Ventilators Market Summary

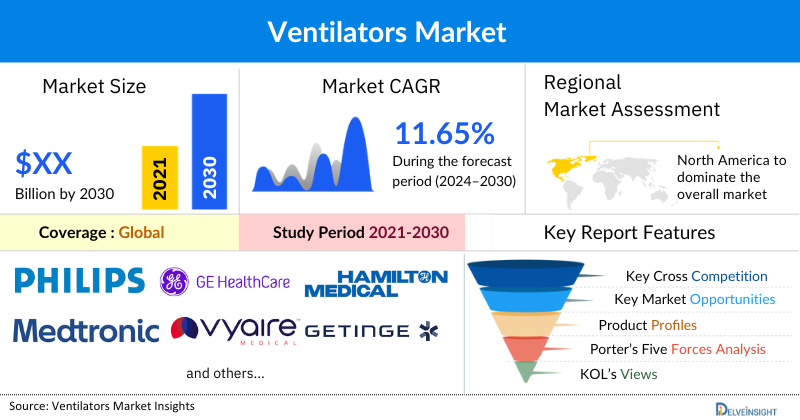

- The global Ventilators market is expected to grow at a CAGR of 11.65% during the forecast period from 2024 to 2032.

- The Ventilators market is expected to witness substantial growth, fueled by several important factors. Primarily, the increasing prevalence of respiratory and cardiovascular diseases serves as a major growth driver. Conditions such as chronic obstructive pulmonary disease (COPD), asthma, acute myocardial infarction, congestive heart failure exacerbations, severe arrhythmias, and cardiogenic shock create a rising demand for advanced ventilator support. Additionally, the expansion of critical care units significantly contributes to the market’s growth.

Key Market Trends & Insights

- The leading companies working in Ventilators market are Philips, GE Healthcare, Hamilton Medical, Medtronic PLC, Vyaire Medical, Inc., Getinge AB, ResMed, Air Liquide, Shenzhen Mindray Bio-Medical Electronics Co., Ltd., Fisher & Paykel Healthcare Limited, Smiths Group PLC, ACUTRONIC Medical Systems AG, Drägerwerk AG & Co. KGaA, SCHILLER AG, Bunnell Incorporated, Leistung Equipamentos LTDA, ZOLL Medical Corporation, Koninklijke Philips N.V., Nihon Kohden Corporation, General Electric Company, Allied Healthcare Products, Inc., aXcent Medical GmbH, and others.

- Among all the regions, North America is anticipated to hold the largest share of the ventilators market among all regions. This growth is attributed to the rising prevalence of respiratory and cardiovascular conditions requiring emergency support, advancements in ventilator technology, and increasing hospital admissions to intensive care units. Additionally, government initiatives, awareness programs for respiratory and cardiovascular disorders, and the presence of major market players actively involved in mergers, acquisitions, and product launches are expected to further drive the ventilators market in the region during the forecast period.

- The ventilators market is segmented based on mobility into intensive care and portable/transportable ventilators, by type into adult/pediatric and neonatal/infant ventilators, and by interface into invasive and non-invasive ventilation. This segmentation helps address diverse patient needs, optimize critical care delivery, and cater to both hospital and homecare settings.

Request for unlocking the CAGR of the Ventilators Market Forecast

Ventilators Market Size & Forecast

- 2025 Ventilators arket Size: USD XX Million

- 2032 Projected Ventilators Market Size: USD XX Million

- Ventilators CAGR (2025-2032): CAGR of 11.65%

- Ventilators Asia Pacific Market Size: Largest market in 2025

Key factors contributing to the rise in growth of the Ventilators Market:

- Rising Prevalence of Ventilators: Increasing cases of chronic respiratory diseases (COPD, asthma, ARDS) and rising incidence of infectious respiratory conditions are driving higher demand for ventilators.

- Growing Adoption of Ventilators: Expanding use in hospitals, ICUs, homecare, and emergency settings is boosting market penetration, especially for long-term respiratory support.

- Ventilators Technological Advancements & Product Launches: Innovations such as portable ventilators, non-invasive ventilation, AI-driven monitoring, and user-friendly interfaces are enhancing adoption and improving patient outcomes.

- Government Awareness Initiatives for Ventilators: Public health campaigns, preparedness programs, and supportive reimbursement policies are encouraging healthcare providers to strengthen respiratory care infrastructure.

- Expanding Access in Emerging Markets: Growth in healthcare infrastructure, rising healthcare spending, and improved availability of advanced devices in Asia-Pacific, Latin America, and Middle East are fueling demand.

Ventilators by Mobility (Intensive Care Ventilators and Portable/Transportable Ventilators), Type (Adult/Pediatric Ventilators and Neonatal/Infant Ventilators), Interface (Invasive Ventilation and Non-Invasive Ventilation), End-User (Hospitals, Home Care, Ambulatory Surgical Centers, and Others), and Geography (North America, Europe, Asia-Pacific, and Rest of the World) is expected to grow at a steady CAGR forecast till 2030 owing to the rising burden of severe respiratory and cardiovascular disorders, the surge in critical care units, and increase in product launches and approvals by key market players across the globe.

The ventilators market is expected to grow at a CAGR of 11.65% during the forecast period from 2024 to 2030. The market for Ventilators is set to experience significant growth driven by several key factors. First, the rising burden of respiratory and cardiovascular diseases is the major driver. Chronic respiratory conditions and cardiovascular disorders such as chronic obstructive pulmonary disease (COPD), asthma, acute myocardial infarction (heart attack), congestive heart failure exacerbations, severe arrhythmias, and cardiogenic shock necessitate advanced ventilator support. Second, the surge in critical care units plays a crucial role in boosting the ventilator market. Hospitals and healthcare facilities are expanding their ICU and emergency care capacities to accommodate the growing number of critically ill patients. This expansion increases the demand for advanced ventilators equipped with the latest technology to provide effective and efficient respiratory support in these high-pressure environments. Finally, the increase in product launches and approvals by key market players globally further propels the market. Continuous innovation in ventilator technology, including enhancements in features, functionality, and usability, leads to the introduction of new and improved products. Together, these factors are increasing the demand for effective respiratory support solutions across the globe during the forecast period from 2024 to 2030.

Ventilators Market Dynamics

According to the latest data provided by the Australian Institute of Health and Welfare, in 2022, around 8.5 million (34%) people in Australia were estimated to have chronic respiratory conditions.

Additionally, as per the recent data provided by the Global Burden of Disease (2023), approximately, 1 in 20 people globally suffers from chronic respiratory diseases.

Additionally, as per the recent data provided by GLOBOCAN, in 2022, globally the estimated new cases of trachea, bronchus, and lung cancer was 2.48 million, and the projections are expected to rise by 4.25 million by the year 2045.

COPD, characterized by progressive airflow limitation and frequent exacerbations, often requires prolonged and intensive ventilator support to manage acute exacerbations and maintain adequate oxygenation. Similarly, cancers of the trachea, bronchus, and lung often lead to significant airway obstruction, reduced lung function, and respiratory failure, necessitating advanced ventilator interventions. As these conditions become more prevalent globally, driven by factors such as smoking, environmental pollution, and aging populations, the demand for sophisticated ventilators increases across the globe.

Furthermore, as per the recent data provided by the British Heart Foundation (2024), coronary (ischemic) heart disease, the most commonly diagnosed worldwide, affects an estimated 200 million people globally of which 110 million are men and 80 million are women. Additionally, around 56 million women and 45 million men are stroke survivors. It is estimated that at least 13 million people worldwide live with congenital heart disease, with potentially millions more undiagnosed. Moreover, according to recent data provided by the British Heart Foundation (2024), globally, approximately 620 million people, or about 1 in 13 individuals, live with heart and circulatory diseases. Additionally, as per the same source, in 2021, the prevalence of heart and circulatory diseases was 100 million in Europe and 340 million in Asia and Australia.

Cardiovascular diseases, such as acute myocardial infarction, congestive heart failure, and cardiogenic shock, often lead to compromised heart function and inadequate oxygen delivery to tissues, which can cause or exacerbate respiratory failure. In severe cases, patients may require mechanical ventilation to support breathing, manage fluid overload, and ensure adequate oxygenation thereby boosting the overall market of ventilators.

Additionally, companies are amplifying their production of ventilators and securing regulatory approvals, thereby strategically expanding their market presence and driving further growth. For instance, in May 2021, CorVent Medical announced that it had received CE Mark approval to launch its RESPOND-19™ Ventilator for commercial use in Europe. The system was designed to easily expand critical care ventilation capacity, aiding hospitals in the treatment of patients with acute respiratory distress syndrome (ARDS).

Moreover, the success of the clinical trial on ventilators gave a significant boost to the market, enhancing its growth prospects and driving increased interest and investment. For instance, in October 2021, at the European Society of Intensive Care Medicine (ESICM) congress, a study from Liège, Belgium was presented on Bactiguard's endotracheal tubes. The new clinical trial demonstrated a 53% reduction in ventilator-associated pneumonia (VAP) among intensive care patients who were intubated with Bactiguard's endotracheal tube with an evacuation lumen (BIP ETT Evac). The study confirmed that the use of this tube significantly decreased the incidence of VAP.

Moreover, advancements in technologies like automated control of the patient’s ventilation and oxygenation, real-time synchronization, and the shift in trend from fixed to portable equipment are fueling the global ventilators market.

Thus, the factors mentioned above are likely to boost the market of ventilators during the forecasted period.

However, the risk of pneumothorax, atelectasis, and others and stringent regulatory concerns may hinder the future market of ventilators.

Ventilators Market Segment Analysis

Ventilators by Mobility (Intensive Care Ventilators and Portable/Transportable Ventilators), Type (Adult/Pediatric Ventilators and Neonatal/Infant Ventilators), Interface (Invasive Ventilation and Non-Invasive Ventilation), End-User (Hospitals, Home Care, Ambulatory Surgical Centers, and Others), and Geography (North America, Europe, Asia-Pacific, and Rest of the World).

In the mobility segment of the ventilators market, intensive care ventilators are expected to hold a significant share in 2023. Intensive care ventilators are significantly boosting the overall ventilator market by driving demand for advanced, high-performance devices designed for critical care settings. These ventilators, which offer sophisticated features such as precise control of ventilation parameters, advanced monitoring, and adaptive algorithms, are crucial for managing complex respiratory conditions in intensive care units (ICUs). As healthcare systems globally increasingly focus on improving critical care capabilities and patient outcomes, the need for state-of-the-art intensive care ventilators has surged. This demand is further fueled by the rising prevalence of chronic respiratory diseases, the aging population, and the ongoing need for enhanced preparedness for pandemics and respiratory emergencies.

Consequently, manufacturers are investing in innovation to meet these needs, leading to expanded market opportunities and growth. Enhanced features in intensive care ventilators not only improve patient care but also stimulate the overall ventilator market by driving technological advancements and increasing adoption across healthcare facilities. For instance, in January 2023, Getinge expanded its intensive care unit offerings by launching the new Servo-c ventilator. Targeting selected markets, the Servo-c provided lung-protective tools for treating both pediatric and adult patients. With decades of expertise, it aimed to make healthcare more accessible and affordable for hospitals worldwide.

Moreover, the success of the clinical trial on intensive care units gave a significant boost to the market, enhancing its growth prospects and driving increased interest and investment. For instance, in July 2023, ART MEDICAL, an Israeli medical device company, revealed impressive results from a randomized study on its smART+ Platform, published by ESPEN's Clinical Nutrition. The study showed that the smART+ Platform improved feeding efficiency, meeting nearly 90% of nutrition goals, and reduced ICU stay and ventilation time by 3.3 days. This breakthrough marked a significant step toward commercializing ART MEDICAL's innovative technology.

Hence, all the above-mentioned factors are expected to generate considerable revenue for the segment pushing the overall growth of the global ventilators market during the forecast period.

|

Report Metrics |

Details |

|

Study Period |

2021 to 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2024 to 2030 |

|

CAGR | |

|

Ventilators Market Size |

USD XX by 2030 |

|

Key Ventilators Companies |

Philips, GE Healthcare, Hamilton Medical, Medtronic PLC, Vyaire Medical, Inc., Getinge AB, ResMed, Air Liquide, Shenzhen Mindray Bio-Medical Electronics Co., Ltd., Fisher & Paykel Healthcare Limited, Smiths Group PLC, ACUTRONIC Medical Systems AG, Drägerwerk AG & Co. KGaA, SCHILLER AG, Bunnell Incorporated, Leistung Equipamentos LTDA, ZOLL Medical Corporation, Koninklijke Philips N.V., Nihon Kohden Corporation, General Electric Company, Allied Healthcare Products, Inc., aXcent Medical GmbH, and Many Others. |

Ventilators Treatment Devices Regional Insights

North America is expected to dominate the overall Ventilators Market:

North America is expected to account for the highest proportion of the ventilators market in 2023, out of all regions. This can be ascribed to the increasing prevalence of respiratory and cardiovascular diseases that require emergency support across the region, increase in technological advancement, increase in hospital admission to an intensive care unit during hospitalization, increased government initiatives coupled with increased awareness programs for respiratory and cardiovascular disorders, and the presence of key market players engaged in merger, acquisition, product launches, and other market activities across the region are expected to escalate the market of ventilators during the forecast period.

Additionally, as per the recent data provided by the Centre for Disease Control and Prevention (2024), in 2022, approximately 4.9% of adults have been diagnosed with coronary heart disease. Physician offices record around 13.0 million visits annually where coronary atherosclerosis and chronic ischemic heart disease are the primary diagnoses. Additionally, 6.9% of visits indicate coronary artery disease, ischemic heart disease, or a history of myocardial infarction in the medical records. Cardiovascular diseases often lead to severe complications that affect respiratory function, such as heart failure and acute myocardial infarction, which frequently require mechanical ventilation. As the prevalence of cardiovascular conditions rises globally, there is a growing need for advanced ventilator support during emergencies to manage these complex cases effectively.

Additionally, as per the data provided by the Centre for Disease Control and Prevention (2024), in 2022, 4.6% of adults had been diagnosed with COPD, emphysema, or chronic bronchitis in the United States. COPD, a progressive lung disease characterized by obstructed airflow and breathing difficulties, often leads to severe respiratory complications that require mechanical ventilation for effective management. COPD patients frequently experience exacerbations that can lead to acute respiratory failure, necessitating the use of ventilators to maintain adequate oxygenation and carbon dioxide removal. This has led to an increased need for both invasive and non-invasive ventilators that can provide precise and adjustable respiratory support tailored to the individual needs of COPD patients thereby escalating the market of ventilators.

Furthermore, as per the recent data and stats provided by the Centre for Disease Control and Prevention (2023), in 2022, The admission rate of mothers to an intensive care unit (ICU) during delivery hospitalization was 1.8 per 1,000 live births.

The increasing number of product development activities in the region is further going to accelerate the growth of the ventilator market. For instance, in July 2023, Getinge received US FDA 510(k) clearance for the Servo-air® Lite, a wall gas-independent non-invasive mechanical ventilator.

Furthermore, in March 2023, Clario, a healthcare research technology company known for its endpoint technology solutions for clinical trials, announced a partnership with the technology startup ArtiQ. This collaboration aimed to improve the accuracy of respiratory clinical trials that require spirometry data. The partnership allowed for AI-based reviews of spirometry data collected on the Clario platform.

Therefore, the above-mentioned factors are expected to bolster the growth of the ventilator market in North America during the forecast period.

Key Ventilators Companies In The Market Landscape:

Some of the key ventilators companies operating in the market include Hamilton Medical, Medtronic PLC, Vyaire Medical, Inc., Getinge AB, ResMed, Air Liquide, Shenzhen Mindray Bio-Medical Electronics Co., Ltd., Fisher & Paykel Healthcare Limited, Smiths Group PLC, ACUTRONIC Medical Systems AG, Drägerwerk AG & Co. KGaA, SCHILLER AG, Bunnell Incorporated, Leistung Equipamentos LTDA, ZOLL Medical Corporation, Koninklijke Philips N.V., Nihon Kohden Corporation, General Electric Company, Allied Healthcare Products, Inc., aXcent Medical GmbH, and others.

Recent Developmental Activities in the Ventilators Market:

- On April 29, 2024, Philips agreed to a $1.1 billion settlement in the U.S. over personal injury claims related to its global ventilator recall, without admitting fault, to resolve litigation uncertainty.

- On July 15, 2024, Pune-based Noccarc received the BIS Certification IS 13450: Part 2: SEC 12:2023 for its V730i ICU Ventilator, marking a significant milestone in India's medical technology sector and aligning it with global standards like US FDA and CE certifications.

- In August 2023, Medline, the largest privately-held manufacturer and distributor of medical supplies and devices in the U.S., announced a new partnership with Israeli-based Flight Medical, making its Flight 60 transportable ventilator exclusively available through Medline.

- On March 29, 2023, Superior Sensor Technology introduced a new pressure sensor designed to enhance response times and reduce system noise in ventilators and high-flow oxygen equipment, addressing patient-ventilator dyssynchrony and improving mechanical ventilation efficiency.

- In October 2021, Movair Announced the Commercial Launch of Luisa Life Supporting Ventilator with High-Flow Oxygen Therapy.

- In May 2021, CorVent Medical Secures CE Mark Approval For Its Critical Care RESPOND-19™ Ventilator.

Key Ventilators Highlights Summary (2022–2025)

| Category | Key Developments |

|---|---|

| Product Launches | Introduction of advanced portable ventilators, AI-enabled ICU ventilators, and non-invasive homecare devices. |

| Regulatory Approvals | FDA and CE approvals for next-generation ventilators with enhanced monitoring, safety features, and improved patient interfaces. |

| Partnerships | Strategic collaborations between ventilator manufacturers and tech companies for AI integration and telemonitoring solutions. |

| Acquisitions | Mergers and acquisitions to expand product portfolios, enter new geographies, and strengthen R&D capabilities. |

| Company Strategy | Focus on innovation, expansion in emerging markets, and targeting homecare and critical care segments to capture market growth. |

| Setbacks | Supply chain disruptions, component shortages, and delays in product launches due to regulatory and manufacturing challenges. |

| Emerging Technology | Integration of AI-driven ventilation management, portable and battery-operated ventilators, remote patient monitoring, and smart connectivity features. |

Impact Analysis

AI Advancement in Ventilators

- Intelligent Ventilation Management: AI algorithms adjust ventilator settings in real-time based on patient-specific parameters like oxygen levels, lung compliance, and respiratory rate, optimizing respiratory support.

- Predictive Analytics: AI can forecast potential complications, such as ventilator-associated pneumonia or acute respiratory distress, enabling early interventions.

- Personalized Therapy: Machine learning models tailor ventilation strategies to individual patient needs, improving outcomes for critical care, neonatal, and pediatric patients.

- Remote Monitoring & Tele-ICU Integration: AI-enabled ventilators allow clinicians to monitor and manage patients remotely, enhancing care efficiency, especially in resource-limited settings.

- Alarm Reduction & Workflow Optimization: AI reduces false alarms by analyzing multiple physiological signals, minimizing caregiver fatigue and streamlining ICU workflow.

- Data-Driven Insights for R&D: AI collects and analyzes ventilator performance data, aiding manufacturers in product improvement and development of next-generation ventilators.

- Integration with Wearables & IoT Devices: AI-enabled ventilators can communicate with wearable sensors, providing continuous patient monitoring and early detection of respiratory deterioration.

Tariff Inclusion in Ventilators

- Understanding Tariff Implications: Tariff inclusion analysis helps identify import/export duties, taxes, and customs regulations applicable to ventilators in various regions.

- Impact on Product Pricing: By factoring in tariffs, companies can accurately assess the landed cost of ventilators, helping in pricing strategies.

- Market Competitiveness: Awareness of tariff structures allows manufacturers and distributors to remain competitive in international markets.

- Policy Updates: Staying updated with tariff revisions ensures compliance and prevents unexpected financial burdens.

- Global Trade Considerations: Tariff analysis aids in evaluating the feasibility of sourcing components or ventilators from different countries.

How This Analysis Helps Clients

- Cost Management:

- Provides insights into total landed costs including tariffs and duties.

- Helps in identifying cost-saving opportunities by comparing tariff rates across regions.

- Enables accurate budgeting and financial forecasting for ventilator procurement.

- Supply Chain Optimization:

- Guides decisions on sourcing locations to minimize tariff-related costs.

- Helps in selecting distribution hubs that reduce overall customs expenses.

- Supports risk mitigation by identifying tariff-related bottlenecks in logistics.

- Regulatory Navigation:

- Ensures compliance with local import/export laws and customs regulations.

- Reduces the risk of penalties or shipment delays due to tariff miscalculations.

- Provides a clear roadmap for regulatory approvals and documentation requirements.

- Strategic Planning:

- Supports market entry decisions by factoring in tariffs for cost-benefit analysis.

- Helps in long-term planning for partnerships, acquisitions, or local manufacturing.

- Aligns pricing and sales strategies with regional tariff structures to maximize profitability.

Startup Funding & Investment Trends in Ventilators

| Company Name | Total Funding | Main Products/Focus | Stages of Development | Core Technology |

|---|---|---|---|---|

| Ventec Life Systems | $20M | Portable multi-function ventilator | Commercialization | Integrated ventilator with AI diagnostics |

| CorVent Medical | $4.5M | Single-use critical care ventilator | Seed stage | Simplified, low-cost ventilator design |

| Umbulizer | $80K | Portable ventilator (UMV-001) | Prototype phase | Mobile app integration for real-time alerts |

| AgVa Healthcare | Not disclosed | Gesture-controlled ventilators | Market-ready | Gesture recognition for ICU ventilation |

| Noccarc | $2M | Smart medical devices, including ventilators | R&D and market penetration | Smart, connected medical devices |

Key Takeaways from the Ventilators Market Report Study

- Market size analysis for current ventilators size (2023), and market forecast for 6 years (2024 to 2030)

- Top key product/technology developments, mergers, acquisitions, partnerships, and joint ventures happened over the last 3 years

- Key companies dominating the ventilators market.

- Various opportunities available for the other competitors in the ventilators market space.

- What are the top-performing segments in 2023? How these segments will perform in 2030?

- Which are the top-performing regions and countries in the current ventilators market scenario?

- Which are the regions and countries where companies should have concentrated on opportunities for ventilator market growth in the coming future?

Target Audience who can be benefited from this Ventilators Market Report Study

- Ventilators product providers

- Research organizations and consulting companies

- Ventilators -related organizations, associations, forums, and other alliances

- Government and corporate offices

- Start-up companies, venture capitalists, and private equity firms

- Distributors and traders dealing in ventilators

- Various end-users who want to know more about the ventilator market and the latest technological developments in the ventilator market.