Pacemakers Market Summary

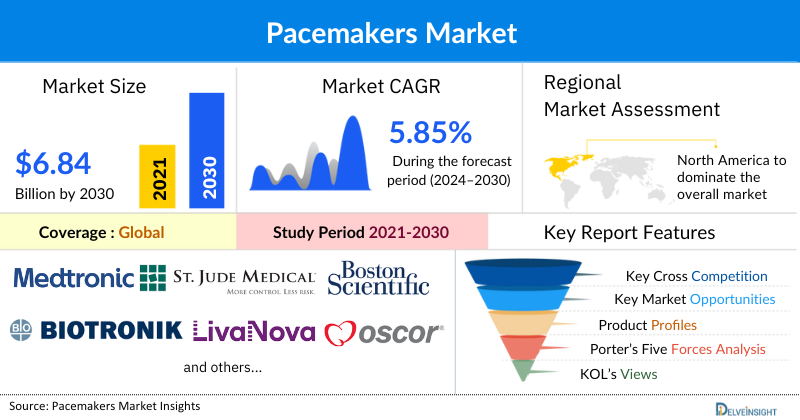

- The Global Pacemakers Market is expected to increase from USD 4.88 billion in 2024 to USD 6.84 billion by 2032, reflecting strong and sustained growth.

- The Global Pacemakers Market is growing at a CAGR of 5.85% during the forecast period from 2025 to 2032.

Pacemakers Market Trends & Insights

- The Global Pacemakers Market is undergoing a transformative phase, driven by advances in technology, an aging population, and a rising prevalence of cardiovascular diseases. Pacemakers, life-saving devices used to regulate abnormal heart rhythms, have witnessed significant improvements in terms of efficiency, size, and features.

- North America is expected to dominate the overall Pacemakers Market during the forecast period. This domination is due to the increasing prevalence of cardiovascular diseases, rising geriatric population base prone to CVDs, and increasing product launches and approvals, among others, which will propel the Pacemakers Market in the United States.

- The leading Pacemakers Companies such as Medtronic, Inc., St. Jude Medical, Inc., Boston Scientific Corporation, Biotronik SE & Co. KG, LivaNova PLC, Shree Pacetronix Ltd., OSCOR Inc., MEDICO S.p.A., Lepu Medical Technology Co. Ltd., MicroPort Scientific Corporation, and others.

Pacemakers Market Size & Forecast

- 2023 Market Size: USD 4.88 Billion

- 2030 Projected Market Size: USD 6.84 Billion

- Growth Rate (2025-2032): 5.85% CAGR

- Largest Market: North America

- Fastest Growing Market: Asia-Pacific

- Market Structure: Moderately Consolidated

Request for Unlocking the Sample Page of the "Pacemakers Market"

Factors Contributing to the Growth of Pacemakers

-

Rising Prevalence of Cardiovascular Diseases

The growing burden of cardiovascular diseases, including arrhythmias, heart block, and Bradycardia, is significantly driving the pacemakers market. As the global population ages, heart-related conditions are becoming more common, creating a strong demand for pacemaker implantation. This rising disease prevalence directly accelerates the adoption of cardiac rhythm management devices worldwide.

-

Technological Advancements in Pacemaker Devices

Continuous advancements in pacemaker technology, such as leadless pacemakers, MRI-compatible models, and wireless monitoring capabilities, are key market drivers. These innovations enhance patient safety, improve device longevity, and provide better outcomes, making pacemakers more appealing to patients and healthcare providers. The push toward miniaturization and longer battery life is also fueling demand.

-

Awareness and Early Diagnosis of Heart Conditions

Increased awareness programs and advances in diagnostic technologies are leading to the early detection of heart rhythm disorders. Early diagnosis ensures timely intervention with devices like pacemakers, preventing complications and improving survival rates. As both patients and healthcare providers recognize the benefits of timely treatment, the adoption of pacemakers is growing rapidly.

Pacemakers Market By Implantability (Implantable Pacemaker [Single-Chamber Pacemaker, Dual-Chamber Pacemaker, and Biventricular/CRT Pacemaker], and External Pacemaker), Device Type (MRI Compatible Pacemaker and Leadless MRI Compatible Pacemaker), End-User (Hospitals, Ambulatory Surgical Centres, and Others), and Geography is estimated to grow at an appreciable CAGR forecast till 2030 owing to the increasing number of people suffering from cardiovascular diseases (CVDs) and rising technological advancements.

The Global Pacemakers Market was valued at USD 4.88 billion in 2023, growing at a CAGR of 5.85% during the forecast period from 2025 to 2032, to reach USD 6.84 billion by 2032. The demand for pacemakers is primarily motivated due to the rise in cardiovascular diseases (CVDs), superior treatment outcomes of sudden cardiac arrests, and growing technological advancements among others during the forecast period.

Scope of the Pacemakers Market Report | |

|

Study Period |

2022 to 2032 |

|

Forecast Period |

2025 to 2032 |

|

Pacemakers CAGR |

5.85% |

|

Pacemakers Market Size |

USD 6.84 billion by 2032 |

|

Pacemakers Companies |

|

What are the latest Pacemakers Market Dynamics and Trends?

One of the key factors influencing the growth of the pacemakers market is the increasing prevalence of various cardiovascular diseases across the globe. According to the American Heart Association 2022, globally, about 244.1 million people were living with coronary (ischemic) heart disease in 2020. As per the data provided by British Heart Foundation 2022, worldwide around 550 million were living with heart and circulatory diseases in 2019 and this includes about 290 million women and around 260 million men.

The source mentioned above further stated that coronary (ischemic) heart disease (200 million cases), peripheral arterial vascular disease (110 million cases), stroke (100 million cases), and atrial fibrillation (60 million cases) remained the commonest and prevalent cardiovascular conditions worldwide in 2019. According to Pan American Health Organization (PAHO) 2022, cardiovascular diseases cause more deaths yearly than any other disease. Heart disease and stroke-related fatalities account for more than three-quarters of all deaths in low- and middle-income nations, in 2021.

The increasing number of risk factors such as old age, obesity, smoking, and others causing the development of cardiovascular diseases in one or another way further driving the market growth for pacemakers. For instance, according to the data provided by the WHO (2022), in 2020, about one billion people across the world were over the age of 60. The elderly population aged 60 and above is expected to double in number representing about 2.1 billion people by 2050. Also, people in the age group of 80 and above are estimated to triple between 2020 and 2050 to reach 426 million.

Thus, the increasing prevalence and mortality rate from the above-mentioned disorders can be either managed or reduced by providing proper treatment using pacemakers, thereby leading to an increased demand for the device. Therefore, the afore-said factor will propel the overall Pacemakers Market in the upcoming years. However, product recalls and failures due to safety issues and the high cost of pacemakers may act as a restraint in the growth of the pacemakers market.

Pacemakers Market Segment Analysis

Pacemakers Market By Implantability (Implantable Pacemaker [Single-Chamber Pacemaker, Dual-Chamber Pacemaker, and Biventricular/CRT Pacemaker], and External Pacemaker), Device Type (MRI Compatible Pacemaker and Leadless MRI Compatible Pacemaker), End-User (Hospitals, Ambulatory Surgical Centres, and Others), and Geography (North America, Europe, Asia-Pacific, and Rest of the World).

In the implantability segment of the pacemakers market, the dual-chamber pacemaker under the implantable pacemaker category is expected to hold the largest share in the market and this trend is expected to continue during the forecast period. This can be attributed to the wide applicability, properties, technical advantages, and increasing product development activities such as collaborations and regulatory approvals of dual-chamber pacemakers during the given forecast period.

Dual-chamber (DDD) pacemakers have two leads, one in the right atrium and one in the right ventricle, each capable of sensing intrinsic electrical activity to determine the need for pacing in each chamber. The dual chamber pacemakers stimulate both the right atrium and the right ventricle. Also, dual-chamber pacing reduces the risk of atrial fibrillation, reduces signs and symptoms of heart failure, and slightly improves the quality of life. Overall, dual-chamber pacing offers significant improvement as compared with ventricular pacing.

The dual-chamber pacemaker also resembles cardiac physiology more closely by maintaining atrioventricular (AV) synchrony and dominance of the sinus node, which in turn may reduce cardiovascular morbidity and mortality thus contributing to patient survival and quality of life. In January 2022, Medtronic received approval from Japan's Ministry of Health, Labor, and Welfare for the sale and reimbursement of the Micra™ AV Transcatheter Pacing System (TPS). Micra Tv is a dual-chamber pacemaker. Thus, the above-mentioned factors are likely to propel the demand for dual-chamber pacemakers, thereby contributing to the growth of the pacemakers market during the forecast period from 2024-2030.

Pacemakers Market Size is anticipated to be dominated by North America

North America is expected to dominate the overall Pacemakers market during the forecast period. This domination is due to the increasing prevalence of cardiovascular diseases, rising geriatric population base prone to CVDs, and increasing product launches and approvals, among others which will propel the Pacemakers Market in the United States. The Centers for Disease Control and Prevention (CDC) 2022, estimated that about 20.1 million adults aged 20 and older had Coronary artery disease (CAD) in the US, in 2020.

Also, the same source stated that in the United States, someone has a heart attack every 40 seconds. Every year, about 805,000 people in the United States have a heart attack. Out of these, 605,000 are a first heart attack, 200,000 happen to people who have already had a heart attack and about 1 in 5 heart attacks are silent—the damage is done, but the person is not aware of it. The increasing approvals by the US FDA will also impact the market for pacemakers in the upcoming years. For instance, in April 2022, Abbott announced that the US Food and Drug Administration (FDA) approved the Aveir™ single-chamber (VR) leadless pacemaker for the treatment of patients in the US with slow heart rhythms. Thus, the above-mentioned factors are likely to propel the growth of the pacemakers market in the region during the forecast period from 2024-2030.

Who are the major players in Pacemakers?

The following are the leading companies in Pacemakers. These companies collectively hold the largest Pacemakers market share and dictate industry trends.

- Medtronic, Inc.

- St. Jude Medical Inc.

- Boston Scientific Corporation

- Biotronik SE & Co. KG

- LivaNova PLC

- Shree Pacetronix Ltd.

- OSCOR Inc.

- MEDICO S.p.A.

- Lepu Medical Technology Co. Ltd.

- MicroPort Scientific Corporation

Recent Developments and Activities in the Pacemakers Treatment Market

- On September 17, 2024, Boston Scientific Corporation received U.S. Food and Drug Administration (FDA) approval to expand the indication for the current-generation INGEVITY™+ Pacing Leads, which are thin wires placed inside the heart and connected to an implantable device. The approval now includes conduction system pacing (CSP) and sensing of the left bundle branch area (LBBA) when connected to a single- or dual-chamber pacemaker.

Key Takeaways from the Pacemakers Market Report Study

- Market size analysis for current market size (2023), and market forecast for 5 years (2025-2032)

- The effect of the COVID-19 pandemic on this market is significant. Our experts are closely watching the Pacemakers market to capture and analyze suitable indicators.

- Top key product/services/technology developments, mergers, acquisitions, partnerships, and joint ventures happened for the last 3 years

- Key companies dominating the Global Pacemakers Market.

- Various opportunities are available for the other competitor in the Pacemakers Market space.

- What are the top-performing segments in 2024? How these segments will perform in 2032?

- Which are the top-performing regions and countries in the current market scenario?

- Which are the regions and countries where companies should have concentrated on opportunities for Pacemakers market growth in the coming future?

Target Audience who can be benefited from this Pacemakers Market Report Study

- Pacemakers providers

- Research organizations and consulting Pacemakers Companies

- Pacemaker-related organizations, associations, forums, and other alliances

- Government and corporate offices

- Start-up companies, venture capitalists, and private equity firms

- Distributors and Traders in Pacemakers

- Various end-users want to know more about the Pacemakers Market and the latest technological developments in the Pacemakers market.

Stay updated with us for Recent Articles