Alcohol-related Liver Disease Market

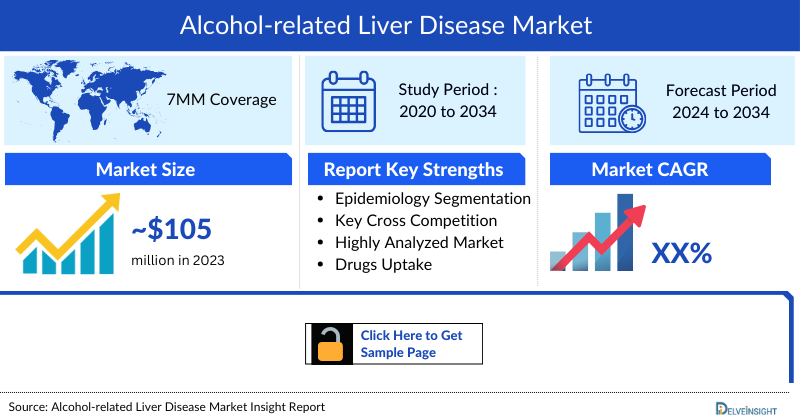

- The Alcohol-related Liver Disease market size is projected to witness consistent growth throughout the forecast period (2024–2034). The market size of Alcohol-related Liver Disease in the 7MM is expected to increase, driven by better diagnosis and the launch of emerging therapies, namely, Larsucosterol.

- DelveInsight’s analyst projects that among the total prevalent cases of ARLD in 7MM approximately 51% of cases were from the US. As per our estimations, in 2023, the US accounted for nearly 4.2 million diagnosed prevalent cases of ARLD.

- In the 7MM, the market mainly consisted of supportive care, which generated nearly USD 105 million in 2023.

- The market for therapeutics targeting Alcohol-related Liver Disease is projected to experience robust growth, with an anticipated CAGR of approximately 20% from 2020 to 2034. This dynamic expansion reflects increasing demand for advanced treatment options and underscores the growing investment in addressing this serious condition.

- In May 2024, DURECT Corporation received Breakthrough Therapy designation from the FDA for larsucosterol, its top candidate aimed at treating severe alcohol-associated hepatitis (AH). This designation highlights the significant potential of larsucosterol to transform the management of severe AH, a condition with significant unmet medical needs. With this prestigious recognition, DURECT is well-positioned to advance its efforts and provide innovative solutions for this difficult-to-treat disease.

- In July 2024, DURECT held a Type B meeting with the FDA to discuss the design of its planned Phase III clinical trial of larsucosterol in alcohol-associated hepatitis that, if successful, could support a potential NDA filing. The Company plans to provide additional details of the Phase III trial design following receipt of the written minutes from this meeting. DURECT’s goal is to initiate its Phase III trial in 2024, subject to obtaining sufficient funding, with topline results expected by the second half of 2026.

Key Factors Driving Alcohol-related Liver Disease Market

Alcohol-related Liver Disease Patient Pool and Rising Prevalence

In 2023, the total diagnosed prevalent cases in the 7MM were approximately 8.2 million, with the US accounting for nearly 4.2 million cases, representing around 51% of the total burden. EU4 and the UK together accounted for about 2.3 million diagnosed cases, which are projected to decline slightly over the forecast period due to improved awareness and interventions. ARLD prevalence highlights a substantial patient population in need of effective therapeutic strategies beyond supportive care.

Alcohol-related Liver Disease Market Growth and Treatment Landscape

The ARLD market in the 7MM primarily comprised supportive care, generating approximately USD 105 million in 2023. The overall market is projected to experience robust growth, with an anticipated CAGR of ~20% from 2024 to 2034, driven by advancements in diagnostics, increasing awareness, and the development of emerging pharmacologic therapies. Current challenges include the limited availability of approved disease-modifying treatments, high costs, and patient adherence issues, emphasizing the need for novel, targeted therapies.

Alcohol-related Liver Disease Marketed and Emerging Therapies

Emerging therapies under development include Larsucosterol (Durect) and INT-787 (Intercept Pharmaceuticals), both designed to target underlying liver pathology and improve disease outcomes. These investigational agents aim to address the high unmet need for effective treatments capable of slowing or reversing liver damage in ARLD patients.

Alcohol-related Liver Disease Clinical Trials and Competitive Landscape

Ongoing clinical trials are evaluating the safety, efficacy, and long-term benefits of Larsucosterol and INT-787 in ARLD populations. Key companies actively advancing the therapeutic pipeline include Durect and Intercept Pharmaceuticals, reflecting a focused and competitive landscape driven by innovation in disease-modifying approaches.

DelveInsight’s “Alcohol-related Liver Disease (ARLD) Market Insights, Epidemiology, and Market Forecast – 2034” report delivers an in-depth understanding of the ARLD, historical and forecasted epidemiology and the Alcohol-related Liver Disease therapeutics market trends in the United States, EU4 (Germany, France, Italy, and Spain) and the United Kingdom, and Japan.

The Alcohol-related Liver Disease market report provides current treatment practices, emerging drugs, market share of individual therapies, and current and forecasted 7MM Alcohol-related Liver Disease market size from 2020 to 2034. The report also covers current Alcohol-related Liver Disease treatment practices/algorithms and unmet medical needs to curate the best of the opportunities and assesses the underlying potential of the market.

|

Study Period |

2020 to 2034 |

|

Forecast Period |

2024-2034 |

|

Geographies Covered |

|

|

Alcohol Related Liver Disease Market |

|

|

Alcohol Related Liver Disease Market Size | |

|

Alcohol Related Liver Disease Companies |

Biohaven Pharmaceutical Holding Company Ltd., Alkermes plc, Intra-Cellular Therapies, Inc., Takeda Pharmaceutical Company Limited, Johnson & Johnson, Mylan N.V., Cipla Limited, Eli Lilly and Company, Pfizer Inc., Bristol-Myers Squibb Company, GlaxoSmithKline plc, Lundbeck A/S, Otsuka Pharmaceutical Co., Ltd., H. Lundbeck A/S, Neurocrine Biosciences Inc., Impel NeuroPharma, Janssen Pharmaceuticals, Inc. (a subsidiary of Johnson & Johnson), Novartis International AG, Sun Pharmaceutical Industries Ltd., Allergan plc (now part of AbbVie Inc.), and others. |

|

Alcohol Related Liver Disease Epidemiology Segmentation |

|

Alcohol-related Liver Disease Treatment Market

Alcohol-related Liver Disease Overview

ARLD is a medical condition encompassing liver manifestations arising from excess alcohol intake. Alcoholic liver disease covers a spectrum of disorders, beginning from the fatty liver, progressing at times to alcoholic hepatitis, and culminating in alcoholic cirrhosis, which is the most advanced and irreversible form of liver injury related to the consumption of alcohol. The amount of alcohol intake is the most important cause and risk factor for developing ARLD. Other disease modifiers that influence the development and progression of ARLD include alcohol-related factors (i.e., pattern of drinking, predominant type of alcoholic beverage consumed), environmental factors (presence of undernutrition/obesity, co-existence of chronic hepatitis B or C, and cigarette smoking), and genetic/epigenetic factors.

Symptoms of ARLD are not evident during the early phase and arise after the liver is badly damaged. Some common symptoms include feeling sick, weight loss, loss of appetite, yellowing of the whites of the eyes or skin (jaundice), swelling in the ankles and tummy, confusion or drowsiness, vomiting blood or passing blood in stools, and others.

ARLD Diagnosis

Diagnosing alcohol-related liver disease requires a detailed patient history with supportive laboratory and imaging studies. There is no specific test for alcohol-related liver disease, but if the diagnosis is suspected, liver tests (prothrombin time [PT]; serum bilirubin, aminotransferase, and albumin levels) and CBC are done to detect signs of liver injury and anemia. Imaging tests of the liver are not routinely needed for diagnosis. Because features of hepatic steatosis, alcoholic hepatitis, and cirrhosis overlap, describing the precise findings is more useful than assigning patients to a specific category, which can only be determined by liver biopsy.

ARLD Treatment

Management of ARLD includes abstinence, nutrition/diet modifications, pharmacotherapy, and liver transplantation. Abstinence is the hallmark of therapy for ARLD, and nutritional therapy is the first line of therapeutic intervention. The role of steroids in patients with moderate to severe alcoholic hepatitis is gaining acceptance. Despite abstinence, liver transplantation for alcohol-associated cirrhosis is considered for all patients with decompensated liver disease (ascites, spontaneous bacterial peritonitis, variceal bleeding, and hepatic encephalopathy).

Emerging treatments for ALD are currently in the process of development. These encompass farnesoid X receptor (FXR) agonists, interleukin 1 beta inhibitors, DNA methylation inhibitors, and other options.

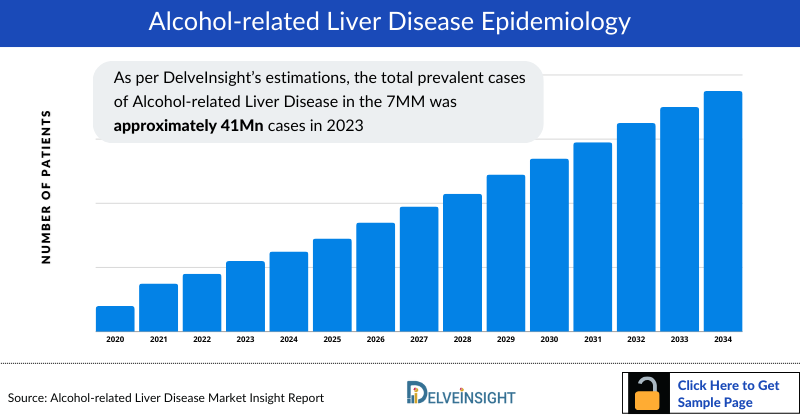

Alcohol-related Liver Disease Epidemiology

As the market is derived using the patient-based model, the Alcohol-related Liver Disease epidemiology chapter in the report provides historical as well as forecasted epidemiology segmented by Total Prevalent Cases of Alcohol-related Liver Disease (ARLD), Total Diagnosed Prevalent Cases of Alcohol-related Liver Disease (ARLD), Gender-specific Diagnosed Prevalent cases of Alcohol-related Liver Disease (ARLD), Distribution of Diagnosed Prevalent cases of Alcohol-related Liver Disease (ARLD) by Fibrosis Stage, Distribution of Diagnosed Prevalent cases of Alcohol-related Liver Disease (ARLD) by Fatty Liver Grade, Distribution of Diagnosed Prevalent cases of Alcohol-related Liver Disease (ARLD) by Necroinflammatory activity in the 7MM covering the United States, EU4 countries (Germany, France, Italy, and Spain) and the United Kingdom, and Japan, from 2020 to 2034. As per DelveInsight’s estimations, the total prevalent cases of Alcohol-related Liver Disease in the 7MM was approximately 41 million cases in 2023 and are projected to decrease during the forecast period.

- The total diagnosed prevalent cases of Alcohol-related Liver Disease in the 7MM was approximately 8.2 million cases in 2023 and are projected to decline during the forecast period

- Among the 7MM, EU4 and the UK accounted for nearly 2.3 million diagnosed prevalent cases of ARLD, and these cases are expected to decrease during the forecast period (2024–2034).

- Among EU4 and the UK, Germany had the highest diagnosed prevalent population of ARLD, with ~0.9 million cases, followed by the UK and France in 2023. On the other hand, Italy had the lowest diagnosed prevalent population in EU4 and the UK in 2023.

- In Japan, there were around 1.7 million diagnosed prevalent cases of ARLD in 2023. These cases are expected to decrease at a significant CAGR.

- Gender-specific diagnosed prevalent cases of ARLD showed that males were more affected by ARLD than females in the 7MM in 2023.

- F3 stage had the highest number of diagnosed prevalent cases (~2 million) followed by the F0 Stage (~1.9 million) in the 7MM.

- Among the diagnosed ARLD cases classified from Grade 0 to Grade 3 based on fatty liver involvement, guiding treatment choices accordingly, Grade 1 had the highest number of diagnosed prevalent cases (~2.8 million) of ARLD in the 7MM followed by Grade 2 (~2.1 million), Grade 0 (~2 million), and Grade 3 (~1.3 million) in 2023.

- Based on the Necroinflammatory activity, cases were divided into two subtypes, Non-alcoholic hepatitis and Alcoholic hepatitis. Nearly 6 million cases for individuals without alcoholic hepatitis and ~2.3 million cases for those with alcoholic hepatitis were reported in 2023, in the 7MM.

Alcohol-related Liver Disease Drug Chapters

The drug chapter segment of the Alcohol-related Liver Disease report encloses a detailed analysis of Alcohol-related Liver Disease marketed drugs and late-stage (Phase III and Phase II) pipeline drugs. It also understands Alcohol-related Liver Disease clinical trial details, expressive pharmacological action, agreements and collaborations, approval, and patent details, advantages and disadvantages of each included drug, and the latest news and press releases.

ARLD Emerging Drugs

Larsucosterol: Durect

Larsucosterol, or "DUR-928“ by Durect is an innovative compound currently in clinical development and serves as the central focus of the company’s Epigenetic Regulator Program. This orally bioavailable, naturally occurring small molecule has shown substantial regulatory capabilities in lipid metabolism, stress response, inflammation, and cell survival through laboratory and animal investigations. The ongoing research is dedicated to unlocking larsucosterol's potential as a therapeutic option for alcohol-associated hepatitis (AH), a critical and life-threatening liver ailment for which no approved treatments currently exist. Currently, the drug is in Phase II of clinical development as per the company’s pipeline.

Data from the Company’s Phase IIb AHFIRM trial, which evaluated the safety and efficacy of larsucosterol as a treatment for patients with severe AH, were featured in a late-breaking oral presentation at the European Association for the Study of the Liver (EASL) Congress 2024 in June 2024, in Milan, Italy. This was the first presentation of the AHFIRM data at a medical meeting. Top line data from the study were previously announced in 2023.

INT-787: Intercept Pharmaceuticals

INT-787 is Intercept's next-generation farnesoid X receptor (FXR) agonist; 16-fold more water soluble than OCA2. Its characteristics provide an opportunity to explore its potential in diseases involving the gut and the liver, such as severe alcohol-associated hepatitis (sAH). INT-787 is currently being evaluated in a Phase IIa proof-of-concept study.

Note: Detailed emerging therapies assessment will be provided in the final report of ARLD...

Alcohol-related Liver Disease Market Outlook

Alcohol-related Liver Disease has a diverse treatment classification associated with the disease landscape. ARLD treatment aims to mitigate symptoms through abstinence, diet modifications, pharmacological interventions, (TIPS) procedures, and liver transplantation as needed.

Supportive care options (corticosteroids or pentoxifylline) are major revenue generators in the current treatment landscape.

The market for Alcohol-related Liver Disease is expected to experience positive growth with the approval of potential drugs like Larsucosterol.

- Out of the 7MM, the United States dominated the market in 2023, representing the largest share at 61%.

- In 2023, EU4 and the UK captured an estimated USD 23 million, which is anticipated to increase at a substantial CAGR. Among the European countries, Germany covered the largest market share in 2023, followed by the UK, and France. Spain and Italy accounted for the least market in the same year.

- Japan alone represented approximately 17% of the total ARLD market in 2023, projected to increase at a CAGR during the study period.

- The total market size of the ARLD treatment market is anticipated to experience growth during the forecast period due to the emergence of new and effective treatments.

Alcohol-related Liver Disease Drugs Uptake

This section focuses on the uptake rate of potential drugs expected to launch in the market during 2020–2034. For example, Larsucosterol in the US is expected to be launched by 2025.

Further detailed analysis of emerging therapies drug uptake in the report…

Alcohol-related Liver Disease Pipeline Development Activities

The report provides insights into ARLD clinica trials within Phase III, Phase II, and Phase I stage. It also analyzes key players involved in developing targeted therapeutics.

Pipeline Development Activities

The report covers information on collaborations, acquisitions and mergers, licensing, and patent details for Alcohol-related Liver Disease emerging therapies.

KOL Views

To keep up with current market trends, we take KOLs and SMEs’ opinions working in the domain through primary research to fill the data gaps and validate the secondary research. Industry Experts were contacted for insights on Alcohol-related Liver Disease evolving treatment landscape, patient reliance on conventional therapies, patient therapy switching acceptability, and drug uptake along with challenges related to accessibility, including KOL from Department of Health, Behavior and Society, Johns Hopkins Bloomberg School of Public Health, Baltimore; Die Medizinische Klinik I, University of Frankfurt, Frankfurt am Main, Germany; Hepatology and Gastroenterology, ASST Grande Ospedale Metropolitano Niguarda, Milan Italy; Department of Internal Medicine, School of Medicine, Keio University, Tokyo, Japan, and others.

Delveinsight’s analysts connected with 50+ KOLs to gather insights; however, interviews were conducted with 15+ KOLs in the 7MM. Their opinion helps understand and validate current and emerging therapies, treatment patterns, or Alcohol-related Liver Disease market trends. This will support the clients in potential upcoming novel treatments by identifying the overall scenario of the market and the unmet needs.

Qualitative Analysis

We perform Qualitative and market Intelligence analysis using various approaches, such as SWOT and Conjoint Analysis. In the SWOT analysis, strengths, weaknesses, opportunities, and threats in terms of disease diagnosis, patient awareness, patient burden, competitive landscape, cost-effectiveness, and geographical accessibility of therapies are provided. These pointers are based on the Analyst’s discretion and assessment of the patient burden, cost analysis, and existing and evolving treatment landscape.

Conjoint Analysis analyzes multiple approved and emerging therapies based on relevant attributes such as safety, efficacy, frequency of administration, route of administration, and order of entry. Scoring is given based on these parameters to analyze the effectiveness of therapy.

Further, the therapies’ safety is evaluated wherein the acceptability, tolerability, and adverse events are majorly observed, and it sets a clear understanding of the side effects posed by the drug in the trials. In addition, the scoring is also based on the route of administration, order of entry and designation, probability of success, and the addressable patient pool for each therapy. According to these parameters, the final weightage score and the ranking of the emerging therapies are decided.

Market Access and Reimbursement

The high cost of therapies for the treatment is a major factor restraining the growth of the global drug market. Because of the high cost, the economic burden is increasing, leading the patient to escape from proper treatment.

The report further provides detailed insights on the country-wise accessibility and reimbursement scenarios, cost-effectiveness scenario of approved therapies, programs making accessibility easier and out-of-pocket costs more affordable, insights on patients insured under federal or state government prescription drug programs, etc.

Scope of the ARLD Therpeutics Market Report

- The report covers a segment of key events, an executive summary, descriptive overview of Alcohol-related Liver Disease (ARLD), explaining its causes, signs and symptoms, pathogenesis, and currently available therapies.

- Comprehensive insight has been provided into the epidemiology segments and forecasts, the future growth potential of diagnosis rate, disease progression, and treatment guidelines.

- Additionally, an all-inclusive account of the current and emerging therapies and the elaborative profiles of late-stage and prominent therapies will impact the current treatment landscape.

- A detailed review of the Alcohol-related Liver Disease (ARLD) market, historical and forecasted market size, market share by therapies, detailed assumptions, and rationale behind the approach is included in the report covering the 7MM drug outreach.

- The report provides an edge while developing business strategies, by understanding trends, through SWOT analysis and expert insights/KOL views, patient journey, and treatment preferences that help shape and drive the 7MM Alcohol-related Liver Disease (ARLD) market.

Alcohol-related Liver Disease Report Insights

- Patient Population

- Therapeutic Approaches

- Alcohol-related Liver Disease Pipeline Analysis

- Alcohol-related Liver Disease Market Size and Trends

- Existing and Future Market Opportunity

Alcohol-related Liver Disease Report Key Strengths

- 11 years Forecast

- The 7MM Coverage

- Alcohol-related Liver Disease Epidemiology Segmentation

- Key Cross Competition

- Attribute Analysis

- Drugs Uptake and Key Market Forecast Assumptions

Alcohol-related Liver Disease Report Assessment

- Current Treatment Practices

- Unmet Needs

- Pipeline Product Profiles

- Market Attractiveness

- Qualitative Analysis (SWOT and Conjoint Analysis)

Key Questions Answered In The ARLD ARLD Market Report:

ARLD Market Insights

- What was the Alcohol-related Liver Disease (ARLD) total market size, the market size by therapies, and market share (%) distribution in 2020, and how would it all look in 2034? What are the contributing factors for this growth?

- What unmet needs are associated with the current treatment market of Alcohol-related Liver Disease (ARLD)?

- What are the patents of emerging therapies for ARLD?

- Which drug is going to be the largest contributor by 2034?

- What are the pricing variations among different geographies for approved and off-label therapies?

- How would the market drivers, barriers, and future opportunities affect the market dynamics and subsequent analysis of the associated trends?

Epidemiology Insights

- What are the disease risks, burdens, and unmet needs of Alcohol-related Liver Disease (ARLD)? What will be the growth opportunities across the 7MM concerning the patient population of Alcohol-related Liver Disease (ARLD)?

- What is the historical and forecasted Alcohol-related Liver Disease (ARLD) patient pool in the United States, EU4 (Germany, France, Italy, and Spain), the United Kingdom, and Japan?

- Why do only limited patients appear for diagnosis?

- Which country is more prevalent for Alcohol-related Liver Disease (ARLD) and why?

- What factors are affecting the diagnosis of the indication?

Current ARLD Treatment Scenario, Marketed Drugs, and Emerging Therapies

- What are the current options for treating Alcohol-related Liver Disease (ARLD)? What are the current guidelines for treating Alcohol-related Liver Disease (ARLD) in the US and Europe?

- How many companies are developing therapies for treating Alcohol-related Liver Disease (ARLD)?

- How many emerging therapies are in the mid-stage and late stage of development for treating Alcohol-related Liver Disease (ARLD)?

- What are the recent novel therapies, targets, mechanisms of action, and technologies developed to overcome the limitations of existing therapies?

- What are the key designations that have been granted for the emerging therapies for Alcohol-related Liver Disease (ARLD)?

- Patient acceptability in terms of preferred treatment options as per real-world scenarios?

- What are the country-specific accessibility issues of expensive, recently approved therapies? Focus on reimbursement policies.

- What are the 7MM historical and forecasted markets of Alcohol-related Liver Disease (ARLD)?

Reasons to Buy ARLD Market Forecast Report

- The report will help develop business strategies by understanding the latest trends and changing treatment dynamics driving the Alcohol-related Liver Disease (ARLD) Market.

- Insights on patient burden/disease prevalence, evolution in diagnosis, and factors contributing to the change in the epidemiology of the disease during the forecast years.

- To understand the existing market opportunity in varying geographies and the growth potential over the coming years.

- Distribution of historical and current patient share based on real-world prescription data along with reported sales of approved products in the US, EU4 (Germany, France, Italy, and Spain), the United Kingdom, and Japan.

- Identifying strong upcoming players in the market will help devise strategies that will help get ahead of competitors.

- Detailed analysis and ranking of potential current and emerging therapies under the conjoint analysis section to provide visibility around leading classes.

- Highlights of Access and Reimbursement policies of approved therapies, barriers to accessibility of off-label expensive therapies, and patient assistance programs.

- To understand the perspective of Key Opinion Leaders around the accessibility, acceptability, and compliance-related challenges of existing treatment to overcome barriers in the future.

- Detailed insights on the unmet needs of the existing market so that the upcoming players can strengthen their development and launch strategy.