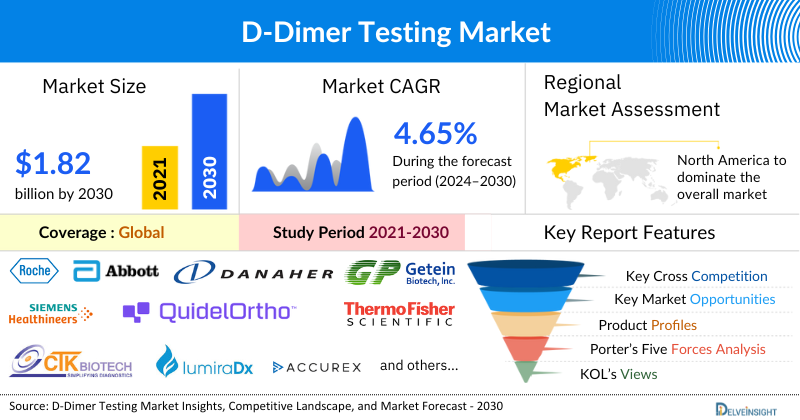

D-Dimer Testing Market

- The D-Dimer Testing Market is expected to witness continued growth in the coming years due to increased adoption of point-of-care testing, advancements in diagnostic technologies, and the rising global burden of thrombotic disorders.

- The leading D-Dimer Testing Companies such as F. Hoffmann-La Roche Ltd., Siemens Healthineers AG, Abbott, Danaher Corporation, biomérieux, QuidelOrtho Corporation, Thermo Fisher Scientific Inc., CTK Biotech, Getein Biotech, Inc., LumiraDx, Accurex, Werfen, Randox Laboratories Ltd., Sekisui Diagnostics, Laboratory Corporation of America Holdings, Helena Laboratories (UK) Limited, BioMedica Diagnostics, Diazyme Laboratories, Inc., HORIBA, Ltd., Sysmex Corporation, and others.

Request for Unlocking the Sample Page of the “D-Dimer Testing Market”

D-Dimer Testing Market by Product Type (Instruments and Reagents and Kits), Assay Type (Enzyme-linked Immunosorbent Assay (ELISA), Latex Immunoturbidimetric Assay, Fluorescence Immunoassay, and Others), Application (Deep Vein Thrombosis (DVT), Pulmonary Embolism, Disseminated Intravascular Coagulation (DIC), and Stroke), End-User (Hospitals and Clinics, Diagnostic Centers, and Others), and Geography (North America, Europe, Asia-Pacific, and Rest of the World) is expected to grow at a steady CAGR forecast till 2030 owing to the rising prevalence of cardiovascular and thrombotic disorders and increasing number of risk factors for blood-clot related disorders.

The D-Dimer Testing Market was valued at USD 1.33 billion in 2023, growing at a CAGR of 4.65% during the forecast period from 2024 to 2030 to reach USD 1.82 billion by 2030. The demand for D-dimer testing is being significantly driven by the increasing prevalence of cardiovascular and thrombotic disorders. As risk factors associated with blood clot-related conditions rise, the need for accurate diagnostic tools becomes more critical. Additionally, heightened research and development activities, along with collaborations among key industry players, are advancing innovations in D-dimer testing methodologies.

These efforts are leading to the introduction of more sensitive and reliable assays, further enhancing diagnostic capabilities. Furthermore, ongoing advancements in diagnostic technology are facilitating quicker and more efficient testing processes, which is essential in emergency and critical care settings. Collectively, these factors are expected to contribute substantially to the growth of the D-dimer testing market during the forecast period from 2024 to 2030, as healthcare providers increasingly rely on D-dimer testing for timely diagnosis and management of thromboembolic conditions.

For More Insights of the Report @ Deep Vein Thrombosis Market

|

Study Period |

2021 to 2030 |

|

Forecast Period |

2024-2030 |

|

Geographies Covered | Global |

|

D-Dimer Testing CAGR | 4.65% |

|

D-Dimer Testing Market Size |

USD 1.63 Billion in 2023 |

|

D-Dimer Testing Companies |

F. Hoffmann-La Roche Ltd., Siemens Healthineers AG, Abbott, Danaher Corporation, Biomérieux, QuidelOrtho Corporation, Thermo Fisher Scientific Inc., CTK Biotech, Getein Biotech Inc., LumiraDx, Accurex, Werfen, Randox Laboratories Ltd., Sekisui Diagnostics, Helena Laboratories (UK) Limited, BioMedica Diagnostics, Diazyme Laboratories, HORIBA Ltd., Sysmex Corporation., and others. |

D-Dimer Testing Market Dynamics

According to The Global Stroke Factsheet 2022, the risk of developing a stroke has increased by 50% over the past 17 years, with an estimated 1 in 4 individuals expected to experience a stroke in their lifetime. Furthermore, the report indicates that approximately 101 million people globally have suffered from a stroke. A recent study highlights that over 10 million cases of deep vein thrombosis (DVT) and pulmonary embolism (PE) are diagnosed worldwide each year, with about 1 million cases occurring in the United States and more than 700,000 cases in France, Italy, Germany, Spain, Sweden, and the United Kingdom combined annually. The rising prevalence of cardiovascular diseases (CVDs), including DVT, PE, and myocardial infarction, necessitates increased diagnostic evaluations. D-Dimer testing plays a crucial role in ruling out or confirming these thrombotic conditions, driving its heightened usage. Consequently, the growing prevalence of cardiovascular and thrombotic disorders is expected to significantly boost market demand for D-Dimer testing.

Additionally, the increasing number of risk factors associated with blood-clot disorders is a key driver of the D-Dimer testing market. According to the World Health Organization (WHO), in 2022, 1 in 8 individuals globally was living with obesity, with approximately 2.5 billion people classified as overweight and 890 million suffering from obesity. Excess body weight exerts additional pressure on the veins, particularly in the legs and pelvis, heightening the likelihood of clot formation. Moreover, the prevalence of sedentary lifestyles, especially in developed nations, contributes to this risk, as individuals with minimal physical activity are more prone to developing blood clots. This trend is expected to further elevate the demand for D-Dimer testing during the forecast period from 2024 to 2025.

However, challenges remain for the D-Dimer testing market, including poor specificity and lower diagnostic sensitivity of D-Dimer assays, as well as a lack of standardization among these tests. These limitations may hinder market growth despite the increasing demand driven by the rising prevalence of thrombotic disorders and associated risk factors.

Get More Insights of the Report @ Pulmonary Embolism Market

D-Dimer Testing Market Segment Analysis

D-dimer Testing market by Product Type (Instruments and Reagents and Kits), Assay Type (Enzyme-linked Immunosorbent Assay (ELISA), Latex Immunoturbidimetric Assay, Fluorescence Immunoassay, and Others), Application (Deep Vein Thrombosis (DVT), Pulmonary Embolism, Disseminated Intravascular Coagulation (DIC), and Stroke), End-User (Hospitals and Clinics, Diagnostic Centers, and Others), and Geography (North America, Europe, Asia-Pacific, and Rest of the World)

In the D-Dimer testing market, the instruments category is projected to capture a substantial revenue share in 2023. This growth can be attributed to several factors, including the increasing prevalence of blood-related disorders and significant technological advancements in diagnostic instruments such as analyzers. Continuous innovations in diagnostic technologies have led to the creation of highly sophisticated instruments for D-Dimer testing, which provide faster, more accurate, and reliable results, making them the preferred choice among healthcare providers. These instruments are extensively utilized in hospitals and clinical laboratories, encompassing both large automated analyzers suited for high-throughput environments and portable devices designed for emergency rooms and smaller clinics, thus catering to a variety of healthcare settings.

Furthermore, recent product launches and regulatory approvals within the instruments category are expected to further bolster market growth. For example, in June 2022, LumiraDx announced that it had received CE Mark approval for its D-Dimer test, which is intended for diagnosing deep vein thrombosis (DVT), pulmonary embolism (PE), and venous thromboembolism (VTE) in symptomatic patients. Given these factors, the instruments category is anticipated to experience significant growth, contributing to the overall expansion of the D-Dimer testing market during the forecast period.

For More Insights of the Report @ Disseminated Intravascular Coagulation Market

North America is expected to dominate the overall D-Dimer Testing Market

North America is projected to hold the largest share of the D-Dimer testing market in 2023, driven by several critical factors. The region experiences a high prevalence of cardiovascular and thrombotic disorders, which significantly increases the demand for effective diagnostic tools such as D-Dimer tests. The aging population in North America is particularly vulnerable to these conditions, further amplifying the need for reliable testing solutions.

According to the Centers for Disease Control and Prevention (CDC) in May 2024, approximately 900,000 individuals in the United States suffer from venous thromboembolism (VTE) annually. This rising prevalence of cardiovascular and thrombotic disorders, including VTE and pulmonary embolism, underscores the urgent need for effective detection and diagnosis, thereby increasing the demand for D-Dimer testing in the U.S. Moreover, the CDC reported in 2024 that the prevalence of obesity exceeded 20% in 2022, affecting more than 1 in 5 adults. Obesity is associated with chronic inflammation, which can lead to hypercoagulability, a condition that increases the risk of clot formation. This heightened tendency for clotting elevates the likelihood of developing conditions such as DVT and PE.

Further, the well-established healthcare infrastructure in North America provides extensive access to advanced diagnostic technologies and instruments, facilitating a higher rate of testing. This infrastructure also fosters greater awareness among healthcare providers about the importance of D-Dimer testing in diagnosing conditions like deep vein thrombosis (DVT) and pulmonary embolism (PE). Technological advancements play a pivotal role in this market, with numerous innovations in D-Dimer assay methods and testing instruments enhancing accuracy and efficiency. The presence of leading pharmaceutical and diagnostic companies in the region fuels ongoing research and development, resulting in frequent product launches and regulatory approvals.

Additionally, favorable reimbursement policies and substantial healthcare spending in North America encourage healthcare providers to adopt D-Dimer testing more widely. The emphasis on rapid diagnosis and effective management of thromboembolic conditions, particularly in emergency and critical care settings, further drives market growth. In summary, the combination of a high prevalence of thrombotic disorders, an aging population, advanced healthcare infrastructure, continuous technological innovation, and supportive reimbursement policies positions North America as the leading region in the D-Dimer testing market. The urgent need for effective diagnostic tools in the face of rising cardiovascular risks further solidifies this trend.

D-DIMER Testing Companies

The leading D-Dimer Testing Companies such as F. Hoffmann-La Roche Ltd., Siemens Healthineers AG, Abbott, Danaher Corporation, biomérieux, QuidelOrtho Corporation, Thermo Fisher Scientific Inc., CTK Biotech, Getein Biotech, Inc., LumiraDx, Accurex, Werfen, Randox Laboratories Ltd., Sekisui Diagnostics, Laboratory Corporation of America Holdings, Helena Laboratories (UK) Limited, BioMedica Diagnostics, Diazyme Laboratories, Inc., HORIBA, Ltd., Sysmex Corporation, and others.

Recent Developmental Activities in the D-DIMER Testing Market

- In June 2022, LumiraDx Limited, a next-generation point-of-care diagnostics company, announced that it has expanded its cardiovascular offering with a CE Mark for its new NT-proBNP test to aid in the diagnosis of CHF and an updated CE Mark for its D-dimer test to now rule out venous thromboembolism (VTE) in symptomatic patients.

- In March 2022 SphingoTec GmbH and Rivaara Labs Pvt Ltd. announced that they have entered into a multi-year distribution agreement for the commercialization of SphingoTec’s point-of-care diagnostic solutions in the Indian subcontinent. The Nexus IB10 analyzer and its portfolio of rapid tests allow convenient assessment of biomarkers relevant to critical care conditions such as sepsis, acute kidney injury, cardiogenic shock, acute heart failure, and myocardial infarction.

Key Takeaways from the D-Dimer Testing Market Size Report Study

- D-Dimer Testing Market size analysis for current D-dimer Testing market size (2023), and market forecast for 6 years (2024 to 2030)

- Top key product/technology developments, mergers, acquisitions, partnerships, and joint ventures happened over the last 3 years.

- Key companies dominating the D-dimer testing market.

- Various opportunities available for the other competitors in the D-dimer testing market space.

- What are the top-performing segments in 2023? How these segments will perform in 2030?

- Which are the top-performing regions and countries in the current D-dimer testing market scenario?

- Which are the regions and countries where companies should have concentrated on opportunities for D-dimer testing market growth in the coming future?

Target Audience who can be benefitted from this D-Dimer Testing Market Size Report Study

- D-dimer Testing product providers

- Research organizations and consulting companies

- D-dimer testing - related organizations, associations, forums, and other alliances

- Government and corporate offices

- Start-up companies, venture capitalists, and private equity firms

- Distributors and traders dealing in D-dimer testing

- Various end-users who want to know more about the D-dimer testing market and the latest technological developments in the D-dimer testing market

Stay Updated with us for Recent Articles @ Latest DelveInsight Blogs