Active Pharmaceutical Ingredient Market

Active Pharmaceutical Ingredient (API) Market by Type (Innovative and Generic), Manufacturer Type (Captive and Merchant), Synthesis Type (Synthetic and Biotech), Application (Oncology, Cardiology, Pulmonology, Neurology, Orthopedic, Opthalmology, and Others), and Geography (North America, Europe, Asia-Pacific, Rest of the World) is estimated to register growth at remarkable CAGR forecast till 2030 owing to rising prevalence of various chronic and acute diseases such as cancer, diabetes amount others and growing focus on drug development

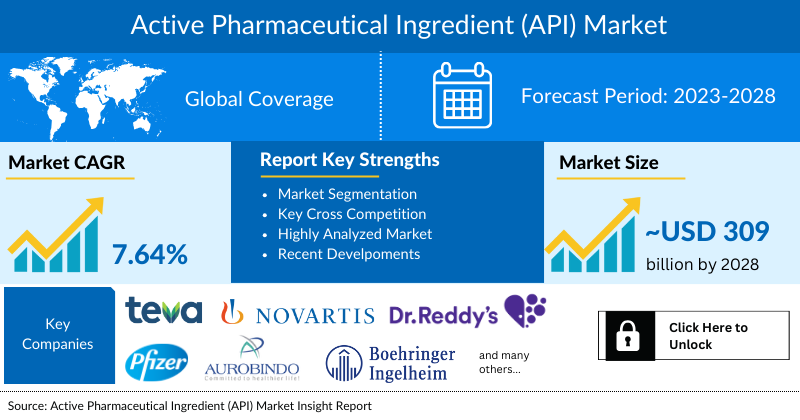

The active pharmaceutical ingredient market size was valued at USD 199.13 billion in 2023, growing at a CAGR of 7.64% during the forecast period from 2024 to 2030 to reach USD 309.73 billion by 2030. The API market is witnessing a positive market growth owing to the factors such as prevalence of various diseases, growing geriatric population, increasing focus on drug development, and rising popularity of biologic drugs among others. The US Active Pharmaceutical Ingredient market is rapidly growing.

Active Pharmaceutical Ingredients Market Dynamics:

One of the main drivers of the API market is the rising prevalence of various diseases. Diabetes and hypertension are two of the most common indications for which synthetic drugs are prescribed. As per the statistics provided by the International Diabetes Federation, in 2021 near about 537 million adults in the age group of 20-79 years are presently living with diabetes. Similarly, in another data provided by the World Health Organization (2021), raised cholesterol is estimated to cause 2.6 million fatalities. It is considered a major cause of disease burden in both the developed and developing world as a risk factor for ischemic heart disease and stroke. The indications mentioned above consist of major risk factors for other diseases and syndromes such as ischemic heart disease, glaucoma, and cancer among others. Synthetically synthesized pharmaceutical drugs such as metformin, atorvastatin, and enalapril among others that are prescribed as popular pharmaceutical treatment for the above-mentioned indications. Therefore, the rising prevalence of various diseases encompassing diseases of various etiologies is expected to drive the demand for pharmaceutical drugs for disease management which in turn is expected to contribute to the demand for APIs, thereby positively impacting the global active pharmaceutical ingredients market growth during the forecast period.

Another key factor responsible for the growth of the API market is the rising focus on drug development. Considering the rise in the number of diseases, there has been a growing focus on the research and development of newer therapeutics. This has resulted in the launch of new products such as drugs and biological products. The active pharmaceutical ingredient for cancer market is growing rapidly. Furthermore, an increase in acquisitions, collaborations, and regional expansions are some of the strategic initiatives ensured by the manufacturers involved in drug manufacturing that helped boost the API market. For instance, Quartic.ai and Bright Path Labs entered into a collaboration in 2020 to develop AI-based technology for continuous manufacturing of critical APIs that are required for producing crucial small-molecule drugs. Therefore, such measures are expected to drive the market for APIs in the coming future. The oncology active pharmaceutical ingredient market is rapidly expanding, driven by advancements in cancer treatments and innovative therapies.

However, stringent regulatory guidelines for the manufacture and approval process and high investment costs may limit the growth of the API market. The oncology active pharmaceutical ingredient market is rapidly expanding, driven by advancements in cancer treatments and innovative therapies.

Active Pharmaceutical Ingredients Market Segment Analysis:

Active Pharmaceutical Ingredient (API) Market by Type (Innovative and Generic), Manufacturer Type (Captive and Merchant), Synthesis Type (Synthetic and Biotech), Application (Oncology, Cardiology, Pulmonology, Neurology, Orthopedic, Opthalmology, and Others), and Geography (North America, Europe, Asia-Pacific, Rest of the World)

In the synthesis type segment of the active pharmaceutical ingredients market, the biotech category is projected to register a faster growth in terms of CAGR in the API market during the forecast period. This can be attributed to the rising prevalence of genetic disorders where biologic drugs have proven to be beneficial compared to conventional chemical drugs. For instance, gene therapy-based biologics have a wide range of applications, from gene replacement and knockdown to vaccination in genetic diseases such as cancer, hemophilia, hypercholesterolemia, and neurodegenerative diseases. Additionally, biologics are being preferred as therapy in autoimmune diseases such as rheumatoid arthritis and different cancer types due to their target-specific action, unlike conventional small-molecule drugs. Therefore, considering the advantages associated with biologic drugs, this product category is expected to witness a faster CAGR growth eventually contributing to the overall growth of the active pharmaceutical ingredients market during the forecast period.

|

Report Metrics |

Details |

|

Study Period |

2021 to 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 to 2030 |

|

CAGR | |

|

Active Pharmaceutical Ingredient Market Size |

~USD 309 billion by 2030 |

|

Key Active Pharmaceutical Ingredient Companies |

Aurobindo Pharma, Teva Pharmaceutical Industries Ltd, Pfizer Inc, Novartis AG, BASF SE, Boehringer Ingelheim GmbH, Dr. Reddy’s Laboratories Ltd, Lupin Ltd, Viatris, Sun Pharmaceutical Industries Ltd, Merck KGaA, AbbVie Inc., Bristol Myers-Squibb Company, Cipla Inc, Divi's Laboratories Limited, GlaxoSmithKline plc, Albemarle Corporation, Orion Corporation, Fidia Farmaceutici s.p.a., AstraZeneca, and others. |

Asia-Pacific is expected to register the fastest growth in the Active Pharmaceutical Ingredients Market:

Among all the regions, Asia-Pacific (APAC) is expected to register the fastest growth in revenue generation in the global API market. This can be ascribed to the large presence of the patient pool, growing interest in the APAC region as a manufacturing hub, rising population of the elderly, among other factors in the region.

One of the key factors supporting the growth of the APAC active pharmaceutical ingredients market is the growing interest in the APAC countries as a manufacturing hub for the pharmaceutical industry. Asia and the Association of Southeast Asian Nations (ASEAN) region have been emerging as attractive alternatives for companies owing to lower costs, the availability of labor and its status as an established manufacturing base. Several companies are investing to establish manufacturing operations across various sectors in APAC countries such as Thailand, Vietnam, and India. Governments of several nations in the region are also increasingly working towards providing opportunities to attract manufacturers by offering land, tax benefits, and other incentives. Countries in the region have also entered into several free trade agreements (FTA) and partnerships thereby enabling manufacturers to consider these countries as viable hubs for export. Therefore, such measures by the national governments of countries in the APAC region are expected to bolster the growth of the APAC API market during the forecast period.

Owing to such efforts, presently, the greatest concentrations of API manufacturers are located around Asia, specifically in India and China. This has led to more companies outsourcing API manufacturing to such places, which has the main benefit of eliminating the need to invest in highly expensive equipment and infrastructure.

For example, India is one of the largest pharmaceutical manufacturers in the world. The country has an outstanding position in the global pharmaceutical market and is also the only country in the world with the largest number of US Food and Drug Administration (USFDA) pharmaceutical factories outside the United States. The country is also the world's third-largest active pharmaceutical ingredients market, producing over 500 different APIs and providing 57% of the APIs to the World Health Organization (WHO) pre-certification list.

Therefore, such factors coupled with the rising patient population encompassing the end users of these formulations and increasing focus on healthcare are expected to contribute to the regional growth of the API market in the APAC region.

Active Pharmaceutical Ingredients Companies Market Key Players:

Some of the key active pharmaceutical ingredient development companies include Aurobindo Pharma, Teva Pharmaceutical Industries Ltd, Pfizer Inc, Novartis AG, BASF SE, Boehringer Ingelheim GmbH, Dr. Reddy’s Laboratories Ltd, Lupin Ltd, Viatris, Sun Pharmaceutical Industries Ltd, Merck KGaA, AbbVie Inc., Bristol Myers-Squibb Company, Cipla Inc, Divi's Laboratories Limited, GlaxoSmithKline plc, Albemarle Corporation, Orion Corporation, Fidia Farmaceutici s.p.a., AstraZeneca, and others.

Recent Developmental Activities in the Active Pharmaceutical Ingredients Market:

- In December 2021, Novasep announced a €6 million investment in its Chasse-sur-Rhône site, in France. This investment is made with the aim to increase and modernize their manufacturing capabilities to support new generation Active Pharmaceutical Ingredients (APIs), in areas such as central nervous system (CNS), oncology, and infectious diseases.

- In April 2021, Novartis NVS signed an initial agreement with Roche RHHBY Ensuring capacity and technology transfer for the production of active pharmaceutical ingredients (APIs) for rheumatoid arthritis, Actemra/RoActemra (tocilizumab).

Key Takeaways from the Active Pharmaceutical Ingredients Market Report Study

- Market size analysis for current API market size (2023), and market forecast for 6 years (2024-2030)

- Top key product/services/technology developments, mergers, acquisitions, partnerships, and joint ventures happened over the last 3 years.

- Key companies dominating the API market.

- Various opportunities available for the other competitors in the API market space.

- What are the top-performing segments in 2023? How these segments will perform in 2030.

- Which are the top-performing regions and countries in the current API market scenario?

- Which are the regions and countries where companies should have concentrated on opportunities for API market growth in the coming future?

Target Audience who can be benefited from this Active Pharmaceutical Ingredients Market Report Study

- API providers

- Research organizations and consulting companies

- API-related organizations, associations, forums, and other alliances

- Government and corporate offices

- Start-up companies, venture capitalists, and private equity firms

- Distributors and Traders dealing in API

- Various End-users who want to know more about the API market and the latest technological developments in the API market.