Blood Collection Devices Market Summary

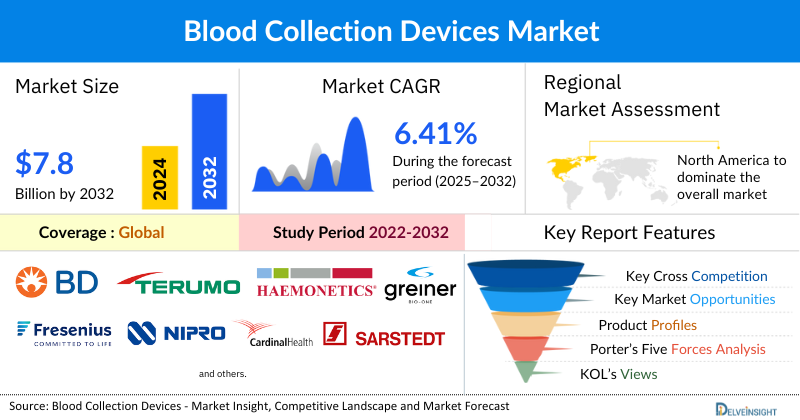

- The global blood collection devices market is expected to increase from USD 4,775.32 million in 2024 to USD 7,810.74 million by 2032, reflecting strong and sustained growth.

- The global blood collection devices market is growing at a CAGR of 6.41% during the forecast period from 2025 to 2032.

- The global blood collection devices market is being propelled by the escalating prevalence of chronic and infectious diseases, the increasing demand for blood and its components in transfusion and therapeutic applications, and the rapid adoption of point-of-care as well as home-based testing solutions, alongside other contributing factors.

- The leading companies operating in the blood collection devices market include BD, Terumo Corporation, Haemonetics Corporation, Fresenius SE & Co. KGaA, Nipro Europe Group Companies, FL MEDICAL s.r.l., Greiner Bio-One International GmbH, Cardinal Health, SARSTEDT AG & Co. KG, Thermo Fisher Scientific Inc., ICU Medical, Grifols, S.A., CML Biotech, INTERNATIONAL SCIENTIFIC SUPPLIES LTD, Demophorius Healthcare LTD, AB MEDICAL Co., Ltd., Trajan Scientific and Medical, Macopharma, VOGT MEDICAL, Ljungberg & Kögel AB, and others.

- The North American blood collection devices market holds the largest share globally, driven primarily by the high prevalence of chronic and lifestyle-related diseases such as diabetes, cardiovascular disorders, and cancer. The region’s aging population, coupled with increasing health awareness and routine diagnostic testing, further fuels demand for blood collection devices. Additionally, well-established healthcare infrastructure, advanced diagnostic facilities, and strong adoption of innovative and safety-engineered blood collection technologies contribute to North America’s leading position in the global market.

- In the product type segment of the blood collection devices market, the needles and syringes category is estimated to account for the largest market share in 2024.

Request for unlocking the report of the @Blood Collection Devices Market

Blood Collection Devices Market Size and Forecasts

|

Report Metrics |

Details |

|

2024 Market Size |

USD 4,775.32 million |

|

2032 Projected Market Size |

USD 7,810.74 million |

|

Growth Rate (2025-2032) |

6.41% CAGR |

|

Largest Market |

North America |

|

Fastest Growing Market |

Asia-Pacific |

|

Market Structure |

Highly Consolidated |

Factors Contributing to the Growth of the Blood Collection Devices Market

- Rising instances of chronic and infectious diseases leading to a surge in the blood collection devices market: The market for blood collection devices is strongly influenced by the increasing burden of chronic conditions such as diabetes, cardiovascular diseases, and cancer, which require frequent diagnostic testing for early detection and treatment monitoring. At the same time, infectious diseases like HIV, hepatitis, and tuberculosis continue to create a substantial demand for accurate and timely blood diagnostics. Regular blood screening is essential for controlling disease spread and ensuring effective patient management. The growing global patient pool has placed greater emphasis on improving laboratory efficiency and sample quality. As a result, the reliance on advanced blood collection devices is steadily rising. Their ability to ensure sterility, safety, and accuracy further strengthens their use in both hospital and diagnostic settings.

- Growing demand for blood and blood components: The rising need for blood and its components in clinical care is another major driver of the market. Blood transfusions are critical in managing trauma, surgeries, obstetric emergencies, and chronic illnesses such as anemia and cancer. Beyond whole blood, the growing use of components such as plasma, platelets, and red blood cells in therapeutic and research applications is fueling demand for reliable collection devices. The expansion of blood donation programs and national initiatives to maintain an adequate supply further adds to the requirement for safe and efficient blood bags, tubes, and needles. Apheresis and component separation techniques are also becoming more common, requiring specialized devices to support precise collection. This trend highlights the indispensable role of blood collection technologies in saving lives and advancing medical care.

- Rise in point-of-care and home testing: The healthcare sector is witnessing a rapid shift toward decentralized diagnostics, with point-of-care and home-based testing gaining prominence. Patients increasingly prefer convenient, minimally invasive solutions that allow for quick sampling outside of traditional laboratory settings. Capillary collection kits, micro-sampling devices, and user-friendly lancets are playing a pivotal role in supporting this transition. These devices are particularly valuable in chronic disease monitoring, such as blood glucose testing, where frequent assessments are needed. The growing adoption of telemedicine and remote patient monitoring is further boosting the demand for home testing solutions. By improving accessibility and reducing the burden on centralized labs, point-of-care and home-based blood collection is reshaping the market. This trend also supports faster clinical decision-making and enhances patient engagement in their own care.

Blood Collection Devices Market Report Segmentation

This Blood Collection Devices market report offers a comprehensive overview of the global Blood Collection Devices market, highlighting key trends, growth drivers, challenges, and opportunities. It covers detailed market segmentation of the Blood Collection Devices Market by Product Type (Blood collection tubes/Vacutainer [EDTA, Heparin, and Others], Needles and Syringes, Blood collection bags, and Others), Method Type (Manual and Automatic), By End-Users (Hospitals and Clinics, Diagnostic Labs, Blood Banks, and Others), and Geography. The report provides valuable insights into the competitive landscape, regulatory environment, and market dynamics across major markets, including North America, Europe, and Asia-Pacific. Featuring in-depth profiles of leading industry players and recent product innovations, this report equips businesses with essential data to identify market potential, develop strategic plans, and capitalize on emerging opportunities in the rapidly growing Blood Collection Devices market.

The Blood collection devices are medical instruments designed to safely and efficiently draw, store, and transport blood samples for diagnostic testing, transfusion, or research. These include vacuum tubes, needles, syringes, lancets, capillary collection kits, and blood bags. They ensure sterility, minimize patient discomfort, and preserve sample integrity for accurate laboratory analysis. With advancements such as safety-engineered needles and micro-sampling technologies, these devices play a vital role in modern healthcare by supporting routine diagnostics, disease monitoring, and therapeutic procedures.

The blood collection devices market is significantly driven by the rising prevalence of chronic diseases such as diabetes, cardiovascular disorders, and cancer, along with infectious conditions like HIV and hepatitis, which necessitate frequent and reliable blood testing for early detection and monitoring. In addition, the growing demand for blood and blood components is fueling the adoption of advanced collection devices, as transfusions and component therapies are vital in trauma care, surgeries, oncology, and critical care management. Expanding blood donation initiatives and the increasing use of plasma and platelets in therapeutic procedures further strengthen this trend.

Moreover, the rise in point-of-care and home testing is reshaping the market landscape, with patients increasingly opting for convenient, minimally invasive solutions that support decentralized and remote diagnostics. The availability of user-friendly collection kits and micro-sampling technologies is enhancing accessibility while reducing the burden on centralized laboratories. Together, these factors underscore the pivotal role of blood collection devices in modern healthcare delivery and disease management.

Get More Insights into the Report @Blood Collection Devices Market

What are the latest Blood Collection Devices Market Dynamics and Trends?

The blood collection devices market is undergoing rapid transformation, propelled by rising diagnostic demand in response to the growing prevalence of chronic and infectious diseases, an expanding aging population, and the increasing emphasis on preventive healthcare and routine screening. Safety has become a central focus, with manufacturers advancing safety-engineered needles, retractable systems, and closed-loop technologies designed to reduce needlestick injuries, prevent cross-contamination, and ensure higher standards of infection control.

The rising global burden of chronic diseases further underscores the need for efficient blood collection solutions. According to DelveInsight (2024), in 2022, nearly 50% of the global cancer population was concentrated in Asia, 23% in Europe, and around 15% in North America. By 2045, the number of cancer cases worldwide is expected to reach approximately 32.5 million. Similarly, diabetes poses a significant challenge, with an estimated 537.5 million adults aged 20–79 currently living with the disease, about one in every ten individuals. This figure is projected to climb to 643 million by 2030 and 783.5 million by 2045, with more than three-quarters of patients residing in low- and middle-income countries. These statistics highlight the rising demand for reliable, accessible, and scalable blood collection devices to support timely diagnosis and long-term disease management.

Parallel to these epidemiological trends, technological innovation is redefining the market landscape. Automation, AI-powered validation systems, RFID-enabled tracking, and digital labeling are being increasingly adopted to improve sample accuracy, streamline laboratory operations, and enhance diagnostic efficiency. At the same time, decentralization is gaining momentum, with home-based and point-of-care collection solutions enabling greater convenience, supporting the growth of telemedicine, and easing the pressure on centralized laboratories.

Geographically, developed regions such as North America and Europe continue to dominate due to robust regulatory frameworks, strong R&D ecosystems, and advanced healthcare infrastructures. However, Asia-Pacific is emerging as the fastest-growing region, fueled by expanding healthcare access, rising disposable incomes, and greater awareness of safe blood collection practices. Despite these opportunities, the market faces challenges such as risks of sample contamination during storage and transport, shortages of skilled phlebotomists, and the high cost of advanced automated systems in resource-constrained regions. Adding to this complexity is the growing emphasis on sustainability, with manufacturers increasingly exploring eco-friendly materials and waste-reduction strategies to align with environmental goals.

Therefore, the interplay of rising disease burden, safety-focused innovations, technological integration, and regional growth dynamics is shaping a highly dynamic blood collection devices market poised for continued global expansion.

Despite the rising demand for blood collection devices, the market encounters several challenges that could restrain growth. A major concern is the risk of blood sample contamination during transport and storage, which can compromise diagnostic accuracy and lead to repeated testing, thereby increasing healthcare costs and patient discomfort. Additionally, the shortage of skilled phlebotomists in many regions further complicates the situation, as improper handling or collection techniques can result in hemolysis, insufficient samples, or patient safety risks. These challenges highlight the need for continuous training programs, stricter quality controls, and technological advancements to ensure the reliability and efficiency of blood collection practices.

Blood Collection Devices Market Segment Analysis

Blood Collection Devices Market by Product Type (Blood collection tubes/Vacutainer [EDTA, Heparin, and Others], Needles and Syringes, Blood collection bags, and Others), Method Type (Manual and Automatic), By End-Users (Hospitals and Clinics, Diagnostic Labs, Blood Banks, and Others), and Geography (North America, Europe, Asia-Pacific, and Rest of the World)

By Product Type: Needles and Syringes Category Dominates the Market

The needles and syringes category is the dominant force in the blood collection devices market. In 2024, needles and syringes accounted for a significant share of approximately 39%. The needles and syringes category holds a dominant position in the global blood collection devices market, primarily because they are the most fundamental, widely used, and trusted tools for venipuncture and diagnostic testing. These devices play a vital role in drawing accurate volumes of blood safely and efficiently, making them indispensable across hospitals, clinics, diagnostic laboratories, and blood banks worldwide. Their simplicity, low cost, and universal availability ensure widespread adoption, especially in emerging regions where advanced automated systems may be less accessible. Beyond routine blood draws, needles and syringes also serve multiple functions, including transfusions, medication administration, and emergency procedures, which further strengthen their demand and utility across healthcare systems.

The dominance of this category is further reinforced by continuous product innovations and safety improvements. Leading manufacturers have introduced advanced solutions such as BD Vacutainer® Eclipse™ blood collection needles, Terumo SurGuard® Safety Needles, and Greiner Bio-One VACUETTE® needles, which combine precision with enhanced safety features. The adoption of retractable needles, pre-attached syringes, and ergonomic safety mechanisms has significantly reduced the risks of needlestick injuries and cross-contamination, making them the preferred choice for healthcare professionals. Innovations like BD Integra™ Syringe with retracting needle technology, Nipro SafeTouch™, and Terumo’s SurGuard®3 highlight the industry’s focus on operator safety and efficiency. Additionally, the integration of ultra-thin wall needles has improved patient comfort by reducing insertion pain without compromising blood flow rates.

Their compatibility with a wide range of blood collection tubes and diagnostic systems adds further convenience, streamlining clinical workflows and ensuring adaptability in diverse healthcare settings. While vacuum-based and automated blood collection technologies are gaining momentum, needles and syringes remain the cornerstone of the market due to their versatility, affordability, reliability, and continuous technological evolution. This powerful combination of widespread utility, patient-centric innovation, and cost-effectiveness firmly secures the dominance of the needles and syringes category in the global blood collection devices market.

By Method Type: Manual Dominates the Market

In the blood collection devices market, the manual category held the largest market share, capturing nearly 55% of the global market in 2024. The manual category dominates the blood collection devices market largely because of its simplicity, affordability, and wide accessibility. Devices such as syringes, needles, lancets, and venipuncture systems are easy to use, require minimal training, and are available across all tiers of healthcare infrastructure, from large hospitals to small clinics. Their cost-effectiveness makes them especially valuable in low- and middle-income countries, where healthcare budgets are often limited and the adoption of advanced automated systems remains a challenge. This affordability, coupled with their reliability, ensures that manual methods remain the preferred choice for routine diagnostics and emergency care.

Moreover, manual blood collection devices have built long-standing clinical trust due to their proven accuracy and consistent performance over decades of use. They are highly versatile, supporting everything from small-scale diagnostic testing to large-scale public health screening programs. While automation and AI-powered systems are gradually gaining ground in developed markets, manual devices continue to play a central role globally, particularly in resource-limited settings where advanced technologies are less accessible. Their combination of dependability, versatility, and cost efficiency secures the manual category’s dominant position in the global blood collection devices market.

By End-Users: Hospitals and Clinics Dominate the Market

Hospitals and clinics dominate the global blood collection devices market due to their central role in diagnostics, treatment, and patient monitoring. These facilities are the primary points of care where large volumes of blood tests are conducted daily for disease detection, surgical procedures, emergency cases, and routine health checkups. The rising prevalence of chronic conditions such as diabetes, cancer, and cardiovascular disorders has further increased the dependency on hospitals and clinics for regular diagnostic evaluations.

Moreover, the availability of advanced infrastructure, skilled healthcare professionals, and sophisticated laboratory facilities in hospitals enables the adoption of innovative blood collection technologies, including safety-engineered needles, vacuum-based systems, and automated sample handling. The high patient inflow, coupled with the ability of hospitals and clinics to invest in bulk procurement and integrate advanced solutions into clinical workflows, positions them as the dominant end-users in the blood collection devices market globally.

Blood Collection Devices Market Regional Analysis

North America Blood Collection Devices Market Trends

North America, led by the United States, dominates the global blood collection devices market, accounting for approximately 41% of the total market share in 2024. The North America blood collection devices market is experiencing strong and sustained growth, driven by the high prevalence of chronic and lifestyle-related diseases such as diabetes, cancer, and cardiovascular disorders. The rising focus on early diagnosis, preventive healthcare, and routine health screenings is significantly boosting the demand for advanced and reliable blood collection solutions.

Cancer prevalence is a particularly influential factor. According to a 2024 analysis by DelveInsight, cancer incidence in the U.S. continues to climb sharply, with an estimated 3 million new cases expected to be diagnosed by the end of 2024, including nearly 14,910 cases among adolescents aged 13 to 19. Within the region, the U.S. accounted for nearly 89.1% of all cancer cases in 2022, while Canada represented 10.9%, underlining the disproportionate demand for diagnostic testing and blood collection devices in the U.S. market. Alongside this, North America’s aging population is accelerating demand, as older adults require more frequent diagnostic testing, monitoring, and chronic disease management, further reinforcing the widespread use of blood collection products across hospitals, diagnostic centers, and home healthcare settings.

Technological innovation is another defining element shaping the North American market. Leading companies are at the forefront of developing safety-engineered devices, closed-system blood collection technologies, and automation-compatible solutions that reduce the risk of contamination and needlestick injuries while improving workflow efficiency. Moreover, the integration of AI-powered sample validation systems, smart labeling, and digital tracking technologies is transforming laboratory operations by enhancing accuracy, quality control, and traceability in diagnostics. The growing adoption of decentralized testing, point-of-care diagnostics, and home-based blood collection is also reshaping patient care models, driven by rising consumer demand for convenience and the expanding role of telehealth.

From a business perspective, the market remains highly competitive and concentrated, with major players such as BD, Terumo, and Greiner Bio-One holding significant shares due to their broad product portfolios, robust R&D pipelines, and strategic partnerships. Regulatory oversight from the U.S. Food and Drug Administration (FDA) continues to emphasize safety, innovation, and quality, compelling manufacturers to consistently advance their offerings. At the same time, high healthcare expenditure, advanced infrastructure, and the strengthening of collaborations between diagnostic laboratories and medical device manufacturers are supporting long-term market expansion.

Altogether, these drivers firmly establish North America as a global leader in the blood collection devices industry, setting new benchmarks for safety, innovation, efficiency, and patient-centered care, while reinforcing the region’s pivotal role in shaping the future of diagnostic technologies.

Europe Blood Collection Devices Market Trends

The Europe blood collection devices market is witnessing steady growth, supported by a well-established healthcare infrastructure, rising disease burden, and strong focus on innovation. The increasing prevalence of chronic conditions such as cardiovascular disorders, diabetes, and cancer, along with persistent concerns about infectious diseases, has driven demand for accurate diagnostic testing, where blood collection remains the gold standard. This demand is reinforced by the region’s aging population, which is more susceptible to health complications and requires frequent diagnostic monitoring, thereby fueling the adoption of advanced blood collection devices.

Regulatory support and stringent safety standards in Europe are also shaping the market, as healthcare providers prioritize devices that reduce the risk of needlestick injuries, cross-contamination, and errors. Companies are responding with innovations in safety-engineered needles, vacuum-based tubes, and closed-system collection technologies, ensuring compliance with EU regulations while enhancing patient and operator safety. Additionally, the region is at the forefront of adopting eco-friendly and sustainable medical devices, with manufacturers increasingly focusing on recyclable and biodegradable materials to align with Europe’s environmental goals.

Technological advancements and automation are further transforming the landscape, as hospitals and laboratories integrate digital labeling, RFID-enabled tracking, and AI-powered systems to improve efficiency and traceability in blood sample handling. Moreover, Europe’s push toward decentralized healthcare and home-based diagnostics is encouraging the uptake of micro-sampling devices and portable blood collection solutions. With strong investments in research and development, strategic partnerships, and mergers among leading players, the European blood collection devices market is evolving toward greater safety, sustainability, and efficiency, making it a key hub for innovation in this sector.

Asia-Pacific Blood Collection Devices Market Trends

The Asia-Pacific Blood Collection Devices market is witnessing rapid expansion, reflecting a robust CAGR of 7.67% during the forecast period from 2025 to 2032. The Asia-Pacific blood collection devices market is experiencing rapid growth, driven by a combination of demographic shifts, rising disease prevalence, and technological advancements. The region’s expanding population, coupled with an increasing burden of chronic and infectious diseases such as diabetes, cancer, and hepatitis, is significantly boosting the demand for reliable blood testing and collection solutions. This is further supported by the growing emphasis on preventive healthcare and early diagnosis, which is encouraging both governments and private healthcare providers to strengthen diagnostic infrastructure across emerging economies like India, China, and Southeast Asia.

In parallel, the expansion of healthcare infrastructure and rising healthcare expenditure in the region are creating favorable conditions for the adoption of advanced blood collection technologies. Countries such as China and Japan are at the forefront of integrating automation and digital technologies into laboratory workflows, while emerging markets are increasingly embracing portable and safety-engineered devices to improve efficiency and patient safety. The rising adoption of point-of-care testing and home-based diagnostics in urban and semi-urban areas is further reshaping demand dynamics, as patients seek more convenient and less invasive blood sampling options.

Additionally, local manufacturing initiatives and supportive regulatory frameworks are playing a key role in reducing dependence on imports and making blood collection devices more affordable and accessible. Global players are also actively expanding their footprint in Asia-Pacific through joint ventures, partnerships, and distribution agreements to capitalize on this rapidly evolving landscape.

Therefore, the Asia-Pacific market is witnessing strong momentum, fueled by a convergence of rising healthcare needs, increasing investments in diagnostic technologies, and growing awareness of patient safety, positioning it as one of the most dynamic growth regions for blood collection devices worldwide.

Who are the major players in the Blood Collection Devices Market?

The following are the leading companies in the Blood Collection Devices market. These companies collectively hold the largest market share and dictate industry trends.

- BD

- Terumo Corporation

- Haemonetics Corporation

- Fresenius SE & Co. KGaA

- Nipro Europe Group Companies

- FL MEDICAL s.r.l.

- Greiner Bio-One International GmbH

- Cardinal Health

- SARSTEDT AG & Co. KG

- Thermo Fisher Scientific Inc.

- ICU Medical

- Grifols, S.A

- CML Biotech

- INTERNATIONAL SCIENTIFIC SUPPLIES LTD

- Demophorius Healthcare LTD

- AB MEDICAL Co., Ltd.

- Trajan Scientific and Medical

- Macopharma

- VOGT MEDICAL

- Ljungberg & Kögel AB

How is the competitive landscape shaping the Blood Collection Devices Market?

The competitive landscape of the blood collection devices market is shaped by the strong presence of a few dominant global players, making it a highly concentrated industry. Leading companies such as BD, Terumo Corporation, Greiner Bio-One, Sarstedt AG & Co., and Nipro Corporation hold significant market shares due to their broad product portfolios, global distribution networks, and continuous investment in innovation. These players are setting the pace of competition by introducing advanced safety-engineered devices, closed-system solutions, and automation-compatible products to meet the rising demand for efficiency and patient safety.

Smaller and emerging companies are also entering the market with niche innovations such as micro-sampling technologies, AI-powered sample validation systems, and eco-friendly blood collection tubes. However, their growth opportunities are often influenced by strategic collaborations or acquisitions with larger firms that have the resources to scale and commercialize new technologies. Thus, the competitive landscape remains highly consolidated, with innovation, regulatory approvals, and partnerships serving as key differentiators among established players striving to maintain their market leadership.

Recent Developmental Activities in the Blood Collection Devices Market

- In March 2025, Vitestro unveiled an autonomous robotic system for blood collection, named Aletta Jacobs in honor of the Netherlands’ first female physician. The device is designed to optimize the blood draw process, enhancing efficiency and patient experience.

- In January 2025, Fresenius secured FDA 510(k) Clearance for the Adaptive Nomogram to Improve Plasma Collection Efficiency.

|

Report Metrics |

Details |

|

Study Period |

2022 to 2032 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2032 |

|

Blood Collection Devices Market CAGR |

6.41% |

|

Key Companies in the Blood Collection Devices Market |

BD, Terumo Corporation, Haemonetics Corporation, Fresenius SE & Co. KGaA, Nipro Europe Group Companies, FL MEDICAL s.r.l., Greiner Bio-One International GmbH, Cardinal Health, SARSTEDT AG & Co. KG, Thermo Fisher Scientific Inc., ICU Medical, Grifols, S.A, CML Biotech, INTERNATIONAL SCIENTIFIC SUPPLIES LTD, Demophorius Healthcare LTD, AB MEDICAL Co., Ltd., Trajan Scientific and Medical, Macopharma, VOGT MEDICAL, Ljungberg & Kögel AB, and others |

|

Blood Collection Devices Market Segments |

by Product Type, by Method Type, by End-Users, and by Geography |

|

Blood Collection Devices Regional Scope |

North America, Europe, Asia Pacific, Middle East, Africa, and South America |

|

Blood Collection Devices Country Scope |

U.S., Canada, Mexico, Germany, United Kingdom, France, Italy, Spain, China, Japan, India, Australia, South Korea, and key Countries |

Blood Collection Devices Market Segmentation

- Blood Collection Devices by Product Type Exposure

- Blood collection tubes/Vacutainer

- EDTA

- Heparin

- Others

- Needles and Syringes

- Blood collection bags

- Others

- Blood Collection Devices by Method Type Exposure

- Manual

- Automatic

- Blood Collection Devices End-Users Exposure

- Hospitals and Clinics

- Diagnostic Labs

- Blood Banks

- Others

- Blood Collection Devices Geography Exposure

- North America Blood Collection Devices Market

- United States Blood Collection Devices Market

- Canada Blood Collection Devices Market

- Mexico Blood Collection Devices Market

- Europe Blood Collection Devices Market

- United Kingdom Blood Collection Devices Market

- Germany Blood Collection Devices Market

- France Blood Collection Devices Market

- Italy Blood Collection Devices Market

- Spain Blood Collection Devices Market

- Rest of Europe Blood Collection Devices Market

- Asia-Pacific Blood Collection Devices Market

- China Blood Collection Devices Market

- Japan Blood Collection Devices Market

- India Blood Collection Devices Market

- Australia Blood Collection Devices Market

- South Korea Blood Collection Devices Market

- Rest of Asia-Pacific Blood Collection Devices Market

- Rest of the World Blood Collection Devices Market

- South America Blood Collection Devices Market

- Middle East Blood Collection Devices Market

- Africa Blood Collection Devices Market

Blood Collection Devices Market Recent Industry Trends and Milestones (2022-2025)

|

Category |

Key Developments |

|

Blood Collection Devices Product Launches |

BD launched the Vacutainer® UltraTouch blood collection set designed for improved patient comfort; Greiner Bio-One expanded its VACUETTE® EVOPROTECT Safety Blood Collection Set in Europe and North America; Terumo introduced advanced closed-system blood collection kits to minimize contamination risk. |

|

Blood Collection Devices Regulatory Approvals |

FDA clearance granted to new safety blood collection devices by Nipro and Haemotronic; CE Mark approval for HemoCue’s next-generation blood sampling systems; Sarstedt received regulatory clearance for its micro-collection devices aimed at pediatric and home-use testing |

|

Partnerships in the Blood Collection Devices Market |

BD partnered with Babson Diagnostics to develop small-volume blood collection technology for retail health settings; Greiner Bio-One collaborated with digital health companies to integrate smart labeling and traceability; Terumo engaged in partnerships to expand point-of-care testing compatibility with its blood collection systems. |

|

Acquisitions in the Blood Collection Devices Market |

ICU Medical acquired Smiths Medical, expanding its infusion and blood collection product portfolio; Greiner Bio-One acquired regional distributors to strengthen its European and Asian market presence |

|

Company Strategy |

BD focused on advancing digital integration and smart blood collection systems; Terumo prioritized growth in minimally invasive, closed-system devices; Sarstedt invested in automation-friendly collection products for laboratory efficiency. |

|

Setbacks in the Blood Collection Devices Market |

Temporary recalls of certain blood collection tubes due to additive instability; supply chain disruptions impacted the availability of single-use devices during high-demand periods |

|

Emerging Technology |

Adoption of AI-powered quality control systems for sample validation; growing use of micro-sampling devices for at-home and decentralized testing; expansion of biodegradable and eco-friendly blood collection tubes; integration of digital barcoding and RFID tracking for improved sample traceability |

Impact Analysis

AI-Powered Innovations and Applications:

The blood collection devices market is increasingly witnessing the integration of artificial intelligence (AI) to enhance efficiency, accuracy, and patient safety. AI-powered innovations are being applied across multiple stages of the blood collection process, from sample identification to workflow management. Intelligent software systems now assist healthcare providers in predicting optimal collection times, minimizing patient discomfort, and reducing the likelihood of errors such as mislabeling or contamination.

Automation and AI-enabled robotic systems are also transforming laboratory operations by streamlining the handling and processing of blood samples. These systems can analyze large volumes of data in real time, track inventory, and optimize the allocation of resources, thereby improving operational efficiency. Furthermore, AI-driven predictive analytics help in identifying trends and patterns in blood usage, enabling hospitals and blood banks to better manage supply and demand.

In addition, AI technologies are enhancing patient-centric care by enabling personalized collection protocols based on patient health data, age, and medical history. Machine learning algorithms also improve quality control by detecting anomalies in sample integrity or device performance before errors occur. Overall, the integration of AI in blood collection devices is driving greater accuracy, safety, and efficiency, while reducing human error and operational costs, positioning the market for continued innovation and growth.

U.S. Tariff Impact Analysis on the Blood Collection Devices Market:

The U.S. tariffs on medical devices, including blood collection equipment, have created notable challenges for the healthcare sector. These tariffs have increased the cost of essential supplies, impacting both manufacturers and healthcare providers. Many blood collection device companies rely on imported components, and tariffs on materials such as steel, aluminum, and semiconductors have raised production costs. These added expenses are often passed on to healthcare providers, resulting in higher prices for medical devices.

Hospitals and clinics face budgetary pressures as a result, forcing them to prioritize essential procedures and sometimes delay or reduce the use of certain medical devices to manage costs. The broader supply chain is also affected, with potential disruptions in component availability and finished products leading to shortages and delays in patient care. Given the global nature of medical device manufacturing, these tariffs complicate procurement and production processes, making it more difficult for companies to quickly adapt to changing trade policies. Thus, the tariffs place significant economic pressure on both manufacturers and healthcare providers, highlighting the need for strategic planning to mitigate their impact on the healthcare system.

How This Analysis Helps Clients

- Cost Management: By understanding the tariff landscape, clients can anticipate cost increases and adjust pricing strategies accordingly, ensuring profitability.

- Supply Chain Optimization: Clients can identify alternative sourcing options and diversify their supply chains to reduce dependency on high-tariff regions, enhancing resilience.

- Regulatory Navigation: Expert guidance on navigating the evolving regulatory environment helps clients maintain compliance and avoid potential legal challenges.

- Strategic Planning: Insights into tariff impacts enable clients to make informed decisions about manufacturing locations, partnerships, and market entry strategies.

Startup Funding & Investment Trends

|

Company Name |

Total Funding |

Main Products |

Stage of Development |

Core Technology |

|

HemoCue AB (Startup/Innovative Segment) |

Early-stage Funding |

Point-of-care blood sampling devices for hemoglobin & glucose testing |

Clinical Pilot Programs |

Microcuvette-based diagnostic sampling technology. |

|

Greiner Bio-One |

Early-stage venture funding & innovation grants |

VACUETTE® blood collection tubes, lancets |

Growth |

Safety-focused and vacuum-based collection systems |

Key takeaways from the Blood Collection Devices market report study

- Market size analysis for the current Blood Collection Devices market size (2024), and market forecast for 8 years (2025 to 2032)

- Top key product/technology developments, mergers, acquisitions, partnerships, and joint ventures happened over the last 3 years.

- Key companies dominating the Blood Collection Devices market.

- Various opportunities available for the other competitors in the Blood Collection Devices market space.

- What are the top-performing segments in 2024? How these segments will perform in 2032?

- Which are the top-performing regions and countries in the current Blood Collection Devices market scenario?

- Which are the regions and countries where companies should have concentrated on opportunities for the Blood Collection Devices market growth in the future?