Transcatheter Aortic Valve Replacement Market Summary

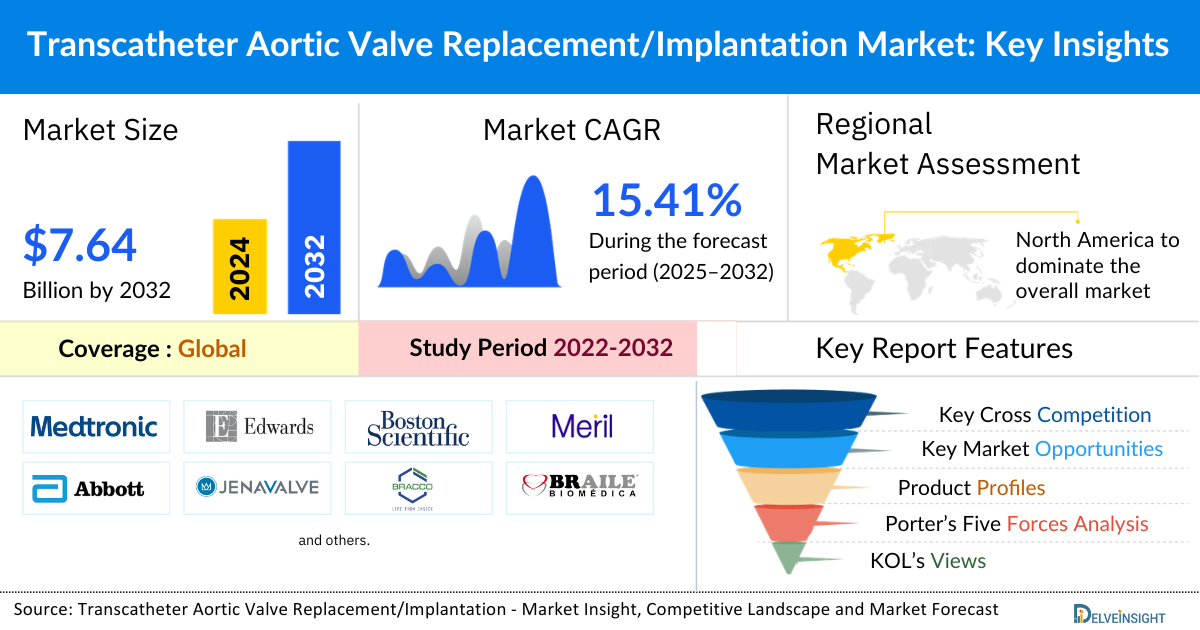

- Global Transcatheter Aortic Valve Devices Market was valued at USD 3.23 billion in 2024, growing at a CAGR of 15.41% during the forecast period from 2024 to 2032 to reach USD 7.64 billion by 2032.

- Some of the leading companies operating in the transcatheter aortic valve replacement devices market includes Medtronic, Edwards Lifesciences Corporation, Boston Scientific Corporation, Meril Life Sciences, Abbott, JenaValve Technology, Inc., Bracco SpA, Transcatheter Technologies GmbH, Braile Biomedica, Venus Medtech, Direct Flow Medical, Sorin group, Blue Sail Medical Co. Ltd., JC Medical Inc., Cook Medical Inc., Sysmetis SA, SMT Pvt Ltd., LivaNova, Peijia Medical, and P+F Products + Features GmbH., and others.

Key Transcatheter Aortic Valve Devices Market Trends & Insights

- The demand for transcatheter aortic valve replacement devices is primarily being boosted by the increasing prevalence of aortic stenosis disorder, rise in cardiovascular disorders, increasing demand for TAVR procedures, increasing prevalence of aortic regurgitation and the technological advancements pertaining to the transcatheter aortic valve replacement arena which are expected to increase in the product demand thereby contributing in the growth of the transcatheter aortic valve replacement devices market during the forecast period from 2025-2032.

- North America is expected to account for the significant market revenue share in the transcatheter aortic valve replacement devices market.

- In the application segment of the transcatheter aortic valve replacement devices market, the TAVR devices used in the aortic stenosis segment is estimated to hold a significant share in the transcatheter aortic valve replacement devices market during the forecast period.

Transcatheter Aortic Valve Devices Market Size and Forecasts

- 2024 Market Size: USD 3.23 billion

- 2032 Projected Market Size: USD 7.64 billion

- Growth Rate (2025-2032): 15.41% CAGR

- Largest Market: North America

- Fastest Growing Market: Asia-Pacific

- Market Structure: Moderately Consolidated

Factors Contributing to Transcatheter Aortic Valve Devices Market Growth

- Rising Prevalence of Aortic Stenosis: The growing elderly population worldwide has increased the incidence of aortic stenosis, a key driver for transcatheter aortic valve replacement (TAVR) procedures.

- Shift Toward Minimally Invasive Procedures: Preference for minimally invasive cardiac interventions over open-heart surgery is accelerating adoption of transcatheter aortic valve devices due to shorter hospital stays and faster recovery.

- Expanding Indications & Favorable Clinical Outcomes: Clinical trials demonstrating strong safety and efficacy across low-, intermediate-, and high-risk patients have broadened regulatory approvals and patient eligibility.

- Technological Advancements in Valve Design: Continuous innovation in device durability, repositionability, and delivery systems has improved procedural success rates and reduced complications.

- Growing Healthcare Infrastructure & Reimbursement Support: Improved access to advanced cardiac care centers and favorable reimbursement policies in developed markets are supporting procedural volume growth.

Scope Transcatheter Aortic Valve Replacement Devices Market

| |

|

Report Metrics |

Details |

|

Study Period |

2022 to 2032 |

|

Forecast Period |

2025-2032 |

|

CAGR |

15.41% (Request Sample To Know More) |

|

Anastomosis Device Market | |

|

Key Transcatheter Aortic Valve Devices Companies |

Medtronic, Edwards Lifesciences Corporation, Boston Scientific Corporation, Meril Life Sciences, Abbott, JenaValve Technology, Inc., Bracco SpA, Transcatheter Technologies GmbH, Braile Biomedica, Venus Medtech, Direct Flow Medical, Sorin group, Blue Sail Medical Co. Ltd., JC Medical Inc., Cook Medical Inc., Sysmetis SA, SMT Pvt Ltd., LivaNova, Peijia Medical, and P+F Products + Features GmbH and others |

What are the latest Transcatheter Aortic Valve Replacement Devices Market Dynamics and Trends?

The transcatheter aortic valve replacement devices market is witnessing an increase in product demand owing to numerous reasons and one of the key aspects being the rising prevalence of aortic stenosis disorder. According to the World Health Organization 2020, the prevalence of calcific aortic valve stenosis had been found to be 9 million across the world. Also, as per the John Muir Health statistics, in the year 2020, about 1.5 million people in the United States tend to suffer from aortic stenosis and about 500,000 people within this group of patients tend to suffer from severe aortic stenosis. As per the same source in 2020, about 250,000 patients suffering from aortic stenosis were symptomatic in the United States.

As per the European Society of Cardiology, 2020, Degenerative Calcific aortic stenosis is found to be very common (with a prevalence of 12.4%) in high-income countries. As per the same source, in the year 2020 the prevalence of severe aortic stenosis in people aged >=75 years is approximately 3.4% in Europe and the United States. Additionally, the disease is the second most common valvular lesion in the United States, affecting about 5% of the population at an age of 65 years in the year 2020. Due to the rise in aortic stenosis around the world, there will be a high demand for trans-catheter valves and TAVR procedures worldwide. As per the source, John Muir Health, up until 2021 45,000 patients have been implanted with Edwards’ trans-catheter valves alone by multi-disciplinary teams across the world. Therefore, due to the rise in aortic stenosis disorder and the rise in TAVR procedures worldwide, there will be an increase in the demand of transcatheter aortic valve replacement devices for implantation, thereby fueling the market growth for Transcatheter Aortic Valve Replacement Devices.

Another key aspect influencing the demand for transcatheter aortic valve replacement devices is the rising prevalence of cardiovascular disorders. As per the data provided by the World Health Organization 2021, cardiovascular disorders are considered as the leading cause of death worldwide affecting about 17.9 million lives every year. Furthermore, the World Heart Federation in the year 2019 had estimated that more than 23 million lives will be affected owing to cardiovascular disorders by the year 2032. Therefore, the rising prevalence of cardiovascular disorders across the globe is further expected to aid in the increasing demand for transcatheter aortic valve replacement devices, thereby boosting the growth of the global transcatheter aortic valve replacement devices market during the forecast period.

However, stringent regulatory approval process for transcatheter aortic valves and high costs associated with the TAVR procedures may prove to be challenging factors for the transcatheter aortic valve replacement devices market growth.

Transcatheter Aortic Valve Replacement Devices Market Segment Analysis:

Transcatheter Aortic Valve Replacement Devices Market By Material [Valve Frame Material (Nitinol, Stainless Steel, Cobalt Chromium and Others), Valve Leaflet Material (Porcine, Bovine and Others)], By Procedure (Transfemoral, Transapical and Transaortic Approach), By Application (Aortic Stenosis, Aortic Regurgitation and Others), By End User (Hospitals, Ambulatory Surgical Centers, and Others), and by Geography (North America, Europe, Asia-Pacific, and Rest of the World)

In the application segment of the transcatheter aortic valve replacement devices market, the TAVR devices used in the aortic stenosis segment is estimated to hold a significant share in the transcatheter aortic valve replacement devices market during the forecast period. This can be ascribed to the increasing prevalence of aortic stenosis disorder globally, approval and launch of TAVR devices indicated for use in aortic stenosis disorder and the technological advancements in the TAVR devices in the treatment of aortic stenosis. According to the American Heart Association, around 1.5 million people tend to suffer from aortic valve stenosis in the United States in the year 2020. As per the same source, around more than 100,000 patients had undergone TAVR procedures in the United States in contradiction to only 50,000 patients who had opted for open surgery for aortic valve replacement in the United States in the year 2020. Also in the year 2019, TAVR procedures were initially indicated for patients suffering from severe symptomatic aortic stenosis that were not suitable for surgery, as assessed by the Heart Valve Team, however the newer guidelines have approved the treatment of TAVR in intermediate risk patients of aortic stenosis. Therefore, due to the rise in patients suffering from aortic stenosis and the approval of TAVR procedures for intermediate risk patients of aortic stenosis, there will be an increase in demand for TAVR procedures by patients suffering from aortic stenosis, thereby leading to a growth in the TAVR devices market.

Additionally, the approval and launch of devices for aortic stenosis indication will lead to an increase in the demand of transcatheter aortic valve replacement devices in the aortic stenosis application, thereby leading to an increase in the overall transcatheter aortic valve replacement devices market growth. For instance, on September 21, 2021, the United States Food and Drug Administration had approved Abbott’s Portico with FlexNav transcatheter aortic valve replacement (TAVR) system for treatment of individuals suffering from symptomatic, and severe aortic stenosis.

Transcatheter Aortic Valve Replacement Devices Market Segmentation

Transcatheter Aortic Valve Replacement Devices Market By Material Type

- Valve Frame Material

- Nitinol

- Stainless Steel

- Cobalt Chromium and Others

- Valve Leaflet Material

- Porcine

- Bovine and others

Transcatheter Aortic Valve Replacement Devices By Procedure Type

- Transfemoral

- Transapical and Transaortic Approach

Transcatheter Aortic Valve Replacement Devices By Application Type

- Aortic Stenosis

- Aortic Regurgitation and others

Transcatheter Aortic Valve Replacement Devices By End User

- Hospitals

- Ambulatory Surgical Centers, and others

Myopia Treatment Devices Market by Geography

- North America Myopia Treatment Devices Market

- United States Myopia Treatment Devices Market

- Canada Myopia Treatment Devices Market

- Mexico Myopia Treatment Devices Market

- Europe Myopia Treatment Devices Market

- France Myopia Treatment Devices Market

- Germany Myopia Treatment Devices Market

- United Kingdom Myopia Treatment Devices Market

- Italy Myopia Treatment Devices Market

- Spain Myopia Treatment Devices Market

- Russia Myopia Treatment Devices Market

- Rest of Europe

- Asia-Pacific Myopia Treatment Devices Market

- China Myopia Treatment Devices Market

- Japan Myopia Treatment Devices Market

- India Myopia Treatment Devices Market

- Australia Myopia Treatment Devices Market

- South Korea Myopia Treatment Devices Market

- Rest of Asia Pacific

- Rest of the World (RoW)

- Middle East Myopia Treatment Devices Market

- Africa Myopia Treatment Devices Market

- South America Myopia Treatment Devices Market

Transcatheter Aortic Valve Replacement Devices Market Regional Analysis

North America Transcatheter Aortic Valve Replacement Devices Market Trends

Among all the regions, North America is expected to account for the significant market revenue share in the transcatheter aortic valve replacement devices market. North America is expected to dominate the global market and would continue to maintain its dominance in revenue generation in the transcatheter aortic valve replacement devices market during the forecast period. This domination is attributed to the increasing number of aortic stenosis and aortic regurgitation cases, rising prevalence of cardiovascular diseases, rise in transcatheter aortic valve replacement device approvals and launches, and their expansion in newer indications are the key factor contributing to the transcatheter aortic valve replacement devices market in the country and are expected to aid in the growth of the North America transcatheter aortic valve replacement devices market.

According to the Centers for Disease Control and Prevention 2021, heart disease is the leading cause of death for men, women and people in United States. According to the same source, one person tends to die in every 36 seconds from cardiovascular diseases and about 6,59,000 people tends to die of heart diseases every year that is about one in four deaths. Furthermore, according to the American Heart Association 2021, in the year 2019 cardiovascular disorders was the leading cause of death in the United States and coronary heart disease had accounted to about 42.1% of the deaths attributable to CVD in the United States. Also, as per the former source, in the year 2018, stoke had accounted for about 1 in every 19 deaths in the United States. Owing to the rising cases of cardiovascular disorders, there will be an increase in demand of transcatheter aortic valve replacement devices, leading to a rise in the transcatheter aortic valve replacement devices market in the North American region.

Additionally, according to the American Heart Association, in the year 2020, 20% of the older Americans tend to suffer from aortic stenosis. It is common in people over the age of 65 years and if left untreated can cause heart failure and death. Owing to the increase in the prevalence of patients suffering from aortic stenosis, there will be an increase in the demand of TAVR devices, leading to an overall growth of the TAVR devices in the forecasting period of 2022-27.

Also, several approvals have also lead to increase in the demand for transcatheter aortic valve replacement devices, for instance FDA had approved Medtonic’s Evolut FX TAVR system in the year 2019 for all risk categories of patients with symptomatic and severe aortic stenosis in the United States. Additionally, on January 09, 2020, Jenavalve transcatheter aortic valve replacement system had been designated as a breakthrough device for severe aortic regurgitation (AR) and AR-dominant mixed aortic valve disease. Thus, owing to an increase in the number of approvals for TAVR devices in the United States, there will be an increase in availability and demand for TAVR devices in US leading to a growth in the overall market for TAVR devices.

Key Transcatheter Aortic Valve Replacement Devices Companies in the Market Landscape:

Some of the key Transcatheter Aortic Valve Replacement Devices compnaies operating in the market includes -

- Medtronic

- Edwards Lifesciences Corporation

- Boston Scientific Corporation

- Meril Life Sciences

- Abbott

- JenaValve Technology, Inc.

- Bracco SpA

- Transcatheter Technologies GmbH

- Braile Biomedica

- Venus Medtech

- Direct Flow Medical

- Sorin group

- Blue Sail Medical Co. Ltd.

- JC Medical Inc.

- Cook Medical Inc.

- Sysmetis SA

- SMT Pvt Ltd.

- LivaNova

- Peijia Medical, and others

Recent Developmental Activities in Transcatheter Aortic Valve Replacement Devices Market:

- In May 2025, Edwards Lifesciences announced that the U.S. Food and Drug Administration (FDA) has approved its SAPIEN 3 transcatheter aortic valve replacement (TAVR) therapy for use in severe aortic stenosis (AS) patients without symptoms. This approval marks the first time TAVR has been authorized for asymptomatic patients, expanding treatment options for individuals with severe AS.

- In April 2025, SoloPace Incorporated announced FDA clearance and the first use of its SoloPace control system for temporary pacing in transcatheter aortic valve implantation (TAVI) procedures. The system aims to enhance pacing efficiency and reduce patient risks, with initial cases completed at Scripps Clinic in San Diego.

- In March 2025, Medtronic plc (NYSE: MDT) announced late-breaking five-year data from the Evolut Low Risk Trial. The results show that, compared to surgery, the Evolut™ transcatheter aortic valve replacement (TAVR) system offers a numerically lower rate of all-cause mortality or disabling stroke at five years, along with strong valve performance and durable clinical outcomes.

- In Sept 2021, Abbott had announced that Food and Drug Administration (FDA) has approved the company's Portico™ with FlexNav™ transcatheter aortic valve replacement (TAVR) system to treat people with symptomatic, severe aortic stenosis who are at high or extreme risk for open-heart surgery.

- In Aug 2021, Medtronic plc, had announced the U.S. Food and Drug Administration (FDA) approval of its newest-generation, self-expanding transcatheter aortic valve replacement (TAVR) system, the Evolut™ FX TAVR system.

- In May 2021, Abbott had announced that it had received CE Mark for its latest-generation transcatheter aortic valve implantation (TAVI) system, Navitor™, making the minimally invasive device available for people in Europe with severe aortic stenosis who are at high or extreme surgical risk.

Key Transcatheter Aortic Valve Replacement Devices Highlights Summary (2022–2025)

| Category | Key Developments (2022–2025) |

|---|---|

| Product Launches | Introduction of next-generation TAVR systems with improved deliverability, lower-profile catheters, enhanced sealing skirts to reduce paravalvular leak, and expanded size ranges for broader patient eligibility. |

| Regulatory Approvals | Expansion of TAVR indications to low-risk surgical patients; approvals for next-gen valves in the U.S., Europe, and Asia-Pacific markets; updated labeling reflecting long-term durability data. |

| Partnerships | Strategic collaborations between device manufacturers and hospitals/research institutions to enhance clinical trial enrollment, develop AI-assisted imaging tools, and improve procedural planning. |

| Acquisitions | Major medtech companies acquiring innovative startups specializing in valve design, delivery systems, and structural heart technologies to strengthen competitive positioning. |

| Company Strategy | Focus on geographic expansion in emerging markets, portfolio diversification into structural heart therapies, and increased R&D investment in durability and lifetime management solutions. |

| Setbacks | Product recalls, safety concerns related to valve durability or thrombosis, supply chain disruptions, and regulatory delays impacting product rollout timelines. |

| Emerging Technology | Development of fully repositionable and retrievable valves, AI-driven procedural guidance, next-ge |

Impact Analysis

AI Advancement in Transcatheter Aortic Valve Replacement Devices

Artificial Intelligence (AI) is playing an increasingly transformative role in optimizing Transcatheter Aortic Valve Replacement (TAVR) procedures by enhancing precision, patient selection, and clinical outcomes.

Key AI Advancements in TAVR

- AI-Driven Imaging & Pre-Procedural Planning: Machine learning algorithms analyze CT scans and echocardiography images to accurately measure annulus size, calcification burden, and vascular access, improving valve sizing and reducing complications.

- Automated Patient Risk Stratification: AI tools assess large datasets including clinical history, biomarkers, and imaging results to identify ideal candidates and predict procedural risks such as stroke or paravalvular leak.

- Intra-Procedural Guidance Systems: Real-time AI-assisted imaging supports optimal valve positioning and deployment, enhancing procedural accuracy and minimizing operator variability.

- Predictive Analytics for Post-Procedural Outcomes: AI models help forecast long-term outcomes, including valve durability, rehospitalization risk, and mortality, enabling personalized follow-up strategies.

- Workflow Optimization & Efficiency: AI-enabled platforms streamline case planning, reduce interpretation time for imaging, and improve cath lab efficiency, lowering procedural costs.

- Integration with Digital Health & Remote Monitoring: AI-powered remote monitoring tools analyze patient data post-TAVR to detect early signs of complications and support proactive intervention.

Tariff Inclusion in Transcatheter Aortic Valve Replacement Devices

Tariff inclusion plays a critical role in shaping the commercial landscape of Transcatheter Aortic Valve Replacement (TAVR) devices. As these devices are high-value, technologically advanced cardiovascular products often manufactured across multiple geographies, import duties, trade policies, and regional tax structures directly impact pricing, procurement, and profitability. With global expansion strategies targeting emerging markets, understanding tariff structures has become essential for manufacturers, distributors, and healthcare providers.

How This Analysis Helps Clients

- Cost Management

- Identifies the impact of import duties, VAT, and trade tariffs on final device pricing.

- Supports accurate budgeting and pricing strategies across regions.

- Helps evaluate landed cost structures to protect profit margins.

- Assists in reimbursement negotiations by understanding cost pressures.

- Supply Chain Optimization

- Enables assessment of alternative manufacturing or assembly locations to reduce tariff exposure.

- Supports diversification of supplier networks to mitigate geopolitical risks.

- Helps design regional distribution hubs to lower cross-border duty burdens.

- Improves forecasting by accounting for tariff fluctuations and policy changes.

- Regulatory Navigation

- Clarifies country-specific import classifications and compliance requirements.

- Assists in understanding trade agreements that may provide preferential duty treatment.

- Reduces delays associated with customs clearance and regulatory documentation.

- Aligns product labeling and certification with regional trade frameworks.

- Strategic Planning

- Informs market entry decisions based on tariff competitiveness.

- Supports long-term investment planning, including local manufacturing strategies.

- Enables scenario modeling for potential trade policy shifts.

- Enhances competitive positioning by anticipating pricing advantages or constraints.

Startup Funding & Investment Trends in Transcatheter Aortic Valve Replacement Devices

| Company Name | Total Funding (Approx.) | Main Products / Focus | Stage of Development | Core Technology |

|---|---|---|---|---|

| JenaValve Technology | ~$200M+ | Transfemoral TAVR system for aortic regurgitation | Late-stage clinical / Regulatory review | Self-expanding valve with locator technology for precise positioning |

| Foldax (now part of biotech portfolio investors) | ~$100M+ | Polymer-based surgical and transcatheter heart valves | Clinical-stage development | Proprietary LifePolymer™ material designed for durability and reduced calcification |

| Anteris Technologies | ~$150M+ | DurAVR™ transcatheter aortic valve | Early-to-mid clinical trials | ADAPT® anti-calcification tissue platform with balloon-expandable delivery |

| Venus Medtech | ~$300M+ | VenusA-Valve and next-gen TAVR systems | Commercialized in select markets / Expanding globally | Self-expanding nitinol frame with advanced sealing skirt |

| Peijia Medical | ~$250M+ | Taurus series TAVR devices | Commercial stage in China / Ongoing global trials | Repositionable and retrievable self-expanding valve platform |

Key Takeaways from the Transcatheter Aortic Valve Replacement Devices Market Report Study

- Market size analysis for current transcatheter aortic valve replacement devices market size (2024), and market forecast for 5 years (2024-2032)

- The effect of the COVID-19 pandemic on this market is significant. To capture and analyze suitable indicators, our experts are closely watching the transcatheter aortic valve replacement devices market.

- Top key product/services/technology developments, merger, acquisition, partnership, joint venture happened for last 3 years

- Key companies dominating the Global Transcatheter Aortic Valve Devices Market.

- Various opportunities available for the other competitor in the Transcatheter Aortic Valve Devices Market space.

- What are the top performing segments in 2024? How these segments will perform in 2032.

- Which is the top-performing regions and countries in the current transcatheter aortic valve replacement devices market scenario?

- Which are the regions and countries where companies should have concentrated on opportunities for transcatheter aortic valve replacement devices market growth in the coming future?

Target Audience who can benefit from this Transcatheter Aortic Valve Replacement Devices Market Report Study

- Transcatheter Aortic Valve Devices products providers

- Research organizations and consulting companies

- Transcatheter Aortic Valve Devices-related organizations, associations, forums, and other alliances

- Government and corporate offices

- Start-up companies, venture capitalists, and private equity firms

- Distributors and Traders dealing in transcatheter aortic valve replacement devices

- Various End-users who want to know more about the Transcatheter Aortic Valve Devices market and latest technological developments in the Transcatheter Aortic Valve Devices market.