Bronchiolitis Market

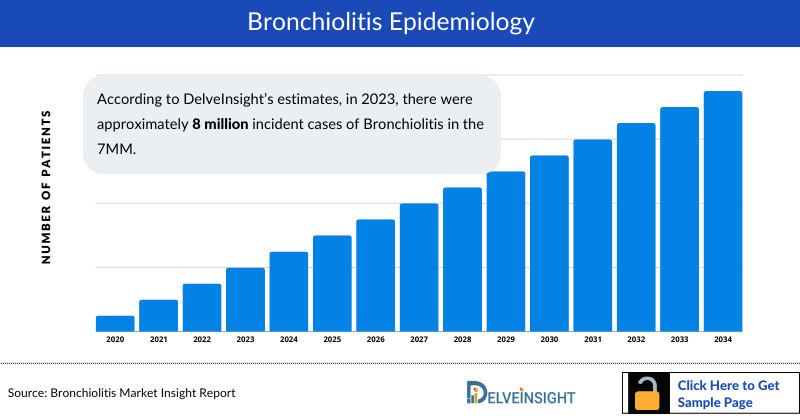

- According to DelveInsight’s estimates, in 2023, there were approximately 8 million incident cases of Bronchiolitis in the 7MM. Of these, the US accounted for nearly 51% of the cases, while EU4 and the UK represented 38% of the cases, and Japan accounted for 11% of cases respectively. These cases are expected to rise driven by factors such as rising birth rates, urbanization, environmental pollutants, heightened seasonal RSV activity, and improved diagnostic practices, collectively amplifying the demand for preventive and therapeutic interventions.

- The Bronchiolitis Market is set for steady growth, with a robust compound annual growth rate (CAGR) anticipated from 2024 to 2034. This expansion in the 7MM is driven by the introduction of innovative therapies such as IVX-A12, and MK-1654, among others.

- According to DelveInsight’s analysis, the Bronchiolitis Market in the 7MM is projected to grow at a compound annual growth rate (CAGR) of 4% during the study period (2020-2034).

- While there are currently no directly acting approved treatments for bronchiolitis, ongoing research and development efforts aim to address this gap. The market is witnessing a focus on developing antiviral therapies and preventive vaccines targeting respiratory syncytial virus (RSV), which is a primary cause of bronchiolitis. The success of these emerging therapies could significantly impact the Bronchiolitis treatment market landscape.

- Given the high unmet needs, key Bronchiolitis Companies in the market include Inmunotek, Sanofi, and AstraZeneca among others, who are actively advancing therapeutic and preventive solutions to address the growing incidence and management of bronchiolitis.

Request for Unlocking the Sample Pages of the "Bronchiolitis Treatment Market"

DelveInsight’s “Bronchiolitis Market Insights, Epidemiology, and Market Forecast – 2034” report delivers an in-depth understanding of Bronchiolitis, historical and forecasted epidemiology, as well as the Bronchiolitis market trends in the United States, EU4 (Germany, France, Italy, and Spain) and the United Kingdom, and Japan.

The Bronchiolitis Treatment Market report provides current treatment practices, emerging drugs, market share of individual therapies, and current and forecasted 7MM Bronchiolitis market size from 2020 to 2034. The report also covers Bronchiolitis treatment market practices/algorithms and unmet medical needs to curate the best opportunities and assess the market’s potential.

|

Study Period |

2020–2034 |

|

Forecast Period |

2024–2034 |

|

Geographies Covered |

US, EU4 (Germany, France, Italy, and Spain) and the UK, and Japan |

|

Bronchiolitis Epidemiology |

|

|

Bronchiolitis Market |

|

|

Bronchiolitis Market Analysis |

|

|

Bronchiolitis Companies |

|

|

Future Opportunity |

A significant future opportunity in the bronchiolitis treatment market lies in the development and deployment of targeted RSV vaccines and long-acting monoclonal antibodies. These innovations have the potential to reduce the incidence and severity of bronchiolitis, addressing unmet needs in both prevention and management. As these therapies advance through clinical trials and achieve regulatory approvals, they are poised to enhance patient outcomes and expand market growth by providing effective, long-term protection for high-risk populations. |

Bronchiolitis Treatment Market: Understanding and Algorithm

Bronchiolitis is primarily characterized by virus-induced inflammation of the small bronchioles and adjacent tissues, typically triggered by respiratory viruses that invade the epithelial cells of the airways. It commonly presents with upper respiratory symptoms such as rhinorrhea, followed by a persistent cough, tachypnea, and chest wall recessions, with clinical signs including widespread crackles and wheezing. The condition exhibits a distinct seasonal pattern, with respiratory syncytial virus (RSV) causing consistent annual or biannual epidemics across various regions, although the timing and intensity of these outbreaks can differ by geography. Risk factors include exposure to RSV, environmental pollutants, secondhand smoke, and prematurity, all of which contribute to the increased susceptibility and severity of bronchiolitis.

Bronchiolitis diagnosis

Diagnosis of bronchiolitis should be based on a comprehensive assessment of the patient's clinical history and manifestations, including symptoms such as persistent cough, wheezing, and tachypnea. Evaluating the severity involves correlating these symptoms with physical examination findings such as chest wall recessions and crackles. Key diagnostic investigations include viral identification through assays like PCR or rapid antigen tests, which confirm the presence of the causative virus. RSV accounts for approximately 80% of bronchiolitis cases, making it a primary target for diagnostic testing. Additionally, the exclusion of other respiratory conditions and the assessment of disease severity can guide appropriate management strategies.

Further details related to country-based variations are provided in the report…

Bronchiolitis treatment

The treatment for bronchiolitis remains focused on supportive care, with oxygen therapy, hydration, and nasal suctioning as standard practices. FDA-approved therapies are limited, with ribavirin being the only antiviral agent approved for severe RSV infections, though its use is rare due to toxicity and high cost. SYNAGIS (palivizumab), a monoclonal antibody licensed for RSV protection, has been available for over 20 years but is primarily reserved for high-risk infants due to its high cost and limited use in broader populations.

Emerging drugs are shifting the landscape, particularly with AstraZeneca and Sanofi’s BEYFORTUS (nirsevimab), an extended half-life monoclonal antibody that has recently gained FDA approval for RSV. Nirsevimab promises to offer single-dose protection against RSV for all infants during their first season, marking a significant advance in passive immunization strategies. Another innovative approach is Inmunotek's MV130, a trained immunity-based vaccine (TIbV) that has shown efficacy in reducing wheezing episodes in bronchiolitis patients during phase III trials. While the pipeline remains heavily oriented toward RSV-related therapies, the introduction of these novel agents could significantly alter bronchiolitis management by reducing the incidence and severity of RSV-induced bronchiolitis in infants.

Bronchiolitis Epidemiology

As the market is derived using a patient-based model, the Bronchiolitis epidemiology chapter in the report provides historical as well as forecasted epidemiology segmented by Incidence of Bronchiolitis and Incidence of Bronchiolitis by Etiologies in the 7MM covering the United States, EU4 countries (Germany, France, Italy, and Spain) and the United Kingdom, and Japan from 2020 to 2034.

- According to DelveInsight’s epidemiology model, in the US, the total Bronchiolitis incident cases were approximately 4 million in 2023. This number is anticipated to rise during the forecast period (2024-2034), driven by increased awareness and screening, along with advancements in genetic testing.

- Among the etiology-specific incident cases of Bronchiolitis in the US in 2023, there were approximately 2 million cases of Respiratory Syncytial Virus (RSV) and 1 million cases of Non-RSV/others.

- In 2023, Japan reported 677 thousand cases of bronchiolitis caused by Respiratory Syncytial Virus and 208 thousand cases attributed to other etiologies.

Bronchiolitis Marketed Therapies

- ABRYSVO: Pfizer

ABRYSVO is a vaccine developed by Pfizer Inc. for the active immunization of individuals to prevent lower respiratory tract disease (LRTD) caused by respiratory syncytial virus (RSV). In May 2023, the FDA approved ABRYSVO for use in older adults aged 60 and above, making it one of the first vaccines available to protect against RSV in this age group. Additionally, ABRYSVO received FDA approval in August 2023 for use in pregnant women to help protect their newborns from RSV during their first months of life. This dual indication makes ABRYSVO a significant advancement in preventing RSV-related LRTD in both vulnerable older adults and infants. The vaccine works by targeting the F protein of the RSV virus, inducing an immune response that helps prevent severe RSV infections.

BEYFORTUS (nirsevimab-alip): Sanofi/ AstraZeneca

BEYFORTUS (nirsevimab-alip) is an RSV F protein-directed fusion inhibitor developed by AstraZeneca. It is designed for the prevention of RSV lower respiratory tract disease (LRTD) in neonates and infants. BEYFORTUS is a monoclonal antibody that provides passive immunization by binding to the RSV F protein, preventing the virus from entering cells and causing infection.

In July 2023, the FDA approved BEYFORTUS for use in all infants entering their first RSV season, as well as for high-risk infants, such as those with congenital heart disease or chronic lung disease, entering their second RSV season. This approval marks a significant advancement in protecting infants, especially those who are most vulnerable, from RSV-related lower respiratory tract disease. BEYFORTUS is administered as a single intramuscular injection, offering long-lasting protection throughout the RSV season.

|

Drug |

MoA |

RoA |

Company |

Logo |

|

ABRYSVO |

Immunostimulants |

Intramuscular injection |

Pfizer |

|

|

BEYFORTUS (nirsevimab-alip) |

Monoclonal antibodies |

IV |

Sanofi |

|

|

XX |

XXX |

XX |

XXX |

|

Note: Further marketed drugs and their details will be provided in the report…

Bronchiolitis Emerging Drugs

- Clesrovimab (MK-1654): Merck

Clesrovimab (MK-1654) is an investigational extended half-life monoclonal antibody (mAb) developed by Merck for passive immunization to prevent RSV-associated medically attended lower respiratory infection (MALRI). Designed to provide rapid and durable protection through a single, fixed-dose administration, clesrovimab is currently being studied in both pre-term and full-term infants to cover their first RSV season. As of the latest update, clesrovimab is in Phase III of development, focusing on assessing its efficacy and safety in a broader population.

- IVX-A12: Icosavax/ AstraZeneca

IVX-A12 is an investigational monoclonal antibody developed by Icosavax is intended for prevention of RSV and hMPV infections, which are significant contributors to respiratory illnesses, including bronchiolitis. It targets the RSV F protein to inhibit the virus's ability to enter and infect cells. The company posted positive topline interim results from the Phase II trial RSV and hMPV in older adults.

|

Drug |

MoA |

RoA |

Company |

Logo |

Phase |

|

Clesrovimab (MK-1654) |

Monoclonal antibodies |

IM |

Merck |

|

III |

|

IVX-A12 |

Immunostimulants |

IV |

Icosavax/ AstraZeneca |

|

II |

|

XX |

XX |

XX |

XXX |

XX |

X |

Note: Further emerging therapies and their detailed assessment will be provided in the final report.

Bronchiolitis Drugs Market Insights

The treatment of bronchiolitis involves several drug classes, each targeting different aspects of the disease. Antivirals, such as ribavirin, are used in severe cases to inhibit the replication of RSV, although their use is limited due to toxicity and cost. Bronchodilators may be employed to relieve wheezing by relaxing bronchial muscles, though their effectiveness in bronchiolitis is debated. Corticosteroids, while commonly used in other respiratory conditions, generally have limited benefit in bronchiolitis and are not recommended routinely. Nebulized hypertonic saline helps by thinning mucus, thereby facilitating its clearance from the airways. The monoclonal antibody class, including palivizumab, offers passive immunization to prevent RSV in high-risk infants, reducing the incidence of severe bronchiolitis. Thus, each drug class plays a specific role in managing symptoms, preventing severe outcomes, or targeting the underlying viral cause of bronchiolitis.

Bronchiolitis Market Outlook

The current treatment landscape for RSV has seen notable advancements with the US FDA-approved therapies. ABRYSVO, an RSV vaccine developed by Pfizer, has been approved for use in older adults and pregnant women. This vaccine is designed to provide essential protection against RSV, aiming to reduce the incidence of severe disease and its complications. Additionally, BEYFORTUS (nirsevimab-alip), an extended half-life monoclonal antibody developed by AstraZeneca, has been approved for preventing RSV-associated lower respiratory tract disease in infants. Administered as a single intramuscular injection, BEYFORTUS offers long-lasting protection for neonates and high-risk infants throughout their first RSV season.

In the emerging pipeline, clesrovimab (MK-1654), an investigational monoclonal antibody developed by Merck, is currently in Phase III trials. It aims to provide extended protection through a single intravenous infusion, focusing on infants.

Supportive care remains a cornerstone of bronchiolitis management. Common practices include oxygen therapy via heated humidified high-flow nasal cannula (HFNC) to ensure adequate oxygenation, nasal suctioning to clear mucus from the airways, and appropriate hydration and nutrition management. Nebulized hypertonic saline is often used to aid in mucus clearance. Although bronchodilators, antibiotics, and antivirals like ribavirin are available, their use is generally limited to specific cases. The advancements in RSV therapies are poised to significantly impact the treatment of bronchiolitis, signaling a transformative shift in the management of this common respiratory condition.

Continued in report…

Key Bronchiolitis Companies such as Inmunotek, Sanofi, AstraZeneca, Merck & Co, and others are evaluating their lead candidates in different stages of clinical development. They aim to investigate their products to treat Bronchiolitis.

Bronchiolitis Drugs Uptake

This section focuses on the uptake rate of potential Bronchiolitis drugs expected to be launched in the market during 2020–2034. For example MK-1654 is expected to enter the US market in 2027 and is projected to have a medium uptake during the forecast period.

Further detailed analysis of emerging therapies drug uptake in the report…

Bronchiolitis Pipeline Development Activities

The Bronchiolitis therapeutics market report provides insights into different therapeutic candidates in Phase III, Phase II, and Phase I. It also analyzes key Bronchiolitis Companies involved in developing targeted therapeutics.

Pipeline development activities

The Bronchiolitis therapeutics market report covers information on collaborations, acquisitions and mergers, licensing, and patent details for Bronchiolitis emerging therapies.

Take Your Research to the Next Level! Click Here to Get Access to the Full Pipeline Report @ Bronchiolitis Obliterans Syndrome Treatment Drugs

KOL Views

To keep up with current market trends, we take KOLs and SMEs’ opinions working in the domain through primary research to fill the data gaps and validate our secondary research. Industry Experts contacted for insights on Bronchiolitis evolving treatment landscape, patient reliance on conventional therapies, patient therapy switching acceptability, and drug uptake, along with challenges related to accessibility, including Medical/scientific writers, Medical Professionals, Professors, Directors, and Others.

DelveInsight’s analysts connected with 50+ KOLs to gather insights; however, interviews were conducted with 15+ KOLs in the 7MM. Centers like the Centers for Disease Control and Prevention, Normandie University, University of Oxford, and the NIHR Oxford Biomedical Research Centre among others, were contacted. Their opinion helps understand and validate current and emerging therapy treatment patterns or Bronchiolitis market trends. This will support the clients in potential upcoming novel treatments by identifying the overall scenario of the market and the unmet needs.

Physician’s View

“As per the KOLs from the UK, According to the European classification, bronchiolitis is the first lower respiratory tract infection in infants less than 12 months of age. It is the American classification that includes children less than 24 months. Almost all children get RSV infection by the age of two years but only a minority of them develop bronchiolitis. This is possible due to viral or host immune factors.”

Bronchiolitis Drugs Market: Qualitative Analysis

We perform Qualitative and market Intelligence analysis using various approaches, such as SWOT and Conjoint Analysis. In the SWOT analysis, strengths, weaknesses, opportunities, and threats in terms of disease diagnosis, patient awareness, patient burden, competitive landscape, cost-effectiveness, and geographical accessibility of therapies are provided. These pointers are based on the Analyst’s discretion and assessment of the patient burden, cost analysis, and existing and evolving treatment landscape.

Conjoint Analysis analyzes multiple emerging therapies based on relevant attributes such as safety, efficacy, frequency of administration, route of administration, and order of entry. Scoring is given based on these parameters to analyze the effectiveness of therapy. To analyze the effectiveness of these therapies, have calculated their attributed analysis by giving them scores based on their ability to improve atrial and ventricular dimension/function and ability to regulate heart rate. Further, the therapies’ safety is evaluated wherein the adverse events are majorly observed, and it sets a clear understanding of the side effects posed by the drug in the trials, which directly affects the safety of the molecule in the upcoming trials.

It sets a clear understanding of the side effects posed by the drug in the trials. In addition, the scoring is also based on the route of administration, order of entry and designation, probability of success, and the addressable patient pool for each therapy. According to these parameters, the final weightage score and the ranking of the emerging therapies are decided.

Bronchiolitis Therapeutics Market Access and Reimbursement

The high cost of therapies for the treatment is a major factor restraining the growth of the global drug market. Because of the high cost, the economic burden is increasing, leading the patient to escape from proper treatment. The Bronchiolitis therapeutics market report further provides detailed insights on the country-wise accessibility and reimbursement scenarios, cost-effectiveness scenario of approved therapies, programs making accessibility easier and out-of-pocket costs more affordable, insights on patients insured under federal or state government prescription drug programs, etc. The Bronchiolitis therapeutics market report provides detailed insights on the country-wise accessibility and reimbursement scenarios, cost-effectiveness scenarios, programs making accessibility easier and out-of-pocket costs more affordable, insights on patients insured under federal or state government prescription drug programs, etc.

Bronchiolitis Therapeutics Market Report Scope

- The Bronchiolitis therapeutics market report covers a segment of key events, an executive summary, and a descriptive overview explaining its causes, signs and symptoms, pathogenesis, and currently available therapies.

- Comprehensive insight into the epidemiology segments and forecasts, the future growth potential of diagnosis rate, disease progression, and treatment guidelines have been provided.

- Additionally, an all-inclusive account of the current and emerging therapies and the elaborative profiles of late-stage and prominent therapies will impact the current Bronchiolitis treatment market landscape.

- A detailed review of the Bronchiolitis treatment market, historical and forecasted Bronchiolitis market size, Bronchiolitis drugs market share by therapies, detailed assumptions, and rationale behind our approach is included in the report, covering the 7MM drug outreach.

- The Bronchiolitis therapeutics market report provides an edge while developing business strategies by understanding trends through SWOT analysis and expert insights/KOL views, patient journey, and treatment preferences that help shape and drive the 7MM Bronchiolitis drugs market.

Bronchiolitis Therapeutics Market Report Insights

- Patient-based Bronchiolitis Market Forecasting

- Therapeutic Approaches

- Bronchiolitis Pipeline Drugs Analysis

- Bronchiolitis Market Size and Trends

- Existing and Future Bronchiolitis Drugs Market Opportunity

Bronchiolitis Therapeutics Market Report Key Strengths

- 11 years Bronchiolitis Market Forecast

- The 7MM Coverage

- Bronchiolitis Epidemiology Segmentation

- Key Cross Competition

- Attribute analysis

- Bronchiolitis Drugs Uptake

- Key Bronchiolitis Market Forecast Assumptions

Bronchiolitis Therapeutics Market Report Assessment

- Current Bronchiolitis Treatment Mrket Practices

- Bronchiolitis Unmet Needs

- Bronchiolitis Pipeline Drugs Analysis Profiles

- Bronchiolitis Drugs Market Attractiveness

- Qualitative Analysis (SWOT and Attribute Analysis)

Key Questions

Bronchiolitis Therapeutics Market Insights

- What was the total Bronchiolitis market size, the Bronchiolitis treatment market size by therapies, and Bronchiolitis drugs market share (%) distribution in 2020, and what would it look like by 2034? What are the contributing factors for this growth?

- How will clesrovimab (MK-1654) affect the treatment paradigm of Bronchiolitis?

- How will BEYFORTUS compete with the upcoming therapies?

- Which drug is going to be the largest contributor by 2034?

- What are the pricing variations among different geographies for approved and marketed therapies?

- How would future opportunities affect the market dynamics and subsequent analysis of the associated trends?

Bronchiolitis Epidemiology Insights

- What are the disease risks, burdens, and Bronchiolitis Unmet Needs? What will be the growth opportunities across the 7MM with respect to the patient population pertaining to Bronchiolitis?

- What is the historical and forecasted Bronchiolitis patient pool in the United States, EU4 (Germany, France, Italy, and Spain) and the United Kingdom, and Japan?

- Out of the countries mentioned above, which country would have the highest diagnosed prevalent Bronchiolitis population during the forecast period (2024–2034)?

- What factors are contributing to the growth of Bronchiolitis cases?

Current Bronchiolitis Treatment Market Scenario, Marketed Drugs, and Emerging Therapies

- What are the current options for the treatment of Bronchiolitis? What are the current clinical and treatment guidelines for treating Bronchiolitis?

- How many companies are developing therapies for the treatment of Bronchiolitis?

- How many emerging therapies are in the mid-stage and late stage of development for treating Bronchiolitis?

- What are the recent novel therapies, targets, Bronchiolitis Mechanisms of Action, and technologies developed to overcome the limitations of existing therapies?

- What is the cost burden of current treatment on the patient?

- Patient acceptability in terms of preferred treatment options as per real-world scenarios?

- What are the accessibility issues of approved therapy in the US?

- What is the 7MM historical and forecasted Bronchiolitis Drugs Market?

Reasons to Buy

- The Bronchiolitis drugs market report will help develop business strategies by understanding the latest trends and changing treatment dynamics driving the Bronchiolitis market.

- Insights on patient burden/disease Bronchiolitis prevalence, evolution in diagnosis, and factors contributing to the change in the epidemiology of the disease during the forecast years.

- Understand the existing market opportunities in varying geographies and the growth potential over the coming years.

- The distribution of historical and current patient share is based on real-world prescription data in the US, EU4 (Germany, France, Italy, and Spain) and the United Kingdom, and Japan.

- Identifying upcoming solid players in the Bronchiolitis drugs market will help devise strategies to help get ahead of competitors.

- Detailed analysis and ranking of class-wise potential current and emerging therapies under the conjoint analysis section to provide visibility around leading classes.

- Highlights of Access and Reimbursement policies for Bronchiolitis, barriers to accessibility of approved therapy, and patient assistance programs.

- To understand Key Opinion Leaders’ perspectives around the accessibility, acceptability, and compliance-related challenges of existing treatment to overcome barriers in the future.

- Detailed insights on the unmet needs of the existing Bronchiolitis drugs market so that the upcoming players can strengthen their development and launch strategy.

Stay Updated with us for Recent Articles