Inflammatory Bowel Disease Market

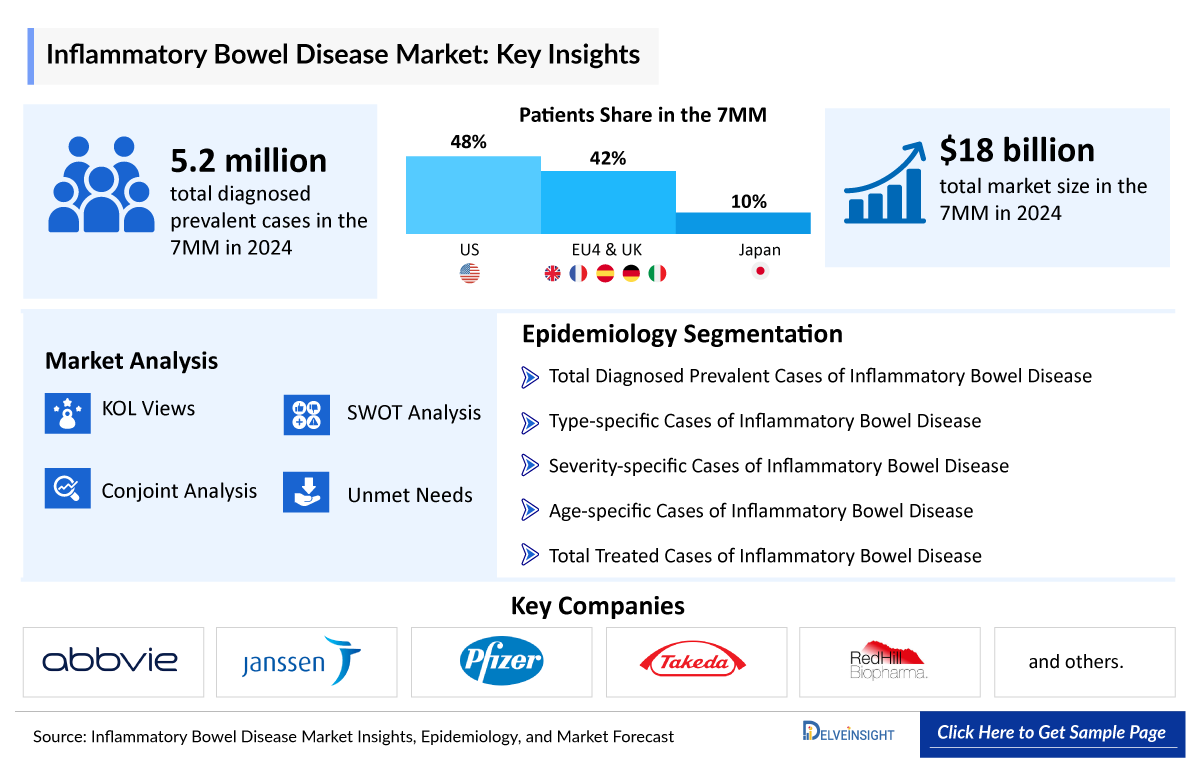

- The largest Inflammatory Bowel Disease Market Size in the 7MM was occupied by the US in 2023.

- The most common medications used to treat Inflammatory Bowel Disease Therapies include ASA anti-inflammatory drugs, anti-TNF, IL antagonists, JAK inhibitors, TLR 9 agonists, and integrins, among others.

- The US accounted for ~50% of the total Inflammatory Bowel Disease Diagnosed Prevalent Cases in the 7MM in 2023. These cases are expected to increase during the forecast period (2024-2034).

- Crohn's disease is typically more severe than ulcerative colitis but is slightly less common. The disease can occur at any age, but Crohn's disease is most often diagnosed in adolescents and adults between 20 and 30.

- In May 2024, Johnson & Johnson announced that the company has submitted applications to the European Medicines Agency (EMA) seeking to expand the Marketing Authorization Application for TREMFYA (guselkumab) to include the treatment of adult patients with moderately to severely active ulcerative colitis and moderately to severely active Crohn's disease.

- In October 2023, the US FDA approved OMVOH (mirikizumab-mrkz) infusion (300 mg/15 mL)/injection (100 mg/mL), the first and only interleukin-23p19 antagonist for the treatment of moderately to severely active ulcerative colitis in adults.

Request for Unlocking the CAGR of the "Inflammatory Bowel Disease Treatment Market"

DelveInsight’s "Inflammatory Bowel Disease Market Insight, Epidemiology, and Market Forecast – 2034" report delivers an in-depth understanding of Inflammatory Bowel Disease, historical and forecasted epidemiology as well as the Inflammatory Bowel Disease market trends in the United States, EU4 (Germany, France, Italy, and Spain) and the United Kingdom, and Japan.

The Inflammatory Bowel Disease Treatment Market report provides current treatment practices, emerging drugs, Inflammatory Bowel Disease market share of individual therapies, and current and forecasted Inflammatory Bowel Disease market size from 2020 to 2034, segmented by seven major markets. The report also covers current Inflammatory Bowel Disease treatment market practices/algorithms and unmet medical needs to curate the best of the opportunities and assess the underlying potential of the Inflammatory Bowel Disease drugs market.

|

Study Period |

2020 to 2034 |

|

Forecast Period |

2024-2034 |

|

Geographies Covered |

|

|

Inflammatory Bowel Disease Treatment Market |

|

|

Inflammatory Bowel Disease Market Size | |

|

Inflammatory Bowel Disease Companies |

|

Inflammatory Bowel Disease Treatment Market

Inflammatory bowel disease encompasses two primary disorders, Crohn's disease and ulcerative colitis, both characterized by chronic inflammation of the gastrointestinal tract. While they share similar symptoms, they differ in the nature and location of inflammation. Crohn's disease can affect any part of the digestive tract, commonly impacting the end of the small intestine (ileum) and the beginning of the large intestine (colon). Its inflammation may permeate through the entire bowel wall in patches, leaving healthy tissue interspersed. On the other hand, ulcerative colitis predominantly targets the colon and rectum, leading to inflammation and ulcers on the inner lining of the colon. Unlike Crohn's, ulcerative colitis tends to manifest continuously from the rectum upwards along the colon. Understanding these distinctions is crucial for accurate diagnosis and effective management of these chronic conditions.

Inflammatory bowel disease Diagnosis

In diagnosing inflammatory bowel disease, a combination of diagnostic techniques is often utilized to comprehensively evaluate the extent of inflammation, pinpoint affected areas, and distinguish between Crohn's disease and ulcerative colitis. Endoscopic procedures, such as endoscopy and colonoscopy, provide direct visualization of the gastrointestinal tract, enabling the identification of characteristic signs of inflammation specific to each condition. Contrast radiography aids in visualizing structural abnormalities like strictures or fistulas in Crohn's disease, while MRI and CT scans offer detailed images without radiation exposure, assisting in assessing inflammation and complications in both Crohn's disease and ulcerative colitis. Stool sample analysis is employed to detect markers of inflammation and rule out infectious causes, while blood tests assess various indicators such as inflammation, anemia, nutritional deficiencies, and autoimmune antibodies associated with IBD. By integrating findings from these diagnostic modalities, healthcare providers can accurately diagnose IBD, differentiate between its subtypes, and develop tailored treatment plans to effectively manage the condition and improve patient outcomes.

Further details related to diagnosis will be provided in the report...

Inflammatory bowel disease Treatment

The goal of inflammatory bowel disease treatment is to reduce the inflammation that triggers the signs and symptoms. In the best cases, this may lead not only to symptom relief but also to long-term remission and reduced risks of complications. IBD treatment usually involves either drug therapy or surgery. Anti-inflammatory drugs are the first step in IBD treatment. These drugs help decrease inflammation of the digestive tract. Glucocorticoids, a subcategory of corticosteroids, are examples of anti-inflammatory drugs used for IBD. They include budesonide, prednisone, prednisolone, and methylprednisolone. These drugs are available in a variety of forms, from oral tablets to injections to rectal foams.

Inflammatory bowel disease Epidemiology

The Inflammatory bowel disease epidemiology chapter in the report provides historical as well as forecasted epidemiology segmented by the Total Diagnosed Prevalent Cases of Inflammatory Bowel Disease, Type-specific Cases of Inflammatory Bowel Disease, Severity-specific Cases of Inflammatory Bowel Disease, Age-specific Cases of Inflammatory Bowel Disease, and Treatable cases of Inflammatory Bowel Disease in the 7MM covering the United States, EU4 (Germany, France, Italy, and Spain) and the United Kingdom, and Japan from 2020 to 2034.

- The US accounted for ~50% of the total Inflammatory Bowel Disease Diagnosed Prevalent Cases in the 7MM in 2023. These cases are expected to increase during the forecast period.

- In the US, the moderate to severe cases were found to be higher than the mild cases of Inflammatory Bowel Disease in 2023.

- In the US, the 18-44 years age segment accounted for the highest number of cases of Inflammatory Bowel Disease in 2023.

- Among EU4 and the UK, Germany accounted for the highest prevalent cases of Inflammatory Bowel Disease , followed by the UK in 2023.

Unlock comprehensive insights! Click Here to Purchase the Full Epidemiology Report @ Inflammatory Bowel Disease Prevalence

Inflammatory Bowel Disease Recent Developments

- In May 2025, ALPCO announced the European launch of its Calprotectin Immunoturbidimetric Assay to support the diagnosis of inflammatory bowel disease (IBD), including Crohn's disease and ulcerative colitis. Already FDA-cleared and IVDD-certified, the assay helps distinguish IBD from irritable bowel syndrome (IBS) when used with other clinical data.

- In January 2025, Eli Lilly and Company announced that the U.S. Food and Drug Administration (FDA) has approved Omvoh® (mirikizumab-mrkz) for treating moderately to severely active Crohn's disease in adults. Omvoh is now approved in the U.S. for two types of inflammatory bowel disease (IBD), after its approval in October 2023 as a first-in-class treatment for moderately to severely active ulcerative colitis (UC) in adults.

Inflammatory Bowel Disease Drug Chapters

The drug chapter segment of the Inflammatory bowel disease drugs market report encloses a detailed analysis of the late-stage (Phase III ) and mid-stage (Phase II/III and Phase II) pipeline drugs. The current key Inflammatory Bowel Disease Companies include include Abbvie (RINVOQ), Janssen Pharmaceuticals (STELARA), Pfizer (XELJANZ), Abivax (ABX464), and others. The drug chapter also helps understand the Inflammatory bowel disease clinical trial details, pharmacological action, agreements and collaborations, approval, and patent details, and the latest news and press releases.

Inflammatory Bowel Disease Marketed Drugs

- RINVOQ (upadacitinib): AbbVie

RINVOQ is a Janus kinase (JAK) inhibitor. JAKs are intracellular enzymes that transmit signals arising from cytokine or growth factor-receptor interactions on the cellular membrane to influence cellular processes of hematopoiesis and immune cell function. Within the signaling pathway, JAKs phosphorylate and activate signal transducers and activators of transcription (STATs) which modulate intracellular activity including gene expression. Upadacitinib modulates the signaling pathway at the point of JAKs, preventing the phosphorylation and activation of STATs. In March 2022, the US FDA approved RINVOQ for the treatment of adults with moderately to severely active ulcerative colitis.

STELARA (ustekinumab): Janssen Pharmaceuticals

STELARA is a human monoclonal antibody. It mediates the body's T-cell response by acting as an antagonist against interleukin-12 (IL12) and interleukin-23 (IL23). IL-12 and IL-23 are cytokines that modulate lymphocyte function and have been implicated in the pathogenesis of inflammatory diseases. In September 2016, the US FDA approved STELARA for the treatment of adults with moderately to severely active Crohn's disease.

Inflammatory Bowel Disease Emerging Drugs

- Obefazimod: Abivax

Obefazimod is an orally available, small molecule binder of the cap-binding complex (CBC) 80/20 being developed by Abivax. It is being investigated in the Phase III (ABTECT) clinical trial for patients with moderately to severely active ulcerative colitis and the Phase II trial for patients with Crohn’s disease. The company is anticipating the enrolment of the last patient in the ABTECT induction trial in the fourth quarter of 2024.

- MORF-057: Morphic Therapeutic

MORF-057 is a selective, oral small molecule inhibitor of the α4β7 integrin in development to treat patients suffering from inflammatory bowel disease and is currently in Phase IIb (EMERALD-2) clinical trial. The company is anticipating results in the first half of 2025. The EMERALD-1 Phase IIa study achieved its primary endpoint, demonstrated consistent, clinically meaningful improvements across secondary and exploratory measures, and was well tolerated with no safety signal observed.

Inflammatory Bowel Disease Market Outlook

Over the last decade, the introduction of several key therapies has shaped the management of inflammatory bowel disease. Drugs like HUMIRA (AbbVie), REMICADE (Janssen), and ENTYVIO (Takeda) have helped patients achieve meaningful endpoints of clinical remission and mucosal healing. They have also helped many patients avoid colectomy, an outcome once much more common before the expansion of the IBD medicine cabinet. Dual-targeted therapy shows promise in treating patients with refractory IBD. It may provide new opportunities to improve the patient’s quality of life and long-term prognosis, making it possible to break through the current ceiling of IBD treatment. Moreover, in recent years, the success of bispecific antibodies in tumor management has provided new ideas for treating immune diseases including IBD.

Detailed market assessment will be provided in the final report...

Key Findings

- Among the 7MM, the United States accounted for the highest Inflammatory bowel disease Market Size.

- With the launch of emerging therapies such as obefazimod, MORF-057, tulisokibart, and others, the market size is expected to show positive growth.

- Limited treatment options available in case of relapsed or refractory pool, provide lucrative opportunities in the ulcerative colitis therapeutic space.

- With rising Inflammatory Bowel Disease prevalence, improved Inflammatory Bowel Disease diagnosis, aging population, advancements in therapies, increased healthcare spending, expanding awareness, and geographical expansion of healthcare services, the Inflammatory Bowel Disease market size is projected to increase during the forecast period (2024-2034).

Inflammatory bowel disease Drugs Uptake

This section focuses on the uptake rate of potential Inflammatory Bowel Disease drugs expected to be launched in the market during 2024–2034. The Inflammatory Bowel Disease treatment market landscape has experienced a transformation with the uptake of novel drugs. These innovative therapies are redefining standards of care. TREMFYA is the first approved fully human monoclonal antibody that selectively binds to the p19 subunit of IL-23 and inhibits its interaction with the IL-23 receptor. IL-23 is an important driver of the pathogenesis of inflammatory diseases such as moderate to severe plaque PsO and active PsA.

Inflammatory bowel disease Pipeline Development Activities

The Inflammatory Bowel Disease drugs market report provides insights into therapeutic candidates in different stages. It also analyzes key Inflammatory Bowel Disease Companies involved in developing targeted therapeutics. Inflammatory Bowel Disease Companies like Abivax, Morphic Therapeutic, Merck, and others actively engage in late and mid-stage research and development efforts for Inflammatory bowel disease. The Inflammatory Bowel Disease pipeline therapies possesses potential drugs. However, there is a positive outlook for the therapeutics market, with expectations of growth during the forecast period (2024–2034).

Pipeline Development Activities

The Inflammatory Bowel Disease drugs market report covers information on collaborations, acquisitions and mergers, licensing, and patent details for Inflammatory bowel disease emerging therapy. At the European Crohn’s and Colitis Organisation (ECCO) Congress, AbbVie showcased 17 abstracts, comprising nine oral presentations and eight posters, across its inflammatory bowel disease portfolio. The Inflammatory bowel disease pipeline ppossesses many potential drugs and there is a positive outlook for the Inflammatory Bowel Disease therapeutics market, with expectations of growth during the forecast period (2024–2034).

KOL Views

To keep up with current market trends, we take KOLs and SMEs’ opinions working in the domain through primary research to fill the data gaps and validate our secondary research. Industry Experts were contacted for insights on the Inflammatory bowel disease evolving Inflammatory Bowel Disease Treatment Market Landscape, patient reliance on conventional therapies, patient therapy switching acceptability, and drug uptake.

DelveInsight’s analysts connected with 30+ KOLs to gather insights; however, interviews were conducted with 15+ KOLs in the 7MM. The opinion helps understand and validate current and emerging therapy treatment patterns or Inflammatory bowel disease market trends. This will support the clients in potential upcoming novel treatments by identifying the overall scenario of the Inflammatory Bowel Disease Drugs Market and the unmet needs.

Qualitative Analysis

We perform Qualitative and Inflammatory Bowel Disease Drugs Market Intelligence analysis using various approaches, such as SWOT and Conjoint Analysis. In the SWOT analysis, strengths, weaknesses, opportunities, and threats in terms of disease diagnosis, patient awareness, patient burden, competitive landscape, cost-effectiveness, and geographical accessibility of therapies are provided. These pointers are based on the Analyst’s discretion and assessment of the patient burden, cost analysis, and existing and evolving Inflammatory Bowel Disease Treatment Market Landscape.

Inflammatory Bowel Disease Therapeutics Market Access and Reimbursement

The United States drug pricing regime is complex given its multi-payer model. It is currently undergoing significant changes, with recent federal legislation, such as the Prescription Drug Pricing Reform provisions of the Inflation Reduction Act, significantly altering the pricing regime under certain federal programs. The US healthcare system includes both private and public health insurance coverage. Whether a drug product is covered, and at what price, is determined by each payer’s coverage, coding, and payment criteria for health insurance plans. The largest government-funded programs are Medicare and Medicaid.

Private plans, which cover far more Americans than public plans, have more flexibility in making coverage and reimbursement determinations. Inflammatory Bowel Disease Therapeutics Market access for pharmaceuticals in Germany differs from the systems implemented and followed in many other countries as no pricing and reimbursement approval is required during the launch of a new therapy.

Inflammatory Bowel Disease Therapeutics Market Report Scope

- The Inflammatory Bowel Disease therapeutics market report covers a segment of key events, an executive summary, and a descriptive overview, explaining its causes, signs, symptoms, pathogenesis, and currently used therapies.

- Comprehensive insight into the Inflammatory Bowel Disease epidemiology segments and forecasts, disease progression, and treatment guidelines has been provided.

- Additionally, an all-inclusive account of the emerging therapies and the elaborative profiles of late-stage and prominent therapies will impact the current Inflammatory Bowel Disease Treatment Market Landscape.

- A detailed review of the Inflammatory bowel disease therapeutics market, historical and forecasted Inflammatory Bowel Disease treatment market size, Inflammatory Bowel Disease market share by therapies, detailed assumptions, and rationale behind our approach is included in the report, covering the 7MM drug outreach.

- The Inflammatory Bowel Disease therapeutics market report provides an edge while developing business strategies by understanding trends through SWOT analysis and expert insights/KOL views, patient journey, and treatment preferences that help shape and drive Inflammatory bowel disease.

Inflammatory Bowel Disease Therapeutics Market Report Insights

- Patient-based Inflammatory Bowel Disease Market Forecasting

- Therapeutic Approaches

- Inflammatory bowel disease Pipeline Analysis

- Inflammatory bowel disease Market Size

- Inflammatory Bowel Disease Market Trends

- Existing and Future Inflammatory Bowel Disease Therapeutics Market Opportunity

Inflammatory Bowel Disease Therapeutics Market Report Key Strengths

- 11 Years Inflammatory Bowel Disease Market Forecast

- The 7MM Coverage

- Inflammatory bowel disease Epidemiology Segmentation

- Key Cross Competition

- Inflammatory Bowel Disease Drugs Uptake

- Key Inflammatory Bowel Disease Market Forecast Assumptions

Inflammatory Bowel Disease Therapeutics Market Report Assessment

- Current Inflammatory Bowel Disease Treatment Market Practices

- Inflammatory Bowel Disease Unmet Needs

- Inflammatory Bowel Disease Pipeline Product Profiles

- Inflammatory Bowel Disease Therapeutics Market Attractiveness

- Qualitative Analysis (SWOT and Conjoint Analysis)

FAQs

- What was the Inflammatory bowel disease market size, the Inflammatory Bowel Disease treatment market size by therapies, Inflammatory Bowel Disease market share (%) distribution in 2023, and what would it look like by 2034? What are the contributing factors for this growth?

- What can be the future treatment paradigm for Inflammatory bowel disease?

- What are the disease risks, burdens, and Inflammatory bowel disease unmet needs? What will be the growth opportunities across the 7MM concerning the patient population with Inflammatory bowel disease?

- What are the current options for the Inflammatory bowel disease treatment? What are the current guidelines for treating Inflammatory bowel disease?

- What are the recent novel therapies, targets, mechanisms of action, and technologies being developed to overcome the limitations of existing therapies?

- What is the patient who shares Inflammatory bowel disease?

Reasons to Buy

- The Inflammatory Bowel Disease drugs market report will help develop business strategies by understanding the latest trends and changing treatment dynamics driving Inflammatory bowel disease.

- Insights on patient burden/disease Inflammatory Bowel Disease prevalence, evolution in diagnosis, and factors contributing to the change in the epidemiology of the disease during the forecast years.

- Understand the existing Inflammatory Bowel Disease drugs market opportunities in varying geographies and the growth potential over the coming years.

- Identifying strong upcoming Inflammatory Bowel Disease Companies in the market will help devise strategies to help get ahead of competitors.

- Detailed analysis ranking of class-wise potential current and emerging therapies under the analyst view section to provide visibility around leading classes.

- Highlights of access and reimbursement policies of current therapies, barriers to accessibility of expensive off-label therapies, and patient assistance programs.

- To understand Key Opinion Leaders’ perspectives around the accessibility, acceptability, and compliance-related challenges of existing treatment to overcome barriers in the future.

- Detailed insights on the unmet needs of the existing Inflammatory Bowel Disease drugs market so that the upcoming players can strengthen their development and launch strategy.

Stay Updated with us for Recent Articles

-diagnostic-market.png&w=256&q=75)