AKT Inhibitor Market Forecast

- AKT inhibitors are targeted therapies designed to block the activity of AKT (also known as protein kinase B), a key enzyme in the PI3K/AKT/mTOR signaling pathway. This pathway regulates cell growth, survival, and metabolism, and its dysregulation is implicated in various cancers and other diseases.

- As of now, TRUQAP (capivasertib) is the only AKT inhibitor approved by the US FDA. Approved in November 2023, capivasertib is indicated in combination with fulvestrant for the treatment of adults with hormone receptor (HR)-positive, HER2-negative locally advanced or metastatic breast cancer harboring specific genetic alterations.

- In June 2024, AstraZeneca’s TRUQAP in combination with FASLODEX (fulvestrant) was approved in the European Union (EU) for the treatment of adult patients with estrogen receptor (ER)-positive, HER2‑negative locally advanced or metastatic breast cancer with one or more PIK3CA, AKT1, or PTEN-alterations following recurrence or progression on or after an endocrine-based regimen.

- Multiple pharmaceutical companies are actively developing investigational AKT inhibitors targeting a range of diseases. For instance, Almac Discovery is advancing ALM301, a novel, patent-protected, and highly potent AKT kinase inhibitor with subtype selectivity.

- In November 2024, positive high-level results from the CAPItello-281 Phase III trial showed that AstraZeneca’s TRUQAP in combination with abiraterone and androgen deprivation therapy (ADT) demonstrated a statistically significant and clinically meaningful improvement in the primary endpoint of radiographic progression-free survival (rPFS) versus abiraterone and ADT with placebo in patients with PTEN-deficient de novo metastatic hormone-sensitive prostate cancer (mHSPC).

- A significant unmet need in the development of AKT inhibitors is the lack of predictive biomarkers to identify patients who are most likely to benefit from these therapies. Despite the central role of the PI3K/AKT/mTOR pathway in various cancers, clinical trials have shown variable responses to AKT inhibitors, highlighting the necessity for biomarkers that can guide patient selection and optimize treatment outcomes.

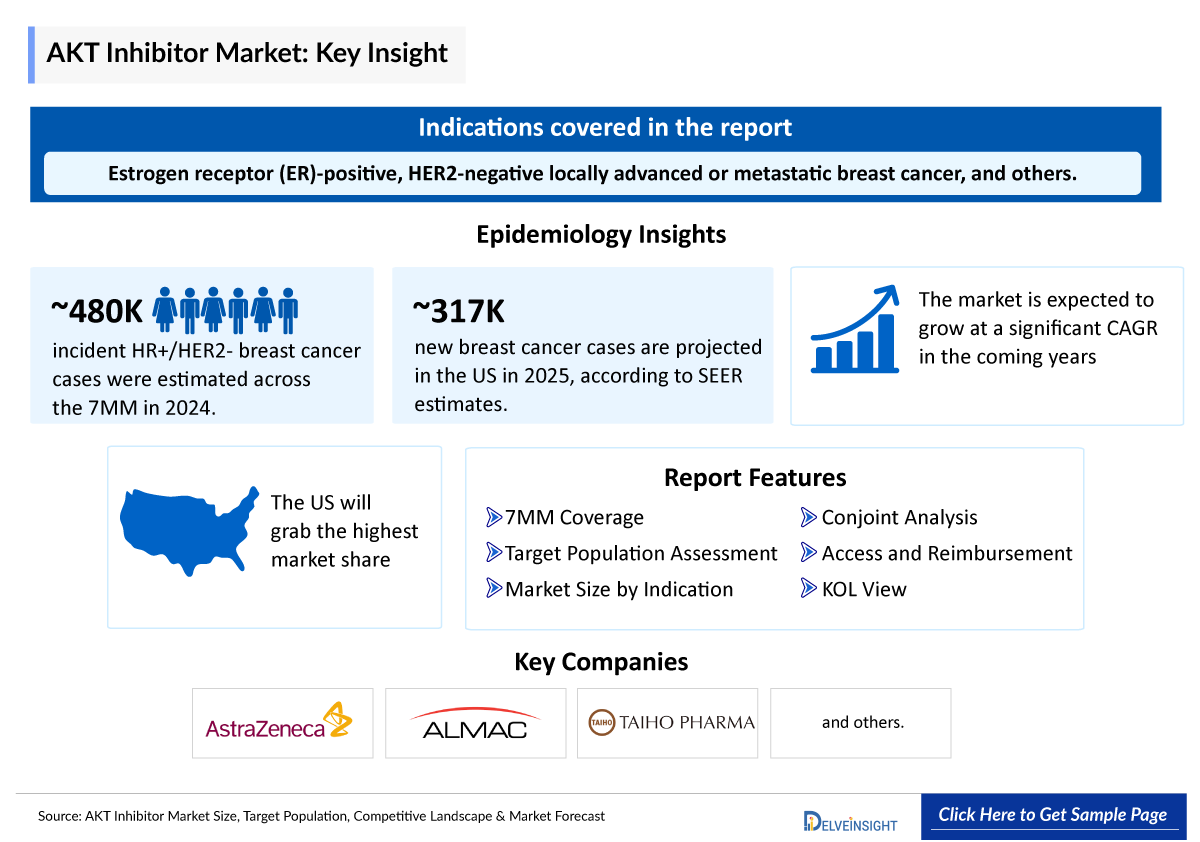

DelveInsight’s “AKT Inhibitors Target Population, Competitive Landscape, and Market Forecast 2034” report delivers an in-depth understanding of the AKT Inhibitors, historical and projected epidemiological data, competitive landscape as well as the AKT Inhibitors market trends in the United States, EU4 (Germany, France, Italy, and Spain) and the United Kingdom, and Japan.

The AKT Inhibitors’ market report provides current treatment practices, emerging drugs, market share of individual therapies, and current and forecasted 7MM AKT Inhibitors market size from 2020 to 2034. The report also covers current AKT Inhibitors’ treatment practices/algorithms and unmet medical needs to curate the best opportunities and assess the market’s potential.

|

Study Period |

2020–2034 |

|

Forecast Period |

2025–2034 |

|

Geographies Covered |

US, EU4 (Germany, France, Italy, and Spain), the UK, and Japan |

|

AKT Inhibitor Epidemiology |

Segmented by:

|

|

AKT Inhibitor Key Companies |

|

|

AKT Inhibitor Key Therapies |

|

|

AKT Inhibitor Clinical Relevance |

|

|

AKT Inhibitor Market |

Segmented by:

|

|

Analysis |

|

AKT Inhibitor Disease Understanding and Treatment Algorithm

AKT Inhibitor overview and clinical relevance

AKT inhibitors are targeted therapies designed to disrupt the PI3K/AKT/mTOR signaling pathway, which is frequently dysregulated in various diseases, particularly cancers. By inhibiting AKT, these agents aim to reduce tumor cell proliferation and survival.

The development of AKT inhibitors has led to the approval of TRUQAP by the FDA for specific breast cancer subtypes. However, challenges such as resistance mechanisms and off-target effects have limited the broader clinical adoption of AKT inhibitors.

Clinically, AKT inhibitors have shown promise in treating various cancers, including breast, and prostate cancers. However, their efficacy as monotherapies has been limited, leading to ongoing research into combination therapies and patient stratification to improve outcomes.

Further details related to indications are provided in the report…

AKT Inhibitor Epidemiology

The AKT inhibitors epidemiology chapter in the report provides historical as well as forecasted epidemiology segmented as total cases in selected indications for AKT inhibitors, total eligible patient pool in selected indications for AKT inhibitors, and total treated cases in selected indications for AKT inhibitors in the 7MM covering the United States, EU4 (Germany, France, Italy, and Spain), the United Kingdom, and Japan from 2020 to 2034.

Breast Cancer

- As per the SEER database, in 2025, the United States is projected to report approximately 316,950 new cases of breast cancer.

- According to the estimates, the total incident population of HR+/HER2- Breast Cancer in the 7MM was nearly ~480 thousand cases in 2024. The cases in the 7MM are expected to increase during the forecast period, i.e., 2025–2034.

- As per the analysis, in 2022, Germany reported around 74,512 cases of breast cancer among women.

- As per the data from Cancer research UK, there are around 56,800 new breast cancer cases in the UK every year (2017-2019).

Prostate Cancer

- As per the SEER database, in 2025, the United States is projected to report approximately 313,780 new cases of prostate cancer, making it the second most commonly diagnosed cancer among men, following breast cancer in women.

- As per the research, prostate cancer is expected to account for about 15.4% of all new cancer cases in the US.

- As per the secondary research, in 2020, Germany reported approximately 65,000 new cases of prostate cancer, making it the most frequently diagnosed cancer among men in the country.

Note: Indications have been selected based on pipeline activity. Further details regarding these indications will be provided in the full report..

AKT Inhibitor Drug Chapters

The drug chapter segment of the AKT inhibitor report encloses a detailed analysis of AKT inhibitor’s marketed drugs and different-stage of pipeline drugs. It also helps understand the AKT inhibitor’s clinical trial details, expressive pharmacological action, agreements and collaborations, approval and patent details, advantages and disadvantages of each included drug and the latest news and press releases.

Marketed Drugs

TRUQAP (capivasertib) + FASLODEX (fulvestrant) - AstraZeneca

TRUQAP (capivasertib) is a first-in-class, potent, adenosine triphosphate (ATP)-competitive inhibitor of all three AKT isoforms (AKT1/2/3). TRUQAP 400mg is administered twice daily according to an intermittent dosing schedule of four days on and three days off. This was chosen in early phase trials based on tolerability and the degree of target inhibition.

TRUQAP is currently being evaluated in Phase III trials for the treatment of multiple subtypes of breast cancer and in other tumor types either as monotherapy or in combination with established treatments. The ongoing clinical research programme is focused on tumors reliant on signaling via the PI3K/AKT pathway, and in tumors harboring biomarker alterations in this pathway.

TRUQAP was discovered by AstraZeneca subsequent to a collaboration with Astex Therapeutics (and its collaboration with the Institute of Cancer Research and Cancer Research Technology Limited).

|

Product |

Company |

Indication |

|

TRUQAP (capivasertib) + FASLODEX (fulvestrant) |

AstraZeneca |

Breast Cancer |

Note: Detailed current therapies assessment will be provided in the full report of AKT Inhibitors.

Emerging Drugs

TAS-117: Taiho Pharma

TAS-117 is an oral, allosteric pan-AKT inhibitor developed by Taiho Pharmaceutical, targeting the PI3K/AKT/mTOR signaling pathway frequently dysregulated in various cancers. Preclinical studies demonstrated its potent anti-proliferative activity across multiple tumor cell lines, including breast, ovarian, gastric, and endometrial cancers, particularly those harboring PI3K mutations, PTEN loss, or HER2 amplification.

In a first-in-human Phase I study, TAS-117 exhibited a manageable safety profile with dose-proportional pharmacokinetics and showed preliminary antitumor activity, leading to the establishment of recommended dosing regimens. Subsequent Phase II trials in patients with advanced solid tumors harboring PI3K/AKT pathway mutations reported limited overall response rates but indicated potential clinical benefit in select cases, such as ovarian and breast cancers with specific genetic alterations.

As per the company’s pipeline, it is currently being evaluated in Phase II trials for solid tumors with germline PTEN mutations.

ALM301: Almac Discovery (Almac Group)

ALM301 is a novel, patent-protected, potent, subtype selective AKT kinase inhibitor with good pharmacokinetic properties across multiple species, and an excellent selectivity profile. It has demonstrated robust efficacy in pre-clinical prostate, breast and other cancer xenograft models, both as a single agent and in combination with standard chemotherapeutic agents, where synergy has been observed.

In May 2020, Almac Discovery, a member of the Almac Group, has announced an out-licensing partnership with an undisclosed biotechnology company in order to advance the development and commercialization of one of its portfolio projects – ALM301.

Note: Detailed emerging therapies assessment will be provided in the final report.

|

List of Emerging Drugs | |||||

|

Drug Name |

Company |

Indication |

ROA |

Phase |

NCT ID |

|

TAS-117 |

Taiho Pharma |

Solid tumors with germline PTEN mutations |

Oral |

II |

NCT03017521 |

|

ALM301 |

Almac Discovery (Almac Group) |

- |

- |

Preclinical |

- |

|

XX |

XX |

XX |

XX |

XX |

XX |

Note: The emerging drug list is indicative, the full list will be given in the final report.

AKT Inhibitor Market Outlook

The global AKT inhibitor market is experiencing significant growth, propelled by the increasing prevalence of cancers and advancements in targeted therapies. AKT inhibitors, which disrupt the PI3K/AKT/mTOR signaling pathway, have shown promise in treating various cancers, including breast, prostate, and ovarian cancers. Currently, TRUQAP by AstraZeneca is the only FDA-approved AKT inhibitor, approved for specific breast cancer subtypes. However, several other AKT inhibitors are in various stages of clinical development.

According to recent statistical reports, cancer incidence is rising globally and is expected to continue to grow in the coming years. As the incidence of cancer increases, the demand for effective cancer therapies, including AKT inhibitors, is also expected to rise. However, challenges such as resistance mechanisms and off-target effects have limited the broader clinical adoption of AKT inhibitors. Current research is exploring isoform-specific targeting strategies to enhance efficacy and minimize toxicity. Additionally, the identification of predictive biomarkers is crucial to optimize patient selection and therapeutic outcomes.

AKT Inhibitor Drugs Uptake

This section focuses on the uptake rate of potential approved and emerging AKT Inhibitor expected to be launched in the market during 2020–2034.

AKT Inhibitor Pipeline Development Activities

The report provides insights into different therapeutic candidates in phase III phase II, and phase I. It also analyzes key players involved in developing targeted therapeutics.

The presence of numerous drugs under different stages is expected to generate immense opportunity for AKT Inhibitor’s market growth over the forecasted period.

KOL Views

To keep up with current and future market trends, we take Industry Experts’ opinions working in the domain through primary research to fill the data gaps and validate our secondary research. Industry experts were contacted for insights on AKT Inhibitor’s evolving treatment landscape, patient reliance on conventional therapies, patient therapy switching acceptability, drug uptake, along challenges related to accessibility.

DelveInsight’s analysts connected with 25+ KOLs to gather insights; however, interviews were conducted with 10+ KOLs in the 7MM.

Their opinion helps understand and validate current and emerging therapy treatment patterns or AKT Inhibitor’s market trends. This will support the clients in potential upcoming novel treatments by identifying the overall scenario of the market and the unmet needs.

“Patients with advanced HR-positive breast cancer typically experience tumor progression or resistance with widely used first-line endocrine therapies and there is an urgent need to extend the effectiveness of these approaches. The combination of capivasertib and fulvestrant, a first-of-its-kind combination, provides a much-needed new treatment option for up to half of patients in this setting”.

Qualitative Analysis

We perform qualitative and market intelligence analysis using various approaches, such as SWOT analysis. In the SWOT analysis, strengths, weaknesses, opportunities, and threats in terms of disease diagnosis, patient awareness, patient burden, competitive landscape, cost-effectiveness, and geographical accessibility of therapies are provided. These pointers are based on the analyst’s discretion and assessment of the patient burden, cost analysis, and existing and evolving treatment landscape.

Market Access and Reimbursement

The report further provides detailed insights on the country-wise accessibility and reimbursement scenarios, cost-effectiveness scenario of approved therapies, programs making accessibility easier and out-of-pocket costs more affordable, insights on patients insured under federal or state government prescription drug programs, etc.

AstraZeneca Access 360 Program

The AstraZeneca Access 360 program offers comprehensive, personalized support to streamline access and reimbursement for TRUQAP. It assists patients with understanding insurance and pharmacy options, supports prior authorization and the claims and appeals process, and helps with enrollment in AstraZeneca’s Co-pay Savings and AZ&Me Prescription Savings Programs. Additionally, it provides information about independent charitable assistance foundations, thereby improving treatment accessibility and reducing financial barriers for eligible patients.

Scope of the Report

- The report covers a segment of key events, an executive summary, and a descriptive overview of AKT inhibitor, explaining their mechanism, and therapies (current and emerging).

- Comprehensive insight into the competitive landscape, forecasts, and the future growth potential of treatment rate, drug uptake, and drug information have been provided.

- Additionally, an all-inclusive account of the current and emerging therapies and the elaborative profiles of late-stage and prominent therapies that will impact the current landscape.

- A detailed review of the AKT inhibitor market, historical and forecasted market size, market share by therapies, detailed assumptions, and rationale behind our approach is included in the report, covering the 7MM drug outreach.

- The report provides an edge while developing business strategies, by understanding trends, through SWOT analysis, expert insights/KOL views, and treatment preferences that help shape and drive the 7MM AKT inhibitor market.

AKT Inhibitor Report Insights

- AKT inhibitors Targeted Patient Pool

- AKT inhibitors Therapeutic Approaches

- AKT inhibitors Pipeline Analysis

- AKT inhibitors Market Size and Trends

- Existing and future Market Opportunity

AKT Inhibitor Report Key Strengths

- 10 Years Forecast

- The 7MM Coverage

- Key Cross Competition

- Drugs Uptake and Key Market Forecast Assumptions

AKT Inhibitor Report Assessment

- Current Treatment Practices

- Unmet Needs

- Pipeline Product Profiles

- Market Attractiveness

- Qualitative Analysis (SWOT)

Key Questions

- What was the AKT inhibitor total market size, the market size by therapies, market share (%) distribution in 2024, and what would it look like in 2034? What are the contributing factors for this growth?

- Which drug is going to be the largest contributor in 2034?

- Which is the most lucrative market for AKT inhibitors?

- What are the pricing variations among different geographies for approved therapies?

- How the reimbursement landscape has evolved for AKT inhibitors since the first one was approved? Do patients have any access issues that are driven by reimbursement decisions?

- What are the risks, burdens, and unmet needs of treatment with AKT inhibitors? What will be the growth opportunities across the 7MM for the patient population of AKT inhibitors?

- What are the key factors hampering the growth of the AKT inhibitors market?

- What are the indications for which recent novel therapies and technologies have been developed to overcome the limitations of existing treatments?

- What key designations have been granted to the therapies for AKT inhibitors?

- What is the cost burden of approved therapies on the patient?

- Patient acceptability in terms of preferred therapy options as per real-world scenarios?

- What are the country-specific accessibility issues of expensive, recently approved therapies?

Reasons to buy

- The report will help develop business strategies by understanding the latest trends and changing dynamics driving the AKT inhibitors Market.

- Understand the existing market opportunities in varying geographies and the growth potential over the coming years.

- Distribution of historical and current patient share based on real-world prescription data along with reported sales of approved products in the US, EU4 (Germany, France, Italy, and Spain) the United Kingdom, and Japan.

- Identifying strong upcoming players in the market will help devise strategies to help get ahead of competitors.

- Detailed analysis and ranking of indication-wise current and emerging therapies under the attribute analysis section to provide visibility around leading indications.

- To understand Key Opinion Leaders’ perspectives around the accessibility, acceptability, and compliance-related challenges to overcome barriers in the future.

- Detailed insights on the unmet needs of the existing market so that the upcoming players can strengthen their development and launch strategy.