Pulmonary Aterial Hypertension Market Summary

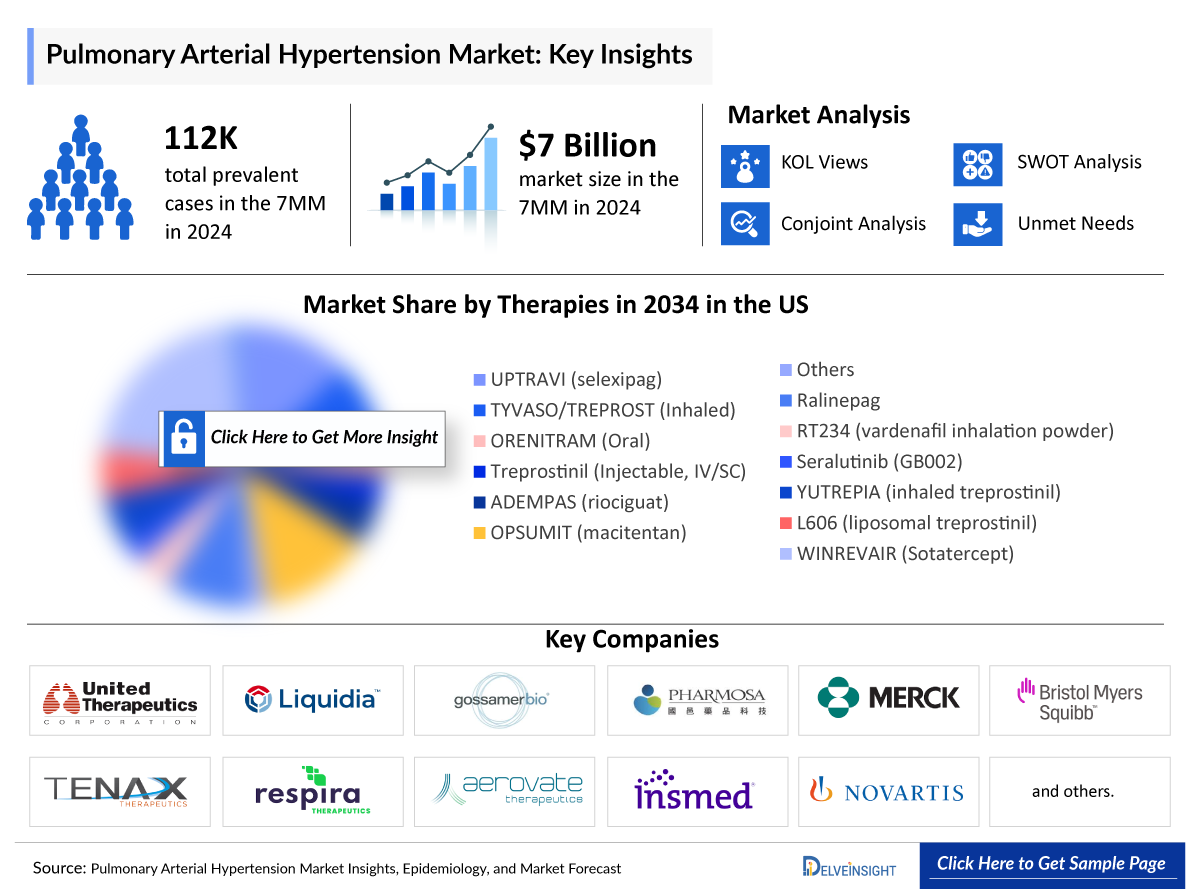

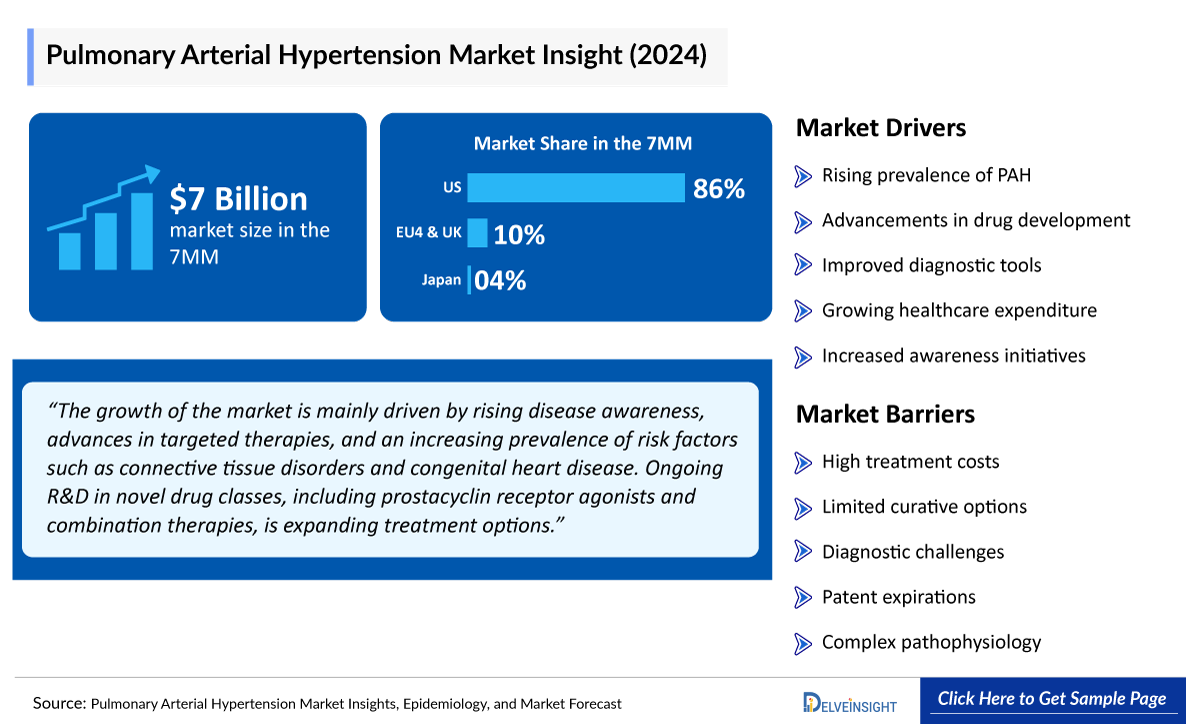

- The Pulmonary Aterial Hypertension Market in the 7MM was valued at approximately USD 6,971 million in 2025 over the forecast period from 2024 to 2034.

- The Pulmonary Aterial Hypertension Market is projected to grow at a CAGR of 6.3% by 2034 in leading countries like US, EU4, UK and Japan.

Pulmonary Aterial Hypertension Market and Epidemiology Analysis

- Pulmonary Arterial Hypertension is a rare, progressive disorder characterized by hypertension in the pulmonary arteries for no apparent reason.

- Pulmonary Arterial Hypertension is classified by the WHO into the following types: idiopathic PAH (IPAH), heritable PAH (HPAH), drug- and toxin-induced PAH, and PAH associated with other diseases and disorders.

- The exact cause of PAH is unknown, but in HPAH, an autosomal dominant genetic condition, mutations in the BMPR2 gene are the most common cause.

- PAH leads to disruption in one or more of three key pathways: nitric oxide (NO), prostacyclin (PGI2), thromboxane A2 (TXA2), and endothelin-1 (ET-1) leading to vasoconstriction, increased smooth muscle cell formation, inflammation, and thrombosis.

- Symptoms usually go unnoticed and may be present for up to 2 or 3 years before a diagnosis is made, often leading to misdiagnosis or a delay in early-stage diagnosis.

- Treatment of patients with PAH is based on a patient's vasoreactivity test and functional capacity as determined by the WHO functional capacity classification. The goal is to increase vasodilation of the pulmonary vasculature and decrease PAP to increase CO.

- Individuals with PAH who respond to a vasoreactivity test performed during their RHC are treated with calcium channel blockers (CCB) such as nifedipine, diltiazem, and amlodipine.

- The marketed therapies approved for the Pulmonary Arterial Hypertension Treatment across various WHO Functional Classes (FC) include Johnson & Johnson/Nippon Shinyaku’s UPTRAVI (selexipag) and OPSUMIT (macitentan), United Therapeutics and Mochida Pharmaceutical’s TYVASO (treprostinil, Inhaled), United Therapeutics’ ORENITRAM (treprostinil), Sotatercept (MK-7962) (Merck/Bristol Myers Squibb), and Bayer/Merck’s ADEMPAS (riociguat).

- Other Pulmonary Arterial Hypertension Pipeline Therapies that were approved but have their generics in the market include REVATIO (sildenafil), ADCIRCA (tadalafil), LETAIRIS/VOLIBRIS (ambrisentan), VENTAVIS (iloprost), TRACLEER (bosentan), BERAPROST (TRK-100), and VELETRI (epoprostenol).

- Recently, a combination therapy of macitentan and tadalafil (OPSYNVI) received approval in May 2024.

- The Pulmonary Arterial Hypertension Treatment Market Size in the 7MM is anticipated to grow and increase by 2034 from ~USD 7,000 million in 2024, during the study period (2020–2034).

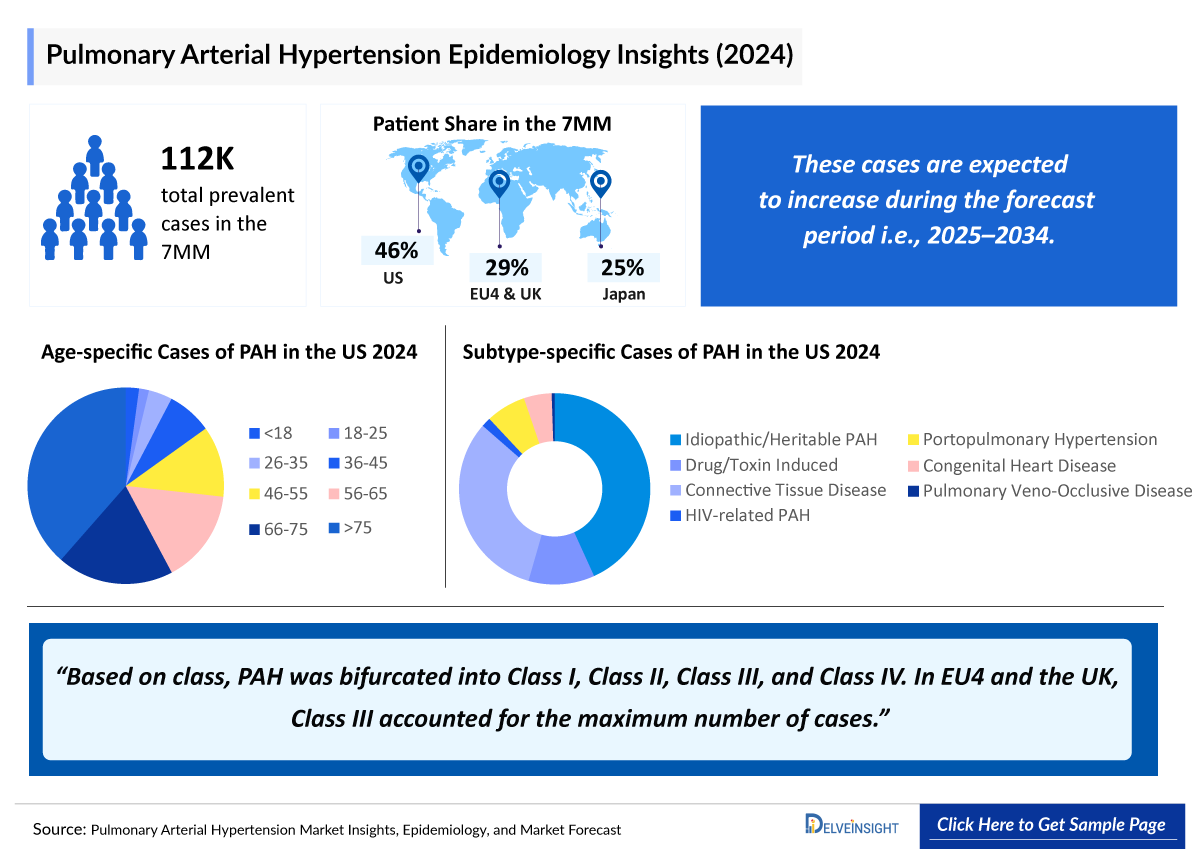

- According to DelveInsight’s estimates, the Pulmonary Arterial Hypertension Prevalent Cases in the 7MM were estimated to be around 112,500 cases in 2024, which are expected to increase by 2034.

- In 2024, the Pulmonary Arterial Hypertension Diagnosed Cases in the US were 43,000 which as per DelveInsight’s estimates, are expected to increase by 2034.

Pulmonary Aterial Hypertension Market size and forecast

- 2025 Market Size: USD 6,971 million in 2025

- Growth Rate (2025-2032): 6.3% CAGR

- Largest Market: United States

Request for Unlocking the Sample Page of the "Pulmonary Arterial Hypertension Treatment Market"

Pulmonary Arterial Hypertension Medicine Market Report Summary

- The Pulmonary Arterial Hypertension Market Report offers extensive knowledge regarding the epidemiology segments and predictions, presenting a deep understanding of the potential future growth in diagnosis rates, disease progression, and treatment guidelines. It provides comprehensive insights into these aspects, enabling a thorough assessment of the subject matter.

- Additionally, an all-inclusive account of the current management techniques and Pulmonary Arterial Hypertension emerging therapies and the elaborative profiles of late-stage (Phase III and Phase II) and prominent therapies that would impact the current Pulmonary Arterial Hypertension Treatment Market Landscape and result in an overall market shift has been provided in the report.

- The report also encompasses a comprehensive analysis of the Pulmonary Arterial Hypertension Treatment Market, providing an in-depth examination of its historical and projected market size (2020–2034). It also includes the Pulmonary Arterial Hypertension Drugs Market share of therapies, detailed assumptions, and the underlying rationale for our methodology. The report also includes drug outreach coverage in the 7MM region.

- The report includes qualitative insights that provide an edge while developing business strategies by understanding trends through SWOT analysis and expert insights/KOL views, including experts from various hospitals and prominent universities, patient journey, and treatment preferences that help shape and drive the 7MM Pulmonary Arterial Hypertension Drugs Market.

Scope of the Pulmonary Arterial Hypertension Market Report | |

|

Study Period |

2020–2034 |

|

Forecast Period |

2025–2034 |

|

Geographies Covered |

|

|

Pulmonary Arterial Hypertension Epidemiology |

Segmented by:

|

|

Pulmonary Arterial Hypertension Market |

Segmented by:

|

|

Pulmonary Arterial Hypertension Market Analysis |

|

Key Factors Impacting the Pulmonary Arterial Hypertension Market Growth

-

Pulmonary arterial hypertension burden elevating market potential

Pulmonary arterial hypertension is a rare, life-threatening cardiopulmonary disease. In the 7MM, prevalent cases were approximately 112K in 2024 and are expected to grow by 2034. This growth is driven by increasing awareness, better diagnostics, enhanced registries, and aging populations, factors that are expected to expand the PAH market and support investment in next-generation treatments.

-

Pulmonary arterial hypertension treatment modalities

PAH treatments include prostacyclins (e.g., epoprostenol), ERAs (macitentan), PDE5 inhibitors (sildenafil), sGC stimulators (riociguat), and oral prostacyclin agonists, with combination therapy common in moderate-to-severe cases. The 7MM PAH market was worth about USD 7 billion in 2024. Key therapies include J&J/Nippon Shinyaku’s UPTRAVI (selexipag) and OPSUMIT (macitentan), United Therapeutics’ TYVASO (inhaled treprostinil) and ORENITRAM (oral treprostinil), Merck/BMS’s Sotatercept (MK-7962), and Bayer/Merck’s ADEMPAS (riociguat).

-

Pulmonary arterial hypertension Pipeline diversification

The PAH treatment landscape is rapidly advancing, focusing on new pathways like anti-inflammatory agents, metabolic modulators, and BMPR2 enhancers to create more effective and patient-friendly therapies. Promising drugs such as Ralinepag (United Therapeutics), RT234 (Respira Therapeutics), and Seralutinib (Gossamer Bio) are nearing launch. Innovations like inhaled and liposomal treprostinil formulations, YUTREPIA (Liquidia Technologies), and L606 (Pharmosa Biopharm) aim to improve convenience for patients. Leading companies driving these developments include United Therapeutics, Janssen/Actelion, Bayer, GSK, Merck, Acceleron, and others.

Pulmonary Arterial Hypertension Market Outlook

Market growth is driven by rising disease awareness, advances in targeted therapies, and increasing prevalence of risk factors like connective tissue disorders and congenital heart disease. Ongoing R&D in novel drug classes, including prostacyclin receptor agonists and combination therapies, is expanding treatment options. However, challenges remain, including care concentration in sub-specialty centers, high treatment costs, and the need for long-term disease-modifying data to support premium pricing and broader adoption.

Pulmonary Arterial Hypertension Market Analysis

The leading Pulmonary Arterial Hypertension Companies such as United Therapeutics, Mochida Pharmaceutical, Johnson & Johnson, Merck, Nippon Shinyaku, and Others. The details of the country-wise and therapy-wise market size have been provided below.

- According to DelveInsight’s estimates, among the 7MM, the US had the largest Pulmonary Arterial Hypertension Market Size with USD ~ 6,000 million in 2024, followed by Japan and Germany.

- DelveInsight’s estimates indicate that within EU4 and the UK, Germany had the largest Pulmonary Arterial Hypertension Market Size with approximately USD 80 million in 2024, followed by France with USD 70 million, while Spain had the smallest Pulmonary Arterial Hypertension Treatment Market Size with USD 45 million in the same year.

- Some of the treatments expected to be launched during the forecast period (2025–2034) include ralinepag (United Therapeutics), RT234 (vardenafil inhalation powder) (Respira Therapeutics), Seralutinib (GB002) (Gossamer Bio), YUTREPIA (treprostinil) (Liquidia Technologies), and L606 (liposomal treprostinil) (Pharmosa Biopharm/Liquidia) for the Pulmonary Arterial Hypertension Treatment.

Pulmonary Arterial Hypertension Market Recent Developments and Breakthroughs

- In September 2025, AllRock Bio announced a $50 million Series A funding round, co-led by Versant Ventures and Westlake BioPartners, to advance ROC-101 into Phase 2 clinical development. ROC-101 is a first-in-class oral pan-ROCK inhibitor targeting pulmonary arterial hypertension (PAH) and pulmonary hypertension with interstitial lung disease (ILD-PH), addressing critical unmet needs in these life-threatening conditions by modulating inflammatory, proliferative, and fibrotic remodeling.

- In Aug 2025, Cereno Scientific’s lead candidate CS1 received FDA Fast Track designation for pulmonary arterial hypertension, recognizing its potential as a novel, disease-modifying treatment for this rare and serious condition.

- In July 2025, Merck announced the FDA has accepted and granted priority review for a supplemental application to update WINREVAIR™ (sotatercept-csrk) labeling. Approved in 2024 for pulmonary arterial hypertension (PAH), the update is based on Phase 3 ZENITH trial results, with a target decision date of October 25, 2025.

- In May 2025, Liquidia Corporation (NASDAQ: LQDA) announced FDA approval of YUTREPIA™ (treprostinil) inhalation powder to improve exercise ability in adults with pulmonary arterial hypertension (PAH) and pulmonary hypertension due to interstitial lung disease (PH-ILD).

- In August 2024, Liquidia Corporation (NASDAQ: LQDA) announced that the FDA has granted tentative approval for YUTREPIA™ (treprostinil) inhalation powder. This treatment is designed for adults with pulmonary arterial hypertension (PAH) and pulmonary hypertension associated with interstitial lung disease (PH-ILD). While YUTREPIA has met all FDA requirements for safety, quality, and efficacy, final approval is pending the expiration of regulatory exclusivity for a competing product.

- In August 2024, Merck announced that the European Commission approved WINREVAIR™ (sotatercept) for use in combination with other therapies to treat pulmonary arterial hypertension (PAH) in adult patients with WHO Functional Class II to III. WINREVAIR, the first activin signaling inhibitor therapy for PAH, was approved across all 27 EU member states, Iceland, Liechtenstein, and Norway. The approval is based on positive safety and efficacy results from the Phase 3 STELLAR trial.

Pulmonary Arterial Hypertension Drug Analysis

The section dedicated to drugs in the Pulmonary Arterial Hypertension Drugs Market Report provides an in-depth evaluation of late-stage pipeline drugs (Phase III and Phase II) related to Pulmonary Arterial Hypertensio pipeline drugs analysis. The drug chapters section provides valuable information on various aspects related to clinical trials of Pulmonary Arterial Hypertension, such as the pharmacological mechanisms of the drugs involved, designations, approval status, patent information, and a comprehensive analysis of the pros and cons associated with each drug. Furthermore, it presents the most recent news updates and press releases on drugs targeting Pulmonary Arterial Hypertension.

Pulmonary Arterial Hypertension Marketed Therapies

-

TYVASO/TYVASO DPI/TREPROST Inhalation Solution (treprostinil): United Therapeutics/Mochida Pharmaceutical

TYVASO (treprostinil), developed by United Therapeutics, is a drug-device combination therapy that consists of a dry powder formulation of treprostinil and a small, portable inhaler. The inhaler uses a single-dose plastic cartridge containing 1% treprostinil. This prostacyclin analog is inhaled to provide direct vasodilation, reducing pulmonary and systemic arterial pressure, decreasing right and left ventricular afterload, and improving cardiac output while also offering an antiplatelet effect.

In December 2022, the MHLW approved Mochida’s TREPROST inhalation solution 1.74 mg for the treatment of PAH in Japan (Mochida Pharmaceutical, 2022).

-

OPSYNVI/YUVANCI (macitentan and tadalafil): Johnson & Johnson

OPSYNVI (macitentan and tadalafil) is the first and only once-daily single-tablet combination therapy indicated for the chronic treatment of (PAH, WHO Group I) in adult patients of WHO Functional Class (FC) II-III. This innovative treatment combines macitentan, an Endothelin Receptor Antagonist (ERA), with tadalafil, a Phosphodiesterase type 5 (PDE5) inhibitor, to address both the underlying pathophysiology and symptoms of PAH. Macitentan works to reduce the risk of clinical worsening events and hospitalization, while tadalafil enhances exercise capacity in patients.

In March 2024, the US FDA approved OPSYNVI (macitentan and tadalafil) as the first and only once-daily single-tablet combination therapy for PAH.

|

Drug Name |

Company |

MoA |

RoA |

Molecule Type |

Approval |

|

TYVASO/ TYVASO DPI/ TREPROST (inhalation) |

United Therapeutics/ Mochida Pharmaceutical |

Prostacyclin analog (vasodilator and platelet aggregation inhibitors) |

Inhalation |

Small molecule |

US-2009: (inhalation solution) 2022: (inhalation powder) JP-2022 (inhalation solution) |

|

OPSYNVI/YUVANCI (macitentan and tadalafil) |

Johnson & Johnson |

Endothelin receptor antagonist (ERA), phosphodiesterase 5 (PDE5) inhibitor |

Oral |

Small molecule |

US-2024 EU-2024 JP-2024 |

|

WINREVAIR (sotatercept) |

Merck |

Activin inhibitors; Transforming growth factor beta inhibitors |

Subcutaneous |

Recombinant fusion proteins |

US-2024 EU-2024 |

|

UPTRAVI (selexipag) |

Johnson & Johnson/ Nippon Shinyaku |

Prostacyclin receptor agonist |

Oral and IV |

Small molecule |

US-2015 EU-2016 JP-2016 |

Pulmonary Arterial Hypertension Emerging Therapies

-

Ralinepag: United Therapeutics

Ralinepag is a novel, oral, selective, and potent prostacyclin receptor agonist being developed by United Therapeutics for the treatment of PAH. In vitro studies indicate that ralinepag has high binding affinity and selectivity at the human prostacyclin (IP) receptor. In phase II studies, ralinepag demonstrated a potential for a once-a-day dosing profile and potentially enhanced affinity compared to selexipag. United Therapeutics is currently assessing ralinepag in a Phase III ADVANCE OUTCOMES registrational study. It is a global, multicenter, placebo-controlled trial of patients on approved oral background PAH therapies, with data expected by 2025.

-

YUTREPIA (inhaled treprostinil): Liquidia Technologies

YUTREPIA (treprostinil), being developed by Liquidia Technologies, is an investigational, inhaled dry powder formulation of treprostinil delivered through a convenient, palm-sized device designed using Liquidia’s PRINT technology to enhance deep-lung delivery to treat PAH. PRINT technology enables the development of drug particles that are precise and uniform in size, shape, and composition and that are engineered for optimal deposition in the lung following oral inhalation. YUTREPIA was previously referred to as LIQ861 in investigational studies. Despite YUTREPIA’s mechanism of action not being novel, the clinical development of YUTREPIA is significant because of its less cumbersome dosing administration than the currently available PAH treatment options.

|

Drug Name |

Company |

Pulmonary Arterial Hypertension MoA |

RoA |

Molecule Type |

Phase |

|

Ralinepag |

United Therapeutics |

Selective prostacyclin receptor agonist |

Oral |

Small molecule |

III |

|

YUTREPIA (treprostinil) |

Liquidia Technologies |

Prostacyclin receptor agonist |

Inhalation |

Small molecule |

III |

|

Seralutinib (GB002) |

Gossamer Bio |

PDGFR, CSF1R, and c-KIT kinase inhibitor |

Inhalation |

Small molecule |

III |

|

L606 (liposomal treprostinil) |

Pharmosa Biopharm/ Liquidia |

DP1, EP2, and IP receptor agonists |

Inhalation |

Small molecule |

III |

Pulmonary Arterial Hypertension Market Outlook

Pulmonary Arterial Hypertension Market Outlook

Pulmonary Arterial Hypertension (PAH) is a progressive and life-threatening lung disease marked by pulmonary vascular angiopathy, leading to dyspnea, exercise intolerance, and right heart failure. While still incurable, median survival has improved from 2–3 years to over 6–10 years with the advent of targeted therapies. Current treatments aim to dilate the pulmonary vasculature, reduce resistance, and support right ventricular function. Therapy decisions are based on WHO functional class, exercise capacity, lab markers, and hemodynamic/echo data. Four key drug classes—PDE5 inhibitors, sGC stimulators, ERAs, and prostacyclin analogs/agonists—target three main pathways: prostacyclin, endothelin, and nitric oxide. Approved agents include UPTRAVI, TYVASO, ADEMPAS, OPSUMIT, ORENITRAM, WINREVAIR, and OPSYNVI. Older branded therapies like REVATIO, ADCIRCA, and TRACLEER now face revenue erosion due to generics.

The Pulmonary Arterial Hypertension Pipeline remains strong, with next-gen agents like ralinepag showing superior anti-proliferative and vasodilatory activity, Merck’s inhaled MK-5475, and innovative treprostinil formulations such as TPIP. These developments are poised to significantly reshape the Pulmonary Arterial Hypertension Treatment Market Landscape in the coming years.

Pulmonary Arterial Hypertension Understanding

Pulmonary arterial hypertension (PAH), characterized by increased pulmonary vascular resistance and arterial pressure, affects an estimated 15–60 per million of the population and is more commonly diagnosed in women. PAH causes a range of nonspecific symptoms (including breathlessness, fatigue, chest pain, and weakness) and is associated with significant morbidity and mortality triggered by the debilitating progressive nature of the disease, which eventually leads to right heart failure and death. The effect of disease symptoms on the patient’s physical mobility and emotional state adversely affects health-related quality of life (HRQoL).

Pulmonary Arterial Hypertension symptoms generally occur due to insufficient oxygen in the blood; signs and symptoms of PAH worsen with the progression of the disease. The main symptom is shortness of breath; fatigue, dizziness, swelling in the limbs, blue lips, irregular heartbeats, and chest pain are also reported. Each person with PAH will experience a different assortment of symptoms. The severity of the symptoms will also differ from person to person. One person’s journey with having and treating PAH would not necessarily be helpful to another person because the path with PAH and the treatment options are individualized.

Pulmonary Arterial Hypertension Diagnosis

PAH is characterized by similar symptoms that appear during heart and lung conditions. Several techniques and blood tests, such as chest X-rays, blood tests, cardiac catheterization, electrocardiograms, and echocardiograms, are used for diagnosing PAH.

- Cardiac catheterization: Cardiac catheterization involves the insertion of a thin tube into a vein of the neck. Right heart catheterization measures the amount of pressure developed in pulmonary arteries. It is also used for assessing the functioning of the heart.

- Blood Tests: Blood tests are mostly recommended to determine the presence of connective tissue disease, HIV infection, and sickle cell anemia.

- Physical Examination: Physical examination is preferred for examining the visible signs and symptoms of PAH. It includes listening to the heart and lungs by using a stethoscope. Physicians also examine the swelling of the lips and skin.

Pulmonary Arterial Hypertension Treatment

The main purpose of the treatment of PAH is to improve patients’ symptoms and slow the rate of clinical deterioration. General measures, supportive therapy, pharmacological treatment, and surgical treatment are used for treating PAH.

General measures

Patients are advised to adapt the lifestyle changes regarding the general activities of daily living. Women with PAH are recommended to avoid pregnancy. Vaccinations against influenza and pneumococcal infection are also recommended. Patients are advised to avoid undergoing excessive physical activity.

Supportive therapy

Oral anticoagulants, supplemental oxygen therapy, and cardiovascular drugs are used as supportive therapy for treating PAH. Several studies reported that the use of anticoagulants had improved survival rates among patients with IPAH; these effectively reduce the risk of developing venous thromboembolism and heart failure.

Pharmacological treatment

Calcium channel blockers (CCBs), endothelin receptor antagonists (ERAs), and PDE-5i are used as a pharmacological treatment for PAH; PDE-5i, such as sildenafil and tadalafil, are efficient in providing antiproliferative effects on vascular smooth muscle cells and inducing vasodilation.

Pulmonary Arterial Hypertension Epidemiology

The Pulmonary Arterial Hypertension epidemiology chapter in the report provides historical as well as forecasted epidemiology segmented by total Pulmonary Arterial Hypertension Prevalent Cases, total v Diagnosed Prevalent Cases, Age-specific cases, Pulmonary Arterial Hypertension Gender-specific cases, Pulmonary Arterial Hypertension Class-specific cases, Pulmonary Arterial Hypertension Subtype-specific cases and total treated cases in the United States, EU4 countries (Germany, France, Italy, Spain) and the United Kingdom, and Japan from 2020 to 2034.

Key Findings from Pulmonary Arterial Hypertension Epidemiological Analyses and Forecast

- According to DelveInsight’s estimates, the total prevalent cases of PAH in the 7MM were ~112,700 cases in 2024, which are expected to increase by 2034.

- The US accounts for the highest share of diagnosed prevalent PAH cases among the 7MM, representing approximately 45% of the total patient population.

- In 2024, Japan accounted for the second highest diagnosed cases of PAH in the 7MM, with a total of ~23,000 cases reported.

- In 2024, EU4 and the UK reported a total of ~26,000 treated cases of PAH. By 2034, these numbers are estimated to increase.

Pulmonary Arterial Hypertension Epidemiology Segmentation:

- Total Pulmonary Arterial Hypertension Prevalent Cases

- Total Diagnosed Prevalent Cases

- Pulmonary Arterial Hypertension Age-specific cases

- Pulmonary Arterial Hypertension Gender Specific cases

- Pulmonary Arterial Hypertension Class-specific cases

- Pulmonary Arterial Hypertension Subtype-specific cases

- Total Pulmonary Arterial Hypertension Treated Cases

Latest KOL Views on Pulmonary Arterial Hypertension

To stay abreast of the latest trends in the market, we conduct primary research by seeking the opinions of Key Opinion Leaders (KOLs) and Subject Matter Experts (SMEs) who work in the relevant field. This helps us fill any gaps in data and validate our secondary research. We have reached out to industry experts to gather insights on various aspects of Pulmonary Arterial Hypertension, including the evolving treatment landscape, patients’ reliance on conventional therapies, their acceptance of therapy switching, drug uptake, and challenges related to accessibility. The experts we contacted included medical/scientific writers, professors, and researchers from prestigious universities in the US, Europe, the UK, and Japan.

Our team of analysts at Delveinsight connected with more than 15 KOLs across the 7MM. We contacted institutions such as the University of Pennsylvania Hospital, University of Chicago, University of Pittsburgh, etc., among others. By obtaining the opinions of these experts, we gained a better understanding of the current and emerging treatment patterns in the Pulmonary Arterial Hypertension market, which will assist our clients in analyzing the overall epidemiology and market scenario.

Pulmonary Arterial Hypertension Report Qualitative Analysis

We perform Qualitative and Market Intelligence analysis using various approaches, such as SWOT analysis and Conjoint Analysis. In the SWOT analysis, strengths, weaknesses, opportunities, and threats in terms of disease diagnosis, patient awareness, patient burden, competitive landscape, cost-effectiveness, and geographical accessibility of therapies are provided. These pointers are based on the Analyst’s discretion and assessment of the patient burden, cost analysis, and existing and evolving treatment landscape.

Conjoint Analysis analyzes multiple approved and emerging therapies based on relevant attributes such as safety, efficacy, frequency of administration, designation, route of administration, and order of entry. Scoring is given based on these parameters to analyze the effectiveness of therapy. In efficacy, the trial’s primary and secondary outcome measures are evaluated; for instance, in trials for Essential Thrombocythemia, one of the most important primary endpoints was achieving hemolysis control, LDH normalization, etc. Based on these, the overall efficacy is evaluated.

Further, the therapies’ safety is evaluated wherein the acceptability, tolerability, and adverse events are majorly observed, and it sets a clear understanding of the side effects posed by the drug in the trials. In addition, the scoring is also based on the route of administration, order of entry and designation, probability of success, and the addressable patient pool for each therapy. According to these parameters, the final weightage score and the ranking of the emerging therapies are decided.

Pulmonary Arterial Hypertension Therapeutics Market Access and Reimbursement

Because newly authorized Pulmonary Arterial Hypertension drugs are often expensive, some patients escape receiving proper treatment or use off-label, less expensive prescriptions. Reimbursement plays a critical role in how innovative treatments can enter the market. The cost of the medicine, compared to the benefit it provides to patients who are being treated, sometimes determines whether or not it will be reimbursed. Regulatory status, target population size, the setting of treatment, unmet needs, the number of incremental benefit claims, and prices can all affect market access and reimbursement possibilities.

The Pulmonary Arterial Hypertension Treatment Market Report further provides detailed insights on the country-wise accessibility and reimbursement scenarios, cost-effectiveness scenario of approved therapies, programs making accessibility easier and out-of-pocket costs more affordable, insights on patients insured under federal or state government prescription drug programs, etc.

Pulmonary Arterial Hypertension Treatment Market Report Insights

- Patient-based Pulmonary Arterial Hypertension Market Forecasting

- Therapeutic Approaches

- Pulmonary Arterial Hypertension Market Size and Trends

- Existing Market Opportunity

Pulmonary Arterial Hypertension Market Report Key Strengths

- 10-year Pulmonary Arterial Hypertension Market Forecast

- The 7MM Coverage

- Pulmonary Arterial Hypertension Epidemiology Segmentation

- Key Cross Competition

Pulmonary Arterial Hypertension Medicine Market Report

- Current Pulmonary Arterial Hypertension Treatment Practices

- Reimbursements

- Pulmonary Arterial Hypertension Medicine Market Attractiveness

- Qualitative Analysis (SWOT, Conjoint Analysis, Unmet Needs)

Key Questions Answered in the Pulmonary Arterial Hypertension Market Report

- Would there be any changes observed in the current treatment approach?

- Will there be any improvements in Pulmonary Arterial Hypertension management recommendations?

- Would research and development advances pave the way for future tests and therapies for Pulmonary Arterial Hypertension?

- Would the diagnostic testing space experience a significant impact and lead to a positive shift in the treatment landscape of Pulmonary Arterial Hypertension?

- What kind of uptake will the new therapies witness in the coming years in Pulmonary Arterial Hypertension patients?

Stay updated with us for Recent Articles

- WINREVAIR Approval for Pulmonary Arterial Hypertension Treatment: Is It A Game-Changer for Merck?

- New Clinical Developments in the Pulmonary Arterial Hypertension Treatment Domain

- Pulmonary Arterial Hypertension Therapies

- Outbreak of Companies Challenging New Pathways for Treatment of Pulmonary Arterial Hypertension

- Pulmonary Arterial Hypertension Newsletter

- Pulmonary Arterial Hypertension Market: Infographics

- New DelveInsight Blogs