Download Case Study to Unlock Valuable Insights

Fill out the form to gain access to exclusive content and data-driven strategies

Competitive Landscape Assessment

- Home

- case study

- competitive landscape assessment

Objective:

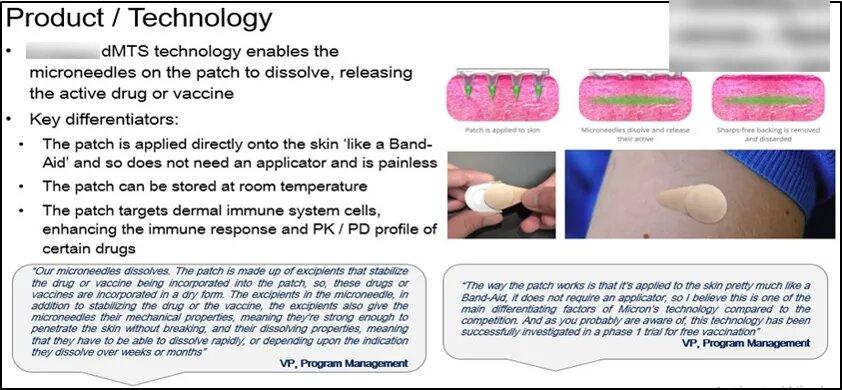

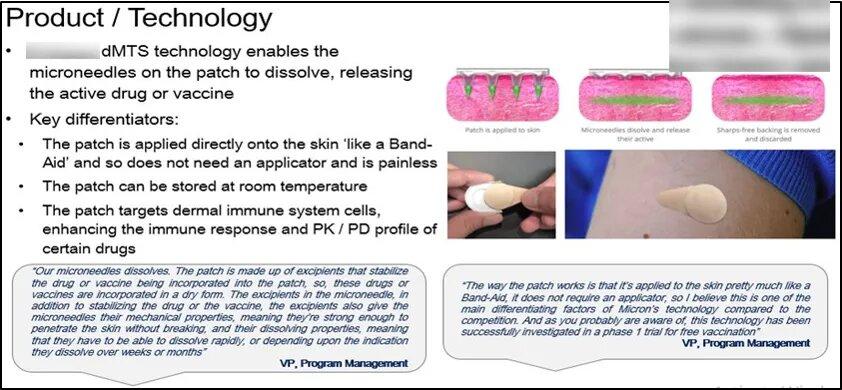

In a rapidly evolving medical device and drug delivery market, companies must continuously explore emerging technologies, assess competitive threats, and identify innovation pathways. The objective of this engagement was to help the client evaluate a novel dissolvable microneedle drug delivery technology, assess its commercial attractiveness, and understand its strategic fit within long-term growth plans.

The overarching goal was to support the client in expanding their product portfolio, strengthening their competitive landscape positioning, and making an informed decision regarding a high-impact merger and acquisition (M&A) opportunity.

Problem Statement

A leading US-based medical device company specializing in drug delivery systems engaged DelveInsight to evaluate the strategic value and risks associated with a potential merger focused on dissolvable microneedle technology.

The company aimed to acquire critical intellectual property (IP) to enhance its product pipeline but needed clarity on:

- How the merger would influence its existing business strategy

- The commercial viability and competitive intensity surrounding dissolvable microneedles

- Post-merger risks that could threaten operational stability

- Alignment of both entities’ long-term visions and technological strengths

The client sought a comprehensive competitive landscape analysis, risk assessment, and guidance on ensuring seamless post-merger integration.

Solution

DelveInsight delivered an end-to-end, data-driven solution to support the client’s M&A decision-making and competitive positioning:

- Developed a strategic framework to ensure the client retained full control of critical, strategy-driven processes post-merger.

- Assessed the company’s exposure to post-merger operational, regulatory, and commercial risks, with actionable mitigation strategies.

- Evaluated the manufacturing and import licensing workflows associated with the new drug delivery technology to clarify regulatory expectations.

- Outlined protective measures for both merging entities to maintain governance, transparency, and control throughout the transition phase.

- Executed internal strategy workshops to foster cross-functional visibility, collaboration, and alignment before and after the merger.

This approach provided the client with the clarity and confidence required to move toward a high-value acquisition.

Our Methodology

To enable a precise and evidence-based assessment, DelveInsight employed a multi-level methodology combining market analysis, IP evaluation, technology benchmarking, and M&A advisory principles:

1. Technology & IP Evaluation

A complete evaluation of the dissolvable microneedle technology landscape was conducted to identify companies with strong IP coverage, robust manufacturing capabilities, and differentiated product advantages.

2. Partner Feasibility & Strategic Fit

Using competitive landscape analytics, we assessed both entities’ strategies, long-term goals, and potential for technological integration to determine the most compatible partner.

3. Compatibility & Cohesion Analysis

In-depth assessments were carried out to evaluate cultural, operational, and technological compatibility to ensure seamless post-merger synergy.

4. Transaction Cost & Economic Impact Analysis

A detailed financial and transactional assessment was performed to understand cost implications and project long-term ROI.

5. Post-Merger Environment Mapping

We created scenario-based insights to help the client visualize the post-merger business environment, including governance considerations, operational workflows, and market positioning.

Impact

DelveInsight’s comprehensive competitive landscape assessment enabled the client to:

- Establish a new niche in the drug delivery market through the integration of an advanced dissolvable microneedle platform.

- Maintain and strengthen their competitive edge through strategic acquisition and well-informed risk mitigation.

- Ensure optimal resource allocation for research and future commercial initiatives.

- Proceed with confidence regarding merger decisions backed by clear data, market intelligence, and strategic foresight.

Our Related Services

Sample Visuals

Get Visuals