Chronic Refractory Cough Market Summary

Key Highlights

- RCC is a chronic cough condition defined by persistent symptoms despite thorough evaluation and appropriate treatment of underlying causes, reflecting an underlying neurogenic cough hypersensitivity. It is clinically distinct from other chronic cough etiologies, and diagnosis is made through exclusion, supported by assessments such as spirometry, FeNO testing, chest imaging, nasendoscopy, and reflux evaluation to rule out treatable contributors and confirm persistent hypersensitivity-driven cough.

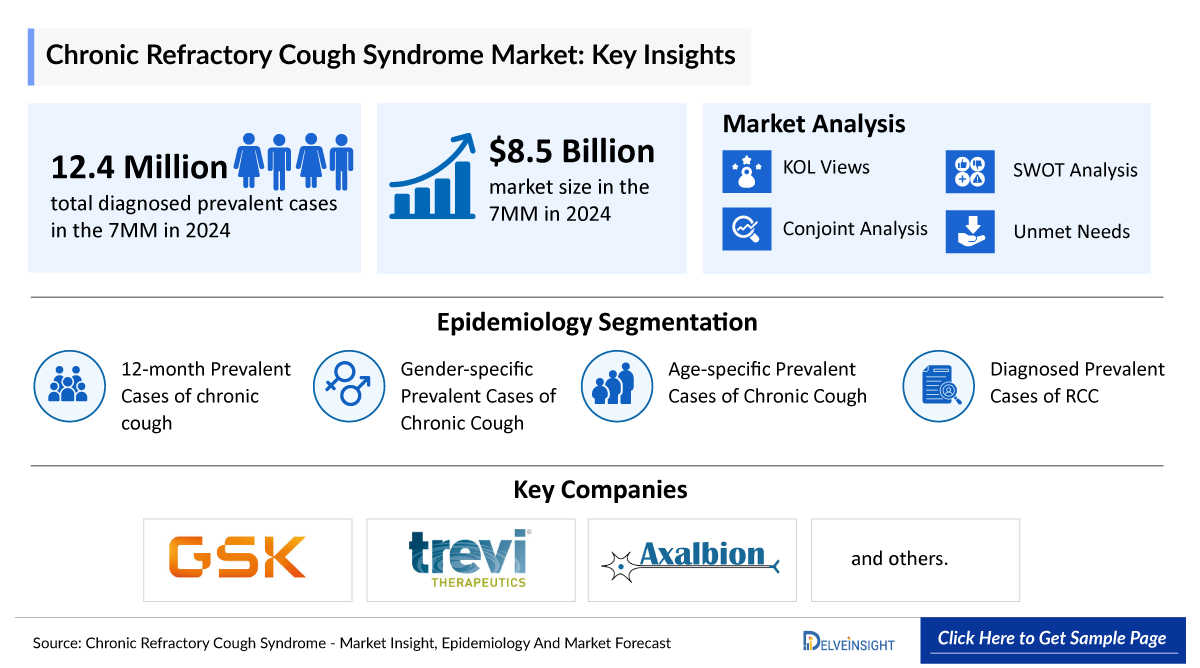

- In 2024, DelveInsight estimated more than 6 million diagnosed prevalent cases of RCC lasting more than 1 year across the 7MM, highlighting the sizable chronic patient pool and the increasing clinical recognition of long-standing, hypersensitivity-driven cough that persists despite treatment of underlying conditions.

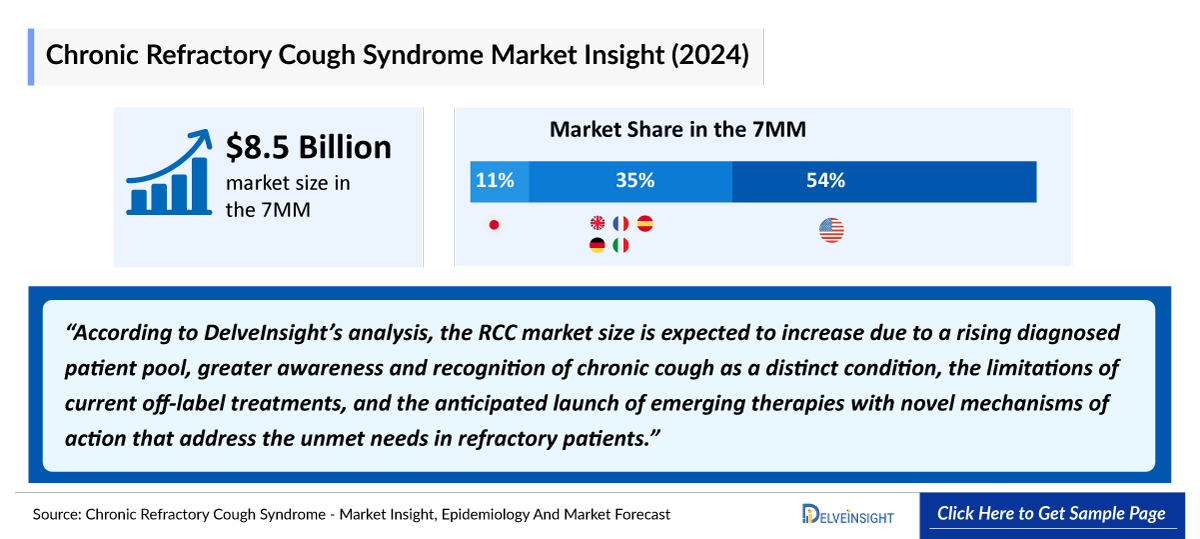

- According to DelveInsight’s 2024 analysis, the RCC market across the 7MM was valued at approximately USD 8.5 billion, driven by increasing recognition of cough hypersensitivity, broader diagnostic evaluation in specialty care, and the continued clinical burden associated with long-standing, treatment-refractory chronic cough.

- RCC currently has only one approved targeted therapy, LYFNUA (gefapixant), and its availability is limited to Europe and Japan, leaving the US without any approved option. Consequently, clinicians continue to rely on off-label neuromodulators and symptomatic treatments that offer inconsistent benefit and fail to address the core neurogenic hypersensitivity driving the disease. This gap underscores a persistent need for more effective, mechanism-based therapies that can deliver meaningful and durable symptom control.

- The RCC pipeline remains relatively limited, with only three emerging therapies including camlipixant (GSK5464714, BLU-5937), haduvio (nalbuphine ER), and AX-8 advancing through development. This narrow pool of candidates highlights the slow pace of innovation in a condition with significant unmet need, even as these agents signal meaningful momentum toward targeted, mechanism-driven treatment.

DelveInsight’s “Refractory chronic cough (RCC)” – Market Insights, Epidemiology, and Market Forecast – 2034” report delivers an in-depth understanding of the RCC, historical and projected epidemiological data, competitive landscape as well as RCC market tends in the United States, EU4 (Germany, France, Italy, and Spain), the United Kingdom, and Japan.

The RCC market report provides current treatment practices, emerging drugs, market share of individual therapies, and current and forecasted 7MM RCC market size from 2020 to 2034. The report also covers emerging RCC treatment practices/algorithms and unmet medical needs to curate the best opportunities and assess the market’s potential.

Geography Covered

- The United States

- EU4 (Germany, France, Italy, and Spain) and the United Kingdom

- Japan

|

Study Period |

2020–2034 |

|

Forecast Period |

2025–2034 |

|

Geographies Covered |

US, EU4 (Germany, France, Italy, and Spain), the UK, and Japan |

|

RCC Epidemiology |

|

|

RCC Key Companies |

|

|

Market Analysis |

|

|

RCC Key Companies |

|

|

Future Opportunity |

Future opportunities in the management of RCC lie in the integration of both approved and emerging therapies that are redefining the treatment landscape. LYFNUA (gefapixant citrate) by Merck and KYORIN Pharmaceutical, the first approved P2X3 antagonist in Europe and Japan has set a new standard by directly targeting the sensory hyper excitability that drives persistent cough. Building on this foundation, a strong pipeline is advancing with next-generation candidates such as Camlipixant (GSK5464714, BLU-5937) from GSK, Haduvio (nalbuphine ER, NAL ER) from Trevi Therapeutics, and AX-8 from Axalbion, each offering differentiated mechanisms aimed at modulating cough hypersensitivity more precisely and consistently. Together, these approved and emerging therapies signal a shift toward mechanism-driven, patient-focused interventions that have the potential to provide more durable symptom control, reduce reliance on empirical multi-drug regimens, and meaningfully enhance quality of life for individuals living with RCC. |

Refractory chronic cough (RCC) Understanding and Treatment Algorithm

RCC Overview

RCC is a chronic cough condition defined by persistent cough hypersensitivity that continues despite appropriate evaluation and treatment of common causes such as asthma, GERD, and upper airway disease. Heightened sensitivity of peripheral and central neural pathways leads to an exaggerated cough response, producing ongoing coughing episodes, throat irritation, and disrupted breathing patterns. Although often triggered by viral infections, environmental exposures, or airway inflammation, RCC persists long after the initial insult and significantly affects daily functioning, sleep quality, social interaction, and overall well-being. Advances in neurocough biology have clarified the sensory-neural mechanisms driving this condition, enabling diagnosis that is more accurate and fueling development of targeted therapies aimed at modulating cough reflex pathways. Despite progress, challenges remain in timely identification, objective assessment tools, and access to specialized care. RCC continues to be a rapidly evolving field, with emerging science and novel therapeutics reshaping future approaches to precision respiratory care.

RCC Diagnosis

RCC is diagnosed through a structured, exclusion-based process that focuses on identifying and ruling out all potential causes of chronic cough before confirming persistent cough hypersensitivity. Evaluation begins with a detailed history, physical examination, and screening for alarm features such as hemoptysis or abnormal chest findings. If no serious underlying disease is suspected, clinicians assess common cough-related conditions including asthma, eosinophilic bronchitis, rhinitis, GERD, ACE inhibitor use, and sleep apnea using tools such as spirometry, FeNO, nasendoscopy, and chest radiography. When the cough continues despite appropriate investigation and targeted treatment, secondary assessments such as flexible nasendoscopy, bronchial challenge testing, and 24-hour pH monitoring are used to further clarify contributing mechanisms and exclude hidden etiologies. Because no single test can confirm RCC, diagnosis ultimately depends on demonstrating persistent cough despite optimal management of all identifiable causes, making it a true diagnosis of exclusion grounded in comprehensive clinical evaluation.

RCC Treatment

RCC treatment begins only after all identifiable causes of chronic cough have been addressed, shifting the focus to the underlying cough hypersensitivity that drives persistent symptoms. Management combines pharmacologic and nonpharmacologic strategies aimed at reducing neural excitability and restoring control over the dysregulated cough reflex. Pharmacologic options include centrally acting neuromodulators such as low-dose morphine, gabapentin, and pregabalin, which can lessen cough severity but are limited by tolerability concerns, and peripherally acting agents such as gefapixant, the first approved RCC therapy in Europe and Japan, though not in the US, and constrained by taste-related side effects. Emerging therapies like camlipixant, nalbuphine ER, and AX-8 aim to improve efficacy while minimizing adverse effects. Alongside medications, nonpharmacologic approaches such as speech and behavioral therapy play a central role by recalibrating the sensitized cough reflex through sensory desensitization, improved laryngeal mechanics, and strengthened cortical inhibitory control, offering durable benefit and aligning closely with the condition’s neurogenic mechanisms.

Further details related to disease overview are provided in the report…

Refractory chronic cough (RCC) Epidemiology

The RCC epidemiology chapter in the report provides historical as well as forecasted epidemiology segmented 12-month prevalent cases of chronic cough, gender-specific prevalent cases of chronic cough, age-specific prevalent cases of chronic cough and diagnosed prevalent cases of RCC in the 7MM covering the United States, EU4 (Germany, France, Italy, and Spain), the United Kingdom, and Japan from 2020 to 2034.

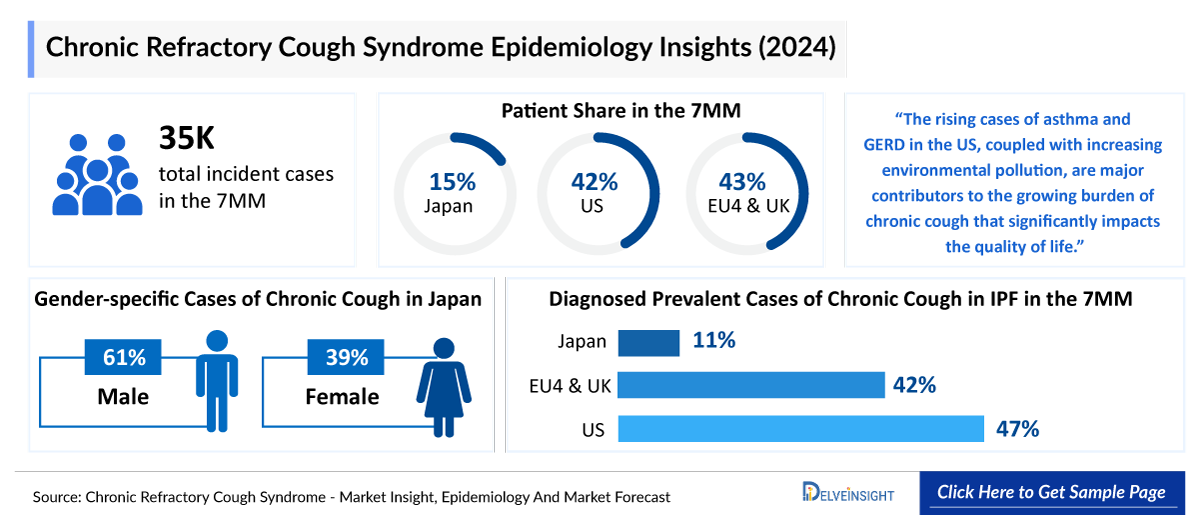

- In 2024, DelveInsight estimated that approximately 12.9 million individuals in the US were living with chronic cough, reflecting the substantial burden of a symptom that often persists despite treatment of underlying conditions. While chronic cough arises from diverse etiologies, this large patient pool highlights its significant clinical impact and the continued need for improved recognition and targeted management.

- In 2024, DelveInsight estimated that chronic cough showed a clear gender-specific pattern across the EU4 and the UK, with approximately 8.2 million females affected compared with 5.9 million males. This female predominance underscores the well-established higher susceptibility to cough hypersensitivity in women and reflects its significant and differentiated clinical burden across populations.

- In 2024, DelveInsight estimated that in Germany, chronic cough showed its highest age-specific burden in adults aged 18–49 years, with approximately 1.3 million cases, followed by 1.09 million cases in those aged 50–64 years and 1.08 million cases in individuals aged 65 years and above. This distribution reflects a disproportionately higher patient pool in the younger adult population.

- In Japan, DelveInsight’s 2024 assessment indicated that diagnosed prevalent cases of RCC lasting more than one year totaled approximately 930,000, representing a comparatively smaller burden than seen in Western markets. This reflects Japan’s distinct clinical patterns, narrower chronic cough recognition pathways, and variation in healthcare-seeking behavior that reduces the proportion of long-duration cases captured in routine practice.

Refractory chronic cough (RCC) Drug Chapters

The drug chapter segment of the RCC reports encloses a detailed analysis of RCC late-stage (Phase III and Phase I) and early stage pipeline drugs. It also helps understand the RCC clinical trial details, expressive pharmacological action, agreements and collaborations, approval and patent details, advantages and disadvantages of each included drug the latest news and press releases.

Marketed Drugs

LYFNUA (gefapixant citrate): Merck/ KYORIN Pharmaceutical

LYFNUA (gefapixant citrate) is an oral, twice-daily P2X3 receptor antagonist developed by Merck to target the heightened sensory reflex that underlies refractory and unexplained chronic cough. By dampening vagal nerve hypersensitivity, it reduces cough frequency and improves cough-related quality of life. Taste disturbances remain the most common but typically reversible adverse effect.

- In December 2023, Merck reported that the FDA issued a complete response letter for gefapixant, citing insufficient evidence of effectiveness and no safety issues. Merck subsequently withdrew the US application and confirmed it does not intend to resubmit.

- In July 2023, Merck reported that the EMA’s CHMP recommended approval of gefapixant, a non-narcotic oral P2X3 antagonist for treating refractory or unexplained chronic cough in adults.

- In January 2022, MSD K.K. received manufacturing and marketing approval in Japan for LYFNUA (gefapixant), the world’s first selective P2X3 receptor antagonist for chronic cough.

- In April 2021, MSD K.K. and KYORIN Pharmaceutical reported an exclusive distribution agreement in Japan for gefapixant citrate, a selective P2X3 receptor antagonist under regulatory review.

|

Drug |

MoA |

RoA |

Company |

|

LYFNUA (gefapixant citrate) |

P2X3 receptor antagonist |

Oral |

Merck/ KYORIN Pharmaceutical |

|

XXX |

XXX |

X |

XXX |

Emerging Drugs

Camlipixant (GSK5464714, BLU-5937): GSK

Camlipixant is an orally administered, highly selective P2X3 receptor antagonist being evaluated as a targeted therapy for RCC. It is currently in two pivotal Phase III trials, CALM-I and CALM-II, which measure changes in 24-hour cough frequency at Week 12 and Week 24, respectively. Topline data are anticipated in the second half of 2025, and GSK expects to pursue regulatory submissions in the second half of 2026.

- In September 2025, GSK presented several posters at the ERS Congress, including one focused on camlipixant and RCC, addressing awareness and understanding challenges among the US healthcare professionals.

- In May 2025, GSK shared new analyses at ATS supporting camlipixant development in RCC, including a model-based dose-response meta-analysis assessing reductions in taste-related side effects associated with the P2X3 class.

- In June 2023, GSK finalized its USD 2 billion acquisition of Bellus Health, securing camlipixant, a Phase III P2X3 antagonist in development for RCC.

Haduvio (nalbuphine ER, NAL ER): Trevi Therapeutics

Haduvio (nalbuphine ER, NAL ER) is an investigational oral therapy for RCC that modulates the cough reflex through a dual kappa-agonist and mu-antagonist mechanism. Its design aims to reduce cough hypersensitivity with lower misuse potential compared with traditional opioids. Nalbuphine has decades of clinical use as a non-scheduled analgesic in the US and Europe. Trevi Therapeutics plans to begin a Phase IIb RCC trial in early 2026.

- In October 2025, Trevi Therapeutics presented an oral presentation and supporting abstracts at the CHEST 2025 Annual Meeting, including a poster highlighting patient-reported outcomes from the Phase IIa RIVER trial evaluating nalbuphine ER in RCC.

- In September 2025, Trevi Therapeutics presented Phase IIa RIVER trial data in RCC across two posters at the ERS Congress in Amsterdam.

- In May 2025, Trevi Therapeutics presented additional analyses from the Phase IIa RIVER trial of Haduvio in RCC during an investor meeting held alongside the ATS International Conference.

- In March 2025, Trevi Therapeutics reported positive topline results from the Phase IIa RIVER trial of Haduvio in RCC, showing a highly significant reduction in 24-hour cough frequency (p<0.0001) on both baseline and placebo-adjusted measures, with secondary patient-reported outcomes supporting the primary results.

- As of December 2024, Trevi Therapeutics holds five US patents and 19 foreign patents for Haduvio, with expiries ranging from 2032 to 2039, while pending applications could extend protection to 2045. In February 2025, a notice of allowance was issued for a US patent covering Haduvio for chronic cough in IPF patients with hepatic impairment, expected to expire in 2042.

AX-8: Axalbion

AX-8 is a selective oral TRPM8 agonist in development for chronic cough, designed to activate TRPM8-expressing sensory fibers in the upper airways to normalize hypersensitivity, reduce cough, and throat irritation. The approach builds on two decades of evidence linking TRPM8 activation to modulation of sensory dysfunction across neuropathic and inflammatory pathways. In August 2024, Axalbion began dosing in the second part of its Phase II randomized, placebo-controlled trial in patients with chronic cough and moderate-to-severe throat discomfort, supported by secured funding to advance toward Phase III readiness.

- In May 2023, Axalbion presented positive Part I Phase II proof-of-concept results for AX-8 at ATS, showing encouraging efficacy signals in refractory or unexplained chronic cough, particularly in patients with moderate-to-severe throat discomfort.

- In June 2022, Axalbion reported positive Part I Phase II proof-of-concept results for AX-8 in refractory or unexplained chronic cough, demonstrating reductions in cough frequency and improvements in patient-reported outcomes with the TRPM8 agonist.

- In June 2019, the exploratory AX8-001 study (EudraCT 2017-003108-27) demonstrated that AX-8 achieved reductions in awake cough frequency in patients with RCC.

Drug

MoA

RoA

Company

Phase

Camlipixant (GSK5464714, BLU-5937)

P2X3 antagonist

Oral

GSK

III

Haduvio (nalbuphine ER, NAL ER)

Kappa agonist and mu antagonist

Oral

Trevi Therapeutics

II

AX-8

Selective TRPM8 agonist

Oral

Axalbion

II

XXX

XXX

X

XXX

X

Drug Class Insights

The RCC treatment landscape remains dominated by broad symptomatic therapies rather than targeted, mechanism-based interventions that address the underlying cough hypersensitivity driving the condition. Neuro-modulating agents such as opioids, baclofen, gabapentin, pregabalin, and amitriptyline provide partial relief but are limited by side effects and inconsistent long-term benefit. PPIs including omeprazole, lansoprazole, and esomeprazole, along with a wide range of respiratory drugs such as inhaled or nasal corticosteroids, bronchodilators, muscarinic antagonists, leukotriene modifiers, and antihistamines, are frequently used despite offering limited efficacy in true RCC. Additional options such as antibiotics, oral steroids, non-codeine opioids, and cough suppressants like levodropropizine and cloperastine similarly provide only temporary or incomplete improvement. This heavy reliance on nonspecific therapies underscores the need for mechanism-directed treatments capable of modulating the neural pathways that sustain chronic, refractory cough.

Emerging therapies for RCC are reshaping the treatment landscape by directly targeting the neurobiologic mechanisms that drive cough hypersensitivity. Next-generation agents such as Camlipixant (GSK5464714, BLU-5937), Haduvio (nalbuphine ER), and AX-8 aim to modulate peripheral and central sensory pathways, offering meaningful reductions in cough frequency and symptom burden. By addressing the underlying neural dysregulation rather than providing transient symptomatic relief, these therapies represent a significant shift toward mechanism-based, durable control of persistent cough.

Refractory chronic cough (RCC) Market Outlook

The market for RCC is entering a period of rapid expansion as clinical understanding, diagnostic capabilities, and therapeutic innovation continue to advance. Growing recognition of cough reflex hypersensitivity as the central driver of RCC rather than persistent airway inflammation paired with heightened awareness of its psychosocial burden is steadily enlarging the treatable patient population. Despite widespread use of PPIs, inhaled corticosteroids, bronchodilators, neuromodulators, and opioid-based suppressants, current care remains largely empirical and symptomatic, offering only partial or inconsistent relief and contributing to significant polypharmacy.

A new generation of mechanism-based therapies is now poised to reshape the landscape. Camlipixant targets peripheral sensory nerve hypersensitivity through selective P2X3 antagonism, Haduvio modulates central and peripheral pathways via its dual KAMA mechanism, and AX-8 recalibrates upper-airway sensory signaling through TRPM8 activation. By directly addressing the neural dysfunction underlying RCC, these candidates move beyond symptomatic suppression toward targeted, biologically grounded intervention.

Supported by strong R&D momentum, evolving clinical guidelines, and growing real-world evidence of unmet need, RCC is transitioning toward a mechanistic era one defined by precision therapies that aim to deliver sustained symptom control and meaningful improvements in quality of life.

- The market size for RCC in the US exceeded USD 4.6 billion in 2024 and is projected to expand further with the introduction of novel, mechanism-based therapies targeting the underlying neurobiology of the disorder.

- The total market size of RCC in the EU4 and the UK was nearly USD 2.9 billion in 2024, accounting for around 35% of the total 7MM market revenue, and is expected to change by 2034.

- In 2024, the total market size of RCC in Japan was more than USD 950 million, which is anticipated to change during the forecast period.

Refractory chronic cough (RCC) Uptake

This section focuses on the uptake rate of potential emerging RCC expected to be launched in the market during 2020–2034.

Refractory chronic cough (RCC) Pipeline Development Activities

The report provides insights into different therapeutic candidates in preregistration, Phase III, and early stage molecule. It also analyzes key players involved in developing targeted therapeutics.

The presence of numerous drugs under different stages is expected to generate immense opportunity for RCC market growth over the forecasted period.

Pipeline Development Activities

The report covers information on collaborations, acquisitions and mergers, licensing, and patent details for RCC emerging therapies.

KOL Views

To keep up with current and future market trends, we take industry experts’ opinions working in the domain through primary research to fill the data gaps and validate our secondary research. Industry experts were contacted for insights on RCC evolving treatment landscape, patient reliance on conventional therapies, patient therapy switching acceptability, drug uptake, along challenges related to accessibility.

DelveInsight’s analysts connected with 25+ KOLs to gather insights; however, interviews were conducted with 10+ KOLs in the 7MM. Centers like the University of Cincinnati, US; Charité University Medicine, Germany; University Hospital of Reims, France; Ospedale Policlinico San Martino, Italy; La Paz University Hospital, Spain; Imperial College London, UK; – Tokyo Medical University, Japan; among others.

Their opinion helps understand and validate current and emerging therapy treatment patterns or RCC market trends. This will support the clients in potential upcoming novel treatments by identifying the overall scenario of the market and the unmet needs.

Physician’s View

As per KOL from the US, “No drug is approved for the treatment of CRC in the US. Drugs are being evaluated for the patients. Orvepitant and other therapies are promising therapies for CRC that may modulate cough reflex hypersensitivity through a central-acting mechanism of action.”

As per KOL from the UK, “A subset of patients with RCC produces significant sputum despite having no underlying lung disease, a phenotype that closely resembles dry RCC but has been largely overlooked. This newly described group highlights an important gap in current understanding, and future research must recognize and evaluate this cohort to ensure they receive appropriate, evidence-based care.”

As per KOL from Japan, “RCC remains a challenging condition with substantial unmet needs, as treatment responses are often limited and patient burden is significant. Current options such as neuromodulators and emerging P2X3 receptor antagonists offer modest benefit, while nonpharmacologic approaches are still evolving. Continued research into cough hypersensitivity and novel therapeutic pathways is essential to improve outcomes.”

Qualitative Analysis

We perform Qualitative and market Intelligence analysis using various approaches, such as SWOT analysis. In the SWOT analysis, strengths, weaknesses, opportunities, and threats in terms of disease diagnosis, patient awareness, patient burden, competitive landscape, cost-effectiveness, and geographical accessibility of therapies are provided. These pointers are based on the analyst’s discretion and assessment of the patient burden, cost analysis, and existing and evolving treatment landscape.

Market Access and Reimbursement

The report further details country-wise reimbursement and accessibility status, cost-effectiveness assessments, patient assistance initiatives that improve affordability, and insights into coverage under government prescription drug programs.

Scope of the Report

- The report covers a segment of key events, an executive summary, and a descriptive overview of RCC, explaining their mechanism and therapies (current and emerging).

- Comprehensive insight into the competitive landscape, and forecasts, the future growth potential of treatment rate, drug uptake, and drug information have been provided.

- Additionally, an all-inclusive account of the current and emerging therapies and the elaborative profiles of late-stage and prominent therapies will affect the current landscape.

- A detailed review of the RCC market, historical and forecasted market size, market share by therapies, detailed assumptions, and rationale behind our approach is included in the report, covering the 7MM drug outreach.

- The report provides an edge while developing business strategies, by understanding trends, through SWOT analysis, expert insights/KOL views, and treatment preferences that help shape and drive the 7MM RCC.

Refractory chronic cough (RCC) Report Insights

- RCC Targeted Patient Pool

- RCC Therapeutic Approaches

- RCC Pipeline Analysis

- RCC Market Size and Trends

- Existing and Future Market Opportunity

Refractory chronic cough (RCC) Report Key Strengths

- 10 years Forecast

- The 7MM Coverage

- Key Cross Competition

- Attribute Analysis

- Drugs Uptake and Key Market Forecast Assumptions

Refractory chronic cough (RCC) Report Assessment

- Current Treatment Practices

- Unmet Needs

- Pipeline Product Profiles

- Market Attractiveness

- Qualitative Analysis (SWOT)

Key Questions

- What was the RCC total market size, the market size by therapies, market share (%) distribution in 2024, and what would it look like in 2034? What are the contributing factors for this growth?

- Which drug is going to be the largest contributor in 2034?

- Which is the most lucrative market for RCC?

- Which drug accounts for maximum RCC sales?

- What are the risks, burdens, and unmet needs of treatment with RCC? What will be the growth opportunities across the 7MM for the patient population RCC?

- What are the key factors hampering the growth of the RCC market?

- What are the indications for which recent novel therapies and technologies have been developed to overcome the limitations of existing treatments?

- What key designations have been granted to the therapies for RCC?

- Patient acceptability in terms of preferred therapy options as per real-world scenarios?

Reasons to buy

- The report will help develop business strategies by understanding the latest trends and changing dynamics driving the RCC Market.

- Understand the existing market opportunities in varying geographies and the growth potential over the coming years.

- Identifying strong upcoming players in the market will help devise strategies to help get ahead of competitors.

- Detailed analysis, ranking of indication-wise current, and emerging therapies under the attribute analysis section to provide visibility around leading indications.

- To understand key opinion leaders’ perspectives around the accessibility, acceptability, and compliance-related challenges of existing treatment to overcome barriers in the future.

- Detailed insights on the unmet needs of the existing market so that the upcoming players can strengthen their development and launch strategy.

-market.png&w=256&q=75)