KRAS Inhibitors Market Summary

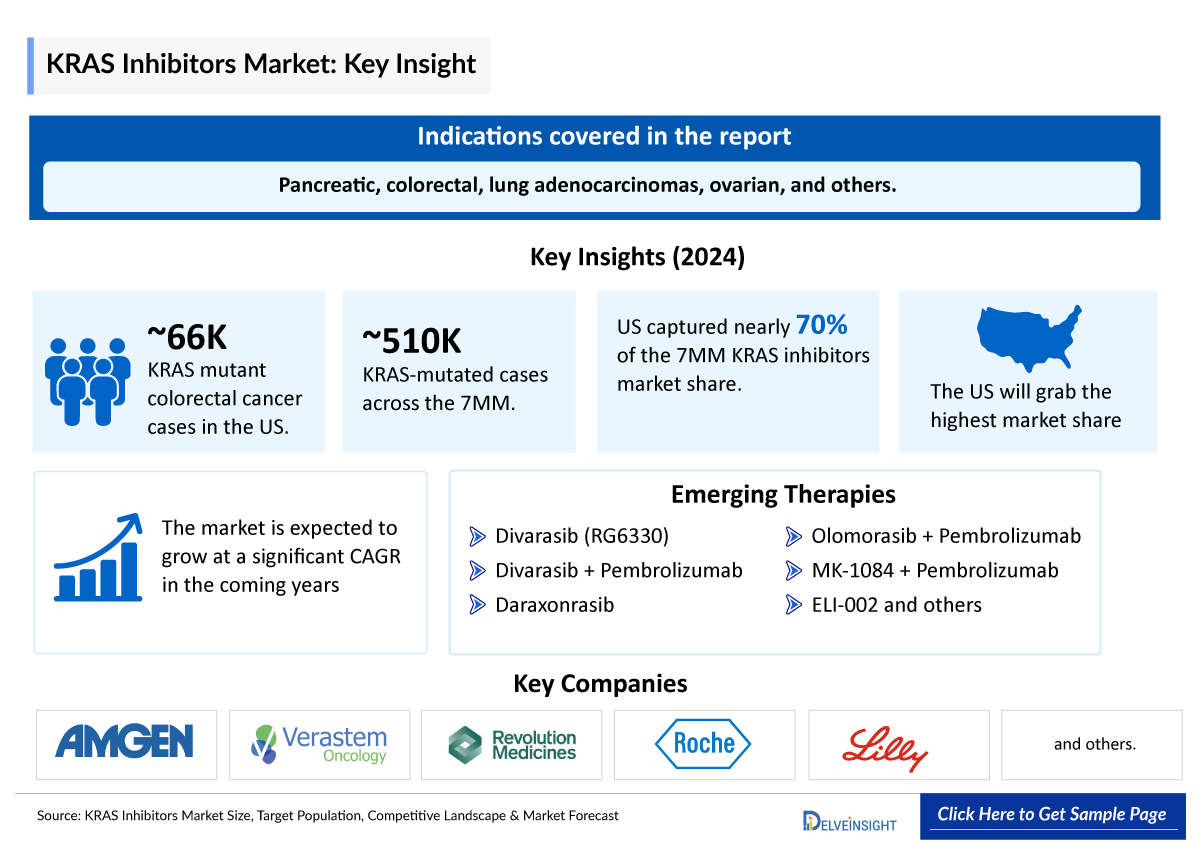

- The KRAS Inhibitors market in the 7MM was valued at approximately USD 526 million in 2025 and is projected to reach USD 7,847 million by 2034 over the forecast period from 2024 to 2034.

- The KRAS Inhibitors market is projected to grow at a CAGR of 35% by 2034 in leading countries (US, EU4, UK and Japan).

- Among the 7MM, the United States captured the highest KRAS inhibitors market size in 2024, accounting for nearly 70% of the total KRAS inhibitors market share.

- Among the EU4 and the UK, Germany has the highest KRAS inhibitors market size in 2024, while Spain had the lowest market size.

KRAS Inhibitors Market and Epidemiology Analysis

- KRAS is the most frequently mutated of the three RAS genes, followed by NRAS and HRAS. KRAS mutations are commonly associated with several types of cancer, including pancreatic, colorectal, lung adenocarcinomas, ovarian, and others.

- Among the approved therapies in the United States, KRAZATI is expected to have the edge over LUMAKRAS in revenue generated during the study period (2020–2034).The United States had the highest number of KRAS mutation cases in NSCLC among the 7MM. Approximately 46% of all KRAS mutation cases in NSCLC in the 7MM were reported in the United States.

- The G12D variant is especially found in pancreatic and ovarian cancers, which are often hard to treat, while the G12C mutation is more common in NSCLC.

- Many KRAS subtypes have no treatment options; in these casepan-KRAS-targetinging medicines can be helpful. A wider patient base will be available for such therapies. One drug that has demonstrated a pan-KRAS inhibitory impact in CRC is onvansertib. A few other companies, including ELICIO and Revolution Medicines, are researching pan-KRAS therapies.

- Many KRAS inhibitors companies are focusing on developing their candidates in pan-KRAS, like Cardiff Oncology (onvansertib), Immuneering Corporation (IMM-1-104), Jacobio Pharma (JAB-23E73), Eli Lilly and Company (LY4066434), and others are expected to have tremendous market potential due to the broad target patient population they can address.

- The current landscape of KRAS-targeted drug development is heavily focused on the G12C mutation, with the majority of approved therapies and investigational agents specifically designed for this variant.

- Revolution’s unique selling proposition lies in its focus on targeting the active, or “on,” states of KRAS proteins. According to the company, it is the persistent “on” signaling of RAS that drives uncontrolled cellular proliferation. As such, Revolution believes its approach may offer a therapeutic advantage over KRAS “off” inhibitors such as LUMAKRAS and KRAZATI.

- Several KRAS inhibitors companies have recently entered the race to develop therapies targeting the KRAS G12D mutation. A few KRAS inhibitors companies are Tyligand Pharmaceuticals (Suzhou), Verastem Oncology and GenFleet Therapeutics, AstraZeneca, PAQ Therapeutics, Astellas Pharma, and others with additional companies rapidly emerging as interest in this high-potential target continues to grow.

- Leading KRAS inhibitors companies developing therapies targeting KRAS include Roche/Chugai/Genentech (Divarasib), Revolution Medicines (Daraxonrasib), Eli Lilly and Company (Olomorasib), Merck, Taiho, and Astex Pharmaceuticals (MK-1084), Cardiff Oncology (Onvansertib), Genfleet Therapeutics and Innovent (DUPERT), Elicio Therapeutics (ELI-002), D3 Bio (D3S-001), and others with their candidates in different stages of clinical development.

KRAS Inhibitors Market size and Forecast

- 2025 KRAS Inhibitors Market Size: USD 526 million

- 2034 Projected KRAS Inhibitors Market Size: USD 7,847 million

- KRAS Inhibitors Growth Rate (2025-2034): 35% CAGR

- Largest KRAS Inhibitors Market: United States

DelveInsight’s “KRAS Inhibitors Market Size, Target Population, Competitive Landscape & Market Forecast - 2034” report delivers an in-depth understanding of the KRAS inhibitors, historical and forecasted epidemiology as well as the KRAS inhibitors market trends in the United States, EU4 (Germany, France, Italy, and Spain) and the United Kingdom, and Japan.

KRAS inhibitors market report provides current treatment practices, emerging drugs, market share of individual therapies, and current and forecasted the 7MM KRAS inhibitors market size from 2020 to 2034. The KRAS inhibitors market report also covers current KRAS inhibitor treatment practices/algorithms and unmet medical needs to curate the best opportunities and assess the KRAS inhibitors market’s potential.

|

Study Period |

2020–2034 |

|

Forecast Period |

2025–2034 |

|

Geographies Covered |

US, EU4 (Germany, France, Italy, and Spain) and the UK, and Japan |

|

KRAS Inhibitors Epidemiology |

Segmented by

|

|

KRAS Inhibitors Key Companies |

|

|

KRAS Inhibitors Key Therapies |

|

|

KRAS Inhibitors Market Segmentation |

Segmented by

|

|

KRAS Inhibitors Market Analysis |

|

Key Factors Driving the KRAS Inhibitors Market

- Large, Addressable Patient Population Across Solid Tumours

KRAS is the most frequently mutated of the three RAS genes, followed by NRAS and HRAS. KRAS mutations are commonly associated with several types of cancer, including pancreatic, colorectal, lung adenocarcinomas, ovarian, and others. The United States had the highest number of KRAS mutation cases in NSCLC among the 7MM. ~46% of all KRAS mutation cases in NSCLC in the 7MM were reported in the United States.

- Promise of Combination Approaches in KRAS Therapies

Combining KRAS-targeted therapies with other treatment modalities, such as immunotherapies or traditional chemotherapy, holds promise for improving treatment outcomes. The potential for combination therapies creates additional market opportunities and enhances the overall market strength of KRAS mutations.

- Expanding Opportunities in the Pan-KRAS Space

Many KRAS inhibitor companies are focusing on developing their candidates in pan-KRAS, like Cardiff Oncology (onvansertib), Immuneering Corporation (IMM-1-104), Jacobio Pharma (JAB-23E73), Eli Lilly and Company (LY4066434), and others are expected to have tremendous market potential due to the broad target patient population they can address.

- Advancing Treatment Across Mutation Subtypes and Tumor Types

Several KRAS inhibitor companies, including Roche, Revolution Medicines, Eli Lilly, and others, are advancing promising candidates such as divarasib, daraxonrasib, and olomorasib, aiming to expand the therapeutic scope of KRAS-targeted treatment across mutation subtypes and tumor types.

KRAS Inhibitors Treatment Market

KRAS Inhibitors Overview

KRAS belongs to a group of small GTP-binding proteins known as the RAS superfamily or RAS-like GTPases. Rat sarcoma virus (RAS), an oncogene, functions as a signal transducer, important for regulating cell proliferation, differentiation, and survival in normal and malignant cells. The RAS-mitogen-activated protein kinase-ERK kinase-extracellular signal-related kinase (RAS-RAF-MEK-ERK) pathway is one of the best-characterized signal transduction pathways, and its aberrancies are commonly implicated in the development of multiple different cancer types. KRAS mutations are genetic alterations in the KRAS gene, which encodes a protein in cell signaling pathways. These mutations are commonly found in various types of cancer, including CRC, lung, and pancreatic cancer. Unfortunately, KRAS mutations have historically been challenging to target with specific treatments. However, recent advancements in research have led to the development of some promising strategies to treat KRAS-mutated cancers, but these treatments are limited to NSCLC only.

Generally, treatment for KRAS-mutated cancers includes surgery, radiation therapy, chemotherapy, targeted therapies, immunotherapy, and others. Radiofrequency Ablation (RFA) might be considered for some people with small lung tumors near the outer edge of the lungs, especially if they cannot tolerate surgery.

KRAS Inhibitors Diagnosis

KRAS mutation can be diagnosed by conducting genetic sequencing of the tumor tissue or with the help of a liquid biopsy.

The clinician typically initiates KRAS testing requests for a patient. Usually, the testing is performed on tumor tissue removed from the patient during a previous surgery or biopsy procedure. Typically, patients undergoing KRAS testing with high-stage tumors require adjuvant therapy. If metastatic disease is present, it is important to clarify that the sample needed for testing is not the primary tumor but a representative tissue sample from the metastatic lesion. DNA is usually extracted from FFPE tissue blocks. It is the pathologist’s responsibility to identify the best tumor section to be subjected to testing. This includes evaluation of the slide with cut tissue or the tissue block, followed by microdissection and macro dissection for tumor enrichment to eliminate portions of necrotic tumor and nonneoplastic tissue. Typically, tumor-enriched areas will have relatively easily identified histology and can be dissected away from benign tissue. This process is often aided by having the fixed tissue cut placed on an unstained slide and having a standard H&E-stained (hematoxylin and eosin) slide of the same tissue cut available for comparison.

KRAS Inhibitors Epidemiology

As the KRAS inhibitors market is derived using a patient-based model, the KRAS inhibitors epidemiology chapter in the report provides historical as well as forecasted epidemiology segmented by total incident cases of NSCLC, CRC, pancreatic cancer, and LGSOC, total KRAS incident cases in NSCLC, CRC, pancreatic cancer, and LGSOC, total KRAS variant cases in NSCLC, CRC, pancreatic cancer, and LGSOC in the 7MM covering the United States, EU4 (Germany, France, Italy, and Spain) and the United Kingdom, and Japan from 2020 to 2034.

Key Findings from KRAS Inhibitors Epidemiological Analyses and Forecast

- The total KRAS-mutated cases in the 7MM comprised more than ~509,700 cases in 2024 and are projected to increase during the forecast period.

- Among the selected cancer types, the most KRAS mutant cases are found in CRC, followed by pancreatic cancer, NSCLC, and LGSOC. In the United States, there were about ~66,000 cases of KRAS mutant colorectal cancer in 2024.

- The most frequent KRAS variant observed in NSCLC is G12C. In addition, the most common KRAS variation in CRC, pancreatic cancer, and LGSOC is G12D. In the United States, KRASG12C is present in ~37% of NSCLC cases. The highest rates of KRASG12D, i.e., ~42%, ~30%, and ~42%, were found in pancreatic cancer, CRC, and LGSOC, respectively.

- In Japan, the contribution of KRAS mutations is lower compared to Western countries like the United States and Europe.

KRAS Inhibitors Market Recent Developments and Breakthroughs

- In May 2025, Verastem Oncology announced that the US FDA approved AVMAPKI + FAKZYNJA CO-PACK (avutometinib capsules; defactinib tablets) for the treatment of adult patients with KRAS-mutated recurrent LGSOC who received prior systemic therapy. AVMAPKI and FAKZYNJA CO-PACK is the first and only FDA-approved medicine for this disease. This indication is approved under accelerated approval based on the tumor response rate and DoR.

- In April 2025, BMS announced anticipation of Phase III trial data readouts for KRYSTAL-10 by 2026 for 2L CRC, KRYSTAL-7 trial results in 2028 for 1L NSCLC PD-L1=50%, and KRYSTAL-4 trial results in 2029 for 1L.

- In March 2025, Verastem Oncology announced plans to launch avutometinib in the first-half of 2025 to maximize market opportunity in KRAS mutant recurrent LGSOC. The company plans to submit for National Comprehensive Cancer Network (NCCN) Guideline inclusion upon FDA approval, which may enable patients with KRAS wild-type LGSOC to access therapy.

- According to BMS’s Q1 2025 presentations, KRAZATI (KRYSTAL-17) early-stage data for 1L NSCLC (TPS <50%) are expected in 2025.

- In January 2025, Elicio Therapeutics announced that, based on the feedback from the FDA in the End of Phase I Type B meeting, the company anticipates submitting a BLA contingent upon the results of a planned Phase III trial.

KRAS Inhibitors Drug Chapters

The drug chapter segment of the KRAS inhibitors drugs market reports encloses a detailed analysis of KRAS inhibitors marketed drugs such as LUMAKRAS/LUMYKRAS, KRAZATI, AVMAPKI + FAKZYNJA Co-Pack, and late-stage (Phase III and Phase II) pipeline drugs including divarasib, daraxonrasib, olomorasib, MK-1084, and others. It also helps understand the KRAS inhibitors clinical trial details, expressive pharmacological action, agreements and collaborations, approval and patent details, advantages and disadvantages of each included the drug, and the latest news and press releases.

Marketed KRAS inhibitors Drugs

LUMAKRAS/LUMYKRAS (sotorasib): Amgen

LUMAKRAS is an inhibitor of the RAS GTPase family indicated for treating adult patients with KRAS G12C-mutated locally advanced or metastatic NSCLC who have received at least one prior systemic therapy. It has also recieved BTD by the US FDA. The drug received accelerated approval from the FDA in May 2021 for treating patients with KRAS G12C-mutated locally advanced or metastatic NSCLC, as determined by an FDA-approved test, following at least one prior systemic therapy. Conditional marketing authorization was subsequently granted in the European Union. In January 2022, it was approved in Japan for KRAS G12C-mutated advanced or recurrent NSCLC after prior systemic therapy.

- In December 2024, Amgen stated in its Q4 presentation that LUMAKRAS has multiple patents in the US and Europe, ensuring market exclusivity until 2040.

- In December 2023, Amgen announced that the FDA issued a complete response letter for its supplemental new drug application for full approval of LUMAKRAS, based on the CodeBreaK 200 trial. The FDA also set a new postmarketing requirement for a confirmatory study to be completed by February 2028.

KRAZATI (adagrasib): Bristol Myers Squibb (Mirati Therapeutics)

KRAZATI is an oral targeted treatment option for adult patients with KRAS G12C-mutated locally advanced or metastatic NSCLC, as determined by an FDA-approved test, who have received at least one prior systemic therapy. KRAZATI received approval from the FDA and launched commercially in the US in December 2022. In January 2024, the EC granted conditional marketing authorization for KRAZATI for treating KRASG12C-mutated advanced NSCLC and disease progression after at least one prior systemic therapy.

- In April 2025, Bristol Myers Squibb announced anticipation of Phase III trial data readouts for KRYSTAL-10 by 2026 for 2L CRC, KRYSTAL-7 trial results in 2028 for 1L NSCLC PD-L1=50%, and KRYSTAL-4 trial results in 2029 for 1L NSCLC.

- According to the company’s SEC filing, the confirmatory results from the KRYSTAL-12 trial in patients with 2L+ mutated NSCLC are expected in 2025 or 2026.

- According to Q1 2025 company’s presentations, KRAZATI (KRYSTAL-17) early-stage data for 1L NSCLC (TPS <50%) are expected in 2025.

Comparison of KRAS inhibitors Marketed Drugs | ||||||

|

Product |

Company |

MoA |

RoA |

Patient Segment |

Molecule Type |

Approval Year |

|

LUMAKRAS/LUMYKRAS (sotorasib) |

Amgen |

KRAS G12C inhibitor |

Oral |

Adult patients with KRAS G12C-mutated locally advanced or metastatic NSCLC. |

Small molecule |

US: May 2021 EU: January 2022 JP: January 2022 |

|

Adult patients with KRAS G12C-mutated CRC. |

US: January 2025 | |||||

|

KRAZATI (adagrasib) |

Bristol Myers Squibb (Mirati Therapeutics) |

KRAS G12C inhibitor |

Oral |

Adult patients with KRAS G12C-mutated locally advanced or metastatic NSCLC. |

Small molecule |

US: December 2022 EU: January 2024 (conditional marketing authorization) |

|

Adult patients with KRAS G12C-mutated colorectal cancer. |

US: June 2024 | |||||

|

AVMAPKI + FAKZYNJA Co-Pack (avutometinib + defactinib) |

Verastem Oncology |

Mitogen-activated protein kinase inhibitors; Raf kinase inhibitor |

Oral |

Adult patients with KRAS-mutated recurrent LGSOC who received prior systemic therapy. |

Small molecule |

US: May 2025 |

Note: Detailed current therapies assessment will be provided in the full report of KRAS inhibitors....

Emerging KRAS inhibitors Drugs

Olomorasib (LY3537982): Eli Lilly and Company

Olomorasib is an investigational, oral, potent, and highly selective second-generation inhibitor of the KRAS G12C protein. Olomorasib was specifically designed to target KRAS G12C mutations and has pharmacokinetic properties that allow for high predicted target occupancy and high potency when used as monotherapy or in combination. Olomorasib is currently in Phase III of development, with three ongoing clinical trials focused on KRAS G12C-mutant advanced NSCLC and other solid tumors.

- In June 2024, Eli Lilly presented updated results from its Phase I/II clinical trial of olomorasib at the 2024 American Society of Clinical Oncology (ASCO) Annual Meeting.

MK-1084: Merck, Taiho, and Astex Pharmaceuticals

MK-1084 is an investigational oral, selective KRAS G12C inhibitor. MK-1084 is being developed in combination with KEYTRUDA. MK-1084 is being developed through a collaboration with Taiho Pharmaceutical and Astex Pharmaceuticals (UK), a wholly owned subsidiary of Otsuka Pharmaceutical. In May 2025, Merck anticipated the data readout at ASCO 2025.

- In February 2025, the company stated in its SEC filing that the anticipated expiration year for MK-1084 in the US is 2040.

- In January 2025, Merck anticipated the data readout for MK-1084 by 2028 and beyond, which is being developed in combination with KEYTRUDA during Phase III of its clinical development.

Comparison of KRAS inhibitors Emerging Drugs Under Development | ||||||

|

Drug Name |

Company |

Highest Phase |

Indication |

RoA |

MoA |

Molecule Type |

|

Divarasib (RG6330) |

Roche/Chugai/ Genentech |

III |

Patients with previously treated KRAS G12C-positive advanced or metastatic NSCLC |

Oral |

KRAS G12C inhibitor |

Small molecule |

|

Divarasib + Pembrolizumab |

Patients with previously untreated, KRAS G12C-mutated, advanced or metastatic nonsquamous NSCLC | |||||

|

Daraxonrasib (RMC-6236) |

Revolution Medicines |

III |

Patients with previously treated locally advanced or metastatic RAS mutation NSCLC |

Oral |

RAS(ON) multi-selective non-covalent inhibitor |

Small molecule |

|

Standard of care therapy in patients with previously treated metastatic PDAC | ||||||

|

Olomorasib + Pembrolizumab ± Chemotherapy |

Eli Lilly and Company |

III |

1L treatment in KRAS G12C-mutant advanced NSCLC With PD-L1 Expression ≥50% or, platinum regardless of PD-L1 expression |

Oral |

KRAS G12C inhibitor |

Small molecule |

|

Olomorasib + Pembrolizumab |

Participants with resected or unresectable KRAS G12C-mutant NSCLC | |||||

|

MK-1084 + Pembrolizumab |

Merck, Taiho, and Astex Pharmaceuticals |

III |

First-line treatment of participants with KRAS G12C-mutant, metastatic NSCLC with PD-L1 TPS ≥50% |

Oral |

KRAS G12C inhibitor |

Small molecule |

|

Onvansertib + Bevacizumab + FOLFIRI/ FOLFOX |

Cardiff Oncology |

II |

First-line treatment of mCRC in patients with a KRAS or NRAS mutation. |

Oral |

Small molecule | |

|

ELI-002 |

Elicio Therapeutics |

II |

Adjuvant treatment in high relapse-risk mKRAS+ cancers: PDAC and CRC |

SC |

Immunostimulant |

AMP cancer vaccine |

|

HRS-4642 + Gemcitabine + Albumin-bound Paclitaxel |

Jiangsu Hengrui Pharmaceuticals |

II |

Neoadjuvant and adjuvant treatment of pancreatic cancer |

IV infusion |

KRAS G12D inhibitor |

Small molecule |

|

DUPERT (Fulzerasib/GFH925) + Cetuximab |

Genfleet Therapeutics and Innovent |

Ib/II |

Previously untreated advanced NSCLC harboring the KRAS G12C mutation |

Oral |

KRAS G12C inhibitor |

Small molecule |

|

JAB-23E73 |

Jacobio Pharma |

I/IIa |

Advanced Solid Tumors With KRAS Alteration |

Oral |

pan-KRAS inhibitor |

Small molecule |

|

TSN1611 |

Tyligand Pharmaceuticals (Suzhou) |

I/II |

Advanced solid tumors ( pancreatic cancer, CRC, NSCLC, or other solid tumors) harboring KRAS G12D mutation |

Oral |

KRAS G12D inhibitor |

Small molecule |

|

SIL204 |

Silexion Therapeutics and Catalent |

I |

Pancreatic cancer and CRC |

Intratumoral and systemic administration |

Pan-KRAS inhibitor |

Small Interfering RNA |

|

ASP3082 |

Astellas Pharma |

I |

Locally advanced or metastatic solid tumor (pancreatic) malignancies with KRAS G12D mutation |

IV infusion |

KRAS G12D inhibitor |

Small molecule |

|

INCB186748 |

Incyte |

I |

Participants with advanced or metastatic solid tumors with the KRAS G12D mutation |

Oral |

KRAS G12D Inhibitor |

Small molecule |

|

RMC-9805 ± RMC-6236 + cetuximab ± mFOLFOX6 |

Patients with RAS G12D-mutant unresectable or metastatic CRC or metastatic PDAC | |||||

|

RMC-9805 ± RMC-6236 + gemcitabine + nab-paclitaxel |

Patients with RAS G12D-mutant metastatic PDAC | |||||

|

PF-07985045 |

Pfizer |

I |

Participants with advanced solid tumors, including NSCLC, CRC, and PDAC |

Oral |

KRAS inhibitor |

Small molecule |

|

PF-07934040 |

Pfizer |

I |

Participants with advanced solid tumors harboring mutations in the KRAS gene. |

Oral |

KRAS inhibitor |

Small molecule |

|

BAY3498264 |

Bayer |

I |

Participants with advanced KRASG12C-mutated solid tumors. |

Oral |

SOS1 inhibitor |

Small molecule |

|

KQB365 ± cetuximab |

Kumquat Biosciences |

I |

Participants with advanced solid malignancies with KRAS G12S or G12C mutations. |

IV |

- |

Small molecule |

|

QTX3544 |

Quanta Therapeutics |

I |

Solid tumors with KRAS G12V mutations |

Oral |

G12V+ Multikinase inhibitor |

Small molecule |

KRAS Inhibitors Market Outlook

KRAS is a well-established oncogene frequently mutated in several cancers, including NSCLC, PDAC, CRC, and ovarian cancer. Historically considered undruggable, KRAS has become a renewed focus with the emergence of mutation-specific inhibitors—most notably those targeting the KRAS G12C mutation. These agents, such as LUMAKRAS/LUMYKRAS (sotorasib) and KRAZATI (adagrasib), selectively inhibit KRAS in its inactive GDP-bound state, offering clinical benefit in previously treated patients with KRAS G12C-mutated tumors.

Amgen’s LUMAKRAS was the first KRAS G12C inhibitor to receive FDA approval in 2021 for NSCLC, followed by approvals in multiple global markets. Subsequent approvals were extended to CRC in combination with VECTIBIX, based on data showing improved progression-free outcomes. Companion diagnostics, like Qiagen’s therascreen KRAS RGQ PCR Kit, are aiding patient selection.

Bristol Myers Squibb’s KRAZATI entered the market in 2022 and has since surpassed LUMAKRAS in clinical momentum, receiving accelerated approvals for use in both NSCLC and mCRC. LUMAKRAS witnessed a decrease in sales, coinciding with the launch of KRAZATI. Amgen stated that the decline in sales was primarily due to a price adjustment implemented as part of a reimbursement agreement in Germany. It has also been incorporated into NCCN Guidelines for CNS-metastatic NSCLC, solidifying its role in the evolving standard of care. Despite these advances, primary and acquired resistance to KRAS G12C inhibitors remains a key hurdle.

Beyond G12C, the need for effective therapies targeting other KRAS variants is driving next-generation drug development. Verastem’s AVMAPKI FAKZYNJA Co-Pack recently became the first FDA-approved therapy for KRAS-mutated recurrent LGSOC, addressing an underserved indication. Meanwhile, combination strategies—pairing KRAS inhibitors with chemotherapy, immune checkpoint inhibitors, or pan-KRAS agents—are under active investigation.

Numerous key players actively explore alternative KRAS variants and expand their research to include other types of cancers beyond NSCLC. This shift in focus holds promising potential for developing effective therapies that can address a wider range of KRAS mutations and target multiple cancer types. Many companies are focusing on developing their candidates in pan-KRAS, like Cardiff Oncology (onvansertib), Immuneering Corporation (IMM-1-104), Verastem (Avutometinib + Defactinib), and others.

Several KRAS inhibitors companies, including Roche, Revolution Medicines, Eli Lilly, and others, are advancing promising candidates such as divarasib, daraxonrasib, and olomorasib, aiming to expand the therapeutic scope of KRAS-targeted treatment across mutation subtypes and tumor types. Despite progress, KRAS-driven cancers remain challenging due to tumor heterogeneity and resistance mechanisms. Ongoing innovation in targeted therapies, biomarker-driven approaches, and combination regimens will be essentito realize the potential of KRAS inhibition in oncology fullyogy.

- The KRAS Inhibitors market in the 7MM was valued at approximately USD 526 million in 2025 and is projected to reach USD 7,847 million by 2034 at a CAGR of 35% over the forecast period from 2024 to 2034.

- Among the EU4 and the UK, Germany has the highest KRAS inhibitors market size in 2024, while Spain had the lowest market size.

- The KRAS inhibitors market size in Japan was approximately 6% of the total 7MM KRAS inhibitors market in 2024.

- Among the approved KRAS inhibitors drugs, AVMAPKI + FAKZYNJA is expected to capture more KRAS inhibitors market share than KRAZATI and LUMAKRAS throughout the study period (2020–2034).

- Among the emerging KRAS inhibitors therapies, Onvansertib is expected to generate the highest KRAS inhibitors revenue by 2034.

KRAS Inhibitors Drugs Uptake

This section focuses on the uptake rate of potential KRAS inhibitors drugs expected to be launched in the KRAS inhibitors market during 2020–2034. Further detailed analysis of emerging therapies and drug uptake is in the KRAS inhibitors market report.

KRAS Inhibitors Pipeline Development Activities

The KRAS inhibitors treatment market report covers information on collaborations, acquisitions and mergers, licensing, and patent details for KRAS inhibitors therapies.

Latest KOL Views on KRAS Inhibitors

To keep up with current KRAS inhibitors market trends, we take KOLs and SMEs’ opinions working in the domain through primary research to fill the data gaps and validate our secondary research. Industry experts were contacted for insights on KRAS inhibitors evolving treatment landscape, patient reliance on conventional therapies, patient therapy switching acceptability, drug uptake, along with challenges related to accessibility.

What KOLs are saying on KRAS Inhibitors Patient Trends?

Delveinsight’s analysts connected with 50+ KOLs to gather insights; however, interviews were conducted with 15+ KOLs in the 7MM. Centers such as VCS Research Institute, Florida Cancer Specialists & Research Institute in the US, Japanese Foundation for Cancer Research in Japan, etc., were contacted. Their opinion helps understand and validate current and emerging therapy treatment patterns or KRAS inhibitors market trends. This will support the clients in potential upcoming novel treatments by identifying the overall scenario of the market and the unmet needs.

|

KOL Views |

|

“The approval of KRAZATI (adagrasib) represents a significant addition to the armamentarium to treat patients with KRAS G12C mutation in NSCLC, and hopefully other indications soon. In the pivotal study, KRYSTAL-1, patients with advanced NSCLC had an overall response of 43%, mDoR of 8.5 months, and with an acceptable toxicity profile.” |

|

“KRAS has been considered undruggable, in part due to its structure, which lacks small-molecule binding sites. But recent developments in bioengineering, organic chemistry, and related fields have provided the infrastructure to make direct KRAS targeting possible. The first successes occurred with allele-specific targeting of KRAS p.G12C in NSCLC, resulting in regulatory approval of two agents-sotorasib and adagrasib.” |

KRAS Inhibitors Report Qualitative Analysis

We perform qualitative and market intelligence analysis using various approaches, such as SWOT analysis and conjoint analysis. In the SWOT analysis, strengths, weaknesses, opportunities, and threats in terms of gaps in disease diagnosis, patient awareness, physician acceptability, competitive landscape, cost-effectiveness, and geographical accessibility of therapies are provided.

Conjoint Analysis analyzes multiple approved and emerging KRAS inhibitors therapies based on relevant attributes such as safety, efficacy, frequency of administration, route of administration, and order of entry. Scoring is given based on these parameters to analyze the effectiveness of therapy.

In efficacy, the trial’s primary and secondary outcome measures are evaluated; for instance, in event-free survival, one of the most important primary outcome measures is event-free survival and overall survival.

Further, the therapies’ safety is evaluated wherein the acceptability, tolerability, and adverse events are majorly observed, and it sets a clear understanding of the side effects posed by the drug in the trials. In addition, the scoring is also based on the probability of success and the addressable patient pool for each therapy. According to these parameters, the final weightage score and the ranking of the emerging KRAS inhibitors therapies are decided.

KRAS inhibitors Market Access and Reimbursement

UK

|

NICE Decisions for KRAS Inhibitors | |||

|

Drug |

Decision |

Month and Year of Decision |

Indication |

|

LUMAKRAS |

Sotorasib is recommended for use within the Cancer Drugs Fund as an option for treating KRAS G12C mutation-positive locally advanced or metastatic NSCLC in adults whose disease has progressed on, or who cannot tolerate platinum-based chemotherapy or anti-PD-1/PD-L1 immunotherapy. |

March 2022 |

Previously treated KRAS G12C mutation-positive advanced NSCLC |

France

|

Haute Autorité de Santé (HAS) Decisions for KRAS Inhibitors | ||||||

|

Drug |

Indication |

Date of Decision |

ASMR |

SMR |

Reimbursement Rate |

Summary of Opinion |

|

KRAZATI |

Adult patients with advanced NSCLC with KRAS G12C mutation, whose disease has progressed after at least one prior systemic therapy. |

March 2025 |

V (Non-existent) |

Weak |

- |

The medical service provided by KRAZATI 200 mg (adagrasib), film-coated tablet, is low in the MA indication. |

Scope of the KRAS Inhibitor Market Report

- The KRAS inhibitors treatment market report covers a segment of key events, an executive summary, and a descriptive overview of KRAS inhibitors, explaining its causes, signs and symptoms, pathogenesis, and currently available therapies.

- Comprehensive insight into the epidemiology segments and forecasts, the future growth potential of diagnosis rate, disease progression, and treatment guidelines have been provided.

- Additionally, an all-inclusive account of the current and emerging therapies and the elaborative profiles of late-stage and prominent therapies will impact the current KRAS inhibitors treatment landscape.

- A detailed review of the KRAS inhibitors market, historical and forecasted market size, market share by therapies, detailed assumptions, and rationale behind our approach is included in the KRAS inhibitors treatment market report, covering the 7MM drug outreach.

- The KRAS inhibitors market report provides an edge while developing business strategies by understanding the trends through SWOT analysis and expert insights/KOL views, patient journey, and treatment preferences that help shape and drive the 7MM KRAS inhibitors market.

KRAS Inhibitors Market Report Insights

- KRAS-targeted patient pool

- KRAS inhibitors Therapeutic approaches

- KRAS inhibitors pipeline analysis

- KRAS inhibitors market size

- KRAS inhibitors Market trends

- Existing and future KRAS inhibitors market opportunity

KRAS Inhibitors Market Report Key Strengths

- Ten years forecast

- The 7MM coverage

- KRAS inhibitors epidemiology segmentation

- Key cross competition

- KRAS inhibitors Drugs uptake

- Key KRAS inhibitors market forecast assumptions

KRAS Inhibitors Market Report Assessment

- Current treatment practices

- KRAS inhibitors Unmet needs

- KRAS inhibitors Pipeline product profiles

- KRAS inhibitors Market attractiveness

- Qualitative analysis (SWOT and analyst views)

- KRAS Inhibitors Market Drivers

- KRAS Inhibitors Market Barriers

Key Questions Answered In The KRAS Inhibitors Market Report:

KRAS inhibitors Market Insights

- What was the KRAS mutated cancers market size, the market size by therapies, market share (%) distribution in 2023, and what would it look like in 2034? What are the contributing factors for this growth?

- How will KRAZATI affect the treatment paradigm in NSCLC?

- What will be the market share of NSCLC, CRC, and pancreatic cancer in 2034?

- Which drug is going to be the largest contributor in 2034?

- What are the pricing variations among different geographies for approved KRAS inhibitors therapies?

KRAS inhibitors Epidemiology Insights

- What are the disease risk, burdens, and unmet needs of KRAS inhibitors? What will be the growth opportunities across the 7MM with respect to the patient population pertaining to KRAS inhibitors?

- What is the historical and forecasted KRAS inhibitors patient pool in the United States, EU4 (Germany, France, Italy, and Spain) and the United Kingdom, and Japan?

- Which type of KRAS mutation is the largest contributor in patients affected with NSCLC, CRC, and pancreatic cancer?

- Among EU4 and the UK, which country will have the highest number of patients during the forecast period?

- What are the key findings pertaining to the KRAS mutant cancer epidemiology across the 7MM, and which country will have the highest number of patients during the forecast period?

Current KRAS Inhibitors Treatment Scenario, Marketed Drugs, and Emerging Therapies

- Which are the approved KRAS inhibitors? What are the current treatment guidelines for treating KRAS-mutated cancers in the US and Europe?

- How many KRAS inhibitors companies are developing therapies for the treatment of KRAS-mutated cancers?

- How many emerging KRAS inhibitors therapies are in the mid-stage and late stage of development for treating KRAS-mutated cancers?

- What are the recent novel therapies, targets, mechanisms of action, and technologies developed to overcome the limitations of existing therapies?

- What key designations have been granted for the emerging therapies for KRAS inhibitors?

- What is the cost burden of approved KRAS inhibitors therapies on the patient?

- Patient acceptability in terms of preferred treatment options as per real-world scenarios?

- What are the country-specific accessibility issues of expensive, recently approved therapies?

Reasons to Buy KRAS Inhibitors Market Forecast Report

- The KRAS inhibitors market report will help develop business strategies by understanding the latest trends and changing treatment dynamics driving the KRAS inhibitors market.

- Insights on patient burden/KRAS inhibitors prevalence, evolution in diagnosis, and factors contributing to the change in the epidemiology of KRAS-mutated cancers during the forecast years.

- Understand the existing KRAS inhibitors market opportunities in varying geographies and the growth potential over the coming years.

- Distribution of historical and current KRAS inhibitors patient share based on real-world prescription data along with reported sales of approved products in the US, EU4 (Germany, France, Italy, and Spain) and the United Kingdom, and Japan.

- Identifying strong upcoming KRAS inhibitors companies in the KRAS inhibitors market will help devise strategies to help get ahead of competitors.

- Detailed analysis and ranking of class-wise potential current and emerging therapies under the conjoint analysis section to provide visibility around leading classes.

- Highlights of Access and Reimbursement policies of approved therapies, barriers to accessibility of expensive off-label therapies, and patient assistance programs.

- To understand key opinion leaders’ perspectives around the accessibility, acceptability, and compliance-related challenges of existing treatment to overcome barriers in the future.

- Detailed insights on the unmet needs of the existing KRAS inhibitors market so that the upcoming KRAS inhibitors companies can strengthen their development and launch strategy.