Diabetic Macular Edema Market

- Diabetic macular edema (DME) stems from diabetic retinopathy (DR), a common complication of diabetes and the leading cause of irreversible blindness among working-age individuals worldwide. DR arises from prolonged damage to the retina's small blood vessels, resulting in fluid leakage and swelling, particularly in the macula.

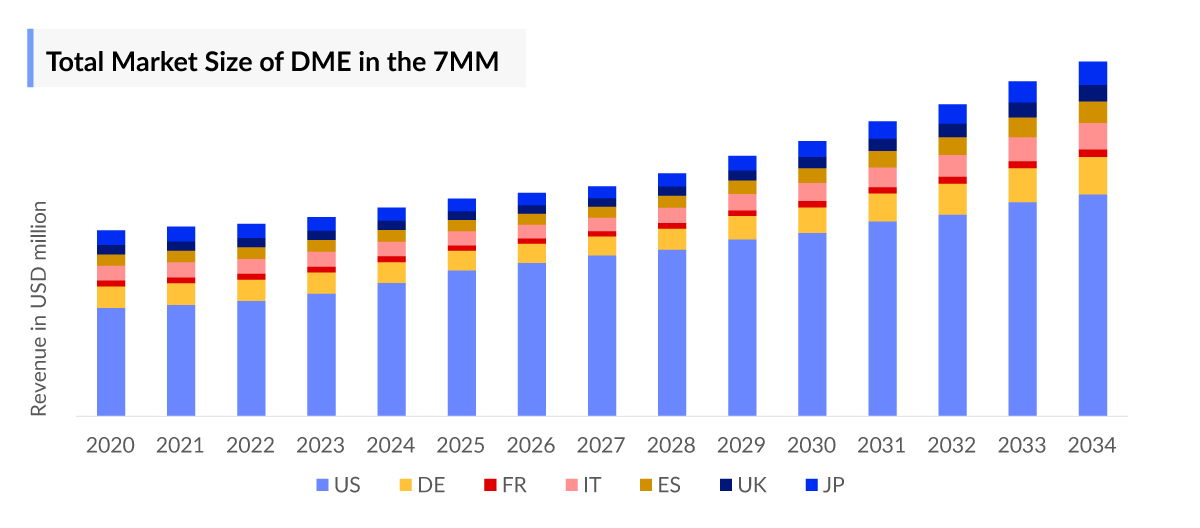

- The United States accounts for the largest market size, i.e. around 60% of the Diabetic Macular Edema (DME), in comparison to EU4 (Germany, Spain, Italy, France), the United Kingdom, and Japan.

- Owing to the higher patient pool and higher treatment cost, according to the estimates, the United States had the highest market size in DME, i.e., ~60% of the total market size of DME in the 7MM, in 2023, followed by Germany and Japan.

- Treatment mainly involves the usage of anti-VEGF Drugs, corticosteroids, and Laser photocoagulation. Nonsteroidal anti-inflammatory drugs (NSAIDs), in the form of eye drops, are sometimes used either before or after cataract surgery to prevent the development of macular edema.

- Anti-VEGFs are the gold standards of treatment due to proven efficacy and clear role of steroids in the DME treatment paradigm. Secondary findings suggest that about half of the US ophthalmologists still prescribe off-label bevacizumab as first-line DME therapy. In EU4 and the UK and Japan, there is substantial variability in the use of off-label bevacizumab with lower usage in EU4 and the countries and relatively higher usage in Japan, although usage in both region is quite low when compared to the US.

- The growth of the DME market is expected to be mainly driven by increase in diabetes cases mainly due to the aging population and sedentary lifestyle, expected entry of emerging therapies having similar efficacy and safety to current standard of care with less frequent requirement of injections, addressing barriers to screening and personalization of treatment.

- Secondary findings suggest that about half of the US ophthalmologists still prescribe off-label bevacizumab as first-line DME therapy.

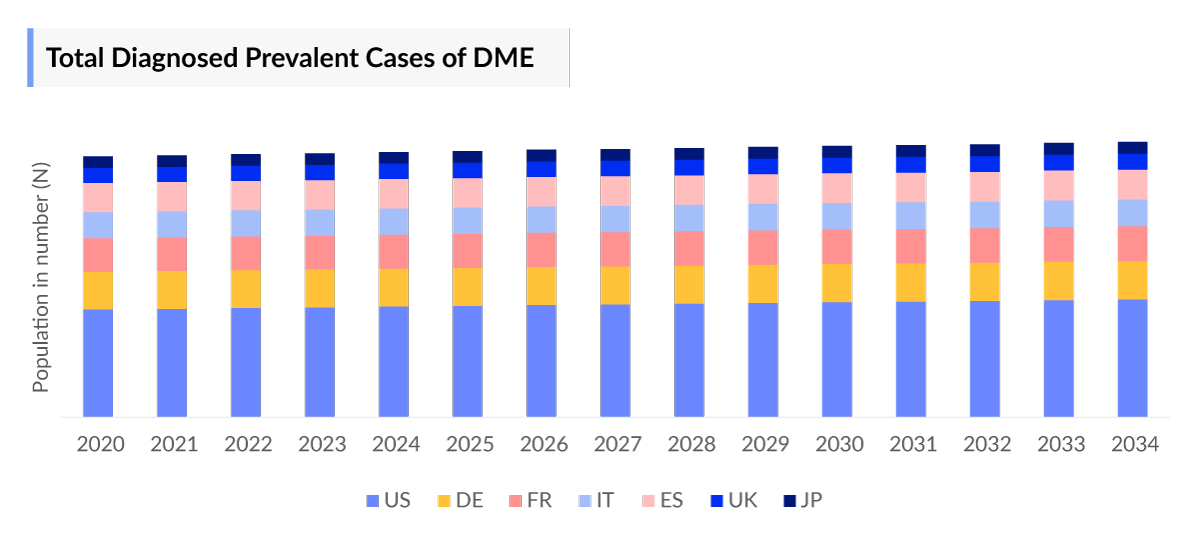

- In 2023, highest total prevalent cases of DME in the 7MM were accounted by the US, i.e. approximately 55%.

- In March 2022, the European Commission approved Novartis' BEOVU (brolucizumab) 6 mg for treating visual impairment due to diabetic macular edema (DME), marking its second indication after initially being approved for wet age-related macular degeneration in 2020.

DelveInsight's “Diabetic Macular Edema Market Insights, Epidemiology and Market Forecast – 2034” report delivers an in-depth understanding of Diabetic Macular Edema, historical and forecasted epidemiology as well as the Diabetic Macular Edema (DME) market trends in the United States, EU4 (Germany, Spain, Italy, and France) and the United Kingdom, and Japan.

Diabetic Macular Edema market report provides real-world prescription pattern analysis, emerging drugs, market share of individual therapies, and historical and forecasted 7MM Diabetic Macular Edema (DME) market size from 2020 to 2034. The report also covers current Diabetic Macular Edema (DME) treatment practices/algorithms and unmet medical needs to curate the best opportunities and assess the market’s underlying potential.

Geography Covered

- The United States

- EU4 (Germany, France, Italy, and Spain) and the United Kingdom

- Japan

Study Period: 2020–2034

Diabetic Macular Edema (DME) Understanding and Treatment Algorithm

Diabetic Macular Edema (DME) Overview, Country-Specific Treatment Guidelines and Diagnosis

Diabetic retinopathy (DR) results from damage to the retina's small blood vessels, leading to fluid leakage and swelling, particularly in the macula. This condition, known as diabetic macular edema (DME), is the primary cause of vision loss in DR patients. Both type 1 and type 2 diabetes can lead to DME. Factors such as poor blood sugar control and high blood pressure increase the risk of blindness. DME can manifest at any stage of DR but is more common in advanced stages. The macula, responsible for central vision, swells due to fluid accumulation, causing distortion in vision.

It is essential to realize that the determination of the presence of CSME is a clinical diagnosis based on a retinal biomicroscopic examination of the patient and not based on fluorescein angiography (FA).

Further details related to country-based variations in diagnosis are provided in the report...

Diabetic Macular Edema Treatment

The standard treatment for DME involves intravitreal injections, where numbing drops are applied, and medication is injected into the vitreous gel. Drugs like AVASTIN, EYLEA, and LUCENTIS are commonly used to block VEGF activity. Corticosteroids are also effective for DME caused by inflammatory eye diseases, administered through eye drops, pills, or injections around the eye to reduce inflammation.

Diabetic Macular Edema Epidemiology

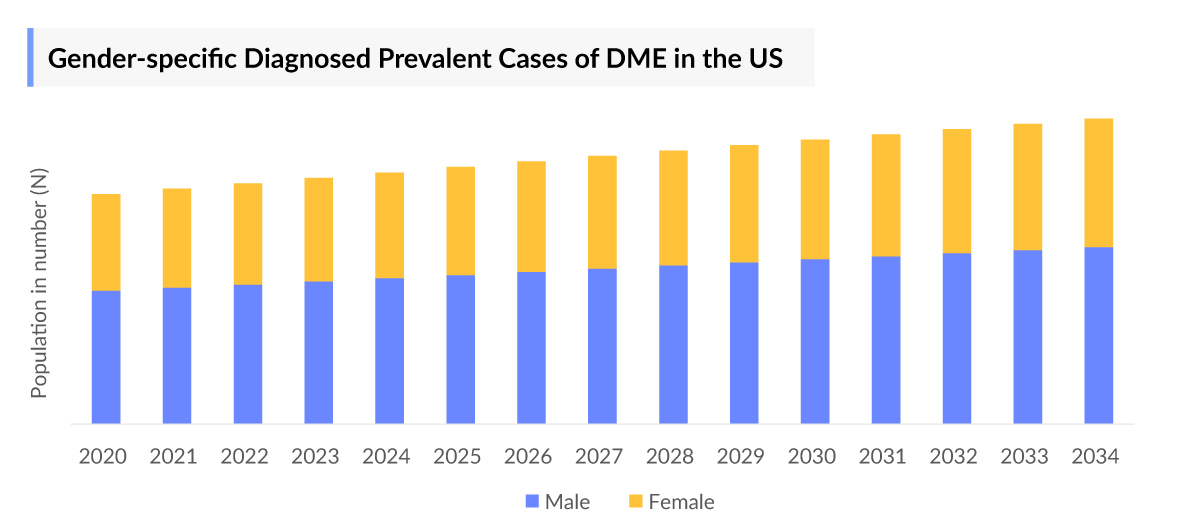

The Diabetic Macular Edema (DME) epidemiology chapter in the report provides historical as well as forecasted in the 7MM covering the United States, EU4 countries (Germany, France, Italy, and Spain), the United Kingdom, and Japan from 2024 to 2034. The Diabetic Macular Edema (DME) epidemiology is segmented with detailed insights into Total Prevalent Cases, Total Diagnosed Prevalent Cases, Gender-specific Cases, Age-specific Cases, Subgroups-specific Cases, Treated Cases of DME.

- Highest total prevalent cases of DME in the 7MM were accounted by US.

- Among the EU4 and the UK countries, the highest number of cases of DME were in Germany ~30%.

- In 2023, gender-specific prevalence data in the United States showed that approximately 57% of cases were male, while around 40% were female.

Diabetic Macular Edema (DME) Recent Developments

- In February 2025, Roche announced that the U.S. FDA approved Susvimo® (ranibizumab injection) 100 mg/mL for the treatment of diabetic macular edema (DME), a leading cause of vision loss in adults with diabetes, affecting over 29 million adults worldwide.

Diabetic Macular Edema (DME) Drug Chapter

The drug chapter segment of the Diabetic Macular Edema (DME) report encloses a detailed analysis of Diabetic Macular Edema (DME) marketed drugs and late-stage (Phase III and Phase II) pipeline drugs. It also deep dives into the Diabetic Macular Edema (DME) pivotal clinical trial details, recent and expected market approvals, patent details, the latest news, and recent deals and collaborations.

Marketed Drugs

LUCENTIS (ranibizumab): Genentech/Novartis

Ranibizumab, marketed as LUCENTIS, binds to active forms of VEGF-A, including VEGF110, blocking its interaction with VEGFR1 and VEGFR2 receptors on endothelial cells. This prevents endothelial cell proliferation, vascular leakage, and new blood vessel formation, addressing conditions like diabetic retinopathy (DR), diabetic macular edema (DME), wet age-related macular degeneration (AMD), retinal vein occlusion, and myopic choroidal neovascularization (mCNV).

EYLEA (aflibercept): Bayer/Regeneron Pharmaceuticals/Santen

Aflibercept is a recombinant fusion protein consisting of portions of human VEGF receptors 1 and 2 extracellular domains fused to the Fc portion of human IgG1 formulated as an iso-osmotic solution for intravitreal administration. Aflibercept is designed to block the growth of new blood vessels and decrease fluid ability to pass through blood vessels (vascular permeability) in the eye by blocking VEGF-A and placental growth factor (PLGF), two growth factors involved in angiogenesis. It helps prevent VEGF-A and PLGF from interacting with their natural VEGF receptors, as shown in preclinical studies. Aflibercept is produced in recombinant Chinese hamster ovary (CHO) cells.

Note: Detailed current therapies assessment will be provided in the full report of Diabetic Macular Edema...

Emerging Drugs

KSI-301: Kodiak Sciences

KSI-301 is built on Kodiak’s Antibody Biopolymer Conjugate (ABC) Platform and is intended to maintain potent and effective drug levels in ocular tissues for longer than the existing agents. KSI-301 is a bioconjugate comprised of two novel components: The first component is a recombinant, full-length humanized anti-VEGF monoclonal antibody, and the second component is a branched, optically clear phosphorylcholine biopolymer. Currently, KSI-301 is being investigated in Phase III studies.

GB-102: Graybug Vision

Sunitinib is a potent pan-VEGF inhibitor and neuroprotectant. It works by blocking all VEGF receptors associated with angiogenesis, vascular permeability, cellular proliferation, and fibrosis and could benefit over traditional VEGF A inhibitors. Moreover, sunitinib is a DLK-inhibitor as well, which may result in a neuroprotective effect. The drug is in Phase IIb stage of clinical development.

|

Therapy Name |

Company Name |

ROA |

MOA |

Phase |

|

KSI-301 |

Kodiak Sciences |

Intravitreal Injection |

Anti-VEGF therapy |

III |

|

GB-102 (sunitinib malate) |

Graybug Vision |

Intravitreal |

Pan-VEGF inhibitor |

IIb |

Note: Detailed emerging therapies assessment will be provided in the final report...

Diabetic Macular Edema (DME) Market Outlook

Key players, such as Novartis Pharmaceuticals, Genentech/Roche, Adverum Biotechnologies and others are evaluating their lead candidates in different stages of clinical development, respectively. They aim to investigate their products for the treatment of Diabetic Macular Edema (DME).

- Exorbitant cost, shortage of trained ophthalmologists, lack of awareness of eye conditions, underdiagnosis of DME, entry of biosimilars and expected approval of drugs are likely to hinder the market growth.

- Among EU4 and the UK, Germany accounted for the highest market size ~ 30%.

- Anti-VEGFs are the gold standards of treatment due to proven efficacy and clear role of steroids in the DME treatment paradigm.

Diabetic Macular Edema Drugs Uptake

This section focuses on the uptake rate of potential drugs expected to be launched in the market during 2024–2034, which depends on the competitive landscape, safety, and efficacy data along with order of entry. It is important to understand that the key players evaluating their novel therapies in the pivotal and confirmatory trials should remain vigilant when selecting appropriate comparators to stand the greatest chance of a positive opinion from regulatory bodies, leading to approval, smooth launch, and rapid uptake.

Further detailed analysis of emerging therapies drug uptake in the report...

Diabetic Macular Edema (DME) Activities

The report provides insights into different therapeutic candidates in Phase III and Phase II stages. It also analyzes key players involved in developing targeted therapeutics.

Pipeline Development Activities

The report covers information on collaborations, acquisitions and mergers, licensing, and patent details for Diabetic Macular Edema (DME) emerging therapies.

KOL Views

To keep up with the real-world scenario in current and emerging market trends, we take opinions from Key Industry leaders working in the domain through primary research to fill the data gaps and validate our secondary research. Industry Experts were contacted for insights on the evolving treatment landscape, patient reliance on conventional therapies, patient therapy switching acceptability, and drug uptake along with challenges related to accessibility.

DelveInsight’s analysts connected with 10+ KOLs to gather insights; however, interviews were conducted with 5+ KOLs in the 7MM. Their opinion helps understand and validate current and emerging treatment patterns of Diabetic Macular Edema (DME). This will support the clients in potential upcoming novel treatments by identifying the overall scenario of the market and the unmet needs.

Qualitative Analysis

We perform Qualitative and market Intelligence analysis using various approaches, such as SWOT analysis and Conjoint Analysis. In the SWOT analysis, strengths, weaknesses, opportunities, and threats in terms of gaps in disease diagnosis, patient awareness, physician acceptability, competitive landscape, cost-effectiveness, and geographical accessibility of therapies are provided.

Conjoint Analysis analyzes multiple approved and emerging therapies based on relevant attributes such as safety, efficacy, frequency of administration, route of administration, and order of entry. Scoring is given based on these parameters to analyze the effectiveness of therapy.

Further, the therapies’ safety is evaluated wherein the acceptability, tolerability, and adverse events are majorly observed, and it sets a clear understanding of the side effects posed by the drug in the trials. In addition, the scoring is also based on the probability of success, and the addressable patient pool for each therapy. According to these parameters, the final weightage score and the ranking of the emerging therapies are decided.

Market Access and Reimbursement

The report further provides detailed insights on the country-wise accessibility and reimbursement scenarios, cost-effectiveness scenario of currently used therapies, programs making accessibility easier and out-of-pocket costs more affordable, insights on patients insured under federal or state government prescription drug programs, etc.

Scope of the Report

- The report covers a segment of key events, an executive summary, descriptive overview of Diabetic Macular Edema (DME), explaining its causes, signs and symptoms, pathogenesis, and currently available therapies.

- Comprehensive insight has been provided into the epidemiology segments and forecasts, the future growth potential of diagnosis rate, and disease progression along with country specific treatment guidelines.

- Additionally, an all-inclusive account of both the current and emerging therapies, along with the elaborative profiles of late-stage and prominent therapies, will have an impact on the current treatment landscape.

- A detailed review of the Diabetic Macular Edema (DME) market, historical and forecasted market size, market share by therapies, detailed assumptions, and rationale behind our approach is included in the report, covering the 7MM drug outreach.

- The report provides an edge while developing business strategies, by understanding trends, through SWOT analysis and expert insights/KOL views, patient journey, and treatment preferences that help in shaping and driving the 7MM Diabetic Macular Edema (DME) market.

Diabetic Macular Edema (DME) Report Insights

- Patient Population

- Therapeutic Approaches

- Diabetic Macular Edema (DME) Pipeline Analysis

- Diabetic Macular Edema (DME) Market Size and Trends

- Existing and future Market Opportunity

Diabetic Macular Edema (DME) Report Key Strengths

- Eleven Years Forecast

- 7MM Coverage

- Diabetic Macular Edema (DME) Epidemiology Segmentation

- Inclusion of Country specific treatment guidelines

- KOL’s feedback on approved and emerging therapies

- Key Cross Competition

- Conjoint analysis

- Drugs Uptake and Key Market Forecast Assumptions

Diabetic Macular Edema (DME) Report Assessment

- Current Treatment Practices

- Unmet Needs

- Pipeline Product Profiles

- Market Attractiveness

- Qualitative Analysis (SWOT and Conjoint Analysis)

FAQs

- What is the growth rate of the 7MM Diabetic Macular Edema (DME) treatment market?

- What was the Diabetic Macular Edema (DME) total market size, the market size by therapies, market share (%) distribution in 2020, and what would it look like in 2034? What are the contributing factors/key catalysts for this growth?

- Is there any unexplored patient setting that can open the window for growth in the future?

- What are the pricing variations among different geographies for approved and off-label therapies?

- How would the market drivers, barriers, and future opportunities affect the market dynamics and subsequent analysis of the associated trends? Although multiple expert guidelines recommend testing for targetable mutations before therapy initiation, why do barriers to testing remain high?

- What are the current and emerging options for the treatment of Diabetic Macular Edema (DME)?

- How many companies are developing therapies for the treatment of Diabetic Macular Edema (DME)?

- What are the recent novel therapies, targets, mechanisms of action, and technologies developed to overcome the limitations of existing therapies?

- Patient/physician acceptability in terms of preferred treatment options as per real-world scenarios?

- What are the country-specific accessibility issues of expensive, recently approved therapies?

Reasons to buy

- The report will help in developing business strategies by understanding the latest trends and changing treatment dynamics driving the Diabetic Macular Edema (DME) Market.

- Insights on patient burden/disease prevalence, evolution in diagnosis, and factors contributing to the change in the epidemiology of the disease during the forecast years

- Understand the existing market opportunities in varying geographies and the growth potential over the coming years.

- Distribution of historical and current patient share based on real-world prescription data along with reported sales of approved products in the US, EU4 (Germany, France, Italy, and Spain), the United Kingdom, and Japan.

- Identifying strong upcoming players in the market will help devise strategies to help get ahead of competitors.

- Detailed analysis and ranking of class-wise potential current and emerging therapies under the conjoint analysis section to provide visibility around leading classes.

- Highlights of access and reimbursement policies of approved therapies, barriers to accessibility of expensive off-label therapies, and patient assistance programs.

- To understand Key Opinion Leaders’ perspectives around the accessibility, acceptability, and compliance-related challenges of existing treatment to overcome barriers in the future.

- Detailed insights on the unmet needs of the existing market so that the upcoming players can strengthen their development and launch strategy.