Crohn's Disease Market Summary

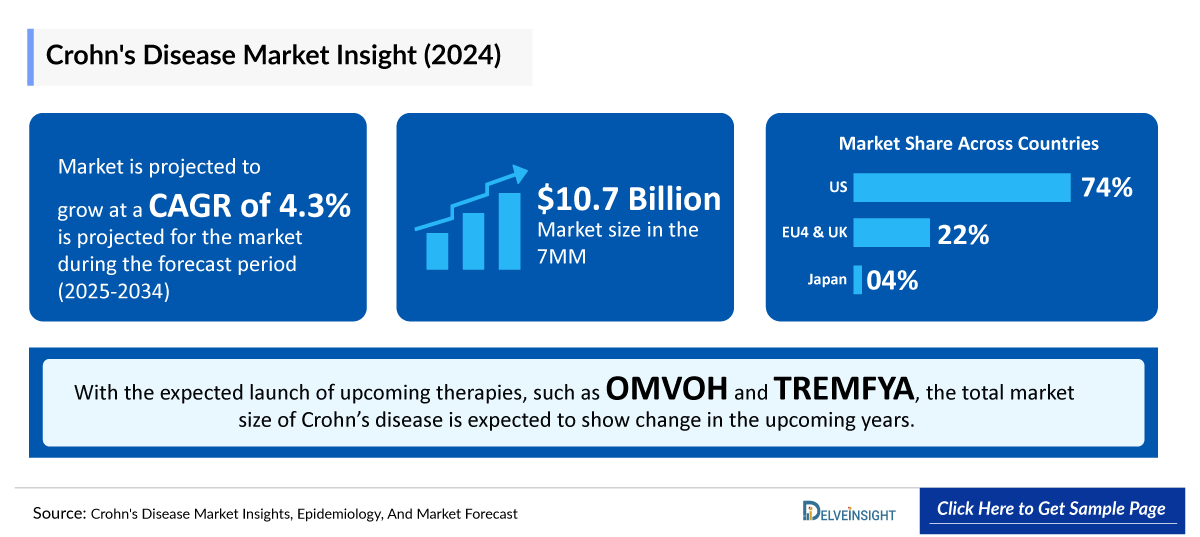

- The Crohn's Disease market size in the 7MM is expected to grow from USD 11,367 million in 2025 to USD 16,840 million in 2034.

- The Crohn's Disease market is projected to grow at a CAGR of 4.40% by 2034 in leading countries like US, EU4, UK and Japan.

Crohn's Disease Market & Epidemiology Analysis

- In May 2025, ALPCO announced the European launch of its Calprotectin Immunoturbidimetric Assay to support the diagnosis of inflammatory bowel disease (IBD), including Crohn's disease and ulcerative colitis. Already FDA-cleared and IVDD-certified, the assay helps distinguish IBD from irritable bowel syndrome (IBS) when used with other clinical data.

- In May 2025, Teva Pharmaceuticals and Alvotech announced that the FDA has approved SELARSDI™ (ustekinumab-aekn) injection as interchangeable with the reference biologic Stelara® (ustekinumab). Starting April 30, 2025, SELARSDI is available in all presentations matching the reference product, for the treatment of adults and pediatric patients with psoriatic arthritis, plaque psoriasis, Crohn’s disease, and ulcerative colitis.

- In March 2025, Celltrion announced the U.S. launch of STEQEYMA® (ustekinumab-stba), a biosimilar to STELARA® (ustekinumab), following FDA approval in December 2024. STEQEYMA is approved for the same indications as STELARA, offering consistent treatment for patients and healthcare providers.

- In March 2025, Johnson & Johnson announced that the FDA approved TREMFYA® (guselkumab), the first and only IL-23 inhibitor with both subcutaneous (SC) and intravenous (IV) induction options, for treating adults with moderately to severely active Crohn’s disease (CD), a chronic inflammatory gastrointestinal condition

- In March 2025, the US Food and Drug Administration (FDA) approved TREMFYA (guselkumab), the first and only IL-23 inhibitor offering both subcutaneous (SC) and intravenous (IV) induction options, for the treatment of adults with moderately to severely active Crohn’s disease.

- In 2024, the market size of Crohn’s disease was highest in the US among the 7MM, accounting for approximately USD 8,000 million, which is further expected to increase at a CAGR of 4.5%.

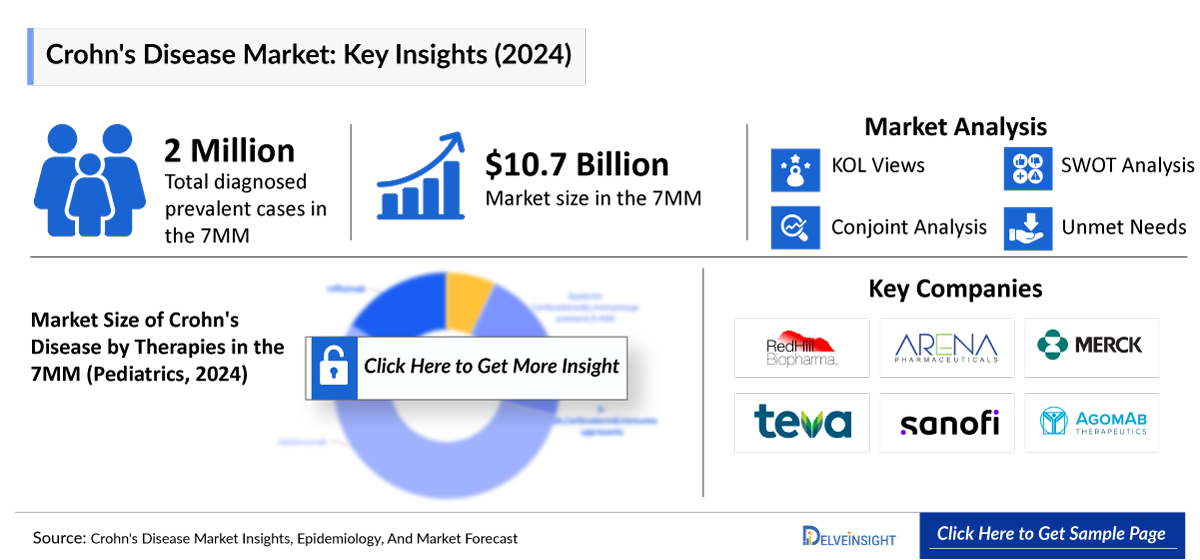

- The leading Crohn's Disease companies such as Takeda Pharmaceutical, Janssen Pharmaceuticals, UCB, Biogen, AbbVie, AstraZeneca, NImmune Biopharma, Tillotts Pharma (Zeria Pharmaceutical), Gilead Sciences and Galapagos NV, Boehringer Ingelheim, Celgene (Bristol Myers Squibb), Eli Lilly and Company, RedHill Biopharma, Arena Pharmaceuticals, Mesoblast, and others are developing therapies for Crohn's Disease treatment.

- The current treatment strategies mainly rely upon the use of adalimumab (HUMIRA and biosimilar), STELARA (ustekinumab), Infliximab (REMICADE and biosimilar), systemic corticosteroids, immunosuppressant, 5-ASA, and others. Adalimumab accounted for the highest market share of ~ 4,000 million in 2024 for treatment of Crohn’s disease in the 7MM.

- Out of the overall market size of Crohn’s disease, roughly 10% of revenue is generated through pediatric patients. Pediatric Crohn’s disease treatment leans heavily on two approved biologics, HUMIRA (AbbVie) and REMICADE (Janssen Biotech), due to their long-standing efficacy and physician preference, along with immunomodulators and corticosteroids.

- The total market size of the Crohn’s disease is anticipated to experience growth during the forecast period due to the recently approved and emerging therapies that include RINVOQ (upadacitinib), OMVOH (mirikizumab), SKYRIZI (risankizumab), TREMFYA (guselkumab), STELARA (ustekinumab–pediatric), ENTYVIO (vedolizumab–pediatric), VELSIPITY (etrasimod), Tulisokibart, LITFULO (ritlecitinib), AGMB-129, Duvakitug, and others.

- In January 2025, the FDA approved OMVOH (mirikizumab) for Crohn’s disease, further solidifying the IL-23 inhibitor class. With strong long-term efficacy, OMVOH is also being investigated for pediatric patients, potentially addressing a significant unmet need in this population.

- RedHill Biopharma, Arena Pharmaceuticals, Johnson & Johnson, Merck, Pfizer, Agomab Therapeutics, Teva Pharmaceuticals, Sanofi, and others are developing promising late- and mid-stage emerging pipeline assets for Crohn’s disease.

Crohn's Disease Market Size & Forecasts

- 2025 Market Size: USD 11,367 million in 2025

- 2034 Projected Market Size: USD 16,840 million in 2034

- Growth Rate (2025-2032): 4.40% CAGR

- Largest Market: United States

DelveInsight’s ‘Crohn’s Disease Market Insights, Epidemiology and Market Forecast – 2034’ report delivers an in-depth understanding of Crohn’s disease, historical and forecasted epidemiology as well as the Crohn’s disease therapeutics market trends in the United States, EU4 and the UK (Germany, France, Italy, Spain) and the United Kingdom, and Japan.

The Crohn’s disease market report provides current treatment practices, approved therapies revenue estimates, emerging drugs analysis, market share of individual therapies, and current and forecasted 7MM Crohn’s disease market size from 2020 to 2034. The report also covers current Crohn’s disease treatment practices, market drivers, market barriers, SWOT analysis, reimbursement and market access, and unmet medical needs to curate the best of the opportunities and assess the underlying potential of the market.

|

Scope of the Crohn's Disease Market Report | |

|

Study Period |

2020 to 2034 |

|

Forecast Period |

2024-2034 |

|

Geographies Covered |

|

|

Crohn's Disease Market |

|

|

Crohn's Diseases Market Size | |

|

Crohn's Disease Companies |

Takeda Pharmaceutical, Janssen Pharmaceuticals, UCB, Biogen, AbbVie, AstraZeneca, NImmune Biopharma, Tillotts Pharma (Zeria Pharmaceutical), Gilead Sciences and Galapagos NV, Boehringer Ingelheim, Celgene (Bristol Myers Squibb), Eli Lilly and Company, RedHill Biopharma, Arena Pharmaceuticals, Mesoblast, and others |

|

Crohn's Disease Epidemiology Segmentation |

|

Key Factors Driving the Crohn's Disease Market

Rising Crohn's Disease Prevalence

The prevalence of Crohn’s disease is on the rise, particularly in developed regions. In the United States, in 2024, the diagnosed prevalent cases were 1.1 million. These numbers are further expected to reach 1.5 million by 2034.

Advancements in Biologic and Targeted Crohn's Disease Therapies

Innovations in biologic and targeted therapies have significantly improved the management of Crohn’s disease. Crohn's Disease drugs like anti-TNF agents (CIMZIA, HUMIRA, REMICADE), anti-integrins (TYSABRI, ENTYVIO), and interleukin inhibitors (OMVOH, SKYRIZI, STELARA) have enhanced treatment efficacy and patient outcomes.

Rising Adoption of JAK Inhibitors and Immunomodulators

New treatments like JAK inhibitors (LITFULO) and immunomodulators are being developed, with targeted biologic therapies expected to have higher penetration in moderate-to-severe Crohn’s disease. This is due to the availability of more products with improved clinical profiles and convenient administration options.

Crohn’s Disease Clinical Trial Landscape for Novel Inhibitors

First-in-class therapies, such as Tulisokibart (TL1A inhibitor) and AGMB-129 (ALK5 or TGFβR1 inhibitor), are currently being evaluated in Crohn’s disease clinical trials, presenting a promising avenue for market entry and innovation.

Strong Crohn’s Disease Clinical Trial Activity

The Crohn’s disease clinical trial landscape includes several drugs in mid- and late-stage development that are expected to be approved in the near future. The emerging landscape holds a diverse range of therapeutic alternatives for treatment, including RHB-104, Tulisokibart, VELSIPITY, LITFULO (ritlecitinib), AGMB-129, Duvakitug, and others. The expected launch of these therapies shall further create a positive impact on the market.

Crohn’s Disease Disease Overview

Crohn’s Disease Overview

Crohn’s disease is a chronic inflammatory condition of the GI tract, classified as a type of Inflammatory Bowel Disease. It can affect any part of the digestive system, from the mouth to the anus, but most commonly affects the small intestine and colon. The exact cause remains unknown, though it is believed to result from a combination of genetic, environmental, and immune system factors.

Symptoms vary in severity and may include abdominal pain, diarrhea, weight loss, fatigue, and malnutrition. While there is no cure, treatment focuses on reducing inflammation, managing symptoms, and preventing complications through medications, biologics, lifestyle changes, and, in some cases, surgery. With ongoing research and advancements in targeted therapies, new treatment options continue to emerge, offering hope for improved disease management and quality of life for patients with Crohn’s disease.

Crohn’s Disease Diagnosis

Diagnosing Crohn’s disease can be challenging as its symptoms overlap with other gastrointestinal conditions, such as ulcerative colitis and IBS. A comprehensive approach is used, combining clinical evaluation, laboratory tests, imaging studies, and endoscopic procedures. Blood tests help detect markers of inflammation, anemia, or nutritional deficiencies, while stool tests rule out infections. Imaging techniques like CT scans, MRI, and intestinal ultrasound provide detailed views of the digestive tract to identify inflammation, strictures, or fistulas. Endoscopic procedures, including colonoscopy and upper endoscopy, allow direct visualization of the intestines and tissue biopsy for confirmation. Since no single test can definitively diagnose Crohn’s disease, physicians rely on a combination of findings to ensure accurate detection and appropriate treatment planning.

Further details related to the diagnosis are provided in the report…

Crohn’s Disease Treatment

The treatment of Crohn’s disease focuses on reducing inflammation, managing symptoms, and preventing complications to improve patients' quality of life. Treatment strategies vary based on disease severity, location, and patient response. First-line therapies often include aminosalicylates and corticosteroids for mild-to-moderate cases, while immunomodulators such as azathioprine and methotrexate help control immune system activity in more persistent cases.

For moderate-to-severe Crohn’s disease, biologic therapies such as TNF inhibitors (adalimumab, infliximab), IL-12/23 inhibitors (STELARA), and integrin inhibitors (ENTYVIO) target specific pathways of inflammation. More recently, small-molecule therapies such as JAK inhibitors (RINVOQ) have emerged as oral alternatives for patients who do not respond to biologics. In severe or complicated cases, surgery may be necessary to remove damaged sections of the intestine. With ongoing research and advancements, treatment approaches continue to evolve, offering more personalized and effective options for managing Crohn’s disease.

Further details related to treatment are provided in the report…

Crohn’s Disease Epidemiology

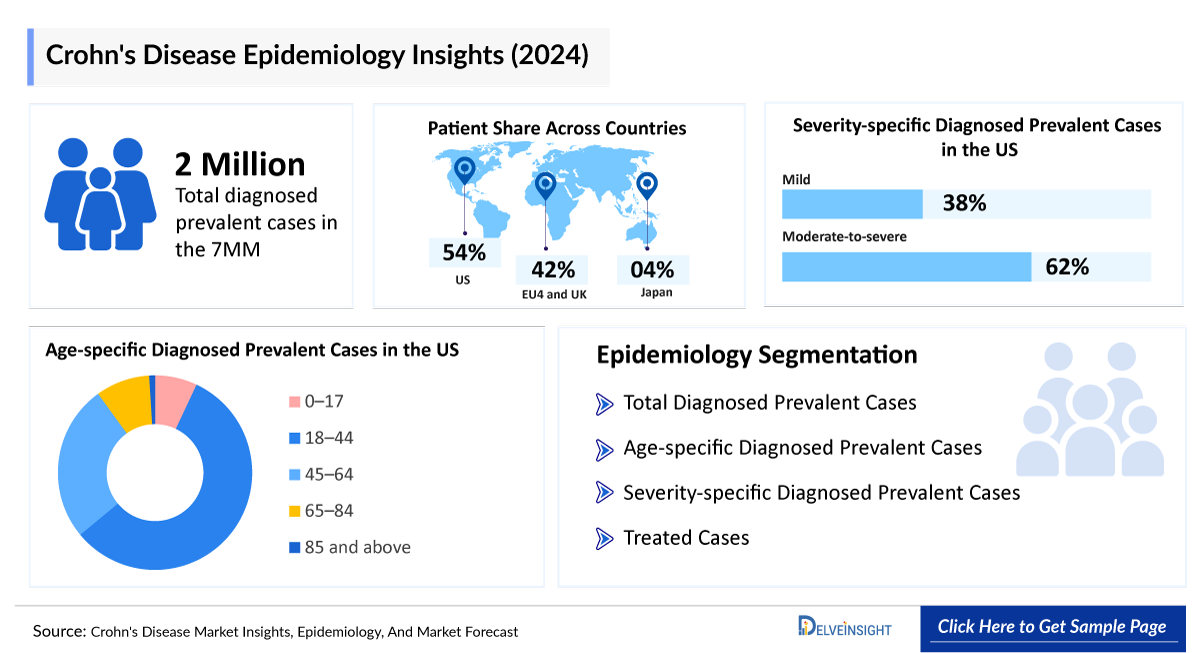

As the market is derived using a patient-based model, the Crohn’s disease epidemiology chapter in the report provides historical as well as forecasted epidemiology segmented by total diagnosed prevalent cases of Crohn’s disease, age-specific diagnosed prevalent cases of Crohn’s disease, severity-specific diagnosed prevalent cases of Crohn’s disease, and treated cases of Crohn’s disease, in the 7MM covering, the United States, EU4 countries (Germany, France, Italy, and Spain), United Kingdom, and Japan from 2020 to 2034.

Key Findings from Crohn's Disease Epidemiological Analyses and Forecast

- The total diagnosed prevalent cases of Crohn’s disease in the United States were around 1.1 million cases in 2024.

- The United States contributed to the largest diagnosed prevalent population of Crohn’s disease, acquiring ~54% of the 7MM in 2024. Whereas EU4 and the UK, and Japan accounted for around 42% and 4% of the total population share, respectively, in 2024.

- Among the EU4 countries, Germany accounted for the largest number of diagnosed prevalent Crohn’s disease (299,000 cases) cases, followed by the UK (234,000 cases), whereas Spain accounted for the lowest number of cases (93,000 cases) in 2024.

- In 2024, it was estimated that there were around 461,000 diagnosed prevalent cases of mild severity and 755,000 cases of moderate-to-severe severity in the US.

- According to DelveInsight estimates, in 2024, among the age-specific diagnosed prevalent cases of Crohn’s disease in the US, the highest number of cases was in the 18–44 years age group (~657,000), followed by 45–64 years (~298,000), 65–84 years (~104,000), 0–17 years (~81,000), and those aged 85 and above (~11,000).

Crohn's Disease Epidemiology Segmentation:

- Total diagnosed prevalent cases of Crohn’s disease

- Age-specific diagnosed prevalent cases of Crohn’s disease

- Severity-specific diagnosed prevalent cases of Crohn’s disease

- Treated cases of Crohn’s disease

Crohn’s Disease Market Recent Developments and Breakthroughs:

- In May 2025, ALPCO announced the European launch of its Calprotectin Immunoturbidimetric Assay to support the diagnosis of inflammatory bowel disease (IBD), including Crohn's disease and ulcerative colitis. Already FDA-cleared and IVDD-certified, the assay helps distinguish IBD from irritable bowel syndrome (IBS) when used with other clinical data.

- In May 2025, Teva Pharmaceuticals and Alvotech announced that the FDA has approved SELARSDI™ (ustekinumab-aekn) injection as interchangeable with the reference biologic Stelara® (ustekinumab). Starting April 30, 2025, SELARSDI is available in all presentations matching the reference product, for the treatment of adults and pediatric patients with psoriatic arthritis, plaque psoriasis, Crohn’s disease, and ulcerative colitis.

- In March 2025, Celltrion announced the U.S. launch of STEQEYMA® (ustekinumab-stba), a biosimilar to STELARA® (ustekinumab), following FDA approval in December 2024. STEQEYMA is approved for the same indications as STELARA, offering consistent treatment for patients and healthcare providers.

- In March 2025, Johnson & Johnson announced that the FDA approved TREMFYA® (guselkumab), the first and only IL-23 inhibitor with both subcutaneous (SC) and intravenous (IV) induction options, for treating adults with moderately to severely active Crohn’s disease (CD), a chronic inflammatory gastrointestinal condition.

Crohn’s Disease Drugs Analysis

The drug chapter segment of the Crohn’s disease report encloses a detailed analysis of Crohn’s disease off-label drugs and late-stage (Phase-III and Phase-II) Crohn's Disease pipeline drugs. It also helps to understand the Crohn’s disease clinical trial details, expressive pharmacological action, agreements and collaborations, approval and patent details, advantages and disadvantages of each included drug, and the latest news and press releases.

Marketed Crohn’s Disease Drugs

OMVOH (mirikizumab/LY3074828): Eli Lilly

OMVOH is an interleukin-23p19 antagonist indicated for the treatment of moderately to severely active ulcerative colitis and Crohn's disease in adults. OMVOH selectively targets the p19 subunit of IL-23 and inhibits the IL-23 pathway. Inflammation due to over-activation of the IL-23 pathway plays a critical role in the pathogenesis of IBD. OMVOH and its delivery device base are trademarks owned by Eli Lilly and Company.

- In February 2025, Eli Lilly announced the results from the VIVID-2 open-label extension study, which showed the majority of patients with moderately-to-severely active Crohn's disease receiving 2 years of continuous treatment with OMVOH achieved long-term clinical and endoscopic outcomes, including those (43.8%) with previous biologic failure at the Crohn's and Colitis Congress (CCC).

- In January 2025, Eli Lilly and Company announced that the FDA had approved OMVOH for the treatment of moderately to severely active Crohn's disease in adults.

- In October 2024, Eli Lilly has submitted the approval for OMVOH in Japan for the treatment of Crohn's disease.

ENTYVIO (vedolizumab): Takeda Pharmaceutical

Vedolizumab is a gut-selective biologic developed by Takeda Pharmaceutical and marketed under the brand name ENTYVIO. It is approved in the US for the treatment of adult patients with moderately-to-severely active ulcerative colitis and Crohn’s disease who have had an inadequate response with lost response to or were intolerant to either conventional therapy or a TNFα-antagonist.

- In April 2024, the FDA approved ENTYVIO SC administration for maintenance therapy in adults with moderately to severely active Crohn’s disease after induction therapy with IV ENTYVIO.

- In September 2023, Takeda announced the approval of SC formulation of ENTYVIO in pen and syringes form in Japan for the maintenance therapy of moderate-to-severe active Crohn’s disease.

TREMFYA (Guselkumab): Johnson & Johnson

TREMFYA is a human monoclonal antibody against the p19 subunit of Interleukin (IL)-23 developed by Janssen. TREMFYA is produced in a mammalian cell line using recombinant DNA technology.

- TREMFYA is the only IL-23 inhibitor to demonstrate superiority to ustekinumab in the overall population of patients with Crohn’s disease, inclusive of those who are biologic-naïve and biologic-refractory.

- In May 2024, Johnson & Johnson's company announced it had submitted applications to the European Medicines Agency (EMA) seeking to expand the Marketing Authorization Application for TREMFYA (guselkumab) to include the treatment of adult patients with moderately to severely active ulcerative colitis and moderately to severely active Crohn’s disease.

Further detail in the report…

Emerging Crohn’s Disease Drugs

Tulisokibart (MK-7240, PRA023): Merck

Tulisokibart is an investigational humanized monoclonal antibody directed to a novel target, TNF-like Cytokine 1A (TL1A), that is associated with both intestinal inflammation and fibrosis. Tulisokibart is thought to bind both soluble and membrane-bound human TL1A. Clinical studies suggest that tulisokibart may inhibit inflammatory pathways involved in IBD and help reduce intestinal fibrosis, which may be important in altering disease progression in IBD.

- In June 2023, Merck announced the completion of the Prometheus Biosciences acquisition. Prometheus is now a wholly owned subsidiary of Merck.

- In the United States, patent exclusivity for tulisokibart extends into the 2040s. This treatment has the potential to become a significant growth driver for Merck well into the next decade.

- Merck is developing tulisokibart for the treatment of immune-mediated inflammatory diseases, including ulcerative colitis, Crohn’s disease, and Systemic Sclerosis-associated Interstitial Lung Disease (SSc-ILD).

AGMB-129: Agomab Therapeutics

AGMB-129 is an oral small molecule GI-restricted inhibitor of ALK5 (or TGFβR1) intended for the treatment of Fibrostenosing Crohn’s Disease (FSCD). TGFβ is a master regulator of fibrosis, and preliminary clinical data supports targeting the pathway in fibrotic indications. AGMB-129 is specifically designed to inhibit ALK5 in the GI tract.

- Agomab is expecting Interim data from the Phase IIa STENOVA trial in the first quarter of 2025.

- In October 2024, – Agomab Therapeutics announced a USD 89 million Series D financing round, with participation from new investors Sanofi and Invus, as well as existing investors.

An indicative list of emerging therapies is listed below:

| Comparison of Crohn's Disease Emerging Drugs | ||||

|

Drug |

MoA |

RoA |

Company |

Phase |

|

RHB-104 |

Macrolide antibiotics |

Oral |

RedHill Biopharma |

III |

|

VELSIPITY |

Sphingosine 1-phosphate (S1P) receptor modulator |

Oral |

Arena Pharmaceuticals |

III |

|

Tulisokibart |

TL1A inhibitor |

IV and SC |

Merck |

III |

|

LITFULO |

JAK3 inhibitor |

Oral |

Pfizer |

II |

|

AGMB-129 |

ALK5 (or TGFβR1) Inhibitor |

Oral |

Agomab Therapeutics |

II |

|

Omilancor |

Inflammation mediator inhibitors; LANCL2 protein stimulants |

Oral |

NImmune Biopharma |

II |

Note: Detailed emerging therapies assessment will be provided in the final report of Crohn’s disease.

Crohn’s Disease Market Outlook

Crohn’s disease is a progressive form of IBD that causes chronic inflammation, leading to strictures, fistulas, and ulcers in the GI tract, primarily affecting the terminal ileum and colon. Treatment aims to reduce inflammation, alleviate symptoms, maintain remission, and prevent complications to preserve intestinal integrity and improve patient quality of life. Treatment options include nutritional therapy, pharmacological therapy, and, in severe cases, surgery. Pharmacological therapy often begins with glucocorticosteroids like budesonide, while alternatives such as 5-Aminosalicylate (5-ASA) are used when steroids are contraindicated. Immunomodulators like azathioprine, methotrexate, and 6-mercaptopurine are recommended for moderate disease, but long-term steroid use is avoided due to side effects.

Biologic therapies dominate the Crohn’s disease market, targeting specific proteins responsible for inflammation. TNF inhibitors like infliximab (REMICADE and biosimilar), adalimumab (HUMIRA and biosimilar), and CIMZIA (certolizumab pegol) have been mainstays of treatment but can lose effectiveness over time. Anti-integrin therapy such as ENTYVIO and the IL-12/23 inhibitor STELARA have emerged as preferred second-line options. Cell-based therapy, such as ALOFISEL (darvadstrocel), was explored for complex perianal fistulas but is being withdrawn from the EU market in 2024 due to insufficient clinical benefit. Meanwhile, newer therapies like the JAK inhibitor RINVOQ and IL-23 inhibitors such as SKYRIZI are gaining momentum, with additional treatments like S1P receptor modulators and TYK2 inhibitors under development.

Biosimilars have significantly impacted the market by reducing costs and improving access to biologic therapies. The first REMICADE biosimilar was approved in 2016, followed by INFLECTRA, RENFLEXIS, and AVSOLA. HUMIRA faced biosimilar competition in 2023, with AMJEVITA and CYLTEZO among those entering the market, increasing affordability. However, adoption challenges remain due to physician hesitancy, patient concerns, and payer policies. The late 2020s expect biosimilars for STELARA, while the first TYSABRI biosimilar, TYRUKO, was approved in Germany in 2024, signaling further competition in the biologics space.

Despite biosimilar competition, innovation in Crohn’s disease treatments continues. Several emerging therapies are targeting novel inflammatory pathways to enhance efficacy and durability. RHB-104, a macrolide antibiotic combination, is in Phase III trials for potential mycobacterial involvement in Crohn’s. VELSIPITY, an S1P receptor modulator, aims to reduce lymphocyte migration and inflammation. TREMFYA, an IL-23 inhibitor, is under investigation for targeted immune modulation, while ABBV-154, a TNF biologic with steroid conjugation, seeks to improve TNF inhibition.

Other therapies include Merck’s TL1A inhibitor Tulisokibart (PRA023/MK-7240) in Phase III trials and Pfizer’s JAK3 inhibitor LITFULO in Phase II development. Additionally, Teva and Sanofi are developing Duvakitug, a monoclonal antibody targeting TNFSF15. These advancements highlight the ongoing evolution of Crohn’s disease management, offering new hope for patients who do not respond to existing therapies.

Several other promising therapies are currently in development for Crohn’s disease, targeting diverse mechanisms to enhance treatment outcomes. Omilancor (BT-11) by NImmune is in Phase II, focusing on LANCL2 mediation, while AVB-114, developed by Avobis Bio/Alimentiv, is also undergoing Phase II evaluation. Obefazimod (ABX464) by Abivax S.A. is in Phase II, exploring miR-124 upregulation. RVT-3101 (RG6631) from Roche, an anti-TL1A monoclonal antibody, is progressing through Phase II trials. RYONCIL (Remestemcel-L) by Mesoblast is advancing in Phase III as a mesenchymal stem cell therapy, offering a potential regenerative approach. Zasocitinib (TAK-279) from Takeda, a TYK2 inhibitor, is in Phase II trials, while AZD7798 by AstraZeneca, a monoclonal antibody targeting CCR9 receptors, is also in Phase II.

Other promising candidates include Balinatunfib (SAR441566) by Sanofi, which inhibits TNFR1 signaling, and AGMB-129 by Agomab Therapeutics, targeting ALK5/TGFβR1, both in Phase II development. MBF-118 by Medibiofarma, a partial agonist of PPARγ, and MORF-057 from Eli Lilly and Morphic Therapeutic, an α4β7 integrin inhibitor, are also in Phase II trials.

- The therapeutic market size of Crohn’s disease in the 7MM was approximately USD 10,777 million in 2024.

- The market size in the 7MM will increase at a CAGR of 4.3% due to increasing awareness of the disease, better diagnosis, and the launch of the emerging therapy.

- The United States accounted for the highest market size of Crohn’s disease, approximately 74% of the total market size in 7MM in 2024, in comparison to the other major markets, i.e., EU4 countries (Germany, France, Italy, and Spain), and the United Kingdom, and Japan.

- Among the European countries, Germany had the highest market size, with nearly USD 670 million, while Spain had the lowest market size for Crohn’s disease, with ~USD 207 million in 2024.

- The market size for Crohn’s disease in Japan was estimated to be ~USD 423 million in 2024, which accounts for 4% of the total 7MM market.

- With the expected launch of upcoming therapies, such as OMVOH and TREMFYA the total market size of Crohn’s disease is expected to show change in the upcoming years.

Crohn’s Disease Drugs Chapter Analysis

This section focuses on the uptake rate of potential drugs expected to launch in the market during 2020–2034. For example, OMVOH in the US is expected to be launched by 2025 with a peak share of 1%. OMVOH is anticipated to take 7 years to peak with a medium uptake.

Further detailed analysis of emerging therapies drug uptake in the report…

Crohn’s Disease Pipeline Development Activities

The Crohn’s Disease pipeline report provides insights into different Crohn’s Disease clinical trials within Phase III, Phase II, and Phase I. It also analyzes key players involved in developing targeted therapeutics.

Crohn’s Disease Pipeline Development Activities

The Crohn’s Disease clinical trials analysis report covers information on collaborations, acquisitions and mergers, licensing, and patent details for Crohn’s disease emerging therapies.

Latest KOL Views on Crohn's Disease

To keep up with current market trends, we take KOLs and SMEs’ opinions working in the domain through primary research to fill the data gaps and validate the secondary research. Industry Experts were contacted for insights on Crohn’s disease evolving treatment landscape, patient reliance on conventional therapies, patient therapy switching acceptability, and drug uptake` along with challenges related to accessibility, including KOL from MD, Professor, Université Sorbonne Paris, Paris, France; Surgeon, Burlo Garofolo Maternal and Child Health Research Institute of Trieste, Italy; MD, Icahn School of Medicine at Mount Sinai, US; Department of Preventive Medicine and Public Health, Keio University School of Medicine, Tokyo, Japan; and others.

Delveinsight’s analysts connected with 50+ KOLs to gather insights; however, interviews were conducted with 15+ KOLs in the 7MM. Their opinion helps understand and validate current and emerging therapies, treatment patterns, or Crohn’s disease market trends. This will support the clients in potential upcoming novel treatments by identifying the overall scenario of the market and the unmet needs.

Qualitative Analysis

We perform qualitative and market Intelligence analysis using various approaches, such as SWOT and conjoint analysis. In the SWOT analysis, strengths, weaknesses, opportunities, and threats in terms of disease diagnosis, patient awareness, patient burden, competitive landscape, cost-effectiveness, and geographical accessibility of therapies are provided. These pointers are based on the analyst’s discretion and assessment of the patient burden, cost analysis, and existing and evolving treatment landscape.

Conjoint analysis analyzes multiple approved and emerging therapies based on relevant attributes such as safety, efficacy, frequency of administration, route of administration, and order of entry. Scoring is given based on these parameters to analyze the effectiveness of therapy.

Further, the therapies’ safety is evaluated wherein the acceptability, tolerability, and adverse events are majorly observed, and it sets a clear understanding of the side effects posed by the drug in the trials. In addition, the scoring is also based on the route of administration, order of entry and designation, probability of success, and the addressable patient pool for each therapy. According to these parameters, the final weightage score and the ranking of the emerging therapies are decided.

Market Access and Reimbursement

The high cost of therapies for the treatment is a major factor restraining the growth of the global drug market. Because of the high cost, the economic burden is increasing, leading the patient to escape from proper treatment.

The report further provides detailed insights on the country-wise accessibility and reimbursement scenarios, cost-effectiveness scenario of approved therapies, programs making accessibility easier and out-of-pocket costs more affordable, insights on patients insured under federal or state government prescription drug programs, etc.

Scope of the Crohn’s Disease Market Report

- The report covers a segment of key events, an executive summary, and a descriptive overview of Crohn’s disease, explaining its causes, signs and symptoms, and currently available therapies.

- Comprehensive insight has been provided into the epidemiology segments and forecasts, the future growth potential of diagnosis rate, disease progression, and treatment guidelines.

- Additionally, an all-inclusive account of the current and emerging therapies and the elaborative profiles of late-stage and prominent therapies will impact the current treatment landscape.

- A detailed review of the Crohn’s disease market, historical and forecasted market size, market share by therapies, detailed assumptions, and rationale behind the approach is included in the report covering the 7MM drug outreach.

- The report provides an edge while developing business strategies by understanding trends through SWOT analysis and expert insights/KOL views, patient journey, and treatment preferences that help shape and drive the 7MM Crohn’s disease market.

Crohn’s Disease Market Report Insights

- Crohn’s Disease Patient population

- Crohn’s Disease Therapeutic approaches

- Crohn’s disease pipeline analysis

- Crohn’s disease market size and trends

- Existing and Future Market opportunities

Crohn’s Disease Market Report Key Strengths

- 10 years forecast

- The 7MM coverage

- Crohn’s disease epidemiology segmentation

- Key cross competition

- Conjoint analysis

- Crohn’s Disease Drugs uptake

- Key Crohn’s Disease market forecast assumptions

Crohn’s Disease Market Report Assessment

- Current Crohn’s Disease treatment practices

- Crohn’s Disease Unmet needs

- Crohn’s Disease Pipeline product profiles

- Crohn’s Disease Market attractiveness

- Qualitative analysis (SWOT and conjoint analysis)

- Crohn’s Disease Market Drivers

- Crohn’s Disease Market Barriers

Key Questions Answered In The Crohn’s Disease Market Report:

Crohn’s Disease Market Insights

- What was the Crohn’s disease market share (%) distribution in 2020, and what it would look like in 2034?

- What would be the Crohn’s disease total market size as well as market size by therapies across the 7MM during the forecast period (2025–2034)?

- What are the key findings pertaining to the market across the 7MM, and which country will have the largest Crohn’s disease market size during the forecast period (2025–2034)?

- At what CAGR, the Crohn’s disease market is expected to grow at the 7MM level during the forecast period (2025–2034)?

- What would be the Crohn’s disease market outlook across the 7MM during the forecast period (2025–2034)?

- What would be the Crohn’s disease market growth until 2034 and what will be the resultant market size in the year 2034?

- How would the market drivers, barriers, and future opportunities affect the market dynamics and subsequent analysis of the associated trends?

Crohn’s Disease Epidemiology Insights

- What are the disease risks, burden, and unmet needs of Crohn’s disease?

- What is the historical Crohn’s disease patient population in the United States, EU4 (Germany, France, Italy, Spain) ,the UK, and Japan?

- What would be the forecasted patient population of Crohn’s disease at the 7MM level?

- What will be the growth opportunities across the 7MM with respect to the patient population pertaining to Crohn’s disease?

- Out of the countries mentioned above, which country would have the highest Incident population of Crohn’s disease during the forecast period (2025–2034)?

- At what CAGR is the population expected to grow across the 7MM during the forecast period (2025–2034)?

Current Crohn’s Disease Treatment Scenario, Marketed Drugs, and Emerging Therapies

- What are the current options for the treatment of Crohn’s disease, along with the approved therapy?

- What are the current treatment guidelines for the treatment of Crohn’s disease in the US, Europe, and Japan?

- What are the Crohn’s disease-marketed drugs and their MOA, regulatory milestones, product development activities, advantages, disadvantages, safety, efficacy, etc.?

- How many Crohn’s Disease companies are developing therapies for the treatment of Crohn’s disease?

- How many emerging therapies are in the mid-stage and late stages of development for the treatment of Crohn’s disease?

- What are the key collaborations (Industry–Industry, Industry-Academia), Mergers and acquisitions, and licensing activities related to Crohn’s disease therapies?

- What are the recent therapies, targets, mechanisms of action, and technologies developed to overcome the limitations of existing therapies?

- What are the clinical studies going on for Crohn’s disease and their status?

- What are the key designations that have been granted for the emerging therapies for Crohn’s disease?

- What are the 7MM historical and forecasted market of Crohn’s disease?