Interventional Cardiology Devices Market Summary

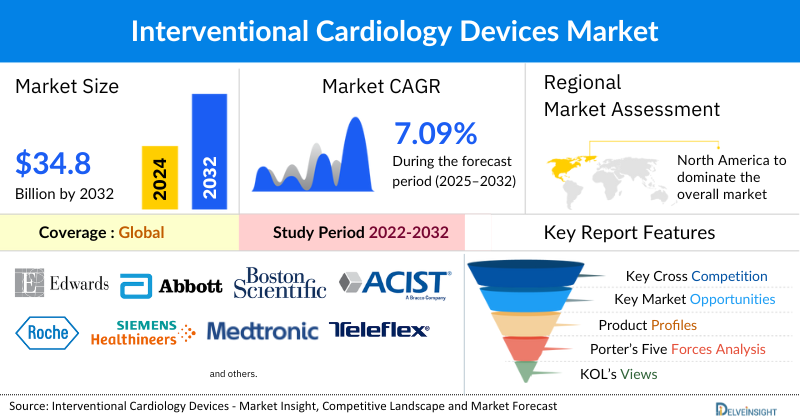

- The global interventional cardiology devices market is expected to increase from USD 20,192.60 million in 2024 to USD 34,866.30 million by 2032, reflecting strong and sustained growth.

- The global interventional cardiology devices market is growing at a CAGR of 7.09% during the forecast period from 2025 to 2032.

Interventional Cardiology Devices Market and Targeted Patient Pool Trends

- The global interventional cardiology devices market is driven by the growing prevalence of cardiovascular diseases (CVDs) and its associated risk factors, increasing preference for mimimally invasive procedures, increasing technological advancement in product design, and increase in strategic activites among the key market players.

- The leading companies operating in the interventional cardiology devices market include Edwards Lifesciences Corporation, Abbott Laboratories, Boston Scientific Corporation, ACIST Medical Systems., F. Hoffmann-La Roche Ltd., Siemens Healthineers AG., Medtronic, Teleflex Incorporated, B. Braun SE., MicroPort Scientific Corporation, SIS MEDICAL AG., Lepu Medical Technology (Beijing) Co., Ltd., Terumo Corporation., Sahajanand Laser Technology Limited, Biotronik SE & Co. KG, Cordis, Abiomed, Inc., Merit Medical Systems, Koninklijke Philips N.V., Cook, and others.

- North America is expected to dominate the overall interventional cardiology devices market in 2024, due to the high prevalence of cardiovascular diseases, well-established healthcare infrastructure, and strong adoption of advanced treatment technologies. The region benefits from the presence of major medical device manufacturers, continuous product innovations such as drug-eluting stents, bioresorbable scaffolds, and minimally invasive catheter-based solutions, as well as significant investments in research and development.

- In the product segment of the interventional cardiology devices market, the angioplasty stents category is estimated to account for the largest market share in 2024.

Request for unlocking the report of the @ Interventional Cardiology Devices Market

Interventional Cardiology Devices Market Size and Forecasts

|

Report Metrics |

Details |

|

2024 Market Size |

USD 20,192.60 million |

|

2032 Projected Market Size |

USD 34,866.30 million |

|

Growth Rate (2025-2032) |

7.09% CAGR |

|

Largest Market |

North America |

|

Fastest Growing Market |

Asia-Pacific |

|

Market Structure |

Moderately Consolidated |

Factors Contributing to the Growth of the Interventional Cardiology Devices Market

- Rising prevalence of cardiovascular diseases and its associated risk factors leading to surge in interventional cardiology devices: The rising prevalence of cardiovascular diseases, driven by risk factors such as obesity, hypertension, diabetes, and sedentary lifestyles, is significantly increasing the demand for interventional cardiology devices. As heart conditions like coronary artery disease and heart attacks become more common, the need for stents, catheters, and minimally invasive procedures is growing rapidly to ensure effective treatment and improved patient outcomes.

- Increasing preference in minimally invasive procedures escalating the overall market of interventional cardiology devices: The increasing preference for minimally invasive procedures is escalating the overall market of interventional cardiology devices, as these approaches offer shorter hospital stays, quicker recovery, reduced complications, and improved patient comfort compared to traditional open-heart surgeries. Advancements in stents, catheters, and image-guided technologies are making these procedures safer and more effective, driving higher adoption rates among patients and healthcare providers. This shift toward less invasive interventions is significantly boosting demand for interventional cardiology devices worldwide.

- Increasing technological advancement in product design: Increasing technological advancements in product design are boosting the overall market of interventional cardiology devices by enhancing safety, precision, and treatment outcomes. Innovations such as drug-eluting and bioresorbable stents, advanced balloon catheters, atherectomy systems, and AI-assisted imaging technologies are improving procedural success rates while reducing complications. These cutting-edge designs not only expand the scope of minimally invasive treatments but also encourage faster adoption by healthcare providers, ultimately driving market growth.

Interventional Cardiology Devices Market Report Segmentation

This interventional cardiology devices market report offers a comprehensive overview of the global interventional cardiology devices market, highlighting key trends, growth drivers, challenges, and opportunities. It covers detailed market segmentation by Product (Angioplasty Balloons [Drug-Eluting Balloons and Others], Angioplasty Stents [Drug-Eluting Stents, Bare-Metal Stents, and Bioabsorbable Stents], Structural Heart Devices [Aortic Valve Therapy Devices and Others], Catheters [Angiography Catheters, Guiding Catheters, and IVUS/OCT Catheters], Plaque Modification Devices [Atherectomy Devices and Thrombectomy Devices], Hemodynamic Flow Alteration Devices, [Embolic Protection Devices and Chronic Total Occlusion Devices], and Others), End-User (Hospitals, Ambulatory Surgical Centers, and Others), and geography. The report provides valuable insights into the competitive landscape, regulatory environment, and market dynamics across major markets, including North America, Europe, and Asia-Pacific. Featuring in-depth profiles of leading industry players and recent product innovations, this report equips businesses with essential data to identify market potential, develop strategic plans, and capitalize on emerging opportunities in the rapidly growing interventional cardiology devices market.

Interventional cardiology devices are specialized medical tools used in minimally invasive, catheter-based procedures to diagnose and treat cardiovascular conditions such as coronary artery disease, structural heart defects, and arrhythmias. These devices including stents, catheters, balloons, embolic protection systems, and transcatheter valve replacement/repair technologies enable physicians to restore blood flow, repair heart structures, and prevent complications like stroke or cardiac arrest without the need for open-heart surgery. They play a vital role in improving patient outcomes, reducing recovery times, and lowering the overall risk associated with traditional surgical interventions.

The overall market of interventional cardiology devices is being strongly boosted by a combination of factors, including the growing prevalence of cardiovascular diseases (CVDs) and associated risk factors such as diabetes, obesity, and hypertension, which are creating a consistent demand for effective treatment solutions. At the same time, the rising preference for minimally invasive procedures is accelerating device adoption, as patients and physicians seek safer interventions with faster recovery times. Technological advancements in product design, including the development of drug-eluting stents, bioresorbable scaffolds, and AI-enabled imaging systems, are further improving clinical outcomes and broadening treatment options. Additionally, increasing product development activities and continuous innovations by key market players are expanding the availability of advanced solutions, collectively driving the growth and expansion of the interventional cardiology devices market worldwide.

Get More Insights into the Report @ Interventional Cardiology Devices Market

What are the latest Interventional Cardiology Devices Market Dynamics and Trends?

The interventional cardiology devices market is being fueled by several interconnected factors, with the rapidly increasing prevalence of cardiovascular diseases (CVDs) and its associated risk factors such as diabtes, hypertension, among others.

According to DelveInsight analysis (2024), acute myocardial infarction in the 7MM were ~1,468,400 in 2023 out of which the highest incident cases of this disease were in the United States. Acute myocardial infraction (AMI) often requires urgent procedures such as angioplasty and stent placement to quickly restore blood flow and minimize heart muscle damage. With AMI being one of the leading causes of hospitalization and mortality worldwide, the growing patient pool is driving demand for advanced devices including drug-eluting stents, balloon catheters, and guidewires.

Additionally, as per our analyst estimates (2025), approximately 641 million people were living with heart and circulatory disease globally, underscoring the enormous patient pool in need of advanced treatment solutions. These disorders significantly increase the risk of stroke, heart failure, and other severe complications, necessitating timely and effective treatment. The rising incidence of these conditions is driving demand for stents, catheters, embolic protection devices, and advanced ablation technologies that enable minimally invasive interventions. With the growing patient pool suffering from arrhythmias and structural heart issues, healthcare providers are increasingly adopting interventional cardiology solutions to improve patient outcomes, reduce hospital stays

At the same time, obesity has become a critical contributing factor in boosting the overall market of iterventional cardiology devices. As per DelveInsight’s estimates (2025), more than 895 million of world population was living with obesity. Obesity is a major risk factor for developing cardiovascular diseases, including coronary artery disease, hypertension, and heart failure. Excess body weight contributes to plaque buildup in arteries, increasing the likelihood of blockages that require interventions such as angioplasty and stent placement thereby boosting the overall market of interventional cardiology devices.

Additionally, the increase in product development activites such as product launch, product approvals among others among the key market player are further increasing the adoption of interventional cardiology devices. For instance, in March 2024, Boston Scientific AGENT™ Drug-Coated Balloon received FDA approval for treating coronary in-stent restenosis the first of its kind in the U.S.

Thus, the factors mentioned above are expected to boost the overall market of interventional cardiology devices.

The interventional cardiology devices market faces significant restraints and challenges, primarily due to stringent regulatory hurdles and high costs. Gaining approval for new devices is a complex, time-consuming, and expensive process, with evolving regulations like the EU's Medical Device Regulation (MDR) adding to the burden. This is compounded by the high cost of devices and procedures, which can limit patient access, especially in developing countries, and is often not fully covered by inadequate reimbursement policies. Additionally, the market is highly competitive, facing pressure from alternative treatments and the emergence of lower-cost local manufacturers. Finally, a shortage of skilled healthcare professionals and the need for continuous specialized training also act as a significant challenge, impacting the adoption of new technologies and putting a strain on the healthcare system.

Interventional Cardiology Devices Market Segment Analysis

Interventional Cardiology Devices Market by Product (Angioplasty Balloons [Drug-Eluting Balloons and Others], Angioplasty Stents [Drug-Eluting Stents, Bare-Metal Stents, Bioabsorbable Stents], Structural Heart Devices [Aortic Valve Therapy Devices and Others], Catheters [Angiography Catheters, Guiding Catheters, and IVUS/OCT Catheters], Plaque Modification Devices [Atherectomy Devices and Thrombectomy Devices], Hemodynamic Flow Alteration Devices, [Embolic Protection Devices and Chronic Total Occlusion Devices], and Others), End-User (Hospitals, Ambulatory Surgical Centers, Others), and Geography (North America, Europe, Asia-Pacific, and Rest of the World)

By Product: Angioplasty Stents Category Dominates the Market

In the angioplasty stents segment of the interventional cardiology devices market, drug-eluting stents (DES) are projected to dominate, capturing an estimated 78% share in 2024, driven by their superior efficacy in reducing restenosis and the growing preference for advanced minimally invasive cardiac interventions. DES significantly reduce the risk of restenosis and stent thrombosis by releasing antiproliferative drugs that prevent arterial re-narrowing, leading to higher patient safety and long-term efficacy. Continuous technological advancements, such as improved polymer coatings, thinner struts, and enhanced biocompatibility, have further strengthened their adoption. For instance, in May 2024 Abbott launched the next-generation XIENCE Sierra™ Everolimus Eluting Coronary Stent System in key markets, including India. This stent builds upon the well-established XIENCE platform, offering improved deliverability, flexibility, and unique sizes to help cardiologists treat challenging and complex coronary anatomies.

Additionally, the rising prevalence of coronary artery disease, growing demand for minimally invasive procedures, and favorable reimbursement policies are further driving the dominance of drug-eluting stents in the global market.

By End-User: Hospitals Dominate the Market

Hospitals are boosting the overall market of interventional cardiology devices by serving as the primary centers for advanced cardiovascular diagnostics and treatments, where the majority of angioplasty, stent placements, and structural heart interventions are performed. Equipped with specialized catheterization labs, advanced imaging systems, and skilled cardiologists, hospitals drive high procedural volumes, ensuring consistent demand for devices such as stents, catheters, balloons, and embolic protection systems. Moreover, hospitals are often the first adopters of newly approved technologies, supported by strong reimbursement structures and government funding, which accelerates the uptake of innovative interventional cardiology solutions. Their role in clinical trials, training programs, and multidisciplinary cardiac care further strengthens their contribution to market growth.

Interventional Cardiology Devices Market Regional Analysis

North America Interventional Cardiology Devices Market Trends

North America is expected to lead the global interventional cardiology devices market in 2024, holding an estimated 43% share, driven by the high prevalence of cardiovascular diseases, advanced healthcare infrastructure, and strong adoption of minimally invasive cardiac procedures. The region benefits from the presence of major medical device manufacturers, continuous product innovations such as drug-eluting stents, bioresorbable scaffolds, and minimally invasive catheter-based solutions, as well as significant investments in research and development.

According to the DelveInsight analysis (2024), around 4.0% of U.S. adults were diagnosed with coronary heart disease. With the growing patient pool suffering from structural heart issues, healthcare providers are increasingly adopting interventional cardiology solutions to improve patient outcomes, reduce hospital stays, and lower long-term healthcare costs, thereby fueling strong market growth.

In parallel, rapid technological advancements are transforming the market, with innovations in angioplasty balloons, stents, catheters, and imaging systems enhancing procedural precision, safety, and patient recovery. For instance, in March 2024, the FDA approved Medtronic’s Evolut™ FX+ TAVR system, designed for symptomatic severe aortic stenosis. This next-gen valve features larger coronary access windows to enhance catheter maneuverability without compromising valve performance.

The region also benefits from the widespread adoption of telehealth and remote monitoring platforms, which enable clinicians to optimize patient care before, during, and after interventions. Strong healthcare infrastructure, coupled with favorable reimbursement frameworks for minimally invasive procedures, further accelerates device utilization. Together, these dynamics position North America as a dominant hub for interventional cardiology, setting benchmarks for both innovation and adoption.

Europe Interventional Cardiology Devices Market Trends

Europe is driving the growth of the cardiac monitoring devices market, due to the region’s rising burden of cardiovascular diseases, an aging population, and strong emphasis on preventive healthcare. As per our analyst estimates (2024), an estimated 85 million people across Europe were living with cardiovascular disorders, underscoring the urgent demand for advanced interventional solutions.

Additionally, the presence of advanced healthcare infrastructure, coupled with supportive government initiatives for early diagnosis and treatment of heart conditions, product approvals and product launch is accelerating adoption of interventional cardiology devices. For instance, in October 2024, Medtronic received CE Mark for its Evolut™ FX+ TAVI System, which offers enhanced coronary access and improved procedural efficiency.

Thus, the factors mentioned above are expected to boost the overall market of interventional cardiology devices across the region.

Asia-Pacific Interventional Cardiology Devices Market Trends

The Asia-Pacific region is emerging as a major growth driver of the interventional cardiology devices, due to the rapidly increasing prevalence of cardiovascular diseases, rising obesity and diabetes rates, and a large aging population. Growing healthcare investments, improving hospital infrastructure, and expanding access to advanced minimally invasive treatments are fueling adoption. Additionally, government initiatives, the presence of cost-effective device manufacturers are further accelerating market growth across the region. For instance, in July 2024, Firesorb®, described as the world’s first next-generation fully bioresorbable cardiac stent, received market approval from China's National Medical Products Administration (NMPA). Clinical studies highlighted its strong safety profile, a low four-year thrombosis rate of just 0.32%, and promising outcomes in late lumen loss and target lesion failure.

Thus, the factors mentioned above are expected to boost the market of Asia-Pacific interventional cardiology devcies during the forecast period.

Who are the major players in the Interventional Cardiology Devices Market?

The following are the leading companies in the interventional cardiology devices market. These companies collectively hold the largest market share and dictate industry trends.

- Edwards Lifesciences Corporation

- Abbott Laboratories

- Boston Scientific Corporation

- ACIST Medical Systems.

- F. Hoffmann-La Roche Ltd.

- Siemens Healthineers AG.

- Medtronic

- Teleflex Incorporated

- B. Braun SE.

- MicroPort Scientific Corporation

- SIS MEDICAL AG.

- Lepu Medical Technology (Beijing) Co., Ltd.

- Terumo Corporation.

- Sahajanand Laser Technology Limited

- Biotronik SE & Co. KG

- Cordis

- Abiomed, Inc.

- Merit Medical Systems

- Koninklijke Philips N.V.

- Cook

How is the competitive landscape shaping the interventional cardiology devices market?

The competitive landscape of the interventional cardiology devices market is shaped by a mix of global leaders and emerging players, with a moderately concentrated structure dominated by companies such as Abbott, Boston Scientific, Medtronic, Edwards Lifesciences, and Terumo. These players maintain strong market positions through continuous product innovation, strategic acquisitions, and extensive distribution networks. The market is witnessing intense competition in segments like stents, catheters, and structural heart devices, with growing emphasis on bioresorbable technologies, AI integration, and minimally invasive solutions. While established players focus on expanding their product portfolios and global footprint, regional manufacturers are leveraging cost advantages to penetrate developing markets, collectively driving innovation and shaping competitive intensity.

Recent Developmental Activities in the Interventional Cardiology Devices Market

- In May 2025, iVascular and Medico’s Hirata announced that Luminor Drug Coated Balloon (DCB) has received approval from Japan’s Ministry of Health, Labour and Welfare (MHLW).

- In April 2025, Elixir Medical LithiX™ HC-IVL System, was launched in Europe (date unspecified, but recent). This intravascular lithotripsy device targets calcified coronary lesions, expanding plaque-modification toolsets beyond traditional balloons and stents.

- In February 2025, Medtronic has begun enrolling patients in a new global clinical trial evaluating its Prevail paclitaxel-coated balloon catheter for use in percutaneous coronary intervention (PCI). The study is designed to assess the device’s effectiveness in treating in-stent restenosis (ISR) and de novo small vessel disease in patients with coronary artery disease (CAD).

- In March 2024, Boston Scientific AGENT™ Drug-Coated Balloon received FDA approval for treating coronary in-stent restenosis the first of its kind in the U.S.

|

Report Metrics |

Details |

|

Study Period |

2022 to 2032 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2032 |

|

Interventional Cardiology Devices Market CAGR |

7.09% |

|

Key Companies in the Interventional Cardiology Devices Market |

Edwards Lifesciences Corporation, Abbott Laboratories, Boston Scientific Corporation, ACIST Medical Systems., F. Hoffmann-La Roche Ltd., Siemens Healthineers AG., Medtronic, Teleflex Incorporated, B. Braun SE., MicroPort Scientific Corporation, SIS MEDICAL AG., Lepu Medical Technology (Beijing) Co., Ltd., Terumo Corporation., Sahajanand Laser Technology Limited, Biotronik SE & Co. KG, Cordis, Abiomed, Inc., Merit Medical Systems, Koninklijke Philips N.V., Cook, and others |

|

Interventional Cardiology Devices Market Segments |

by Product, by End-User, and by Geography |

|

Interventional Cardiology Devices Regional Scope |

North America, Europe, Asia Pacific, Middle East, Africa, and South America |

Interventional Cardiology Devices Market Segmentation

- Interventional Cardiology Devices by Product Exposure

- Angioplasty Balloons

- Drug-Eluting Balloons

- Others

- Angioplasty Stents

- Drug-Eluting Stents

- Bare-Metal Stents

- Bioabsorbable Stents

- Structural Heart Devices

- Aortic Valve Therapy Devices

- Others

- Catheters

- Angiography Catheters

- Guiding Catheters

- IVUS/OCT Catheters

- Plaque Modification Devices

- Atherectomy Devices

- Thrombectomy Devices

- Hemodynamic Flow Alteration Devices

- Embolic Protection Devices

- Chronic Total Occlusion Devices

- Others

- Angioplasty Balloons

- Interventional Cardiology Devices End-User Exposure

- Hospitals

- Ambulatory Surgical Centers

- Others

- Interventional Cardiology Devices Geography Exposure

- North America Interventional Cardiology Devices Market

- United States Interventional Cardiology Devices Market

- Canada Interventional Cardiology Devices Market

- Mexico Interventional Cardiology Devices Market

- Europe Interventional Cardiology Devices Market

- United Kingdom Interventional Cardiology Devices Market

- Germany Interventional Cardiology Devices Market

- France Interventional Cardiology Devices Market

- Italy Interventional Cardiology Devices Market

- Spain Interventional Cardiology Devices Market

- Rest of Europe Interventional Cardiology Devices Market

- Asia-Pacific Interventional Cardiology Devices Market

- China Interventional Cardiology Devices Market

- Japan Interventional Cardiology Devices Market

- India Interventional Cardiology Devices Market

- Australia Interventional Cardiology Devices Market

- South Korea Interventional Cardiology Devices Market

- Rest of Asia-Pacific Interventional Cardiology Devices Market

- Rest of the World Interventional Cardiology Devices Market

- South America Interventional Cardiology Devices Market

- Middle East Interventional Cardiology Devices Market

- Africa Interventional Cardiology Devices Market

- North America Interventional Cardiology Devices Market

Interventional Cardiology Devices Market Recent Industry Trends and Milestones (2022-2025)

|

Category |

Key Developments |

|

Interventional Cardiology Devices Product Launches |

Abbott launched the Xience Skypoint Drug-Eluting Stent in the U.S., Boston Scientific introduced the Synergy Megatron DES for complex PCI, Elixir launched Medical LithiX™ HC-IVL System |

|

Interventional Cardiology Devices Regulatory Approvals |

Boston Scientific - AGENT™ Drug-Coated Balloon (FDA), Abbott - Esprit BTK Everolimus-Eluting Resorbable Scaffold (CE), Medtronic - Evolut™ FX+ TAVR system |

|

Partnerships in the Interventional Cardiology Devices Market |

Abbott partnered with Siemens Healthineers for advanced cardiac imaging integration; Philips collaborated with Medtronic for hybrid cath lab solutions; Boston Scientific & Mayo Clinic entered into AI-driven cardiovascular care initiatives. |

|

Acquisitions in the Interventional Cardiology Devices Market |

Boston Scientific acquired Baylis Medical to strengthen structural heart and left-heart access solutions |

|

Company Strategy |

Terumo expanding in Asia-Pacific with affordability-focused balloon and catheter technologies; Abbott investing in bioabsorbable stents and digital integration |

|

Setbacks in the Interventional Cardiology Devices Market |

Philips faced recalls linked to software and imaging system malfunctions; Bioresorbable scaffold adoption slowed due to safety concerns in early-generation products |

|

Emerging Technology |

Bioresorbable vascular scaffolds (BVS), drug-coated balloons (DCB), robotic-assisted PCI systems, intravascular imaging (OCT/IVUS) with AI, and digital twin heart modeling for pre-procedural planning |

Impact Analysis

AI-Powered Innovations and Applications:

AI is significantly advancing the interventional cardiology devices market by making procedures smarter, safer, and more personalized to each patient. In angioplasty balloons and stents, AI leverages imaging modalities such as CT angiography, IVUS, and OCT to detect vulnerable plaques, recommend optimal stent size and placement, and even predict the effectiveness of drug delivery in drug-eluting technologies, thereby reducing risks like restenosis. For structural heart devices, particularly in complex procedures like TAVR, AI creates 3D reconstructions of the patient’s heart and vascular system, allowing cardiologists to simulate interventions and select the most suitable device size and position, improving both procedural safety and long-term performance. In the catheter segment, AI enhances image-guided interventions by providing real-time segmentation and anatomical labeling, shortening procedure time and lowering radiation exposure for patients. Furthermore, for plaque modification and hemodynamic flow alteration devices, AI enables detailed plaque characterization, differentiates calcified from non-calcified lesions, and predicts post-intervention blood flow, ensuring more targeted treatment strategies. Collectively, these applications are not only optimizing clinical outcomes but also accelerating the adoption of advanced interventional cardiology devices worldwide.

U.S. Tariff Impact Analysis on the Interventional Cardiology Devices Market:

In the U.S., tariffs primarily affect interventional cardiology devices through component and raw-material costs rather than finished-device duties, squeezing margins and nudging list prices upward. Section 301 tariffs on China-sourced electronics, polymers, and subassemblies and steel/aluminum duties raise bill-of-materials costs, while volatile freight adds further pressure. Because hospitals and GPO contracts cap price increases, manufacturers often absorb part of the impact, which can slow new launches, lengthen upgrade cycles, and shift volumes toward value lines. To offset tariffs, suppliers are accelerating supply-chain diversification (nearshoring to Mexico/Ireland; dual-sourcing), U.S. final assembly to qualify for “Made in USA” preferences, and design-for-cost to reduce reliance on tariffed inputs. Temporary exclusions and reclassifications can blunt impacts, but uncertainty itself elevates inventory buffers and working capital needs. Net effect: modest ASP pressure, margin compression, and portfolio reprioritization, with scale players (Abbott, Boston Scientific, Medtronic, etc.) better positioned to negotiate and reconfigure sourcing than smaller entrants.

How This Analysis Helps Clients

- Cost Management: By understanding the tariff landscape, clients can anticipate cost increases and adjust pricing strategies accordingly, ensuring profitability.

- Supply Chain Optimization: Clients can identify alternative sourcing options and diversify their supply chains to reduce dependency on high-tariff regions, enhancing resilience.

- Regulatory Navigation: Expert guidance on navigating the evolving regulatory environment helps clients maintain compliance and avoid potential legal challenges.

- Strategic Planning: Insights into tariff impacts enable clients to make informed decisions about manufacturing locations, partnerships, and market entry strategies.

Key takeaways from the interventional cardiology devices market report study

- Market size analysis for the current interventional cardiology devices market size (2024), and market forecast for 8 years (2025 to 2032)

- Top key product/technology developments, mergers, acquisitions, partnerships, and joint ventures happened over the last 3 years.

- Key companies dominating the interventional cardiology devices market.

- Various opportunities available for the other competitors in the interventional cardiology devices market space.

- What are the top-performing segments in 2024? How these segments will perform in 2032?

- Which are the top-performing regions and countries in the current interventional cardiology devices market scenario?

- Which are the regions and countries where companies should have concentrated on opportunities for the interventional cardiology devices market growth in the future?