Atrasentan Market Summary

Key Factors Driving Atrasentan Growth

Market Share Gains and New Patient Starts

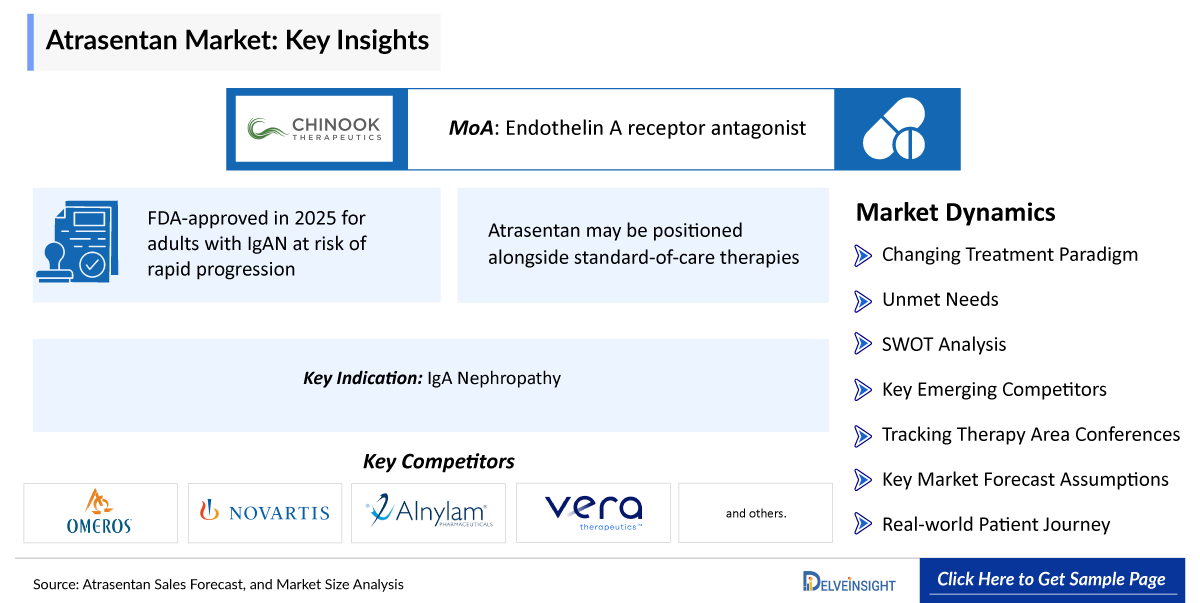

- Atrasentan, a selective endothelin A (ETA) receptor antagonist, is emerging as a high-potential disease-modifying therapy in IgA nephropathy (IgAN), a condition with limited approved treatment options.

- Growing nephrologist awareness and strong late-stage clinical data are expected to drive early adoption and new patient starts, particularly among high-risk IgAN patients with persistent proteinuria.

- Commercial momentum is anticipated as treatment paradigms shift from supportive care and steroids toward targeted, mechanism-based therapies.

Expansion Across Key Indications

- IgA Nephropathy (Primary Focus): Atrasentan is being developed for patients with IgAN at high risk of progression, supported by robust reductions in proteinuria and favorable kidney protection signals.

- Chronic Kidney Disease (CKD) Subsets: Given the central role of endothelin signaling in kidney disease progression, there is longer-term potential to explore use in broader proteinuric CKD populations.

- Combination Therapy Potential: Atrasentan may be positioned alongside standard-of-care therapies such as RAAS inhibitors and SGLT2 inhibitors, strengthening its role in comprehensive renal disease management.

- Pipeline Expansion Opportunities: Success in IgAN could enable lifecycle expansion into other rare or progressive glomerular diseases.

Geographic Expansion

- U.S. and Europe as Core Markets: Initial commercialization efforts are expected to focus on regions with established nephrology networks and strong rare-disease reimbursement frameworks.

- Asia-Pacific Growth Potential: High IgAN prevalence in countries such as China and Japan positions Asia-Pacific as a significant long-term growth region, pending regulatory approvals.

- Global Development Strategy: Broader geographic expansion will be supported by increasing recognition of IgAN as a progressive, treatable disease rather than a benign condition.

New Indication Approvals

- Regulatory Filings in IgAN: Positive Phase III outcomes support planned regulatory submissions for IgAN, representing a major step toward approval in a high-unmet-need indication.

- Potential for Accelerated or Conditional Pathways: Use of surrogate endpoints such as proteinuria reduction may facilitate earlier approvals, with confirmatory outcomes data to follow.

- Portfolio Strengthening: Approval of atrasentan would significantly enhance its sponsor’s renal portfolio and diversify revenue into rare kidney diseases.

Strong IgAN Volume Momentum

- High Unmet Clinical Need: Many IgAN patients continue to progress to end-stage kidney disease despite optimized supportive care.

- Compelling Efficacy Signals: Consistent and clinically meaningful reductions in proteinuria are expected to drive strong prescribing momentum among nephrologists.

- Shifting Treatment Paradigms: Increasing acceptance of early intervention in IgAN is expected to support sustained patient volumes over time.

Competitive Differentiation and Market Trends

- Targeted ETA Receptor Blockade: Atrasentan offers a focused mechanism that reduces proteinuria while avoiding broader endothelin-related side effects seen with less selective agents.

- Oral Therapy Convenience: Once-daily oral dosing supports patient adherence compared with injectable or more complex regimens.

- Alignment with Precision Nephrology Trends: Growing emphasis on biomarker-driven risk stratification and early disease intervention favors atrasentan’s positioning.

- Increasing Role of Real-World Evidence (RWE): Post-approval RWE will be important for payer confidence, long-term safety validation, and expansion of treatment guidelines.

Atrasentan Recent Developments

In April 2025, Novartis announced the US Food and Drug Administration (FDA) granted accelerated approval for VANRAFIA (Atrasentan), a potent and selective endothelin A (ETA) receptor antagonist, for the reduction of proteinuria in adults with primary immunoglobulin A nephropathy (IgAN) at risk of rapid disease progression. This is generally defined as a urine protein-to-creatinine ratio (UPCR) ≥1.5 g/g. VANRAFIA is a once-daily, non-steroidal, oral treatment that can be added onto supportive care, including a renin-angiotensin system (RAS) inhibitor with or without a sodium-glucose co-transporter-2 (SGLT2) inhibitor.

“Atrasentan Sales Forecast, and Market Size Analysis – 2034” report provides comprehensive insights of Atrasentan for approved indication like Myasthenia gravis; as well as potential indications like Fetal erythroblastosis; Neonatal alloimmune thrombocytopenia; Sjogren's syndrome; and Systemic lupus erythematosus in the 7MM. A detailed picture of Atrasentan’s existing usage in approved and anticipated entry and performance in potential indications in the 7MM, i.e., the United States, EU4 (Germany, France, Italy, and Spain) and the United Kingdom, and Japan for the study period 2020 –2034 is provided in this report along with a detailed description of the Atrasentan for approved and potential indications. The Atrasentan market report provides insights about Atrasentan’s sales forecast, mechanism of action (MoA), dosage and administration, as well as research and development including regulatory milestones, along with other developmental activities. Further, it also consists of historical and current Atrasentan performance, future market assessments inclusive of the Atrasentan market forecast analysis for approved and potential indications in the 7MM, SWOT, analysts’ views, comprehensive overview of market competitors, and brief about other emerging therapies in respective indications. It also provides analysis of Atrasentan sales forecasts, along with factors driving its market.

Atrasentan Drug Summary

Atrasentan (brand name VANRAFIA) is an oral, selective endothelin A receptor (ETAR or ETA) antagonist developed by Novartis for treating immunoglobulin A nephropathy (IgAN), a progressive kidney disease characterized by proteinuria. With high selectivity (Ki = 0.034 nM for ETA versus 63.3 nM for ETB), it blocks endothelin-1 binding to ETA receptors on renal cells, reducing glomerular hypertension, efferent arteriolar vasoconstriction, inflammation, fibrosis, and proteinuria while preserving renal function. FDA-approved in 2025 for adults with IgAN at risk of rapid progression, it is dosed once daily (0.75 mg) alongside standard supportive care like renin-angiotensin system blockade, showing clinically meaningful proteinuria reductions in Phase III trials. The report provides Atrasentan’s sales, growth barriers and drivers, post usage and approvals in multiple indications.

Atrasentan is in the Phase II stage of clinical development for the treatment of patients with IgA Nephropathy (NCT04573920).

Scope of the Atrasentan Market Report

The report provides insights into:

- A comprehensive product overview including the Atrasentan MoA, description, dosage and administration, research and development activities in approved indications like Myasthenia gravis; as well as potential indications like Fetal erythroblastosis; Neonatal alloimmune thrombocytopenia; Sjogren’s syndrome; and Systemic lupus erythematosus.

- Elaborated details on Atrasentan regulatory milestones and other development activities have been provided in Atrasentan market report.

- The report also highlights Atrasentan‘s cost estimates and regional variations, reported and estimated sales performance, research and development activities in approved and potential indications across the United States, Europe, and Japan.

- The Atrasentan market report also covers the patents information, generic entry and impact on cost cut.

- The Atrasentan market report contains current and forecasted Atrasentan sales for approved and potential indications till 2034.

- Comprehensive coverage of the late-stage emerging therapies for respective indications.

- The Atrasentan market report also features the SWOT analysis with analyst views for Atrasentan in approved and potential indications.

Methodology

The Atrasentan market report is built using data and information sourced primarily from internal databases, primary and secondary research and in-house analysis by DelveInsight’s team of industry experts. Information and data from the secondary sources have been obtained from various printable and nonprintable sources like search engines, news websites, global regulatory authorities websites, trade journals, white papers, magazines, books, trade associations, industry associations, industry portals and access to available databases.

Atrasentan Analytical Perspective by DelveInsight

In-depth Atrasentan Market Assessment

This Atrasentan sales market forecast report provides a detailed market assessment of Atrasentan for approved indication like Myasthenia gravis; as well as potential indications like Fetal erythroblastosis; Neonatal alloimmune thrombocytopenia; Sjogren’s syndrome; and Systemic lupus erythematosus in the seven major markets, i.e., the United States, EU4 (Germany, France, Italy, and Spain) and the United Kingdom, and Japan. This segment of the report provides current and forecasted Atrasentan sales data uptil 2034.

Atrasentan Clinical Assessment

The Atrasentan market report provides the clinical trials information of Atrasentan for approved and potential indications covering trial interventions, trial conditions, trial status, start and completion dates.

Atrasentan Competitive Landscape

The report provides Insights on competitors and marketed products within the domain, along with a summary of emerging products and their respective launch dates, posing significant competition in the market.

Atrasentan Market Potential & Revenue Forecast

- Projected market size for the Atrasentan and its key indications

- Estimated Atrasentan sales potential (Atrasentan peak sales forecasts)

- Atrasentan Pricing strategies and reimbursement landscape

Atrasentan Competitive Intelligence

- Number of competing drugs in development (pipeline analysis)

- Atrasentan Market positioning compared to existing treatments

- Atrasentan Strengths & weaknesses relative to competitors

Atrasentan Regulatory & Commercial Milestones

- Atrasentan Key regulatory approvals & expected launch timelines

- Commercial partnerships, licensing deals, and M&A activity

Atrasentan Clinical Differentiation

- Atrasentan Efficacy & safety advantages over existing drugs

- Atrasentan Unique selling points

Atrasentan Market Report Highlights

- In the coming years, the Atrasentan market scenario is set to change due to strong adoption, increased prescriptions and broader uptake in multiple immunological indications; which would expand the size of the market.

- The Atrasentan companies are developing therapies that focus on novel approaches to treat/improve the disease condition, assess challenges, and seek opportunities that could influence Atrasentan’s dominance.

- Other emerging products for Myasthenia gravis; as well as potential indications like Fetal erythroblastosis; Neonatal alloimmune thrombocytopenia; Sjogren’s syndrome; and Systemic lupus erythematosus are expected to give tough market competition to Atrasentan and launch of late-stage emerging therapies in the near future will significantly impact the market.

- A detailed description of regulatory milestones, and developmental activities, provide the current development scenario of Atrasentan in approved and potential indications.

- Analyse Atrasentan cost, pricing trends and market positioning to support strategic decision-making in the immunology landscape.

- Our in-depth analysis of the forecasted Atrasentan sales data uptil 2034 will support the clients in decision-making process regarding their therapeutic portfolio by identifying the overall scenario of Atrasentan in approved and potential indications.

Key Questions

- What is the class of therapy, route of administration and mechanism of action of Atrasentan? How strong is Atrasentan’s clinical and commercial performance?

- What is Atrasentan’s clinical trial status in each individual indications such as Myasthenia gravis; as well as potential indications like Fetal erythroblastosis; Neonatal alloimmune thrombocytopenia; Sjogren’s syndrome; and Systemic lupus erythematosus and study completion date?

- What are the key collaborations, mergers and acquisitions, licensing and other activities related to the Atrasentan Manufacturers?

- What are the key designations that have been granted to Atrasentan for approved and potential indications? How are they going to impact Atrasentan’s penetration in various geographies?

- What is the current and forecasted Atrasentan market scenario for approved and potential indications? What are the key assumptions behind the forecast?

- What are the current and forecasted sales of Atrasentan in the seven major countries, including the United States, Europe (Germany, France, Italy, Spain) and the United Kingdom, and Japan?

- What are the other emerging products available and how are these giving competition to Atrasentan for approved and potential indications?

- Which are the late-stage emerging therapies under development for the treatment of approved and potential indications?

- How cost-effective is Atrasentan? What is the duration of therapy and what are the geographical variations in cost per patient?