Download Case Study to Unlock Valuable Insights

Fill out the form to gain access to exclusive content and data-driven strategies

Out-Licensing Opportunity: Strategic Partner Identification and Market Opportunity Assessment for Proprietary Neonatal MSC Technology

- Home

- case study

- out licensing opportunity

Objective

The objective of DelveInsight's engagement with this Sweden-based pharmaceutical innovator was to identify and assess optimal licensing partners for its proprietary neonatal mesenchymal stem cell (MSC) technology on a global scale. The strategic initiative aimed to facilitate market entry, accelerate commercialization pathways, and maximize the value realization of their novel stem cell-based API through carefully vetted partnership opportunities. By identifying the right licensee partner, one aligned with strategic capabilities, market access, and financial strength, the client could unlock the commercial potential of their differentiated cell therapy platform while maintaining intellectual property protection and revenue-sharing benefits.

Problem Statement: Finding the Right Licensing Partner in an Expanding Cell Therapy Landscape

A leading Swedish pharmaceutical company, with specialized expertise in neonatal mesenchymal stem cells, faced a critical business development challenge. While the company possessed proprietary, high-quality neonatal MSC technology with significant therapeutic potential, it lacked the global commercial infrastructure, regulatory expertise, and market access necessary for independent worldwide development and commercialization. The company required a strategic partner, a licensee capable of advancing its innovative stem cell API across multiple therapeutic indications and geographic markets.

The complexity of the task lay in identifying the right fit. A partner with demonstrated interest in cell therapy, sufficient financial resources for late-stage development and regulatory navigation, established relationships with healthcare systems and payers, and a strategic vision aligned with the Swedish company's long-term objectives. The decision was further complicated by the rapidly evolving stem cell landscape, emerging competitive technologies, and varying regulatory frameworks across different regions.

The fundamental challenge was how the company could identify, evaluate, and engage with the most promising licensing partners across the global biotech and pharmaceutical ecosystem, partners who possessed both the capability and willingness to license and develop this proprietary neonatal MSC technology.

Our Methodology

DelveInsight deployed a comprehensive, multi-layered methodology combining market analysis, competitive intelligence, portfolio assessment, and deal-flow evaluation to identify and rank potential licensing partners. The approach encompassed:

-

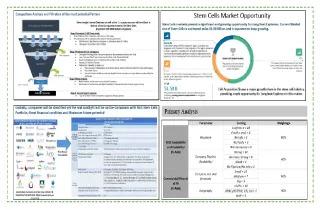

Stem Cell Market Assessment

Conducted extensive secondary research analyzing the global stem cell market landscape, including market size projections, therapeutic applications, regulatory trends, and clinical adoption patterns. This provided critical context for identifying partners with active interest and investment commitments in the cell therapy sector.

-

Companies Assessment

Performed deep-dive evaluations of potential partner organizations, assessing their organizational capabilities, strategic priorities, licensing track records, and cultural alignment. Intelligence gathering included an analysis of company positioning within the stem cell and regenerative medicine ecosystem.

-

Portfolio Assessment

Examined each prospective partner's existing pipeline, therapeutic focus areas, indications under development, and stage-of-development profile. This allowed DelveInsight to identify companies whose product portfolios would benefit from complementary neonatal MSC technology and where therapeutic synergies could be realized.

-

Deal and Investment Assessment

Analyzed historical deal structures, licensing agreements, and investment patterns within the stem cell therapeutics space. This included evaluation of companies' previous licensing activities, partnership strategies, and demonstrated appetite for acquiring or in-licensing novel cell therapy assets.

-

Interest in Client's Neonatal MSC Technology

Synthesized primary and secondary intelligence to assess genuine interest and strategic fit. This multifaceted evaluation considered each company's stated therapeutic objectives, geographic expansion plans, pipeline gaps, and competitive positioning—all factors influencing whether neonatal MSCs would represent a strategically valuable addition to their portfolio.

Results

The comprehensive assessment delivered a portfolio of strategic intelligence and actionable outputs:

-

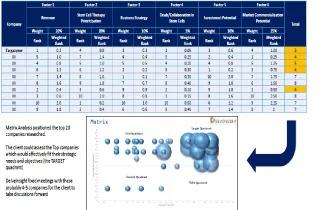

Matrix Analysis and Partner Positioning

DelveInsight conducted matrix analysis positioning the top 20 companies researched across multiple dimensions, including strategic fit, capability alignment, market presence, and partnership potential. This analytical framework enabled rapid identification of organizations most likely to value the client's proprietary neonatal MSC technology and possess the requisite capabilities for successful commercialization.

-

Strategic Quadrant Positioning

The client gained clear visibility into how each prospective partner aligned with their strategic objectives. Companies were positioned within the TARGET quadrant—those representing optimal strategic fit, strong capability profiles, demonstrated interest in cell therapy, and realistic partnership potential. This framework allowed the Swedish company to prioritize engagement efforts toward the most promising opportunities.

-

Curated Partnership Opportunities

Rather than approaching numerous companies with limited differentiation, DelveInsight identified and prioritized approximately 4-5 leading companies representing the strongest partnership potential. These companies exhibited:

-

- Active portfolios in stem cell therapeutics or regenerative medicine

- Strategic need for complementary cell therapy assets

- Demonstrated licensing and partnership capacity

- Geographic footprint and market access aligned with client objectives

- Financial strength to support late-stage development and commercialization

-

Facilitated Business Development

DelveInsight facilitated direct meetings between the Swedish client and these prioritized partner candidates, enabling substantive business development discussions. This transition from market analysis to active partnership negotiation represented a critical inflection point, moving from the research phase to the commercial engagement phase.

Conclusion: From Analysis to Partnership

Through systematic market assessment, comprehensive company evaluation, and strategic intelligence synthesis, DelveInsight transformed an overwhelming partner identification challenge into a focused, prioritized engagement strategy. The client moved from uncertainty about potential global licensing partners to a refined list of vetted, qualified organizations representing genuine commercial opportunities.

For innovative biotech firms with differentiated technologies but limited commercial infrastructure, having access to strategic partner identification intelligence proves invaluable. DelveInsight's multi-dimensional approach, combining market analysis, portfolio assessment, deal intelligence, and strategic positioning frameworks, enables emerging companies to make informed partnership decisions, accelerate market access, and maximize value realization of proprietary technologies in competitive, rapidly evolving therapeutic domains like stem cell therapeutics.

By bridging the gap between innovative science and commercial execution, DelveInsight enabled the Swedish MSC company to move forward with confidence—armed with a prioritized partner pipeline and the strategic intelligence necessary to negotiate partnerships that unlock long-term value creation in the dynamic cell therapy marketplace.

Our Related Services

Sample Visuals

Get Visuals