Coronary Stents Market

Coronary Stents Market by Product Type (Bare Metal Stents, Drug Eluting Stents, and Bioresorbable Scaffolds), Material (Metal [Stainless Steel, Cobalt-Chromium {CoCr}, Platinum-Chromium {PtCr}, Nitinol], and Polymer), End-User (Hospitals, Ambulatory Surgical Centers, and Others), and Geography (North America, Europe, Asia-Pacific, and Rest of the World) is expected to grow at a significant CAGR forecast till 2030 owing to the growing prevalence of cardiovascular disorders (CVDs) and increasing risk factors associated with coronary artery disease

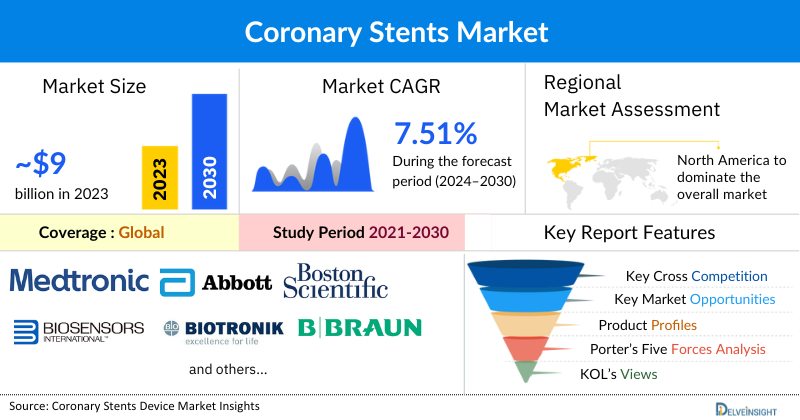

The coronary stents market was valued at USD 9.27 billion in 2023, growing at a CAGR of 7.51% during the forecast period from 2024 to 2030, to reach USD 14.28 billion by 2030. The rising demand for coronary stents is primarily attributed to the growing prevalence of cardiovascular diseases and the increasing risk factors associated with coronary artery disease. Additionally, the rise in minimally invasive surgeries performed globally, along with technological innovations in coronary stents, are key factors contributing to the positive growth of the coronary stents market during the forecast period from 2024 to 2030.

Request for unlocking the CAGR of the Coronary Stents Market

|

Study Period |

2021 to 2030 |

|

Forecast Period |

2024-2030 |

|

Geographies Covered |

Global |

|

Coronary Stents CAGR | 7.51% |

|

Coronary Stents Market Size | |

|

Coronary Stents Companies |

|

Coronary Stents Market Dynamics

According to data from the British Heart Foundation published in January 2024, around 620 million people worldwide were living with heart disease as of early 2024. Additionally, the same source reported that approximately 250 million individuals suffered from coronary heart disease (CHD) in 2021. This escalating burden of cardiovascular conditions can be alleviated through the appropriate use of coronary stents, which are medical devices designed to keep arteries open and ensure a continuous flow of blood to the heart muscle. By maintaining optimal blood circulation, coronary stents can substantially reduce heart damage and improve health outcomes, thereby driving market growth.

According to data from the Government of the United Kingdom in March 2024, 1,862,500 individuals were diagnosed with coronary heart disease in England for the financial year ending in 2023. Coronary stents are commonly employed in angioplasty procedures to enhance arterial function by keeping them open and ensuring continuous blood flow. As the prevalence of cardiovascular diseases continues to rise, the demand for coronary stents is expected to drive significant market growth.

The increasing number of minimally invasive surgeries, such as coronary angioplasty and percutaneous coronary intervention (PCI), is a significant factor contributing to the growth of the coronary stent market. Data published by Eurostat, the statistical office of the European Union, in October 2023, indicated that approximately 1.1 million percutaneous coronary angioplasty procedures were performed across Europe in 2021. During these procedures, coronary stents are inserted and expanded using a balloon catheter to support and maintain the artery's openness at the blockage site. The primary objective of coronary angioplasty is to restore adequate blood flow to the heart muscle. As the frequency of these minimally invasive interventions increases, the demand for coronary stents is expected to surge, significantly driving market expansion.

Technological advancements in bioresorbable coronary stent systems are also significantly contributing to market growth. For instance, in April 2024, Abbott Laboratories announced the U.S. Food and Drug Administration (FDA) approval of the Esprit™ BTK Everolimus Eluting Resorbable Scaffold System (Esprit BTK System). This innovative stent dissolves over time after opening blocked arteries below the knee (BTK) and is specifically designed for patients with chronic limb-threatening ischemia (CLTI) in the BTK region. The Esprit BTK System not only maintains arterial openness but also delivers the drug Everolimus to facilitate vessel healing before it is gradually absorbed by the body. Such advancements by leading companies are expected to drive substantial expansion in the coronary stent market.

However, certain factors, such as product recalls due to malfunctioning and the risk of restenosis, may constrain the growth of the coronary stent market.

Coronary Stents Market Segment Analysis

Coronary Stents Market by Product Type (Bare Metal Stents, Drug Eluting Stents, and Bioresorbable Scaffolds), Material (Metal [Stainless Steel, Cobalt-Chromium {CoCr}, Platinum-Chromium {PtCr}, Nitinol], and Polymer), End-User (Hospitals, Ambulatory Surgical Centers, and Others), and Geography (North America, Europe, Asia-Pacific, and Rest of the World)

In the product segment of the coronary stents market, drug-eluting stents are expected to hold the largest market share during the forecast period. This trend is attributed to the increasing prevalence of coronary heart disease (CHD). According to data published by the National Heart Foundation of Australia in January 2024, over 590,000 Australians were living with CHD in 2022, accounting for 2% of the total population. Drug-eluting stents are commonly used to treat CHD by preventing the narrowing of arteries, which helps improve patient outcomes. The rising demand for such effective treatments is anticipated to further drive market expansion.

Drug-eluting stents offer several advantages, particularly in preventing restenosis. These advanced devices significantly reduce the risk of restenosis and lower the incidence of stent thrombosis and myocardial infarction. Newer-generation drug-eluting stents (DES) further enhance these benefits by improving long-term clinical outcomes in cardiovascular disease treatment. By effectively minimizing restenosis, DES decreases the likelihood of repeat revascularization procedures, thereby improving patient health and reducing complications. In percutaneous coronary interventions (PCI), DES plays a crucial role in reopening blocked coronary arteries and maintaining arterial patency, thereby enhancing the efficacy of the procedure and mitigating the risk of restenosis.

Recent product approvals are expected to accelerate the growth of the coronary stent market. Key players in the industry are intensifying their research and development efforts to create advanced drug-eluting coronary stents for patients with coronary artery disease (CAD). For example, in August 2022, Medtronic launched its latest drug-eluting coronary stent, the Onyx Frontier™. Following its recent CE Mark approval, the Onyx Frontier™ features an advanced delivery system and builds upon the proven performance and clinical data of the Resolute Onyx™ stent. This new DES is specifically designed to treat patients with CAD, a condition characterized by plaque buildup in the coronary arteries. Such innovations are poised to enhance treatment efficacy and drive significant market expansion.

Overall, the factors mentioned above are likely to propel the growth of the drug-eluting stent segment, contributing to the overall expansion of the coronary stents market.

North America is expected to dominate the overall Coronary Stents Market

Among all countries, North America is expected to dominate the overall coronary stents market during the forecast period. This dominance is attributed to the rising prevalence of heart disease, increased governmental and organizational initiatives aimed at raising awareness about cardiovascular conditions, and significant advancements in technology and product development by key players in the region.

According to data from the Centers for Disease Control and Prevention (CDC) in June 2024, approximately 20.5 million individuals in the United States were living with coronary heart disease (CHD) in 2021. As coronary stents are essential for the treatment of CHD, the increasing prevalence of this condition is expected to drive substantial market growth for these devices.

The growing prevalence of coronary heart disease (CHD) and other cardiovascular diseases (CVDs) is projected to significantly propel the coronary stent market in the region. For instance, data published by the CDC in May 2024 revealed that approximately 702,880 people, equivalent to 1 in every 5 deaths, died from cardiovascular and other circulatory system diseases in the United States in 2022. Coronary stents are crucial in preventing such mortality by alleviating narrowed or obstructed coronary arteries, thereby restoring blood flow to the heart muscle. This intervention is particularly critical in emergencies like myocardial infarctions (heart attacks), where prompt action can prevent extensive heart damage or death.

Technological innovations and active product development by key players are significantly contributing to the growth of the coronary stent market in North America. Recent product approvals are further fueling this expansion. For example, in October 2023, Boston Scientific Corporation reported positive 12-month results from the pivotal AGENT IDE clinical trial for the AGENT™ drug-coated balloon. This device is utilized during coronary angioplasty to place a stent at the site of a narrowed artery. The trial assessed the safety and effectiveness of the drug-coated balloon (DCB) for treating coronary in-stent restenosis (ISR) caused by coronary artery disease. Such advancements in research and development by leading companies are expected to drive substantial growth in the coronary stent market in North America.

Europe and the Asia-Pacific region also hold significant potential for future growth in the coronary stents market. This growth is driven by the increasing burden of an aging population in these regions, enhanced government funding for managing cardiovascular disorders, and rising healthcare awareness. Additionally, recent product approvals and launches are poised to further stimulate market growth. For example, in April 2022, Biosensors International received approval from the Pharmaceuticals and Medical Devices Agency (PMDA) in Japan for the BioFreedom™ Ultra coronary stent system. This innovative drug-coated stent features a unique polymer and carrier-free design and incorporates the proprietary drug Biolimus A9™ (BA9™), a highly lipophilic anti-restenotic agent specifically developed for coronary vascular applications. Such advancements are expected to drive substantial growth in the coronary stent market in these regions.

Coronary Stents Companies

Some of the key market players operating in the coronary stents market include Medtronic, Abbott Laboratories, Boston Scientific Corporation, Biosensors International Group, Ltd., BIOTRONIK SE & Co. KG, B. Braun SE, Terumo Corporation, MicroPort Scientific Corporation, Meril Life Sciences Pvt. Ltd., Cook, Scitech Medical, Lepu Medical Technology (Beijing) Co., Ltd., OrbusNeich Medical Group Holdings Limited, Cordis, Johnson & Johnson Services, Inc., ENDOCOR GmbH & CO. KG, BD, Vascular Concepts, Translumina, Elixir Medical, and others.

Coronary Stents Recent Developmental Activities

- In July 2024, BIOTRONIK launched the maximum allowed diameters (MAD) range for the Orsiro Mission drug-eluting stent (DES). This product launch is a global effort to advance Orsiro Mission stent technology, aligning with modern percutaneous coronary intervention (PCI) practices. It allows physicians to optimize vessel apposition and adapt to tapered anatomies more effectively.

- In April 2023, Terumo Corporation, announced the initiation of a new prospective clinical study for the Ultimaster Nagomi™ sirolimus-eluting coronary stent system, focusing on complex PCI patients. This stent system inherits the sirolimus-eluting drug while offering an optimized delivery system and enhanced capability to treat coronary heart disease. The primary goal of this clinical study is to assess the clinical outcomes for patients receiving the Ultimaster Nagomi™ stent in complex PCI procedures.

- In February 2023, Abbott Laboratories completed the acquisition of Cardiovascular Systems, Inc. for an amount of USD 890 million. Through this acquisition, Abbott expanded its innovative stent system product portfolio and advanced technical capabilities in interventional vascular devices to increase its global market penetration.

- In July 2022, MicroPort Scientific Corporation received approval from the Chinese National Medical Products Administration (NMPA) to market its Firehawk Pro™ Coronary Rapamycin Target Eluting Stent System. This stent consists of a balloon-expandable design with a groove-binding single-sided drug coating and an advanced delivery system for the treatment of symptomatic primary coronary artery lesions. The drug coating on the stent helps inhibit smooth muscle cell proliferation at the lesion site, supporting the artery while reducing the risk of restenosis.

Key Takes Away from the Coronary Stents Market Report Study

- Market size analysis for current Coronary Stents Market size (2023), and market forecast for 6 years (2024 to 2030)

- Top key product/technology developments, mergers, acquisitions, partnerships, and joint ventures happened over the last 3 years

- Key companies dominating the Coronary Stents market.

- Various opportunities available for the other competitors in the Coronary Stents Market space.

- What are the top-performing segments in 2023? How these segments will perform in 2030?

- Which are the top-performing regions and countries in the current Coronary Stents market scenario?

- Which are the regions and countries where companies should have concentrated on opportunities for Coronary Stents market growth in the coming future?

Target Audience Who Can benefited from Coronary Stents Market Report Study

- Coronary Stents product providers

- Research organizations and consulting companies

- Coronary Stents related organizations, associations, forums, and other alliances

- Government and corporate offices

- Start-up companies, venture capitalists, and private equity firms

- Distributors and Traders dealing in Coronary Stents

- Various end-users who want to know more about the Coronary Stents Market and the latest technological developments in the Coronary Stents Market.