Insomnia Market

- The diagnosed prevalence of insomnia has risen gradually, driven by stress, demanding lifestyles, and increased awareness, alongside advancements in sleep medicine and personalized therapies. In 2023, the estimated number of diagnosed cases across the 7MM was approximately 87,051 thousand.

- Insomnia is a significant health issue in the United States, and its prevalence has been increasing over the past few decades. According to DelveInsight estimates, among the 7MM, the US has the highest number of cases of Insomnia accounting for 67% of cases alone, followed by France, Japan, and Germany in 2023.

- DelveInsight's analysis reveals that in the 7MM, the prevalence of insomnia is higher among females, accounting for 58%, compared to 42% in males.

- The insomnia market faces challenges such as high costs and market saturation. Complex drug development and patient non-compliance further complicate outcomes. Key unmet needs in the Insomnia management include long-term, low-side-effect solutions, therapies targeting root causes, and personalized treatments.

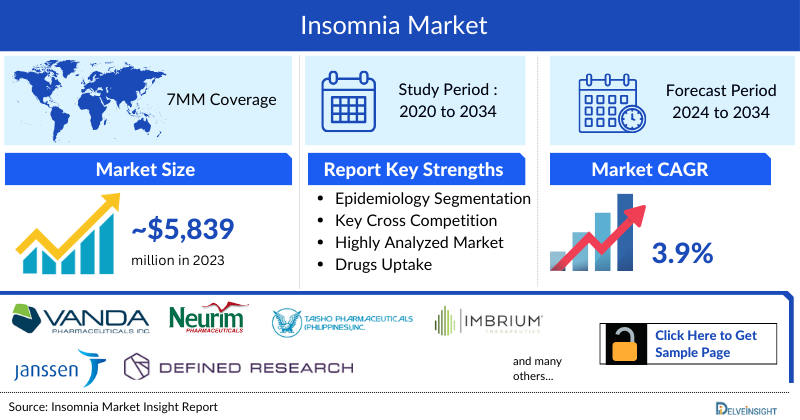

- In 2023, the market size of Insomnia in the 7MM, accounted for approximately USD 5,839 million which is further expected to increase at a significant compound annual growth rate (CAGR) of 3.9% by 2034.

- The total market size of Insomnia is anticipated to upsurge during the forecast period due to the expected entry of emerging therapies that includes Seltorexant, TS-142 and others.

- In July 2024, the European Medicines Agency's CHMP endorsed an extension for SLENYTO to treat insomnia in children with neurogenetic disorders (NGDs). Originally approved in 2018 for autism spectrum disorder and Smith-Magenis Syndrome, SLENYTO is set to be the sole medication for insomnia in this group. The extended indication includes children aged 2─18 with NGDs and aberrant melatonin secretion and addresses a critical need for effective treatment in this pediatric population.

DelveInsight’s “Insomnia Market Insights, Epidemiology, and Market Forecast – 2034” report delivers an in-depth understanding of the Insomnia, historical and forecasted epidemiology as well as the Insomnia therapeutics market trends in the United States, EU4 and the UK (Germany, France, Italy, Spain) and the United Kingdom, and Japan.

The Insomnia market report provides current treatment practices, emerging drugs, and market share of the individual therapies, current and forecasted 7MM Insomnia market size from 2020 to 2034. The Report also covers current Insomnia treatment practice, market drivers, market barriers, SWOT analysis, reimbursement and market access, and unmet medical needs to curate the best of the opportunities and assess the underlying potential of the market.

|

Study Period |

2020 to 2034 |

|

Forecast Period |

2024-2034 |

|

Geographies Covered |

|

|

Insomnia Market |

|

|

Insomnia Market Size | |

|

Insomnia Companies |

Vanda Pharmaceuticals, Janssen Pharmaceutical, Taisho Pharmaceutical, Neurim Pharmaceuticals, Imbrium Therapeutics, Defined Research, and others. |

|

Insomnia Epidemiology Segmentation |

|

Insomnia Treatment Market

Insomnia Overview

Insomnia, a prevalent sleep–wake disorder, is marked by dissatisfaction with sleep quality or duration, manifesting as difficulties falling asleep, frequent awakenings, or early-morning wakefulness with inability to return to sleep. The American Academy of Sleep Medicine defines insomnia as trouble falling or staying asleep with resultant daytime impairments. The International Classification of Sleep Disorders (ICSD-3) characterizes it by issues initiating, maintaining sleep, or early awakenings, accompanied by daytime dysfunction. The DSM-V describes insomnia as dissatisfaction with sleep quantity or quality, often involving difficulty falling or staying asleep, present for at least three months or occurring three times per week, now termed Insomnia disorder.

Although no single cause is established, physiological arousal, including heightened heart rate and increased cortisol, often disrupts sleep. Insomnia is categorized into short-term and chronic types, with chronic insomnia marked by persistent symptoms over three months or longer. Age, gender, medical and psychiatric conditions, and shift work are significant risk factors.

Insomnia Diagnosis

Insomnia diagnosis relies on subjective reports of sleep initiation or maintenance difficulties and associated daytime impairments. Objective assessment uses actigraphy, which tracks limb movements with wearable devices, providing data on sleep patterns like latency and efficiency. For detailed sleep analysis, including Non-REM and REM cycles, polysomnography is employed but is not routinely used for insomnia unless another disorder is suspected, such as sleep apnea. Additionally, diagnostic tools include the Insomnia Severity Index (ISI), which scores up to 28 to gauge insomnia severity, and the Pittsburgh Sleep Quality Index (PSQI), a 19-question survey assessing various sleep aspects over a month.

Despite advances in insomnia diagnostics, several unmet needs persist. Current diagnostic tools, while useful, often lack sensitivity in distinguishing between primary insomnia and secondary sleep disorders, leading to potential misdiagnoses. Actigraphy and polysomnography, although valuable, can be costly and cumbersome, limiting their accessibility and routine use. There is also a need for more precise biomarkers or objective measures to complement subjective reports and improve diagnostic accuracy. Additionally, existing questionnaires like the ISI and PSQI may not fully capture the complexity of insomnia's impact on daily functioning. Enhanced diagnostic methods that integrate comprehensive sleep assessments with technological innovations and personalized approaches could address these gaps and lead to more effective management strategies.

Further details related to diagnosis are provided in the report…

Insomnia Treatment

The treatment goal for insomnia is improving the patient’s ability to fall, stay, wake, and function well. According to various guidelines, insomnia is primarily treated using behavioral and psychological therapies such as Cognitive Behavioral Therapy for insomnia (CBT-I).

CBT-I is a multi-component gold standard for treating chronic insomnia, including cognitive, behavioral, and psychoeducational interventions. The first line of treatment recommended for insomnia is delivered through 4–8 sessions, typically by a clinician with specialized training in this area. In 2020, the US FDA approved Pear Therapeutics, SOMRYST, the first digital therapeutic drug to treat chronic insomnia.

In most acute cases, to increase the effectiveness of non-pharmacological therapies, various pharmacological therapies are also recommended to ameliorate the condition.

Across decades, various classes have been approved by the US FDA for the treatment of insomnia, that include benzodiazepines (temazepam, triazolam, estazolam, flurazepam, and quazepam), non-benzodiazepines (also called “Z-drugs”) (zolpidem, eszopiclone, zaleplon, or zolpidem tartrate), both of which are used as first-line pharmacotherapy. The additional classes approved by the US FDA include selective histamines antagonists, melatonin receptor agonists, such as ramelteon, and orexin receptor antagonists, such as suvorexant, lemborexant, and daridorexant.

Dual orexin receptor antagonists (DORAs), the latest entrants in the treatment landscape, changed this treatment paradigm of Z-drug or a benzodiazepine associated with some significant side effects, including drowsiness the next morning, impacting the quality of life. The three approved products in this class include BELSOMRA, DAYVIGO, and QUVIVIQ.

Merck’s BELSOMRA (suvorexant) is the first entrant in the US (2014) market, followed by Eisai’s DAYVIGO (lemborexant). The recent product to be marketed in the US and Europe is Idorsia, Syneos Health, and Mochida Pharmaceutical’s QUVIVIQ (daridorexant), a dual orexin receptor antagonist. This product was approved by the US FDA in January 2014 for the treatment of adults with insomnia.

Further details related to treatment are provided in the report…

Insomnia Epidemiology

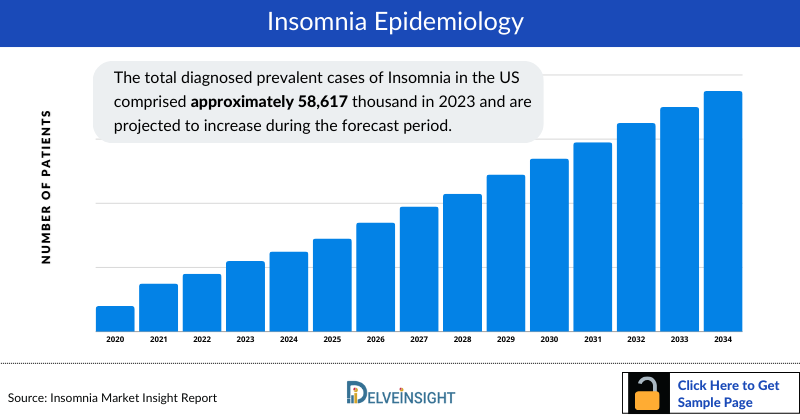

As the market is derived using the patient-based model, the Insomnia epidemiology chapter in the report provides historical as well as forecasted epidemiology segmented by Total Diagnosed Prevalent Cases of Insomnia, Type-Specific Cases of Insomnia, Gender-Specific Cases of Insomnia, and Age-Specific Cases of Insomnia in the 7MM covering the United States, EU4 countries (Germany, France, Italy, and Spain) and the United Kingdom, and Japan, from 2020 to 2034.

- The total diagnosed prevalent cases of Insomnia in the US comprised approximately 58,617 thousand in 2023 and are projected to increase during the forecast period.

- In 2023, France represented a significant share of diagnosed prevalent cases of insomnia among the EU4 and the UK, accounting for 43% of cases alone, while Spain reported the lowest prevalence at just 11%. This disparity highlights France's predominant role in the regional insomnia landscape compared to Spain’s minimal case load.

- DelveInsight’s estimates indicate a higher prevalence of insomnia among females compared to males in the US. Specifically, there are approximately 32,685 thousand cases in females versus 25,932 thousand cases in males, reflecting a notable gender disparity in insomnia prevalence.

- The age-specific distribution of diagnosed prevalent cases of insomnia in 2023 showed the highest prevalence among individuals aged 65+ with nearly 2,221 thousand cases and the lowest among those aged 18–24 with approximately 292 thousand cases in Japan.

- EU4 and the UK accounted for around 23,283 thousand diagnosed prevalent cases of Insomnia in 2023. Of these cases, nearly 9,903 thousand and 13,380 thousand cases accounted for acute and chronic insomnia respectively.

Stay Informed on Insomnia Epidemiology! Access comprehensive data on demographics and disease burden for effective healthcare planning.

Insomnia Drug Chapters

The drug chapter segment of the Insomnia report encloses a detailed analysis of Insomnia off-label drugs and late-stage (Phase-III and Phase-II) pipeline drugs. It also helps to understand the Insomnia clinical trial details, expressive pharmacological action, agreements and collaborations, approval and patent details, advantages and disadvantages of each included drug, and the latest news and press releases.

Insomnia Marketed Drugs

QUVIVIQ (daridorexant): Idorsia Pharmaceutical/ Syneos Health/ Mochida Pharmaceutical

QUVIVIQ (daridorexant), developed by Idorsia Pharmaceuticals, is an orexin receptor antagonist designed to treat insomnia in adults by addressing difficulties with sleep onset and maintenance. By targeting orexin, a neuropeptide that promotes wakefulness, QUVIVIQ reduces nocturnal hyperarousal, enhancing sleep quality without causing next-morning residual effects. Initially developed by Actelion and later acquired by Johnson & Johnson, Idorsia now leads its development. The drug has completed Phase III trials in Japan, with an NDA submitted, as per the company’s latest July 2024 corporate presentation. In Japan, Idorsia has a license agreement with Mochida Pharmaceutical for the supply, co-development and comarketing of daridorexant. All potential milestones have been assigned to Nxera. The recommended dose is 25–50 mg taken orally before bed.

In January 2022, the US FDA approved QUVIVIQ (daridorexant) 25 mg and 50 mg for treating adults with insomnia characterized by difficulties with sleep onset and/or sleep maintenance. QUVIVIQ was launched in the US in May 2022. In November 2022, QUVIVIQ was launched in Italy and Germany, followed by Spain in September 2023, the UK in October 2023, and France in March 2024.

BELSOMRA (suvorexant): Merck

BELSOMRA (suvorexant), developed by Merck, is an orexin receptor antagonist used to treat insomnia by addressing difficulties with sleep onset and maintenance. It works by blocking orexin receptors, which are crucial for promoting wakefulness, thereby reducing wakefulness. BELSOMRA is contraindicated in narcolepsy patients and can impair daytime wakefulness, with CNS depressant effects potentially lasting several days after discontinuation. It is also approved for insomnia in patients with mild-to-moderate Alzheimer’s disease. The recommended dose is 10 mg per night, with a maximum of 20 mg if needed and well-tolerated.

In August 2014, the US FDA approved BELSOMRA for the treatment of Insomnia in adults. In February 2020, Merck received approval from the US FDA for an update to the prescribing information for BELSOMRA (suvorexant) C-IV to include findings on its use for the treatment of insomnia in patients with mild-to-moderate Alzheimer’s disease.

Insomnia Emerging Drugs

Seltorexant (JNJ-42847922): Janssen Pharmaceutical

Seltorexant (JNJ-42847922), developed by Janssen Pharmaceutical, is a selective orexin-2 receptor antagonist for major depressive disorder (MDD) and insomnia. Targeting the orexin system, which regulates arousal and wakefulness, seltorexant aims to address excessive arousal in mood disorders. It is the leading ORX2 antagonist in clinical trials, currently in Phase III for adjunctive MDD treatment with insomnia. Additionally, seltorexant is being explored for Alzheimer's patients exhibiting significant agitation or aggression. Currently as per the company’s pipeline the drug is in Phase III for the adjunctive treatment for major depressive disorder with insomnia symptoms (OARS).

TS-142: Taisho Pharmaceutical

TS-142, also known as ORN-0829, is an orexin receptor antagonist developed by Taisho Pharmaceutical for insomnia treatment. It functions as a dual orexin OX1 and OX2 receptor antagonist (DORA) with a short elimination half-life of about 6 hours. Orexins are neuropeptides crucial for regulating wakefulness and the sleep-wake cycle, with OX2 receptors involved in sleep regulation and OX1 receptors supporting REM sleep. In April 2024, Taisho Pharmaceutical Co., Ltd. reported that favorable results were obtained in a domestic Phase III clinical trial (TS142-301 study), conducted as a multicenter, randomized, placebo-controlled, parallel-group comparative study, for an orexin receptor antagonist (generic name: bornolexant hydrate, development code "TS-142", hereinafter "bornolexant") being developed in Japan for the expected indication of insomnia. As a result, in terms of efficacy, statistically significant improvements were observed in both the 5 mg and 10 mg bornolexant groups compared to the placebo group in both sSL, which evaluates the effect of falling asleep, and sSE, which evaluates the effect of maintaining sleep (P<0.001 for all evaluation items and doses).

|

Drug |

MoA |

RoA |

Company |

Logo |

Phase |

|

Seltorexant (JNJ-42847922) |

Orexin receptor antagonist |

Oral |

Janssen Pharmaceutical |

III | |

|

TS-142 |

Dual orexin receptor antagonist |

Oral |

Taisho Pharmaceutical |

III | |

|

XXX |

Nociceptin receptor agonist |

XXX |

XXX |

II |

Explore the latest insights into the Insomnia pipeline, emerging therapies, and future treatment potential. Stay informed today!

Insomnia Market Outlook

Insomnia, the most prevalent sleep-wake disorder, often remains inadequately treated. It is marked by difficulties with falling or staying asleep, leading to daytime issues such as fatigue, concentration problems, and irritability. The disorder is linked to increased risks of comorbidities, accidents, and workplace impairment. Cognitive Behavioral Therapy for Insomnia (CBT-I) is recommended as a primary treatment by leading sleep organizations but faces challenges like limited access to trained therapists and high costs, leaving pharmacotherapy as a crucial management option.

Approved pharmacotherapies in the US for insomnia include benzodiazepines and non-benzodiazepines or Z-drugs. Additional options include selective histamine H1 antagonists, melatonin receptor agonists like ramelteon, and orexin receptor antagonists such as suvorexant and lemborexant. The latest addition is QUVIVIQ, by Idorsia, which is also being developed in Japan.

Benzodiazepines and Z-drugs are associated with significant side effects like next-day drowsiness, while melatonin receptor agonists are more effective for sleep onset but less so for maintaining sleep. Existing drugs are facing revenue declines due to generic competition. DORAs like BELSOMRA and DAYVIGO have struggled with market adoption, but QUVIVIQ’s recent approval in Europe positions Idorsia with a potential breakthrough advantage in the insomnia treatment landscape.

The current market has been segmented into different commonly used therapeutic classes based on the prevailing treatment pattern across the 7MM, which presents minor variations in the overall prescription pattern. Benzodiazepines, non-benzodiazepines, melatonin receptor agonists, other antidepressants, BELSOMRA, DAYVIGO, and QUVIVIQ are the major drugs covered in the forecast model.

The launch of emerging therapies, such as Seltorexant (JNJ-42847922), TS-142, and others are expected to impact the market positively. The approval of these therapies could significantly impact market dynamics, although their success rates remain uncertain.

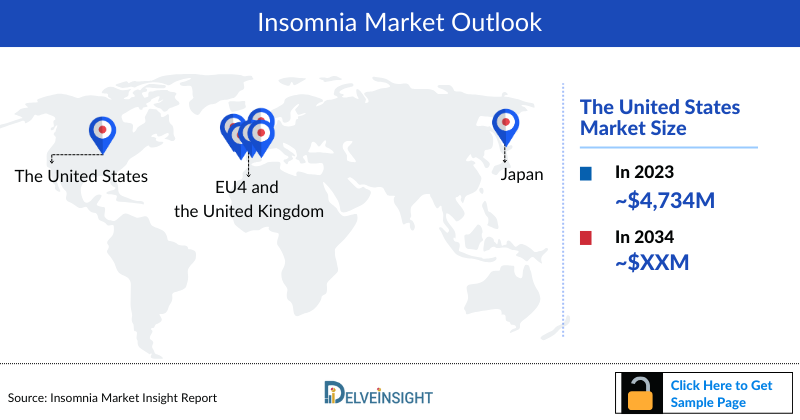

- The market size of Insomnia in the US was nearly USD 4,734 million in 2023, which is further anticipated to increase at a significant compound annual growth rate (CAGR) of 4.1% during the forecast period.

- The EU4 and the UK accounted for the approximately USD 774 million market size of Insomnia approximately in 2023 and is estimated to rise at compound annual growth rate (CAGR) of 3.1%.

- Among the EU countries, France had the highest market size with nearly ~USD 352 million in 2023, while Spain had the lowest market size for Insomnia with USD ~82million in 2023.

- With the expected launch of upcoming therapies, such as Seltorexant (JNJ-42847922) and TS-142, among others, the total market size of Insomnia is expected to show change in the upcoming years.

Insomnia Drugs Uptake

This section focuses on the uptake rate of potential drugs expected to launch in the market during 2020–2034. For example, Seltorexant in the US is expected to be launched by 2025 with a peak share of 6.6%. TS-142 is anticipated to take 9 years to peak with a slow uptake.

Further detailed analysis of emerging therapies drug uptake in the report…

Insomnia Pipeline Development Activities

The report provides insights into Insomnia clinical trials within Phase III, Phase II, and Phase I stage. It also analyzes key players involved in developing targeted therapeutics.

Pipeline Development Activities

The report covers information on collaborations, acquisitions and mergers, licensing, and patent details for Insomnia emerging therapies.

KOL Views

To keep up with current market trends, we take KOLs and SMEs’ opinions working in the domain through primary research to fill the data gaps and validate the secondary research. Industry Experts were contacted for insights on Insomnia evolving treatment landscape, patient reliance on conventional therapies, patient therapy switching acceptability, and drug uptake along with challenges related to accessibility, including KOL from The University of Missouri, Columbia, Missouri, US; University of Iowa, Iowa City, Iowa, US; Keele University, Staffordshire, UK; Hospital Universitari de la Ribera, Alzira, Valencia, Spain; Université Montpellier, Montpellier, France; University of Pisa, Pisa, Italy; Robert Koch Institute, Berlin, Germany; Teikyo University School of Medicine, Tokyo, Japan; and others.

Delveinsight’s analysts connected with 50+ KOLs to gather insights; however, interviews were conducted with 15+ KOLs in the 7MM. Their opinion helps understand and validate current and emerging therapies, treatment patterns, or Insomnia market trends. This will support the clients in potential upcoming novel treatments by identifying the overall scenario of the market and the unmet needs.

Qualitative Analysis

We perform Qualitative and market Intelligence analysis using various approaches, such as SWOT and Conjoint Analysis. In the SWOT analysis, strengths, weaknesses, opportunities, and threats in terms of disease diagnosis, patient awareness, patient burden, competitive landscape, cost-effectiveness, and geographical accessibility of therapies are provided. These pointers are based on the Analyst’s discretion and assessment of the patient burden, cost analysis, and existing and evolving treatment landscape.

Conjoint Analysis analyzes multiple approved and emerging therapies based on relevant attributes such as safety, efficacy, frequency of administration, route of administration, and order of entry. Scoring is given based on these parameters to analyze the effectiveness of therapy.

Further, the therapies’ safety is evaluated wherein the acceptability, tolerability, and adverse events are majorly observed, and it sets a clear understanding of the side effects posed by the drug in the trials. In addition, the scoring is also based on the route of administration, order of entry and designation, probability of success, and the addressable patient pool for each therapy. According to these parameters, the final weightage score and the ranking of the emerging therapies are decided.

Market Access and Reimbursement

The high cost of therapies for the treatment is a major factor restraining the growth of the global drug market. Because of the high cost, the economic burden is increasing, leading the patient to escape from proper treatment.

The report further provides detailed insights on the country-wise accessibility and reimbursement scenarios, cost-effectiveness scenario of approved therapies, programs making accessibility easier and out-of-pocket costs more affordable, insights on patients insured under federal or state government prescription drug programs, etc.

Scope of the Insomnia Market Report

- The report covers a segment of key events, an executive summary, descriptive overview of Insomnia, explaining its causes, signs and symptoms, and currently available therapies.

- Comprehensive insight has been provided into the epidemiology segments and forecasts, the future growth potential of diagnosis rate, disease progression, and treatment guidelines.

- Additionally, an all-inclusive account of the current and emerging therapies and the elaborative profiles of late-stage and prominent therapies will impact the current treatment landscape.

- A detailed review of the Insomnia market, historical and forecasted market size, market share by therapies, detailed assumptions, and rationale behind the approach is included in the report covering the 7MM drug outreach.

- The report provides an edge while developing business strategies, by understanding trends, through SWOT analysis and expert insights/KOL views, patient journey, and treatment preferences that help shape and drive the 7MM Insomnia market.

Insomnia Report Insights

- Insomnia Patient Population

- Insomnia Therapeutic Approaches

- Insomnia Pipeline Analysis

- Insomnia Market Size and Trends

- Existing and Future Market Opportunity

Insomnia Report Key Strengths

- 11 years Forecast

- The 7MM Coverage

- Insomnia Epidemiology Segmentation

- Key Cross Competition

- Conjoint Analysis

- Insomnia Drugs Uptake

- Key Insomnia Market Forecast Assumptions

Insomnia Report Assessment

- Current Treatment Practices

- Insomnia Unmet Needs

- Insomnia Pipeline Product Profiles

- Insomnia Market Attractiveness

- Qualitative Analysis (SWOT and Conjoint Analysis)

- Insomnia Market Drivers

- Insomnia Market Barriers

Key Questions Answered In The Insomnia Market Report:

Insomnia Market Insights

- What was the Insomnia market share (%) distribution in 2020 and how it would look like in 2034?

- What would be the Insomnia total market size as well as market size by therapies across the 7MM during the forecast period (2024–2034)?

- What are the key findings pertaining to the market across the 7MM and which country will have the largest Insomnia market size during the forecast period (2024–2034)?

- At what CAGR, the Insomnia market is expected to grow at the 7MM level during the forecast period (2024–2034)?

- What would be the Insomnia market outlook across the 7MM during the forecast period (2024–2034)?

- What would be the Insomnia market growth till 2034 and what will be the resultant market size in the year 2034?

- How would the market drivers, barriers, and future opportunities affect the market dynamics and subsequent analysis of the associated trends?

Insomnia Epidemiology Insights

- What is the disease risk, burden, and unmet needs of Insomnia?

- What is the historical Insomnia patient population in the United States, EU5 (Germany, France, Italy, Spain, and the UK), and Japan?

- What would be the forecasted patient population of Insomnia at the 7MM level?

- What will be the growth opportunities across the 7MM with respect to the patient population pertaining to Insomnia?

- Out of the above-mentioned countries, which country would have the highest prevalent population of Insomnia during the forecast period (2024–2034)?

- At what CAGR the population is expected to grow across the 7MM during the forecast period (2024–2034)?

Current Insomnia Treatment Scenario, Marketed Drugs, and Emerging Therapies

- What are the current options for the treatment of Insomnia along with the approved therapy?

- What are the current treatment guidelines for the treatment of Insomnia in the US, Europe, And Japan?

- What are the Insomnia marketed drugs and their MOA, regulatory milestones, product development activities, advantages, disadvantages, safety, and efficacy, etc.?

- How many companies are developing therapies for the treatment of Insomnia?

- How many emerging therapies are in the mid-stage and late stages of development for the treatment of Insomnia?

- What are the key collaborations (Industry–Industry, Industry-Academia), Mergers and acquisitions, licensing activities related to the Insomnia therapies?

- What are the recent therapies, targets, mechanisms of action and technologies developed to overcome the limitation of existing therapies?

- What are the clinical studies going on for Insomnia and their status?

- What are the key designations that have been granted for the emerging therapies for Insomnia?

- What are the 7MM historical and forecasted market of Insomnia?

Reasons to Buy Insomnia Market Report

- The report will help in developing business strategies by understanding the latest trends and changing treatment dynamics driving the Insomnia Market.

- Insights on patient burden/disease incidence, evolution in diagnosis, and factors contributing to the change in the epidemiology of the disease during the forecast years.

- To understand the existing market opportunity in varying geographies and the growth potential over the coming years.

- Distribution of historical and current patient share based on real-world prescription data along with reported sales of approved products in the US, EU4 (Germany, France, Italy, and Spain), the United Kingdom, and Japan.

- Identification of strong upcoming players in the market will help in devising strategies that will help in getting ahead of competitors.

- Detailed analysis and potential of current and emerging therapies under the conjoint analysis section to provide visibility around leading emerging drugs.

- Highlights of Access and Reimbursement policies of approved therapies, barriers to accessibility of off-label expensive therapies, and patient assistance programs.

- To understand the perspective of Key Opinion Leaders around the accessibility, acceptability, and compliance-related challenges of existing treatment to overcome barriers in future.

- Detailed insights on the unmet need of the existing market so that the upcoming players can strengthen their development and launch strategy.