Artificial Pancreas Device System Market

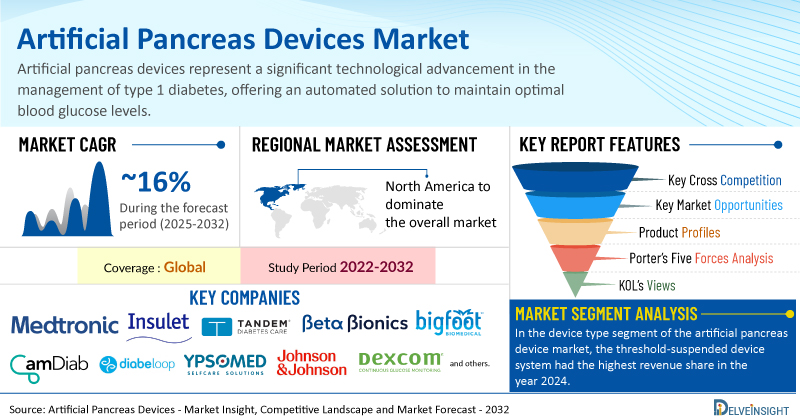

Artificial Pancreas Device Market by Device Type (Threshold Suspended Device System and Non-Threshold Suspended Device System), End-User (Hospitals & Clinics, Homecare Settings, Ambulatory Surgical Centers, and Others), and Geography (North America, Europe, Asia-Pacific, and Rest of the World) is expected to grow at a steady CAGR forecast till 2032 owing to the rising cases of diabetes, rising awareness and screening programs, and increase in product development activities across the globe.

The global artificial pancreas device market was valued at USD 334.76 million in 2024, growing at a CAGR of 16.33% during the forecast period from 2025 to 2032, to reach USD 1,116.86 million by 2032. The rising incidence of diabetes globally is a significant driver of the artificial pancreas device market, as the growing patient population increases the demand for effective diabetes management solutions. Additionally, increasing awareness of diabetes and the implementation of screening programs have led to earlier diagnosis and better disease management, further supporting the need for advanced technologies like artificial pancreas systems. Moreover, increased product development activities by key players have resulted in improved and innovative artificial pancreas devices, enhancing their efficiency and accessibility. Collectively, these factors are expected to contribute to the expansion of the artificial pancreas device market during the forecast period from 2025 to 2032.

Artificial Pancreas Device Market Dynamics:

Additionally, according to the recent update provided by the International Diabetes Federation, in 2021, approximately 537 million adults aged 20-79 were living with diabetes globally. This number was projected to rise to 643 million by 2030 and 783 million by 2045.

Additionally, as per the recent data provided by the IDF Diabetes Atlas, in 2022, out of the 8.75 million people living with type 1 diabetes worldwide, 1.52 million were under 20 years old. However, 62% of all new type 1 diabetes cases in 2022 occurred in people aged 20 years or older. With diabetes being a chronic condition that demands continuous monitoring and precise insulin administration, artificial pancreas systems, which combine insulin pumps and continuous glucose monitoring (CGM) to provide automated insulin delivery, offer a significant improvement in the quality of life for diabetes patients.

Additionally, hyperglycemia in pregnancy poses significant health risks to both the mother and the baby, including increased chances of complications such as preterm birth, macrosomia, and preeclampsia. As per the data provided by the International Diabetes Federation (2025), approximately 21.1 million live births globally (16.7%) were affected by hyperglycemia during pregnancy. Women over 45 or with a history of gestational diabetes mellitus are at higher risk of developing type 2 diabetes post-delivery. Thus, maintaining optimal blood glucose levels is crucial for a healthy pregnancy, as hyperglycemia poses risks for both mother and baby. Traditional diabetes management, like multiple daily insulin injections, can be challenging due to hormonal changes that cause unpredictable glucose levels. Artificial pancreas devices, with automated insulin delivery based on continuous glucose monitoring (CGM), offer an effective solution by managing blood sugar fluctuations with minimal manual intervention thereby boosting the overall market of artificial pancreas devices across the globe.

Furthermore, the significance of key market players involved in strategic product development activities is further boosting the overall market of artificial pancreas devices. For instance, in March 2023, Tandem Diabetes Care, Inc., a leading insulin delivery and diabetes technology company, announced the publication of results from the Pediatric Artificial Pancreas (PEDAP) Clinical Trial in the New England Journal of Medicine. The study showed an approximate 3-hour per day increase in time in range for children aged 2-5 years using the t:slimX2 insulin pump with Control-IQ advanced hybrid closed-loop technology, compared to those using a standard insulin pump or multiple daily injections. All participants utilized a Dexcom G6 Continuous Glucose Monitoring (CGM) System.

Thus, the factors mentioned above are likely to boost the market of artificial pancreas devices during the forecasted period.

However, the risk of skin irritation and other device-related discomfort, and the increase in product recalls may hinder the future market of artificial pancreas devices.

Artificial Pancreas Device Market Segment Analysis:

Artificial Pancreas Device Market by Device Type (Threshold Suspended Device System and Non-Threshold Suspended Device System), End User (Hospitals & Clinics, Homecare Settings, Ambulatory Surgical Centers, and Others), and Geography (North America, Europe, Asia-Pacific, and Rest of the World)

In the device type segment of the artificial pancreas device market, the threshold-suspended device system is expected to have a revenue share in the year 2024. Threshold-suspended device systems are enhancing the overall market for artificial pancreas devices by offering numerous advantages that address both safety and convenience in diabetes management. One of the primary benefits is the significant reduction in the risk of hypoglycemia, as these systems automatically suspend insulin delivery when glucose levels drop to a specified threshold, allowing patients to avoid potentially dangerous situations. This feature not only promotes safety but also improves users' peace of mind, leading to increased adherence to treatment protocols.

Additionally, these systems enhance patient autonomy by minimizing the need for constant manual monitoring and intervention. Patients can engage in daily activities with greater confidence, knowing that their device will automatically adjust insulin delivery in response to changing glucose levels. This convenience can lead to improved quality of life and reduced stress for both patients and their families. Moreover, the integration of advanced algorithms in threshold-suspended systems allows for more precise and dynamic insulin delivery, adapting to the individual needs of users based on their unique glucose patterns. This personalization further enhances glycemic control, ultimately leading to better long-term health outcomes.

Furthermore, the significance of key market players involved in strategic product development activities and increased government initiatives are further boosting the overall market of artificial pancreas devices. For instance, in May 2023, the U.S. Food and Drug Administration cleared the Beta Bionics iLet ACE Pump and iLet Dosing Decision Software for individuals aged six and older with type 1 diabetes. These devices, along with a compatible FDA-cleared iCGM, formed a new system called the iLet Bionic Pancreas, an automated insulin dosing (AID) system using an algorithm to control insulin delivery.

Thus, the factors mentioned above are likely to boost the market of artificial pancreas devices during the forecasted period.

Thus, owing to the above-mentioned factors the segment is expected to generate considerable revenue thereby pushing the overall growth of the global artificial pancreas device market during the forecast period.

North America is expected to dominate the overall artificial pancreas device market:

Among all the regions, North America is expected to hold the largest share of the artificial pancreas device market in 2024. This dominance is driven by the rising cases of diabetes, increased healthcare initiatives by the government the presence of key market players involved in strategic product development activities, and the heightened awareness among the population across the region are expected to boost the market during the forecast period across the region.

According to the latest report provided by the Centre for Disease Control and Prevention (2024), estimates indicated that 38.4 million people of all ages, or 11.6% of the U.S. population, had diabetes. Additionally, 38.1 million individuals aged 18 years and older, representing 14.7% of all U.S. adults, were affected by diabetes in 2021. With the rise in diabetes cases, particularly type 1 diabetes, there is a growing need for advanced technologies that can simplify and enhance blood glucose control. Artificial pancreas devices, which automate insulin delivery and monitor glucose levels, offer a promising solution to improve patient outcomes and reduce the burden of daily diabetes management thereby escalating the overall demand of artificial pancreas devices across the region.

Additionally, awareness about diabetes plays a crucial role in boosting the market for artificial pancreas devices, primarily through increased demand for advanced diabetes management solutions. For example, the initiative, launched by the National Institutes of Health (NIH) and the Centers for Disease Control and Prevention (CDC), focuses on raising awareness about diabetes and its management. Through community-based programs, the NDEP educates individuals about the importance of continuous glucose monitoring and automated insulin delivery systems, which include artificial pancreas devices.

Furthermore, the ongoing strategic activities among the key market players are further boosting the overall market of artificial pancreas devices across the region. For instance, in May 2024, an artificial pancreas CamAPS FX, developed by researchers at the University of Cambridge was granted approval by the USA’s Food and Drug Administration (FDA) for use by individuals with type 1 diabetes aged two and older, including during pregnancy.

Thus, all the above-mentioned factors are anticipated to propel the market for artificial pancreas devices in North America during the forecast period from 2025 to 2032.

Artificial Pancreas Device Market Key Players:

Some of the key market players operating in the artificial pancreas device market include Medtronic PLC, Insulet Corporation, Tandem Diabetes Care, Inc., Beta Bionics, Inc., BIGFOOT BIOMEDICAL, INC., CamDiab Ltd., Diabeloop SA, Ypsomed, INREDA® DIABETIC B.V., Nikkiso Co., Ltd., Pancreum, Inc., Johnson & Johnson Services, Inc., Dexcom, Inc., TypeZero Technologies, Animas Corporation, and others.

Recent Developmental Activities in the Artificial Pancreas Device Market:

- In September 2024, Tandem Diabetes Care, Inc., announced that its t:slim X2 insulin pump with Control-IQ automated insulin delivery (AID) technology was cleared for use with Eli Lilly and Company’s Lyumjev® (insulin lispro-aabc injection) ultra-rapid acting insulin in the European Union (EU).

- In June 2024, MCRA, a leading privately held independent medical device, diagnostics, and biologics Clinical Research Organization (CRO) and advisory firm, announced its role in assisting CamDiab's artificial pancreas software, CamAPS FX, in achieving U.S. Food and Drug Administration (FDA) clearance.

Key Takeaways From the Artificial Pancreas Device Market Report Study:

- Market size analysis for current artificial pancreas device size (2024), and market forecast for 8 years (2025 to 2032)

- Top key product/technology developments, mergers, acquisitions, partnerships, and joint ventures happened over the last 3 years.

- Key companies dominating the artificial pancreas device market.

- Various opportunities available for the other competitors in the artificial pancreas device market space.

- What are the top-performing segments in 2024? How these segments will perform in 2032?

- Which are the top-performing regions and countries in the current artificial pancreas device market scenario?

- Which are the regions and countries where companies should have concentrated on opportunities for artificial pancreas device market growth in the coming future?

Target Audience Who Can Benefited From This Artificial Pancreas Device Market Report Study:

- Artificial pancreas device product providers

- Research organizations and consulting companies

- Artificial pancreas device-related organizations, associations, forums, and other alliances

- Government and corporate offices

- Start-up companies, venture capitalists, and private equity firms

- Distributors and traders dealing in artificial pancreas device

- Various end-users who want to know more about the artificial pancreas device market and the latest technological developments in the artificial pancreas device market.

Frequently Asked Questions for the Artificial Pancreas Device Market:

1. What are artificial pancreas devices?

- An artificial pancreas device is an automated system that combines an insulin pump with a continuous glucose monitor (CGM) and an algorithm to regulate blood glucose levels in people with diabetes, mimicking the function of a healthy pancreas.

2. What is the market for artificial pancreas devices?

- The global artificial pancreas device market was valued at USD 334.76 million in 2024, growing at a CAGR of 16.33% during the forecast period from 2025 to 2032, to reach USD 1,116.86 million by 2032.

3. What are the drivers for the artificial pancreas device market?

- The rising incidence of diabetes globally is a significant driver of the artificial pancreas device market, as the growing patient population increases the demand for effective diabetes management solutions. Additionally, increasing awareness of diabetes and the implementation of screening programs have led to earlier diagnosis and better disease management, further supporting the need for advanced technologies like artificial pancreas systems. Moreover, increased product development activities by key players have resulted in improved and innovative artificial pancreas devices, enhancing their efficiency and accessibility. Collectively, these factors are expected to contribute to the expansion of the artificial pancreas device market during the forecast period from 2025 to 2032.

4. Who are the key players operating in the artificial pancreas device market?

- Some of the key market players operating in the artificial pancreas device market include Medtronic, Insulet Corporation, Tandem Diabetes Care, Inc., Beta Bionics, Inc., BIGFOOT BIOMEDICAL, INC., CamDiab Ltd., Diabeloop SA, Ypsomed, INREDA® DIABETIC B.V., Nikkiso Co., Ltd., Pancreum, Inc., Johnson & Johnson Services, Inc., Dexcom, Inc., TypeZero Technologies, Animas Corporation, and others.

5. Which region has the highest share in the artificial pancreas device market?

- Among all the regions, North America is expected to hold the largest share of the artificial pancreas device market in 2024. This dominance is driven by the rising cases of diabetes, increased healthcare initiatives by the government and the presence of key market players involved in strategic product development activities, and the heightened awareness among the population across the region is expected to boost the market during the forecast period across the region.

Get detailed insights @ DelveInsight Blogs.