Complicated Urinary Tract Infection Market

-

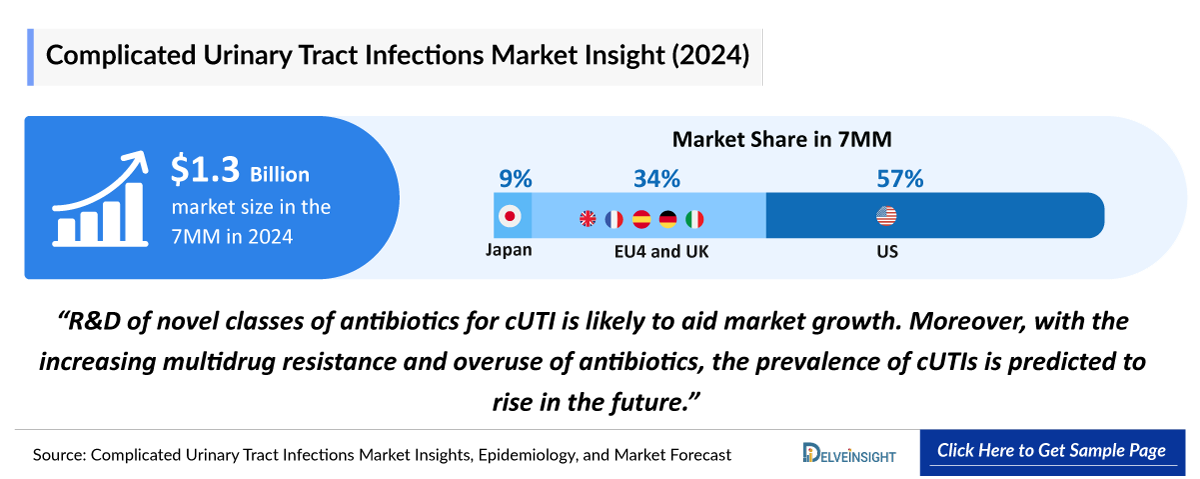

The Complicated Urinary Tract Infections market in the 7MM was valued at approximately USD 1,375 million in 2025 and is projected to reach USD 2,259 million by 2034 over the forecast period from 2025 to 2034.

-

The Complicated Urinary Tract Infections market is projected to grow at a CAGR of 5.7% by 2034 in leading countries (US, EU4, UK and Japan).

cUTIs Market and Epidemiology Analysis

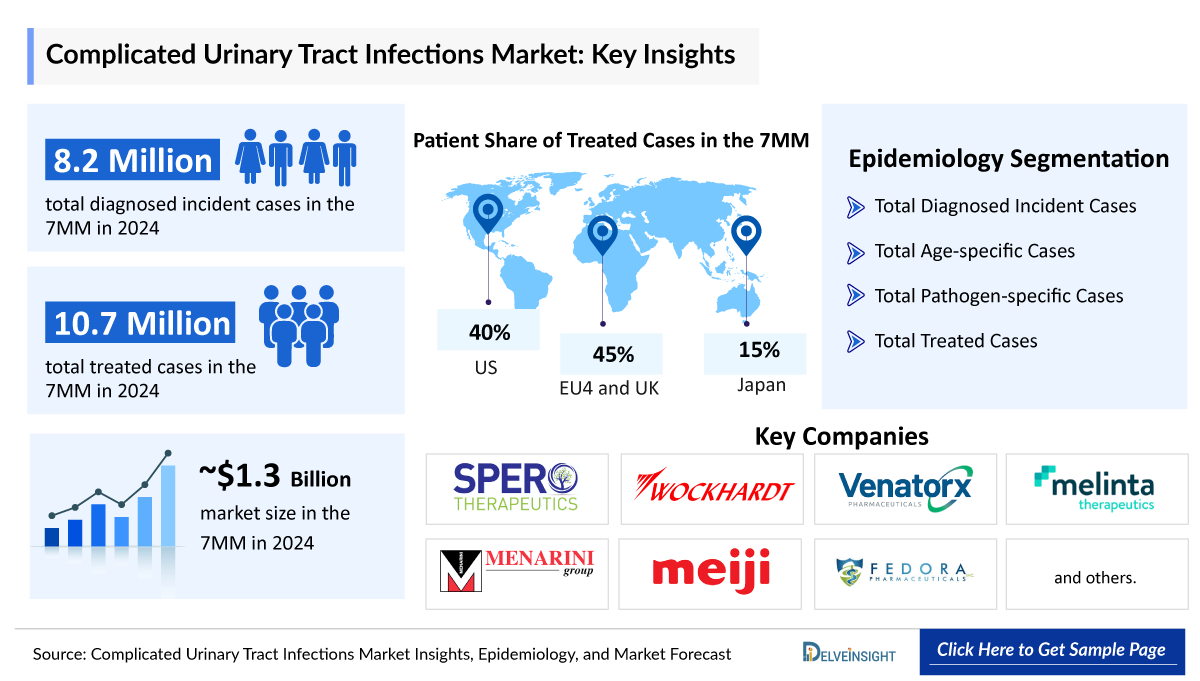

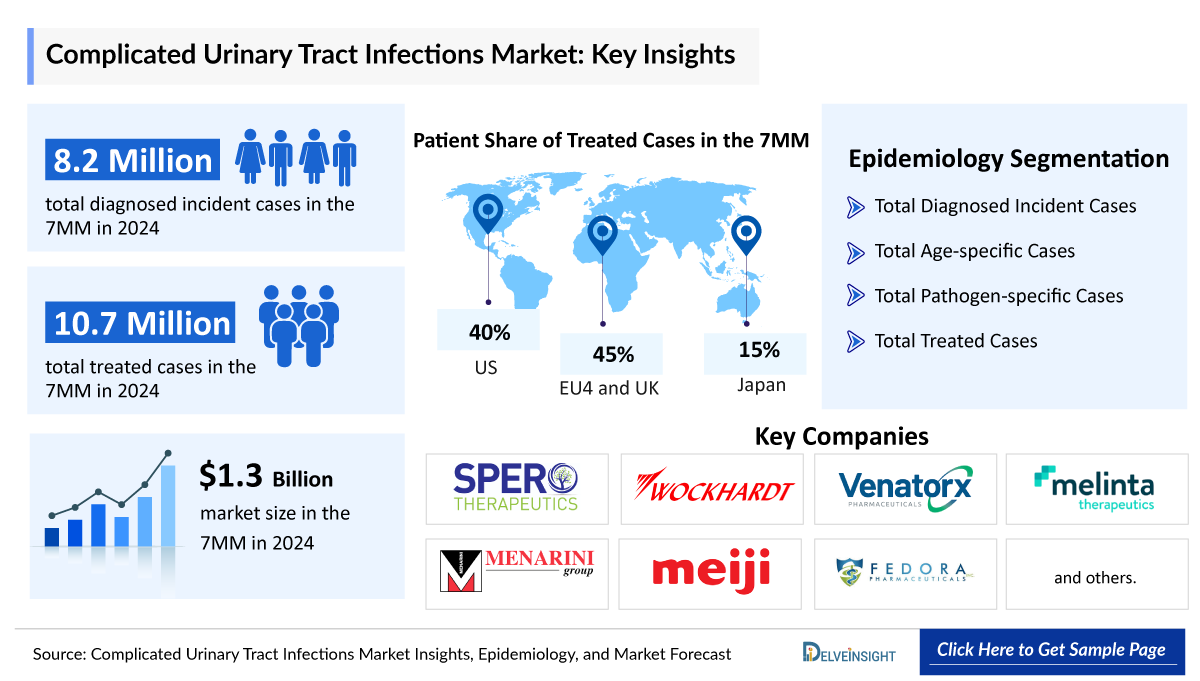

- In 2024, there were approximately 8,266,000 diagnosed incident cases of cUTI in the 7MM.

- In the 7MM, female accounted for approximately 70% cases and male accounted for almost 30% cases of cUTI in 2024.

- Treatment for cUTIs typically lasts 7–14 days and often requires hospitalization with IV, broad-spectrum antibiotics, especially in cases involving multidrug-resistant organisms or severe illness.

- Empiric therapy may include extended-spectrum cephalosporins, beta-lactam inhibitor, or carbapenems for high-risk patients. Newer agents like ceftazidime-avibactam and ceftolozane-tazobactam are effective against resistant gram-negative pathogens, including ESBL-producing and fluoroquinolone-resistant strains.

- In 2024, the United States dominated the cUTIs market among the 7MM, capturing approximately 57% of the total 7MM market share.

- In 2024, the total market size for cUTIs in EU4 and the UK was approximately USD 454 million, accounting for almost 34% of market in 7MM.

- The leading Complicated Urinary Tract Infections companies such as Spero Therapeutics, Wockhardt, Venatorx Pharmaceuticals, Melinta Therapeutics, Menarini Group, Meiji Seika Pharma, Fedora Pharmaceuticals, and others are developing therapies for Complicated Urinary Tract Infections treatment.

- Wockhardt stated in its annual report that global approval for ZAYNICH was expected by the end of 2025 or early 2026.

- Meanwhile, the pipeline for cUTI continues to expand, with drugs such as Tebipenem Pivoxil Hydrobromide (SPR994), (zidebactam/cefepime, WCK 5222), Cefepime/Taniborbactam (VNRX-5133) and others showing promise in clinical development.

Complicated Urinary Tract Infections Market size and Forecast

- 2025 cUTIs Market Size: USD 1,375 million

- 2034 Projected cUTIs Market Size: USD 2,259 million

- cUTIs Growth Rate (2025-2034): 5.7% CAGR

- Largest cUTIs Market: United States

DelveInsight's "Complicated Urinary Tract Infections Market Insights, Epidemiology, and Market Forecast-2034" report delivers an in-depth understanding of the Complicated Urinary Tract Infections, historical and forecasted epidemiology as well as the Complicated Urinary Tract Infections therapeutics market trends in the United States, EU5 (Germany, Spain, Italy, France, and United Kingdom) and Japan.

|

Study Period |

2020 to 2034 |

|

Forecast Period |

2025-2034 |

|

Geographies Covered |

|

|

Complicated Urinary Tract Infections Market |

|

|

Complicated Urinary Tract Infectionss Market Size | |

|

Complicated Urinary Tract Infections Companies |

Spero Therapeutics, Wockhardt, Venatorx Pharmaceuticals, Melinta Therapeutics, Menarini Group, Meiji Seika Pharma, Fedora Pharmaceuticals, and others |

|

Complicated Urinary Tract Infections Epidemiology Segmentation |

|

Key Factors Driving the Complicated Urinary Tract Infection Market

Increase in cUTI Incidence

In 2024, over 1 million diagnosed-incident cases of uUTI progressed to cUTI in the 7MM, which is expected to increase during the forecast period (2025–2024).

Rising Catheter Use Driving cUTI Market Expansion

Rising use of urinary catheters and other drainage devices is likely to offer an uptick in cUTI treatment market growth as patients using urinary catheters are more likely to acquire cUTI.

Expected Launch of Emerging cUTI Drugs

Some of the drugs in the pipeline include tebipenem pivoxil hydrobromide, cefepime/zidebactam, and cefepime-Taniborbactam among others.

Complicated Urinary Tract Infection Disease Understanding

Complicated Urinary Tract Infection Overview

UTIs are one of the most frequent infectious illnesses in the world, yet they remain understudied. Although uropathogenic E. coli (UPEC) accounts for a high percentage of UTIs, various bacteria, each of which will have its host–pathogen interactions with the bladder environment, can infect the urinary tract.

UTIs present in various forms, from mild uncomplicated cases to more serious conditions like cUTIs, pyelonephritis, and urosepsis, making patient stratification essential. cUTIs carry a higher risk of recurrence, chronicity, and severe outcomes, largely influenced by host factors rather than pathogens. These infections are also commonly associated with high rates of antibiotic resistance.

Asymptomatic bacteriuria (ASB) is the most common form of complicated urinary infection, especially prevalent in patients with chronic catheters, neurogenic bladder, or elderly residents in care facilities. Symptomatic cases range from mild urinary symptoms to severe conditions like bacteremia and sepsis, with complete obstruction or trauma—particularly with hematuria—linked to more serious outcomes.

Further details are provided in the report…

Complicated Urinary Tract Infection Diagnosis

This diagnosis of a cUTI is based on three main features: the clinical picture, microbiological tests, and radiological investigations.

Clinical Picture: The most common clinical presentations of UTI include acute cystitis, pyelonephritis, and less commonly acute prostatitis, but patients with abnormal urinary tracts can present more atypically.

Laboratory Tests: Basic laboratory tests may reveal elevated inflammatory markers, and renal function should be recorded. The urine dipstick is a simple and cheap bedside test and is very useful in confirming a diagnosis of UTI.

Radiological Tests: All patients with cUTIs, including first-time pyelonephritis in healthy nonpregnant women, should undergo renal ultrasound to assess for obstruction or abnormalities, as these cannot be reliably excluded by clinical evaluation alone.

Further details related to country-based variations are provided in the report…

Complicated Urinary Tract Infection Treatment

Treatment for complicated UTIs tends to take longer compared with simple UTIs, and may take between 7 and 14 days. While a course of antibiotics may treat a typical UTI at home, complicated cases may require broad-spectrum, intravenous antibiotics as well as hospitalization. The exact treatment timeline depends on how soon patient’s body responds to broad-spectrum antibiotics, as well as whether any complications develop.

The treatment goals are to get rid of the infection, prevent complications, and help provide symptomatic relief. In order to lower the risk of developing pyelonephritis, early treatment is recommended. When considering empirical antimicrobial selection, it is critical to recognize antimicrobial resistance trends. The main course of treatment for individuals with lower UTIs is an oral medication with an empirically selected antibiotic that is effective against Gram-negative aerobic coliform bacteria, such as Escherichia coli.

Further details related to treatment and management are provided in the report…

Complicated Urinary Tract Infection Epidemiology

The cUTI epidemiology chapter in the report provides historical as well as forecasted epidemiology segmented by diagnosed incident cases of cUTI, age-specific cases of cUTI, gender-specific cases of cUTI, pathogen-specific cases of cUTI, and treated cases of cUTI in the United States, EU4 countries (Germany, France, Italy, Spain) and the United Kingdom, and Japan from 2020 to 2034.

Key Findings from cUTI Epidemiological Analyses and Forecast

- In 2024, the Complicated Urinary Tract Infection Diagnosed Incident Cases were approximately 3,558,000 in the US.

- In 2024, the age-specific cases of cUTI were approximately 40,000, 268,000, 247,000, 511,500, 1,759,500 and 732,000 cases for 0-17 years, 18–44 years, 45–54 years, 55–64 years, 65–84 years and =85 years, respectively, in the US.

- In the US, male accounted for approximately 30% cases and female accounted for ~70% cases of cUTI in 2024.

- In 2024, the treated Cases of cUTI was approximately 10,746,500 in the 7MM, out of which ~ 8,266,500 were 1st line and ~ 2,480,000 were recurrent rate.

Complicated Urinary Tract Infection Epidemiology Segmentation

- Diagnosed Incident Cases of cUTI

- Age-specific Cases of cUTI

- Gender-specific Cases of cUTI

- Pathogen-specific Cases of cUTI

- Treated Cases of cUTI

Complicated Urinary Tract Infection Market Recent Developments and Breakthroughs

- In March 2025, Meiji Seika Pharma announced that it had achieved positive results in a global Phase III clinical trial of OP0595, a novel ß-lactamase inhibitor developed to combat AMR. The trial targeted patients with cUTI or acute, uncomplicated pyelonephritis.

- In January 2025, Wockhardt announced that ZAYNICH demonstrated unprecedented efficacy in a global, pivotal Phase III study for cUTI, achieving a clinical cure rate of 96.8% and successfully meeting superiority criteria for registration.

Complicated Urinary Tract Infection Drug Chapters

The section dedicated to drugs in the cUTI report provides an in-depth evaluation of late-stage cUTI pipeline drugs (Phase III and Phase II) related to cUTI. The drug chapters section provides valuable information on various aspects related to clinical trials of cUTI, such as the pharmacological mechanisms of the drugs involved, designations, approval status, patent information, and a comprehensive analysis of the pros and cons associated with each drug. Furthermore, it presents the most recent news updates and press releases on drugs targeting cUTI.

cUTI Marketed Therapies

EXBLIFEP (Cefepime/Enmetazobactam): Allecra Therapeutics

EXBLIFEP (cefepime/enmetazobactam), a novel intravenous antibiotic targeting MDR gram-negative bacteria particularly ESBL-producing strains.

Approved by the FDA in February 2024 for cUTI. Despite demonstrating strong clinical efficacy, especially against resistant pathogens, the drug was unexpectedly withdrawn from the US market. In March 2024, the European Commission granted marketing authorisation for EXBLIFEP for the treatment of adult patients with cUTI, including pyelonephritis.

RECARBRIO (imipenem, cilastatin, and relebactam): Merck Sharp & Dohme

RECARBRIO is a combination of imipenem, a cell wall inhibitor; cilastatin, a renal dehydropeptidase inhibitor; and relebactam, a beta-lactamase inhibitor.

The recommended dose is 1.25 g (imipenem 500 mg, cilastatin 500 mg, and relebactam 250 mg) for adult patients with creatinine clearance of 90 mL/min or greater.

In July 2019, the US FDA approved RECARBRIO (imipenem, cilastatin, and relebactam), an antibacterial drug product to treat adults with cUTI. In February 2020, the European medicines agency granted marketing authorization to RECARBRIO for the treatment of gram-negative bacteria. In July 2021, the Ministry of Health, Labour and Welfare (MHLW) approved RECARBRIO for the treatment of infections caused by RECARBRIO-sensitive Escherichia coli, Citrobacter spp, Klebsiella spp, Enterococcus spp, Serratia spp, Pseudomonas aeruginosa, and Acinetobacter spp.

Comparison of cUTIs Marketed Therapies | |||||

|

Drug Name |

Company |

MoA |

RoA |

Molecule Type |

Approval |

|

RECARBRIO (imipenem, cilastatin, and relebactam) |

Merck Sharp & Dohme |

Cell wall inhibitor/ Renal dehydropeptidase inhibitor/ Beta-lactamase inhibitor |

IV |

Small molecule |

US:2019 EU:2020 JP:2021 |

|

ZERBAXA (ceftolozane/tazobactam) |

Merck Sharp & Dohme |

Cephalosporin antibacterial / Beta-lactamase inhibitors |

IV |

Small molecule |

For adults US: 2014 EU: 2015 JP: 2019 <18 years old: US: 2022 |

|

AVYCAZ/ ZAVICEFTA (Ceftazidime – Avibactam) |

AbbVie |

Cell wall inhibitor/ Beta-lactamase inhibitors |

IV |

Small molecule |

US: 2018 EU: 2020 JP: 2024 |

|

FETROJA (cefiderocol) |

Shionogi |

Cell wall inhibitors |

IV |

Antibacterial |

US: 2019 EU: 2020 |

|

VABOMERE (Meropenem/vaborbactam) |

Melinta Therapeutics |

Cell wall inhibitor/ Beta-lactamase inhibitors |

IV |

Small molecule |

US-2017 EU-2018 |

Emerging cUTI Therapies

Tebipenem Pivoxil Hydrobromide (SPR994): Spero Therapeutics

Tebipenem HBr (tebipenem pivoxil hydrobromide; formerly SPR994) is an oral antibiotic used for the treatment of cUTI and AP to help patients avoid hospitalizations and/or transition patients to home after IV therapy.

In March 2019, Spero Therapeutics announced the US FDA grant of FTD for SPR994 for the treatment of cUTI and AP. Tebipenem HBr has also been granted Qualified Infectious Disease Product (QIDP) designations for cUTI.

ZAYNICH (zidebactam/cefepime, WCK 5222): Wockhardt

ZAYNICH, a combination of zidebactam and cefepime, is Wockhardt’s novel proprietary antibiotic, targeted towards MDR gram-negative infections. ZAYNICH is a novel ß-lactam enhancer mechanism of action drug, which overcomes all the clinically important resistance mechanisms in gram-negative pathogens, including tough-to-treat Pseudomonas, Stenotrophomonas, Acinetobacter, and Klebsiella.

ZAYNICH has completed a multi-national Phase III study, which would support its registration/marketing authorization globally. In December 2015, the US FDA granted breakthrough QIDP drug discovery status to WCK-5222.

Comparison of cUTIs Emerging Therapies | |||||

|

Drug Name |

Company |

Phase |

RoA |

Molecule Type |

MoA |

|

Tebipenem PIntravenousoxil Hydrobromide |

Spero Therapeutics |

III |

Oral |

Small molecule |

Cell wall inhibitors |

|

Cefepime-zidebactam |

Wockhardt |

III |

IV |

Small molecule |

Cell wall inhibitor/ Beta-lactamase enhancer |

|

Cefepime/ taniborbactam |

Venatorx Pharmaceuticals |

III |

IV |

Small molecule |

Cell wall inhibitor/ Beta-lactamase inhibitors |

|

Nacubactam (OP0595) |

Meiji |

III |

IV |

Small molecule |

Beta-lactamase inhibitors |

|

XNW4107 |

Evopoint Pharmaceuticals |

III |

IV |

Small molecule |

Beta-lactamase inhibitors |

Complicated Urinary Tract Infection Market Outlook

The Complicated Urinary Tract Infections market outlook of the report helps to build the detailed comprehension of the historic, current, and forecasted Complicated Urinary Tract Infections market trends by analyzing the impact of current therapies on the market, unmet needs, drivers and barriers and demand of better technology.

This segment gives a thorough detail of Complicated Urinary Tract Infections market trend of each marketed drug and late-stage pipeline therapy by evaluating their impact based on annual cost of therapy, inclusion and exclusion criteria's, mechanism of action, compliance rate, growing need of the market, increasing patient pool, covered patient segment, expected launch year, competition with other therapies, brand value, their impact on the market and view of the key opinion leaders. The calculated market data are presented with relevant tables and graphs to give a clear view of the market at first sight.

According to DelveInsight, Complicated Urinary Tract Infections market in 7MM is expected to change in the study period 2019-2032.

Key Findings

This section includes a glimpse of the Complicated Urinary Tract Infections market in 7MM.

The United States cUTIs Market Outlook

This section provides the total Complicated Urinary Tract Infections market size and market size by therapies in the United States.

EU-5 Countries cUTIs Market Outlook

The total Complicated Urinary Tract Infections market size and market size by therapies in Germany, France, Italy, Spain, and the United Kingdom is provided in this section.

Japan cUTIs Market Outlook

The total Complicated Urinary Tract Infections market size and market size by therapies in Japan is also mentioned.

During the forecast period (2025–2034), pipeline candidates such as Tebipenem PIntravenousoxil Hydrobromide, Cefepime-zidebactam, Cefepime/ taniborbactam and others are expected to drive the rise in cUTI market size.

- The Complicated Urinary Tract Infections market in the 7MM was valued at approximately USD 1,375 million in 2025 and is projected to reach USD 2,259 million by 2034 at a CAGR of 5.7% over the forecast period from 2024 to 2034.

- In 2024, in the EU4 and the UK, Germany has the highest market size of approximately USD 115 million.

- In 2024, the total market size for cUTI in Japan was approximately 120 USD million.

- In a nutshell, many potential therapies are being investigated to manage cUTI. Even though it is too soon to comment on the above-mentioned promising candidate to enter the market during the forecast period (2024–2034), it is safe to assume that the future of this market is bright. Eventually, these drugs will create a significant difference in the landscape of cUTI in the coming years. The treatment space is expected to experience a significant positive shift in the coming years owing to the improvement in healthcare spending worldwide.

Further details are provided in the report…

Complicated Urinary Tract Infections Drugs Uptake

This section focuses on the uptake rate of potential drugs expected to be launched in the market during 2025–2034. The landscape of Complicated Urinary Tract Infections treatment has experienced a profound transformation with the uptake of novel drugs.

Further detailed analysis of emerging therapies drug uptake in the report…

Complicated Urinary Tract Infections Pipeline Development Activities

The Complicated Urinary Tract Infections pipeline report provides insights into Complicated Urinary Tract Infections clinical trials Phase III, Phase II, and Phase I/II. It also analyzes key players involved in developing targeted therapeutics.

Complicated Urinary Tract Infections Pipeline Development Activities

The Complicated Urinary Tract Infections clinical trials analysis report covers detailed information on collaborations, acquisitions and mergers, licensing, and patent details for Complicated Urinary Tract Infections emerging therapies.

Latest KOL Views on Complicated Urinary Tract Infections

To stay abreast of the latest trends in the market, we conduct primary research by seeking the opinions of Key Opinion Leaders (KOLs) and Subject Matter Experts (SMEs) who work in the relevant field. This helps us fill any gaps in data and validate our secondary research.

We have reached out to industry experts to gather insights on various aspects of cUTI, including the evolving treatment landscape, patients’ reliance on conventional therapies, their acceptance of therapy switching, drug uptake, and challenges related to accessibility. The experts we contacted included medical/scientific writers, professors, and researchers from prestigious universities in the US, Europe, the UK, and Japan.

What KOLs are saying on Complicated Urinary Tract Infections Patient Trends?

Our team of analysts at Delveinsight connected with more than 10 KOLs across the 7MM. We contacted institutions such as the University of Munich, the University of Tokyo, UCLA Medical Centre, and University of Minnesota, etc., among others. By obtaining the opinions of these experts, we gained a better understanding of the current and emerging treatment patterns in the cUTI market, which will assist our clients in analyzing the overall epidemiology and market scenario.

We perform Qualitative and Market Intelligence analysis using various approaches, such as SWOT analysis and Conjoint Analysis. In the SWOT analysis, strengths, weaknesses, opportunities, and threats in terms of disease diagnosis, patient awareness, patient burden, competitive landscape, cost-effectiveness, and geographical accessibility of therapies are provided. These pointers are based on the Analyst’s discretion and assessment of the patient burden, cost analysis, and existing and evolving treatment landscape.

Conjoint Analysis analyzes multiple approved and emerging therapies based on relevant attributes such as safety, efficacy, frequency of administration, designation, route of administration, and order of entry. Scoring is given based on these parameters to analyze the effectiveness of therapy.

In efficacy, the trial’s primary and secondary outcome measures are evaluated; for instance, in trials for cUTI, one of the most important primary endpoints was achieving Test-of-Cure, micro Intent-to-treat population, etc. Based on these, the overall efficacy is evaluated.

Further, the therapies’ safety is evaluated wherein the acceptability, tolerability, and adverse events are majorly observed, and it sets a clear understanding of the side effects posed by the drug in the trials. In addition, the scoring is also based on the route of administration, order of entry and designation, probability of success, and the addressable patient pool for each therapy. According to these parameters, the final weightage score and the ranking of the emerging therapies are decided.

cUTI Market Access and Reimbursement

Because newly authorized drugs are often expensive, some patients escape receiving proper treatment or use off-label, less expensive prescriptions. Reimbursement plays a critical role in how innovative treatments can enter the market. The cost of the medicine, compared to the benefit it provides to patients who are being treated, sometimes determines whether or not it will be reimbursed. Regulatory status, target population size, the setting of treatment, unmet needs, the number of incremental benefit claims, and prices can all affect market access and reimbursement possibilities.

Inpatient prospective payment system (IPPS) participating acute care hospitals will be eligible to receive an NTAP for RECARBRIO up to USD 3,532.78 per qualified case starting at the beginning of October 2020 when RECARBRIO is used to treat cUTI and cIAI. This additional payment will be given in addition to the MS-DRG reimbursement for Medicare inpatient cases that qualify. The ICD-10-PCS codes are XW033U5 (Introduction of imipenem-cilastatin-relebactam anti-infective into a peripheral vein, percutaneous approach, new technology group 50 and XW043U5 (Introduction of imipenem-cilastatin-relebactam anti-infective into central vein, percutaneous approach, new technology group 5).

The report further provides detailed insights on the country-wise accessibility and reimbursement scenarios, cost-effectiveness scenario of approved therapies, programs making accessibility easier and out-of-pocket costs more affordable, insights on patients insured under federal or state government prescription drug programs, etc.

Scope of the cUTIs Market Report

- The report covers a segment of key events, an executive summary, and a descriptive overview of cUTIs, explaining its causes, signs and symptoms, pathogenesis, and currently available therapies.

- Comprehensive insight into the epidemiology segments and forecasts, the future growth potential of diagnosis rate, disease progression, and treatment guidelines have been provided.

- Additionally, an all-inclusive account of the current and emerging therapies and the elaborative profiles of late-stage and prominent therapies will impact the current treatment landscape.

- A detailed review of the cUTIs market, historical and forecasted market size, market share by therapies, detailed assumptions, and rationale behind our approach is included in the report, covering the 7MM drug outreach.

- The report provides an edge while developing business strategies by understanding trends through SWOT analysis and expert insights/KOL views, patient journey, and treatment preferences that help shape and drive the 7MM cUTIs market.

Complicated Urinary Tract Infection Market Report Insights

- cUTI Patient Population

- cUTI Therapeutic Approaches

- cUTI Market Size and Trends

- Existing Market Opportunity

- cUTI Drugs Market

Complicated Urinary Tract Infection Market Report Key Strengths

- Ten-year Forecast

- The 7MM Coverage

- cUTI Epidemiology Segmentation

- Key Cross Competition

- cUTI Drugs Uptake

Complicated Urinary Tract Infection Market Report Assessment

- Current cUTI Treatment Practices

- cUTI Market Reimbursements

- cUTI Market Attractiveness

- Qualitative Analysis (SWOT, Conjoint Analysis, Unmet needs)

- cUTI Market Drivers

- cUTI Market Barriers

Key Questions Answered In The cUTI Market Report:

- Would there be any changes observed in the current treatment approach?

- Will there be any improvements in cUTI management recommendations?

- Would research and development advances pave the way for future tests and therapies for cUTI?

- Would the diagnostic testing space experience a significant impact and lead to a positive shift in the treatment landscape of cUTI?

- What kind of uptake will the new therapies witness in the coming years in cUTI patients?