Ovarian Cancer Market Summary

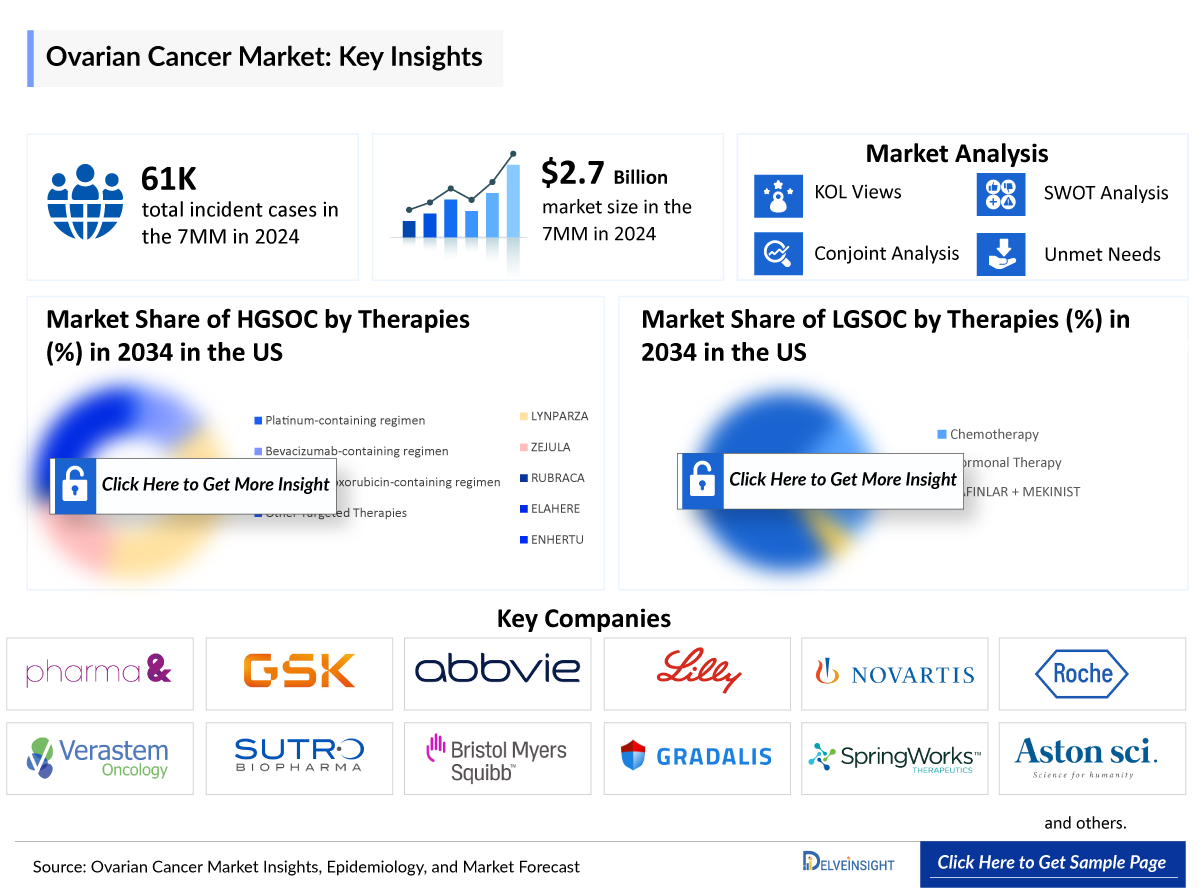

- The High-Grade vs. Low-Grade Serous Ovarian Cancer market size in the 7MM is expected to grow from USD 3,012 million in 2025 to USD 5,703 million in 2034.

- The High-Grade vs. Low-Grade Serous Ovarian Cancer market is projected to grow at a CAGR of 7.40% by 2034 in leading countries like US, EU4, UK and Japan.

High-Grade vs. Low-Grade Serous Ovarian Cancer Market and Epidemiology Analysis

- Currently, there is no standard, widely accepted screening test for ovarian cancer. This makes early detection difficult, as ovarian cancer often does not cause noticeable symptoms until it is advanced.

- Platinum-based chemotherapy has been the standard of care for ovarian cancer for the past three decades. Although most patients respond to platinum-based treatment, the emergence of platinum resistance in recurrent ovarian cancer is inevitable during the course.

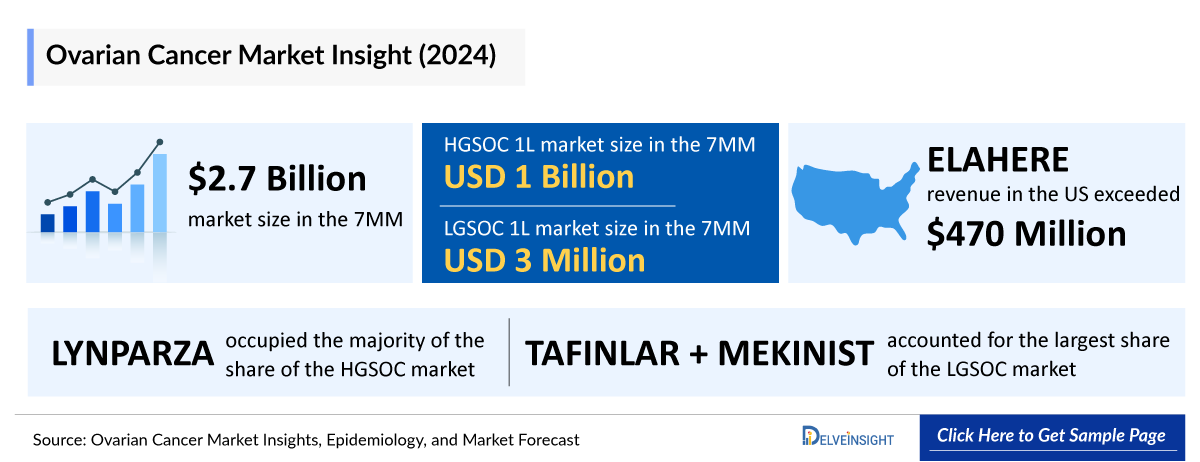

- The ovarian cancer market is dominated by Poly (ADP ribose) polymerase (PARP) inhibitors in maintenance settings. Currently, three PARP inhibitors are being used that are approved by the United States Food and Drug Administration (US FDA) for the treatment of ovarian cancer, including ZEJULA (niraparib), LYNPARZA (olaparib), and RUBRACA (rucaparib). LYNPARZA is the most successful PARP inhibitor, with ZEJULA coming in second.

- The restrictions imposed on PARP inhibitors highlight the evolving nature of cancer therapeutics, where initial optimism must be balanced with emerging clinical evidence. While ovarian cancer therapies remain a crucial option for patients with BRCA mutations, their universal use in maintenance therapy is no longer supported due to concerns over survival outcomes.

- Low-grade serous ovarian cancer (LGSOC) market is major held by TAFINLAR + MEKINIST. The ovarian cancer market is set to expand with the expected approval for Avutometinib + Defactinib in 2025.

- ELAHERE is one of the most rapidly adopted ADC in the US oncology market. ELAHERE continues to show a promising launch trajectory for FR-alpha-positive platinum-resistant ovarian cancer. Sales in the United States exceeded USD 470 million annually in 2024. In addition to this, commercialization is already underway in key overseas markets where AbbVie is accelerating regulatory and reimbursement timelines.

- Apart from the approved therapies, the emerging landscape of highgrade serous ovarian cancer (HGSOC) in the first-line setting contains JEMPERLI + niraparib + chemotherapy and KEYTRUDA + chemotherapy + maintenance LYNPARZA (when it comes to the segment of advanced ovarian cancer).

- Expected launch of potential ovarian cancer therapies such as Avutometinib (VS-6766) + Defactinib (VS-6063) (Verastem Oncology), Relacorilant (Corcept Therapeutics), Oregovomab (OncoQuest Pharmaceuticals/Quest PharmaTech/Canariabio), Luveltamab Tazevibulin (Sutro Biopharma), Raludotatug deruxtecan (Daiichi Sankyo and Merck), and others may increase the ovarian cancer market size in the coming years, assisted by an increase in the population of High and Low-grade serous ovarian cancer.

High-Grade vs. Low-Grade Serous Ovarian Cancer Market size and forecast

- 2025 Market Size: USD 3,012 million in 2025

- 2034 Projected Market Size: USD 5,703 million in 2034

- Growth Rate (2025-2034): 7.40% CAGR

- Largest Market: United States

Key Factors Driving the Ovarian Cancer Market

Rising Ovarian Cancer Burden and Patient Awareness

In the 7MM, ovarian cancer remains a significant health concern, with nearly 37.6K incident cases of high- and low-grade serous ovarian cancer reported in 2024. The United States accounted for the highest share of these cases. Rising disease awareness, improved diagnostic strategies, and ongoing research into genetic predisposition, including BRCA mutations, are driving earlier detection and intervention.

Current Ovarian Cancer Treatment Landscape

The ovarian cancer market is dominated by PARP inhibitors in the maintenance setting, with ZEJULA (niraparib), LYNPARZA (olaparib), and RUBRACA (rucaparib) approved by the US FDA. Among these, LYNPARZA leads the market, followed by ZEJULA. However, recent restrictions on PARP inhibitor use have highlighted the need for careful patient selection, particularly among those with BRCA mutations. In low-grade serous ovarian cancer, the TAFINLAR + MEKINIST combination remains the key therapy, with Avutometinib + Defactinib anticipated to gain approval in 2025. On the other hand, ELAHERE has rapidly emerged as one of the most successful antibody–drug conjugates (ADCs), generating more than USD 470 million in US sales in 2024 and expanding into key global markets.

Emerging Therapies Shaping the Ovarian Cancer Pipeline

The clinical trials in advanced and high-grade serous ovarian cancer are active, with novel combinations such as JEMPERLI + niraparib + chemotherapy and KEYTRUDA + chemotherapy + maintenance LYNPARZA under investigation. Promising therapies expected to drive future growth include Avutometinib + Defactinib (Verastem Oncology), Relacorilant (Corcept Therapeutics), Oregovomab (OncoQuest/Quest PharmaTech/Canariabio), Luveltamab Tazevibulin (Sutro Biopharma), and Raludotatug deruxtecan (Daiichi Sankyo/Merck).

Ovarian Cancer Market Outlook

The ovarian cancer market is set to expand over the coming years, supported by the introduction of next-generation targeted agents, ADCs, and immunotherapy combinations. With leading players such as AstraZeneca, AbbVie, Genmab, GSK, Verastem, Daiichi Sankyo, Merck, Novartis, and others investing heavily in this space, the treatment paradigm is expected to evolve significantly, offering patients more durable and personalized treatment options.

DelveInsight’s "High and Low-grade Serous Ovarian Cancer Treatment Market Insight, Epidemiology, and Market Forecast - 2034" report delivers an in-depth understanding of High and Low-grade serous ovarian cancer, its historical and forecasted epidemiology, and the market trends in the United States, EU4 (Germany, France, Italy, and Spain) and the United Kingdom, and Japan.

The High and Low-grade serous ovarian cancer treatment market report provides current treatment practices, emerging ovarian cancer therapies, High and Low-grade serous ovarian cancer market share of individual therapies, and current and forecasted High and Low-grade serous ovarian cancer market size from 2020 to 2034, segmented by seven major markets. The report also covers current High and Low-grade serous ovarian cancer treatment practices/algorithms and unmet medical needs to curate the best of the opportunities and assess the underlying potential of the ovarian cancer treatment market.

High and Low-grade Serous Ovarian Cancer Disease Understanding

Ovarian Cancer Overview

Ovarian cancer has a high mortality rate and is the fifth most common cause of death among females worldwide. Its etiology remains unclear, but several factors, such as smoking, obesity, and an unhealthy diet, may influence the risk of ovarian cancer. A family history of breast cancer and ovarian cancer is one of the primary risk factors, and mutations in the BRCA1 and BRCA2 genes are also associated with an increased risk.

The histopathological classification of ovarian cancer identifies five primary types: serous, clear cell, endometrioid, mucinous, and un-specified, all of which are epithelial in origin, while other types are rare. Additionally, ovarian cancer is categorized into Type I and Type II. Type I tumors are most likely associated with atypical proliferative tumors and are typically detected at an early stage with a favorable prognosis. In contrast, Type II tumors include HGSOC, carcinosarcoma, and undifferentiated carcinoma, which often originate from tubal intraepithelial carcinoma of the serous type. Type II tumors are generally classified as highgrade, are commonly diagnosed at advanced International Federation of Gynecology and Obstetrics (FIGO) stages and are associated with a poor prognosis.

Ovarian cancer often lacks obvious early symptoms, making detection difficult. However, common signs include abdominal bloating, feeling full quickly, frequent urination, pelvic or abdominal pain, digestive issues, menstrual irregularities, fatigue, pain during intercourse, and unexplained weight changes. While these symptoms may stem from other conditions, persistent or worsening signs warrant medical evaluation.

Ovarian Cancer Diagnosis

Ovarian cancer is suspected based on symptoms, physical exams, and imaging tests like ultrasound, CT, or MRI, but a definitive diagnosis requires surgery. Blood tests like CA-125 can support suspicion but are not conclusive. The primary diagnostic procedure is exploratory laparotomy, where tissue samples are examined for cancer, and if confirmed, the surgeon removes as much cancerous tissue as possible (debulking). In some cases, a less invasive laparoscopy may be used. For advanced-stage cancer, biopsy confirmation is needed before chemotherapy. Surgery by a gynecologic oncologist improves outcomes, and fertility-preserving options may be considered for younger patients.

Further details related to the diagnosis will be provided in the report…

Ovarian Cancer Treatment

Ovarian cancer treatment involves a combination of surgery, radiation, and systemic therapies. Surgery is the primary approach, including staging and debulking to remove as much tumor as possible, sometimes involving other organs. In some cases, fertility-preserving surgery is an option. Radiation therapy is rarely the first-line treatment but is used for cancer spread, with advanced techniques like MRI-Linac improving precision. Systemic treatments include chemotherapy (typically carboplatin and paclitaxel), hormone therapy for hormone-sensitive tumors, targeted therapies such as bevacizumab (which blocks the blood supply), PARP inhibitors (for BRCA-mutated tumors), and novel ovarian cancer therapies like ELAHERE and BRAF/MEK inhibitors. Immunotherapy, though still under research, shows promise, especially in combination with targeted treatments. Each treatment plan is personalized based on cancer type, stage, and patient health.

Further details related to treatment will be provided in the report…

High and Low-grade Serous Ovarian Cancer Epidemiology

The ovarian cancer epidemiology chapter in the report provides historical as well as forecasted epidemiology segmented by the total incident cases of ovarian cancer, age-specific cases of ovarian cancer, type-specific cases of ovarian cancer, stage-specific cases of HGSOC and LGSOC, and biomarker-specific cases of HGSOC and LGSOC in the 7MM market covering the United States, EU4 (Germany, France, Italy, and Spain) and the United Kingdom, and Japan from 2020 to 2034.

Key Findings from High-Grade vs. Low-Grade Serous Ovarian Cancer Epidemiological Analysis and Forecast:

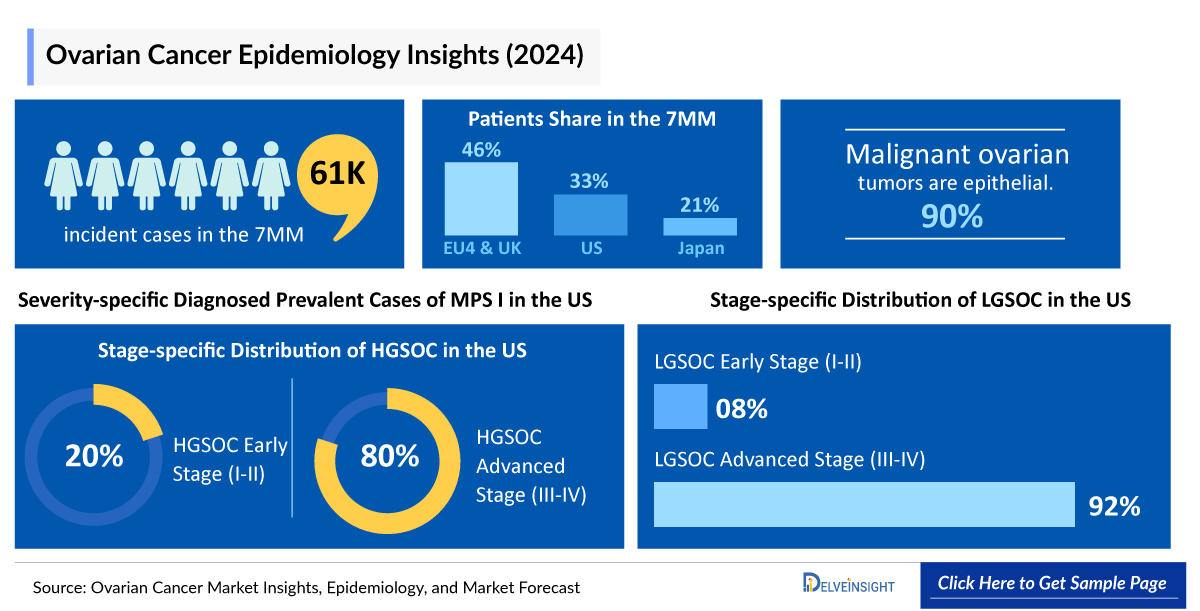

- In the 7MM, the US accounted for the highest number of incident cases of High and Low-grade serous ovarian Cancer. In the 7MM, there were nearly 37,600 cases in 2024.

- Among EU4 and the UK, the UK had the highest number of cases of LGSOC, followed by Germany, whereas Spain was at the bottom of the ladder.

- The number of incident cases of HRD (gLOH = 16%) was much higher in HGSOC than in MAPK (BRAF/KRAS/NRAS/NF1). MAPK cases are predominant in LGSOC. In the US, in 2024, the HRD cases accounted for nearly 5,160.

- Data suggest that in LGSOC, the majority of cases have Stage III disease at diagnosis. About 70-80% of people are diagnosed with Stage III, and about 10% of people are diagnosed with Stage IV. In Japan, LGSOC early-stage and advanced-stage were around 30 and 325, respectively, in 2024.

High-Grade vs. Low-Grade Serous Ovarian Cancer Epidemiology Segmentation:

- Total incident cases of ovarian cancer

- Age-specific cases of ovarian cancer

- Type-specific cases of ovarian cancer

- Stage-specific cases of HGSOC and LGSOC

- Biomarker-specific cases of HGSOC and LGSOC

Ovarian Cancer (High and Low-grade Serous Ovarian Cancer) Market Recent Developments and Breakthroughs:

- In September 2025, Corcept Therapeutics (NASDAQ: CORT) announced that the FDA accepted its NDA for relacorilant to treat platinum-resistant ovarian cancer, with a PDUFA date set for July 11, 2026.

- In August 2025, Allarity Therapeutics received FDA Fast Track designation for stenoparib, its investigational dual PARP and WNT inhibitor for advanced ovarian cancer.

- In May 2025, Verastem Oncology (Nasdaq: VSTM) announced FDA approval of AVMAPKI™ FAKZYNJA™ CO-PACK (avutometinib and defactinib) for treating KRAS-mutated recurrent low-grade serous ovarian cancer (LGSOC) in adults previously treated with systemic therapy. It is the first and only FDA-approved therapy for this indication.

- In May 2025, PMV Pharmaceuticals (Nasdaq: PMVP) reported Q1 results and corporate updates, announcing interim Phase 2 PYNNACLE trial data expected mid-2025. The analysis will include around 50 patients, with 40% from the ovarian cancer cohort, each followed for at least 18 weeks. The trial evaluates rezatapopt monotherapy in TP53 Y220C and KRAS wild-type advanced solid tumors.

- In May 2025, UTR Therapeutics Inc. announced the submission of an IND application to the FDA for UTRxM1-18, a novel therapy designed to target c-MYC driven cancers, including triple-negative breast, pancreatic, colorectal, and ovarian cancers. Leveraging its 3’UTR engineering platform, UTRxM1-18 selectively degrades cancer-specific transcripts while sparing healthy cells. In preclinical studies, the drug showed strong, dose-dependent efficacy across tumor types with no dose-limiting toxicities.

- In April 2025, Biocon Biologics received FDA approval for Jobevne™ (bevacizumab-nwgd), a biosimilar to Avastin®, for intravenous use. Jobevne is approved for multiple cancers, including metastatic colorectal cancer, non-squamous non-small cell lung cancer, recurrent glioblastoma, metastatic renal cell carcinoma, advanced cervical cancer, and ovarian, fallopian tube, or primary peritoneal cancer.

- In February 2025, the FDA granted fast track designation to CUSP06, a CDH6-directed antibody-drug conjugate (ADC), for the treatment of patients with platinum-resistant ovarian cancer.

Ovarian Cancer (High and Low-grade Serous Ovarian Cancer) Drug Chapter Analysis

The drug chapter segment of the ovarian cancer report encloses a detailed analysis of the late-stage (Phase III and Phase II/III) and early-stage (Phase I/II) ovarian cancer pipeline drugs. The current key ovarian cancer companies for emerging ovarian cancer drugs and their respective drug candidates include Verastem Oncology (Avutometinib + Defactinib), Corcept Therapeutics (Relacorilant), ProfoundBio/Genmab (Rinatabart sesutecan), Advenchen Laboratories (Catequentinib), Daiichi Sankyo and Merck (Raludotatug deruxtecan), Mural Oncology (Nemvaleukin alfa), Genelux Corporation (Olvimulogene nanivacirepvec), Sutro Biopharma (Luveltamab tazevibulin), Merck and Kelun-Biotech (Sacituzumab tirumotecan), TORL BioTherapeutics (TORL-1-23), Zentalis Pharmaceuticals and K-Group Beta (Azenosertib) and others. The drug chapters also help understand the High and Low-grade serous ovarian cancer clinical trial details, expressive pharmacological action, agreements and collaborations, approval, patent details, and the latest news and press releases.

Ovarian Cancer Marketed Drugs

RUBRACA (rucaparib): pharma& GmbH

RUBRACA is an oral, small-molecule inhibitor of Poly (ADP-ribose) Polymerase (PARP) 1, 2, and 3 that is being developed in multiple tumor types, including ovarian and prostate cancers, as monotherapy and in combination with other anti-cancer agents. Currently, it is approved for the maintenance treatment of adult patients with recurrent Epithelial Ovarian Carcinoma (EOC), Fallopian Tube Carcinoma (FTC), or Primary Peritoneal Cancer (PPC) who are in complete response (CR) or partial response (PR) to platinum-based chemotherapy. It was granted the first US FDA approval in 2016 for the treatment of patients with deleterious BRCA mutation (germline and/or somatic) associated with advanced ovarian cancer. In November 2023, the European Commission granted marketing authorization for a Type II variation for RUBRACA as a first-line maintenance treatment for all women with advanced ovarian cancer, regardless of their BRCA mutation status, who have responded to first-line platinum-based chemotherapy.

ZEJULA (niraparib): GlaxoSmithKline

Niraparib is an oral potent, highly selective PARP1 and PARP2 inhibitor. PARP is a protein that plays a fundamental role in detecting and repairing DNA damage in cells, including damage induced by chemotherapy. Niraparib is a PARP inhibitor; it works by inhibiting the repair of damaged DNA and inducing cell death. In March 2017, the US FDA approved ZEJULA for the maintenance treatment (intended to delay cancer growth) of adult patients with recurrent EOC, FTC, or PPC, whose tumors have completely or partially shrunk (CR or PR), respectively, in response to platinum-based chemotherapy. In 2020, the FDA approved ZEJULA for the maintenance treatment of adult patients with advanced EOC, FTC, or PPC who are in CR or PR to first-line platinum-based chemotherapy.

Ovarian Cancer Emerging Drugs

Avutometinib (VS-6766) + Defactinib (VS-6063): Verastem Oncology

Avutometinib is an RAF/MEK Clamp that induces inactive complexes of MEK with ARAF, BRAF, and CRAF, potentially creating a more complete and durable antitumor response through maximal RAS pathway inhibition. Avutometinib blocks both RAF and MEK in a single molecule, suggesting it may help overcome resistance and ultimately block tumor growth and proliferation.

In December 2024, Verastem Oncology announced that the US FDA has accepted for review the (New Drug Application) NDA under the accelerated approval pathway for avutometinib for the treatment of adult patients with recurrent LGSOC who received at least one prior systemic therapy and have a KRAS mutation. In March 2024, Verastem Oncology announced that the US FDA granted orphan drug designation (ODD) to avutometinib for the treatment of all patients with recurrent LGSOC.

Raludotatug deruxtecan: Daiichi Sankyo

Raludotatug deruxtecan (R-DXd) is an investigational, potential first-in-class CDH6-directed ADC. Designed using Daiichi Sankyo’s proprietary DXd ADC Technology, raludotatug deruxtecan is comprised of a humanized anti-CDH6 IgG1 monoclonal antibody attached to a number of topoisomerase I inhibitor payloads (an exatecan derivative, DXd) via tetrapeptide-based cleavable linkers.

Currently, the drug is being evaluated in the Phase II/III REJOICE-Ovarian01 trial for ovarian cancer, which was initiated in April 2024. In 2023, Daiichi Sankyo and Merck entered into a global development and commercialization agreement for three of Daiichi Sankyo’s DXd ADC candidates, including raludotatug deruxtecan. The ovarian cancer companies will jointly develop and potentially commercialize these ADC candidates worldwide, except in Japan, where Daiichi Sankyo will maintain exclusive rights. Daiichi Sankyo will be solely responsible for manufacturing and supply.

Ovarian Cancer Drug Class Analysis

Few targeted therapies inhibit specific molecular targets involved in signaling pathways. Targets include PARP inhibitors (Poly (ADP-ribose) polymerase inhibitors), Folate receptor a inhibitor, PD-1 inhibitor (programmed cell death protein 1), and others. RUBRACA belongs to PARP inhibitors.

PARP Inhibitors

PARP inhibitors are a type of targeted therapy commonly used to treat breast cancer and ovarian cancer, among others. PARP inhibitors are especially effective at treating cancers with gene mutations that negatively affect DNA repair, such as BRCA gene mutations. RUBACA, LYNPARZA, and ZEJULA are the established PARP inhibitors being utilized for the treatment of ovarian cancer. The PARP inhibitors, including LYNPARZA, ZEJULA, and RUBRACA, are used in recurrent maintenance but withdrawn between 2022 and 2023 from specific segments, such as non-BCRA ovarian cancer and as monotherapy from 3L and above. LYNPARZA and ZEJULA are two leading PARP inhibitors; ZEJULA boasts a broad FDA label in ovarian cancer, allowing it to be used in patients regardless of their biomarker status. The restrictions imposed on PARP inhibitors highlight the evolving nature of cancer therapeutics, where initial optimism must be balanced with emerging clinical evidence. While these drugs remain a crucial option for patients with BRCA mutations, their universal use in maintenance therapy is no longer supported due to concerns over survival outcomes.

Further detailed analysis will be provided in the report….

Ovarian Cancer (High and Low-grade Serous Ovarian Cancer) Market Outlook

Ovarian cancer treatment typically involves a combination of surgery, chemotherapy, and targeted therapy. Surgery aims to remove cancerous tissue, while chemotherapy, administered orally or intravenously, works to shrink or destroy cancer cells. Targeted therapy blocks cancer growth and spread and is used when specific tests confirm its suitability. HGSOC, the most common type, is usually treated with surgery and chemotherapy. Patients with early-stage disease often undergo surgery first, followed by approximately six rounds of chemotherapy. Those with advanced disease may begin with chemotherapy to shrink tumors before surgery, followed by additional chemotherapy afterward. A patient’s BRCA (breast cancer gene) or HRD (homologous recombination deficiency) status does not alter initial chemotherapy but influences maintenance therapy. Patients with BRCA or HRD mutations often benefit from PARP inhibitors, a type of oral targeted therapy designed to prevent recurrence. Ongoing ovarian cancer clinical trials are evaluating new treatment options. Radiation therapy, including intraperitoneal radiation, is being studied for advanced cases. Immunotherapy is being explored to strengthen the body's natural ability to fight cancer, while vaccine therapy is being developed to train the immune system to recognize and attack cancer cells more effectively.

Many ovarian cancer patients face significant barriers to receiving quality care, particularly those from racial minority and low-income backgrounds. Limited access to specialized providers and treatment facilities often leads to delays in care and lower survival rates. Geographic and socioeconomic challenges further restrict patients from receiving guideline-based treatments, making it harder to achieve the best possible outcomes. Additionally, many patients and even some healthcare providers lack sufficient education on treatment options and post-surgical expectations, which can prevent individuals from choosing life-saving procedures. Early detection is another challenge, as routine screening is not widely available, and tests like CA-125 are difficult to interpret without baseline values. Awareness of BRCA testing is also low, particularly among minority communities, limiting opportunities for preventive care. Overcoming these barriers requires expanding access to specialists, improving patient education, and strengthening early detection efforts to ensure better outcomes for all.

- Current key players in the field include pharma& GmbH, GSK, Abbvie, Eli Lilly, Novartis, Roche, and others.

- The US accounted for the largest market size of ovarian cancer in the 7MM, with nearly USD 1,922 million in 2024.

- In 2024, Germany had the largest market share among EU4 and the UK, while Spain was at the bottom of the ladder.

- The treatment for LGSOC pertains to a highunmet need. There is only one FDA-approved treatment (TAFINLAR + MEKINIST) for low-grade serous, and Avutometinib + Defactinib is expected to attain approval in 2025.

- The HGSOC 1L and LGSOC 1L treatment market was nearly USD 1,088 million and USD 3.2 million in 2024.

Further details will be provided in the report….

High and Low-grade Serous Ovarian Cancer Drugs Uptake

This section focuses on the rate of uptake of the potential drugs expected to be launched in the market during the study period. The analysis covers High and Low-grade serous ovarian cancer therapeutics market uptake by drugs, patient uptake by therapies, and sales of each drug.

Fewer players are working for the first-line treatment options. Merck’s (KEYTRUDA + Chemotherapy + maintenance with LYNPARZA), Daiichi’s (ENHERTU + bevacizumab), GSK’s (JEMPERLI + Chemotherapy + niraparib), and AstraZeneca’s (IMFINZI + Chemotherapy + bevacizumab, followed by maintenance with IMFINZI + bevacizumab + olaparib) are the only promising candidates to enter the present market soon.

High and Low-grade Serous Ovarian Cancer Pipeline Development Activities

The report provides insights into different therapeutic candidates in Phase III, Phase II, and Phase I/II stages. It also analyzes key players involved in developing targeted therapeutics.

Pipeline Development Activities

The report covers detailed information on collaborations, acquisitions and mergers, licensing, and patent details for ovarian cancer emerging therapies.

Latest KOL Views

To keep up with current market trends, we take KOLs and SMEs' opinions working in the domain through primary research to fill the data gaps and validate our secondary research. Some of the leaders like MDs, professors, and Vice Chair Department of Critical Care Medicine, and Director, PhD, and others. Their opinion helps to understand and validate current and emerging therapies and treatment patterns or ovarian cancer therapeutics market trends. This will support the clients in potential upcoming novel treatments by identifying the overall scenario of the market and the unmet needs.

DelveInsight’s analysts connected with 30+ KOLs to gather insights; however, interviews were conducted with 10+ KOLs in the 7MM. Centers such as the Dana-Farber Cancer Institute, Smilow Cancer Hospital, University of Chicago, etc., were contacted. Their opinion helps understand and validate ovarian cancer epidemiology and market trends.

What KOLs are saying on Ovarian Cancer Patient Trends?

- In United States, “Ovarian cancer is a global problem, is typically diagnosed at a late stage, and has no effective screening strategy. It is not a single disease and hence can be subdivided into at least five different histological subtypes that have different identifiable risk factors, cells of origin, molecular compositions, clinical features, and treatments.” - MD, Dana-Farber Cancer Institute, US

- In United Kingdom, “We need better strategies to prevent ovarian cancer. Currently, women with BRCA1/2 mutations, who are at very high risk, are offered surgery that prevents cancer but robs them of the chance to have children afterward. At the same time, many other cases of ovarian cancer are not picked up until they are in a much later stage. Teaching the immune system to recognize the very early signs of cancer is a tough challenge. But we now have highly sophisticated tools which give us real insights into how the immune system recognizes ovarian cancer.” - Professor, University of Oxford, UK

Ovarian Cancer Qualitative Analysis

We perform Qualitative and market Intelligence analysis using various approaches, such as SWOT and conjoint analysis. In the SWOT analysis, strengths, weaknesses, opportunities, and threats in terms of disease diagnosis, patient awareness, patient burden, competitive landscape, cost-effectiveness, and geographical accessibility of therapies are provided. These pointers are based on the Analyst’s discretion and assessment of the patient burden, cost analysis, and existing and evolving treatment landscape.

The analyst analyzes multiple emerging therapies based on relevant attributes such as safety, efficacy, frequency of administration, route of administration, and order of entry.

In efficacy, the trial’s primary and secondary outcome measures are evaluated.

Further, the therapies’ safety is evaluated wherein the acceptability, tolerability, and adverse events are majorly observed, and it sets a clear understanding of the side effects posed by the drug in the trials.

Ovarian Cancer Market Access and Reimbursement

The QuickStart Program helps patients start RUBRACA if they experience coverage delays, regardless of income or insurance, by providing a 15-day supply for up to 60 days while coverage is pending or until alternate funding resources are identified and approved. The Coverage Link Program offers a free supply of RUBRACA in 15-day increments for up to 90 days to eligible patients who experience a change in commercial insurance status, such as switching insurers due to a job change or an employer’s annual enrollment period. The RUBRACA Co-pay Assistance Program allows eligible patients with private or commercial insurance to pay as little as USD 0 for their prescribed RUBRACA. The Patient Assistance Program (PAP) supports eligible patients who are uninsured or cannot afford the medication.

Further detailed analysis will be provided in the report….

Scope of the Ovarian Cancer Market Report

- The report covers a descriptive overview of High and Low-grade serous ovarian cancer, explaining its causes, signs and symptoms, pathogenesis, and currently available therapies.

- Comprehensive insight has been provided into High and Low-grade serous ovarian cancer epidemiology and treatment.

- Additionally, an all-inclusive account of both the current and emerging therapies for High and Low-grade serous ovarian cancer is provided, along with the assessment of new therapies that will have an impact on the current treatment landscape.

- A detailed review of the High and Low-grade serous ovarian cancer treatment market, historical and forecasted, is included in the report, covering the 7MM drug outreach.

- The report provides an edge while developing business strategies by understanding trends shaping and driving the 7MM High and Low-grade serous ovarian cancer treatment market.

High and Low-grade serous ovarian cancer market Report Insights

- Patient Population

- Therapeutic Approaches

- High and Low-grade serous Ovarian Cancer Pipeline Analysis

- High and Low-grade serous ovarian cancer Market Size and Trends

- Market Opportunities

- Impact of Upcoming Therapies

High and Low-grade serous ovarian cancer Market Report Key Strengths

- Ten Years Forecast

- 7MM Coverage

- High and Low-grade serous ovarian cancer Epidemiology Segmentation

- Key Cross Competition

- Highly Analyzed Market

- Ovarian Cancer Therapies Uptake

High and Low-grade serous ovarian cancer Report Assessment

- Current Treatment Practices

- Unmet Needs

- Pipeline Product Profiles

- Market Attractiveness

- Qualitative Analysis (SWOT and Conjoint Analysis)

FAQs answered through our Ovarian Cancer Market Report

- What was the High and Low-grade serous ovarian cancer market share (%) distribution in 2020, and what will it look like in 2034?

- At what CAGR is the High and Low-grade serous ovarian cancer therapeutics market expected to grow at the 7MM level during the study period (2020–2034)?

- What are the disease risks, burdens, and unmet needs of High and Low-grade serous ovarian cancer?

- What is the historical High and Low-grade serous ovarian cancer patient pool in the United States, EU4 (Germany, France, Italy, and Spain), and the UK, and Japan?

- What will be the growth opportunities across the 7MM concerning the patient population of High and Low-grade serous ovarian cancer?

- At what CAGR is the population expected to grow across the 7MM during the study period (2020–2034)?

- How many ovarian cancer companies are developing therapies for the treatment of High and Low-grade serous ovarian cancer?

- What are the key collaborations (Industry–Industry, Industry-Academia), Mergers and acquisitions, and licensing activities related to High and Low-grade serous ovarian cancer therapies?

- What are the recent novel therapies, targets, ovarian cancer mechanism of action, and technologies developed to overcome the limitations of existing therapies?

- What are the key designations that have been granted for the emerging therapies for High and Low-grade serous ovarian cancer?

Reasons to buy

- The report will help in developing business strategies by helping to understand the trends shaping and driving highgrade and low-grade serous ovarian cancer.

- To understand the future market competition in the High and Low-grade serous ovarian cancer treatment market and an Insightful review of the SWOT analysis of High and Low-grade serous ovarian cancer.

- Organize sales and marketing efforts by identifying the best opportunities for High and Low-grade serous ovarian cancer in the US, EU4 (Germany, France, Italy, and Spain), the United Kingdom, and Japan.

- Identifying strong upcoming players in the market will help devise strategies for staying ahead of competitors.

- Organize sales and marketing efforts by identifying the best opportunities in the High and Low-grade serous ovarian cancer markets.

- To understand the future market competition in the High and Low-grade serous ovarian cancer therapeutics market.

Get detailed insights through our latest blogs @ DelveInsight Blogs