Major Depressive Disorder Market

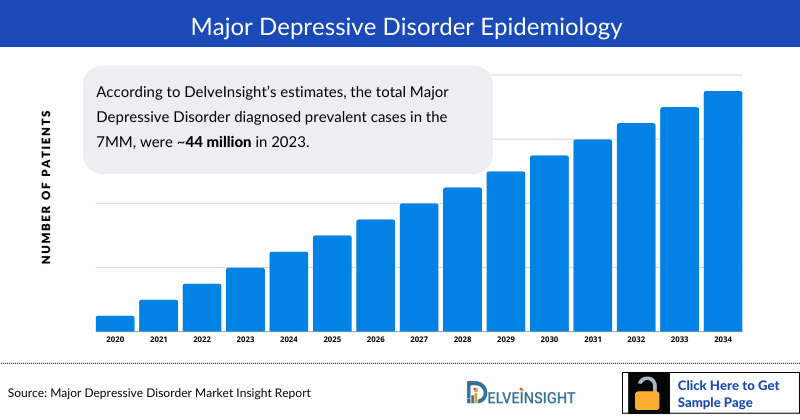

- According to DelveInsight’s estimates, the total Major Depressive Disorder diagnosed prevalent cases in the 7MM, were ~44 million in 2023.

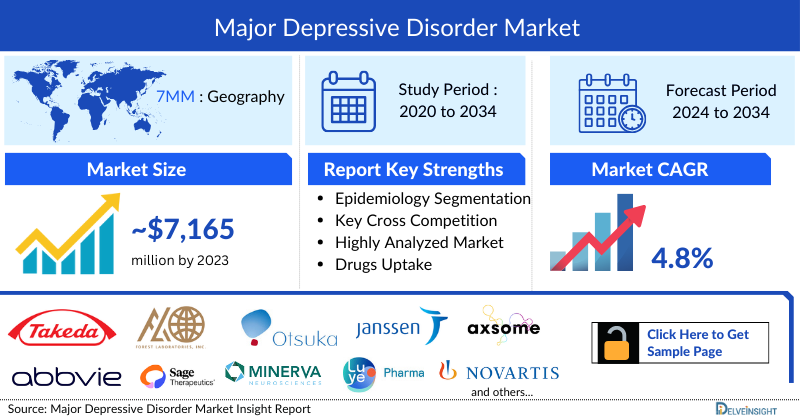

- In 2023, the Major Depressive Disorder Market Size was highest in the US among the 7MM, accounting for approximately USD 5,600 million which is further expected to increase by 2034 at a CAGR of 4.8%.

- The current Major Depressive Disorder Treatment includes VRAYLAR, AUVELITY, SPRAVATO, REXULTI, and others, an approved drug for the treatment of Major Depressive Disorder.

- The different pharmacological therapies used to treat Major Depressive Disorder belong mainly to classes of Selective serotonin reuptake inhibitors (SSRIs), Serotonin nonepinephrine reuptake inhibitors (SNRIs), Atypical Antipsychotics/Adjuvant therapies and other antidepressants, used for the management of the disease.

- The total SHTG treatment market size is anticipated to experience growth during the forecast period due to expected entry of emerging therapies, including Seltorexant, Navacaprant (NMRA-335140), JNJ-67953964 (Aticaprant) and others.

- The emerging drug Seltorexant is expected to launch in the US by 2025, in EU4 and the UK by 2026, and in Japan by 2027, which has the potential to reduce the disease burden of Major Depressive Disorder in the forecasted years.

- In May 2024, Johnson & Johnson (J&J) updated about topline results from the MDD3001 study, which showed that seltorexant met all primary and secondary endpoints in its Phase III trial for Major Depressive Disorder.

- The MDD treatment market is expanding due to rising prevalence, advances in research, and improved diagnostics. Increased investments, supportive regulations, and efforts to reduce stigma also drive demand for new and personalized therapies.

Request for unlocking the CAGR of the Major Depressive Disorder Treatment Market

DelveInsight’s “Major Depressive Disorder Market Insights, Epidemiology, and Market Forecast – 2034” report delivers an in-depth understanding of Major Depressive Disorder, historical and forecasted epidemiology as well as the Major Depressive Disorder market trends in the United States, EU4, and the UK (Germany, France, Italy, Spain) and the United Kingdom, and Japan.

The Major Depressive Disorder Treatment Market report provides current treatment practices, emerging drugs, market share of individual therapies, and current and forecasted 7MM Major Depressive Disorder market size from 2020 to 2034. The Report also covers current Major Depressive Disorder treatment market practices, market drivers, market barriers, SWOT analysis, reimbursement and market access, and unmet medical needs to curate the best of the opportunities and assess the underlying potential of the Major Depressive Disorder Drugs Market.

|

Study Period |

2020 to 2034 |

|

Forecast Period |

2024-2034 |

|

Geographies Covered |

|

|

Major Depressive Disorder Treatment Market |

|

|

Major Depressive Disorder Market Size | |

|

Major Depressive Disorder Companies |

|

Major Depressive Disorder Treatment Market

Major Depressive Disorder is one of the most prevalent psychiatric disorders and has been projected by the World Health Organization to be the leading cause of disease burden in high-income countries by 2032. MDD is characterized by persistent sadness, loss of interest or pleasure, low energy, worse appetite and sleep, and even suicide, disrupting daily activities and psychosocial functions.

MDD is a complex and frequent psychiatric condition that poses significant challenges to both the patients who experience it and the physicians who treat them. The goal of therapy is for patients to achieve remission, which requires identifying and measuring symptoms at the outset and throughout treatment to document both response and resistance to treatment. Profound disease understanding, development of novel therapeutic agents, and patient-centered treatment approaches will improve patient outcomes in the coming years.

Major Depressive Disorder Diagnosis

It is diagnosed when an individual has a persistently low or depressed mood, anhedonia or decreased interest in pleasurable activities, feelings of guilt or worthlessness, lack of energy, poor concentration, appetite changes, psychomotor retardation or agitation, sleep disturbances, or suicidal thoughts. As per the Diagnostic and Statistical Manual of Mental Disorders, 5th Edition (DSM-5), an individual must have five of the above-mentioned symptoms, one of which must be a depressed mood or anhedonia causing social or occupational impairment, to be diagnosed with MDD.

Further details related to diagnosis are provided in the report…

Major Depressive Disorder Treatment

The treatment strategies for depression consist of pharmacological and nonpharmacological options, including psychotherapy, electroconvulsive therapy, and transcranial magnetic stimulation. In recent years, psychotherapy has been shown to affect depression, including attenuating depressive symptoms and improving quality of life. Therefore, several practice guidelines increasingly recommend psychotherapy as a monotherapy or in combination with antidepressants.

The currently recommended range of pharmacological treatments includes a variety mainly antidepressants, monoamines, tricyclic antidepressants (TCAs), monoamine oxidase inhibitors (MAOIs), selective reuptake including VRAYLAR, Brintellix (Brintellix (vortioxetine) renamed Trintellix, SPRAVATO, REXULTI, and FETZIMA as currently approved for treating MDD. With many treatment options already present, the market anticipates the launch of emerging products with novel MoAs targeting remission, relapse control, and onset of action.

Further details related to treatment are provided in the report…

Major Depressive Disorder Epidemiology

As the market is derived using a patient-based model, the Major Depressive Disorder epidemiology chapter in the report provides historical as well as forecasted epidemiology segmented by Diagnosed Prevalent Cases of Major Depressive Disorder, Gender-specific Diagnosed Prevalent Cases of Major Depressive Disorder, and Severity-specific Diagnosed Prevalent Cases of Major Depressive Disorder in the 7MM covering, the United States, EU4 countries (Germany, France, Italy, and Spain), United Kingdom, and Japan from 2020 to 2034.

- The highest total Major Depressive Disorder diagnosed prevalent cases were accounted by the US in 2023 (~22 million), which is expected to show a rise in the future.

- Among the European countries, Germany had the highest Major Depressive Disorder diagnosed prevalent cases with ~6.8 million cases, followed by the UK, which had Major Depressive Disorder diagnosed prevalent population of ~4 million in 2023. On the other hand, Spain had the lowest diagnosed prevalent population (~1.9 million cases).

- Japan had ~3 million total Major Depressive Disorder diagnosed prevalent cases in 2023, accounting for approximately 7% in 7MM.

- In 2023, in the US, the gender-specific Major Depressive Disorder diagnosed prevalent cases were highest for females (~64%), as compared to males (~36%), which is attributed to factors such as hormonal differences and physiology, lifestyle and occupational factors and others.

- In EU4 and the UK, among cases of Major Depressive Disorder categorized by severity, moderate cases were the most prevalent at 37%, followed by mild cases at 32%, and severe cases at 31%, in 2023.

Unlock comprehensive insights! Click Here to Purchase the Full Epidemiology Report @ Major Depressive Disorder Prevalence

Major Depressive Disorder Recent Developments

- In September 2025, BrainsWay received US FDA clearance expansion for its Deep Transcranial Magnetic Stimulation (Deep TMS™) system, adding an accelerated protocol for treating major depressive disorder (MDD), including patients with comorbid anxiety symptoms.

- In March 2025, Sooma Medical announced it received FDA Investigational Device Exemption (IDE) for its transcranial direct current stimulation (tDCS) device. This approval allows the company to begin a pivotal study of the device. Based in Helsinki, Finland, Sooma designed the tDCS device to treat depression through portable neuromodulation.

- In January 2025, the FDA approved Johnson & Johnson’s supplemental New Drug Application for Spravato (esketamine) CIII nasal spray, making it the first and only monotherapy for adults with major depressive disorder (MDD) who have not responded adequately to at least two oral antidepressants.

- In January 2025, Neumora Therapeutics, Inc. announced results from the Phase 3 KOASTAL-1 Study of navacaprant for treating major depressive disorder (MDD). This study is the first of three Phase 3 trials in the pivotal KOASTAL program.

- In November 2024, Magstim, a global leader in neuroscience and mental health treatment, received FDA clearance for its Horizon Inspire System. This advanced transcranial magnetic stimulation (TMS) technology is designed to assist physicians, nurse practitioners, clinicians, and researchers in treating patients with major depressive disorder (MDD), obsessive-compulsive disorder (OCD), and anxious depression.

- In November 2024, the FDA approved an Investigational New Drug (IND) application from Damona Pharmaceuticals, enabling the company to begin a Phase I trial of DPX-101. The drug is designed to treat cognitive disabilities in major depressive disorder and other brain disorders.

Major Depressive Disorder Drug Chapters

The drug chapter segment of the Major Depressive Disorder drugs market report encloses a detailed analysis of Major Depressive Disorder off-label drugs and late-stage (Phase-III and Phase-II) Major Depressive Disorder pipeline drugs. It also helps to understand the Major Depressive Disorder clinical trials details, expressive pharmacological action, agreements and collaborations, approval and patent details, advantages and disadvantages of each included drug, and the latest news and press releases.

Major Depressive Disorder Marketed Drugs

- VRAYLAR (Cariprazine): AbbVie and Gedeon Richter Plc.

VRAYLAR is an oral, once-daily atypical antipsychotic approved for the acute treatment of adult patients with manic or mixed episodes associated with bipolar I disorder, with a recommended dose range of 3–6 mg/day, and for the treatment of schizophrenia in adults, with a recommended dose range of 1.5–6 mg/day.

While the mechanism of action of VRAYLAR in schizophrenia and bipolar I disorder is unknown, the efficacy of VRAYLAR could be mediated through a combination of partial agonist activity at central dopamine D and serotonin 5-HT1A receptors and antagonist activity at serotonin 5-HT2A receptors.

In December 2022, AbbVie announced that the US FDA has approved VRAYLAR (cariprazine) as an adjunctive therapy to antidepressants for treating Major Depressive Disorder in adults.

Further detail in the report…

Major Depressive Disorder Emerging Drugs

- Zuranolone (SAGE-217/BIIB125): Sage Therapeutics/Biogen Inc., /Shionogi

Zuranolone (SAGE-217/BIIB125) is a novel, highly potent, selective, next-generation, oral, positive allosteric modulator optimized for selectivity to synaptic and extra synaptic GABAA receptors. The binding sites for NASs are distinct from the recognition sites for GABA, benzodiazepines, and barbiturates. The GABA system is the major inhibitory signaling pathway of the brain and central nervous system (CNS) and significantly regulates CNS function.

SAGE-217 is currently being developed for MDD. It is being evaluated in the LANDSCAPE and NEST clinical trial programs. The two development programs include studies examining the use of zuranolone in several thousand people with various dosing, clinical endpoints, and treatment paradigms. The LANDSCAPE program includes five studies of zuranolone in people with MDD (MDD-201B, MOUNTAIN, SHORELINE, WATERFALL, and CORAL Studies). The NEST program includes two placebo-controlled studies of Zuranolone in people with PPD (ROBIN and SKYLARK studies).

The FDA issued a CRL on August 4, 2023, related to the NDA for the treatment of adults with MDD stating that the application did not provide substantial evidence of effectiveness to support the approval of zuranolone for the treatment of MDD and that an additional study or studies will be needed. No Phase III trials are currently ongoing.

Further detail in the report…

- Seltorexant (JNJ42847922): Janssen Pharmaceuticals/Minerva Neurosciences

Seltorexant is a selective orexin-2 receptor antagonist under co-development by Janssen Pharmaceutical NV and Minerva as adjunctive therapy for MDD and insomnia disorder treatment. The orexin system in the brain controls several key functions, including metabolism, stress response, and wakefulness. This system promotes arousal (wakefulness) and is hypothesized to play a role in excessive arousal, which occurs in subsets of patients with mood disorders and has clinical utility in treating such patients.

Seltorexant is the most advanced specific ORX2 molecule in clinical development, with antagonistic activity when binding to its receptor. Seltorexant is currently being developed for two indications: insomnia without associated psychiatric disorders and MDD in patients with inadequate responses to SSRIs and SNRIs. Previous clinical trials have indicated that Seltorexant might be useful in both indications.

In January 2021 Royalty Pharma acquired Minerva’s royalty interest in seltorexant for an upfront payment of USD 60 million and up to USD 95 million in additional milestone payments.

Seltorexant is currently in Phase III development for the treatment of Major Depressive Disorder with insomnia symptoms by Janssen (Johnson & Johnson Services, Inc.).

Further detail in the report…

|

Drug |

MoA |

RoA |

Company |

Logo |

Phase |

|

Zuranolone |

GABA A receptor positive allosteric modulators |

Oral |

Sage Therapeutics |

III | |

|

Seltorexant |

Orexin receptor type 2 antagonists |

Oral |

Johnson & Johnson Services, Inc. |

|

III |

|

XXX |

XXX |

XXX |

XXX |

II |

Note: Detailed emerging therapies assessment will be provided in the final report of Major Depressive Disorder.

Major Depressive Disorder Market Outlook

The Major Depressive Disorder Market is anticipated to evolve largely due to the quick approvals of new therapies by the regulatory agencies like the European Commission and the US FDA. The main reason propelling the substantial growth of MDD market are the rising demand for antidepressants due to the decrement of quality of life associated with the disease. The current market for MDD is undergoing a boom with the approval of several novel drug classes like SNRIs, SSRI, DNRI, atypical antipsychotics among the others.

Various FDA approved therapies by major as well as small pharmaceuticals are available in the Major Depressive Disorder Drugs Market: VRAYLAR (AbbVie and Gedeon Richter), AUVELITY (Axsome Therapeutics), Trintellix (Takeda), SPRAVATO (Johnson & Johnson), REXULTI (Otsuka), and Fetzima (Forest Laboratories). Among the 7MM, the major share of the market is with Europe with approved therapies: Trintellix (Takeda), SPRAVATO (Johnson & Johnson). In Japan currently the therapies that have been approved include TRINTELLIX (Takeda), REXULTI (Otsuka), and others.

The major Major Depressive Disorder Drugs Market class in the Major Depressive Disorder therapeutic market is Selective serotonin reuptake inhibitors (SSRIs).

With a good amount of clinical trials in the Major Depressive Disorder Drugs Market emerging pipeline, ALTO-100 is a drug under development by Alto Neuroscience for treating Major Depressive Disorder and currently in phase II of development for Major Depressive Disorder Drugs Market.

It is a first-in-class drug that targets brain plasticity, which is the ability of the brain to change and adapt. ALTO-100 is a selective AMPA receptor modulator. AMPARs are a type of glutamate receptor that plays a role in learning, playing, and synaptic plasticity. Alto-100 works by increasing the activity of AMPARs, which increases brain plasticity and improves mood.

In the upcoming Major Depressive Disorder Treatment Market Landscape, there are a plethora of companies investigating agents for use in Major Depressive Disorder which includes Sage Therapeutics, Relmada Therapeutics, Johnson & Johnson Services, Inc. and others. There are many more pharma companies which are conducting clinical trials for therapies for Major Depressive Disorder.

- The Major Depressive Disorder Treatment Market Size in the 7MM was approximately USD 7,165 million in 2023, the market is expected to grow at a Compound annual growth rate (CAGR) of 4.6% during the forecast period (2024–2034) attributed to the emerging therapies, and others.

- The United States accounted for the highest Major Depressive Disorder Treatment Market Size approximately 78% of the total market size in 7MM in 2023, in comparison to the other major markets i.e., EU4 countries (Germany, France, Italy, and Spain), and the United Kingdom, and Japan.

- Among the European countries, Germany had the highest Major Depressive Disorder market size with nearly USD 531 million in 2023, while Italy had the lowest market size of Major Depressive Disorder with nearly USD 129 million in 2023.

- The Major Depressive Disorder Market Size in Japan was estimated to be nearly USD 142 million in 2023, which accounts for 2% of the total 7MM market.

- With the expected launch of upcoming therapies, such as Seltorexant the total Major Depressive Disorder Treatment Market Size is expected to show change in the upcoming years.

- An unmet need in the Major Depressive Disorder market is the development of more effective treatments with faster onset and fewer side effects. Current therapies often require weeks to show benefits and can have significant side effects, leading to issues with patient adherence and treatment efficacy.

- Additionally, there is a need for personalized treatment approaches that better address individual variations in response to medication. Improving these aspects could significantly enhance patient outcomes and satisfaction.

Major Depressive Disorder Drugs Uptake

This section focuses on the uptake rate of potential Major Depressive Disorder drugs expected to launch in the market during 2020–2034. For example, Seltorexant in the US is expected to be launched by 2025 with a peak share of 1.3%. Seltorexant is anticipated to take 7 years to peak with a medium uptake.

Major Depressive Disorder Pipeline Development Activities

The Major Depressive Disorder therapeutics market report provides insights into different therapeutic candidates in Phase III, Phase II, and Phase I. It also analyzes key Major Depressive Disorder companies involved in developing targeted therapeutics.

Pipeline Development Activities

The Major Depressive Disorder therapeutics market report covers information on collaborations, acquisitions and mergers, licensing, and patent details for Major Depressive Disorder emerging therapies.

Take Your Research to the Next Level! Click Here to Get Access to the Full Pipeline Report @ Major Depressive Disorder Approved Drugs

KOL Views

To keep up with current market trends, we take KOLs and SMEs’ opinions working in the domain through primary research to fill the data gaps and validate the secondary research. Industry Experts were contacted for insights on Major Depressive Disorder evolving treatment landscape, patient reliance on conventional therapies, patient therapy switching acceptability, and drug uptake along with challenges related to accessibility, including KOL from University of California, Los Angeles (UCLA), US; Duke University School of Medicine, Durham, North Carolina, US; Robert Koch Institute, Dept. of Epidemiology and Health Monitoring, Berlin, Germany; University of Bordeaux, Bordeaux, France, France; Universitat de Barcelona, Spain; Zikei Hospital/ Zikei Institute of Psychiatry, Okayama City, Okayama, Japan; and others.

Delveinsight’s analysts connected with 50+ KOLs to gather insights; however, interviews were conducted with 15+ KOLs in the 7MM. Their opinion helps understand and validate current and emerging therapies, treatment patterns, or Major Depressive Disorder market trends. This will support the clients in potential upcoming novel treatments by identifying the overall scenario of the market and the unmet needs.

Qualitative Analysis

We perform Qualitative and Major Depressive Disorder Therapeutics Market Intelligence analysis using various approaches, such as SWOT and Conjoint Analysis. In the SWOT analysis, strengths, weaknesses, opportunities, and threats in terms of disease diagnosis, patient awareness, patient burden, competitive landscape, cost-effectiveness, and geographical accessibility of therapies are provided. These pointers are based on the Analyst’s discretion and assessment of the patient burden, cost analysis, and existing and evolving treatment landscape.

Conjoint Analysis analyzes multiple approved and emerging therapies based on relevant attributes such as safety, efficacy, frequency of administration, route of administration, and order of entry. Scoring is given based on these parameters to analyze the effectiveness of therapy.

Further, the therapies’ safety is evaluated wherein the acceptability, tolerability, and adverse events are majorly observed, and it sets a clear understanding of the side effects posed by the drug in the trials. In addition, the scoring is also based on the route of administration, order of entry and designation, probability of success, and the addressable patient pool for each therapy. According to these parameters, the final weightage score and the ranking of the emerging therapies are decided.

Major Depressive Disorder Therapeutics Market Access and Reimbursement

The high cost of therapies for the treatment is a major factor restraining the growth of the global drug market. Because of the high cost, the economic burden is increasing, leading the patient to escape from proper treatment. The report further provides detailed insights on the country-wise accessibility and reimbursement scenarios, cost-effectiveness scenario of approved therapies, programs making accessibility easier and out-of-pocket costs more affordable, insights on patients insured under federal or state government prescription drug programs, etc.

Major Depressive Disorder Therapeutics Market Report Scope

- The Major Depressive Disorder therapeutics market report covers a segment of key events, an executive summary, and a descriptive overview, explaining its causes, signs and symptoms, and currently available therapies.

- Comprehensive insight has been provided into the epidemiology segments and forecasts, the future growth potential of diagnosis rate, disease progression, and treatment guidelines.

- Additionally, an all-inclusive account of the current and emerging therapies and the elaborative profiles of late-stage and prominent therapies will impact the current treatment landscape.

- A detailed review of the Major Depressive Disorder treatment market, historical and forecasted Major Depressive Disorder treatment market size, Major Depressive Disorder market share by therapies, detailed assumptions, and rationale behind the approach is included in the report covering the 7MM drug outreach.

- The Major Depressive Disorder report provides an edge while developing business strategies, by understanding trends, through SWOT analysis and expert insights/KOL views, patient journey, and treatment preferences that help shape and drive the 7MM Major Depressive Disorder Drugs Market.

Major Depressive Disorder Therapeutics Market Report Insights

- Patient-based Major Depressive Disorder Market Forecasting

- Therapeutic Approaches

- Major Depressive Disorder Pipeline Analysis

- Major Depressive Disorder Market Size

- Major Depressive Disorder Market Trends

- Existing and Future Major Depressive Disorder Therapeutics Market Opportunities

Major Depressive Disorder Therapeutics Market Report Key Strengths

- 11 years Major Depressive Disorder Market Forecast

- The 7MM Coverage

- Major Depressive Disorder Epidemiology Segmentation

- Key Cross Competition

- Conjoint Analysis

- Major Depressive Disorder Drugs Uptake

- Key Major Depressive Disorder Market Forecast Assumptions

Major Depressive Disorder Treatment Market Report Assessment

- Current Major Depressive Disorder Treatment Market Practices

- Major Depressive Disorder Unmet Needs

- Major Depressive Disorder Pipeline Product Profiles

- Major Depressive Disorder Therapeutics Market Attractiveness

- Qualitative Analysis (SWOT and Conjoint Analysis)

Key Questions

Major Depressive Disorder Therapeutics Market Insights

- What was the Major Depressive Disorder market share (%) distribution in 2020 and what it would look like in 2034?

- What would be the Major Depressive Disorder market size as well as market size by therapies across the 7MM during the forecast period (2024–2034)?

- What are the key findings pertaining to the market across the 7MM and which country will have the largest Major Depressive Disorder market size during the forecast period (2024–2034)?

- At what CAGR, the Major Depressive Disorder therapeutics market is expected to grow at the 7MM level during the forecast period (2024–2034)?

- What would be the Major Depressive Disorder market outlook across the 7MM during the forecast period (2024–2034)?

- What would be the Major Depressive Disorder market growth till 2034 and what will be the resultant market size in the year 2034?

- How would the market drivers, barriers, and future opportunities affect the market dynamics and subsequent analysis of the associated trends?

Major Depressive Disorder Epidemiology Insights

- What are the disease risk, burden, and unmet needs of Major Depressive Disorder?

- What is the historical Major Depressive Disorder patient population in the United States, EU4 (Germany, France, Italy, Spain) and the UK, and Japan?

- What would be the forecasted patient population of Major Depressive Disorder at the 7MM level?

- What will be the growth opportunities across the 7MM with respect to the patient population pertaining to Major Depressive Disorder?

- Out of the above-mentioned countries, which country would have the highest prevalent population of Major Depressive Disorder during the forecast period (2024–2034)?

- At what CAGR the population is expected to grow across the 7MM during the forecast period (2024–2034)?

Current Major Depressive Disorder Treatment Market Scenario, Marketed Drugs, and Emerging Therapies

- What are the current options for the Major Depressive Disorder treatment along with the approved therapy?

- What are the current treatment guidelines for the Major Depressive Disorder treatment in the US, Europe, And Japan?

- What are the Major Depressive Disorder-marketed drugs and their MOA, regulatory milestones, product development activities, advantages, disadvantages, safety, efficacy, etc.?

- How many companies are developing therapies for the treatment of Major Depressive Disorder?

- How many emerging therapies are in the mid-stage and late stages of development for the treatment of Major Depressive Disorder?

- What are the key collaborations (Industry–Industry, Industry-Academia), Mergers and acquisitions, and licensing activities related to the Major Depressive Disorder therapies?

- What are the recent therapies, targets, mechanisms of action, and technologies developed to overcome the limitations of existing therapies?

- What are the clinical studies going on for Major Depressive Disorder and their status?

- What are the key designations that have been granted for the emerging therapies for Major Depressive Disorder?

- What are the 7MM historical and forecasted market of Major Depressive Disorder?

Reasons to Buy

- The patient-based Major Depressive Disorder Market forecasting report will help in developing business strategies by understanding the latest trends and changing treatment dynamics driving the Major Depressive Disorder Therapeutics Market.

- Insights on patient burden/disease prevalence, evolution in diagnosis, and factors contributing to the change in the epidemiology of the disease during the forecast years.

- To understand the existing Major Depressive Disorder Therapeutics Market opportunity in varying geographies and the growth potential over the coming years.

- Distribution of historical and current patient share based on real-world prescription data along with reported sales of approved products in the US, EU4 (Germany, France, Italy, and Spain), the United Kingdom, and Japan.

- Identification of strong upcoming players in the Major Depressive Disorder Drugs Market will help in devising strategies that will help in getting ahead of competitors.

- Detailed analysis and potential of current and emerging therapies under the conjoint analysis section to provide visibility around leading emerging drugs.

- Highlights of Access and Reimbursement policies of approved therapies, barriers to accessibility of off-label expensive therapies, and patient assistance programs.

- To understand the perspective of Key Opinion Leaders around the accessibility, acceptability, and compliance-related challenges of existing treatment to overcome barriers in the future.

- Detailed insights on the unmet needs of the existing Major Depressive Disorder Drugs Market so that the upcoming players can strengthen their development and launch strategy.

Stay Updated with us for Recent Articles

- Long-Awaited Victory: Fabre-Kramer's Major Depressive Disorder Treatment Drug Gains FDA Approval

- Will a Robust Pipeline Address the Major Depressive Disorder Treatment Conundrum?

- Major Depressive Disorder Market Quadrant Growth Soars Owing to Expected Launch of Key Therapies

- Major Depressive Disorder Market: Infographics

- Major Depressive Disorder Market: Newsletter

- Latest DelveInsight Blogs