest Hemophilia A market size during the study period (2020–2034)?

- At what CAGR, the Hemophilia A market is expected to grow at the 7MM level during the study period (2020–2034)?

- What would be the Hemophilia A market outlook across the 7MM during the study period (2020–2034)?

- What would be the Hemophilia A market growth till 2034, and what will be the resultant market size in 2034?

- How would the market drivers, barriers, and future opportunities affect the market dynamics and subsequent analysis of the associated trends?

- What are the disease risk, burden, and unmet needs of Hemophilia A?

- What is the historical Hemophilia A patient pool in the United States, EU4 (Germany, France, Italy, and Spain) and the UK, and Japan?

- What would be the forecasted patient pool of Hemophilia A at the 7MM level?

- What will be the growth opportunities across the 7MM with respect to the patient population pertaining to Hemophilia A?

- Out of the above-mentioned countries, which country would have the highest prevalent population of Hemophilia A during the study period (2020–2034)?

- At what CAGR is the population expected to grow across the 7MM during the study period (2020–2034)?

Reasons to buy the Hemophilia A Forecast Report

- The report will help in developing business strategies by understanding trends shaping and driving the Hemophilia A market.

- To understand the future market competition in the Hemophilia A market and an insightful review of the key market drivers and barriers.

- Organize sales and marketing efforts by identifying the best opportunities for Hemophilia A in the US, EU4 (Germany, France, Italy, and Spain) and the United Kingdom, and Japan.

- Identification of strong upcoming players in the market will help in devising strategies that will help in getting ahead of competitors.

- Organize sales and marketing efforts by identifying the best opportunities for the Hemophilia A market.

- To understand the future market competition in the Hemophilia A market.

Stay Updated with us for Recent Articles