Anti-cancer vaccine Market Outlook

Key Highlights

-

Anti-cancer vaccines are a transformative class of immunotherapies designed to train the immune system to recognize and destroy cancer cells by targeting specific tumor-associated antigens.

-

There are two primary types of anti-cancer vaccines

-

Preventive vaccines: Protect against cancer-causing viruses like HPV and hepatitis B.

-

Therapeutic vaccines: Treat existing cancers by enhancing the immune system's ability to combat tumors.

-

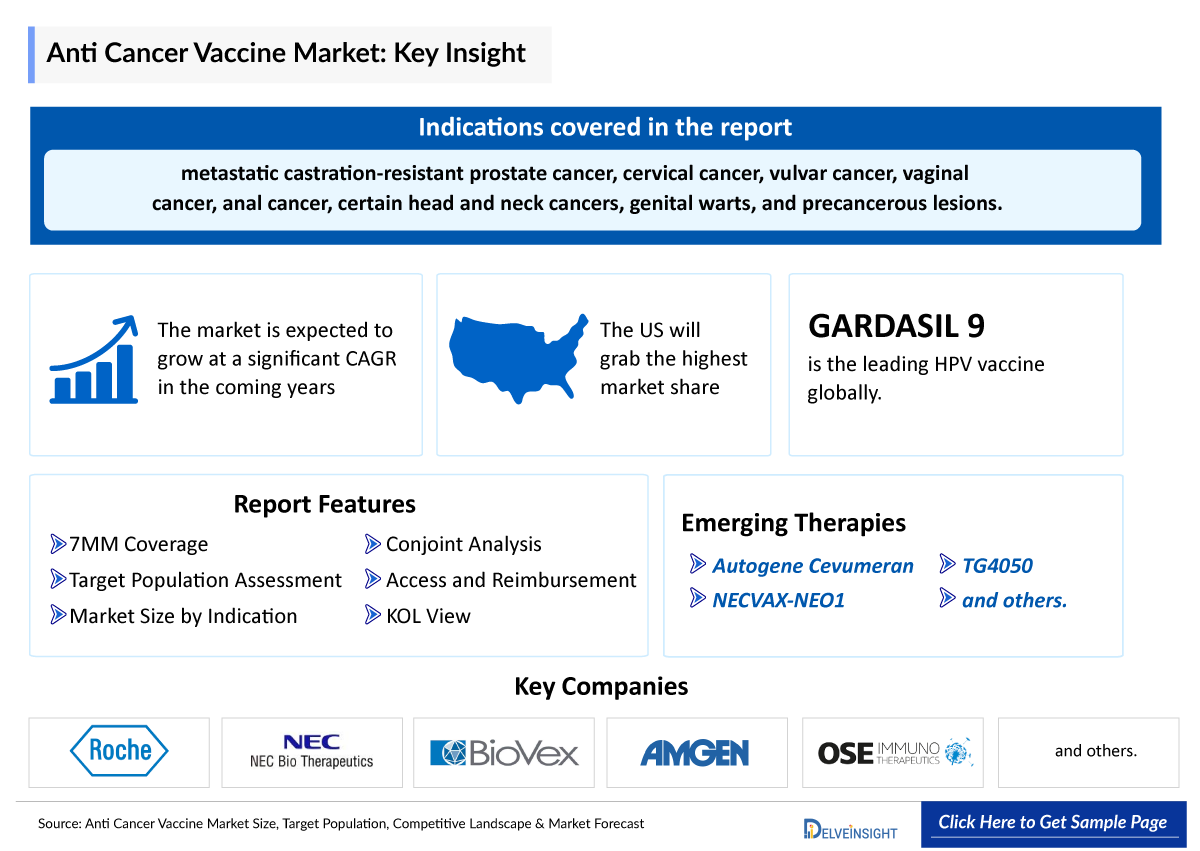

Therapeutic anti-cancer vaccines are being explored for a wide range of cancers, including metastatic castration-resistant prostate cancer, cervical cancer, vulvar cancer, vaginal cancer, anal cancer, certain head and neck cancers, genital warts, and precancerous lesions.

-

In April 2010, PROVENGE (Sipuleucel-T) became the first FDA-approved therapeutic cancer vaccine, designed to treat asymptomatic or minimally symptomatic metastatic castration-resistant prostate cancer by stimulating an immune response against prostate cancer cells.

-

Cervarix, a bivalent HPV vaccine developed by GSK, was approved by the FDA in 2009 to prevent cervical cancer and precancerous lesions caused by HPV types 16 and 18 in females aged 9 to 25. It was voluntarily withdrawn from the U.S. market in 2016 due to low demand.

-

Today, GARDASIL 9 is the leading HPV vaccine globally, offering protection against multiple HPV strains responsible for cervical, anal, vulvar, vaginal, and oropharyngeal cancers. In 2024, it generated USD 8.6 billion in global net product revenue.

-

Numerous anti-cancer vaccines are currently under investigation in clinical trials. One example is Autogene Cevumeran, in development for muscle-invasive urothelial carcinoma, pancreatic ductal adenocarcinoma, and advanced melanoma, with approval anticipated during the forecast period.

-

A groundbreaking collaboration between Moderna and Merck has produced V940/mRNA-4157, a personalized mRNA-based cancer vaccine for high-risk melanoma. In a Phase IIb trial, combining this vaccine with pembrolizumab reduced the risk of recurrence or death by 44% compared to pembrolizumab alone. It has since received Breakthrough Therapy Designation from the FDA, and a Phase III trial is underway.

-

In a major milestone for personalized immunotherapy, researchers at Yale developed a vaccine custom-made from kidney tumor DNA. In early trials, all nine patients remained cancer-free for nearly three years, prompting a larger trial involving 270 patients in partnership with Merck and Moderna.

-

In October 2024, researchers at the University of Oxford secured funding to develop the world’s first preventive ovarian cancer vaccine named OvarianVax, the vaccine is designed to train the immune system to detect and eliminate the earliest signs of ovarian cancer, which affects approximately 7,500 women annually in the UK.

-

At the SITC 2024 Annual Meeting, NEC BIO B.V. presented promising clinical data on TG4050, a personalized neoantigen cancer vaccine developed in partnership with Transgene, showing encouraging results in patients with head and neck cancer.

-

In November 2024, Transgene and NEC presented updated data from a randomized Phase I trial of TG4050 in head and neck cancer. After a median follow-up of 24.1 months, all 16 patients who received TG4050 as adjuvant immunotherapy following standard treatment remained disease-free, while 3 patients in the control arm experienced disease relapse—confirming clinical proof of principle.

-

Multiple biotech leaders, including Hoffmann-La Roche, NEC Bio B.V., BioVex/Amgen, and OSE Immunotherapeutics, are actively engaged in advancing anti-cancer vaccine platforms to expand their therapeutic potential across diverse cancer types.

DelveInsight’s “Anti-cancer vaccines – Market Size, Target Population, Competitive Landscape, and Market Forecast – 2034” report delivers an in-depth understanding of the Anti-cancer vaccines, historical and Competitive Landscape as well as the Anti-cancer vaccines’ market trends in the United States, EU4 (Germany, France, Italy, and Spain) and the United Kingdom, and Japan.

The Anti-cancer vaccines market report provides current treatment practices, emerging anti-cancer vaccines, market share of individual therapies, and current and forecasted 7MM Anti-cancer vaccines market size from 2020 to 2034. The report also covers current Anti-cancer vaccine treatment practices and unmet medical needs to curate the best opportunities and assess the market’s potential.

Geography Covered

-

The United States

-

EU4 (Germany, France, Italy, and Spain) and the United Kingdom

-

Japan

Study Period: 2020–2034

Anti-cancer Vaccines Understanding and Application

Anti-cancer vaccines Overview

Anti-cancer vaccines are an emerging class of immunotherapies that train the immune system to recognize and attack cancer cells, much like traditional vaccines help fight infections. These vaccines work by exposing the body to cancer-specific markers, known as antigens, often in combination with adjuvants substances that stimulate immune activity. Broadly, there are two types: preventive vaccines, which reduce the risk of cancer by preventing infections linked to cancer (like HPV and hepatitis B), and therapeutic vaccines, which aim to treat existing cancers by helping the immune system identify and eliminate malignant cells. Advances in genomics have enabled researchers to identify more precise targets for vaccine design, including neoantigens unique mutations found in cancer cells. Anti-cancer vaccines show particular promise when paired with other immune-stimulating therapies, forming a key part of combination treatments that can enhance overall effectiveness.

.

Further details related to country-based variations are provided in the report

Anti-cancer vaccines Treatment

Therapeutic cancer vaccines are used after cancer has developed to boost the body's ability to combat the disease. These vaccines introduce cancer-specific antigens, paired with immune-activating adjuvants, to help immune cells locate and destroy tumor cells. They are designed not only to reduce tumor growth and prevent metastasis but also to eliminate residual cancer following treatments like surgery or radiation, and to minimize recurrence. FDA-approved examples include PROVENGE (Sipuleucel-T) for metastatic prostate cancer, IMLYGIC (talimogene laherparepvec or T-VEC) & others for advanced melanoma. Researchers are also exploring innovative strategies like oncolytic virus-based vaccines and in situ vaccination, where immune-stimulating agents are injected directly into tumors. As tumors often suppress immune responses, therapeutic vaccines are increasingly combined with checkpoint inhibitors to enhance their effectiveness, signaling a future where multi-pronged immunotherapy could become a standard approach in cancer care.

Further details related to country-based variations are provided in the report…

Anti-cancer vaccines Drug Chapters

The drug chapter segment of the anti-cancer vaccine reports encloses a detailed analysis of approved anti-cancer vaccine late-stage (Phase III and Phase II) anti-cancer vaccines. It also helps understand the anti-cancer vaccine clinical trial details, expressive pharmacological action, agreements and collaborations, approval and patent details, advantages and disadvantages of each included drug, and the latest news and press releases.

Marketed Anti-cancer Vaccines

GARDASIL 9 (Human Papillomavirus 9-valent Vaccine, Recombinant): Merck

Gardasil 9 is a vaccine used to prevent diseases caused by certain strains of the human papillomavirus (HPV), a virus linked to several types of cancer and other serious conditions. It is approved for use in both females and males aged 9 through 45 years. Gardasil 9 protects against nine HPV types—6, 11, 16, 18, 31, 33, 45, 52, and 58—which are responsible for the majority of HPV-related cancers and genital warts. The vaccine is given as a series of two or three injections throughout 6 to 12 months and is typically administered into the upper arm muscle. By targeting the most dangerous HPV types, Gardasil 9 significantly reduces the risk of cervical, vulvar, vaginal, anal, and certain head and neck cancers, as well as genital warts and precancerous lesions.

In females, Gardasil 9 helps prevent cervical, vulvar, vaginal, anal, oropharyngeal, and other head and neck cancers caused by high-risk HPV types. It also protects against genital warts and various precancerous conditions, such as cervical intraepithelial neoplasia, vulvar intraepithelial neoplasia, vaginal intraepithelial neoplasia, and anal intraepithelial neoplasia. For males, the vaccine prevents anal, oropharyngeal, and other head and neck cancers, genital warts, and precancerous anal lesions. While its indication for preventing head and neck cancers is under accelerated approval, continued research is being conducted to confirm its long-term benefits in these areas.

PROVENGE (sipuleucel-T): Dendreon pharmaceuticals

PROVENGE (sipuleucel-T) is a customized, prescription immunotherapy used to treat certain men with advanced prostate cancer, specifically those with metastatic castration-resistant prostate cancer (mCRPC) who have little to no symptoms. It activates the patient’s immune cells to help the body fight the cancer and has been shown to extend survival in some patients.

Approved by the FDA on April 29, 2010, PROVENGE was the first cellular immunotherapy approved for mCRPC. It was originally developed by Dendreon, later acquired by Valeant Pharmaceuticals, and eventually returned to Dendreon.

|

Table 1: Comparison of Key Marketed Anti-cancer Vaccines | |||

|

Product |

Company |

RoA |

Indication |

|

GARDASIL 9 |

Merck |

IM |

Prevention of cervical, vulvar, vaginal, anal, oropharyngeal and other head and neck cancers |

|

PROVENGE (sipuleucel-T) |

Dendreon pharmaceuticals |

IV |

Treatment of asymptomatic or minimally symptomatic metastatic castrate-resistant (hormone refractory) prostate cancer |

Note: Detailed current therapies assessment will be provided in the full report of Anti-cancer vaccines

Emerging Anti-cancer Vaccines

Autogene Cevumeran: Hoffmann-La Roche

Autogene cevumeran (individualized neoantigen-specific therapy, iNeST (RG6180) is a messenger RNA (mRNA)-based, individually tailored, personalized cancer vaccine. Each vaccine will be made using unique neoantigen signatures from an individual patient’s tumor, which is expected to elicit an effective immune response against that patient’s tumor.

It is currently undergoing Phase II clinical trials for the treatment of muscle-invasive urothelial carcinoma, adenocarcinoma, pancreatic ductal carcinoma, and advanced melanoma, with a projected regulatory filing expected after 2027.

NECVAX-NEO1: NEC Bio B.V

NECVAX-NEO1 is an oral, bacteria-based therapeutic vaccine that uses patient-specific neoantigens, selected via the NEC immune profiler, to stimulate a targeted CD8+ T-cell immune response against tumor cells. Designed as a personalized add-on to standard PD-1/PD-L1 inhibitor therapy, it leverages a clinically validated plug-and-play platform for convenient oral administration and self-adjuvanting through its bacterial carrier. Its streamlined, small-scale manufacturing enables rapid turnaround, making it suitable for treating metastatic disease. By presenting neoantigen epitopes on dendritic cells via MHC class I molecules, NECVAX-NEO1 activates antigen-specific T cells that recognize and destroy cancer cells, offering a versatile and effective approach to personalized cancer immunotherapy.

It is currently in Phase I/II clinical trial for triple-negative breast cancer and solid tumors.

|

Table 2: Comparison of Key Emerging Anti-Cancer Vaccines | ||||

|

Product |

Company |

RoA |

Phase |

Indication |

|

Autogene Cevumera |

Hoffmann-La Roche |

Subcutaneous infusion |

II |

muscle-invasive urothelial carcinoma, adenocarcinoma, pancreatic ductal, advanced melanoma |

|

NECVAX-NEO1 |

NEC Bio B.V |

Oral |

I/II |

Triple-negative breast cancer, Solid tumors |

|

TG4050 |

NEC Bio B.V |

SC |

II, I/II |

Head & Neck cancer, Ovarian cancer, Basket solid tumors |

Note: Detailed emerging therapies assessment will be provided in the final report.

Anti-cancer Vaccines Market Outlook

The market for Anti-cancer vaccines is expected to grow significantly in the coming years. This is due to the increasing number of patients who are being diagnosed with cervical cancer, prostate cancer, solid tumors, head & neck cancer, ovarian cancer, adenocarcinoma, and many more types of cancer; the growing awareness of anti-cancer vaccines, and the increasing number of emerging anti-cancer vaccines that are under clinical trials and filed for approval by various companies.

In addition to the rising incidence of cancer and ongoing clinical developments, technological advancements are playing a pivotal role in shaping the anti-cancer vaccine market. Innovations in genetic sequencing and bioinformatics are enabling the identification of tumor-specific antigens and neoantigens, paving the way for more personalized and effective vaccine formulations. The integration of cancer vaccines with other immunotherapies, such as checkpoint inhibitors and oncolytic viruses, is further expanding their therapeutic potential and appeal. Moreover, increasing investments from both public and private sectors, along with favorable regulatory frameworks in key markets like the U.S., Europe, and Asia-Pacific, are accelerating research, development, and commercialization efforts. As these factors converge, the anti-cancer vaccine landscape is expected to evolve rapidly, with significant opportunities for breakthrough therapies and new market entrants in the near future.

Several key players, including NEC Bio B.V, Hoffmann-La Roche, and others, are involved in developing anti-cancer vaccines for various indications such as head & neck cancer, ovarian cancer, adenocarcinoma, and others. Overall, this is an exciting new class of agents with great potential for development. The maturation of current studies over the next few years will lead to a better understanding of anti-cancer vaccines and define their role in the therapy of various types of cancers.

Anti-cancer vaccines Uptake

This section focuses on the uptake rate of potential approved and emerging Anti-cancer vaccines expected to be launched in the market during 2020–2034.

Anti-cancer Vaccines Pipeline Development Activities

The report provides insights into different therapeutic candidates in Phase III, Phase II, and Phase I. It also analyzes key players involved in developing targeted therapeutics.

The presence of numerous anti-cancer vaccines under different stages is expected to generate immense opportunity for Anti-cancer vaccine market growth over the forecasted period.

Pipeline Development Activities

The report covers information on collaborations, acquisitions and mergers, licensing, and patent details for Anti-cancer vaccine therapies.

KOL Views

To keep up with current and future market trends, we take Industry Experts’ opinions working in the domain through primary research to fill the data gaps and validate our secondary research. Industry experts were contacted for insights on Anti-cancer vaccines' evolving treatment landscape, patient reliance on conventional therapies, patient therapy switching acceptability, drug uptake, along challenges related to accessibility.

DelveInsight’s analysts connected with 20+ KOLs to gather insights; however, interviews were conducted with 10+ KOLs in the 7MM. Centers such as Johns Hopkins Sidney Kimmel Cancer Center and others.

Their opinion helps understand and validate current and emerging therapy treatment patterns or Anti-cancer vaccine market trends. This will support the clients in potential upcoming novel treatments by identifying the overall scenario of the market and the unmet needs.

|

KOL Views |

|

“Personalized cancer vaccines are showing immense promise, especially in combination with checkpoint inhibitors. By tailoring vaccines to the unique mutations in a patient’s tumor, we can potentially improve immune recognition and long-term disease control, particularly in aggressive and metastatic cancers.” |

|

“The biggest leap in cancer vaccine development has come from mRNA platforms, which allow for rapid design and manufacturing of vaccines based on an individual's tumor profile. These platforms have demonstrated the ability to elicit strong, specific immune responses, which could transform standard cancer treatment approaches.” |

|

“Cancer vaccines are no longer theoretical. Early-phase clinical trials have demonstrated both safety and signs of efficacy in hard-to-treat cancers like pancreatic and melanoma. As more data matures, we are likely to see vaccines play a critical role in adjuvant and maintenance therapy settings.” |

|

“The integration of cancer vaccines into multimodal treatment regimens—alongside radiation, chemotherapy, or immunotherapy—is the future. Tumors often suppress immune responses, and vaccines help retrain the immune system to stay alert and target residual or recurring disease more effectively.” |

Qualitative Analysis

We perform Qualitative and market Intelligence analysis using various approaches, such as SWOT analysis. In the SWOT analysis, strengths, weaknesses, opportunities, and threats in terms of disease diagnosis, patient awareness, patient burden, competitive landscape, cost-effectiveness, and geographical accessibility of therapies are provided. These pointers are based on the analyst’s discretion and assessment of the patient burden, cost analysis, and existing and evolving treatment landscape.

Market Access and Reimbursement

Reimbursement may be referred to as the negotiation of a price between a manufacturer and payer that allows the manufacturer access to the market. It is provided to reduce the high costs and make the essential anti-cancer vaccines affordable. Health technology assessment (HTA) plays an important role in reimbursement decision-making and recommending the use of a drug. These recommendations vary widely throughout the seven major markets, even for the same drug.

In the US healthcare system, both Public and Private health insurance coverage are included. Also, Medicare and Medicaid are the largest government-funded programs in the US. The major healthcare programs including Medicare, Continuing Medical Education (CME) program, the Children's Health Insurance Program (CHIP), and the state and federal health insurance marketplaces are overseen by the Centers for Medicare & Medicaid Services (CMS). Other than these, Pharmacy Benefit Managers (PBMs), and third-party organizations that provide services, and educational programs to aid patients are also present.

The report further provides detailed insights on the country-wise accessibility and reimbursement scenarios, cost-effectiveness scenario of approved therapies, programs making accessibility easier and out-of-pocket costs more affordable, insights on patients insured under federal or state government prescription drug programs, etc.

Key Updates on Anti-cancer vaccines

-

At the Society for ImmunoTherapy of Cancer (SITC) 2024 Annual Meeting, NEC BIO B.V. presented data showing the effectiveness of TG4050, an individualized neoantigen cancer vaccine developed by Transgene and NEC, in patients with head and neck cancer. In a randomized Phase I trial, after a median follow-up of 24.1 months, all 16 patients who received TG4050 as adjuvant immunotherapy following standard of care remained disease-free, while 3 patients in the control arm experienced relapse.

-

Cervarix was voluntarily taken off the U.S. market by GSK in 2016 due to low demand. It was a preventative cervical cancer vaccine, approved by the FDA in 2009, for use in girls and young women aged 10 to 25. Cervarix targeted oncogenic human papillomavirus (HPV) types 16 and 18, which are responsible for the majority of cervical pre-cancers and cervical cancer cases.

-

A collaboration between Moderna and Merck has resulted in the development of V940/mRNA-4157, a personalized mRNA vaccine for high-risk melanoma. In a Phase IIb trial, patients receiving V940/mRNA-4157 alongside pembrolizumab exhibited a 44% reduction in the risk of recurrence or death compared to those treated with pembrolizumab alone. This promising outcome has led to Breakthrough Therapy Designation by the FDA, and a Phase III trial is ongoing.

The abstract list is not exhaustive, will be provided in the final report…

Scope of the Report

-

The report covers a segment of key events, an executive summary, and a descriptive overview of the Anti-cancer vaccines, explaining their mechanism, and therapies (current and emerging).

-

Comprehensive insight into the competitive landscape, and forecasts, the future growth potential of treatment rate, drug uptake, and drug information have been provided.

-

Additionally, an all-inclusive account of the current and emerging therapies and the elaborative profiles of late-stage and prominent therapies will impact the current landscape.

-

A detailed review of the Anti-cancer vaccines market, historical and forecasted market size, market share by therapies, detailed assumptions, and rationale behind our approach is included in the report, covering the 7MM drug outreach.

-

The report provides an edge while developing business strategies, by understanding trends, through SWOT analysis, expert insights/KOL views, and treatment preferences that help shape and drive the 7MM Anti-cancer vaccines market.

Anti-cancer Vaccines Report Insights

-

Anti-cancer vaccines Targeted Patient Pool

-

Therapeutic Approaches

-

Anti-cancer vaccines Pipeline Analysis

-

Anti-cancer vaccines Market Size and Trends

-

Existing and future Market Opportunity

Anti-cancer vaccines Report Key Strengths

-

Eleven years Forecast

-

The 7MM Coverage

-

Key Cross Competition

-

Anti-cancer Vaccines Uptake and Key Market Forecast Assumptions

Anti-cancer vaccines Report Assessment

-

Current Treatment Practices

-

Unmet Needs

-

Pipeline Product Profiles

-

Market Attractiveness

-

Qualitative Analysis (SWOT)

Key Questions

-

What was the Anti-cancer vaccines total market size, the market size by therapies, market share (%) distribution, and what would it look like in 2034? What are the contributing factors for this growth?

-

Which drug is going to be the largest contributor in 2034?

-

Which is the most lucrative market for Anti-cancer vaccines?

-

What are the pricing variations among different geographies for approved therapies?

-

How the reimbursement landscape has for Anti-cancer vaccines evolved since the first one was approved? Do patients have any access issues that are driven by reimbursement decisions?

-

What are the risks, burdens, and unmet needs of treatment with Anti-cancer vaccines? What will be the growth opportunities across the 7MM for the patient population of Anti-cancer vaccines?

-

What are the key factors hampering the growth of the Anti-cancer vaccines market?

-

What are the indications for which recent novel therapies and technologies have been developed to overcome the limitations of existing treatments?

-

What key designations have been granted to the therapies for Anti-cancer vaccines?

-

What is the cost burden of approved therapies on the patient?

-

Patient acceptability in terms of preferred therapy options as per real-world scenarios?

-

What are the country-specific accessibility issues of expensive, recently approved therapies?

Reasons to buy

-

The report will help develop business strategies by understanding the latest trends and changing dynamics driving the Anti-cancer vaccines market.

-

Understand the existing market opportunities in varying geographies and the growth potential over the coming years.

-

Distribution of historical and current patient share based on real-world prescription data along with reported sales of approved products in the US, EU4 (Germany, France, Italy, and Spain) the United Kingdom, and Japan.

-

Identifying strong upcoming players in the market will help devise strategies to help get ahead of competitors.

-

Detailed analysis and ranking of indication-wise current and emerging therapies under the conjoint analysis section to provide visibility around leading indications.

-

Highlights of Access and Reimbursement policies of approved therapies, barriers to accessibility of expensive off-label therapies, and patient assistance programs.

-

To understand Key Opinion Leaders’ perspectives around the accessibility, acceptability, and compliance-related challenges of existing treatment to overcome barriers in the future.

-

Detailed insights on the unmet needs of the existing market so that the upcoming players can strengthen their development and launch strategy.