Chlamydia Market

- Chlamydia is a common sexually transmitted infection (STI) caused by the bacterium Chlamydia trachomatis. It is one of the most frequently reported STIs globally. It often presents with no symptoms, which can lead to it going undetected and untreated.

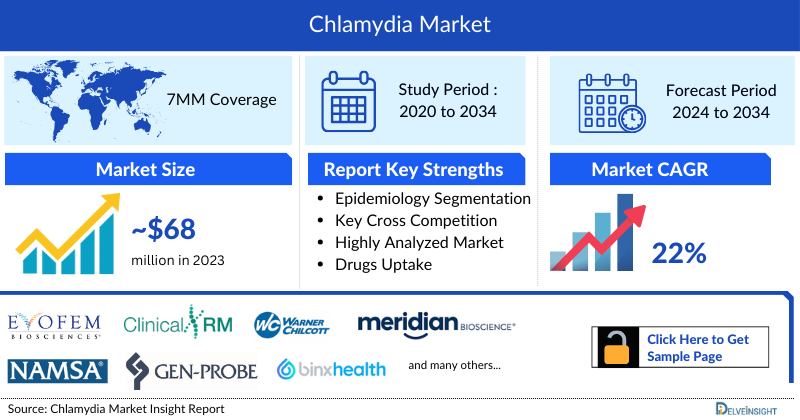

- In 2023, the market size of Chlamydia was highest in the US among the 7MM accounting for approximately USD 48 million that is further expected to increase at a CAGR of 23.4%.

- The current treatment strategies mainly rely upon the use of antibiotics such as Doxycycline, Azithromycin, Levofloxacin, and others. Azithromycin accounted for highest market share of ~22 million in 2023, for treatment of Chlamydia in the US.

- The chlamydia market is driven by increased awareness and education about sexually transmitted infections, advancements in diagnostic technologies, and a focus on sexual health. Rising chlamydia rates, especially among younger populations, and improved treatment options also contribute to market growth. Public health initiatives and routine STI testing further boost demand for chlamydia-related services and products.

- The total market size of the Chlamydia market is anticipated to experience growth during the forecast period due to expected entry of emerging therapies, including Z007 vaccine and others.

DelveInsight’s “Chlamydia Market Insights, Epidemiology, and Market Forecast – 2034” report delivers an in-depth understanding of Chlamydia, historical and forecasted epidemiology as well as the Chlamydia market trends in the United States, EU4, and the UK (Germany, France, Italy, Spain) and the United Kingdom, and Japan.

The Chlamydia market report provides current treatment practices, emerging drugs, market share of individual therapies, and current and forecasted 7MM Chlamydia market size from 2020 to 2034. The Report also covers current Chlamydia treatment practices, market drivers, market barriers, SWOT analysis, reimbursement and market access, and unmet medical needs to curate the best of the opportunities and assess the underlying potential of the market.

Geography Covered

- The United States

- EU4 (Germany, France, Italy, and Spain) and the United Kingdom

- Japan

Study Period: 2020–2034

Chlamydia Treatment Market

Chlamydia Overview

Chlamydial infection, caused by Chlamydia trachomatis, is the most common bacterial sexually transmitted infection (STI). Age is a strong predictor of risk for chlamydial infections, with the highest infection rates in women occurring during ages 15–24 years. As most individuals with the infection are asymptomatic, it is often left untreated, increasing the risk of transmission and serious health consequences in both sexes. If symptoms occur, they usually appear two to six weeks after infection. Symptoms can include vaginal pain and bleeding, painful urination, and an abnormal discharge from the vagina, urethra, or rectum.

Untreated infection can result in serious complications such as pelvic inflammatory disease, infertility, ectopic pregnancy in women, and epididymitis and orchitis in men. Maternal infection is associated with serious adverse outcomes in neonates, such as preterm birth, low birth weight, conjunctivitis, nasopharyngeal infection, and pneumonia. Screening for chlamydia is implemented in several countries and regions, including the US and the UK, to reduce the risks. Screening is recommended in all women younger than 25 years, in all pregnant women, and in women who are at increased risk of infection.

Chlamydia Diagnosis

Chlamydia trachomatis, a common sexually transmitted infection, is diagnosed through a combination of clinical assessment and laboratory tests. Symptoms like abnormal discharge and pain may prompt testing, but many cases are asymptomatic. The primary diagnostic tool is Nucleic Acid Amplification Tests (NAATs), which detect the bacteria's genetic material in urine or swab samples.

Other methods include swab cultures and Direct Fluorescent Antibody (DFA) tests, though they are less commonly used. Routine screening is advised for sexually active women under 25, those with multiple partners, and high-risk men, as well as pregnant women, to prevent complications. Early diagnosis and treatment are crucial for effective management and prevention of chlamydia.

The Aptima Combo 2 Assay and the Xpert CT/NG were the first tests cleared for extragenital diagnostic testing to detect the presence of the bacteria Chlamydia trachomatis via the throat and rectum. These tests were previously only cleared for testing urine, vaginal and endocervical samples. The availability of these two tests helped fill an unmet public health need by allowing for more screening.

Further details related to diagnosis are provided in the report...

Chlamydia Treatment

US FDA approved using the Binx Health IO CT/NG Assay at point-of-care settings to help with more quick and appropriate treatment of chlamydia. Access to faster diagnostic results, appropriate treatments will make significant strides in combatting Chlamydia infections.

Treating C. trachomatis prevents adverse reproductive health complications and continued sexual transmission. Furthermore, treating the sex partners prevent reinfection and infection of other partners. Also, treating pregnant women usually prevents C. trachomatis to neonates during birth.

For the treatment of chlamydia infection, the Centers for Disease Control and Prevention (CDC) recommends 100 mg of doxycycline twice daily for 7 days. Alternate regimens include oral administration of either 1 g of azithromycin in a single dose or Levofloxacin 500 mg orally once daily for seven days.

While antibiotics have successfully treated most uncomplicated C. trachomatis urogenital infections, treatment does not generally resolve persistent infections or prevent autoimmunity.

Further details related to treatment are provided in the report...

Chlamydia Epidemiology

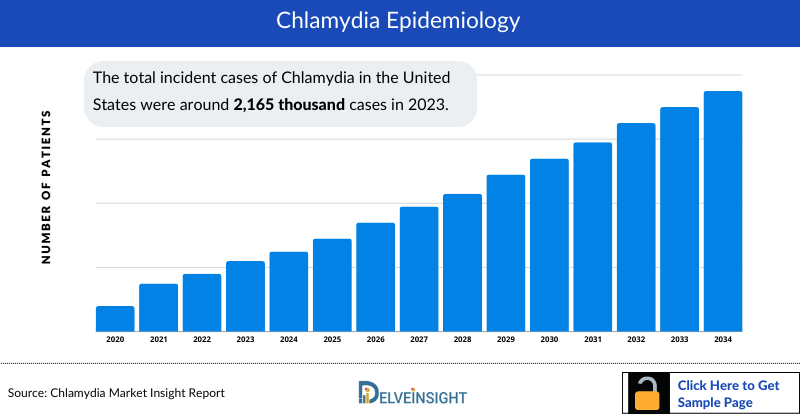

As the market is derived using a patient-based model, the Chlamydia epidemiology chapter in the report provides historical as well as forecasted epidemiology segmented by Total Incident Cases of Chlamydia, Symptom-specific Incident Cases of Chlamydia, Age-specific Incident Cases of Chlamydia, and Gender-specific Incident Cases of Chlamydia in the 7MM covering, the United States, EU4 countries (Germany, France, Italy, and Spain), the United Kingdom, and Japan from 2020 to 2034.

- The total incident cases of Chlamydia in the United States were around 2,165 thousand cases in 2023.

- The United States contributed to the largest incident population of Chlamydia, acquiring ~58% of the 7MM in 2023. Whereas, EU4 and the UK, and Japan accounted for around 33% and 9% of the total population share, respectively, in 2023.

- Among the EU4 countries, Germany accounted for the largest number of incident cases of Chlamydia (479 thousand) followed by France (390 thousand), whereas Italy accounted for the lowest number of cases (1,395) in 2023.

- In 2023, it was estimated that there were around 350 thousand incident cases of Chlamydia in the Japan.

- According to DelveInsight estimates, in 2023 there were approximately 1,391 thousand incident cases of Chlamydia among females and about 773 thousand cases among males in US.

- In France, highest number of age-specific incident cases were among age group 15-24 (229 thousand) followed by group 25-34 (110 thousand), 35-44 (31 thousand), 45+ (18 thousand), and 0-14 (785).

- DelveInsight analysis of the symptoms-specific data in the US revealed that the highest number of people affected with Chlamydia were Asymptomatic (1,569 thousand) and Symptomatic (595 thousand), in 2023.

Chlamydia Recent Developments

- In May 2025, Visby Medical™ submitted its Men’s Sexual Health Test to the FDA for 510(k) clearance and CLIA waiver. If approved, the test will provide PCR results for Chlamydia and Gonorrhea from male urine samples in under 30 minutes, for both symptomatic and asymptomatic men.

- In March 2025, Visby Medical™ announced that the U.S. FDA granted De Novo authorization for its Women's Sexual Health Test for Over-the-Counter (OTC) use, allowing individuals to perform reliable, rapid, and private at-home testing for Chlamydia, Gonorrhea, and Trichomoniasis—the three most common curable STIs.

- In March 2025, the FDA granted fast track designation to Sanofi’s mRNA vaccine candidate for preventing chlamydia infection, recognizing its potential to address a serious condition and unmet public health need.

Chlamydia Drug Chapters

The drug chapter segment of the Chlamydia report encloses a detailed analysis of Chlamydia off-label drugs and late-stage (Phase-III and Phase-II) pipeline drugs. It also helps to understand the Chlamydia clinical trial details, expressive pharmacological action, agreements and collaborations, approval and patent details, advantages and disadvantages of each included drug, and the latest news and press releases.

Chlamydia Marketed Drugs

In 2021, CDC updated STI guidelines for the treatment of chlamydia to overcome resistance development. According to these updated guidelines, the recommended treatment of chlamydia is now doxycycline 100 mg twice daily orally for 7 days. Alternative regimens include either azithromycin 1 g orally in a single dose or levofloxacin 500 mg once daily for 7 days. Notably, there is a delayed-release (DR) formulation of doxycycline available on the market to lighten the pill burden for patients and ease gastrointestinal effects.

Further detail in the report...

Further detail in the report...

Note: Detailed emerging therapies assessment will be provided in the final report of Chlamydia...

Chlamydia Market Outlook

Chlamydia trachomatis is the most frequently diagnosed bacterial sexually transmitted infection worldwide. The number of diagnoses has increased over the past 10 years due to more sensitive tests and increased testing. Genital infection with C trachomatis is asymptomatic in 50–88% of men and women, and 46% of infections clear spontaneously within a year. Persistent chlamydia infection can lead to pelvic inflammatory disease, ectopic pregnancy, tubal infertility in women, and epididymitis and epididymo orchitis in men. Infection can occur at any age but is most common in people under 25, with rates of diagnosis peaking in women aged 16–19 and men aged 20–24. Azithromycin has been considered the drug of choice for treating C. trachomatis infections for many years.

The advent of azithromycin resistance due to its extensive usage to treat infections. For chlamydia treatment, data obtained from azithromycin versus doxycycline studies show higher treatment failure rates with azithromycin compared to doxycycline.

Recently, in 2021, CDC updated STI guidelines for the treatment of chlamydia to overcome resistance development. According to these updated guidelines, the recommended treatment of chlamydia is now doxycycline 100 mg twice daily orally for 7 days.

Antimicrobial stewardship is a program that supports the proper use of antimicrobials to circumvent resistance, one of the major public health problems in the United States. The new updates have been recommended based on the concerns regarding increased rates of azithromycin resistance and ceftriaxone resistance when used at lower doses.

Alternative regimens include either azithromycin 1 g orally in a single dose or levofloxacin 500 mg once daily for 7 days. Notably, there is a delayed-release (DR) formulation of doxycycline available on the market to lighten the pill burden for patients and ease gastrointestinal effects. This regimen should be dosed as doxycycline 200 mg DR tablets once daily for 7 days. This formulation is as effective as the immediate release; however, it is more costly.

Also, Ofloxacin (but not all other quinolones) effectively treats chlamydial infections. In general, erythromycin is considered the backup drug for those who cannot take another regimen.

Chlamydia is a major bacterial pathogen that infects humans. Antibiotics are the only treatment currently available. However, there is mounting pressure to develop Chlamydia vaccines with high reinfection rates. One of the most challenging aspects of Chlamydia vaccine research is replicating mouse vaccine trial results in other host species, specifically non-human primates. Over the last 30 years, there have been only 12 attempts to replicate mouse model trial results in non-human primates. Many key assets, including vaccines, are at the preclinical stage of development. The major market players include Ziphius Vaccines, Abera Bioscience, and others.

- The therapeutic market size of Chlamydia in the 7MM was approximately USD 68 million in 2023.

- The market size in the 7MM will increase at a CAGR of 22% due to increasing awareness of the disease, better diagnosis, and the launch of the emerging therapy.

- The United States accounted for the highest market size of Chlamydia approximately 70% of the total market size in 7MM in 2023, in comparison to the other major markets i.e., EU4 countries (Germany, France, Italy, and Spain), the United Kingdom, and Japan.

- Among the European countries, Germany had the highest market size with nearly USD 6.4 million in 2023, while Italy had the lowest market size of Chlamydia with ~USD 0.02 million in 2023.

- The market size for Chlamydia in Japan was estimated to be ~USD 4 million in 2023, which accounts for 5% of the total 7MM market.

- With the expected launch of upcoming therapies, such as Z007, the total market size of Chlamydia is expected to show change in the upcoming years.

Chlamydia Drugs Uptake

This section focuses on the sales uptake of potential Chlamydia drugs that have recently been launched or are anticipated to be launched in the Chlamydia market between 2020 and 2034. It estimates the market penetration of Chlamydia drugs for a given country, examining their impact within and across classes and segments. It also touches upon the financial and regulatory decisions contributing to the probability of success (PoS) of the drugs in the Chlamydia market.

Further detailed analysis of emerging therapies drug uptake in the report...

Chlamydia Pipeline Development Activities

The report provides insights into Chlamydia clinical trails within Phase III, Phase II, and Phase I. It also analyzes key players involved in developing targeted therapeutics.

Pipeline Development Activities

The report covers information on collaborations, acquisitions and mergers, licensing, and patent details for Chlamydia emerging therapies.

KOL Views

To keep up with current market trends, we take KOLs and SMEs’ opinions working in the domain through primary research to fill the data gaps and validate the secondary research. Industry Experts were contacted for insights on Chlamydia evolving treatment landscape, patient reliance on conventional therapies, patient therapy switching acceptability, and drug uptake along with challenges related to accessibility, including KOL from Massachusetts Department of Public Health, USA; Department of Obstetrics and Gynecology, USA; Skin Neglected Tropical Diseases and Sexually Transmitted Infections Section, Spain; Clinic of Obstetrics and Gynaecology, University of Brescia, Italy; Service de Médecine Légale, APHM, Hôpital de la Timone, France; Division of Infection and Immunology, University College London, United Kingdom; Department of Obstetrics and Gynecology Nakashibetsu Municipal Hospital, Japan; Department of Obstetrics and Gynecology Sapporo Medical University School of Medicine, Japan; and others.

Delveinsight’s analysts connected with 50+ KOLs to gather insights; however, interviews were conducted with 15+ KOLs in the 7MM. Their opinion helps understand and validate current and emerging therapies, treatment patterns, or Chlamydia market trends. This will support the clients in potential upcoming novel treatments by identifying the overall scenario of the market and the unmet needs.

Qualitative Analysis

We perform Qualitative and market Intelligence analysis using various approaches, such as SWOT and Conjoint Analysis. In the SWOT analysis, strengths, weaknesses, opportunities, and threats in terms of disease diagnosis, patient awareness, patient burden, competitive landscape, cost-effectiveness, and geographical accessibility of therapies are provided. These pointers are based on the Analyst’s discretion and assessment of the patient burden, cost analysis, and existing and evolving treatment landscape.

Conjoint Analysis analyzes multiple approved and emerging therapies based on relevant attributes such as safety, efficacy, frequency of administration, route of administration, and order of entry. Scoring is given based on these parameters to analyze the effectiveness of therapy.

Further, the therapies’ safety is evaluated wherein the acceptability, tolerability, and adverse events are majorly observed, and it sets a clear understanding of the side effects posed by the drug in the trials. In addition, the scoring is also based on the route of administration, order of entry and designation, probability of success, and the addressable patient pool for each therapy. According to these parameters, the final weightage score and the ranking of the emerging therapies are decided.

Market Access and Reimbursement

The high cost of therapies for the treatment is a major factor restraining the growth of the global drug market. Because of the high cost, the economic burden is increasing, leading the patient to escape from proper treatment.

The report further provides detailed insights on the country-wise accessibility and reimbursement scenarios, cost-effectiveness scenario of approved therapies, programs making accessibility easier and out-of-pocket costs more affordable, insights on patients insured under federal or state government prescription drug programs, etc.

Scope of the Chlamydia Market Report

- The report covers a segment of key events, an executive summary, and a descriptive overview of Chlamydia, explaining its causes, signs and symptoms, and currently available therapies.

- Comprehensive insight has been provided into the epidemiology segments and forecasts, the future growth potential of diagnosis rate, disease progression, and treatment guidelines.

- Additionally, an all-inclusive account of the current and emerging therapies and the elaborative profiles of late-stage and prominent therapies will impact the current treatment landscape.

- A detailed review of the Chlamydia market, historical and forecasted market size, market share by therapies, detailed assumptions, and rationale behind the approach is included in the report covering the 7MM drug outreach.

- The report provides an edge while developing business strategies, by understanding trends, through SWOT analysis and expert insights/KOL views, patient journey, and treatment preferences that help shape and drive the 7MM Chlamydia market.

Chlamydia Report Insights

- Chlamydia Patient Population

- Chlamydia Therapeutic Approaches

- Chlamydia Pipeline Analysis

- Chlamydia Market Size and Trends

- Existing and Future Market Opportunities

Chlamydia Report Key Strengths

- 11 years Forecast

- The 7MM Coverage

- Chlamydia Epidemiology Segmentation

- Key Cross Competition

- Conjoint Analysis

- Chlamydia Drugs Uptake

- Key Chlamydia Market Forecast Assumptions

Chlamydia Report Assessment

- Current Chlamydia Treatment Practices

- Chlamydia Unmet Needs

- Chlamydia Pipeline Product Profiles

- Chlamydia Market Attractiveness

- Qualitative Analysis (SWOT and Conjoint Analysis)

- Chlamydia Market Drivers

- Chlamydia Market Barriers

Key Questions Answered In The Chlamydia Market Report

Chlamydia Market Insights

- What was the Chlamydia market share (%) distribution in 2020 and what it would look like in 2034?

- What would be the Chlamydia total market size as well as market size by therapies across the 7MM during the forecast period (2024–2034)?

- What are the key findings pertaining to the market across the 7MM and which country will have the largest Chlamydia market size during the forecast period (2024–2034)?

- At what CAGR, the Chlamydia market is expected to grow at the 7MM level during the forecast period (2024–2034)?

- What would be the Chlamydia market outlook across the 7MM during the forecast period (2024–2034)?

- What would be the Chlamydia market growth till 2034 and what will be the resultant market size in the year 2034?

- How would the market drivers, barriers, and future opportunities affect the market dynamics and subsequent analysis of the associated trends?

Chlamydia Epidemiology Insights

- What are the disease risk, burden, and unmet needs of Chlamydia?

- What is the historical Chlamydia patient population in the United States, EU4 (Germany, France, Italy, Spain) and the UK, and Japan?

- What would be the forecasted patient population of Chlamydia at the 7MM level?

- What will be the growth opportunities across the 7MM with respect to the patient population pertaining to Chlamydia?

- Out of the above-mentioned countries, which country would have the highest incident population of Chlamydia during the forecast period (2024–2034)?

- At what CAGR the population is expected to grow across the 7MM during the forecast period (2024–2034)?

Current Chlamydia Treatment Scenario, Marketed Drugs, and Emerging Therapies

- What are the current options for the treatment of Chlamydia along with the approved therapy?

- What are the current treatment guidelines for the treatment of Chlamydia in the US, Europe, And Japan?

- What are the Chlamydia-marketed drugs and their MOA, regulatory milestones, product development activities, advantages, disadvantages, safety, efficacy, etc.?

- How many companies are developing therapies for the treatment of Chlamydia?

- How many emerging therapies are in the mid-stage and late stages of development for the treatment of Chlamydia?

- What are the key collaborations (Industry–Industry, Industry-Academia), Mergers and acquisitions, and licensing activities related to the Chlamydia therapies?

- What are the recent therapies, targets, mechanisms of action, and technologies developed to overcome the limitations of existing therapies?

- What are the clinical studies going on for Chlamydia and their status?

- What are the key designations that have been granted for the emerging therapies for Chlamydia?

- What are the 7MM historical and forecasted market of Chlamydia?

Reasons to Buy Chlamydia Market Report

- The report will help in developing business strategies by understanding the latest trends and changing treatment dynamics driving the Chlamydia Market.

- Insights on patient burden/disease incidence, evolution in diagnosis, and factors contributing to the change in the epidemiology of the disease during the forecast years.

- To understand the existing market opportunity in varying geographies and the growth potential over the coming years.

- Distribution of historical and current patient share based on real-world prescription data along with reported sales of approved products in the US, EU4 (Germany, France, Italy, and Spain), the United Kingdom, and Japan.

- Identification of strong upcoming players in the market will help in devising strategies that will help in getting ahead of competitors.

- Detailed analysis and potential of current and emerging therapies under the conjoint analysis section to provide visibility around leading emerging drugs.

- Highlights of Access and Reimbursement policies of approved therapies, barriers to accessibility of off-label expensive therapies, and patient assistance programs.

- To understand the perspective of Key Opinion Leaders around the accessibility, acceptability, and compliance-related challenges of existing treatment to overcome barriers in the future.

- Detailed insights on the unmet needs of the existing market so that the upcoming players can strengthen their development and launch strategy.

Frequently Asked Questions

1. What is the forecast period covered in the report?

The Chlamydia Epidemiology and Market Insight report for the 7MM covers the forecast period from 2024 to 2034, providing a projection of market dynamics and trends during this timeframe.

2. Who are the key players in the Chlamydia market?

The Chlamydia market is quite robust. The major layers are Ziphius Vaccines, Abera Bioscience, and others which are currently developing drugs for the treatment of Chlamydia.

3. How is the market size estimated in the forecast report?

The market size is estimated through data analysis, statistical modeling, and expert opinions. It may consider factors such as incident cases, treatment costs, revenue generated, and market trends.

4. What is the key driver of the Chlamydia market?

The increase in diagnosed incident cases of Chlamydia and the launch of emerging therapies are attributed to be the key drivers for increasing the Chlamydia market.

5. What is the expected impact of emerging therapies or advancements in Chlamydia treatment on the market?

Introducing new therapies, advancements in diagnostic techniques, and innovations in treatment approaches can significantly impact the Chlamydia treatment market. Market forecast reports may provide analysis and predictions regarding the potential impact of these developments.

6. Does the report provide insights into the competitive landscape of the market?

The market forecast report may include information on the competitive landscape, profiling key market players, their product offerings, partnerships, and strategies, and helping stakeholders understand the competitive dynamics of the Chlamydia market.