b cell inhibitors market forecast

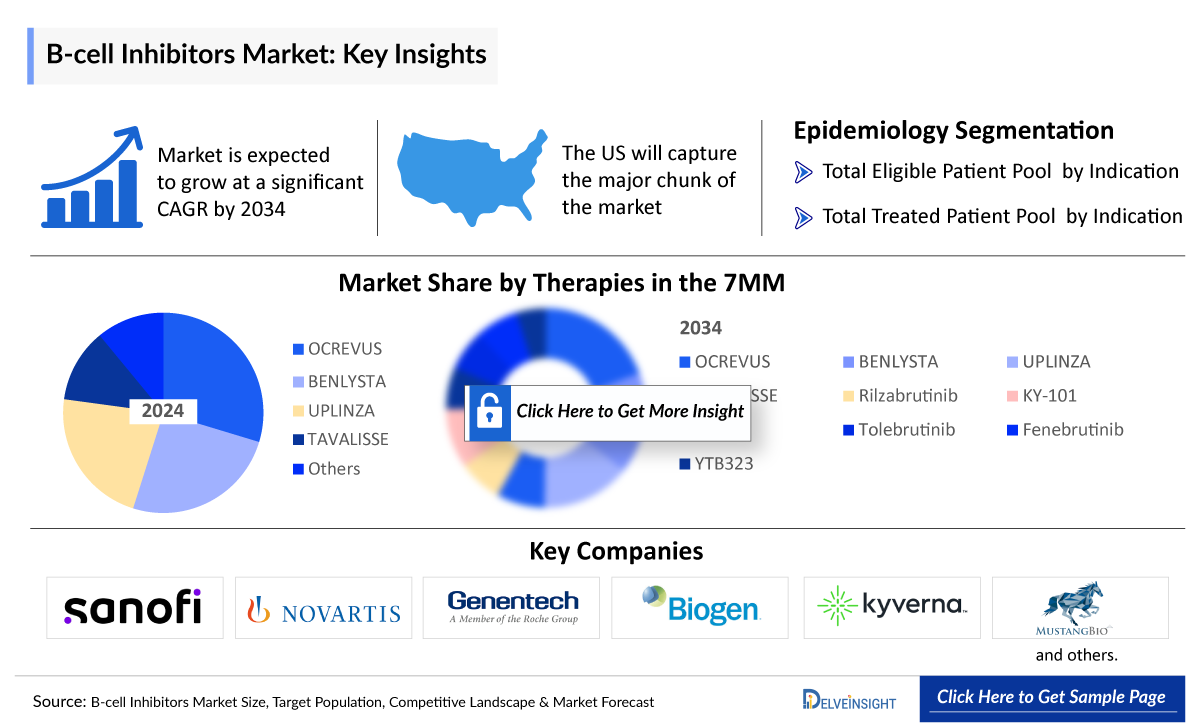

DelveInsight’s “B-cell Inhibitors Market Size, Target Population, Competitive Landscape & Market Forecast - 2034” report delivers an in-depth understanding of B-cell Inhibitors, addressable patient pool, competitive landscape, and future market trends in the United States, EU4 (Germany, France, Italy, and Spain) and the UK, and Japan.

The B-cell Inhibitors market report provides insights around existing treatment practices in patients with B-cell Inhibitors, approved (if any) and emerging B-cell Inhibitors, market share of individual therapies, patient pool eligible for treatment with B-cell Inhibitors, along with current and forecasted 7MM B-cell Inhibitors market size from 2020-2034 by therapies and by indication. The report also covers current unmet needs and challenges while incorporating new classes in treatment paradigm, variations in accessibility and acceptability of new B-cell Inhibitors in different geographies, along with insights on B-cell Inhibitors pricing reimbursements to curate the best opportunities and assess the market’s potential.

Geography Covered

- The United States

- EU4 (Germany, France, Italy, and Spain), and the UK

- Japan

Study Period: 2020–2034

B-cell Inhibitors Overview

B-cell inhibitors are therapeutic agents that modulate B lymphocytes, which play a central role in immune response and antibody production. They include drugs targeting molecules like CD-20, Bruton’s tyrosine kinase (BTK), PI3Kδ, CD-19, BAFF/BLyS, and APRIL, among others, to reduce B-cell activity in diseases such as B-cell lymphomas and autoimmune disorders.

B-cell inhibitors work through several mechanisms, including depleting B cells by binding to proteins like CD-20, blocking signaling pathways such as BTK, and inhibiting survival factors like BLyS and APRIL. These actions help control B-cell activity and prevent abnormal immune responses.

These inhibitors are crucial in managing B-cell cancers, renal disorders, autoimmune diseases as well as some hematological disorders, where abnormal B-cell activity leads to inflammation and tissue damage.

B-cell Inhibitors in Clinical Practice

This section will give in depth information about the existing local and systemic options in the current treatment paradigm of all the potential indications, in which most of the pharmaceutical companies are actively evaluating their inhibitors. Potential of the emerging B-cell Inhibitors in changing the current clinical practice guidelines is crucial to analyze especially when it comes to real world scenario.

It will also include the relevance and importance of incorporation of biomarker testing at varying stages of the disease. It is also important to understand that implementing such tests in routine clinical practice is not uniform in different countries due to issues such as cost, accessibility, reimbursement and non-recommendation in guidelines.

B-cell Inhibitors Drug Chapters

The drug chapter segment of the B-cell Inhibitors report encloses a detailed analysis of marketed therapies and late-stage (Phase III and Phase II) therapies. It also helps understand the B-cell Inhibitors clinical trial details, pharmacological action, agreements and collaborations related to B-cell Inhibitors, their approval timelines, patent details, advantages and disadvantages, latest news and press releases.

B-cell Inhibitors Marketed Drugs

OCREVUS (ocrelizumab)

OCREVUS is a CD20-targeted cytolytic monoclonal antibody indicated for the treatment of autoimmune conditions classified under relapsing forms of multiple sclerosis. This includes clinically isolated syndrome, relapsing-remitting multiple sclerosis (RRMS), and active secondary progressive multiple sclerosis (SPMS) in adults. It is also approved for the treatment of primary progressive multiple sclerosis (PPMS) in adults.

The exact mechanisms by which OCREVUS produces its therapeutic benefits in relapsing and relapsing-remitting multiple sclerosis are not completely understood. However, it is believed to function primarily through immunomodulatory effects, achieved by selectively targeting and binding to CD20-positive B cells.

OCREVUS received approval from the U.S. Food and Drug Administration (FDA) on March 28, 2017, for the treatment of both relapsing and primary progressive forms of multiple sclerosis. This marked it as the first therapy ever approved for primary progressive MS. OCREVUS ZUNOVO, a subcutaneous injection formulation of ocrelizumab, was approved in September 2024.

BENLYSTA (belimumab)

BENLYSTA is an intravenous and subcutaneously administered, fully-humanized monoclonal antibody that binds and inactivates B-lymphocyte stimulator (a cytokine expressed by B-cell lineage cells that activate B-cells and stimulate their proliferation and differentiation), inhibiting B-lymphocyte proliferation and differentiation.

It is the first and only biologic approved for the treatment of both Systemic Lupus Erythematosus (SLE)—a chronic autoimmune disease affecting the kidneys—and lupus nephritis, the kidney inflammation associated with lupus. The drug received regulatory approvals as follows: United States – in 2020 for adults and 2022 for pediatric patients; European Union – in 2021; and Japan – also in 2021.

TAVALISSE (fostamatinib)

TAVALISSE (fostamatinib) is a kinase inhibitor indicated for the treatment of thrombocytopenia in adult patients with chronic immune thrombocytopenia (ITP) who have had an insufficient response to a previous treatment.

TAVALISSE is an oral spleen tyrosine kinase (SYK) inhibitor that targets the underlying autoimmune cause of the disease by impeding platelet destruction, providing an important new treatment option for adult patients with chronic ITP.

B-cell Inhibitors Emerging Drugs

Rilzabrutinib: Sanofi

Rilzabrutinib is an investigational, oral, reversible BTK inhibitor developed using Sanofi’s TAILORED COVALENCY technology, offering selective BTK inhibition with reduced off-target effects. It has potential as a first- and best-in-class treatment for multiple immune-mediated diseases, including warm autoimmune hemolytic anemia (wAIHA) and IgG4-related disease (IgG4-RD), both of which currently lack approved therapies.

Rilzabrutinib has received orphan drug designation in the US for wAIHA and IgG4-RD. It is also under regulatory review in the US and EU for immune thrombocytopenia (ITP), with a FDA decision expected by August 29, 2025. Additionally, it has ODD for ITP in the US, EU, and Japan, and FTD in the US.

KY-101: Kyverna

KYV-101 is an autologous, fully human anti-CD19 chimeric antigen receptor T-cell (CAR T) therapy and serves as the lead clinical candidate in our cell therapy pipeline. It is being developed to treat a range of autoimmune diseases, with active clinical programs in both rheumatology and neurology. Ongoing trials include Phase II studies for stiff person syndrome, multiple sclerosis, and myasthenia gravis, as well as a Phase I/II trial for systemic sclerosis. Additionally, KYV-101 is being evaluated in two multicenter, open-label Phase I/II trials in the United States and Germany for patients with lupus nephritis.

The therapy has received several regulatory designations that underscore its potential and support its accelerated development. These include FTD for lupus nephritis, myasthenia gravis, and multiple sclerosis; RMAT designation; and ODD in both the U.S. and EU for lupus nephritis and systemic sclerosis.

MB-106: Mustangbio

Mustang Bio, in partnership with Fred Hutch, is advancing MB-106, a CD20-targeted CAR T therapy, initially aimed at treating hematologic malignancies and now pivoting toward autoimmune diseases.

As of March 2025, 73 patients have been treated in ongoing Phase I clinical trials, demonstrating a favorable safety profile and high response rates, including a 90% overall response rate in Waldenström macroglobulinemia. Despite these promising results, Mustang closed its own MB-106 trials in mid-2024 due to funding limitations. The clinical development of MB-106 will now focus solely on autoimmune indications, with a Phase I investigator-sponsored trial at Fred Hutch planned for initiation in late 2025. This strategic shift underscores a resource-driven realignment while maintaining development momentum in a promising therapeutic domain.

In March 2024, MB-106 was granted the RMAT designation by the FDA for the treatment of relapsed or refractory CD20-positive WM and FL

Drug Class Insights

The Drug Class Insights section will provide comprehensive information on B-cell Inhibitors as a class. This will include a broad overview of the class and its role in treating specific conditions. Insights may cover the historical clinical development of B-cell Inhibitors, their mechanism of action, their subtypes and future commercial prospects. Additionally, the section will provide detailed information about current trends, challenges, and future prospects for this class of drugs.

B-cell Inhibitors Market Outlook

This section will include details on changing B-cell Inhibitors market dynamics post initiation of clinical development activities of the inhibitor. It will also provide a detailed summary and comparison of all the therapies being developed by leading players in this space. This section will highlight the advantages of one therapy over the other after assessment based on parameters such as data availability in the form of safety and efficacy, number of patients enrolled in each trial, and trial’s inclusion criteria. There will be a Key focus on the importance of development and need for the commercial success of these targeted therapies to achieve treatment goals that physicians and patients are looking for. It will also sum up all the early stage players active in this space.

B-cell Inhibitors Drugs Uptake

This section focuses on the uptake rate of potential B-cell Inhibitors already launched and expected to be launched in the market during 2020–2034, which depends on the competitive landscape, safety, efficacy data, and order of entry. It is important to understand that the key players evaluating their novel therapies in the pivotal and confirmatory trials should remain vigilant when selecting appropriate comparators to stand the greatest chance of a positive opinion from regulatory bodies, leading to approval, smooth launch, and rapid uptake.

B-cell Inhibitors Pipeline Development Activities

The report provides insights into different therapeutic candidates in Phase III and Phase II stages. It also analyzes key players involved in developing targeted therapeutics.

B-cell Inhibitors Pipeline Development Activities

The report covers information on collaborations, acquisitions and mergers, licensing, and patent details for B-cell Inhibitors.

KOL Views

To keep up with current and future market trends, we incorporate Key physicians, Therapy Area Researcher’s, and other Industry Experts’ opinions working in the domain through primary research to fill in the data gaps and validate our secondary research. 25+ Key Opinion Leaders (KOLs) were contacted for insights on B-cell Inhibitors’ incorporation in the evolving treatment landscape, patient reliance on conventional therapies, patient therapy switching acceptability, drug uptake, along with challenges related to accessibility.

Qualitative Analysis

We perform qualitative and market Intelligence analysis using various approaches, such as SWOT analysis and Analyst views. In the SWOT analysis, strengths, weaknesses, opportunities, and threats in terms of disease diagnosis, patient awareness, competitive landscape, cost-effectiveness, and geographical accessibility of therapies are provided. These pointers are based on the analyst’s discretion and assessment of the cost analysis and existing and evolving treatment landscape.

Market Access and Reimbursement

This section will include insights around the standard HTA pricing, recent reformations in 2024 and modifications in reimbursement process in the 7MM. For example, In the United States, a multi payer model exists when it comes to drug pricing regime, which is currently undergoing significant changes, with recent federal legislation, such as the Prescription Drug Pricing Reform provisions of the Inflation Reduction Act, significantly altering the pricing regime under certain federal programs. Whereas in Germany, the market access differs from the systems followed in many other countries as no pricing and reimbursement approval is required during launch of a new therapy.

Moreover, this section will also provide details on reimbursement of approved therapy, if any.

Scope of the Report

- The report covers a segment of key events, an executive summary, target patient pool, epidemiology and market forecasts, information around patient journey and varying biomarker testing rates

- Additionally, an all-inclusive account of the current and emerging therapies drug chapters, insights on B-cell Inhibitors addressable patient pool

- A detailed review of the B-cell Inhibitors market, historical and forecasted market size, market share by therapies, detailed assumptions, and rationale behind our approach is included in the report

- The report provides an edge while developing business strategies by understanding trends through SWOT analysis and expert insights/KOL views, and treatment preferences that help in shaping and driving the 7MM B-cell Inhibitors market.

- Market Size of Inhibitors by therapies and indication will be provided

B-cell Inhibitors Report Key Strengths

- 10 Years B-cell Inhibitors Market Forecast

- The 7MM Coverage

- B-cell Inhibitors Competitive Landscape of current and emerging therapies

- B-cell Inhibitors Total Addressable patient population

- Drugs Uptake and Key Market Forecast Assumptions

- Approved and Emerging therapy Profiles

- Physician’s perspectives/KOL opinions

- Biomarker testing and Patient journey

- Qualitative Analysis (SWOT and Analyst Views)

- B-cell Inhibitors Market Size by therapy and indication

- Existing and Future Market Opportunity

- Unmet Needs

FAQs

- What was the B-cell Inhibitors total market size, the market size by therapies, market share (%) distribution in 2020, and what would it look like by 2034? What are the contributing factors for B-cell Inhibitors market growth?

- Which KRAS Inhibitor is going to be the largest contributor by 2034?

- What is the market access and reimbursement scenario of B-cell Inhibitors?

- What are the pricing variations among different geographies?

- How would the market drivers, barriers, and future opportunities affect the market dynamics and subsequent analysis of the associated trends?

- What are the recent novel therapies, targets, mechanisms of action, and technologies developed to overcome the limitations of existing therapies?

- Patient acceptability in terms of preferred treatment options as per real-world scenarios?

Reasons to Buy

- The report will help in developing business strategies by understanding the latest trends and changing treatment dynamics driving the B-cell Inhibitors Market.

- Understand the existing B-cell Inhibitors market opportunities and future trends in varying geographies

- Identifying strong upcoming players in the market will help devise strategies to help get ahead of competitors.

- Highlights of access and reimbursement policies of approved therapies, barriers to accessibility of expensive off-label therapies, and patient assistance programs.

- To understand Key Opinion Leaders’ perspectives around the accessibility and acceptability of emerging treatment options along with unmet need of current therapies

- Details on report methodology, top indications covered, market assumptions, patient journey and KOLs to strengthen the pharmaceutical companies’ development and launch strategy.