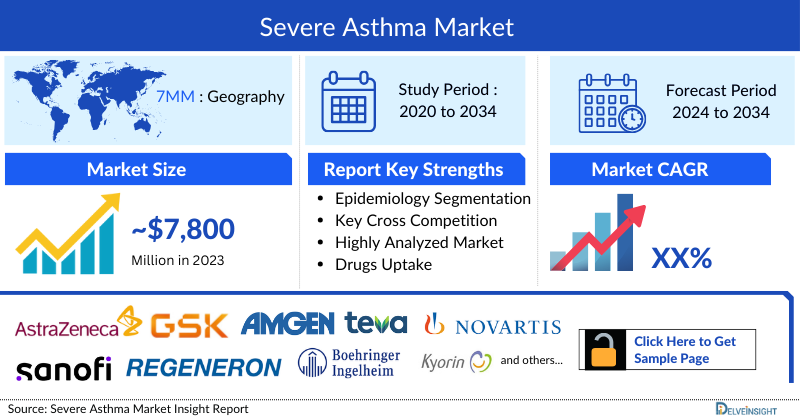

Severe Asthma Market

Key Highlights

- Growth of the severe asthma market is expected to be mainly driven by the rising prevalence of severe asthma, improving diagnostic approaches, an upsurge in the launch of products, and increasing research in pharmaceutical treatment.

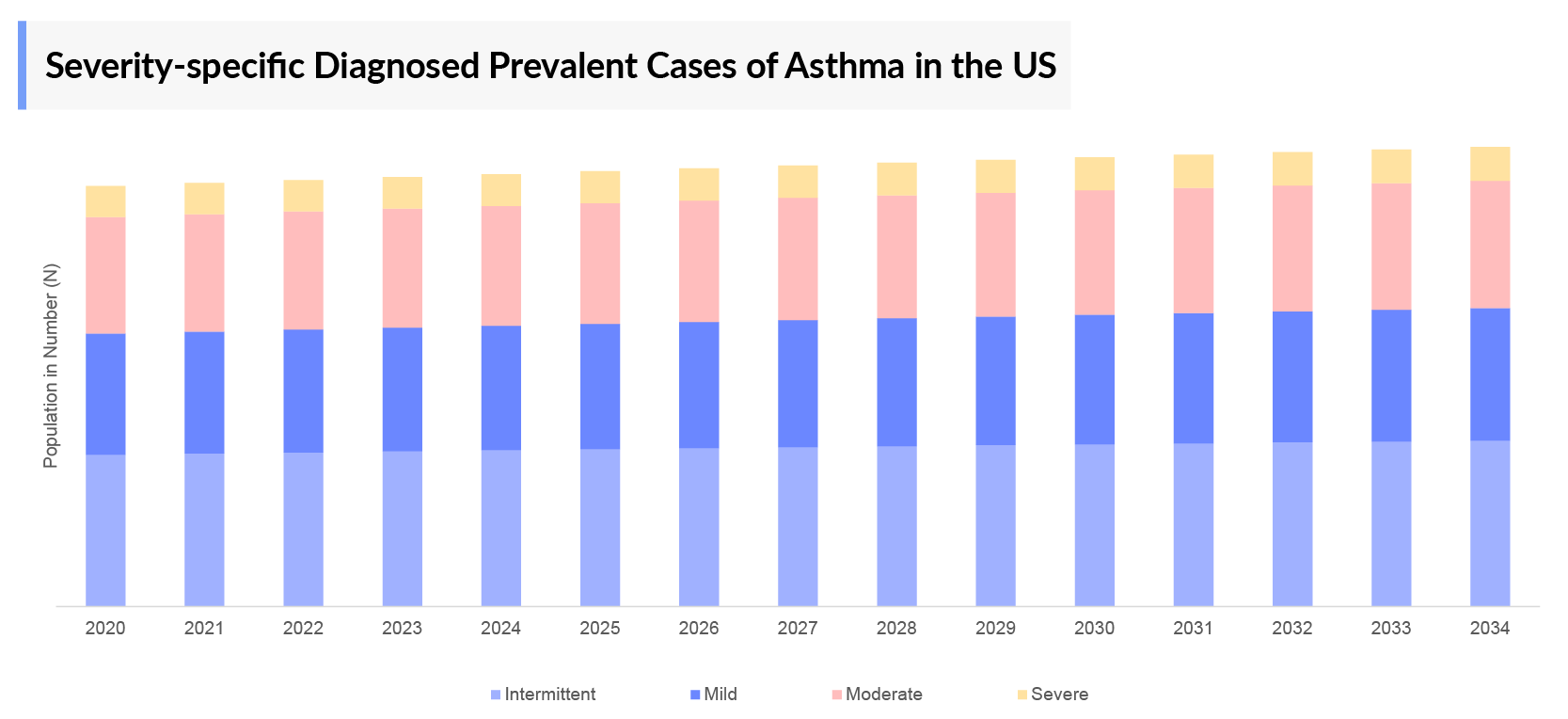

- Among the severity-specific diagnosed cases of asthma, they are divided into two subgroups: Intermittent and Persistent. Persistent asthma encompasses mild, moderate, and severe categories. Intermittent asthma accounted for largest number of cases, comprising approximately 25 million cases in the 7MM in 2023.

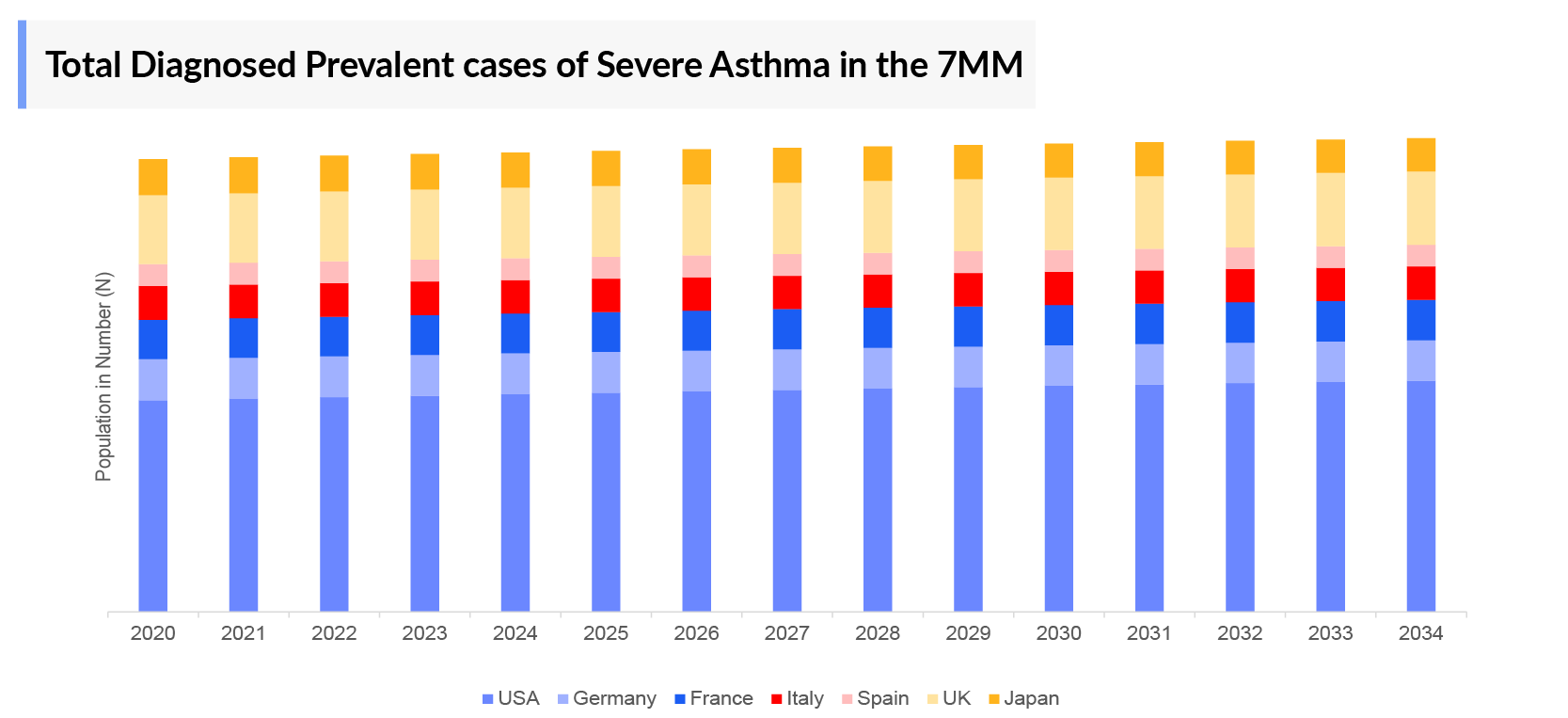

- In the 7MM, the United States accounted for the highest number of severe asthma cases, totaling approximately 2 million cases in 2023, followed by Japan with around 0.8 million cases.

- Among the approved biologics to treat severe asthma, Dupixent (dupilumab) is expected to garner the highest market size by 2034 in the 7MM.

- With the expected approval of new therapies during the forecast period (2024–2034), the overall Severe Asthma therapeutic market is projected to experience a significant upsurge at a substantial CAGR.

DelveInsight’s report titled “Severe Asthma Market Insights, Epidemiology, and Market Forecast – 2034” comprehensively analyzes Severe Asthma. The report provides a comprehensive analysis of historical and projected epidemiological data, covering Total Diagnosed Prevalent cases of Asthma, Severity-specific Diagnosed Prevalent cases of Asthma, and Type-specific Diagnosed Prevalent cases of Severe Asthma.

The Severe Asthma market report provides a comprehensive insight into different facets concerning the patient population, encompassing diagnosis, prescribing trends, physician viewpoints, market accessibility, therapy, and forthcoming market advancements across seven major markets: the United States, EU4 (Germany, France, Italy, and Spain), the UK, and Japan spanning from 2020 to 2034.

The report examines current treatment methodologies and algorithms for Severe Asthma, assessing the overall market potential, identifying business prospects, and addressing pertinent unmet medical requirements.

|

Study Period |

2020–2034 |

|

Forecast Period |

2024–2034 |

|

Geographies Covered |

US, EU4 (Germany, France, Italy, and Spain) and the UK, and Japan |

|

Severe Asthma Epidemiology |

|

|

Severe Asthma Market |

|

|

Market Analysis |

|

|

Severe Asthma Market Players |

|

|

Market Growth Barrier |

A primary barrier hindering the growth of the Severe Asthma market is the combination of high treatment costs, limitations in accurate diagnosis, prevalent incorrect inhaler techniques among patients, and poor adherence to treatment regimens. These challenges collectively impede market expansion by creating barriers to access, diminishing treatment efficacy, and increasing healthcare costs. |

Severe Asthma Overview

Severe asthma presents a formidable challenge within the spectrum of respiratory illnesses, characterized by persistent, debilitating symptoms and frequent exacerbations despite standard treatments. Unlike milder forms, severe asthma often involves continuous symptoms that significantly impair daily activities and quality of life. This complexity stems from various factors, including airway inflammation, remodeling, and hyper-responsiveness, contributing to recurrent bronchial obstruction and airflow limitation. Moreover, the classification of severe asthma into type-2 and non-type-2 inflammation underscores the heterogeneity of the condition, necessitating tailored therapeutic approaches. Despite advancements in asthma management, achieving optimal control remains elusive for many individuals with severe asthma, highlighting the urgent need for targeted interventions to address this unmet medical need.

Severe Asthma Diagnosis and Treatment Algorithm

Severe asthma may be defined not only by difficult-to-control airway disease symptoms but also by the severity of abnormalities and measurements of pulmonary function. Careful physiologic characterizations of patients with well-defined severe asthma are lacking, making diagnosis difficult. In most cases, diagnosis depends on the symptoms and the response to treatment already being administered.

However, to establish a diagnosis of asthma, the clinician determines whether episodic symptoms of airflow obstruction or airway hyperresponsiveness are present and whether airflow obstruction is at least partially reversible, measured by spirometry. Reversibility is determined by an increase in FEV1 of >200 mL and 12% from baseline measure after inhalation of short-acting b2-agonist (SABA).

Most asthma control medications focus on reducing airway inflammation and preventing the associated symptoms. The mainstay treatment for persistent asthma consists of inhaled corticosteroids. Quick-relief (reliever) or rescue medicines quickly ease symptoms that arise acutely Short-acting beta-agonists (SABAs) rapidly reduce airway bronchoconstriction and are recommended rescue medication for rapid symptom relief. Additional long-term controller medicines, such as long-acting beta 2 agonists (LABA), montelukast, or theophylline, are added if asthma is still uncontrolled. Oral corticosteroids can be added to treatment if patients are still experiencing symptoms and flare-ups. There are currently six approved monoclonal antibodies for add-on biological treatment of severe asthma. They include omalizumab, mepolizumab, reslizumab, benralizumab, dupilumab, and tezepelumab for the treatment of severe asthma. At present, there is no approved therapy for severe non-eosinophilic asthma which is non-responsive to corticosteroid treatment also.

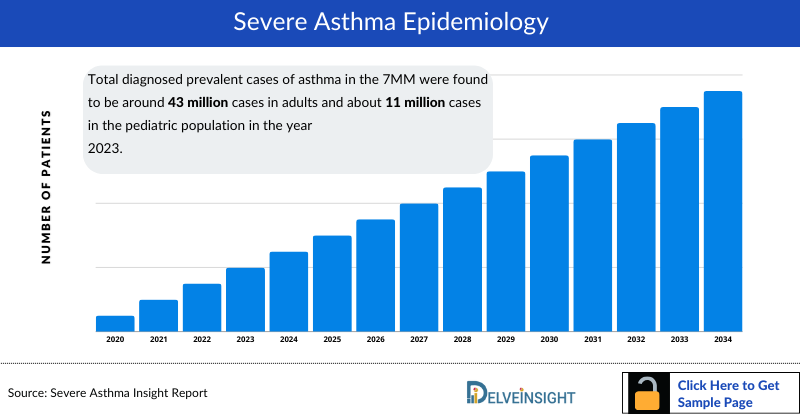

Severe Asthma Epidemiology

The epidemiology section on Severe Asthma offers an analysis of past and present patient populations, along with projected trends across seven major countries (7MM). Drawing from multiple studies and expert opinions, it aims to elucidate the underlying factors driving current and anticipated trends. Additionally, this segment of the report presents data on the diagnosed patient population, highlighting trends and underlying assumptions.

Key Findings

- Total diagnosed prevalent cases of asthma in the 7MM were found to be around 43 million cases in adults and about 11 million cases in the pediatric population in the year 2023. These cases are expected to rise significantly by 2034.

- The United States accounted for around 26 million diagnosed prevalent cases of asthma (including both pediatric and adult population), in 2023.

- In 2023, the aggregate number of reported diagnosed prevalent cases of Severe Asthma across the 7MM amounted to 5.1 million cases, representing approximately 9% of the total diagnosed asthma cases. Projections indicate a substantial increase in these cases by the year 2034.

- In 2023, the UK accounted for the highest number of Severe Asthma diagnosed prevalent cases (0.4 million), followed by France (0.3 million) among the EU4 countries and the UK. In contrast, Spain accounts for the lowest number of cases of Severe Asthma diagnosed population in the EU4 and the UK.

- As per DelveInsight analysis, in Japan, the severity-specific cases segmented as intermittent, mild, moderate, and severe cases of asthma were observed to be 4 million, 0.8 million, 1 million, and 0.8 million cases, respectively in 2023. The severity-specific cases are expected to change by 2034.

- In the US, there were approximately 1.2 million cases of Type-2 inflammation and non-type-2 inflammation severe asthma each in 2023.

Severe Asthma Drug Chapters

The drug chapter segment of the Severe Asthma report encloses the detailed analysis of Severe Asthma marketed drugs, mid-phase, and late-stage pipeline drugs. It also helps to understand the Severe Asthma clinical trial details, expressive pharmacological action, agreements and collaborations, approval, and patent details of each included drug, and the latest news and press releases.

Marketed Therapies for Severe Asthma

Cinqair (reslizumab): Teva Pharmaceutical

Cinqair injection is a humanized interleukin-5 antagonist monoclonal antibody for add-on maintenance treatment of adult patients with severe asthma and with an eosinophilic phenotype, developed by Teva Pharmaceuticals. Cinqair is for intravenous infusion only. It is not to be administered as an intravenous push or bolus. The recommended dosage regimen is 3 mg/kg once every 4 weeks administered by intravenous infusion over 20–50 min.

Fasenra (benralizumab): AstraZeneca

Fasenra (benralizumab) injection is a sterile, preservative-free, clear to opalescent, colorless to slightly yellow solution for subcutaneous injection. Benralizumab is a humanized afucosylated, monoclonal antibody (IgG1, kappa) that directly binds to the alpha subunit of the human interleukin-5 receptor (IL-5Rα) with a dissociation constant of 11 pM, developed by AstraZeneca. The IL-5 receptor is expressed on the surface of eosinophils and basophils. Benralizumab is produced in Chinese hamster ovary cells by recombinant DNA technology.

Note: Detailed Marketed therapies assessment and list of products to be continued in the report…

Emerging Therapies for Severe Asthma

The potential drugs that are expected to launch in the forecasted period include Depemokimab/GSK3511294, PT010, and others.

GSK3511294 (Depemokimab): GlaxoSmithKline

GSK3511294 (depemokimab), which GlaxoSmithKline is developing to treat severe eosinophilic asthma, is a humanized anti-interleukin (IL)-5 monoclonal antibody. As a new biological entity, it is engineered to ensure high affinity and long-acting suppression of IL-5 functions. IL-5 are cytokines responsible for the proliferation, activation, and survival of eosinophils, thus making them a proven treatment target for severe asthma patients with higher levels of eosinophils.Depemokimab with an extended half-life and improved IL-5 affinity compared to other approved therapies is the first biologic to be administered subcutaneously once every 26 weeks. Currently, GlaxoSmithKline is conducting multiple Phase III trials to assess the safety and efficacy of depemokimab for the treatment of severe eosinophilic asthma.

PT010: AstraZeneca

PT010 (Breztri/Trixeo/ BGF MDI (budesonide-glycopyrrolate-formoterol inhalation)) being developed by AstraZeneca, is a fixed-dose combination of micronized budesonide, an inhaled corticosteroid (ICS), micronized glycopyrrolate (an anticholinergic), and micronized formoterol fumarate, an inhaled long-acting beta2-adrenergic agonist (a LABA), for oral inhalation administered via a pressurized metered-dose inhaler (pMDI) using Aerosphere delivery technology. Currently, AstraZeneca is conducting multiple Phase III trials to assess the safety and efficacy of PT010 in adults and adolescents with severe asthma inadequately controlled with the standard of care. The combination is already approved for the treatment of COPD and marketed as Breztri Aerosphere. Note: Detailed emerging therapies assessment and list of products to be continued in the report….

Severe Asthma Market Outlook

The Severe Asthma market outlook is driven by a multifaceted approach aiming to alleviate symptom burden while minimizing adverse events and maintaining normal activity levels. Guideline-based management emphasizes disease severity and the selection of appropriate medical therapies to control symptoms and mitigate exacerbation risks.

In mild persistent disease, low-dose Inhaled Corticosteroids (ICS) have proven efficacy in reducing severe exacerbations and improving asthma control. However, when low-dose ICS alone fails to control the disease, a combination with Long-Acting Beta-Agonists (LABA) is recommended as the first-choice treatment, supplemented with as-needed Short-Acting Beta-Agonists (SABA). Additionally, the combination of low-dose ICS/LABA as single maintenance and reliever treatment offers an alternative strategy.

For severe asthmatics, higher doses of inhalers and adjunct medications like anticholinergics are often necessary to facilitate breathing by relaxing airway muscles. Yet, the long-term efficacy of combination inhaled controller medications may be insufficient, and the prolonged use of oral steroids entails increased side effects.

The Severe Asthma market is witnessing the emergence of several new therapeutic options, with key players such as GlaxoSmithKline, AstraZeneca, Bond Avillion, Novartis, Roche, AB Science, Theravance Biopharma, among others, driving innovation and research in this field. These advancements offer promising avenues for addressing unmet medical needs and improving outcomes for individuals with severe asthma.

Note: Detailed market outlook to be continued in the report….

Severe Asthma Market Segmentation

DelveInsight’s ‘Severe Asthma – Market Insights, Epidemiology, and Market Forecast – 2034’ report provides a detailed outlook of the current and future Severe Asthma market, segmented within countries and by therapies. Further, the market of each region is then segmented by each therapy to provide a detailed view of the current and future market share of all therapies.

Severe Asthma Market Size by Countries

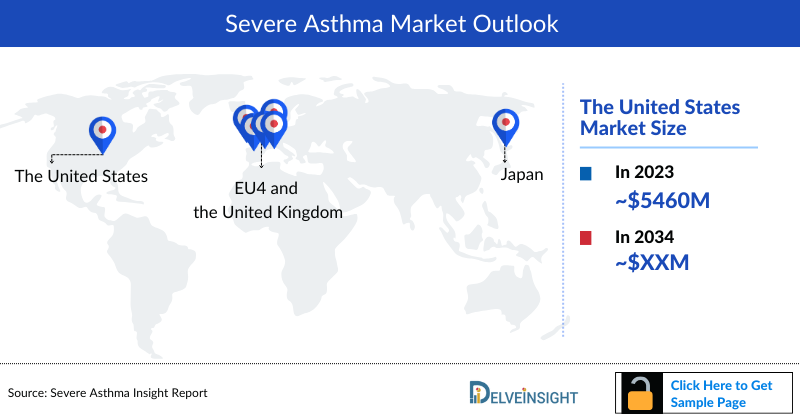

The total Severe Asthma market size is analyzed for individual countries (the United States Market, EU4 (Germany, France, Italy, and Spain) and the UK market, and Japan). The United States accounted for a larger portion of the 7MM market for Severe Asthma in 2023 due to the high prevalence of the condition and high treatment cost. This dominance is predicted to continue with the potential early entry of new products.

Severe Asthma Market Size by Therapies

Several people worldwide have severe asthma that is not controlled with standard asthma inhalers and oral corticosteroids. Drugs are differentiated based on whether they work in different patients, as inflammation can be driven by blood eosinophils, allergic, or non-T2 pathways. The approved therapies in the US for the treatment of severe asthma include Cinqair (reslizumab) by Teva Pharmaceutical Industries, Dupixent (dupilumab) by Sanofi and Regeneron, Fasenra (benralizumab) by AstraZeneca and Kyowa Kirin, Tezspire (tezepelumab) by AstraZeneca and Amgen, Nucala (mepolizumab) by GlaxoSmithKline, and Xolair (omalizumab) by Novartis and Genentech.

It is believed that the Severe Asthma treatment market could change by 2034, in the US with the launch of novel therapies with better and broader efficacy, treatment duration, better dosages, and enhanced convenience.

Key Findings

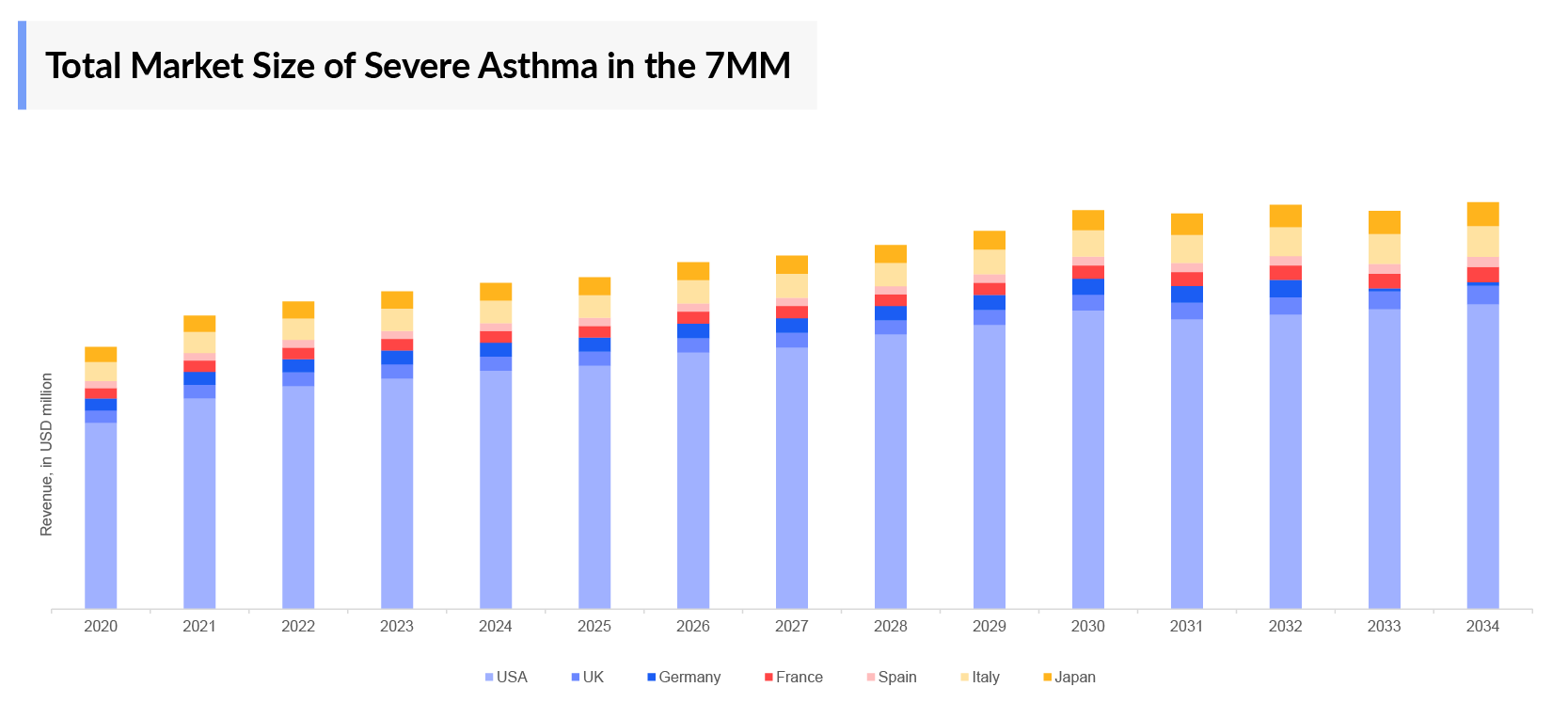

- The market size of Severe Asthma in 7MM was nearly USD 7,800 million in 2023, which is further expected to increase by 2034 at a significant Compound Annual Growth Rate (CAGR) for the study period (2020–2034).

- The United States accounts for the largest market size for Severe Asthma accounting for around 70% of the total 7MM market size.

- Upcoming therapies such as GSK3511294 (Depemokimab) and PT010 have the potential to create a significant positive shift in the Severe Asthma market size.

- Among the European countries, the United Kingdom had the highest market size with USD 430 million in 2023.

- The expected Launch of potential therapies may increase market size in the coming years, assisted by an increase in the diagnosed prevalent population of Severe Asthma.

Note: Detailed market segment assessment will be provided in the final report.

Severe Asthma Drugs Uptake

This section focuses on the sales uptake of potential Severe Asthma drugs that have recently launched or are anticipated to be launched in the Severe Asthma market between 2020 and 2034. It estimates the market penetration of the Severe Asthma drugs for a given country, examining their impact within and across classes and segments. It also touches upon the financial and regulatory decisions contributing to the drug’s probability of success (PoS) in the Severe Asthma market.

For example, for Depemokimab/GSK3511294, we expect the drug uptake to be Slow-medium with a probability-adjusted peak share of around 5.0%, and years to the peak is expected to be 7 years from the year of launch in the US.

Note: Detailed assessment of drug uptake will be provided in the full report on Severe Asthma.

Severe Asthma Market Access and Reimbursement

DelveInsight’s ‘Severe Asthma – Market Insights, Epidemiology, and Market Forecast – 2034’ report provides a descriptive overview of the market access and reimbursement scenario of Severe Asthma.

This section includes a detailed analysis of the country-wise healthcare system for each therapy, enlightening the market access, reimbursement policies, and health technology assessments.

KOL Views

To keep up with current Severe Asthma market trends and fill gaps in secondary findings, we interview KOLs and SMEs working in the Severe Asthma domain. Their opinion helps understand and validate current and emerging therapies and treatment patterns or Severe Asthma market trends. This will support the clients in potential upcoming novel treatments by identifying the overall scenario of the market and the Severe Asthma unmet needs.

Severe Asthma: KOL Insights

DelveInsight’s analysts connected with 50+ KOLs to gather insights; however, interviews were conducted with 15+ KOLs in the 7MM. These KOLs were from organizations, institutes, and hospitals, such as University of Michigan, US; Division of Pulmonary Diseases and Critical Care, UT Health, San Antonio, Texas, US; Dipartimento di Medicina Interna e Specialistica, University of Catania, Italy; Evangelical Clinic Bethel University Hospital, Bielefeld-Bethel, Germany; Department of Respiratory Medicine, Queen Mary University of London, United Kingdom; Department of Respiratory Medicine and Clinical Immunology, Osaka University, Japan; and others.

“ICS/LABA is the preferred treatment choice for patients with severe asthma. Among the upcoming therapies, biologics would be the preferred class by the pulmonogists for severe asthma treatment.”

Note: Detailed assessment of KOL Views will be provided in the full report of Severe Asthma.

Competitive Intelligence Analysis

We perform Competitive and Market Intelligence analysis of the Severe Asthma Market using various Competitive Intelligence tools, including SWOT analysis, Conjoint analysis, Market entry strategies, etc. The inclusion of the analysis entirely depends upon the data availability.

The emerging Severe Asthma therapies are analyzed based on various attributes such as safety and efficacy in randomized clinical trials, order of entry and other market dynamics, and the unmet need they fulfill in the Severe Asthma market.

Note: Detailed assessment of SWOT analysis and conjoint analysis will be provided in the full report on Severe Asthma

Severe Asthma Pipeline Development Activities

The report provides insights into therapeutic candidates in Phase II and III stages. It also analyzes Severe Asthma Companies involved in developing targeted therapeutics.

Pipeline Development Activities

The report covers information on collaborations, acquisition and merger, licensing, patent details, and other information for emerging Severe Asthma therapies.

Scope of the Report

- The report covers a segment of key events, an executive summary, descriptive overview of Severe Asthma, explaining its causes, signs and symptoms, pathogenesis, and currently available therapies

- Comprehensive insight has been provided into the epidemiology segments and forecasts, the future growth potential of diagnosis rate, disease progression along with treatment guidelines

- Additionally, an all-inclusive account of both the current and emerging therapies along with the elaborative profiles of late-stage and prominent therapies will have an impact on the current treatment landscape

- A detailed review of the Severe Asthma market; historical and forecasted market size, market share by therapies, detailed assumptions, and rationale behind our approach is included in the report, covering the 7MM drug outreach

- The report provides an edge while developing business strategies, by understanding trends, through SWOT analysis and expert insights/KOL views, patient journey, and treatment preference that help in shaping and driving the 7MM Severe Asthma market

Severe Asthma Report Insights

- Patient Population

- Therapeutic Approaches

- Severe Asthma Pipeline Analysis

- Severe Asthma Market Size and Trends

- Existing and future Market Opportunity

Severe Asthma Report Key Strengths

- 11 Years Forecast

- 7MM Coverage

- Severe Asthma Epidemiology Segmentation

- Key Cross Competition

- Attribute analysis

- Drugs Uptake and Key Market Forecast Assumptions

Severe Asthma Report Assessment

- Current Treatment Practices

- Unmet Needs

- Pipeline Product Profiles

- Market Attractiveness

- Qualitative Analysis (SWOT and Conjoint Analysis)

Key Questions

Market Insights:

- What was the Severe Asthma total market size, the market size by therapies, and market share (%) distribution in 2020, and how it would all look in 2034? What are the contributing factors for this growth?

- What are the unmet needs are associated with the current treatment market of Severe Asthma?

- How is PT010 going to contribute to the market of Severe Asthma after approval?

- Which drug is going to be the largest contributor in 2034?

- What are the pricing variations among different geographies for approved and off-label therapies?

- How would the market drivers, barriers, and future opportunities affect the market dynamics and subsequent analysis of the associated trends?

Epidemiology Insights:

- What are the disease risk, burden, and unmet needs of Severe Asthma? What will be the growth opportunities across 7MM concerning the patient population of Severe Asthma?

- What is the historical and forecasted Severe Asthma patient pool in the United States, EU4 (Germany, France, Italy, and Spain) the United Kingdom, and Japan?

- Why do only limited patients appear for diagnosis? Why is the current year diagnosis rate not high?

- What factors are affecting the diagnosis and treatment of the indication?

Current Treatment Scenario, Marketed Drugs, and Emerging Therapies:

- What are the current options for the treatment of Severe Asthma? What are the current treatment guidelines for the treatment of Severe Asthma in the US and Europe?

- How many companies are developing therapies for the treatment of Severe Asthma?

- How many emerging therapies are in the mid-stage and late stage of development for the treatment of Severe Asthma?

- What are the recent novel therapies, targets, mechanisms of action, and technologies developed to overcome the limitation of existing therapies?

- What are the key designations that have been granted for the emerging therapies for Severe Asthma?

- Patient acceptability in terms of preferred treatment options as per real-world scenarios?

- What are the country-specific accessibility issues of expensive, recently approved therapies? Focus on reimbursement policies.

- What are the 7MM historical and forecasted market of Severe Asthma?

Reasons to buy

- The report will help in developing business strategies by understanding the latest trends and changing treatment dynamics driving the Severe Asthma Market

- Insights on patient burden/disease prevalence, evolution in diagnosis, and factors contributing to the change in the epidemiology of the disease during the forecast years

- To understand the existing market opportunity in varying geographies and the growth potential over the coming years.

- Distribution of historical and current patient share based on real-world prescription data along with reported sales of approved products in the US, EU4 (Germany, France, Italy, and Spain), the United Kingdom, and Japan.

- Identification of strong upcoming players in the market will help in devising strategies that will help in getting ahead of competitors.

- Detailed analysis and ranking of class-wise potential current and emerging therapies under the Conjoint analysis section to provide visibility around leading classes

- Highlights of Access and Reimbursement policies of approved therapies, barriers to accessibility of off-label expensive therapies, and patient assistance programs

- To understand the perspective of Key Opinion Leaders’ around the accessibility, acceptability, and compliance-related challenges of existing treatment to overcome barriers in future.

- Detailed insights on the unmet need of the existing market so that the upcoming players can strengthen their development and launch strategy