Pancreatic Cancer Market

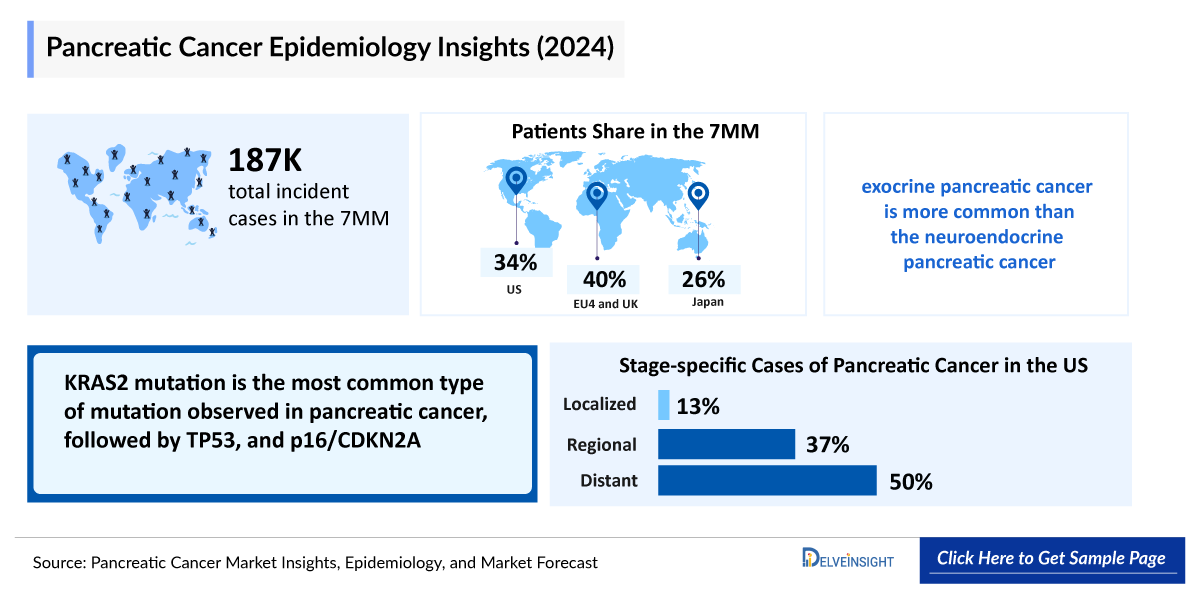

- Pancreatic cancer is one of the most lethal cancers throughout the globe and majorly affects men compared to women. Pancreatic cancer types can be divided into two larger categories: exocrine pancreatic cancer, which includes adenocarcinoma, and neuroendocrine pancreatic cancer.

- The United States accounts for the largest market size (around 50%) of pancreatic cancer, in comparison to EU4 (Germany, Spain, Italy, France), the United Kingdom, and Japan.

- Among the approved therapies, LYNPARZA (olaparib) is expected to garner the highest market share in the United States.

- For pancreatic cancer patients showing BRCA mutations, LYNPARZA (olaparib) was approved by the US FDA in 2019. VITRAKVI (larotrectinib) and ROZLYTREK (entrectinib) are approved for solid tumor patients having NTRK gene expression. Other than these, KEYTRUDA (pembrolizumab) is approved for solid tumor patients having microsatellite instability-high expression.

- In January 2024, Alligator Bioscience announced positive top-line results from the OPTIMIZE-1 Phase II study of the company’s lead asset mitazalimab in first line metastatic pancreatic cancer.

- The study achieved its primary endpoint demonstrating a confirmed objective response rate (ORR) of 40.4%, an unconfirmed ORR of 50.9% and a disease control rate (DCR) of 79% in 57 evaluable patients, as per the response evaluation criteria in solid tumors.

- The development pipeline for pancreatic cancer is robust, with significant involvement from key players like Alligator Bioscience, Actuate Therapeutics, and other companies advancing into mid-stage clinical trials.

- Among the 7MM, the United States had the highest incident cases of pancreatic cancer in 2023, representing approximately 35% of the total incident cases, while Japan had the second highest number of cases with nearly 25% of the total cases.

Request for unlocking the CAGR of the Pancreatic Cancer Drugs Market

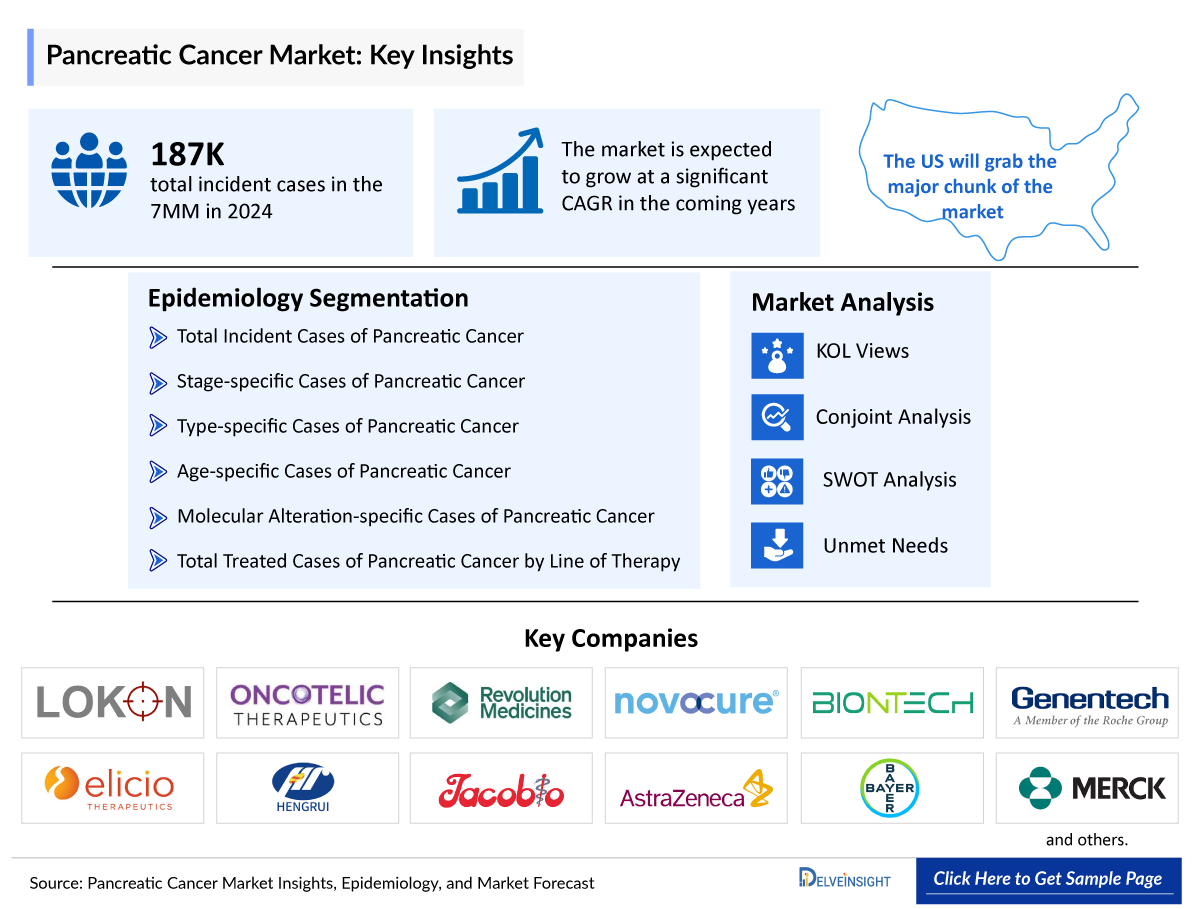

DelveInsight's “Pancreatic Cancer Market Insights, Epidemiology and Market Forecast – 2034” report delivers an in-depth understanding of pancreatic cancer, historical and forecasted epidemiology as well as the pancreatic cancer market trends in the United States, EU4 (Germany, Spain, Italy, and France) and the United Kingdom, and Japan.

Pancreatic cancer market report provides real-world prescription pattern analysis, emerging drugs, market share of individual therapies, and historical and forecasted 7MM pancreatic cancer market size from 2020 to 2034. The report also covers current pancreatic cancer treatment practices/algorithms and unmet medical needs to curate the best opportunities and assess the market’s underlying potential.

Explore More Insights of this Report @ LYNPARZA Market

|

Study Period |

2020 to 2034 |

|

Forecast Period |

2024-2034 |

|

Geographies Covered |

The US, EU4 (Germany, France, Italy, and Spain) and UK, Japan |

|

Pancreatic Cancer Market |

|

|

Pancreatic Cancer Market Size | |

|

Pancreatic Cancer Companies |

AstraZeneca, Merck Sharp & Dohme LLC, Bayer, Roche, Celgene, Bristol Myers Squibb, BioLineRx, Alligator Bioscience, Bellicum Pharmaceuticals, OSE Immunotherapeutics, Actuate Therapeutics, FibroGen, NeoImmuneTech, NOXXON Pharma, Silenseed Ltd., Amgen, NGM Biopharmaceuticals, Merus, Mirati Therapeutics, Rexahn Pharmaceuticals, Ocuphire Pharma, Processa Pharmaceuticals, ImmunityBio, Berg, Panbela Therapeutics, GlaxoSmithKline, Eleison Pharmaceuticals, Molecular Templates, Lokon Pharma AB, Cantargia AB, Bristol-Myers Squibb, and others. |

|

Pancreatic Cancer Epidemiology Segmentation |

|

Key Factors Driving the Growth of the Pancreatic Cancer Market

Rising Pancreatic Cancer Incidence

Increasing incidence rates of pancreatic cancer globally, driven by the aging population and rising prevalence of risk factors such as obesity, diabetes, smoking, and alcohol consumption, are driving the pancreatic cancer market. According to DelveInsight’s analysis, the total number of incident cases of pancreatic cancer in the US was ~63K in 2024. These numbers are further expected to increase by 2034.

Role of Immune Checkpoint Inhibitors in PDAC

The potential of immune checkpoint inhibitors, such as anti-PD-1/PD-L1 therapies, is being explored in PDAC. Clinical trials combining immunotherapy with other treatment modalities (e.g., chemotherapy, radiation, or targeted therapies) may increase efficacy and open new treatment pathways.

Advancing Precision Medicine for Pancreatic Cancer

Novel strategies, including RAS-directed therapies and advanced immunotherapies, are being developed to more effectively tackle pancreatic cancer. These approaches offer hope for improved survival and quality of life by targeting cancer more precisely.

Advancing PDAC Treatment Through Targeted and Combination Approaches

The development of new targeted therapies, such as KRAS inhibitors (like Daraxonrasib) or epigenetic modulators, provides an opportunity to treat PDAC based on specific genetic mutations or tumor characteristics. Additionally, combination therapies, which pair existing treatments with newer agents, offer an opportunity to overcome resistance and enhance therapeutic effectiveness.

Emergence of Novel Pancreatic Cancer Drugs

The pancreatic cancer treatment pipeline for metastatic or unresectable pancreatic cancer includes LOAd703 (Lokon Pharma), OT-101 (Oncotelic), Daraxonrasib (Revolution Medicines) (first-line treatment), and Optune (Novocure). In the adjuvant or neoadjuvant setting, therapies under development include Daraxonrasib for resectable PDAC, BNT122 (BioNTech and Genentech), and ELI-002 (Elicio Therapeutics) for patients with high relapse-risk mKRAS+ PDAC.

Emerging KRAS-Targeted Therapies in Pancreatic Cancer

There are multiple KRAS-targeting drugs in development for pancreatic cancer, including HRS-4642 (Jiangsu Hengrui Pharmaceuticals) (with gemcitabine/nab-paclitaxel) for neoadjuvant/adjuvant use, TSN1611 (Tyligand Pharmaceuticals (Suzhou)) for KRAS G12D-mutated tumors, Glecirasib (Jacobio Pharmaceuticals) (JAB-21822) for KRAS G12C-mutated advanced cancers, and others.

Pancreatic Cancer Treatment Market

Pancreatic Cancer Overview, Country-Specific Treatment Guidelines and Diagnosis

Pancreatic cancer begins in the tissues of the pancreas – an organ in the abdomen that lies behind the lower part of the stomach. The pancreas release enzymes that aid digestion and produces hormones that help manage blood sugar. Pancreatic cancer is a disease in which malignant (cancer) cells form in the tissues of the pancreas. Several types of growth can occur in the pancreas, including cancerous and noncancerous tumors. The most common type of cancer that forms in the pancreas begins in the cells that line the ducts that carry digestive enzymes out of the pancreas (pancreatic ductal adenocarcinoma).

Diagnosing pancreatic cancer involves a medical history review, physical examination, and imaging tests like CT scan, MRI, and endoscopic ultrasound. Biopsy procedures such as fine needle aspiration (FNA) or surgical biopsy confirm cancer presence. Blood tests and additional imaging like PET scan may also be used to assess cancer spread and guide treatment decisions.

The pancreatic cancer report provides an overview of pancreatic cancer pathophysiology, diagnostic approaches, and detailed treatment algorithm along with a real-world scenario of a patient’s journey beginning from the first symptom, the time taken for diagnosis to the entire treatment process.

Further details related to country-based variations in diagnosis are provided in the report

For More Insights @ VITRAKVI Market

Pancreatic Cancer Treatment

About 20% of people diagnosed with pancreatic cancer can have surgery because most pancreatic cancers are found after the disease has already spread. Surgery for pancreatic cancer may be combined with systemic therapy and/or radiation therapy. Typically, these additional treatments are given after surgery, which is called adjuvant therapy. However, systemic therapy and/or radiation therapy may sometimes be used before surgery to shrink a tumor, and this is called neoadjuvant therapy or preoperative therapy.

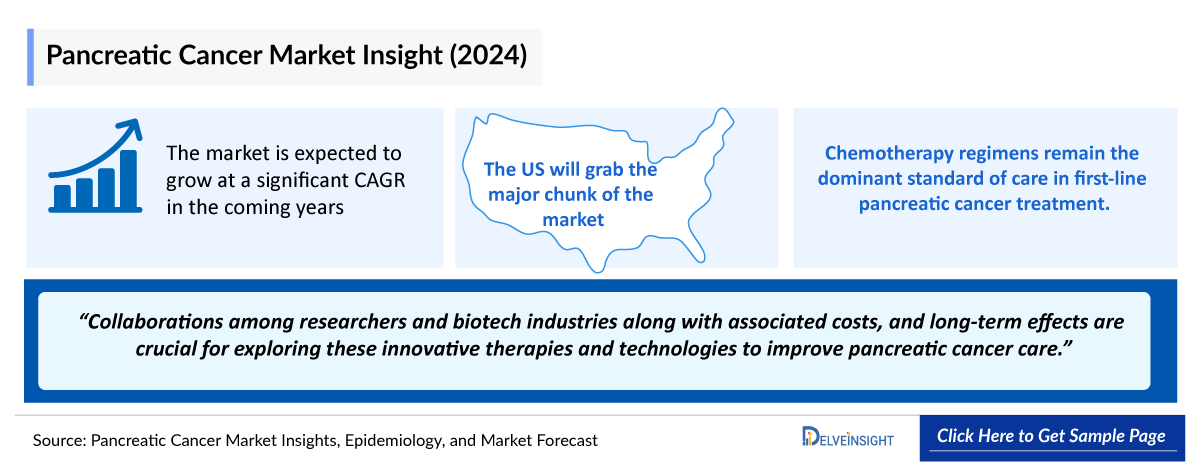

The chemotherapy drugs used for the treatment of pancreatic cancer include XELODA (capecitabine), 5-FU (fluorouracil), GEMZAR (gemcitabine), CAMPTOSAR (irinotecan), and others.

Targeted therapies such as TARCEVA (erlotinib) was approved by the FDA for people with advanced pancreatic cancer in combination with the chemotherapy drug gemcitabine. Another drug, LYNPARZA (olaparib) is approved for people with metastatic pancreatic cancer associated with a germline (hereditary) BRCA mutation.

Read More Insights of this report @ ROZLYTREK Market

Pancreatic Cancer Epidemiology

The pancreatic cancer epidemiology chapter in the report provides historical as well as forecasted in the 7MM covering the United States, EU4 countries (Germany, France, Italy, and Spain), the United Kingdom, and Japan from 2024 to 2034. The pancreatic cancer epidemiology is segmented with detailed insights into Total Incident Cases, Molecular Alteration-specific, and Stage-specific Cases of Pancreatic Cancer.

- As per DelveInsight's estimates, total incident cases of pancreatic cancer in the United States was around 35% cases in 2023.

- The analysis from 2023 suggests that the stage-specific incident cases of pancreatic cancer in the US were maximum for distant, with nearly 50% cases, followed by regional and localized cases.

- The mutation types involved in pancreatic cancer include, KRAS2, TP53, SMAD4/DPC4, BRCA1/2, MSI-H/dMMR, and NTRK. In the United States, KRAS2 and TP53 accounted for the highest number of incident cases of pancreatic cancer in 2023.

- Among EU4 and the UK, the highest number of incident cases of pancreatic cancer was observed in the Germany in 2023, which is followed by France.

Explore the latest insights and forecasts on the Pancreatic Cancer Market to stay ahead in healthcare innovation. Dive into our comprehensive report now @ Pancreatic Cancer Prevalence

Pancreatic Cancer Recent Developments

- In May 2025, UTR Therapeutics Inc. announced the submission of an IND application to the FDA for UTRxM1-18, a novel therapy designed to target c-MYC driven cancers, including triple-negative breast, pancreatic, colorectal, and ovarian cancers. Leveraging its 3’UTR engineering platform, UTRxM1-18 selectively degrades cancer-specific transcripts while sparing healthy cells. In preclinical studies, the drug showed strong, dose-dependent efficacy across tumor types with no dose-limiting toxicities.

- In April 2025, Verastem Oncology received FDA clearance for its IND application of VS-7375, an oral KRAS G12D (ON/OFF) inhibitor, and plans to begin a Phase 1/2a study by mid-year targeting advanced solid tumors including pancreatic, colorectal, and non-small cell lung cancers.

- In March 2025, Boan Biotechnology (06955.HK) announced that its targeted CD228 antibody-drug conjugate, BA1302, received orphan drug designation (ODD) from the U.S. Food and Drug Administration (FDA) for squamous non-small cell lung cancer and pancreatic cancer.

- In February 2025, Alligator Bioscience announced the successful completion of its End of Phase 2 (EOP2) interaction with the FDA, paving the way for a Phase 3 trial in 2025. The trial will test mitazalimab as a first-line treatment for metastatic pancreatic cancer in combination with mFOLFIRINOX.

- In February 2025, Alpha Tau Medical Ltd. announced FDA approval of an Investigational Device Exemption (IDE) supplement for its Alpha DaRT® cancer therapy. This approval expands a clinical study, initially approved in January 2025, to include a broader group of pancreatic cancer patients, exploring the combination of Alpha DaRT and first-line chemotherapy.

- In January 2025, the FDA granted Fast Track Designation to LOAd703, an oncolytic adenovirus with transgenes encoding 4-1BBL and TMZ-CD40L, for the potential treatment of pancreatic cancer. LOAd703 is currently being evaluated in the Phase 1/2 LOKON001 trial, assessing its safety and feasibility in combination with chemotherapy for patients with unresectable or metastatic advanced PDAC.

- In January 2025, Elicio Therapeutics, Inc.announced it received supportive feedback from the U.S. FDA in an End of Phase 1 Type B meeting regarding the registrational strategy for ELI-002. Based on the feedback, Elicio plans to file a Biologics License Application (BLA), contingent on results from a planned Phase 3 trial.

- On October 16, 2024, SONIRE Therapeutics announced that its next-generation High-Intensity Focused Ultrasound (HIFU) therapy system has been designated as a breakthrough device by the FDA for treating pancreatic cancer.

- On September 20, 2024, Amplia Therapeutics announced that the FDA granted Fast Track Designation for its Focal Adhesion Kinase inhibitor, narmafotinib, aimed at treating advanced pancreatic cancer. This designation will expedite the drug’s development, offering Amplia more frequent communication and meetings with the FDA to accelerate patient access.

- On November 21, 2024, NETRIS Pharma announced that the FDA granted Orphan Drug Designation (ODD) to NP137 for the treatment of pancreatic cancer.

Pancreatic Cancer Drug Chapters

The drug chapter segment of the pancreatic cancer report encloses a detailed analysis of pancreatic cancer marketed drugs and late-stage (Phase III and Phase II) pipeline drugs. It also deep dives into the pancreatic cancer pivotal clinical trial details, recent and expected market approvals, patent details, the latest news, and recent deals and collaborations.

Pancreatic Cancer Marketed Drugs

LYNPARZA (olaparib): AstraZeneca

LYNPARZA (olaparib) is a first-in-class PARP inhibitor and the first targeted treatment to block DNA damage response (DDR) in cells/tumors harboring a deficiency in homologous recombination repair, such as mutations in BRCA1 and/or BRCA2. In December 2019, AstraZeneca announced that LYNPARZA (olaparib) had been approved in the US for the maintenance treatment of adult patients with deleterious or suspected deleterious germline BRCA-mutated (gBRCAm) metastatic pancreatic adenocarcinoma (pancreatic cancer) whose disease has not progressed on at least 16 weeks of a first-line platinum-based chemotherapy regimen.

KEYTRUDA (pembrolizumab): Merck Sharp & Dohme

KEYTRUDA (pembrolizumab) is an anti-programmed death receptor-1 (PD-1) therapy that works upon increasing the ability of the body’s immune system to help detect and fight tumor cells. In May 2017, Merck announced that the US FDA had approved KEYTRUDA (pembrolizumab) to treat adult and pediatric patients with unrespectable or metastatic, microsatellite instability-high (MSI-H) or mismatch repair deficient solid tumors that have progressed following prior treatment and who have no satisfactory alternative treatment options.

Get More Insights of this report @ KEYTRUDA Market

|

Drugs |

Company |

MOA |

ROA |

Approval |

|

LYNPARZA (olaparib) |

AstraZeneca |

Selective competitive inhibitor of NAD+ at the catalytic site of PARP1 and PARP2 |

Oral |

US: December 2019 EU: July 2020 JP: December 2020 |

|

KEYTRUDA (pembrolizumab) |

Merck Sharp & Dohme |

PD-1/PD-L1 Inhibitor |

Intravenous |

US: May 2017 EU: April 2022 JP: December 2018 |

|

Vitrakvi (larotrectinib) |

Bayer |

TrkA receptor antagonists |

Oral |

US: November 2018 EU: September 2019 JP: March 2021 |

Note: Detailed marketed therapies assessment will be provided in the final report.

Pancreatic Cancer Emerging Drugs

Mitazalimab (ADC-1013): Alligator Bioscience

Mitazalimab (previously ADC-1013) is an agonistic or stimulatory antibody that targets CD40, a receptor in the dendritic cells of the immune system, which are the cells that detect enemies such as cancer cells. Alligator recently reported top-line data from the clinical Phase II study with mitazalimab for the treatment of first-line metastatic pancreatic cancer, a disease well known for its poor prognosis and is on track to start its pivotal Phase III in 2025. In 2023, mitazalimab received Orphan Drug Designation in pancreatic cancer from the US FDA and Orphan Designation from the European Medicines Agency (EMA).

Elraglusib (9 ING 41): Actuate Therapeutics

Elraglusib (a novel GSK-3 inhibitor) targets multiple molecular pathways in cancer that promote tumor growth and resistance to conventional cancer drugs such as chemotherapy. It is also emerging as a mediator of anti-tumor immunity through the inhibition of multiple immune checkpoints and the regulation of immune cell function. In August 2021, Actuate Therapeutics announced FDA Fast Track Designation for 9-ING-41 in the treatment of pancreatic cancer.

Note: Detailed emerging therapies assessment will be provided in the final report.

Pancreatic Cancer Market Outlook

- Key players, such as Alligator Bioscience, Actuate Therapeutics, and others are evaluating their lead candidates in different stages of clinical development, respectively. They aim to investigate their products for the treatment of pancreatic cancer.

- The United States accounted for nearly 50% of the total market size among the 7MM in 2023.

- By 2034, LYNPARZA (olaparib) is anticipated to achieve the prominent market share in the 7 major markets.

- Japan accounts for the second highest market size in the 7MM during the forecast period 2024–2034.

- The market size of pancreatic cancer is expected to rise during the forecast period, i.e., 2024–2034 due to increasing incidence rates and advancements in early diagnosis, along with the emergence of new and more effective therapies.

Pancreatic Cancer Drugs Uptake

This section focuses on the uptake rate of potential drugs expected to be launched in the market during 2024–2034, which depends on the competitive landscape, safety, and efficacy data along with order of entry. It is important to understand that the key players evaluating their novel therapies in the pivotal and confirmatory trials should remain vigilant when selecting appropriate comparators to stand the greatest chance of a positive opinion from regulatory bodies, leading to approval, smooth launch, and rapid uptake.

Further detailed analysis of emerging therapies drug uptake in the report…

Pancreatic Cancer Activities

The report provides insights into different therapeutic candidates in Phase III and Phase II stages. It also analyzes key players involved in developing targeted therapeutics.

Pipeline Development Activities

The report covers information on collaborations, acquisitions and mergers, licensing, and patent details for pancreatic cancer emerging therapies.

Discover how advancements in Pancreatic Cancer therapies are shaping the industry landscape. Gain actionable intelligence from our detailed market report today! @ Pancreatic Cancer Drugs New

KOL Views

To keep up with the real-world scenario in current and emerging market trends, we take opinions from Key Industry leaders working in the domain through primary research to fill the data gaps and validate our secondary research. Industry Experts were contacted for insights on the evolving treatment landscape, patient reliance on conventional therapies, patient therapy switching acceptability, and drug uptake along with challenges related to accessibility.

DelveInsight’s analysts connected with 20+ KOLs to gather insights; however, interviews were conducted with 10+ KOLs in the 7MM. Centers such as Duke University School of Medicine, Gustave Roussy Institute of Oncology, Heidelberg University Hospital, the University of Texas MD Anderson Cancer Center, etc., were contacted. Their opinion helps understand and validate current and emerging treatment patterns of pancreatic cancer. This will support the clients in potential upcoming novel treatments by identifying the overall scenario of the market and the unmet needs.

|

Region |

KOL Views |

|

United States |

“About 90% of the patients have KRAS mutations, with 12 direct variable repeat, being the most common. However, in the targeted therapy realm, about 20% to 25% can’t have targetable mutations. There are MSI—high 1%, you can have FGFR, or some fusions.” |

|

France |

‘Vaccines are being developed to enhance the immune response by making high quality T-cells. Vaccines can be made for the protein/antigens in the cancer cells. These vaccine can be made so that the expression of different antigens on the tumors can be enhanced and get detected by the immune system. These therapies in combination with immune modulators such as anti PD-L1, anti CTLA4 and others are being studies. Vaccines as a monotherapy have shown to be less effective as compared when give in the combination and tumor shrinkage has been seen in such cases.” |

Qualitative Analysis

We perform Qualitative and market Intelligence analysis using various approaches, such as SWOT analysis and Conjoint Analysis. In the SWOT analysis, strengths, weaknesses, opportunities, and threats in terms of gaps in disease diagnosis, patient awareness, physician acceptability, competitive landscape, cost-effectiveness, and geographical accessibility of therapies are provided.

Conjoint Analysis analyzes multiple approved and emerging therapies based on relevant attributes such as safety, efficacy, frequency of administration, route of administration, and order of entry. Scoring is given based on these parameters to analyze the effectiveness of therapy.

In efficacy, the trial’s primary and secondary outcome measures are evaluated. One of the most important primary endpoints were overall survival (OS), progression-free survival (PFS), and overall response rate (ORR).

Further, the therapies’ safety is evaluated wherein the acceptability, tolerability, and adverse events are majorly observed, and it sets a clear understanding of the side effects posed by the drug in the trials. In addition, the scoring is also based on the probability of success, and the addressable patient pool for each therapy. According to these parameters, the final weightage score and the ranking of the emerging therapies are decided.

Market Access and Reimbursement

LYNPARZA (olaparib)

Medicare covers 100% of medicare prescription drug plans, and in the post-deductible stage, the patient needs to pay their co-pay part, and their plan will cover the rest of the drug cost. The co-pay part which needs to be paid by the patient ranges from USD 28 to USD 129.

KEYTRUDA (pembrolizumab)

Patients with Medicare may or may not have to pay a portion of the cost of KEYTRUDA (pembrolizumab) based on their insurance plan. For example, with a Medicare Advantage plan, 41% of patients had no out-of-pocket costs for the 200 mg dose of KEYTRUDA. Roughly 80% of patients responsible for a portion of the cost paid between USD 0 and USD 925 per infusion after meeting their deductible. Most patients with Medicaid typically pay USD 4–USD 8 per KEYTRUDA infusion. The co-pay part which needs to be paid by the patient ranges from USD 12,045.

The report further provides detailed insights on the country-wise accessibility and reimbursement scenarios, cost-effectiveness scenario of currently used therapies, programs making accessibility easier and out-of-pocket costs more affordable, insights on patients insured under federal or state government prescription drug programs, etc.

Scope of the Report

- The report covers a segment of key events, an executive summary, descriptive overview of pancreatic cancer, explaining its causes, signs and symptoms, pathogenesis, and currently available therapies.

- Comprehensive insight has been provided into the epidemiology segments and forecasts, the future growth potential of diagnosis rate, and disease progression along with country specific treatment guidelines.

- Additionally, an all-inclusive account of both the current and emerging therapies, along with the elaborative profiles of late-stage and prominent therapies, will have an impact on the current treatment landscape.

- A detailed review of the pancreatic cancer market, historical and forecasted market size, market share by therapies, detailed assumptions, and rationale behind our approach is included in the report, covering the 7MM drug outreach.

- The report provides an edge while developing business strategies, by understanding trends, through SWOT analysis and expert insights/KOL views, patient journey, and treatment preferences that help in shaping and driving the 7MM pancreatic cancer market.

Pancreatic Cancer Report Insights

- Pancreatic Cancer Patient Population

- Pancreatic Cancer Therapeutic Approaches

- Pancreatic Cancer Pipeline Analysis

- Pancreatic Cancer Market Size and Trends

- Existing and Future Market Opportunity

Pancreatic Cancer Report Key Strengths

- Eleven-year Forecast

- 7MM Coverage

- Pancreatic Cancer Epidemiology Segmentation

- Inclusion of Country Specific Treatment Guidelines

- KOL’s Feedback On Approved and Emerging Therapies

- Key Cross Competition

- Conjoint Analysis

- Pancreatic Cancer Drugs Uptake

- Key Pancreatic Cancer Market Forecast Assumptions

Pancreatic Cancer Report Assessment

- Current Pancreatic Cancer Treatment Practices

- Pancreatic Cancer Unmet Needs

- Pipeline Product Profiles

- Pancreatic Cancer Market Attractiveness

- Qualitative Analysis (SWOT and Conjoint Analysis)

- Pancreatic Cancer Market Drivers

- Pancreatic Cancer Market Barriers

FAQs

- What is the growth rate of the 7MM pancreatic cancer treatment market?

- What was the pancreatic cancer total market size, the market size by therapies, market share (%) distribution in 2020, and what would it look like in 2034? What are the contributing factors/key catalysts for this growth?

- Is there any unexplored patient setting that can open the window for growth in the future?

- What are the pricing variations among different geographies for approved and off-label therapies?

- How would the market drivers, barriers, and future opportunities affect the market dynamics and subsequent analysis of the associated trends?

- What are the current and emerging options for the treatment of pancreatic cancer?

- How many companies are developing therapies for the treatment of pancreatic cancer?

- What are the recent novel therapies, targets, mechanisms of action, and technologies developed to overcome the limitations of existing therapies?

- Patient/physician acceptability in terms of preferred treatment options as per real-world scenarios?

- What are the country-specific accessibility issues of expensive, recently approved therapies?

Reasons to buy

- The report will help in developing business strategies by understanding the latest trends and changing treatment dynamics driving the pancreatic cancer market.

- Insights on patient burden/disease prevalence, evolution in diagnosis, and factors contributing to the change in the epidemiology of the disease during the forecast years

- Understand the existing market opportunities in varying geographies and the growth potential over the coming years.

- Distribution of historical and current patient share based on real-world prescription data along with reported sales of approved products in the US, EU4 (Germany, France, Italy, and Spain), the United Kingdom, and Japan.

- Identifying strong upcoming players in the market will help devise strategies to help get ahead of competitors.

- Detailed analysis and ranking of class-wise potential current and emerging therapies under the conjoint analysis section to provide visibility around leading classes.

- Highlights of access and reimbursement policies of approved therapies, barriers to accessibility of expensive off-label therapies, and patient assistance programs.

- To understand Key Opinion Leaders’ perspectives around the accessibility, acceptability, and compliance-related challenges of existing treatment to overcome barriers in the future.

- Detailed insights on the unmet needs of the existing market so that the upcoming players can strengthen their development and launch strategy.

Stay Updated with us for new articles:-

- Ipsen’s Onivyde Combo Ends a Decade-Long Dry Spell in Newly Diagnosed Pancreatic Cancer

- Ipsen’s Cabometyx Rejected by NICE; Vertex and CRISPR Therapeutics’s Submit BLA to the FDA for exa-cel; Orphan Drug Designation to Osemitamab for Pancreatic Cancer; FDA Clears Keytruda/Padcev for Bladder and Urothelial Cancer; Cingulate Completes Trial of CTx-1301 for ADHD; Nuance Pharma Announces Dosing of First Patient in ENHANCE Trial

- Treatment to Clinical Development – A Bumpy Journey for Pancreatic Cancer

- Alcon to acquire Ivantis; Philips to takeover Cardiologs; Flunked cancer drug progresses in I-O in pancreatic cancer models; Indigo system CAT RX catheter meets primary endpoint in trial

- Verily - Janssen collaboration; Enhancing the response in pancreatic cancer; Avrobio gene therapy eradicates toxic substrate; Gut microbiome responsible for Multiple Sclerosis

- FDA authorizes first diagnostic test for Covid-19 antibodies; EGenesis's collaboration with Duke; Pancreatic Cancer research updates; Decibel scores $ 82 M

- Incyte meets endpoint in second atopic dermatitis trial; NeoTX lands USD 45 M series C; Five Prime Therapeutics’ pancreatic cancer a bust

- J&J collaborates with BARDA; Virus kills pancreatic cancer cells; ALX raises USD 105 million for CD47 drug

- Metastatic Pancreatic Cancer Market Size: Emerging therapies, Unmet needs and Forecast analysis

- Pancreatic Cancer Treatment to Stride Beyond Chemotherapy

- Pancreatic Cancer Market: Infographics

Learn about emerging trends and key players driving the Pancreatic Cancer market. Access our in-depth analysis to strategize for future growth @ Latest DelveInsight Blogs

-pipeline.png&w=256&q=75)