Aneurysmal Subarachnoid Hemorrhage (SAH) Market

- The Aneurysmal Subarachnoid Hemorrhage Market Size is anticipate to grow with a significant CAGR during thr study period (2020-2034).

- Subarachnoid hemorrhages are severe and life-threatening events caused by bleeding between the arachnoid and pia mater layers of the brain. This condition frequently arises when a weakened area in a blood vessel, known as an aneurysm, ruptures and leaks blood onto the brain's surface.

- The leading Aneurysmal Subarachnoid Hemorrhage companies such as Arbor Pharmaceuticals, Evgen Pharma, Idorsia Pharmaceuticals, Grace Therapeutics, Edge Therapeutics, PDS Biotechnology Corporation, BIT Pharma, and others are dveloping therapies for Aneurysmal Subarachnoid Hemorrhage treatment.

- Aneurysmal subarachnoid hemorrhage (aSAH) is a type of stroke that occurs when a cerebral aneurysm–a weakened and bulging area in the wall of a blood vessel in the brain ruptures, leading to bleeding in the subarachnoid space.

- According to DelveInsight’s estimates, in 2023, there were around 54,700 new cases of aneurysmal subarachnoid hemorrhage across the seven major markets (7MM). This figure is projected to increase significantly from 2020 to 2034, largely due to rising rates of hypertension, cigarette smoking, and a family history of the condition.

- In 2023, approximately 66% of aneurysmal subarachnoid hemorrhage (aSAH) cases in the United States were observed in females, with the highest incidence among those aged 60-69. This highlights a significant gap in the management of the condition, emphasizing the need for increased awareness and access to effective therapies.

- Currently, there is no definitive cure for aneurysmal subarachnoid hemorrhage, and the pipeline for new treatments is limited. The only notable candidate under clinical trial is GTX-104 (Nimodipine Injection for IV Infusion) developed by Acasti Pharma. This highlights a significant unmet need in the management of this serious condition.

- The United States leads the market for aneurysmal subarachnoid hemorrhage, surpassing the EU4 (Germany, Spain, Italy, France), the UK, and Japan in market size. The total market for aneurysmal subarachnoid hemorrhage therapies across the seven major markets (7MM) projected to grow largely driven by standard of care treatments and emerging therapies. This trend underscores the ongoing reliance on established therapies, while also highlighting opportunities for innovation in treatment options.

DelveInsight's “Aneurysmal Subarachnoid Hemorrhage Market Insights, Epidemiology and Market Forecast – 2034” report delivers an in-depth understanding of the indication Aneurysmal Subarachnoid Hemorrhage, historical and forecasted epidemiology as well as the Aneurysmal Subarachnoid Hemorrhage therapeutics market trends in the United States, EU4 (Germany, Spain, Italy, and France) and the United Kingdom, and Japan.

The Aneurysmal Subarachnoid Hemorrhage market report provides real-world prescription pattern analysis, approved drugs, market share of individual therapies, and historical and forecasted 7MM Aneurysmal Subarachnoid Hemorrhage market size from 2020 to 2034. The report also covers current Aneurysmal Subarachnoid Hemorrhage treatment practices/algorithms and unmet medical needs to curate the best opportunities and assess the market’s underlying potential.

|

Study Period |

2020 to 2034 |

|

Forecast Period |

2024-2034 |

|

Geographies Covered |

|

|

Aneurysmal Subarachnoid Hemorrhage Market |

|

|

Aneurysmal Subarachnoid Hemorrhages Market Size | |

|

Aneurysmal Subarachnoid Hemorrhage Companies |

Arbor Pharmaceuticals, Evgen Pharma, Idorsia Pharmaceuticals, Grace Therapeutics, Edge Therapeutics, PDS Biotechnology Corporation, BIT Pharma, and others |

|

Aneurysmal Subarachnoid Hemorrhage Epidemiology Segmentation |

|

Aneurysmal Subarachnoid Hemorrhage Treatment Market

Aneurysmal Subarachnoid Hemorrhage Overview, Country-Specific Treatment Guidelines and Diagnosis

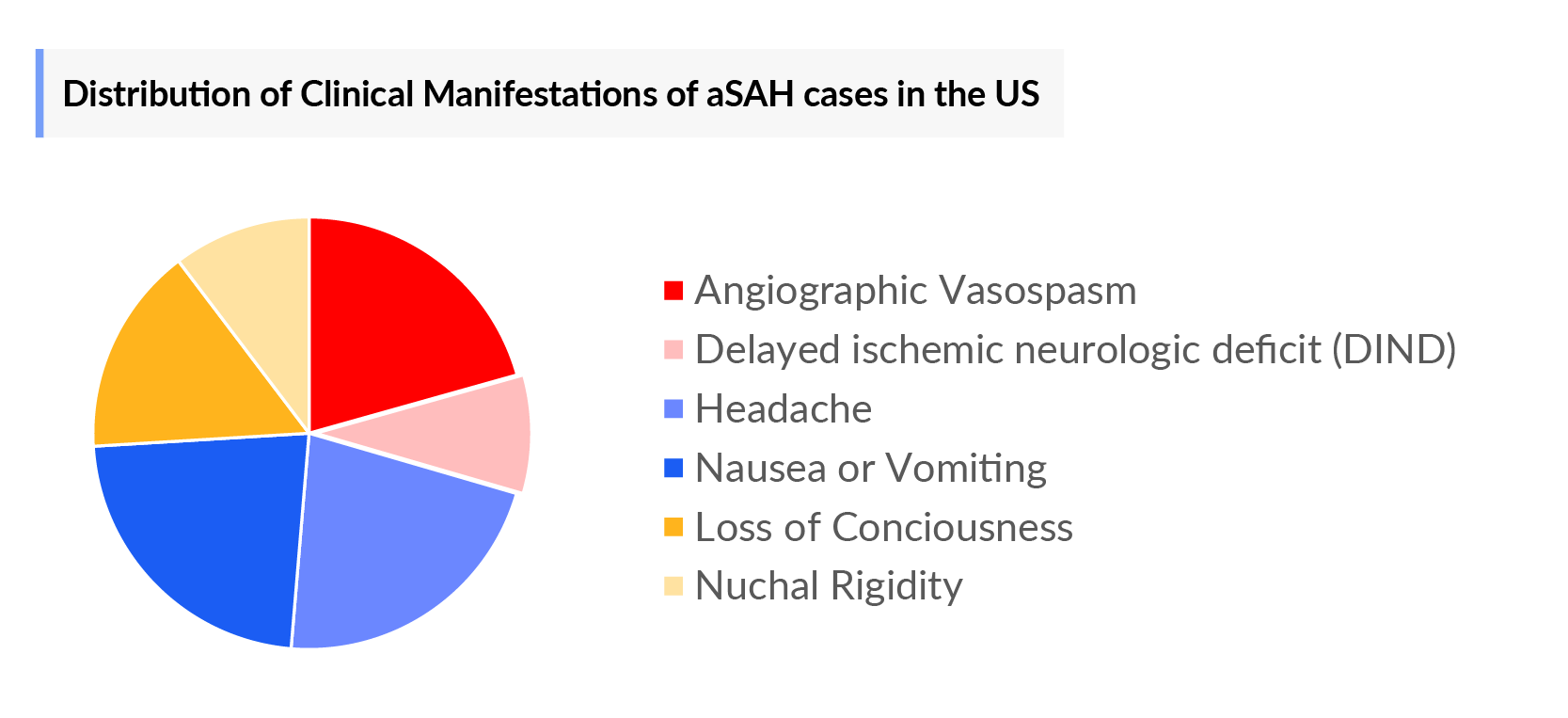

Aneurysmal Subarachnoid Hemorrhage (aSAH) is a life-threatening condition that occurs when a cerebral aneurysm—an abnormal bulging of a blood vessel in the brain—ruptures, leading to bleeding in the subarachnoid space, the area between the brain and the surrounding membrane. This condition accounts for about 5-10% of all strokes but carries a high risk of mortality and morbidity. The initial rupture causes a sudden and severe headache, often described as the "worst headache of one's life," along with symptoms such as nausea, vomiting, and loss of consciousness.

Immediate medical intervention is crucial, as rebleeding, cerebral vasospasm, and delayed cerebral ischemia can significantly worsen outcomes. Management typically involves securing the aneurysm through surgical clipping or endovascular coiling, alongside intensive monitoring and supportive care to prevent complications. Despite advancements in treatment, aneurysmal subarachnoid hemorrhage remains a condition with a significant risk of death and long-term disability, making early detection and rapid intervention essential for improving survival and recovery.

The aneurysmal subarachnoid hemorrhage report provides an overview of aneurysmal subarachnoid hemorrhage pathophysiology, diagnostic approaches, and detailed treatment algorithm along with a real-world scenario of a patient’s journey beginning from the first symptom, the time taken for diagnosis to the entire treatment process.

Further details related to country-based variations in diagnosis are provided in the report...

Aneurysmal Subarachnoid Hemorrhage Treatment

Aneurysmal subarachnoid hemorrhage (aSAH) is a critical condition requiring immediate medical intervention due to the high risk of severe complications and mortality. The current treatment approach focuses on two primary objectives:

- Securing the aneurysm to prevent rebleeding

- Managing secondary complications like cerebral vasospasm and delayed cerebral ischemia.

Securing the aneurysm typically involves surgical clipping or endovascular coiling, both aimed at preventing further hemorrhage. Once the aneurysm is stabilized, the focus shifts to preventing vasospasm, which can lead to delayed ischemic injury. Nimodipine, a calcium channel blocker, is the cornerstone of medical therapy for vasospasm prevention, often administered orally or intravenously. Additional supportive care includes blood pressure management, maintaining electrolyte balance, and monitoring for complications like hydrocephalus. Emerging therapies, such as endothelin receptor antagonists like clazosentan, are under investigation to further reduce the incidence of vasospasm and improve outcomes. The integration of these pharmacologic and interventional strategies forms the backbone of a comprehensive approach to managing aneurysmal subarachnoid hemorrhage, aiming to reduce morbidity and improve survival rates. Ongoing Aneurysmal Subarachnoid Hemorrhage clinical trials are exploring novel therapies, aiming to improve patient survival rates, reduce complications, and advance treatment strategies for this life-threatening neurological condition.

Aneurysmal Subarachnoid Hemorrhage Epidemiology

The Aneurysmal Subarachnoid Hemorrhage epidemiology chapter in the report provides historical as well as forecasted incidence in the 7MM covering the United States, EU4 countries (Germany, France, Italy, and Spain), the United Kingdom, and Japan from 2024 to 2034. The Aneurysmal Subarachnoid Hemorrhage epidemiology is segmented with detailed insights into:

- Total Incident Cases of Subarachnoid Hemorrhage in the 7MM

- Total Incident cases of Aneurysmal Subarachnoid Hemorrhage in the 7MM

- Diagnosed Incident Cases of Aneurysmal Subarachnoid Hemorrhage in the 7MM

- Gender-specific Cases of Aneurysmal Subarachnoid Hemorrhage in the 7MM

- Symptom-specific Cases of Aneurysmal Subarachnoid Hemorrhage in the 7MM

- Aneurysm Location-specific Cases of Aneurysmal Subarachnoid Hemorrhage in the 7MM

- Treatment Eligible and Compliance Patient pool of Aneurysmal Subarachnoid Hemorrhage in the 7MM

Key Epidemiological Highlights

- As per DelveInsight's estimates, in the year 2023, the total incident cases of aneurysmal subarachnoid hemorrhage were 54,700 cases in the 7MM, which might rise by 2034 at a CAGR of XX%.

- EU4 and the UK, accounted for approximately 20% of the total incident cases of aneurysmal subarachnoid hemorrhage in the year 2023.

- In 2023, an estimated 77% of individuals in the United States who experienced an aneurysmal subarachnoid hemorrhage actively sought medical treatment, highlighting a significant engagement with healthcare services for this life-threatening condition.

- In 2023, approximately 66% of aneurysmal subarachnoid hemorrhage cases in the United States were observed in females, with the highest incidence among those aged 60-69.

Aneurysmal Subarachnoid Hemorrhage Drug Chapters

The Aneurysmal Subarachnoid Hemorrhage drug chapter segment encloses a detailed analysis of aneurysmal subarachnoid hemorrhage emerging candidates. It also deep dives into the Aneurysmal Subarachnoid Hemorrhage pivotal clinical trial details, recent and expected market approvals, patent details, the latest news, and recent deals and collaborations. The Aneurysmal Subarachnoid Hemorrhage drugs market is evolving rapidly, driven by advanced therapies, increasing awareness, and ongoing research focused on improving patient outcomes and reducing neurological complications.

Emerging Drugs

GTX-104 (Nimodipine Injection for IV Infusion): Acasti Pharma

GTX-104 is a clinical stage, novel, injectable formulation of nimodipine being developed for intravenous (IV) infusion in aSAH patients to address significant unmet medical needs. The unique nanoparticle technology of GTX-104 facilitates aqueous formulation of insoluble nimodipine for a standard peripheral IV infusion.

GTX-104 provides a convenient IV delivery of nimodipine in the Intensive Care Unit potentially eliminating the need for nasogastric tube administration in unconscious or dysphagic patients. Intravenous delivery of GTX-104 also has the potential to lower food effects, drug-to-drug interactions, and eliminate potential dosing errors.

- In June 2024, Acasti Pharma announced that GTX-104’s pivotal Phase III STRIVE-ON safety trial has exceeded the 50% enrollment milestone.

- GTX-104 has been granted Orphan Drug Designation by the FDA, which provides seven years of marketing exclusivity post-launch in the United States.

|

Approved Drugs | ||||||

|

Drug Name |

Company |

Molecule Type |

RoA |

MoA |

Phase |

Designations |

|

GTX-104 (Nimodipine Injection for IV Infusion) |

Acasti Pharma |

Small Molecule |

IV |

Interleukin 6 receptor antagonists |

III |

ODD |

Further details about emerging drugs will be provided in the report.

Aneurysmal Subarachnoid Hemorrhage Market Outlook

The market size for Aneurysmal Subarachnoid Hemorrhage in the seven major markets is projected to experience significant growth from 2024, driven by a notable increase in incident cases and the necessity for innovative therapies that can provide more effective treatment to the affected patients.

- The United States accounts for the largest market size of Aneurysmal Subarachnoid Hemorrhage, in comparison to EU4 (Germany, Spain, Italy, France), the United Kingdom, and Japan.

- Among EU4 and the UK, Germany had the largest market size accounting for approximately USD 11 million, followed by Italy, with Spain having the smallest market size in 2023.

- In Japan, the total market size of aneurysmal subarachnoid hemorrhage was USD 64 million in 2023, which is expected to rise during the study period (2020–2034).

- Emerging candidate GTX-104 developed by Acasti Pharma emerged as a strong performer, capturing a market value of USD 6.4 million.

Drug Uptake

This section focuses on the uptake rate of potential drugs expected to be launched in the market during 2024–2034, which depends on the competitive landscape, safety, and efficacy data along with order of entry. It is important to understand that the key players evaluating their novel therapies in the pivotal and confirmatory trials should remain vigilant when selecting appropriate comparators to stand the greatest chance of a positive opinion from regulatory bodies, leading to approval, smooth launch, and rapid uptake.

Aneurysmal Subarachnoid Hemorrhage Activities

This Aneurysmal Subarachnoid Hemorrhage pipeline provides insights into Aneurysmal Subarachnoid Hemorrhage clinical trials within candidates. It also analyzes key players involved in developing targeted therapeutics.

Aneurysmal Subarachnoid Hemorrhage Pipeline Development Activities

This Aneurysmal Subarachnoid Hemorrhage clinical trials analysis covers information on collaborations, acquisitions and mergers, licensing, and patent details for emerging therapies.

KOL Views

To keep up with the real-world scenario in current market trends, we take opinions from Key Industry leaders working in the domain through primary research to fill the data gaps and validate our secondary research. Industry Experts were contacted for insights on the evolving treatment landscape, patient reliance on conventional therapies, patient therapy switching acceptability, and drug uptake along with challenges related to accessibility.

DelveInsight’s analysts connected with 10+ KOLs to gather insights; however, interviews were conducted with 5+ KOLs in the 7MM. Their opinion helps understand and validate current treatment patterns of Aneurysmal Subarachnoid Hemorrhage. This will support the clients in potential upcoming novel treatments by identifying the overall scenario of the market and the unmet needs.

Qualitative Analysis

We perform Qualitative and market Intelligence analysis using various approaches, such as SWOT analysis and Conjoint Analysis. In the SWOT analysis, strengths, weaknesses, opportunities, and threats in terms of gaps in disease diagnosis, patient awareness, physician acceptability, competitive landscape, cost-effectiveness, and geographical accessibility of therapies are provided.

Conjoint Analysis analyzes multiple approved therapies based on relevant attributes such as safety, efficacy, frequency of administration, route of administration, and order of entry. Scoring is given based on these parameters to analyze the effectiveness of therapy.

In efficacy, the trial’s primary and secondary outcome measures are evaluated; for instance, in event-free survival, one of the most important primary outcome measures is event-free survival and overall survival.

Further, the therapies’ safety is evaluated wherein the acceptability, tolerability, and adverse events are majorly observed, and it sets a clear understanding of the side effects posed by the drug in the trials. In addition, the scoring is also based on the probability of success, and the addressable patient pool for each therapy.

Market Access and Reimbursement

The report provides detailed insights on the country-wise accessibility and reimbursement scenarios, cost-effectiveness scenario of currently used therapies, programs making accessibility easier and out-of-pocket costs more affordable, insights on patients insured under federal or state government prescription drug programs, etc.

Scope of the Aneurysmal Subarachnoid Hemorrhage Market Report

- The report covers a segment of key events, an executive summary, descriptive overview of Aneurysmal Subarachnoid Hemorrhage, explaining its causes, signs and symptoms, pathogenesis, and currently available therapies.

- Comprehensive insight has been provided into the epidemiology segments and forecasts, the future growth potential of diagnosis rate, and disease progression along with country specific treatment guidelines.

- Additionally, an all-inclusive account of the current therapies, along with the elaborative profiles of late-stage and prominent therapies, will have an impact on the current treatment landscape.

- A detailed review of the Aneurysmal Subarachnoid Hemorrhage market, historical and forecasted market size, market share by therapies, detailed assumptions, and rationale behind our approach is included in the report, covering the 7MM drug outreach.

- The report provides an edge while developing business strategies, by understanding trends, through SWOT analysis and expert insights/KOL views, patient journey, and treatment preferences that help in shaping and driving the 7MM Aneurysmal Subarachnoid Hemorrhage.

Aneurysmal Subarachnoid Hemorrhage Market Report Insights

- Patient Population

- Therapeutic Approaches

- Aneurysmal Subarachnoid Hemorrhage Pipeline Analysis

- Aneurysmal Subarachnoid Hemorrhage Market Size and Trends

- Existing and future Market Opportunity

Aneurysmal Subarachnoid Hemorrhage Market Report Key Strengths

- Eleven Years Forecast

- 7MM Coverage

- Aneurysmal Subarachnoid Hemorrhage Epidemiology Segmentation

- Inclusion of Country specific treatment guidelines

- KOL’s feedback on approved therapies

- Key Cross Competition

- Conjoint analysis

- Drugs Uptake and Key Market Forecast Assumptions

Aneurysmal Subarachnoid Hemorrhage Market Report Assessment

- Current Treatment Practices

- Unmet Needs

- Pipeline Product Profiles

- Market Attractiveness

- Qualitative Analysis (SWOT and Conjoint Analysis)

FAQs

- What is the growth rate of the 7MM Aneurysmal Subarachnoid Hemorrhage treatment market?

- What was the Aneurysmal Subarachnoid Hemorrhage total market size, the market size by therapies, market share (%) distribution in 2020, and what would it look like in 2034? What are the contributing factors/key catalysts for this growth?

- Is there any unexplored patient setting that can open the window for growth in the future?

- What are the pricing variations among different geographies for approved and off-label therapies?

- How would the market drivers, barriers, and future opportunities affect the market dynamics and subsequent analysis of the associated trends?

- What are the current options for the treatment of Aneurysmal Subarachnoid Hemorrhage?

- What are the recent novel therapies, targets, mechanisms of action, and technologies developed to overcome the limitations of existing therapies?

- Patient acceptability in terms of preferred treatment options as per real-world scenarios?

- What are the country-specific accessibility issues of expensive, recently approved therapies?

Reasons to buy Aneurysmal Subarachnoid Hemorrhage Market Forecast Report

- The report will help in developing business strategies by understanding the latest trends and changing treatment dynamics driving the Aneurysmal Subarachnoid Hemorrhage Market.

- Insights on patient burden/disease incidence, evolution in diagnosis, and factors contributing to the change in the epidemiology of the disease during the forecast years

- Understand the existing market opportunities in varying geographies and the growth potential over the coming years.

- Distribution of historical and current patient share based on real-world prescription data along with reported sales of approved products in the US, EU4 (Germany, France, Italy, and Spain), the United Kingdom, and Japan.

- Detailed analysis and ranking of class-wise potential current therapies under the conjoint analysis section to provide visibility around leading classes.

- Highlights of access and reimbursement policies of approved therapies, barriers to accessibility of expensive off-label therapies, and patient assistance programs.

- To understand Key Opinion Leaders’ perspectives around the accessibility, acceptability, and compliance-related challenges of existing treatment to overcome barriers in the future.

- Detailed insights on the unmet needs of the existing market so that the upcoming players can strengthen their development and launch strategy.

-01.png)

-03.png)

-04.png)