Aryl Hydrocarbon Receptor (AHR) Agonist Market Forecast

- AHR agonists are natural or synthetic molecules that bind to and activate the AHR, initiating a transcriptional response. Once activated, AHR moves to the nucleus, where it affects the expression of target genes involved in metabolism, immunity, and more.

- Currently, the US FDA has approved one AHR agonist for clinical use: Tapinarof, marketed under the brand name VTAMA.

- VTAMA (Tapinarof) by Dermavant Sciences is a first-in-class, non-steroidal AHR agonist that restores immune balance and skin barrier integrity by activating the AHR pathway. It offers a targeted, steroid-free approach to treat chronic skin inflammation.

- In October 2024, Organon completed its acquisition of Dermavant, gaining full rights to VTAMA (tapinarof) Cream, 1%, an innovative therapy in dermatology.

- Approved as a 1% topical cream, VTAMA is indicated for adults with plaque psoriasis (since May 2022) and for both adults and children aged 2+ with atopic dermatitis (since December 2024).

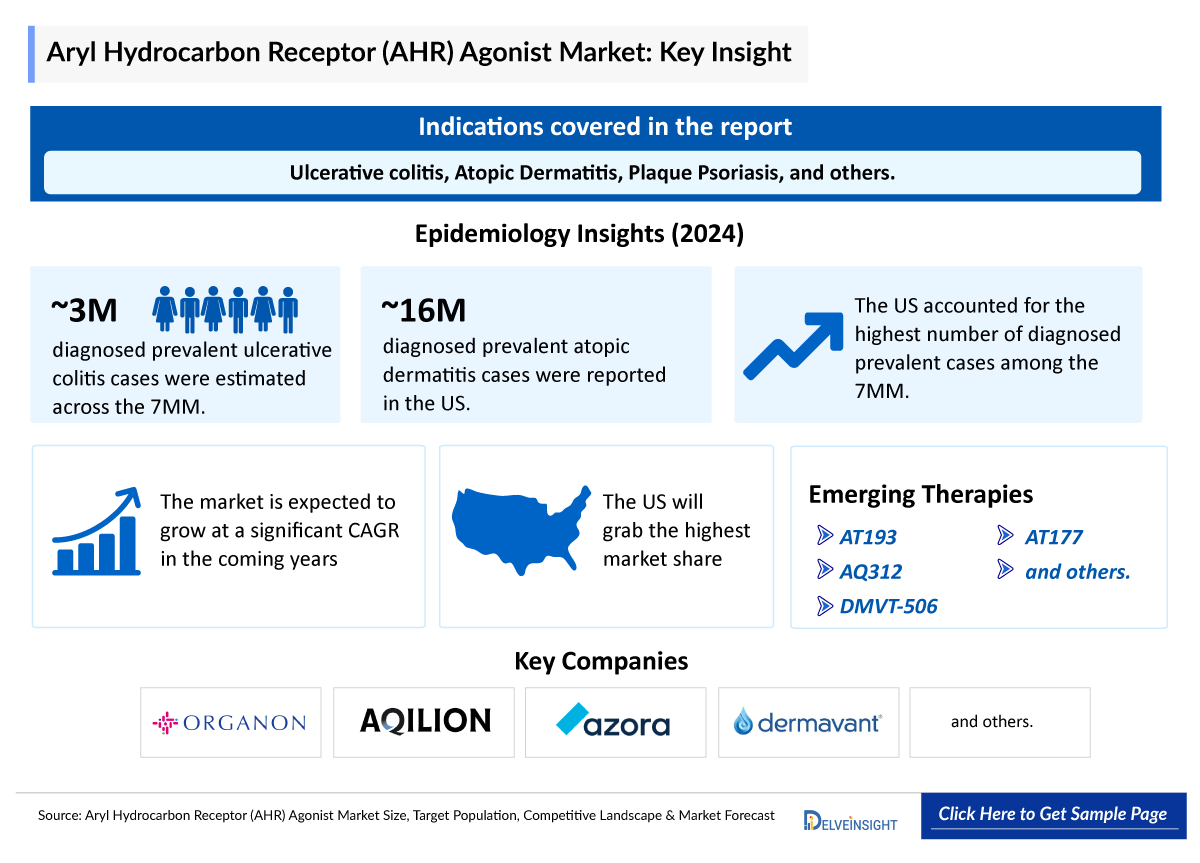

- Several pharmaceutical companies are advancing investigational AHR agonists for inflammatory and autoimmune diseases. Azora, for example, is developing AT193—a topical agent in clinical trials for atopic dermatitis and plaque psoriasis—and AT177, an oral AHR agonist currently in early-stage development.

- Aqilion is developing AQ312, an oral drug candidate that targets the aryl hydrocarbon receptor to modulate immune responses in inflammatory bowel diseases.

- In March 2025, Organon reported results from the Phase III ADORING 3 open-label extension study of VTAMA (tapinarof) cream, 1% in patients aged 2 and older with atopic dermatitis. The data, presented at the American Academy of Dermatology (AAD) 2025 Annual Meeting, showed that patients who achieved treatment success maintained mild disease activity during an average 80-day treatment-free period.

- Despite Tapinarof’s success, significant unmet needs remain in expanding AHR agonist use beyond dermatology. There is growing interest in leveraging AHR modulation for systemic inflammatory, autoimmune, and gastrointestinal disorders, presenting a major future opportunity for oral and tissue-targeted AHR therapies to address immune dysregulation with a favorable safety profile.

DelveInsight’s “AHR agonists – Target Population, Competitive Landscape, and Market Forecast – 2034” report delivers an in-depth understanding of the AHR agonists, historical and projected epidemiological data, competitive landscape as well as the AHR agonists market trends in the United States, EU4 (Germany, France, Italy, and Spain) and the United Kingdom, and Japan.

The AHR agonist’s market report provides current treatment practices, emerging drugs, market share of individual therapies, and current and forecasted 7MM AHR agonist market size from 2020 to 2034. The report also covers current AHR agonist’s treatment practices/algorithms and unmet medical needs to curate the best opportunities and assess the market’s potential.

|

Study Period |

2020–2034 |

|

Forecast Period |

2025–2034 |

|

Geographies Covered |

US, EU4 (Germany, France, Italy, and Spain), the UK, and Japan |

|

AHR agonists Epidemiology |

Segmented by:

|

|

AHR agonists Companies |

|

|

AHR agonists Therapies |

|

|

AHR agonists Clinical Relevance |

|

|

AHR agonists Market |

Segmented by:

|

|

Analysis |

|

Key Factors Driving the AHR Agonists Market

Rising Prevalence of Autoimmune Diseases and Chronic Conditions

The increasing incidence of autoimmune diseases and chronic conditions is a major catalyst for the AhR agonist market. Factors such as genetics, environmental exposures, lifestyle choices, and improved diagnostic capabilities contribute to this rise. AhR agonists have shown potential in modulating immune responses and inflammation, offering therapeutic benefits for conditions like multiple sclerosis and psoriasis.

Advancements in Drug Discovery and Precision Medicine

Recent advancements in biotechnology and genomics have enhanced the understanding of AhR's role in various diseases, leading to the development of novel therapeutic strategies. The growing demand for precision medicine, which tailors treatment to individual genetic profiles, has further accelerated the exploration of AhR modulation as a therapeutic approach.

Strategic Collaborations and Market Expansion

Strategic mergers and acquisitions are shaping the competitive landscape of the AhR agonist market. For instance, Organon & Co.'s acquisition of Dermavant Sciences Ltd. has strengthened its position in dermatology by integrating innovative AhR agonist-based therapies into its portfolio.

Rising AHR Agonists Clinical Trial Activity

The promising AHR agonists in clinical trials that can change the dynamics of the market in the coming years include AT193 (Azora Therapeutics), AQ312 (Aqilion), DMVT-506 (Dermavent), AT177 (Azora Therapeutics), and others.

Aryl Hydrocarbon Receptor (AHR) Agonist Disease Understanding and Treatment Algorithm

AHR agonist overview and clinical relevance

The AHR is a key transcriptional regulator that resides in the cytoplasm until activated by a ligand. Upon activation, it translocates to the nucleus, dimerizes with ARNT, and binds to Xenobiotic Response Elements (XREs) in DNA, promoting the expression of target genes. AHR also interacts with other transcription factors to influence broader gene networks.

The pathway notably regulates cytochrome P450 enzymes like CYP1A1 and CYP1A2, essential for metabolizing environmental toxins and various drugs. Highly expressed in barrier and immune cells, AHR functions as an environmental sensor and plays a critical role in immune modulation.

AHR agonists have demonstrated promising therapeutic potential in preclinical models of autoimmune and inflammatory diseases, including plaque psoriasis, atopic dermatitis, ulcerative colitis, and other forms of inflammatory bowel disease.

Further details related to indications are provided in the report…

Aryl Hydrocarbon Receptor (AHR) Agonist Epidemiology

The AHR agonists epidemiology chapter in the report provides historical as well as forecasted epidemiology segmented as total cases in selected indications for AHR agonists, total eligible patient pool in selected indications for AHR agonists, and total treated cases in selected indications for AHR agonists in the 7MM covering the United States, EU4 (Germany, France, Italy, and Spain), the United Kingdom, and Japan from 2020 to 2034.

Ulcerative colitis

- In 2024, the total diagnosed prevalent cases of ulcerative colitis across the 7MM were estimated at more than 3 million and are expected to increase over the forecast period (2025–2034).

- The US accounted for the highest number of diagnosed prevalent cases in 2024, contributing nearly 47% of the total 7MM population.

- Germany and Japan each represented around 10% of the overall diagnosed prevalent ulcerative colitis population in the 7MM in 2024.

Atopic Dermatitis

- According to secondary analysis, the United States accounted for approximately 16 million prevalent cases of atopic dermatitis in 2024.

- Among the EU4 and the UK, the United Kingdom accounted for the highest number of atopic dermatitis diagnosed prevalent cases, followed by France, whereas Spain accounted for the lowest number of atopic dermatitis cases.

- Plaque Psoriasis

- According to research, plaque psoriasis is the most common form of the psoriasis, accounting for approximately 80% of all psoriasis cases.

- The overall prevalence of psoriasis in Japan is estimated at around 0.3% of the population.

Note: Indications have been selected based on pipeline activity. Further details regarding these indications will be provided in the full report..

Aryl Hydrocarbon Receptor (AHR) Agonist Drug Chapters

The drug chapter segment of the AHR agonist reports encloses a detailed analysis of AHR agonist’ marketed drugs and different-stage of pipeline drugs. It also helps understand the AHR agonist' clinical trial details, expressive pharmacological action, agreements and collaborations, approval and patent details, advantages and disadvantages of each included drug and the latest news and press releases.

Marketed Drugs

Currently, there is only one marketed AHR agonist in two different indications.

VTAMA (Tapinarof) - Organon

VTAMA (tapinarof) Cream, 1% is a once-daily, non-steroidal topical medication approved by the US FDA for the treatment of both plaque psoriasis in adults and atopic dermatitis in adults and pediatric patients aged 2 years and older. It functions as an aryl hydrocarbon receptor agonist, modulating immune responses and enhancing skin barrier integrity.

The FDA approved VTAMA in May 2022 for plaque psoriasis and in December 2024 for atopic dermatitis.

Clinical trial highlights

Plaque Psoriasis: The approval was based on the Phase III PSOARING 1 and PSOARING 2 trials, which demonstrated significant improvements in Physician Global Assessment (PGA) scores, with many patients achieving "clear" or "almost clear" skin after 12 weeks of treatment.

Atopic Dermatitis: The ADORING 1 and ADORING 2 trials supported the approval for atopic dermatitis, showing that a significantly higher proportion of patients treated with tapinarof achieved clear or almost clear skin compared to those receiving a placebo.

|

Product |

Company |

Indication |

|

VTAMA (Tapinarof) |

Organon |

|

Note: Detailed current therapies assessment will be provided in the full report of AHR agonists.

Emerging Drugs

AQ312: Aqilion

AQ312 is an oral small-molecule drug candidate developed by Aqilion for the treatment of ulcerative colitis. It functions as a selective agonist of the AhR, a nuclear receptor involved in immune regulation and mucosal healing.

In October 2024, Aqilion, presents new results from its preclinical development program for the treatment of ulcerative colitis at the United European Gastroenterology (UEG) Week in Vienna.

AT193: Azora Therapeutics

AT-193, a potent AHR agonist developed by Azora Therapeutics, has demonstrated potential in addressing various inflammatory diseases. AT-193 has been studied in patients with hidradenitis suppurativa in a Phase I trial.

Note: Detailed emerging therapies assessment will be provided in the final report.

|

List of Emerging Drugs | |||||

|

Drug Name |

Company |

Indication |

ROA |

Phase |

NCT ID |

|

AT193 |

Azora Therapeutics |

Plaque Psoriasis, atopic dermatitis, among others |

Topical |

I |

NCT05072886 |

|

AQ312 |

Aqilion |

Ulcerative colitis |

Oral |

Preclinical |

- |

|

DMVT-506 |

Dermavent |

Immunological and Inflammatory Diseases |

- |

Preclinical |

- |

|

AT177 |

Azora Therapeutics |

Ulcerative colitis |

- |

Preclinical |

- |

Note: The emerging drug list is indicative, the full list will be given in the final report.

Aryl Hydrocarbon Receptor (AHR) Agonist Market Outlook

The AHR agonist market is expanding, fueled by increasing recognition of AHR’s role in immune regulation, skin barrier repair, and microbiome interaction. The approval of VTAMA for both plaque psoriasis and atopic dermatitis has validated the clinical utility of AHR modulation, positioning it as a novel, non-steroidal option in dermatology.

With a growing pipeline of topical and systemic agents, interest is shifting toward broader immuno-inflammatory indications. AHR agonists offer a targeted approach to immune balance, which is especially attractive in diseases requiring long-term, well-tolerated therapies.

Key challenges include ensuring receptor selectivity and identifying biomarker-driven responder populations. Nonetheless, ongoing innovation is expected to drive consistent market growth, with dermatology anchoring early revenues and systemic indications paving the way for future expansion.

Aryl Hydrocarbon Receptor (AHR) Agonist Drugs Uptake

This section focuses on the uptake rate of potential approved and emerging ARH agonists expected to be launched in the market during 2020–2034.

Aryl Hydrocarbon Receptor (AHR) Agonist Pipeline Development Activities

The report provides insights into different therapeutic candidates in phase III phase II, and phase I. It also analyzes key players involved in developing targeted therapeutics.

The presence of numerous drugs under different stages is expected to generate immense opportunity for AHR agonist’s market growth over the forecasted period.

KOL Views

To keep up with current and future market trends, we take Industry Experts’ opinions working in the domain through primary research to fill the data gaps and validate our secondary research. Industry experts were contacted for insights on AHR agonists' evolving treatment landscape, patient reliance on conventional therapies, patient therapy switching acceptability, drug uptake, along challenges related to accessibility.

DelveInsight’s analysts connected with 25+ KOLs to gather insights; however, interviews were conducted with 10+ KOLs in the 7MM.

Their opinion helps understand and validate current and emerging therapy treatment patterns or AHR agonists market trends. This will support the clients in potential upcoming novel treatments by identifying the overall scenario of the market and the unmet needs.

“With the approval of VTAMA, both adults and pediatric patients down to 2 years of age will have access to a new topical option for atopic dermatitis that is effective and safe for long-term use, improves bothersome symptoms such as itch, and offers the potential for complete disease clearance and potentially treatment-free days regardless of severity”.

Qualitative Analysis

We perform qualitative and market Intelligence analysis using various approaches, such as SWOT analysis. In the SWOT analysis, strengths, weaknesses, opportunities, and threats in terms of disease diagnosis, patient awareness, patient burden, competitive landscape, cost-effectiveness, and geographical accessibility of therapies are provided. These pointers are based on the analyst’s discretion and assessment of the patient burden, cost analysis, and existing and evolving treatment landscape.

Market Access and Reimbursement

The report further provides detailed insights on the country-wise accessibility and reimbursement scenarios, cost-effectiveness scenario of approved therapies, programs making accessibility easier and out-of-pocket costs more affordable, insights on patients insured under federal or state government prescription drug programs, etc.

My VTAMA Savings Program

For commercially insured patients, there are copay assistance programs available, potentially reducing the out-of-pocket cost to as low as USD 0 or USD 35.

Scope of the Report

- The report covers a segment of key events, an executive summary, and a descriptive overview of AHR agonists, explaining their mechanism, and therapies (current and emerging).

- Comprehensive insight into the competitive landscape, forecasts, and the future growth potential of treatment rate, drug uptake, and drug information have been provided.

- Additionally, an all-inclusive account of the current and emerging therapies and the elaborative profiles of late-stage and prominent therapies that will impact the current landscape.

- A detailed review of the AHR agonists market, historical and forecasted market size, market share by therapies, detailed assumptions, and rationale behind our approach is included in the report, covering the 7MM drug outreach.

- The report provides an edge while developing business strategies, by understanding trends, through SWOT analysis, expert insights/KOL views, and treatment preferences that help shape and drive the 7MM AHR agonists market.

Aryl Hydrocarbon Receptor (AHR) Agonist Report Insights

- AHR agonists Targeted Patient Pool

- AHR agonists Therapeutic Approaches

- AHR agonists Pipeline Analysis

- AHR agonists Market Size and Trends

- Existing and future Market Opportunity

Aryl Hydrocarbon Receptor (AHR) Agonists Report Key Strengths

- 10 Years Forecast

- The 7MM Coverage

- Key Cross Competition

- Drugs Uptake and Key Market Forecast Assumptions

Aryl Hydrocarbon Receptor (AHR) Agonists Report Assessment

- Current Treatment Practices

- Unmet Needs

- Pipeline Product Profiles

- Market Attractiveness

- Qualitative Analysis (SWOT)

Key Questions

- What was the AHR agonists total market size, the market size by therapies, market share (%) distribution in 2020, and what would it look like in 2034? What are the contributing factors for this growth?

- Which drug is going to be the largest contributor in 2034?

- Which is the most lucrative market for AHR agonists?

- What are the pricing variations among different geographies for approved therapies?

- How the reimbursement landscape has for AHR agonists evolved since the first one was approved? Do patients have any access issues that are driven by reimbursement decisions?

- What are the risks, burdens, and unmet needs of treatment with AHR agonists? What will be the growth opportunities across the 7MM for the patient population of AHR agonists?

- What are the key factors hampering the growth of the AHR agonists market?

- What are the indications for which recent novel therapies and technologies have been developed to overcome the limitations of existing treatments?

- What key designations have been granted to the therapies for AHR agonists?

- What is the cost burden of approved therapies on the patient?

- Patient acceptability in terms of preferred therapy options as per real-world scenarios?

- What are the country-specific accessibility issues of expensive, recently approved therapies?

Reasons to buy

- The report will help develop business strategies by understanding the latest trends and changing dynamics driving the AHR agonists Market.

- Understand the existing market opportunities in varying geographies and the growth potential over the coming years.

- Distribution of historical and current patient share based on real-world prescription data along with reported sales of approved products in the US, EU4 (Germany, France, Italy, and Spain) the United Kingdom, and Japan.

- Identifying strong upcoming players in the market will help devise strategies to help get ahead of competitors.

- Detailed analysis and ranking of indication-wise current and emerging therapies under the attribute analysis section to provide visibility around leading indications.

- To understand Key Opinion Leaders’ perspectives around the accessibility, acceptability, and compliance-related challenges to overcome barriers in the future.

- Detailed insights on the unmet needs of the existing market so that the upcoming players can strengthen their development and launch strategy.