Candidemia Market

- The candidemia market is expected to experience significant growth during the forecast period (2024–2034). This is a direct consequence of various market-driving factors such as the rising incidence of candidemia, increasing susceptible immune-compromised patient pool, increasing awareness of the disease, and the development of innovative treatment options.

- The current candidemia market is dominated by big pharmaceutical companies like Cidara Therapeutics, Mycovia Pharmaceuticals, and Scynexis offering various approved therapies such as REZZAYO, VIVJOA, and BREXAFEMME for the treatment of candidemia and candidiasis

- Despite advances in diagnosis and treatment, the prognosis of candidemia remains high and far from desirable, with an overall mortality of nearly 30%, due to limitations in diagnostic tests, challenges concerning the timing of antifungal therapy initiation, and the development of new and innovative treatment approaches. However, with the robust emerging pipeline, the market will be driven by both approved and emerging therapies during the forecast period (2024–2034).

- To propel the market in the coming years, several companies like Pfizer, Basilea Pharmaceutical are developing their assets like fosmanogepix, etc. for candidemia. Due to the anticipated approval of some of the emerging therapies that are under development in the coming years, the overall candidemia therapeutics market is expected to grow at a significant CAGR over the forecast period [2024–2034].

DelveInsight’s comprehensive report titled “Candidemia— Market Insights, Epidemiology, and Market Forecast – 2034” offers a detailed analysis of Candidemia. The report presents historical and projected epidemiological data covering total incident cases of candidemia, gender-specific cases of candidemia, age-specific cases of candidemia, and treated cases of candidemia. In addition to epidemiology, the market report encompasses various aspects related to the patient population. These aspects include the diagnosis process, prescription patterns, physician perspectives, market accessibility, treatment options, and prospective developments in the market across seven major markets: the United States, EU4 (Germany, France, Italy, and Spain), the United Kingdom, and Japan, spanning from 2020 to 2034.

The report analyzes the existing treatment practices and unmet medical requirements in candidemia. It evaluates the market potential and identifies potential business prospects for enhancing therapies or interventions. This valuable information enables stakeholders to make well-informed decisions regarding product development and strategic planning for the market.

|

Study Period |

2020–2034 |

|

Forecast Period |

2024–2034 |

|

Geographies Covered |

US, EU4 (Germany, France, Italy, and Spain), the UK, and Japan |

|

Candidemia Epidemiology |

|

|

Candidemia Market |

|

|

Market Analysis |

|

|

Candidemia Market players |

And Others |

|

Future opportunity |

The development of breakthrough therapies, disease-modifying treatments, increased awareness and access to care, advancements in disease research, and personalized medicine may open up new avenues for targeted treatments, providing further opportunities for market growth. |

Candidemia Overview

Candidemia is a serious, life-threatening bloodstream infection and possibly the fourth most common all-type bloodstream infection seen in the intensive care unit setting. The incidence of Candida bloodstream infection is bimodal, with the elderly and very young having the highest risk of any population suffering from this disease.

Invasive fungal infections in critically ill patients are associated with considerable morbidity and mortality. Candida and Aspergillus species are the most frequent causes of healthcare-associated fungal infections in these patients. Although Candida infections are the most frequent fungal infections in ICU patients, invasive aspergillosis is associated with higher morbidity and mortality rates, even in the absence of traditional hematological risk factors. Occasionally, cryptococcosis, pneumocystosis, or zygomycosis may also be encountered in the ICU setting in patients with solid organ or hematopoietic stem cell transplantation, acquired immunodeficiency syndrome, cancer, or hematological malignancies. Symptoms of candidemia can include fever and chills, skin rash, generalized weakness or fatigue, low blood pressure, muscle aches, vision changes or signs of an eye infection headaches, and neurological deficits.

Candidemia Diagnosis and Treatment Algorithm

Prompt and accurate diagnosis of invasive fungal infection is crucial so that appropriate antifungal agents can be started rapidly. However, early diagnosis is not always easy. Microscopic examination is rapid and can be helpful, but a negative result does not exclude infection. Blood cultures are positive in only 50–70% of cases of Candida BSI. Furthermore, it can take several days before Candida is identified at the species level and antifungal susceptibility data are available. Moreover, blood cultures are rarely positive in patients with deep-seated candidiasis. In such patients, cultures of infected tissues can be performed but have their limitations, including the need for invasive surgical procedures and poor sensitivity.

For candidemia, treatment should continue for 2 weeks after signs and symptoms have resolved, and Candida yeasts are no longer in the bloodstream. Other forms of invasive candidiasis, such as infections in the bones, joints, heart, or central nervous system, usually need to be treated for a longer period. The specific type and dose of antifungal medication used to treat invasive candidiasis usually depends on the patient’s age, immune status, location, and severity of the infection. For most adults, the initial recommended antifungal treatment is an echinocandin (caspofungin, micafungin, or anidulafungin) given through the vein (intravenous or IV). Fluconazole, amphotericin B, and other antifungal medications may also be appropriate in certain situations.

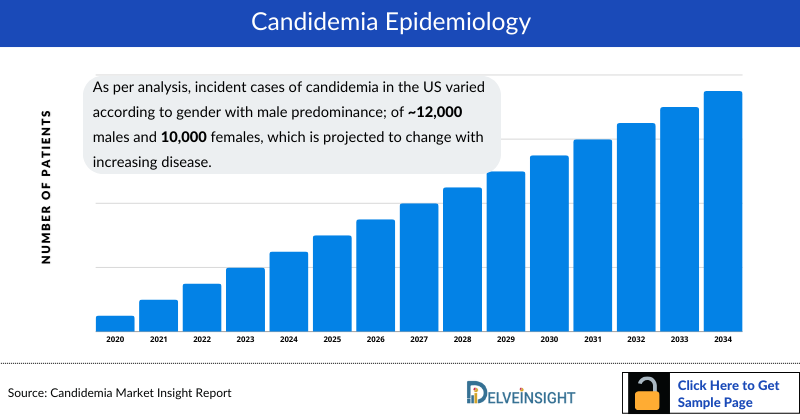

Candidemia Epidemiology

The epidemiology section on the Candidemia market report offers information on the patient populations, including historical and projected trends for each of the seven major markets. Examining key opinion leader views from physicians or clinical experts can assist in identifying the reasons behind historical and projected trends. The diagnosed patient pool, their trends, and the underlying assumptions are all included in this section of the report.

This section also presents the data with relevant tables and graphs, offering a clear and concise view of the occurrence of candidemia. Additionally, the report discloses the assumptions made during the analysis, ensuring data interpretation and presentation transparency. This epidemiological data is valuable for understanding the disease burden and its impact on the patient population across various regions.

Key Findings

As per analysis, incident cases of candidemia in the US varied according to gender with male predominance; of approximately 12,000 males and 10,000 females, which is projected to change with increasing disease.

The five most common Candida species are Candida albicans, Candida glabrata, Candida tropicalis, Candida parapsilosis, and Candida krusei. C. albicans was previously the predominant species isolated in patients with invasive candidiasis, accounting for 65–70% of the total number of Candida isolates. However, the epidemiology has changed in recent years, with non-albicans species responsible for about half of the cases in some centers. C. parapsilosis tends to be more frequent in southern Europe, while C. glabrata is more frequent in the older population than in middle-aged adults

Based on our analysis it is estimated that about 50% of incident candidemia patients were males whereas 40% were females, in Japan.

As per analysis among the European countries, Spain had the highest population of candidemia with approximately 6,000 cases, followed by Germany, which had approximately 3,000 cases in 2020.

Our analysis suggests In 2020, there were approximately 40% of the cases in the age group of 65 years and above, which was the highest in any age group in the US.

Candidemia Market Outlook

The term candidemia describes the presence of Candida infection in the blood. Candidemia is the most common manifestation of invasive candidiasis. Candida in a blood culture should never be viewed as a contaminant and should always prompt a search for the source of the bloodstream infection. For many patients, candidemia is a manifestation of invasive candidiasis that could have originated in a variety of organs, whereas for a few, candidemia originated from an infected indwelling intravenous catheter. As candidemia can cause serious, life-threatening illness, treatment is usually begun when an infection is suspected. Treatment includes finding the infection source, and if possible, removing it (for example, the central venous catheter) and beginning treatment with anti-fungal medication.

The treatments used to manage Candida infections vary substantially. They are based on the anatomic location of the infection, the patient’s underlying disease and immune status, the patient’s risk factors for infection, the specific species of Candida responsible for the infection, and, in some cases, the susceptibility of the Candida species to specific antifungal drugs. The armamentarium of drugs for candidiasis treatment currently comprises three major drug classes: polyenes, azoles, and echinocandins.

With ongoing research and continued dedication, the future holds hope for even more effective treatments and, ultimately, a cure for this challenging condition. According to DelveInsight, the candidemia market in the 7MM is expected to change significantly during the study period 2020–2034.

Candidemia Drug Chapters

Marketed Candidemia Drugs

REZZAYO: Cidara Therapeutics/Mundipharma

REZZAYO (rezafungin) is an echinocandin antifungal medication used to treat candidemia and invasive candidiasis. It is administered intravenously and works by inhibiting the synthesis of 1,3-β-D-glucan, an essential component of fungal cell walls. It is given in the form of IV infusion and comes in a strength of 200mg. Cidara granted Melinta an exclusive license to commercialize rezafungin, Cidara's lead antifungal candidate, in the United States. It got its approval from the US FDA in 2023 and recently, in December 2023, the European Medicines Agency (EMA) also approved REZZAYO.

VIVJOA (oteseconazole): Mycovia Pharmaceuticals

In April 2022, the US FDA approved VIVJOA (oteseconazole) capsules, an azole antifungal indicated to reduce the incidence of recurrent vulvovaginal candidiasis (RVVC), also referred to as chronic yeast infection. It comes in the form of capsules with 150mg strength. Oteseconazole is an azole metalloenzyme inhibitor that mainly targets 14α demethylase (CYP51) which is a fungal sterol that is necessary for the development and integrity of fungal cell membranes. This enzyme catalyzes an early step in the biosynthesis route of ergosterol. Inhibition of CYP51 results in the accumulation of 14-methylated sterols, some of which are toxic to fungi.

BREXAFEMME (ibrexafungerp): Scynexis/GSK

BREXAFEMME (ibrexafungerp) is developed by Scynexis. In June 2021, the US FDA approved BREXAFEMME (ibrexafungerp) for the treatment of vulvovaginal candidiasis (VVC). It is a novel class of antifungal and the first and only oral fungicidal treatment that can cure a vaginal yeast infection in adults and postmenarchal pediatric patients. The recommended dosage in adult and post-menarchal pediatric females is 300 mg which should be administered approximately 12 hours apart for one day. Ibrexafungerp which is a triterpenoid antifungal agent, inhibits glucan synthase, an enzyme involved in the formation of 1,3-β-D-glucan and an essential component of the fungal cell wall. they have entered into an exclusive license agreement for Brexafemme (ibrexafungerp tablets), a US FDA-approved, first-in-class antifungal for the treatment of vulvovaginal candidiasis (VVC) and reduction in the incidence of recurrent VVC (RVVC). In March 2023 an exclusive license agreement was announced between GSK and Scynexis giving GSK rights to commercialise BREXAFEMME.

|

Drug |

MoA |

RoA |

Company |

Logo |

|

REZZAYO (rezafungin) |

Inhibits the 1,3-B-D-glucan synthase enzyme |

IV |

Cidara Therapeutics/ Mundipharma | |

|

VIVJOA (oteseconazole) |

Azole metalloenzyme inhibitor |

Oral |

Mycovia Pharmaceuticals | |

|

BREXAFEMME (ibrexafungerp) |

A triterpenoid antifungal agent that inhibits glucan synthase |

Oral |

Scynexis/GSK | |

|

XXX |

XX |

X |

XXX |

Note: Detailed marketed therapies assessment will be provided in the final report.

Emerging Candidemia Drugs

The pipeline of candidemia is quite robust with several products available in the developmental stage. There are several key players involved in the development of promising products such as Pfizer/ Basilea Pharmaceutica and others.

Fosmanogepix: Pfizer/Basilea Pharmaceutical

Fosmanogepix formerly known as APX001. This is a pro-drug that is metabolized into its active form manogepix (formerly APX001A), also known as E1210. It targets the fungal-specific enzyme Gwt1, responsible for an early step in glycosylphosphatidylinositol (GPI)-anchor biosynthesis. This agent has demonstrated potency against multiple yeasts, molds, and endemic mycoses. It was being developed by Amplyx Pharmaceutics and completed Phase II trials. Pfizer acquired Amplyx in April 2021. In November 2023, Basilea Pharmaceutica announced that it has entered into an asset purchase agreement with Amplyx Pharmaceuticals which is an affiliate of Pfizer to acquire the rights to fosmanogepix. The drug is now in Phase III trial. The US FDA has granted fasttrack designation for both the intravenous and oral formulations of the antifungal candidate, fosmanogepix.

|

Drug |

MoA |

RoA |

Company |

Logo |

Phase |

|

Fosmanogepix |

Targets the fungal-specific enzyme Gwt1 |

Oral/IV |

Pfizer/ Basilea Pharmaceutica |

III | |

|

XXX |

XX |

X |

XXX |

X |

Note: Detailed emerging therapies assessment will be provided in the final report.

Candidemia Market Segmentation

DelveInsight’s ‘Candidemia Market Insights, Epidemiology, and Market Forecast – 2034’ report provides a detailed outlook of the current and future candidemia market, segmented within countries, by therapies, and by classes. Further, the market of each region is then segmented by each therapy to provide a detailed view of the current and future market share of all therapies.

Candidemia Market Size by Countries

The Candidemia market size is assessed separately for various countries, including the United States, EU4 (Germany, France, Italy, and Spain), the UK, and Japan. In 2023, the United States held a significant share of the overall 7MM (Seven Major Markets) Candidemia market, primarily attributed to the country's higher incidence of the condition and the elevated cost of the available treatments. This dominance is projected to persist, especially with the potential early introduction of new products.

|

Country-wise Market Size Distribution of Candidemia |

Candidemia Market Size by Therapies

Candidemia Market Size by Therapies is categorized into current and emerging markets for the study period 2020–2034. One of the emerging drugs anticipated to launch during the forecast period is Fosmanogepix by Pfizer and Basilea Pharmaceutical.

|

Market Share Distribution of Candidemia by Therapies in 2034 |

Note: Detailed market segment assessment will be provided in the final report.

Candidemia Drugs Uptake

This section focuses on the sales uptake of potential candidemia drugs that have recently been launched or are anticipated to be launched in the candidemia market between 2020 and 2034. It estimates the market penetration of candidemia drugs for a given country, examining their impact within and across classes and segments. It also touches upon the financial and regulatory decisions contributing to the probability of success (PoS) of the drugs in the candidemia market.

The emerging candidemia therapies are analyzed based on various attributes such as safety and efficacy in randomized clinical trials, order of entry and other market dynamics, and the unmet need they fulfill in the candidemia market.

Note: Detailed assessment of drug uptake and attribute analysis will be provided in the full report on candidemia

Candidemia Market Access and Reimbursement

DelveInsight’s ‘Candidemia – Market Insights, Epidemiology, and Market Forecast – 2034’ report provides a descriptive overview of the market access and reimbursement scenario of candidemia.

This section includes a detailed analysis of the country-wise healthcare system for each therapy, enlightening the market access, reimbursement policies, and health technology assessments.

KOL Views

To keep up with current Candidemia market trends and fill gaps in secondary findings, we interview KOLs and SMEs working in the Candidemia domain. Their opinion helps understand and validate current and emerging therapies and treatment patterns or Candidemia market trends. This will support the clients in potential upcoming novel treatments by identifying the overall scenario of the market and the Candidemia unmet needs.

Candidemia: KOL Insights

DelveInsight’s analysts connected with 50+ KOLs to gather insights; however, interviews were conducted with 15+ KOLs in the 7MM. These KOLs were from organizations, institutes, and hospitals, such as Stanford Medicine, Mayo Clinic, and Lifespan/Brown University among others.

“ICU patients have many risk factors for developing invasive candidiasis or candidemia. For the specialist, the management of invasive candidiasis and candidemia, from diagnosis to selection of the therapeutic protocol, is often a challenge. Apart from cases with positive blood cultures or fluid/tissue biopsy, diagnosis is neither sensitive nor specific. It relies on many different factors including clinical and laboratory findings, but there is a need for more specific diagnostic markers”.

“Invasive, life-threatening fungal infections are an important cause of morbidity and mortality, particularly for patients with compromised immune function. The number of therapeutic options for the treatment of invasive fungal infections is quite limited when compared with those available to treat bacterial infections.”

Note: Detailed assessment of KOL Views will be provided in the full report on candidemia.

Competitive Intelligence Analysis

We conduct a Competitive and Market Intelligence analysis of the Candidemia Market, utilizing various Competitive Intelligence tools such as SWOT analysis and Market entry strategies. The inclusion of these analyses is contingent upon data availability, ensuring a comprehensive and well-informed assessment of the market landscape and competitive dynamics.

Candidemia Pipeline Development Activities

The report offers an analysis of therapeutic candidates in Phase II and III stages and examines companies involved in developing targeted therapeutics for candidemia. It provides valuable insights into the advancements and progress of potential treatments in clinical development for this condition.

Pipeline Development Activities

The report covers information on collaborations, acquisition and merger, licensing, patent details, and other information for emerging Candidemia therapies.

Candidemia Report Insights

- Candidemia Patient Population

- Therapeutic Approaches

- Candidemia Pipeline Analysis

- Candidemia Market Size and Trends

- Candidemia Market Opportunities

- Impact of Upcoming Therapies

Candidemia Report Key Strengths

- 11 Years Forecast

- The 7MM Coverage

- Candidemia Epidemiology Segmentation

- Key Cross Competition

- Highly Analyzed Candidemia Market

- Candidemia Drugs Uptake

Candidemia Report Assessment

- Candidemia Current Treatment Practices

- Unmet Needs

- Candidemia Pipeline Product Profiles

- Candidemia Market Attractiveness

Key Questions

- How common is Candidemia?

- What are the key findings of Candidemia epidemiology across the 7MM, and which country will have the highest number of patients during the study period (2020–2034)?

- What are the currently available treatments for Candidemia?

- What are the disease risks, burdens, and unmet needs of Candidemia?

- At what CAGR is the Candidemia market and its epidemiology is expected to grow in the 7MM during the forecast period (2024–2034)?

- How would the unmet needs impact the Candidemia market dynamics and subsequently influence the analysis of the related trends?

- What would be the forecasted patient pool of Candidemia in the 7MM covering the United States, EU4 (Germany, France, Italy, and Spain), the UK, and Japan?

- Among EU4 and the UK, which country will have the highest number of patients during the forecast period (2024–2034)?

- How many companies are currently developing therapies for the treatment of Candidemia?