Blood Flow Measurement Devices Market Summary

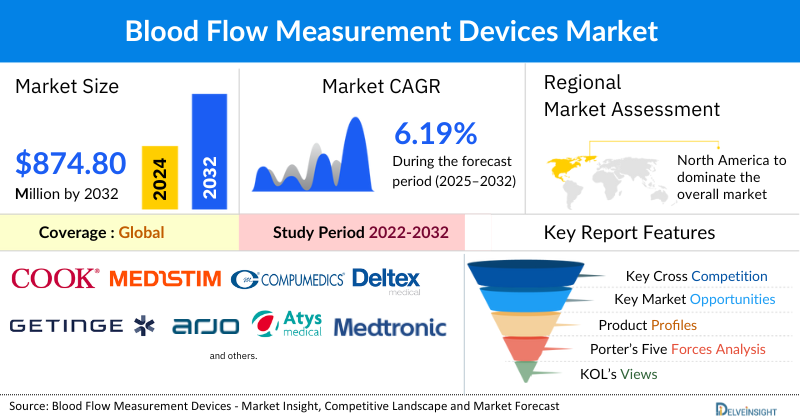

- The global blood flow measurement devices market is expected to increase from USD 544.01 million in 2024 to USD 874.80 million by 2032, reflecting strong and sustained growth.

- The global blood flow measurement devices market is growing at a CAGR of 6.19% during the forecast period from 2025 to 2032.

- The market of blood flow measurement devices is being primarily driven by the rising cases of cardiovascular disorders, diabetes, and other associated risk factors, increase advancements in device technology, increase in expansion of minimally invasive and point-of-care diagnostics, and an increase in product development activities among the key market players.

- The leading companies operating in the blood flow measurement devices market include Cook, Medistim, Compumedics Limited, Permed AB, Deltex Medical Limited, Koninklijke Philips N.V., Getinge, Arjo, ATYS Medical, Moor Instruments Limited, Medtronic, AKW Medical, Inc., D. E. Hokanson, Inc., ELCAT GmbH, Oxford Optronix, QT Medical Inc., Transonic, Carolina Medical Electronics, ADINSTRUMENTS, STAT Health Informatics, Inc., and others.

- North America is expected to dominate the blood flow measurement devices market due to the high prevalence of cardiovascular and metabolic disorders, advanced healthcare infrastructure, and strong adoption of innovative technologies. Major manufacturers, well-established hospitals, and research institutions, along with favorable reimbursement policies and high healthcare spending, drive demand for both clinical and research applications in the region.

- In the product type segment of the blood flow measurement devices market, the CMF ultrasound-based devices category is estimated to account for the largest market share in 2024.

Blood Flow Measurement Devices Market Size and Forecasts

|

Report Metrics |

Details |

|

2024 Market Size |

USD 544.01 million |

|

2032 Projected Market Size |

USD 874.80 million |

|

Growth Rate (2025-2032) |

6.19% CAGR |

|

Largest Market |

North America |

|

Fastest Growing Market |

Asia-Pacific |

|

Market Structure |

Moderately Concentrated |

Factors Contributing to the Growth of the Blood Flow Measurement Devices Market

- The rising cases of cardiovascular disorders, diabetes, and other associated risk factors leading to a surge in blood flow measurement devices: The rising prevalence of cardiovascular disorders, diabetes, and related risk factors is driving demand for blood flow measurement devices. Tools like Doppler ultrasound and laser Doppler flowmeters are vital for early diagnosis, monitoring, and treatment, and the growing adoption of advanced non-invasive technologies is fuelling market growth.

- Increasing advancements in device technology are escalating the market of blood flow measurement devices: Increasing advancements in device technology are boosting the blood flow measurement devices market by making diagnostics more accurate, non-invasive, and real-time. Innovations such as laser speckle imaging, AI integration, portable ultrasound systems, and wireless monitoring enhance clinical efficiency and broaden applications in hospitals, research, and home healthcare, driving faster adoption globally.

- Increase in expansion of minimally invasive and point-of-care diagnostics: The expansion of minimally invasive and point-of-care diagnostics is boosting the blood flow measurement devices market by enabling faster, safer, and more convenient monitoring. These technologies reduce patient risk and recovery time while allowing real-time vascular assessments in hospitals, clinics, and even bedside settings, driving wider adoption.

Blood Flow Measurement Devices Market Report Segmentation

This blood flow measurement devices market report offers a comprehensive overview of the global blood flow measurement devices market, highlighting key trends, growth drivers, challenges, and opportunities. It covers detailed market segmentation by Product Type (Ultrasound-Based Devices [Doppler Ultrasound Systems and Transit-Time Flow Meters] and Laser-Based Devices [Laser Doppler Blood Flowmeters, Laser Doppler Imaging, and Laser Speckle Contrast Imaging]), Modality (Invasive and Non-Invasive), End-Users (Hospitals and Clinics, Ambulatory Surgical Centers (ASCs), and Others), and Geography. The report provides valuable insights into the competitive landscape, regulatory environment, and market dynamics across major markets, including North America, Europe, and Asia-Pacific. Featuring in-depth profiles of leading industry players and recent product innovations, this report equips businesses with essential data to identify market potential, develop strategic plans, and capitalize on emerging opportunities in the rapidly growing blood flow measurement devices market.

Blood flow measurement devices are instruments designed to quantify the rate of blood circulation in the cardiovascular system. These devices, often referred to as blood flowmeters, are crucial for diagnosing and monitoring various medical conditions, as well as for research. They operate on different principles to measure the volume of blood passing through a vessel per unit of time. Some devices are invasive, requiring direct contact with the blood vessel, such as electromagnetic flowmeters and transit-time ultrasonic flowmeters. These are typically used during surgery or in research settings. Others are non-invasive, measuring blood flow without breaking the skin, making them ideal for routine clinical use. The most common non-invasive devices, like Doppler ultrasonic flowmeters, use sound waves to detect the movement of red blood cells and calculate blood flow velocity based on the Doppler effect.

The growth of the blood flow measurement devices market is largely fueled by the rising prevalence of cardiovascular disorders, diabetes, and related risk factors that significantly increase the demand for advanced diagnostic tools. Rapid technological advancements, including the integration of Doppler ultrasound, laser-based systems, and wearable sensors, are enhancing diagnostic accuracy and accessibility. The growing adoption of minimally invasive and point-of-care diagnostics is further accelerating market penetration by enabling faster and more convenient patient monitoring. Additionally, increasing product development initiatives and strategic investments by leading players are expanding the portfolio of innovative solutions, supporting wider clinical and consumer adoption.

What are the latest Blood Flow Measurement Devices Market Dynamics and Trends?

The global market for blood flow measurement devices is witnessing strong growth, primarily driven by the rising prevalence of cardiovascular disorders, diabetes, and stroke. These conditions demand accurate vascular monitoring tools that support early detection, diagnosis, and ongoing treatment management.

According to DelveInsight analysis (2024), nearly 621 million people globally live with heart and circulatory diseases, highlighting a massive and expanding patient pool that requires advanced monitoring solutions. Among these, coronary (ischemic) heart disease is the most prevalent, affecting around 200 million individuals worldwide, with 110 million men and 80 million women (British Heart Foundation, 2024). Given that coronary artery disease is one of the leading causes of morbidity and mortality, there is a heightened demand for precise, non-invasive technologies such as Doppler ultrasound and laser-based systems to assess circulation, detect arterial blockages, and guide timely treatment decisions.

In parallel, the burden of acute ischemic stroke (AIS) is significantly contributing to market growth. Data from DelveInsight Business Research LLP (2024) suggested that in the 7MM (US, EU5, Japan), nearly 754,000 cases of AIS were reported in 2024, a figure expected to rise by 2034. Since stroke is primarily caused by reduced or blocked blood flow to the brain, accurate evaluation of cerebral circulation becomes critical. Devices such as transcranial Doppler ultrasound, laser Doppler flowmeters, and MRI-based perfusion imaging systems play an essential role in assessing blood flow, identifying vascular occlusions, and guiding interventions like thrombolysis or mechanical thrombectomy.

Beyond traditional hospital-based devices, the market is also seeing growth in wearable and point-of-care diagnostics, which align with the global shift toward minimally invasive and patient-centric healthcare. For instance, in June 2023, U.S.-based digital health company STAT Health launched the world’s smallest 24/7 in-ear wearable, designed to measure blood flow to the head. This device addresses conditions linked to impaired circulation, such as long COVID, postural orthostatic tachycardia syndrome (POTS), and chronic fatigue syndrome. By targeting symptoms like dizziness, headaches, brain fog, and fainting, the device demonstrates how innovative technologies are expanding the applications of blood flow monitoring beyond cardiology and neurology into areas such as chronic disease management and wellness monitoring.

Moreover, continuous technological advancements are reshaping this market. The integration of AI and machine learning in Doppler and laser-based systems is enhancing accuracy, real-time data analysis, and predictive insights, while the development of portable and handheld devices is making diagnostics more accessible in emergency care, outpatient clinics, and even home settings.

Taken together, these factors underscore a dynamic market landscape where rising disease prevalence, growing emphasis on preventive healthcare, and rapid innovation are converging to drive sustained growth. As blood flow measurement technologies evolve to become more precise, portable, and patient-friendly, their role in improving clinical outcomes and expanding into new therapeutic areas will continue to strengthen globally.

The growth of the blood flow measurement devices market is hampered by several key factors. A major constraint is the high cost of advanced devices, which limits their affordability and widespread adoption, particularly in developing regions. Furthermore, the market faces various technical limitations, including issues with accuracy and consistency due to factors like probe angle and patient movement, as well as the limited depth penetration of certain non-invasive technologies like laser Doppler. Some devices also suffer from signal interference, which can compromise the reliability of readings and hinder diagnostic imaging. Finally, the market's growth is challenged by operational and regulatory issues, such as a shortage of skilled professionals to operate the equipment, stringent and time-consuming regulatory approval processes, and a lack of clear reimbursement policies in many healthcare systems.

Blood Flow Measurement Devices Market Segment Analysis

Blood Flow Measurement Devices Market by Product Type (Ultrasound-Based Devices [Doppler Ultrasound Systems and Transit-Time Flow Meters] and Laser-Based Devices [Laser Doppler Blood Flowmeters, Laser Doppler Imaging, and Laser Speckle Contrast Imaging]), Modality (Invasive and Non-Invasive), End-Users (Hospitals and Clinics, Ambulatory Surgical Centers (ASCs), and Others), and Geography (North America, Europe, Asia-Pacific, and Rest of the World)

By Product Type: Ultrasound-Based Devices Category Dominates the Market

In the blood flow measurement devices market, the ultrasound-based devices segment is expected to dominate, accounting for 65% of the market share in 2024. Within this category, Doppler ultrasound systems are projected to hold the largest share. Widely recognized as reliable and non-invasive tools, Doppler ultrasound systems are indispensable in cardiology, neurology, and vascular medicine. They deliver real-time hemodynamic data, including blood velocity, flow direction, and turbulence, enabling clinicians to detect, monitor, and manage conditions such as coronary artery disease, peripheral artery disease, venous thrombosis, and cerebrovascular disorders.

The segment’s dominance is reinforced by its versatility and accessibility, as Doppler systems are deployed across hospitals, outpatient clinics, mobile diagnostic units, and point-of-care settings. Advances such as color Doppler, power Doppler, and spectral Doppler imaging have further improved diagnostic accuracy, image clarity, and clinical usability, leading to faster and more confident decision-making.

From a clinical and economic perspective, Doppler systems offer distinct advantages. Being non-invasive, they minimize patient risk compared to catheter-based procedures and allow repeated measurements for ongoing monitoring. Additionally, they are more affordable and easier to maintain than advanced imaging modalities like MRI or CT perfusion systems, broadening their adoption worldwide, especially in resource-constrained healthcare environments.

Innovation and product development are also key growth drivers. For instance, in July 2024, Flosonics Medical launched FloPatch, a wireless, wearable Doppler device adopted by Sutter Health to monitor blood flow in critically ill patients. FDA-cleared and bedside-ready, FloPatch enables continuous, hands-free monitoring and supports fluid management, cardiopulmonary resuscitation, and personalized care in intensive care units. Such breakthroughs are expanding the use of Doppler ultrasound beyond traditional diagnostic settings into critical care, remote monitoring, and patient-centric healthcare.

Collectively, these factors firmly establish Doppler ultrasound systems as the leading sub-segment within ultrasound-based blood flow measurement devices. Their growing clinical utility, cost-effectiveness, and expanding applications are expected to drive sustained growth, thereby contributing significantly to the overall expansion of the global blood flow measurement devices market.

By Modality: Non-Invasive Category Dominates the Market

In the modality segment of the blood flow measurement devices market, the non-invasive category is projected to hold the largest share of 78% in 2024. This dominance is attributed to its safety profile, ease of use, and growing clinical acceptance across diverse healthcare settings. Non-invasive devices, including Doppler ultrasound systems, laser Doppler flowmeters, and wearable monitoring technologies, enable clinicians to assess blood flow without penetrating the skin or accessing the vascular system directly, thereby minimizing patient risk, discomfort, and procedural complications. This benefit is particularly critical in vulnerable populations such as elderly patients, individuals with cardiovascular diseases, and critically ill patients, where invasive procedures carry higher morbidity and require specialized infrastructure.

The rising preference for point-of-care and bedside diagnostics is also accelerating adoption, as non-invasive systems provide rapid, real-time hemodynamic data that support timely decision-making in outpatient clinics, emergency departments, and intensive care units. Technological innovations, including device miniaturization, wireless connectivity, AI-driven data analytics, and enhanced sensor accuracy, have further improved the reliability and usability of these systems. These advances enable continuous monitoring and seamless integration with electronic health records, supporting both acute care and long-term disease management.

From an economic and operational standpoint, non-invasive modalities also offer clear advantages, including lower procedural costs, reduced reliance on highly specialized personnel, and shorter examination times. These efficiencies make them attractive for healthcare providers striving to balance quality care with cost-effectiveness.

When combined with the rising global burden of cardiovascular disease, stroke, and diabetes, as well as the broader healthcare shift toward minimally invasive and patient-centric solutions, these factors firmly establish non-invasive blood flow measurement devices as the dominant modality segment. Their expanding clinical utility and favorable adoption drivers are expected to ensure sustained growth and reinforce their leadership in the global market over the forecast period.

By End-Users: Hospitals and Clinics Dominate the Market

Hospitals and clinics are driving the growth of the blood flow measurement devices market by serving as the primary points of care where these devices are used for diagnosis, monitoring, and treatment of cardiovascular and cerebrovascular conditions. Their increasing adoption of advanced, non-invasive, and real-time monitoring technologies, combined with rising patient volumes, demand for early detection, and focus on personalized care, is significantly boosting market demand. Additionally, hospitals and clinics invest in point-of-care and bedside devices, such as Doppler ultrasound and wearable monitors, further expanding the applications and reach of blood flow measurement solutions.

Blood Flow Measurement Devices Market Regional Analysis

North America Blood Flow Measurement Devices Market Trends

North America is projected to dominate the blood flow measurement devices market in 2024 with a 41% share. This leadership is underpinned by a high prevalence of cardiovascular and metabolic disorders, a well-established healthcare infrastructure, and a strong inclination toward adopting advanced medical technologies. The region also benefits from favourable reimbursement frameworks and a culture of early adoption of innovative solutions. Moreover, the increasing volume of minimally invasive procedures, frequent product launches, and growing awareness of preventive diagnostics are expected to further consolidate North America’s position in the global market.

Impact of Cardiovascular and Metabolic Disorders

The high incidence of cardiovascular diseases remains one of the strongest market drivers. According to DelveInsight (2024), approximately 4.0% of U.S. adults are diagnosed with coronary heart disease, while an estimated 12.2 million people were living with atrial fibrillation (AF) in 2023. Blood flow measurement devices, particularly Doppler ultrasound systems, play a critical role in detecting arterial blockages, assessing blood velocity, and guiding life-saving interventions such as angioplasty and bypass surgery. In AF management, these devices are essential for monitoring blood circulation, helping to prevent severe complications such as ischemic stroke.

Metabolic disorders, especially diabetes, further expand the demand for these devices. The International Diabetes Federation (2025) reported that nearly 56 million people in North America were living with diabetes, a condition often linked to vascular complications such as peripheral artery disease and diabetic neuropathy. In this context, blood flow measurement devices are vital for:

- Early detection of circulatory issues,

- Personalized treatment planning, and

- Prevention of severe complications such as diabetic foot ulcers and amputations.

Advanced tools like Doppler ultrasound and laser Doppler flowmeters provide insights into both macrovascular and microvascular health. Simultaneously, the growing availability of home-based and wearable sensors is transforming disease management by enabling continuous monitoring, reducing hospital visits, and supporting preventive care.

Product Development and Innovation

Market expansion is further fueled by a surge in product development and cross-industry innovation. For instance, the launch of Powerbeats Pro 2 (February 2025), although primarily a consumer electronic, incorporated an advanced optical heart-rate sensor leveraging light pulses to measure blood flow and translate it into heart rate data. Such developments underscore the increasing convergence of medical-grade monitoring technologies with consumer electronics and wearables. This trend is not only expanding the accessibility of blood flow measurement but also creating opportunities for early detection and lifestyle-driven healthcare management.

In addition, established MedTech players are actively investing in R&D to integrate artificial intelligence (AI) and machine learning (ML) into diagnostic platforms, enabling real-time blood flow analytics and predictive modeling for vascular health. These advancements are expected to enhance diagnostic accuracy, streamline clinical workflows, and broaden adoption across both hospital and home-care settings.

Europe Blood Flow Measurement Devices Market Trends

Europe is a major driver of the blood flow measurement devices market, fueled by advanced healthcare infrastructure, high disease prevalence, and rapid adoption of innovative technologies. According to DelveInsight (2024), around 4.0% of U.S. adults are diagnosed with coronary heart disease, and by 2023, 12.2 million Europeans were living with atrial fibrillation, highlighting a significant population requiring continuous cardiovascular monitoring. The rising prevalence of cardiovascular disorders, diabetes, and an aging population is increasing the demand for accurate, non-invasive, real-time blood flow measurement devices to support early diagnosis, risk stratification, and personalized care. Hospitals and clinics are investing in Doppler ultrasound, laser-based flowmeters, wearable monitors, and AI-assisted platforms, while home-based and point-of-care monitoring is gaining traction. Strong government initiatives, reimbursement support, and ongoing R&D are further accelerating adoption, expanding applications beyond hospitals, and driving sustained market growth across Europe.

Asia-Pacific Blood Flow Measurement Devices Market Trends

The Asia-Pacific region is rapidly emerging as a major growth driver for the blood flow measurement devices market, driven by a combination of rising prevalence of cardiovascular diseases, diabetes, and stroke, growing healthcare expenditure, and increasing adoption of advanced medical technologies. Countries such as China, Japan, and India are witnessing a significant increase in the patient population requiring accurate and timely blood flow monitoring due to aging populations, urbanization, and lifestyle-related risk factors. The expansion of healthcare infrastructure, including hospitals, diagnostic centers, and outpatient clinics, is facilitating the adoption of Doppler ultrasound systems, laser-based flowmeters, wearable monitoring devices, and point-of-care solutions. Additionally, increasing awareness among healthcare professionals and patients regarding early diagnosis, preventive care, and personalized treatment is boosting the demand for non-invasive and real-time monitoring technologies. Government initiatives, reimbursement programs, and investments by key market players in R&D, localized manufacturing, and distribution networks are further accelerating market growth. Combined, these factors are positioning the Asia-Pacific region as one of the fastest-growing and most promising markets for blood flow measurement devices globally.

Who are the major players in the blood flow measurement devices market?

The following are the leading companies in the blood flow measurement devices market. These companies collectively hold the largest market share and dictate industry trends.

- Cook

- Medistim

- Compumedics Limited

- Permed AB

- Deltex Medical Limited

- Koninklijke Philips N.V.

- Getinge

- Arjo

- ATYS Medical

- Moor Instruments Limited

- Medtronic

- AKW Medical, Inc.

- D. E. Hokanson, Inc.

- ELCAT GmbH

- Oxford Optronix

- QT Medical Inc

- Transonic

- Carolina Medical Electronics

- ADINSTRUMENTS

- STAT Health Informatics, Inc.

- Others

How is the competitive landscape shaping the blood flow measurement devices market?

The competitive landscape of the blood flow measurement devices market is characterized by the presence of a mix of established multinational medical device companies and emerging innovative startups, leading to a moderately concentrated market. Key players such as GE Healthcare, Philips, Siemens Healthineers, Flosonics Medical, Boston Scientific, and LivaNova dominate the market with a wide portfolio of Doppler ultrasound systems, laser-based flowmeters, MRI/CT-based imaging devices, and wearable monitoring solutions. These companies leverage strong R&D capabilities, strategic partnerships, mergers and acquisitions, and global distribution networks to maintain a competitive edge and expand their market presence. At the same time, innovative startups focusing on wearable, wireless, and AI-assisted blood flow measurement technologies are introducing niche products that target point-of-care and home monitoring applications, driving innovation and diversifying offerings. Market concentration is moderate, as the top players hold significant shares, particularly in hospital and clinical segments, while smaller players and startups are gaining traction in home healthcare and critical care monitoring. Competitive strategies, including product launches, FDA/CE approvals, and technological differentiation, are shaping the market by enhancing accessibility, improving diagnostic accuracy, and driving adoption across regions. This dynamic landscape ensures continuous innovation while promoting broader adoption of blood flow measurement devices globally.

Recent Developmental Activities in the Blood Flow Measurement Devices Market

- In February 2025, Beats launched the Powerbeats Pro 2, featuring advanced heart rate monitoring with LED optical sensors that measure blood flow over 100 times per second, providing precise tracking of circulation.

- In January 2025, electronRx, a digital medicine company, unveiled purpleDx, a cardiopulmonary assessment that uses the iPhone camera to capture and measure blood flow around the face.

- In January 2025, Lumia Health launched a wearable that tracks blood flow to the head. The Lumia™ device is designed to help users monitor and manage symptoms such as dizziness, brain fog, fatigue, and fainting.

In July 2024, Flosonics Medical introduced FloPatch, a wireless, wearable Doppler device adopted by Sutter Health to monitor blood flow in critically ill patients.

In June 2023, U.S.-based digital health company STAT Health launched the world’s smallest 24/7 in-ear wearable, designed to measure blood flow to the head.

In June 2023, STAT Health, a U.S.-based digital health company, launched a 24/7 in-ear wearable that continuously monitors blood flow to the head. This compact device aims to help diagnose and manage symptoms like dizziness, brain fog, and fatigue, which are often linked to conditions such as long COVID, postural orthostatic tachycardia syndrome, and chronic fatigue syndrome.

|

Report Metrics |

Details |

|

Study Period |

2022 to 2032 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2032 |

|

Blood Flow Measurement Devices Market CAGR |

6.19% |

|

Key Companies in the Blood Flow Measurement Devices Market |

Cook, Medistim, Compumedics Limited, Permed AB, Deltex Medical Limited, Koninklijke Philips N.V., Getinge, Arjo, ATYS Medical, Moor Instruments Limited, Medtronic, AKW Medical, Inc., D. E. Hokanson, Inc., ELCAT GmbH, Oxford Optronix, QT Medical Inc., Transonic, Carolina Medical Electronics, ADINSTRUMENTS, STAT Health Informatics, Inc., and others. |

|

Blood Flow Measurement Devices Market Segments |

by Product Type, by Modality, by End-Users, and by Geography |

|

Blood Flow Measurement Devices Regional Scope |

North America, Europe, Asia Pacific, Middle East, Africa, and South America |

|

Blood Flow Measurement Devices Country Scope |

U.S., Canada, Mexico, Germany, United Kingdom, France, Italy, Spain, China, Japan, India, Australia, South Korea, and key Countries |

Blood Flow Measurement Devices Market Segmentation

Blood Flow Measurement Devices by Product Type Exposure

o Ultrasound-Based Devices

Doppler Ultrasound Systems

Transit-Time Flow Meters

o Laser-Based Devices

Laser Doppler Blood Flowmeters

Laser Doppler Imaging

Laser Speckle Contrast Imaging

Blood Flow Measurement Devices Modality Exposure

o Invasive

o Non-Invasive

Blood Flow Measurement Devices End-Users Exposure

o Hospitals and Clinics

o Ambulatory Surgical Centers (ASCs)

o Others

Blood Flow Measurement Devices Geography Exposure

o North America Blood Flow Measurement Devices Market

United States Blood Flow Measurement Devices Market

Canada Blood Flow Measurement Devices Market

Mexico Blood Flow Measurement Devices Market

o Europe Blood Flow Measurement Devices Market

United Kingdom Blood Flow Measurement Devices Market

Germany Blood Flow Measurement Devices Market

France Blood Flow Measurement Devices Market

Italy Blood Flow Measurement Devices Market

Spain Blood Flow Measurement Devices Market

Rest of Europe Blood Flow Measurement Devices Market

o Asia-Pacific Blood Flow Measurement Devices Market

China Blood Flow Measurement Devices Market

Japan Blood Flow Measurement Devices Market

India Blood Flow Measurement Devices Market

Australia Blood Flow Measurement Devices Market

South Korea Blood Flow Measurement Devices Market

Rest of Asia-Pacific Blood Flow Measurement Devices Market

o Rest of the World Blood Flow Measurement Devices Market

South America Blood Flow Measurement Devices Market

Middle East Blood Flow Measurement Devices Market

Africa Blood Flow Measurement Devices Market

Blood Flow Measurement Devices Market Recent Industry Trends and Milestones (2022-2025)

|

Category |

Key Developments |

|

Blood Flow Measurement Devices Product Launches |

Beats launched the Powerbeats Pro 2, electronRx launched purpleDx, and Lumia Health launched Lumia™. |

|

Blood Flow Measurement Devices Regulatory Approvals |

FloPatch - Flosonics Medical (FDA) |

|

Partnerships in the Blood Flow Measurement Devices Market |

Biopac Systems Inc. and Moor Instruments Ltd. continue to serve academic and research institutes with laser Doppler and NIRS-based blood flow instruments. |

|

Acquisitions in the Blood Flow Measurement Devices Market |

Medtronic acquired Laser Associated Sciences, a manufacturer specializing in blood flow measurement devices. |

|

Company Strategy |

· Medtronic is enhancing its portfolio with non-invasive blood flow measurement technologies. The company has expanded its Acute Care & Monitoring portfolio in Europe through a distribution agreement for the Corsano™ multi-parameter wearable, designed for continuous monitoring of vital signs. · Flosonics Medical is revolutionizing critical care with its wearable ultrasound device, FloPatch. The company is expanding the deployment of FloPatch to new hospital sites, aiming to enhance patient safety and care efficiency. |

|

Emerging Technology |

Laser-Based Spectroscopy for Cerebral Blood Flow, Diffuse Speckle Contrast Spectroscopy (DSCS) with SPAD Cameras, Flexible Doppler Ultrasound Devices |

Impact Analysis

AI-Powered Innovations and Applications:

AI-powered innovations are transforming blood flow measurement devices by enhancing diagnostic accuracy, enabling real-time monitoring, and supporting personalized patient care across critical care, cardiovascular health, and chronic disease management. Advanced platforms like BD’s HemoSphere Alta™ integrate AI-driven predictive algorithms to proactively manage blood pressure instability in critical care, while contactless AI-based systems enable rapid detection of hypertension and diabetes without cuffs or blood tests, improving accessibility and early diagnosis. AI-enhanced stethoscopes developed by Imperial College London can diagnose heart failure, valve disease, and arrhythmias within seconds by combining ECG and heart sound data analyzed via the cloud. Similarly, technologies like Shen AI’s remote photoplethysmography use smartphone cameras to monitor multiple health markers, including blood flow, across diverse skin tones and lighting conditions. Continuous nocturnal monitoring systems leveraging ballistocardiogram signals provide comfortable, accurate assessments during sleep. Collectively, these AI-driven innovations are making blood flow measurement more precise, non-invasive, and patient-friendly, expanding its applications in hospitals, outpatient clinics, and home settings.

U.S. Tariff Impact Analysis on Blood Flow Measurement Devices Market:

U.S. tariff policies on imported medical devices are impacting the blood flow measurement devices market by increasing manufacturing costs and creating supply chain challenges. These tariffs can lead to higher device prices, potential delays in equipment upgrades, and occasional shortages of critical technologies. In response, companies are exploring strategies such as shifting production to regions with favorable trade policies, investing in domestic manufacturing, and seeking tariff exemptions. Adjustments in international trade agreements have also helped some companies mitigate tariff impacts. Overall, tariffs are shaping pricing strategies, supply chain decisions, and market dynamics in the sector.

How This Analysis Helps Clients

- Cost Management: By understanding the tariff landscape, clients can anticipate cost increases and adjust pricing strategies accordingly, ensuring profitability.

- Supply Chain Optimization: Clients can identify alternative sourcing options and diversify their supply chains to reduce dependency on high-tariff regions, enhancing resilience.

- Regulatory Navigation: Expert guidance on navigating the evolving regulatory environment helps clients maintain compliance and avoid potential legal challenges.

- Strategic Planning: Insights into tariff impacts enable clients to make informed decisions about manufacturing locations, partnerships, and market entry strategies.

Key takeaways from the blood flow measurement devices market report study:

- Market size analysis for the current blood flow measurement devices market size (2024), and market forecast for 8 years (2025 to 2032)

- Top key product/technology developments, mergers, acquisitions, partnerships, and joint ventures happened over the last 3 years.

- Key companies dominating the blood flow measurement devices market.

- Various opportunities available for the other competitors in the blood flow measurement devices market space.

- What are the top-performing segments in 2024? How these segments will perform in 2032?

- Which are the top-performing regions and countries in the current blood flow measurement devices market scenario?

- Which are the regions and countries where companies should have concentrated on opportunities for the blood flow measurement devices market growth in the future?